Yves here. Most readers will regard the headline question as rhetorical and I suspect Campbell does too, but as an academic, he has to hew to formalities in expressing his views.

By Douglas L. Campbell, Assistant Professor at the New Economic School in Moscow, Russia who previously served as a Staff Economist in the President’s Council of Economic Advisors. Originally published at his website

“When Growth is Not Enough” is the title of a recent Ben Bernanke speech in Portugal. I found it via the NYT article on the “Robocalypse“, which contained this bizarre quote from Ben S. Bernanke “as recent political developments have brought home, growth is not always enough.”

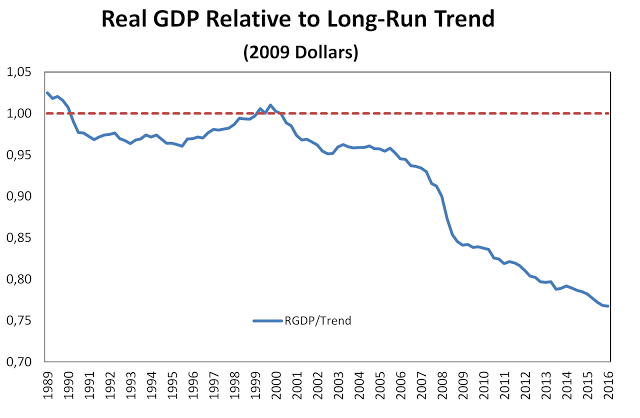

However, as you can see, something terrible has happened to US GDP growth, even if it has escaped the attention of our former Fed Chair. On twitter, Kocherlakota and I were both hoping he’d been taken out of context. Unfortunately, that turned out not to be the case.

In his speech, Bernanke is trying to make sense of how his tenure at the Fed was followed by a populist political rebellion. To his credit, early in the essay, he does admit that the “recovery was slower than we would have liked”, but in the round, as the title of his essays suggests, he is a glass-is-half-full kind of guy on the economy “the [Fed] is close to meeting its … goals of maximum employment and price stability… more than 16 million … jobs have been created… the latest reading on unemployment, 4.3 percent, is the lowest since 2001.” He then writes “So why, despite these positives, are Americans so dissatisfied?” He lists four reasons:

- Slow median income growth, especially for male workers. Hourly wages for males have declined since 1979.

- Declining rates of intergenerational mobility

- Social dysfunction in economically marginalized groups (see Case-Deaton on mortality increases for working-class Americans).

- Political alienation.

What were the causes of these? Bernanke pushes the Gordon thesis that wartime technologies led to the boom in the early post-war period. He notes that productivity growth has been slow the past 10 years. He correctly notes that there was a China shock (which is good, would be nice if he also mentioned exchange rates), and also argues that globalization has led to the rise in inequality. In terms of policy, he argues that more could have been done to secure the safety net and help the downtrodden.

There is much to like in the essay, and I’m not opposed to his policy prescriptions. I also agree that inequality could be part of the problem. But that there were several things that struck me.

First, Bernanke also doesn’t buy the Reagan/Thatcher revolution as the cause of the growth of inequality in the US and UK. He seems to think some combination of globalization/SBTC is the cause. At least he is in good company — Krugman, Avent, DeLong, and David Autor — all people I respect and have learned a lot from, also don’t seem to buy it. I have no idea why.

In my own research with Lester Lusher (see here and here), we concluded that trade almost certainly was not a major cause of the rise of inequality in the US. The aggregate timing just wasn’t quite right, inequality increased just as much in sectors not directly affected by trade, and other countries that trade a lot (Germany, Sweden, Japan) did not see anything like the increase in inequality in the US or UK. And when inequality finally did increase in these countries, it followed cuts in top marginal tax rates just like it did in the US and UK.

Second, reading between the lines, Bernanke seems to have caved a bit in his debate with Summers on the source of Secular Stagnation. Now he seems to be closer to the view that there was some autonomous decline in technological growth. I’m very skeptical of this view, although I’ll concede it’s hard to prove either way.

The big one, of course, is that Bernanke does appear to be in a bit of denial that GDP growth really has slowed. He credits the Fed for price stability, without noting that the Fed has undershot its own stated inflation target for nearly a decade now. He also doesn’t mention how/why both he and the ECB raised interest rates in 2010 (no, that isn’t a typo). Why shouldn’t tight money in a recession lead to slow growth? Of course, it would be nearly impossible for anyone to view such a horrible thing such as the election of Donald Trump, which likely was caused in part by a weak economy (the economy always matters for the economy), and realize that one’s own policies were at fault.

Unfortunately, in recent months, the US has gotten more bad news on the GDP front. Is the problem that we’ve already invented everything worth inventing, and growth will just naturally slow, as Robert Gordon suggests? Or is the Robocalypse upon us, as some would have us believe? Or is it that the Fed ended QE prematurely and then raised interest rates four times in a row despite inflation at 1.5%?

I’m going to go with the latter. After all, if GDP growth and inflation are both below target, and the Fed tightens monetary policy, tell me what is supposed to happen?

QE was a transfer of money from the rental class to the rentier class, allowing the bernankes of the world to proclaim the greatness of the economy by vacuuming up any spare cash (excess capacity in greenspanian) left in the ’09 economy (remember cash for clunkers where gov bought viable used cars and crushed them and now there are 72 month car loans for rapidly depreciating product?), but paychecks are a closed system with currently ever diminishing limits, unlike rehypothecated debt, which to the banksters is the all you can eat grift that keeps on growing.. Rent increasing 10% a year and there’s no inflation? Thanks Ben,

A classical understanding of inflation (change in price of a market basket of goods) is more or less insufficient to explain inflation in the last 25 years:

https://ftalphaville.ft.com/2016/09/12/2174415/least-productive-sectors-only-thing-keeping-inflation-going/?mhq5j=e2

88% of the inflation since 1990 has come from healthcare, housing, and college education. Food, TVs, and watches haven’t become much more expensive than they were in the 1990s and in many cases, the goods in 2017 are better.

If anything, people are spending less money on things they can chose to spend money on and spending more on things that are more or less mandatory (or at least coerced) and inflation doesn’t capture that crapification in quality of life.

+1000

The TVs, phones, computers, and all the illicit substances have never been cheaper (The things you might WANT to buy).

The healthcare, the housing, and education sure went up significantly (The things you HAVE to buy whether you want to or not).

May God help you if you have a significant illness, because your fellow man won’t.

Qui bono?

Like most professional eConmen, Ben cherry-picks data and relies on known-bullshit metrics re. inflation and unemployment to try to divert from the devastated jobs landscape left by decades of neoliberal elite-looting-supporting Fed policies and in the still-deep wake of the GFC. For example, have a gander at these BLS charts and show me the so-called ‘recovery’. What recovery there is has been pathetically weak, and the numbers do not capture the horrendous crapification in the aggregate *quality* of jobs created over time – though the real wage decline mentioned by the author gives a hint there. Not only has the precariat not shared in the productivity gains it has slaved for, its lot has in fact gotten worse, especially when you look beyond mere understated-inflation-adjusted wage trends and factor in things like pension and healthcare benefits and job security. Some ‘highlights’, if they can be called that:

o Labor force participation rate dropped steeply from 66% in 2008 to under 63% in 2014, and has not budged from that level, outside of some noisy fluctuations.

o Employment-population ratio plunged from 63% to just over 58% during the GFC, and has only crept up 1.5% during the so-called recovery. And again, average job quality has also continued to go to shite.

The above two datasets give a better picture than the various unemployment measures, IMO, because with unemployment one just disappears from the data once has been out of work for long enough. Those are games one can;t play with employment and population – like I said, the major problem with the employment data is quantifying average job quality. Probably a feature-not-bug aspect from the perspective of our economic policy elites.

Oh, Ben didn’t happen to mention anything about the perpetrators of the largest financial fraud in human history not only going unprosecuted but being richly rewarded via multi-$trillion government bailouts while the rest of us have coped with double-digit annual inflation in housing, healthcare and higher education while earning zilch in interest on our savings, did he?

+100

Bingo!

Give that man a cupie dol!!!!

Ben Bernanke debuting as an author with the book: “Failure as a Career Choice”, soon on Amazon!

Absolutely. The game is up for these clowns who think interest can accumulate ad infinitum and all will be well.

And yet few commentators discuss the massive decline of unions in the United States which disproportionately hurt those less-educated male workers and caused much of the social dysfunction the media frets about all the time. When the decline of unions is discussed it is always written about as something that was inevitable despite the fact that union strength varies considerably among industrialized countries with Anglophone nations have the weakest labor unions that have seen the greatest declines and continental European countries having the strongest labor unions that have only declined somewhat or in the case of Scandinavia not much at all. This flies in the face of the globalization and robot apocalypse stories that are pushed to provide support for TINA neoliberalism. The issue is one of politics not supposedly “natural” forces like globalization and automation which aren’t really natural either but that is another story.

Furthermore, you would think that social conservatives, who are always worried about the supposed woeful lack of morality among working people, would take the collapse of organized labor into consideration but they rarely do. It is funny because they wax nostalgic about the social conditions of the 1950s but apparently never stop to ask themselves how so many ordinary working men were able to support families on one income. I guess they must think it was because those working men went to church more often.

Sadly, when I have this conversation with many nostalgic for the old days, they often blame the unions for the loss of manufacturing jobs. They have no first hand experience of this of course, but it is a right-wing meme that has seeped deeply into the consciousness of a lot of people.

To me, the saddest thing is that the private sector unions have gone entirely radio silent. When was the last time you heard anything from the Teamsters or the UAW? I guess the UAW has filed for an election at BMW in Mississippi but, as far as a general voice for working people, entirely AWOL.

I have noticed that the United Steelworkers have also been pretty quiet. Started noticing this while I was in Pittsburgh during the middle of the 1980s.

Are you talking about the ruling-class or working-class of the Unions going quiet?

The “leaders” of all “groups” are pretty happy these days.

+1

The Robocalypse comes from the hopper of a modern harvester combine.

Record-breaking performance: 797.656 tonnes (29,309 bushels) in 8 hours

John Henry was a Mail Sortin’ Man

Blaming it on “technology growth” sounds pretty much as an excuse. Greenspan is fossilized. Bernanke is outdated, timed out, finished. What about Yellen?

Health Problems (or Niburu rising):

I’ll go with “Ages in Chaos” for $600 Alex.

See? Bernanke and Sitchin do have something in common; Velikovsky!

(In fairness, I must state that Velikovskys’ book, “Oedipus and Akhnaton” is worthy of serious consideration.)

Safer for whom?

The quip of someone who thinks top-down without acknowledging the pains from the bottom-up.

A reminder of all those who brag about how the US always manages to come back stronger while I can’t help think of the sorrow of the mothers who have lost their children in wars.

we’re much safer

I think the key word here is “we”. I don’t think he means us.

“i’s a big club -and you ain’t in it.”

That quote from Janet Yellen reminds me of the immortal Alfred E. Neuman, who said:

A few people predicted the collapse of 2008, but Janet Yellen and Ben Bernanke were not among them. Their track record does not inspire confidence.

How old is Yellen, like 70-something? Maybe not in her lifetime, but how long is that gonna be…

Ha! You made me look up her birthdate: August 13, 1946.

I suppose we could go for 20 years without a financial crisis, but I suspect it will be much sooner.

I wish high longevity to everyone, but her self-prophecy has made some to give her a nickname. So we already have the nicknames for the last 3 Fed Chairs:

Alan Greenspan, The Out Of Tune Maestro

Ben Bernanke, The Easy Boy

Janet Ellen, The Short-Lived

Ha, this is a fun party game for young & old. :) My own nicks for the first 2:

Alan “Mr. Bubble” Greenspan

Ben “The Banker’s Best Friend” Bernanke

(“Ben Bernanke-Panky” came a close 2nd, said ‘panky’ referring to his bank-bailing financial machinations.)

Never devised a nick for Ms. Yellen, she seems such a complete neolib-policy-continuing non-entity to me.

Fun!!!

Greenspan “SACKeruty giver”

Bernanke “Bankcopter”

The real drama is the congress [ideological capture (rapture – beardo level)]…. where as the fed is just a sub set of the that problem matrix.

Next thing we know, some Congressperson will read the “Beardo Thodol” into the Congressional Record. A practiced Hindu or Buddhist would recognize this phenomenon as “Existential Capture.”

I kind of miss ol Beardo. He was an object lesson in absolutist thinking. Sort of a salutary lesson.

EROEI has been dropping like a rock and the US machine requires ever more energy.

The production of energy will gradually squeeze out the rest of the economy. It has already started but it is happening stealthily thanks to our monetary system which in no way measures the energy intensity of anything and actually rewards discretionary spending over essentials.

Energy is our most important asset yet we have no way of measuring how efficiently it is being distributed across industries as we are distributing based on dollar amounts and not on joules. We think that scarcity will get priced in but it is not necessarily so.

Our monetary system and financial engineering are the culprits. Just printing money or deficit spending will not help because without proper analysis we will keep on wasting large amounts of joules on non essential products and services.

Bernanke is low energy.

…and high entropy.

Example: military industrial complex, shale oil, golf courses, casinos, stadiums, etc.

The US with 5% of the population is already consuming many times its weight in energy… if it decided to print more money for the people that would mean even more energy consumption than the current outsized percentage.

Some would argue that all the US has to do is cut its energy use in the MIC but that would probably lead to a weakening of its reserve currency position which would then lead to a drop of its share of world energy.

The US is consuming too much energy PERIOD. And further increasing this consumption without serious energy efficiency targets means a continuing squeezing out of a larger segment of the population.

I recommend Michael Hudson’s Killing the Host: … as a primer on why both Bernanke and this author are dissembling.

I think that Bernake like most economists falls into the trap of treating “technology” as a magic word. There are different technologies some, such as modern container shipping, facilitated US exports but didn’t change the basic fact of human labor in manufacturing. Others, such as the internet have enabled greater price competition and have killed many local jobs. Economists love this because they love “frictionless” transactions and “productivity gains” but they seem to be unable to connect that to real job losses.

I agree totally with L: the value-added in the retail and media industries has fallen due to internet efficiencies; if productivity has a price element in it (so taking a credit card payment at an expensive boutique is more “productive” in the sense of profit per man-hour than the same payment in a supermarket), then the loss of retail margin makes everyone in supermarkets less productive even if they are doing more work measured, say, by items scanned per minute.

The terrible word is “commoditization”: in that sort of market, a sheaf of corn is a sheaf of corn and no-one really measures quality and provenance any more. But it is hardly news to economists that perfect competition drives down profit. Why, even the investment management industry is under productivity pressure as indexing commoditizes that market…

Looking for economic metrics to explain inequality is looking in the wrong place. Remember when all we could talk about was CEO compensation and how it had skyrocketed? Remember that those CEOs had captured their own governing boards, enriched themselves, and greatly expanded the population of the 1%. Then the nouveau riche waged a political campaign to get the laws changed in their behalf. (Carried interest? Amazing!) They even calculated the ROI on lobbying and found it vastly to their benefit.

The inequality in the US is certainly created in large part by the political campaign of large numbers of enriched CEOs who think the way I just described. Globalization and technology data are just smokescreens for what really is happening. And you do not need to be an economist to figure this out.

As just another example, the oligarchs are now going to go all out to “simplify” the federal tax code. What they do not mention is that the tax code is bloated because of all of the special perks provided the rich and powerful. The codes that affect ordinary Americans are only a few percent of the whole. Those perks helped the wealthy amass even more wealth and now that they have turned that wealth into power, they want to weld those advantages into an even bigger advantage (harder to change in the future) with a “simplified” tax code. This new code will be even more beneficial to the rich.

Globalization and technology data are just smokescreens for what really is happening. And you do not need to be an economist to figure this out.

Here is my lay person’s analysis for how the economy works: There are easier and harder ways for companies to make money. Among the easy ways are stealing, lobbying for tax breaks, finding lower cost workers, dumping social costs (pollution, adequate wages, etc.) on others, and buying other profitable companies. Among the harder ways are: making your product better, investing in new products, providing a better service, etc. Only when the easier ways are foreclosed will companies think about the harder ways, and even then only if those pass a profitability screen.

But it is important for economists to keep with the mumbo-jumbo because otherwise the natives might start asking hard questions.

I am amazed that Bernanke is still allowed to walk this earth freely…

Interesting as always.

Here is another angle. The change in US immigration policies post-1970 have already increased the population by about 100 million more than it would have been otherwise (the percentage of the population that is foreign born has no relevance – it is the total net increase including descendants due to immigration).

We no longer have an open frontier. In addition, our technologies are starting to hit the law of diminishing returns. Also, once an industrial society has developed, it’s harder to increase capacity after the fact than to build it in the first place (Building a highway in an open field is easy. Building a highway underneath modern day Manhattan, less so).

Now all economists from Malthus on have understood that there is no obvious limit to the size of a population that a given country can support. The issue is the rate of growth, the marginal rate of adding new capacity and developing new resources per person, and the physical investable surplus (not fiscal castles in the sky!) available. And, last but not least, whether that surplus is actually being invested wisely in producing new infrastructure and developing new resources.

I think the current per-capita capital base in the United States is on the order of $250,000 per person. This number will increase as population densities increase, and you need more recycling, more efficient industrial systems, etc. (Unless you don’t care if living standards fall, of course). Even an annual growth rate of 1%/year, although it seems low, under current circumstances it would require substantial ongoing investments to maintain the status quo.

So GDP may be growing – but is it growing fast enough to handle our population growth? How much of this new GDP is being fed back into building new roads and water treatment plants and expanding subway capacity etc., and how much is being used to wage pointless winless wars on the other side of the planet? And how much of this GDP ‘growth’ is mere fiscal legerdemain?

One could easily see how GDP per capita might be growing at historically nominal rates, yet the society could still become steadily poorer. It depends on the details. It depends on the physical real world. You don’t need to invoke a ‘roboapocalypse’ or a ‘worker shortage’ (sometimes done at the same time!) for this to happen. Which modern economists – blinded by mere money – seem to have forgotten.

Lending by the commercial banks, DFIs, is not predicated on the level of market clearing interest rates. It is dependent on the volume of their business: credit worthy borrowers and bankable opportunities, e.g., inexhaustible Federal gov’t debt. “Pushing on a string” only applied to the nominal legal adherence to the fallacious “real bills” doctrine (pre-1933).

I.e., the DFIs, from Messari accounts (the entire system’s balance sheet, income, and expense statements, i.e., flow vs. stock), and not from the standpoint of an individual commercial bank’s ledgers, never loan out existing deposits, saved or otherwise. They always pay for their new earning assets – with newly created deposits (S ≠ I) That’s how the money stock conterminously and endogenously expands ex-nihilo in the macro-economy, viz., loans + investments = deposits.

However, raising the remuneration rate, the Fed’s policy administered rate, absorbs the NBFI’s existing savings, or their loanable: wholesale and pooled funds, in the borrow-short, to lend out higher and even longer, savings-investment paradigm (but not the DFI’s deposits). The prologue and precursor was the 1966 S&L credit crunch (where the term credit crunch was first coined). This obviously causes stagflation (as the volume of DFI credit then becomes, by necessity, exaggerated relative to the volume of goods and services proffered (thereby debunking the “Phillips curve’s” tradeoff).

The initial payment of interest on IBDDs during the GFC, resulted in dis-intermediation for the NBFIs, an outflow funds or negative cash flow, but left the DFIs unaffected (where the size of the NBFIs shrank by $6.2T while the size of the DFIs grew by $3.6T), and thus exacerbated the depth and duration of the GFC. I.e., since Roosevelt’s 1933 Banking Act, dis-intermediation is a term that only applies to the non-banks.

And this Romulan cloaking device (remunerating IBDDs), exceeds the level of short term interest rates which is not supposed to be higher than: “the general level of short-term interest rates” as imposed by the 2006 Financial Services Regulatory Relief Act.

Raising the remuneration rate retards the “credit impulse” and destroys money velocity, intermediary lending/investing, where ( S = I ). N-gDp subsequently decelerates immediately and for some time afterwards (for 6 months after the 1st rate hike on 12/15/15), once the FOMC decides to hike rates. It compresses credit spreads flattening the yield curve (narrowing the profit curve).

I.e., the commercial bankers (unlike the non-banks), cannot attract savings (buy their liquidity), so as to expand the total volume of commercial bank credit outstanding, as all savings originate, and never leave, the payment’s system (unless saver-holders convert to other National currencies or decide to hold more cash).

Thus the Fed’s insouciant entropy (output gap) perversely metastases. It’s called secular strangulation.

Changing the size of the Fed’s balance sheet, where the present holdings of IBDDs is un-necessarily and monopolistically skewed towards 2 money center and foreign banking organizations (vastly unlike it would be if higher reserve ratio and reservable liability requirements had been uniformly applied across-the-board), is déjà vu.

Under monetarists’ guidelines, the first rule of reserves and reserve ratios should be to require that all money creating institutions have the same legal reserve requirements, both as to types of assets eligible for reserves, as well as the level of reserve ratios. Monetary policy should limit all reserves to balances in the Federal Reserve banks (IBDDs), and have uniform reserve ratios for all deposits, in all banks, irrespective of size.

The only tool at the disposal of the monetary authorities, in a free capitalistic society, through which the volume of money can be controlled is legal reserves (not interest rate manipulation). The complete deregulation of interest rates and requirements against time deposit banking encourages oligopoly, monopsony, and monopoly or the exploitation of consumers. Why do you think there are no usury capping of ceilings on credit cards, etc. The ABA is public enemy #1.

It is analogous to what happened in the geographical mismatch, and maligned redistribution of deposit-taking and lending activities (mal-investment), in the 1920’s and during the Great Depression, between the former Central Reserve City Banks, vs., Reserve City Banks, vs. Country Banks. This structure precipitated bank panics, accumulated pressures between respondent/correspondent relationships, as the Fed’s country banks classification held upwards of ½ of all vault cash. See 1959 inclusion of vault cash for determining applied / complicit reserves.

This geographic and wholesale funding roll-over (6 months?), restocking, replenishing, and rebalancing of deposits vs. loans is inherently destabilizing even given District Reserve bank backstopping. It develops asset maturity mis-matches in maturity transformation. The liquidity ill-effects are quickly transmitted throughout the system (what anti-trust laws were designed for). It is un-American and treasonable.

It is axiomatic that the smaller the degree of price competition in a market and the greater the degree of private unregulated monopoly power over prices and output, then the higher the amount of unit prices, the greater the tendency for restricted output and employment and the smaller the degree of downward price flexibility. Under these conditions, unless money (and money flows) expands at least at the rate prices are being pushed up, incomes will fall, output can’t be sold, and jobs will be lost.

It is no happenstance that “The Community Reinvestment Act (CRA), enacted by Congress in 1977 (12 U.S.C. 2901) and implemented by Regulations 12 CFR parts 25, 228, 345, and 195, is intended to encourage depository institutions to help meet the credit needs of the communities in which they operate.”

Regarding “the big one…”: Rapid household credit growth leads to future output losses due to negative cash flow from rising debt service. This, and declining real capital investment and resource misallocations into corporate stock buybacks and zombie firms and assets, has led to declining productivity as summarized on pages 48-52 of this year’s BIS Annual Report. Both these developments stem from over 8 years of ZIRP and negative real interest rates under central bank rate policies, together with their encouragement of financial speculation and increasing financial asset prices. Graph III.8 on page 52 of the BIS’ 2017 annual report captures a source of Bernanke’s angst IMO.

https://www.bis.org/publ/arpdf/ar2017e_ec.pdf

If “normalizing interest rates” causes another financial crisis, it will be in part because central bank policies over a prolonged time period have led to poor decisions regarding debt and capital allocations. This is not to excuse the absence of federal domestic fiscal spending under misguided austerity and related policies.

Will be interesting to see what effect, if any, a relatively modest increase in historically low interest rates has on the Velocity of money (and inflation), as Cash is no longer trash.

People borrow more to support their old unsustainable lifestyles. The borrowing binge began when the Fed laid the legal basis for the abolition of 38,000 non-banks (where S = I), and the addition of 38,000 commercial banks, to the 14,000 we already had (where S ≠ I), viz., the DIDMCA of March 31st 1980, which caused the S&L crisis.

This has the impact of destroying money velocity, and thereby N-gDp, as more and more savings have become bottled up in the payment’s system. I.e., the commercial banks always create new money whenever they lend/invest. The DFIs do not loan out existing deposits.

Thus all bank held savings are lost to both consumption and investment. They are un-used and un-spent. Remunerating IBDDs exacerbates this phenomenon (exacerbates stagflation and secular strangulation).

CB Time deposits vs. demand deposits:

1939……..15~~~~~~ 33

1954……..47~~~~~ 121

1964……126~~~~~ 156

1974……421~~~~~ 274

1979……676~~~~~ 401

1986…1,215~~~~~ 491

1996…1,271~~~~~ 420

2006…3,696~~~~~ 317

2016…8,222~~~~1,233

The ratio of TD/DD in 1939 = 0.45

The ratio of TD/DD in 2016 = 6.67

The only way to activate these savings, put them back to work, completing the circuit income and transactions velocity of funds, is for the saver-holder to invest/spend their funds directly, or use non-bank conduits. This is the source of the pervasive error that characterizes the Keynesian economics, the Gurley-Shaw thesis.

Stagflation was predicted in the late 1950’s before the word was coined in 1965. As professor Lester V. Chandler originally theorized in 1961, viz., that in the beginning: “a shift from demand to time/savings accounts involves a decrease in the demand for money balances, and that this shift will be reflected in an offsetting increase in the velocity of money”. His conjecture was correct up until 1981 – up until the saturation of financial innovation for commercial bank deposit accounts (the widespread introduction of ATS, NOW, and MMDA bank deposits). 1981 represented the peak in money velocity (as Dr. Leland Pritchard, the originator of the theory, predicted in May 1980). I.e., the demand for money, Keynes Liquidity Preference Curve, has its limits (Keynes’ theory is wrong).

And the non-banks, contrary to Congress and all economists, are not in competition with the commercial banks. The NBFIs are the DFI’s customers. Savings flowing through the non-banks, never leaves the payment’s system. Savings flowing through the non-banks increases the supply of loan-funds, but not the supply of money.

Thus the U.S. Golden Era in economics (not the Great Moderation), was because savings were put back to work. Savings were pooled by the S&Ls, MSBs, and CUs, who largely invested in real-investment outlets, esp. residential real-estate (which make a direct contribution to R-gDp, for both labor and materials). So the economy has never been optimized. R-gDp in excess of 4 percent is easily obtainable.

The morons running the country, e.g., Bankrupt u Bernanke, didn’t save the economy, no, BuB was the sole cause of the GFC. BuB: “Money is fungible”…“One dollar is like any other”) [sic]

Money flows (volume Xs velocity), short and long distributive lags, are robust, not neutral, contrary to BuB, as evidenced by his FAVAR 2002 paper. Note the definition: “Neutrality of money is the idea that a change in the stock of money affects only nominal variables in the economy such as prices, wages, and exchange rates, with no effect on real variables, like employment, real GDP, and real consumption.” – Wikipedia

R*, the Wicksellian natural rate, is fictitious (homeostasis not). So is the Fisher equation (“relationship between nominal and *real* interest rates under inflation”). Budget driven investment hurdle rates for R&D and CAPEX, viz., MARR (net present value capital projections & IRR), are idiosyncratic (as incentivized by, e.g., MACRS).

Presently, there is an excess of voluntary savings over profitable real-investment outlets (Alvin Hansen’s 1938 chronic condition of “sagging investment & buoyant savings”). And Professor Phillip George got it right: “the fall in investment is a consequence of the fall in consumption, not the cause of it.” Martin Wolf’s (chief economics commentator at the Financial Times) labels this: “structurally deficient aggregate demand” (which has been incremental and cumulative).

This is exactly what Dr. Leland James Pritchard (Ph.D. – Economics, Chicago School, 1933) had predicted in 1958, based on his formulated savings-investment symbiosis: “will have a longer-term debilitating effect on demands, particularly the demands for capital goods. I.e., the demand for loan funds reflects the advantages of spending borrowed money.

And Phillip George has independently figured this mathematically out: “To measure money accurately, we also need to measure the amount of savings contained in M1, and subtract the savings from M1.” All Pritchard’s perspectives on the macro puzzle today fit perfectly in place.

Note: Durable goods is the most volatile component of personal consumption expenditures. And the most volatile of the 4 gDp components is gross private domestic investment, used either to replace or add to the stock of real capital goods, which are: new construction, producers’ durable equipment; and changes in the value of business inventories.

Interest is the price of loan-funds. The price of money is the reciprocal of the price level. Thus residential and business fixed-investment have not been, according to Alan Greenspan, a function of the gross private savings rate (a source of mathematical econometric modeling errors).

Economic fluctuations reveal dynamic lags and concentrations. So the stagflationists (advocates of targeting N-gDp), will inevitably get their comeuppance (as inflation accelerates relative to real-output). The distributed lag effect of money flows, both short and long term impulses, have bottomed and are headed higher until Sept-Oct.

The root cause of the economic staccato is Gresham’s law: a statement of the “principle of substitution” as applied to money: that a commodity (or service) will be devoted to those uses which are the most profitable. I.e., the bad drives out the good – is apropos. So is Alfred Marshall’s “Cash Balances” approach, viz., the differentiation between ex-ante expectations and ex-post realizations).

Business expenditures depend largely on profit-expectations, and favorable profit-expectations depend primarily on cost/price relationship of the recent past and of the present. Cost/price relationships are crucial, and they are particular; they cannot be adequately treated in terms of broad-aggregates or statistical weighted “averages”.

There are no budgeted “money illusions”. The “asked” prices aren’t synonymous with the cost and orbit of production (disputation of Says law).

“Neutrality of money is the idea that a change in the stock of money affects only *nominal* variables in the economy such as Prices, Wages, and Exchange rates, with no effect on *real* variables, like Employment, Real GDP, and Real consumption.” – Wikipedia

Money flows (volume Xs velocity), short and long distributive lags, have turned positive. Thus (contrary to BuB, as evidenced by his FAVAR 2002 paper), since money flows are robust (not neutral), R-gDp should increase in the 3rd qtr.

parse; dt, real-output, inflation:

01/1/2017,,,,, 0.13 ,,,,, 0.19

02/1/2017,,,,, 0.08 ,,,,, 0.16

03/1/2017,,,,, 0.06 ,,,,, 0.13

04/1/2017,,,,, 0.08 ,,,,, 0.18

05/1/2017,,,,, 0.09 ,,,,, 0.23

06/1/2017,,,,, 0.08 ,,,,, 0.21 commodities & rates bottom

07/1/2017,,,,, 0.13 ,,,,, 0.22

08/1/2017,,,,, 0.11 ,,,,, 0.26

09/1/2017,,,,, 0.10 ,,,,, 0.27

10/1/2017,,,,, 0.06 ,,,,, 0.27 commodities & rates peak

11/1/2017,,,,, 0.08 ,,,,, 0.25

12/1/2017,,,,, 0.11 ,,,,, 0.17

– Michel de Nostredame (cracked the macro-economic code in July 1979)

monetaryflows.blogspot.com/

GDP cannot grow at 5% forever.

Get used to it.