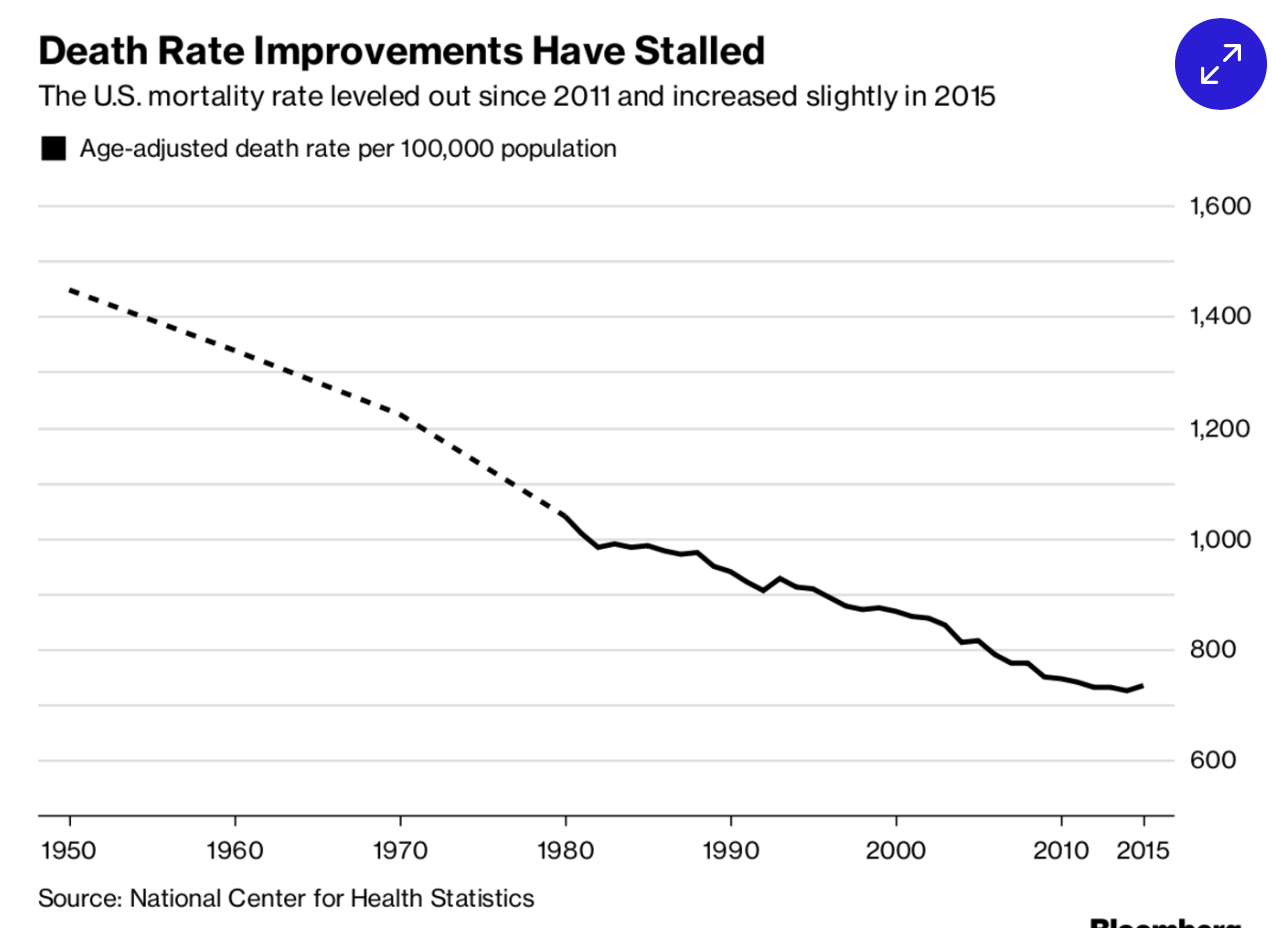

One of Lambert’s principles of neoliberalism, up there with “Because markets” is “Die faster”. It’s now playing out as US life expectancy hasn’t just stalled out but has actually declined as older people are shuffling off the mortal coil at a faster rate. But in our best of all possible worlds, Bloomberg tells us that this is a Good Thing because it’s helping reduce pension fund underfunding, since actuaries had assumed increasing lifespans. No joke, the headline is Americans Are Dying Younger, Saving Corporations Billions.

From Bloomberg:

Steady improvements in American life expectancy have stalled, and more Americans are dying at younger ages. But for companies straining under the burden of their pension obligations, the distressing trend could have a grim upside: If people don’t end up living as long as they were projected to just a few years ago, their employers ultimately won’t have to pay them as much in pension and other lifelong retirement benefits.

In 2015, the American death rate—the age-adjusted share of Americans dying—rose slightly for the first time since 1999. And over the last two years, at least 12 large companies, from Verizon to General Motors, have said recent slips in mortality improvement have led them to reduce their estimates for how much they could owe retirees by upward of a combined $9.7 billion, according to a Bloomberg analysis of company filings…

The fact that people are dying slightly younger won’t cure corporate America’s pension woes—but the fact that companies are taking it into account shows just how serious the shift in America’s mortality trends is…

Absent a war or an epidemic, it’s unusual and alarming for life expectancies in developed countries to stop improving, let alone to worsen. “Mortality is sort of the tip of the iceberg,” says Laudan Aron, a demographer and senior fellow at the Urban Institute. “It really is a reflection of a lot of underlying conditions of life.” The falling trajectory of American life expectancies, especially when compared to those in some other wealthy countries, should be “as urgent a national issue as any other that’s on our national agenda,” she says.

And Bloomberg had similarly only superficially cheery news about Social Security:

It’s not just corporate pensions, either; the shift also affects Social Security, the government’s program for retirees. The most recent data available “show continued mortality reductions that are generally smaller than those projected,” according to a July report from the program’s chief actuary. Longevity gains fell short of what was projected in last year’s report, leading to a slight improvement in the program’s financial outlook.

As you can see from the chart, the decline is recent, but the underlying causes have been grinding along for some time, like termites eating away at a foundation. Neoliberalism seeks to treat people as isolated actors operating in impersonal markets. Therefore social relations, like involvement in one’s community, attachments to colleagues at work, or even one’s family (caring for an aging parent, not moving to pursue a “better” job because it would be bad for the kids), are seen as secondary. If you make enough money (as in are a winner at playing the neoliberal game), these things are all supposed to take care of themselves.

Nevertheless, the crisis and the way it was resolved is a major contributor to the decay. 9.3 million families lost their homes, due either to foreclosure or forced sales, out of a total of 54 millionish homes with mortgages. This was a tsunami of financial and psychological trauma. During the “recovery,” until the last few years, only the top 1% benefitted from GDP growth, leaving everyone else in aggregate worse off. The racial wealth gap is now wider than in the 1960s.

And even those who on paper might be doing OK are generally not in a very secure position unless they are exceedingly affluent. Half of Americans live paycheck to paycheck. Ever-rising medical costs and loophole-filled insurance policies mean a costly medical problem will also lead to stressed finances and potentially a bankruptcy. Job tenures are short and if it takes more than 6 months to land a new job, you may be permanently unemployed. Until 2013, most of the jobs created in the recover were part-time, and even now, the level of part-time jobs is high for an economy which the Fed keeps pretending is near full employment. And those in part-time jobs are subject to depression at a 50% higher rate than those in full-time jobs. And even those who look comfortable on current income basis are unlikely to be putting enough away for retirement.

In other words, members of the shrinking middle class often recognize that the gap between them and the precariat is not large. As we pointed out from the inception of this site, high levels of inequality in and of themselves impair health and longevity, even among the top income group. Among other reasons, highly stratified societies have weak social ties, which is a negative for health. People at each level know they would lose their supposed friends if they were to suffer a meaningful fall in income. They’d no longer be able to afford to participate in the events that were normal for their peers (for the rich, catered dinner parties, memberships in the right clubs and boards, keeping a second or third or fourth home in a posh community, participating in the mutual backscratching of political and charitable fundraising).

Even though the author of Bloomberg article on pensions had the good sense to sound alarms about the broader societal implications, another Bloomberg story tonight is bizarrely depicting older Americans as selfish, or at best inconvenient, for staying in houses they’ve owned a long time: Baby Boomers Who Refuse to Sell Are Dominating the Housing Market. “Refusing to sell”? Why is anyone who owns anything obligated to sell? If you believe in markets uber alles, people who have property rights are free to exercise them as they please. And if there’s a dearth of new building, it’s simple-minded to blame existing owners, when longer term factors are often in play. For instance, as Robert Fitch has documented, New York City has had a long-term plan of turning Manhattan into a community for the wealthy since the 1930s.

Moroever, astonishingly, the article omits the fact that in the wake of the crisis, the number of rentals has increase by 5 million, not just the famed private equity buyers but plenty of traditional small scale landlords. Experts on this trend say that rentals are attractive at home prices of $200,000 and below (that cutoff may have moved up a bit as the “recovery” has progressed). The removal of what would have normally been starter homes for the young has increased generational stress, yet the article perversely heaps all blame on older stick-in-the-muds.

Particularly in light of a dearth of safe, income-producing investments and strained market valuations, many if not most retirees have become even more frugal with spending. That means if you are in a home at a low annual cost, staying there will often be cheaper than any other option. Moving to a smaller home means transaction costs, often fix-up costs, and given how high prices are, not necessarily a reduction in burn rate (as in freeing up equity is likely to translate no lower and probably higher current expenses).

Moving into a retirement community is even more expensive. Most require $400,000 to $500,000 deposits which are either not refundable or only partially refundable upon death. The big motivation for many to move in isn’t cost savings but the risk of needing more care later on (assisted living, nursing home care) and not being able to get into a “better” facility (retirement homes use the lower-cost “independent living” to subsidize the higher-care programs).

But even then, staying in one’s home and having care-givers come in is almost always cheaper than being in a nursing home…provided you can find a reliable service. That usually requires oversight by family members, and if they aren’t nearby, the higher-cost nursing home option is the default.

That is a long-winded way of saying that the Bloomberg posture of implicitly treating older people as selfish for not getting out of the way of young people ignores the realities of the need of retirees to minimize costs, which above all includes hanging on to housing. And that’s before you get to the psychological benefit of staying in a familiar setting with established neighbors and friends.

And for those who would argue that homeowners are standing in the way of needed denser development, let me quote liberally from an important post by Steve Waldman, using the poster child of housing stress, San Francisco, as his point of departure. I strongly suggest you read the entire piece in full. Key sections:

Conventional wisdom has coalesced on the notion that it is NIMBY-ism and exclusionary zoning that are responsible for the crazy, crazy housing prices in San Francisco and other high rent cities, and so the solution to the problem must be a bloody, painful battle to overcome greedy incumbents’ attachments to their homes and neighborhoods. But before we destabilize neighborhoods and displace humans in the name of housing supply, we might want to ask, will all that pain really address the problem? Sure, at the margin, more construction will yield lower prices. And I understand that, following construction boom years, rental prices have stabilized in cities like DC and Chicago.

But within developed cities, construction booms are short and finite. Chemotherapy may be worth the nausea and hairloss if it adds years to ones life, but would it be worth it for an extra week? Infill densification is socially painful and physically expensive in terms of demolition and retrofitting infrastructure. And, yes, buying off the evil NIMBY’s and the permitting authorities who serve them adds to those costs. But how many examples are there of cities that have grown their housing stock in place at anything like the rate that would be required to meet the burgeoning demand in San Francisco or New York? Before we wage war on ourselves, maybe we should inquire whether victory is plausibly achievable. And, if it isn’t, maybe we should come up with a different plan?…

. To people who characterize homeowners’ informal sovereignty over their neighborhoods as a subsidy to the “upper middle class” at the expense of the “economically vulnerable”, I’d ask a few simple questions.

- In a country where the homeownership rate is more than 63%, is it right to characterize homeowners broadly, even in San Francisco, as “upper-middle class”? Many homeowners have lived in their homes for years, and many new homeowners are mortgaged to the hilt.

- Given that even an ahistorical, sustained trebling of unit growth would probably only stabilize, not reduce, the real price of housing in San Francisco, is it fair to characterize the people who would be helped by increased space for new residents as the “economically vulnerable”?

- And given that, for perfectly understandable reasons, homeowners and residents resist fast-paced densification of their neighborhoods, which homeowners and residents would most likely be forced to tolerate changes they dislike or that threaten the value of properties? San Francisco has its share of stunningly beautiful neighborhoods affordable only to plutocrats. Will we put high-rises in those neighborhoods? Or, in the anodyne language of economists for every bad thing, will it be the economically vulnerable who must “adjust”?

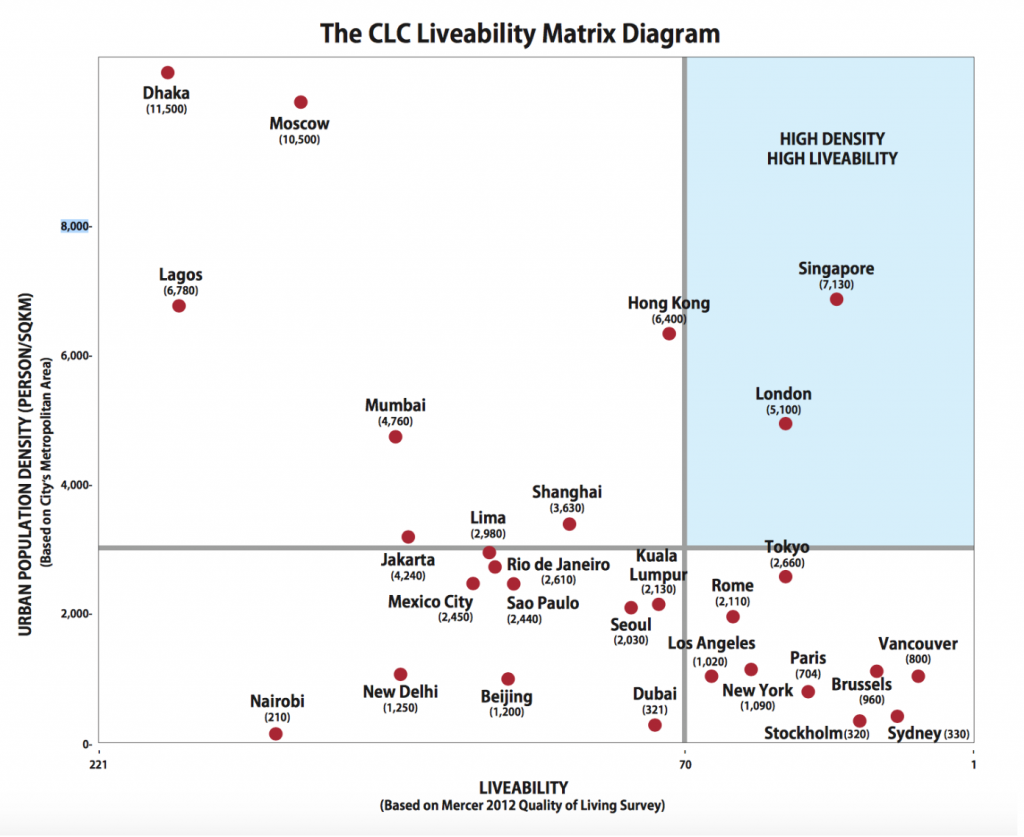

Is Tyler Cowen right, then? “Basically SF is ****ed?” No. San Francisco could be just fine. The thing about San Francisco is that while greenfields have been exhausted in the city, the San Francisco Bay Area is largely undeveloped. We are always arguing over San Francisco, or Palo Alto (ick). Outside of the 47 square miles of San Francisco proper are almost 3200 square miles in San Mateo, Santa Clara, Alameda, and Contra Costa counties. (I’ll leave out the hoity-toity North Bay counties — Marin, Sonoma, Napa — but if it’s Latin-America-style land reform you want, the vines there are ripe for revolution!) Nobody wants new suburban sprawl, thank goodness. But dense development is not sprawl, even when it is greenfield development. When I argue that Singapore is an example we look should look to, people think I’m trying to make some left-wing point about public housing. I’m not. I don’t actually care very much about that. What excites me about Singapore is this:

t’s silly to characterize what Singapore does as “basically greenfield suburban growth“. Singapore’s new towns are denser than any US city, and nicer than most of them. They are designed for their density, not retrofit. What distinguishes Singapore is a “can do”, dirigiste approach to developing new living space, and a remarkable competence at making density green and livable. Singapore is an exuberant site of architectural experimentation, in both private and public building projects. Singapore’s “new towns” can house 100,000 people in less than 5 square miles. In the San Francisco Bay Area, there is plenty of space for Singapore-style new towns. Even Back East, room could be found for these compact conurbations….

But it is in the San Francisco Bay Area, with its dreadful, painful housing situation, and its science fiction tycoons (several of whom individually could provide the necessary finance) where a full-scale, ecotechnological US microcity should really be attempted.

Back to the present post. Now some may point out that Manhattan has had an apartment construction boomlet and rentals have fallen to a meaningful degree. But even this burst of building is expected to take pressure off rents only till 2020, meaning even the addition of new units is merely providing some relief in a long-term trend of price increases.

Others may argue against new building for ecological reasons, although the tradeoff is that denser living is way more energy efficient, particularly if you incorporate decent public transportation into the plan.

But the bigger point is that many of the problems we face are being defined in terms of symptoms as opposed to root causes. Until we can properly define the real drivers, we will be putting band-aids on gunshot wounds.

We (the capitalist) need your house and neighborhood to gentrify for the yuppies. The boomers are sucking up a lot of wall street loot but there is a plan to cash in on boomers. Dying is going to be the next financial bubble. Hospice: A wall street cash cow. Doctor ‘corporations’ armed with end of life counseling from Obama Care. Doctors forced into cooperatives where they get paid more for not giving old folks health care, again, Obama Care. Assisted suicide laws are about the only bipartisan laws being passed in many states. In my small southern town, all three mortuaries have made major up grades to their faculties and advertise about as often as ambulance chasing lawyers.

My friend the ad guy told me that the ad industry and their customers see huge segments of the population as “dead weight” and they want them to either die, expensively, or move somewhere else, soon. Especially if they live in or near cities.

Its not personal.

“It’s the end of the world as we know it

And I feel fine!”

https://m.youtube.com/watch?v=Z0GFRcFm-aY

“Before we wage war on ourselves, maybe we should inquire whether victory is plausibly achievable. And, if it isn’t, maybe we should come up with a different plan?…” -Steve Waldman

Pursuing neoliberal economic goals *is* “waging war on ourselves”, imo.

Thanks for this post.

‘Absent a war or an epidemic, it’s unusual and alarming for life expectancies in developed countries to stop improving, let alone to worsen.‘

One example is the former Soviet Union, whose life expectancy had been flat since the 1960s, until it plunged with the collapse of empire and pauperization of pensioners.

Does this sound like any decaying empire we know? Here’s a clue:

Yeah, right! *flexes massive biceps* Our homeless camps are second to none. And no one beats our low, low heroin prices.

The hyperpower line was far more believable before Iraq.

Historically, it seems that the first qualification of the USA as a hyperpower took place in 1999, by French foreign minister Hubert Védrine.

Perhaps today a more appropriate moniker would be uberpower with all the crapification that term implies.

The ultimate standard of how successful a society is in delivering Life and the Pursuit of Happiness is life expectancy. By that standard Cuba is more successful than the USA in spite of having undergone two economic crisis where it couldn’t even deliver a minimal calorie diet for it’s people!

But we are a Hyperpower with 1400 legionaries’ outposts around the globe! One whose military/CIA has only achieved two total victories in three decades of permanent warfare.

1- The overthrow of Noriega in Panama because he demanded too big a cut of the drug laundering money that was needed to help support clandestine wars in Central America. Worked out perfectly, enabling Panama to become a world center for laundering corporate profits and avoiding taxation, not just drug money.

2- The overthrow of Qaddafi in Lybia because he threatened to move his trade in oil to a gold-based system. The resulting chaos provides a perfect training ground for jihadists that can be inserted into other problem countries in need of destabilization.

Meanwhile the military lost in Vietnam, Afghanistan,Iraq & Syria, and failed in their attempts to assassinate the Castro brothers, to mention the most prominent fiascos.

Looks more like a Hyperloop to me– one where the money goes around in a circle and comes back as a single penny after the “defense” and “homeland security” “industries” have had their way.

You forget the crushing victory against Granada (a midget adversary if there ever was one), and the belated victory in Nicaragua (by exhaustion of the adversary).

Kosovo, as well as various actions against Haïti, and the coups in Honduras and Egypt might be counted as victories, but their upside is elusive.

Somalia (then and now) and Lebanon have not been exactly successes though.

HYPE POWER.. as in Ponzi scheme.

I read somewhere that banks holding mortgages on foreclosed housing from the housing bubble burst have kept those houses off of the market to maintain higher housing and mortgage prices. I cannot confirm that, but if it is true, then there is a solid supply of available housing but due to market manipulation, er, free market economics, we end up with a shortage of housing for sale.

I have pictures of such a house. It’s just a few doors down from my mom’s place.

Yves and Lambert, want me to email them to you?

Ghost houses.

When I’ve driven cross country, I’ve seen entire ghost communities. Completely vacant.

You’ve likely read this in quite a few places. Yves has written extensively about the broken business model of being in the mortgage servicing business. Their incentives are such that they either do nothing or foreclose as quickly as possible as doing mortgage mods is labor-intensive as it has to be done on an individual basis.

So, yes, in many cases banks didn’t foreclose (for a number of reasons, not worth it, issues with chain of title, etc). Large numbers of houses were basically abandoned and neglected by banks. It did have a meaningful impact on supply in a lot of localities.

Keep in mind the Feds signed onto this policy with their approach to mortgage modifications which Tim Geithner openly admitted was about ‘foaming the runway’ so banks could have time to sort out their balance sheet problems.

I have a friend who actually works in foreclosures who is living in a home he hasn’t made a mortgage payment on in years. He went through a divorce right about the time of the meltdown and didn’t want to pay off the house only to have his ex take it anyway. BofA didn’t seem to care and never seriously contacted him or tried to foreclose.

Based on all the other foreclosures that were crossing his desk, he suspects that the reason they didn’t foreclose on him was precisely to try to keep property values up. Too many foreclosures lowering housing prices in the area would only put even more people underwater on their mortgage and tempt them to just walk away and the banks definitely don’t want that. Better to hold off and keep pretending they’re actually solvent.

That Bloomberg article is the kind of thing a person writes when his brains are hooked on the 1%’s favorite drug……..people dying before they should is a good thing because….. “money”……

I suspect that homeownership by the young is down not because seniors are holding on to supply, but because those who aspire to a middle class life start out saddled with a mortgage-equivalent level of student debt. To some extant the crazy lending and foreclosures of the RE Bubble and Bust have left younger Americans less interested in owning a house. And the precarious state of current employment leaves many understandably anxious about signing up for a 30 year mortgage.

Very true!

I agree, these articles smack of desperation when they at their core want people to move in order for the betters to take advantage of them (rural should move to the city, war refugees should invade another country, economic refugees should understand that they can undercut workers in other places, old people should supply sales stock to the poor poor maligned mortgage industry for the health of the young, etc…) They’re just pushing up bubbles and shearing the sheep and under the impression that they are so smart nobody knows what chicanery they are up to…. I’m with JT on this one and will add this for the geezers

https://www.youtube.com/watch?v=pFnNXGRGIzQ

Well, we should get used to people never being able to buy a home or likely soon even rent (because they wont have jobs) because that’s what our policy goals seem to be leading us towards.

A major concern among some people is people’s “unrealistic expectations” of employment. Not broken dreams and millions of people unable to ever get married and have a family. No, they worry about their reactions if they ever figure it out.

They have written off not just the Millennials, but really all of America – they wrote us all off a long long time ago.

The rights to us “have already been sold”, as Frank Zappa said.

BINGO,

I was on the train the other day chatting with a guy who was telling me that he and his wife were both recent law school grads with what seemed like decent, but unspectacular, jobs in their field. He said they had a combined $300K in loans.

On a side note, their jobs were around 100 miles apart from each other so they lived about 1/2 way between each job and, of course, both still had awful commutes.

Most millenials I know in their late 20s/early 30s are unmarried. Many do not even have long-term partners. Very few have children. This is a very different model from previous generations, so I think housing demand will be quite a bit different over the next decade.

This is likely one of the main goals of our healthcare policy, making sure their parents generations assets, perhaps the last generation that had decent jobs, don’t end up being passed down to the younger generation in as many cases as possible.

Thanks for the interfluidity link, good post. I was marveling at what Singapore is doing regarding combining density and a high standard of living. If I were on Twitter I might drop this…

Singapore: We’ve got one city, let’s make it really f-ing awesome!

http://www.dailymail.co.uk/news/article-3307668/The-bizarre-vertical-village-Singapore-named-World-Building-Year-spell-end-generic-tower-blocks.html

USA: Hold my beer while I frack the crap out of Pennsylvania, liquefy the gas, and ship it to Europe because OMG RUSSIA!!!

Thanks, Yves, for debunking the “Boomers aging in place are to blame for the housing crisis” argument and for observing that the root causes of the problem are rarely identified, much less grappled with.

What’s currently driving the insane housing prices in the Bay Area is the flood of property capital washed in by the tech tsunami and international investors looking for a safe return.

I’ve only glanced at the Steve Waldman piece that you cite at length. Right off, I didn’t see anything about high-end demand as a factor. Nor did I notice anything about meager government support for genuinely affordable housing.

I did note Waldman’s fondness for Singapore’s new towns–“extremely dense, but nevertheless green, livable, and attractive”–which he says could be a model for new housing in the Bay Area outside of San Francisco. Check out photos of those towns: they look like the “towers in a park” whose unlivable character Jane Jacobs nailed in Death and Life of Great American Cities.

Waldman assumes that endless growth is a given. Some growth IS a given–and a good one. But not endless growth. How much, then? Where, and what kind would be good? Let’s grapple with those questions.

Jacobs before the Fall

https://www.lrb.co.uk/v39/n15/owen-hatherley/where-are-all-the-people

[paywall]

I find the San Francisco situation bizarre. These are the very same people who are creating the technology to allow people to work from anywhere, anytime and yet they are lost if they aren’t clustered in a rabbit warren with ungodly high rents etc.

Much of the innovation and creativity over the past century or so in the US has occurred in the hinterlands of fly-over country (Corning in Elmira, NY, 3M in Minnesota, Ford and GM in Michigan, etc.). Many of these same areas have lots of land available, with cheap properties available for redevelopment simply by paying off tax liens. Keep in mind that nobody associated Seattle with computers in the early 1980s when Bill Gates & Co. set up shop there. Boeing was the high tech industry there.

US cities have also put so many restrictions on redevelopment that it is very difficult to increase density substantially. So either the local voters are going to have to vote in rezoning rules that allow for much higher density, or they need to rework their business model to go where the property is available, in some cases virtually for free.

Simply complaining that 65 year olds are occupying space that rightfully should belong to the Yuppies (\sarcasm) is showing a remarkably low level of problem-solving creativity.

BTW – by living in upstate NY, we have a fairly high degree of financial freedom because costs are relatively low. Our jobs would not allow us to live the way we do here if we were in some place like SF or NYC. People in our professions do get a pay boost if we move to those areas, but it is nowhere near enough to cover the extra housing and transportation costs and commute times.

It is really striking the extent to which North Americans are obsessed with municipalities and their borders, while most of the world is referring to metropolitan areas when it says “cities.” The “City of London” has only about 7000 full-time residents.

That makes it difficult to have a discussion. Of course San Francisco can’t handle all the new population, if by “San Francisco” you mean the compact municipality in the middle. Marin County gets to define itself as some kind of Grover’s Corners while it becomes a giant gated community.

If only there were some sort of government entity just above municipalities that could exercise leadership to distribute development rationally among different municipalities.

One of the tragedies of American politics was the move by new suburbs in mid-20th century to stop city annexation of outlying areas. These suburbs were either 1) new company towns like Dearborn outside Detroit or Cudahy and West Allis outside Milwaukee that were explicitly formed to evade city regulation and politics or 2) former farm communities that were able to “develop” as bedroom communities on the cheap. All over the midwest, at least, state politicians sided with the outlying areas over the cities, thus locking into place social and financial disparities that linger. One more stupidity of American politics.

In the Bay Area, there such an entity, the Metropolitan Transportation Commission, which recently completed its hostile takeover of the region’s Association of Bay Area Governments. MTC is a rogue state agency with no effective accountability to Bay Area residents. Its ‘build baby build” agenda advances the interests of the local growth machine (see: the Bay Area Council). I’ve written extensively about this for the San Francisco-based online publication 48 hills. Here’s one piece: http://48hills.org/2015/05/12/the-false-promise-of-regional-governance/

The “City of London” is a specific jurisdiction within London. It has its own charter going back to time inmemoriam. It’s the heart of the financial district. The only residential part is a big council flat development that has since been privatized called the Barbican.

In other words, the City of London does not equal London.

The worsening life expectancy, is a new form of “death panels” where decisions at the macro level (lack of universal healthcare) are having worse consequences for the general population. I’m sure the optiod crisis is another symptom of this perverse inaction. It’s unfortunate that we are not getting the type of politicized outrage that the right used during the healthcare debates of 2010.

I have the feeling that very few in the political class want to discuss lower life expectancy… They would have to address it, which is not on the approved list of “America is awesome!!!” topics. Plus they would have to discuss possible reasons, and nasty topics like diet and health care might come up.

The better classes know there are too many useless eaters. Sustainability is ultimately a rationale for depopulation.

I can see it now, ‘ How the opiate crisis is good for climate change”. Sarc/

Strengthening of pension funds in this way certainly seems an area in which tRump and kim jong un could cooperate to make astounding gains. Make America Glow Atomic. And less acolytes of gorka, bannon, et al consider me an ally;this comment was sarcastic.

As a European just following this site, I can’t help wondering whether there is not an increasing inverse correlation between dying younger and having a pension (other than Social Security)?

Little Finger’s quote in Game of Thrones “Chaos is a ladder” seems to be sum up those who support Neoliberalism – they’d prefer to be kings of ashes than ordinary people living in a Renaissance. And the “end” (being king) matters not the “means” (laying waste to everything to get there).

Some Boomers and Millennials are choosing the intergenerational living arrangement because it is ultimately more cost effective than splitting the household up. This also fuels the phenomenon of people staying in their homes.

This might be another sign that the United States is converging with Latin America and other developing countries although it will take time to end the cultural premium that people put on independent living.

I agree with Yves’ arguments but there are issues creating friction between generations.

I will give some arguments based on the situation in Canada.

1. Boomers came before the millenials so they typically have houses located closer to work. So the young get to endure the commutes using highways in disrepair and underfunded public transportation.

2. Owners of sfh in the city core typically do not pay enough taxes.. if we want more densification, they should be paying taxes for the equivalent of 6 dwellings or more which is what the muni gets from multiplexes using the same amount of land. Many current owners are from the older generation.

3. In BC, the 55+ can postpone paying their muni taxes until death or the sale of the house… So who balances the budget? It looks like it’s the young!

Michael Hudson has a good solution – taxes on land value.

http://michael-hudson.com/2013/07/china-avoid-the-wests-debt-overhead-a-land-tax-is-needed-to-hold-down-housing-prices/

The problem is the existing homeowners would fight this one.

The problem with a “land tax” in the current neoliberal-dominated social situation is that such a land tax would be used to drive all possible “house-rich income-poor” sfh homeowners out of their houses and into unpleasant elder-slums somewhere out of sight.

So naturally middle-aged and older sfh owner-dwellers would fight the land tax. Its real purpose would be to eliminate middle-aged and older sfh owner-dwellers from existence just the same way as Stalin’s liquidation of the kulaks was to eliminate peasants from existence.

Yves, I imagine that you could have stayed in the World of Easy Money, but chose not to. You are one of us.

(doffs hat)

“Homeowners” is a nice marketing concept.

But until you sell a home or pay it off, aren’t you just a “mortgage owner”?

http://www.businessinsider.com/mortgage-means-death-pledge-2016-3/

Debt-owners!

I’m wondering if we ought to transition to something like what the Swiss and Germans have – low rates of home ownership. Rent, higher density, and more money invested in mass transit.

On those housing costs in the Bay Area.

The mess has been getting worse for 40+ years.

Anyone could buy a house in the 50s.

In the 60s my minimum wage family with children and a dog, could rent an actual house with full size front and back yard in what would be Silicon Valley. Granted the area at the time was sketchy.

The rents were fine for most until about (I think) 1980, but buying a house was getting too much for most.

From the 80s forward, the rents have been climbing faster than wages.

And people have been having longer and commutes. Whining about my hour commute would die when someone would talk about that three hour commute. BTW that would be one way for both of us. It did put things in perspective.

It’s insane when making nearly six figures still makes you eligible for that unavailable housing assistance. The waiting list for Section 8 in most counties is closed (Marin since 2008)

Now if you have read this far in my written perambulation (thank you) something I’ve been puzzled by is the screeching contempt, even hatred (and strangely fear?) seems to get worse every year. When home owners especially the wealthy ones compare people with jobs as vermin or more often losers or maybe trashy, I have to wonder WTF are they they smoking? Most people are having problems in the Bay, yet those with the money, or at least got here early enough to make a buyin refuse to see the problem let alone work to fix it. It’s like those tech lords who are willing to finance anything, like a trip to Mars, but nothing that would help their neighbors.

2 points about comparing Singapore and SF

1) SF is in a seismic zone. High rises built for withstanding seismic event are expensive and even in Tokyo, are confined to very high end mixed development. As for Tesla cars, high rises may be a case of “Marie-Antoinette” solution.

2) One of the biggest strength of Singapore is the fact that most of the land is state land, meaning that low cost development doesn’t require the public to spend a fortune to acquire the land ( to be more exact, Singaporeans pay very high “market” prices in which a high cost of land is included, but it goes into the State coffers.) It is likely to stay that way because public housing is sold through 99 years leases, thus allowing the state to buy back old stock to refurbish it.

Reporting in from Puget Sound region, where just yesterday I heard from a 30-something whose rent in the city is up 30% suddenly. She has an *excellent* job and is about ready to leave the area.

Meanwhile, friends who tried to buy in the $800,000 range were beat out at least 6x by ‘cash buyers’. If the federal government does not crack down on EB-5 visas, whereby non-US buyers snap up properties for cash so that people who have jobs in the area have a horrendous housing market, I’m actually starting to think we’re going to have some kind of reckoning. You simply cannot let well educated, hard working, highly skilled, smart people unable to afford housing while non-nationals buy up properties in exchange for a visa, plus the right to profit from (ever increasing the) rents.

Also in the past 5 days, friends in Vancouver, WA having to move due to increased rents they refuse to pay. They’ll go out to what’s left of ‘the country’, which means more urban creep. Same in Puget Sound region. And every single on my friends and relatives in small towns between Seattle and Boise are reporting ‘urban refugees’ moving in droves to Wenatchee, Spokane, Coeur d’Alene, Boise, Bellingham, and smaller towns in between. This is, yet again, whacking out housing prices for the locals.

The EB-5 visas are driving part of this mess, and not in a good way.

That Bloomberg article reminds me of when the market bros were warily eyeing the Trump trade and yelling & screaming for a big tax cut, while Trump released his fantasy austerity budget (targeting Meals on Wheels, etc) and the ghoulish Paul Ryan was launching his attack on Medicaid, while shifting the Obamacare subsidies up the income ladder, and giving a huge tax cut to the 1%.

Is this really the best that Anglo-American capitalism can do? I’ve long had a social democratic sensibility, but this exceeds all my expectations.