It’s gratifying to see that that Margaret Brown, who is running for the CalPERS’ board, is already rolling up her sleeves. She e-mailed the board to challenge how staff is hiding investment costs, with the probable aim of fattening staff pay. We’ve included her message at the end of this post.

In reports to the Investment Committee for discussion today, CalPER’S staff appears to have pulled two fast ones. First, it obscured some large investment costs that its own experts have said should be included from its latest results. Second, it appears have restated prior year numbers, with the result that the report is not consistent over time. That gives both the board and public at large the misleading impression that CalPERS reduced costs, as opposed to quit counting some of them.

This incident is yet another example of what white collar criminologist and law professor Bill Black deemed a “culture of corruption”. As a finance-savvy lawyer drily commented, “We can stipulate that CalPERS doesn’t lie well.”

Board candidate Margaret Brown’s concerns are justified in light of the way CalPERS has been playing fast and loose with executive and potentially staff bonuses. CalPERS gave Chief Investment Officer Ted Eliopoulos a $135,000 gift last year via a bonus that violated his bonus formula. We caught CalPERS awarding bonuses and salary increased in violation of the Bagley-Keene Open Meeting Act. And there’s no justification for the way CalPERS hides how and what it pays members of its investment staff. CalSTRS, which is generally more secretive than CalPERS, conducts its compensation award process in a far more open process. As we’ve reported, CalSTRS shows the awards for a large number of staffers, both the maximum percentage allowed under their plan and the level actually granted. In some cases, it also provides explanatory notes.

Brown noticed something that had caught our attention: the suspicious way that the investment staff made $75 million of private equity expenses go poof by omitting them from a report that will be presented formally today. Moreover, CalPERS’ PR department appears to have planted misleading stories in the trade press, messaging a supposed decline in expenses that included this reporting fudge. So not only is the board receiving misleading data, but staff appears to be insuring the con isn’t questioned by ginning up undeservedly flattering stories from insufficiently numerate reporters, and then feeding those to the board through its internal news updates.

The 2017 Con: Just Throw Out a Significant Cost

CalPERS fetishizes being able to claim it is reducing investment expenses and costs. As any follower of John Bogle will tell you, this is an important goal. Unnecessary fees and costs eat into investment returns.

Private equity is far and away the most significant source of CalPERS’ investment costs. But CalPERS’ doesn’t exercise much control over those charges, hence the motivation to play fast and loose with figures to tell the desired story. 1

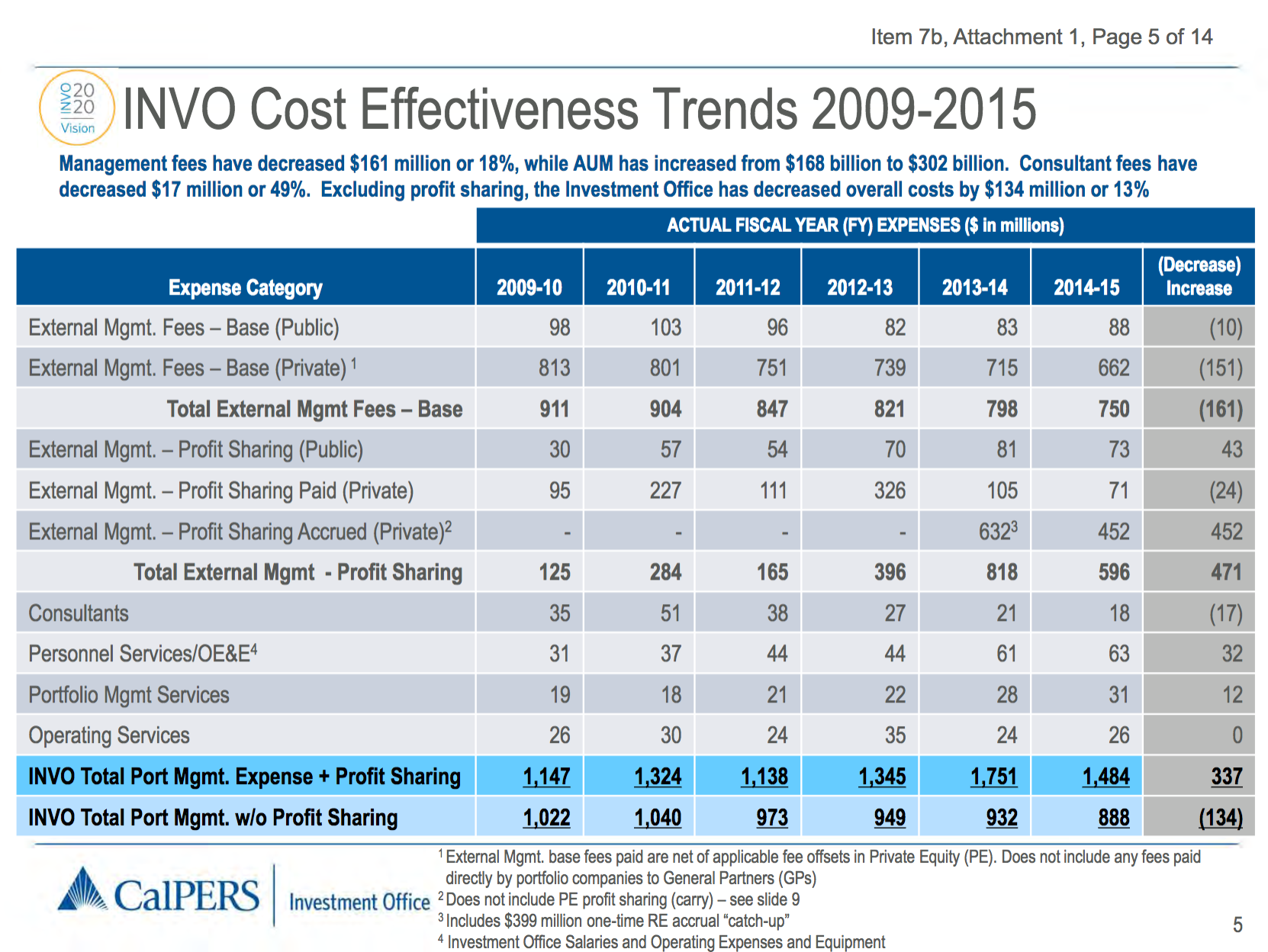

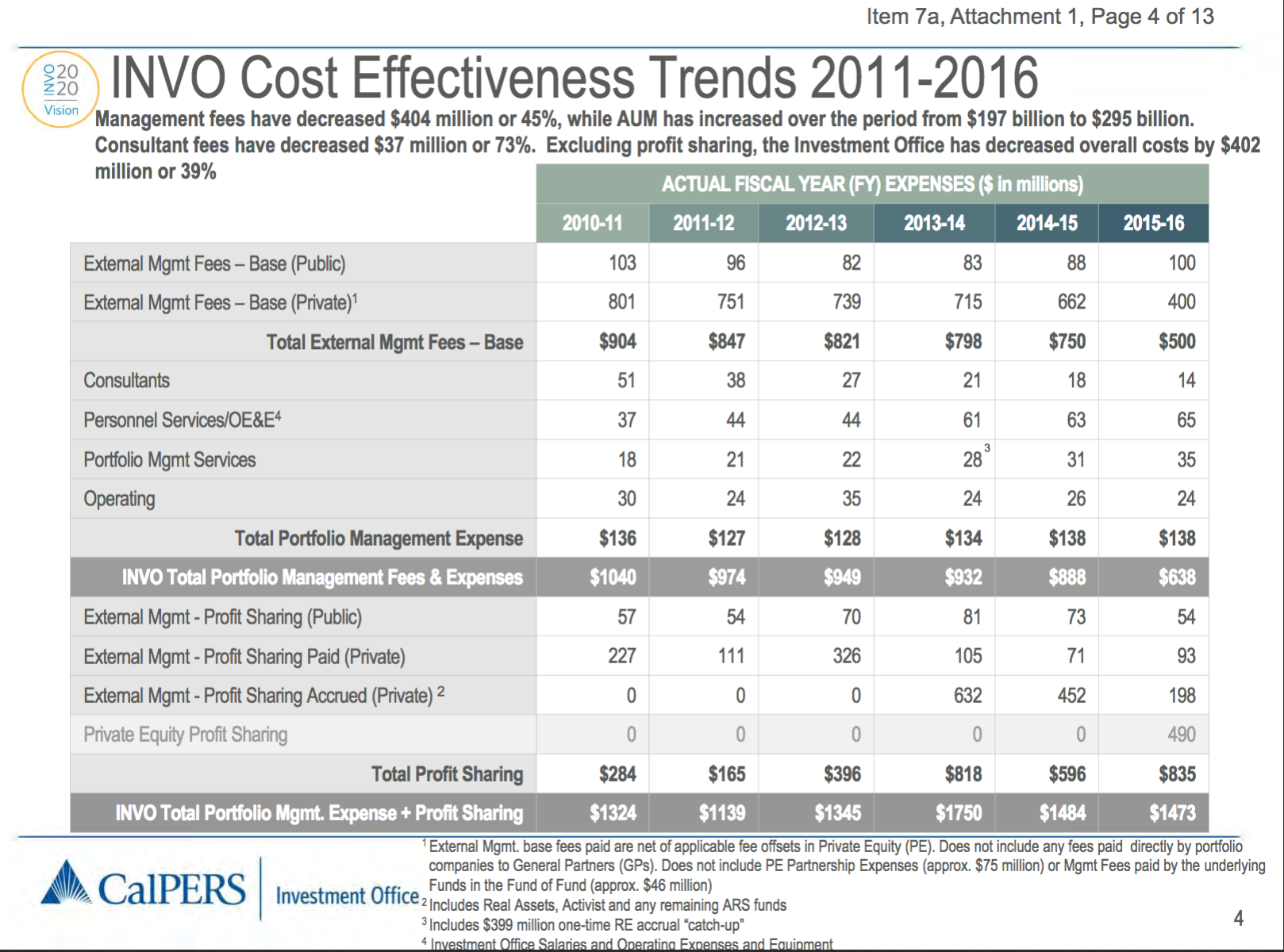

The two charts below show the chicanery that Brown describes in her e-mail to the board.

The “Where’s Waldo?” exercise is to compare the 2016 slide on cost effectiveness trends in CalPERS’ annual Cost Effectiveness presentation with the one from 2017. The older slide, from 2016, comes first:

It was probably unfair to ask you to look at itty bitty type, which naturally is where the sleight of hand occurs. If you look at the first footnote in the second slide, to be presented today, you will see it refers to the second row in the slide, “External Management Fees – Base (Private)”. Here is the detail: “Does not include PE Partnership Expenses (approx. $75 million) or Mgmt Fees paid by the underlying Funds in the Fund of Fund (approx. $46 million).”

The “partnership expenses” are those that the general partner charges directly to the fund, such as organizational costs, legal fees, audit and other financial reporting charges, the costly entertainment and other charges that are part of the annual wining and dining, um, meetings with limited partners. The idea that these are somehow not actual investment expenses and therefore can be ignored is patently absurd.

Partnership and fund of fund expenses vary year by year, yet we have only single figures, which means they refer only to one year. Since there is no corresponding entry on the slide for the previous year, for 2009-2015, that means it’s reasonable to surmise that this combined exclusion of $121 million applies to the 2015-2016 column only. That is consistent with the fact, as Brown points out, that the figures for the prior years for “External Management Fees – Base (Private)” row matches up across slides.

So what CalPERS has done is to put non-comparable data in its report yet present it to the board as if it were prepared on the same basis. There’s no excuse for making an apples and oranges comparison.

It further appears staff recognized it might be caught out and so omitted the column it had last year, where it calculated the difference between the oldest and newest column. However, the absence of that comparison encourages the board to make that computation, or eyeball the difference between the two most recent columns.

Bear in mind that these reports are management information and do not impact what CalPERS will include in its Comprehensive Annual Financial Report. But do not underestimate the significance. The board and the press pays far more attention to reports like this than the CAFR.

Why This Stinks

The board is again deferring to staff rather than doing its job. At a minimum, the Chief Operating Investment Officer, Wylie Tollette and the Chief Investment Officer, Ted Eliopoulos have expense reduction as part of their bonus targets. As we indicated above, thanks to CalPERS’s opaqueness compared to CalSTRS’, we have no idea how many other people benefit from this effort to fool the board. As Brown wrote:

I understand that a number of CalPERS employees receive annual bonuses that are based, in part, on achieving expense control targets. Are these the same people who are deciding to “not count” certain expenses, which could have the effect of boosting their bonuses? Have you looked into this? This seems like a very important fiduciary issue for you.

This chicanery appears to be the result of CalPERS’ board deciding in 2012 to relinquish control for compensation for bonus and salary increases for everyone save the CEO and CIO. This is what you’d expect when you have the foxes running the henhouse.

CalPERS is going against its own experts’ advice by hiding costs.. The 2017 report is inconsistent with what CalPERS’ own consultant, industry standard-setter CEM Benchmarking, called for in a seminal report in 2015, The Time Has Come for Standardized Total Cost Disclosure for Private Equity. CEM stressed then that most investors, save ones that were diligent about tracking down fees and costs, like South Carolina’s state pension fund, were understating the cost of investing in private equity by roughly half. And that was excluding carry fees! Moreover, CEM argued that most public pension funds were not complying with government accounting standards which require them to include costs that are “separable”. The very fact that CalPERS can put a total on its omitted costs is proof that they are “separable”; Brown in her note below goes into more detail as to where they are reported and why they should be included.

CalPERS’ actions contradict its pretense of seeking more private equity cost disclosure. Talk is cheap, and that is all CalPERS seems to care about. Regular readers will recall in 2015, when this site and others were pressing CalPERS to get to the bottom of private equity costs, CalPERS made much of its role in the Institutional Limited Partners’ Association. ILPA was close to completing a template for reporting private equity fees and costs. Not including costs in the ILPA template proves that CalPERS’ claims that it supported more transparency were an empty public relations exercise.

Note that the footnote we flagged shows that CalPERS is still refusing to include another major cost:

External Mgmt. base fees paid are net of applicable fee offsets in Private Equity (PE). Does not include any fees paid directly by portfolio companies to General Partners (GPs).

We’ve been discussing this issue for over two years. Recall that private equity firms charge a prototypical 2% annual management fee and a 20% profit share called a carried interest fee. The fund managers also bill all sorts of charges directly to the portfolio companies they control, such as transaction fees, fees for doing nothing otherwise known as monitoring fees, financing fees. One has to wonder why limited partners continue to sit pat and let private equity firms double or even triple charge for work that was historically covered by the management fee. The compromise, rather than having the limited partners demand a full accounting of monies going from portfolio companies to the general partner, its affiliates, and its staffers, is for a portion of specifically enumerated fees to be rebated against the management fee, which in recent years has averaged 85%.

Bear in mind that this device does not reduce the amount of the annual management fee. All it does is shift some of the payment to investee companies.

It would be less inaccurate for CalPERS to report the entire management fee rather than play along with the general partners’ “hide the ball” game. As we wrote in January 2016:

Whether a dollar is paid directly by the investors via funds they wire to the general partners, or indirectly by being shifted onto the companies they have purchased, the money still comes from the limited partners. Industry standard-setter and CalPERS’ own consulting firm, CEM Benchmarking, underscores this reality…:

We believe that the LP share of portfolio company fees is misrepresented by the industry as a management fee rebate or offset. The net management fee amount does not reflect total management fees paid to the GP because the “rebated” amount is still an expense to the portfolio company and therefore an indirect cost to the LP….

Oxford professor Ludovic Phalippou’s reaction to the CalPERS’ private equity fee claims:

I am surprised that CalPERS is continuing to provide a false number for the fees they pay. By now GPs are saying that they give the detailed portfolio company fees to their LPs and CalPERS said they now had the system in place to track carried interest – hopefully both realized and unrealized one.

Here it is, more than a year later, yet CalPERS still refuses to come clean.

Admittedly, one improvement is that CalPERS is finally including carried fees in its cost totals. But Brown points out that might be what motivated the three-card monte:

I understand that when this same presentation was made last year, there was an issue about the arbitrary exclusion of private equity carried interest from the total fund expense, in the same way that private equity fund expenses are now arbitrarily excluded. CalPERS has now reversed its position on this and has included carried interest (labeled as “Private Equity Profit Sharing”). I wonder whether private equity fund expenses are being excluded in order to “make room” for carried interest that is now included in the total without seeming to cause the total to dramatically increase.

CalPERS’ officers are not held accountable for failing to meet their goals. The board is so credulous and passive that it apparently buys pronouncements like this one from 2015, where Chief Investment Officer outlined his “2014-2016 roadmap”:

As we can see from the discussion above, CalPERS has if anything gone backwards on cost reporting. The only progress it has made is including private equity carry fees. That happened only under duress. As a result of questioning by board member JJ Jelincic, Wylie Tollette made the astonishing statement that CalPERS had no idea what it was paying in private equity carry fees, and further and falsely stated that no one could get that information. When we publicized that exchange, the New York Times, Fortune, and Sacramento Bee picked up on the story, forcing CalPERS to reverse course and collect the information.

Brown highlights that CalPERS is yet again compromising accuracy in the interest of political expediency:

I live by the principle of following the numbers where they lead and would never dream of trying to manipulate numbers to achieve some public relations goal.

Brava. Let’s hope we hear a lot more from her in the coming months and years.

_________

1 As CalPERS staff has repeatedly pointed out, it doesn’t have very good control over how much it has invested in private equity due to the fact that general partners control the timing of capital calls and distributions. On top of that, fundraising is cyclical, so CalPERS has had years (like right after the crisis) when it was not committing much to new private equity funds. That matters because funds charge higher management fees in the “investment period,” typically the first five years, than later on. General partners are also able to set fee levels higher in bull periods. So the level of fees that CalPERS incurs in private equity is to a significant degree determined by factors outside staff’s control. Thus touting the absolute level of fees is misleading.

________

Brown’s e-mail:

Dear CalPERS Board Members,

My name is Margaret Brown. I am a candidate for the CalPERS board, and I am also a manager in a school district where I administer large-scale capital projects involving the expenditure of million of dollars. I am writing to you today because, in looking at the agenda materials for your upcoming Investment Committee meeting, I noticed a serious discrepancy that caused CalPERS’ investment cost to be understated by $75 million dollars in the most recently completed fiscal year.

Agenda item 7a supposedly provides information about CalPERS’ investment costs (see https://www.calpers.ca.gov/docs/board-agendas/201705/invest/item07a-01.pdf). However, the presentation falsely credits CalPERS for apparently fictitious cost reductions. A summary table of cost components (numbered page four) shows CalPERS’ largest single cost as “External Mgmt Fees — Base (Private).” In FY2015, costs in this category totaled $750 million. However, in FY2016, the most recent year shown, the cost declined by $250 million, to $500 million. It is important to note that this supposed $500 million cost in FY2016 was included as a component in the grand-total cost shown at the bottom of the table, which was $1.473 billion in FY2016.

The problem arises because the label for “External Mgmt Fees — Base (Private)” contains a footnote suggesting that, starting in the most recently completed fiscal year, that line item no longer includes private equity partnership expenses of $75 million. There is a strong inference that the $75 million has been subtracted from the total only starting in the most recently completed fiscal year, since the totals shown for prior years in this line item match what was shown in the prior year presentations when there was no footnote acknowledging the exclusion of this expense. For example, in FY2010-11, the total cost for this line item was shown as $801 million in this years report. That same $801 million was shown in last year’s report for that year, though there was no footnote suggesting exclusion of private equity fund expenses. Given the data available to me, I must conclude that the expense was not excluded prior to this most recent report.

There are two important questions that flow from this sudden exclusion of $75 million in private equity fund expenses from this line item. First, why were they excluded? This is a puzzle to me. Second, given that the footnote acknowledges the dollar amount of the excluded expense, why is it excluded from the grand total of investment expenses? If there is some logic to calling out the expense separately, why call it out only in a footnote? Is this change being done in order to obscure the fact that it is not included in the total?

In asking around about this exclusion of $75 million in fund expenses, I learned some disturbing facts. I understand that a number of CalPERS employees receive annual bonuses that are based, in part, on achieving expense control targets. Are these the same people who are deciding to “not count” certain expenses, which could have the effect of boosting their bonuses? Have you looked into this? This seems like a very important fiduciary issue for you.

Second, I discovered a recent article that reported on the exclusion of these same private equity fund expenses from CalPERS’ annual budget. A CalPERS spokesperson is quoted in the story. The explanation he offered seems nonsensical. According to your spokesperson, in the past, CalPERS reported a combined figure for private equity fees plus expenses because that number is generally available from tax forms received by CalPERS. With your new IT system, the spokesperson asserted, CalPERS is now able to collect information about the cost of management fees in isolation. However, the spokesperson seemed to imply that it is not feasible to collect information about fund expenses in isolation. This makes no sense. If you can readily get the total for management fees that includes fund expenses, and you now can additionally get the total for management fees in isolation, then you can simply subtract management fees from the management fees plus expenses total.

Moreover, I have been assured by experts that, under U.S. GAAP, total fund expenses must be presented in fund financial statements that you receive. Deriving your share of the total is a matter of simple arithmetic where you would multiply the reported total by CalPERS’ interest in the fund. Further still, I am told that virtually all private equity funds include CalPERS’ fund expenses directly on the K-1 tax form that you receive each year. For your information, I have attached an example K-1 showing this from Providence Equity, a fund in which CalPERS is an investor.

I understand that when this same presentation was made last year, there was an issue about the arbitrary exclusion of private equity carried interest from the total fund expense, in the same way that private equity fund expenses are now arbitrarily excluded. CalPERS has now reversed its position on this and has included carried interest (labeled as “Private Equity Profit Sharing”). I wonder whether private equity fund expenses are being excluded in order to “make room” for carried interest that is now included in the total without seeming to cause the total to dramatically increase. No matter what the reason, as a financial manager, I live by the principle of following the numbers where they lead and would never dream of trying to manipulate numbers to achieve some public relations goal.

Thank you.

Can someone explain what it is that these investment people do? I realize it’s a hell of a lot of money but is it that different than a regular person parking a chunk of their savings with Etrade? Then some computers track financial indexes and move stuff around once in a while, or whatever it is they do. Those folks earn millions, but are their duties really outside what a good $100K a year tech jockey could figure out? It all seems dubious to me.

I think a regular person parking a chunk of their own savings with Etrade or any investment would look very carefully at the risks before writing the check since it’s their own money they’re risking. The CalPERS board is risking other peoples’ money. Maybe that’s the difference.

adding: kudos to Margaret Brown for challenging the Board’s complacency.

The highest paid person at CalPERS is the Chief Investment Officer, Ted Eliopoulos, who made $751,526 last year, which is way short of “millions”. CalPERS staffers are paid less than people in investment management in the private sector and also at quite a few endowments. However, the issue is that incentive compensation should be incentive compensation. If CalPERS thinks some staff members need a higher level of base pay, they should raise that and not pay for non-performance.

Let Ted or any other Calpers investment pro go out to Wall St for a bid for their intellect and talents, there wont be one. “Variance at risk, portfolio of scale”, complexity in the number of line items, its embarrasing, so $750k is about $725k more than what this failed SJW could earn in the private secfor

Oh that I agree, but the flip side is Oxford professor Ludovic Phallippou says he has highly qualified graduates who’d be willing to take jobs at CalPERS’ pay levels and be good at them too. There are people who are willing to take less than Wall Street pay to have way less backstabbing and pressure.

Great post Yves, and kudos to Margaret Brown for an outstanding letter.

The misleading Report figures should be called out in the CA press. Those figures should be corrected at the Board meeting if such a thing is possible. No staff members should benefit from this kind of fancy footwork with the numbers.

Hoo boy.

Adding, as in all these CalPERS posts, the “games people play” are played at all levels of state and local government. “Always check the footnotes” is as applicable to a report prepared for your local planning board as it is for a ginormous fund like CalPERS. One could almost look at this series as a master class in deconstructing official documents. A useful skill.

Yes yes yes! This is one of the many useful things I learn from reading NC.

What can anybody conclude: Chicanery is the true friend of slimiest thief!

“Give an employee a goal [or bonus structure], and they will do everything to achieve it, including bankrupting the company.” (Deming?)

California is a one party state and like any one party state the corruption has become pervasive over time.

I assume you are referring to the “Blue” Party? The Democrat Party?

The corruption that occurs in state government occurs no matter which party is in control of Administration. Actually, corruption occurs in most large bureacracies (like private corporations). You see, it’s human nature to get “comfortable” in one’s pay grade and learn to “go along to get along”. Others are more precarious in their employment and are simply following orders from above—See: Wells Fargo.

The culture of corruption starts with small things and eventually infects all levels of an organization; state government or otherwise. What the CalPERS drama exposes is the total lack of shame from folks who know better—but, again, don’t want to risk THEIR paycheck and pension (such as it is).

I’m current CalPERS beneficiary, so maybe I take this a little too personally, but I’m very grateful to Margaret Brown for her letter and for taking it upon herself to wade into this swamp. If the hacks on the CalPERS board don’t question this outrageous report (or again attempt to censure board member JJ Jelincic for questioning it), they really ought to be personally sued by the Retired State Employees Association and the Peace Officers Research Association for breach of their constitutionally-mandated fiduciary duty. Staff are running amok, shamelessly failing to properly report expenses and then daring the board to do something about it because they are so certain that the board have abandoned their oversight responsibilities.

Why the CalPERS board believes that the response to admitted criminality by a staffer currently in prison for his malfeasance is less oversight of staff boggles my mind. I’ve seen the numbskulls on the CalPERS board in action (or what passes for action in Sacramento), and they appear to be a bunch of posers incapable of simple arithmetic, which is exactly how their staff treat them. I hope that Margaret Brown succeeds in her bid for election to the board and that she keeps asking smart questions. The conduct of CalPERS staff is simply outrageous — even more if they are using this as a way of hiding their own actual compensation from the public.

If these big pension plans had not gone in alternatives, they would have been forced to use lower projected returns. This means they would have had to cut benefits or increase contributions starting a few years ago.

No one wants to see or hear the truth so the can keeps on getting kicked down the road and the lies grow bigger.

The problem is systemic. The risk free rate should have never gone below 4-5%. Zirp screwed up the entire pension system.

But ZIRP did finance a lovely War Without End for the imperial profiteers of the Military-Industrial Complex, while cutting their taxes!

Yves – think of CalPers like the EU. A corrupt organisation designed to enrich insiders, which claims to exist for the benefit of those who pay in.

It is not easy to reform a self interested entrenched bureaucracy.

Here in Canada, the guaranteed pension equivalent is 18%. That’s how much one needs to save on their own to get the equivalent of a good guaranteed pension.

Over the last 30 years, there is no way employees or ers of guaranteed pensions were contributing anywhere close to 18% of income.

So it is no surprise that pensions are underfunded. Now employers are using all kinds of tricks to keep contribution levels low because if not, they’d have to cut benefits or pick the pockets of current workers.

The entire system broke down, from the employer all the way down to the employee. Even today’s retirees are convinced they paid enough and are entitled to what they were promised. Most wanted to believe that the big returns in the good years would be perpetual and the whole system was built around those optimistic numbers.

Anyone trying to be more conservative would be called a negative person always seeing the glass as half empty.

If these big pension plans are forced to be completely transparent, they will be forced to get out of alternatives and will need to cut benefits or increase contributions which is probably coming anyway…

Margaret Brown’s website.