This is Naked Capitalism fundraising week. 1582 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser,what we’ve accomplished in the last year and our current goal, more original reporting.

Yves here. Readers may have fun with “Shorter” takes on this post. My submission: “What about secular stagnation don’t you understand?”

By Raúl Ilargi Meijer, editor of Automatic Earth. Originally published at Automatic Earth

“The Cost of Missing the Market Boom is Skyrocketing”, says a Bloomberg headline today. That must be the scariest headline I’ve seen in quite a while. For starters, it’s misleading, because people who ‘missed’ the boom haven’t lost anything other than virtual wealth, which is also the only thing those who haven’t ‘missed’ it, have acquired.

Well, sure, unless they sell their stocks. But a large majority of them won’t, because then they would ‘miss’ out on the market boom… Some aspects of psychology don’t require years of study. Is that what behavioral economics is all about?

And it’s not just the headline, the entire article is scary as all hell. It reads way more like a piece of pure and undiluted stockbroker propaganda that it does resemble actual objective journalism, which Bloomberg would like to tell you it delivers. And it makes its point using some pretty dubious claims to boot:

The Cost of Missing the Market Boom Is Skyrocketing

Skepticism in global equity markets is getting expensive. From Japan to Brazil and the U.S. as well as places like Greece and Ukraine, an epic year in equities is defying naysayers and rewarding anyone who staked a claim on corporate ownership. Records are falling, with about a quarter of national equity benchmarks at or within 2% of an all-time high.

If equity markets in places like Greece and Ukraine, ravaged by -in that order- financial and/or actual warfare, are booming, you don’t need to fire too many neurons to understand something’s amiss. Some of their companies may be doing okay, but not their entire economies. Their boom must be a warning sign, not some bullish signal. That makes no sense. Stocks in Aleppo may be thriving too, but…

“You’ve heard people being bearish for eight years. They were wrong,” said Jeffrey Saut, chief investment strategist at St. Petersburg, Florida-based Raymond James, which oversees $500 billion. “The proof is in the returns.” To put this year’s gains in perspective, the value of global equities is now 3 1/2 times that at the financial crisis bottom in March 2009.

If markets crash by, pick a number, 20-30-50% next week, will Mr. Saut still claim “The proof is in the returns”? I doubt it. Though this time he might be right. As for the ‘value’ of global equities being 250% (give or take) higher than in March 2009, does that mean those who were -or still are- bearish were wrong? Or is there some remote chance that the equities are part of a giant planetwide bubble?

Aided by an 8% drop in the U.S. currency, the dollar-denominated capitalization of worldwide shares appreciated in 2017 by an amount – $20 trillion – that is comparable to the total value of all equities nine years ago. And yet skeptics still abound, pointing to stretched valuations or policy uncertainty from Washington to Brussels. Those concerns are nothing new, but heeding to them is proving an especially costly mistake.

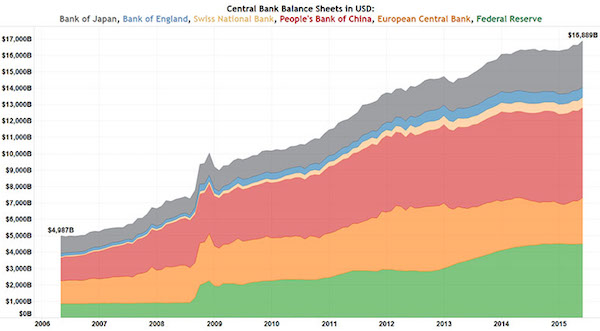

$20 trillion. That’s a lot of dough. It’s what all equities in the world combined were ‘worth’ 9 years ago. It’s also, oh irony, awfully close to the total increase in central bank balance sheets, through QE etc. Might the two be related in any way?

Clinging to such concerns means discounting a harmonized recovery in the global economy that’s virtually without precedent – and set to pick up steam, according to the IMF. At the same time, inflation remains tepid, enabling major central banks to maintain accommodative stances.

‘Harmonized recovery’ is a priceless find. But you have to feel for anyone who believes it. And it’s obviously over the top ironic that central banks are said to be ‘enabled’ to keep rates low precisely because they fail to both understand and raise inflation. Let’s call it the perks of failure.

“When policy is easy and growth is strong, this is an environment more conducive for people paying up for valuations,” said Andrew Sheets, chief cross-asset strategist at Morgan Stanley. “The markets are up in line with what the earnings have done, and stronger earnings helped drive a higher level of enthusiasm and a higher level of risk taking.”

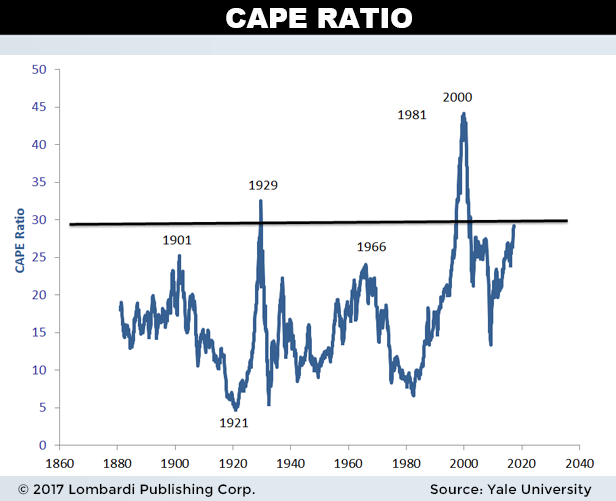

Oh boy. He actually said that? What have earnings done? He hasn’t read any of the warnings on P/E (price/earnings) for the (US) market in general –“the Shiller P/E Cyclically Adjusted P/E, or CAPE, ratio, which is based on the S&P 500’s average inflation-adjusted earnings from the previous 10 years, is above 30 when its average is 16.8”– or for individual companies (tech) in particular?

The CAPE ratio has been higher than it is now only twice in history: right before the Great Depression and during the dotcom bubble, when tech companies didn’t even have to be able to fog a mirror to attract billions in ‘capital’. And the chief cross-asset strategist at Morgan Stanley says markets are in line with earnings? Again, oh boy.

No, it’s not earnings that “..helped drive a higher level of enthusiasm and a higher level of risk taking.” Cheap money did that. Central banks did that. As they were destroying fixed capital, savings, pensions.

The numbers are impressive: more than 85% of the 95 benchmark indexes tracked by Bloomberg worldwide are up this year, on course for the broadest gain since the bull market started. Emerging markets have surged 31%, developed nations are up 16%. Big companies are becoming huge, from Apple to Alibaba.

Look, emerging markets and developed economies have borrowed up the wazoo. Because they could. Often in US dollars. That may cause a -temporary- gain in stock markets, but it casts a dark spell over the reality of these markets. If it’s that obvious that a substantial part of your happy news comes from debt, there’s very little reason to celebrate.

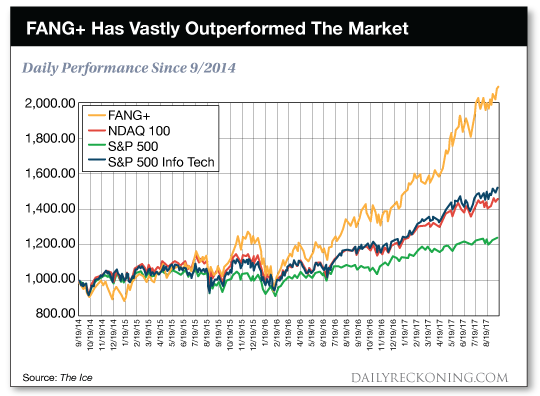

Technology megacaps occupy all top six spots in the ranks of the world’s largest companies by market capitalization for the first time ever. Up 39% this year, the $1 trillion those firms added in value equals the combined worth of the world’s six-biggest companies at the bear market bottom in 2009. Apple, priced at $810 billion, is good for the total value of the 400 smallest companies in the S&P 500.

To cast those exact same words in a whole different light, no, Apple is not ‘good for the total value of the 400 smallest companies in the S&P 500’. Yes, you can argue that Apple’s ‘value’ has lifted other stocks too, but this has happened in a time of zero price discovery AND near zero interest rates. That means people have no way to figure out if a company is actually doing well, so it’s safer to park their cash in Apple.

Ergo: Apple, and the FANGs in general, take valuable money out of the stock market. At the same time that they, companies with P/E earnings ratios to the moon and back, buy back their stocks at blinding speeds. So yeah, Apple may be ‘good’ for the total value of the 400 smallest companies in the S&P 500, but at the same time it’s not good for that value at all. It’s killing companies by sucking up potential productive investment.

And Apple’s just an example. Silicon Valley as a whole is a scourge upon America’s economy, hoovering away even the cheapest and easiest money and redirecting it to questionable start-up projects with very questionable P/E ratios. But then, that’s what you get without price discovery.

Overall, U.S. corporate earnings are expected to rise 11% this year, on track to be the best profit growth since 2010. And after years of disappointments, European profits are set to climb 14% in 2017, Bloomberg data show. The expectations for both regions are roughly in line with forecasts made at the beginning of the year, defying the usual pattern of analysts downgrading their estimates as the months go by.

Come on, the European Central Bank has been buying bonds and securities at a rate of €60 billion a month for years now. How can it be any wonder that officially stock markets are up 14%? Maybe we should be surprised it’s not 114%. Maybe the one main point in all of this is that the ECB is still buying at that rate, and thereby signaling things are still as bad as when they started doing it.

Meanwhile, Asia is home to some of the world’s steepest rallies, led by Hong Kong stocks that are up 29% this year. Shares in Tokyo also hit fresh decade highs this week, bolstered by investor confidence before the local corporate earnings season and a snap election this month. “Asia will benefit from continued improving regional growth, stable macroeconomic conditions and undemanding valuations,” said BNP Paribas Asset Management’s head of Asia Pacific equities Arthur Kwong. Any pullback in Asian equities after the year-to-date rally presents a buying opportunity for long-term investors, he wrote in a note.

In Japan, so-called investor confidence is based solely on the Bank of Japan continuing to purchase anything that’s not bolted down. In China, the central bank buys the kitchen sink as well. How, knowing that, can you harp on about increased investor confidence? As if central banks taking over entire economies either isn’t happening, or makes no difference to economies? Buying opportunity?

Global economic growth has been robust in most places, with Europe finally joining the party and the euro-area economy on track for its best year since at least 2010. The region’s steady recovery has eclipsed worries about populism, which a few years ago would have been enough to derail any stock market rally.

No, global economic growth has not been ‘robust’. Stock market growth perhaps has been, but that’s only due to QE and buybacks. Still, stock markets are not the economy.

“I’ve never been so optimistic about the global economy,” said Vincent Juvyns, global market strategist at J.P. Morgan Asset Management. “Ten years after the financial crisis, Europe is recovering and we have synchronized economic growth around the world. Even if we get it wrong on a country or two, it doesn’t change the big picture, which is positive for the equity markets.”

Oh man. And at that exact moment the ECB announces it wants to cut its QE purchase in half by next year.

Nowhere is the shifting sentiment more pronounced than in Europe, where global investors began the year with a election calendar looming like a sword of Damocles. Ten months later, the Euro Stoxx 50 Index is up 10%, Italy’s FTSE MIB Index is up 17% and Germany’s DAX Index is up 13%. The rally is even stronger when priced in U.S. dollars, with the Euro Stoxx 50 up 23% since the start of the year.

Sure, whatever. I don’t want to kill your dream, and I don’t have to. The dream will kill itself. You’ll hear a monumental ‘POP’ go off, and then you’re back in reality.

Misquoting a Keynes misquote: markets can remain irrational for a long time.

So for those that rode the market up, extracted something real from the gains and then end up riding it down are still better off. Oh, yeah: avoid leverage.

Bill, who really knows what rational and irrational actually mean in the instant financial environment, an environment in which debt is being allowed to function, in many ways, as an asset rather than as a liability.

I only know two things with certainty … first, that every investor I speak with and asset manager I respect is frightened beyond any measure I have experienced before in an rising equity market and second, that approximately half of my contacts fear that we will awaken one morning to the beginning of a war that will not easily be contained (many use the term, miscalculation).

So rather that being a moment or period of extreme euphoria this feels more like the ‘mother’ of all walls of worry.

Shorter version: “the time to sell is when they start targeting the propaganda to buy at the shoeshine boy”

??

Financial bubbles used to work in a fashion where there was oh so much confidence on the way up, and a leper-like quality to whatever was the object of desire once they start on their way down.

When the housing bubble got reignited here after collapse in 2008’ish, I was frankly shocked that it could happen, but I was thinking of the old ways, which used to make sense.

Seeing as there’s a bubble in oh so many ways now (fancy a $100 million+ 20th century painting, do ya?) the bust is gonna be epic.

I am hoping that owning the few remaining undervalued stocks will give me some sort of cover. I am also hoping that the long history of dividend payments from these companies will not drop as precipitously as their prices. I am also hoping that the amount of cash I am holding will take me through the worst of the crash.

Beyond that, I am not going to try to time the market.

It is difficult not to conclude that globally, central bankers cannot seem to apply what they learned in Econ 101 (which is all most of us ever understood). Markets will always be best explained by Chaos theory, and thus it is best for central banks to head off bubbles rather than lend more inflation to them out of political concern. In 2008, Obama bailed out the wrong sector merely kicking the can down the road. Had he bailed out Main Street, the bubble would be smaller, and there would be more cash chasing after goods instead of the next spin of the stock market wheel of fortune.

Most of us put our coin in ETFs and mutual funds in the hope that we will still have some wealth in whichever sectors survive the impending crash that our governments have brought upon themselves. It’s just a damned shame that unlike 1929, the windows of most high rise office buildings no longer open for easy egress. Well, there is always street fentanyl.

Markets will always be

bestonly explained by Chaos theory…not difficult to explain markets…read history…

I’ve discovered Roger Penrose on YouTube. He just explained cosmological inflation as tubular rather than parabolic. Like one long perpetual piston back-pressured by dark matter barriers when enough entropy builds up – like snake grass sectioned off and growing into eternity and it all works because time=matter=frequency=time. And entropy fills the end stage of an aeon like raindrops in a pond. And then a new aeon begins. The universe just devalues an goes on forever. Mark Blythe might like this. We should just let it rain.

They sure make it tough to get out or stay on the sidelines – case in point, Fidelity’s Fixed Income earns exactly 0%. I moved assets from S&P fund in March and feel like a shmuck as I’m not only not earning anything, I get the pleasure of paying fees for my non-participation.

A couple of old cliches:

“Buy low & sell high” – Apparently, no longer operational.

“There’s a sucker born every minute” – seems the “global market analysts” still believe in this one (and probably with good reason)

Evaluating anything and ignoring all save the end product is jaw-dropping foolishness. In poker and gambling, it’s called “playing the results”. You’re gonna up up broke, and will never see it coming. Minsky had it right; capitalism’s instability is the power to turn doing good into speculative fervor.

…follow the $$$$; it’s not difficult:

“JPMorgan Chase shrewdly parks virtually all of its vast derivatives holdings in its commercial bank subsidiary. In the event of a collapse, the bank can use its deposit base to pay off the derivatives, while leaving the Federal Deposit Insurance Corporation to reimburse depositors if their money runs out. This is not a trivial technicality. JPM is the world’s largest purveyor of derivatives. Its total contracts have a notional value of $72 trillion—and 99 percent of them are booked at its FDIC-insured bank. In the event of failure, sorting out the claims and counterclaims will be a costly nightmare for the FDIC. The bulk of the contracts are “plain vanilla” derivatives used as standard hedges against price or currency changes. The exotic derivatives, however, are dangerous—the kind that suddenly blew up in Dimon’s face some weeks ago, when his bank swiftly lost at least $3 billion on one complicated market gambit, with maybe more losses to come.

We are “insuring” other big boys of banking in the same way. Citigroup has nearly all of its $53 trillion in derivatives in its FDIC-insured bank; Goldman Sachs has $44 trillion parked at an FDIC-backed institution. After Bank of America purchased Merrill Lynch, BofA began transferring the securities firm’s derivatives to the FDIC-insured bank, which now holds $47 trillion in contracts. When Senators Sherrod Brown and Carl Levin, among others, complained that regulators’ acquiescence in these transfers contradicted Congressional instructions in the 2010 Dodd-Frank reform law, the Federal Reserve, the FDIC and the Treasury Department’s Office of the Comptroller of the Currency refused to answer their objections. This matter involves “confidential supervisory” and “proprietary business information,” the three agencies responded in unison.”

https://www.thenation.com/article/why-fdic-insuring-jamie-dimons-mistakes/

…one might even say, “telling”…

$ 47 trillion in derivatives at Deutsche bank is I think Europe’s largest version of ” What could possibly go wrong ? “.

Thanks to interest rate suppression below the rate of inflation through central bank QE over the past nine years, suppression of Market Volatility through ‘risk parity’ funds and futures, trillions of dollars of corporate stock buybacks funded with debt that have so enriched a generation of CEOs, direct purchases of equities by central banks or their agents, a constant barrage of corporate media spin and taunting of market nonparticipants such as Ilargi pointed out here, massive engineered short squeezes, HFT algorithms to prevent price discovery, and other devices, I am once again reminded of the “WUN’ERFUL, WUN’ERFUL!” parody of the old Lawrence Welk Show by comedian Stan Freberg when he repeatedly called out, “Turn off the bubble machine!”

Funny how the corporate media presents stock prices as being the product of Mom’s and Pop’s freely made decisions in a “free market” environment. Never a mention of centrally planned policies of financial repression and wealth concentration to benefit a small segment of the population both economically and politically. Where’s the SEC?… or are we just to blame it all on economist Larry Summers’ observation that artificially low interest rates over long time periods cause asset bubbles and high systemic debt leverage, but that repeated asset bubbles are not such a bad thing in an era of “secular stagnation”?

Appreciated former IMF chief economist Simon Johnson’s 2009 article about the three different kinds of bubbles. Believe this one can best be characterized as a “Type 3” political bubble where rising asset prices generate wealth that are fed into the political process. (See: https://baselinescenario.com/2009/07/24/after-peak-finance-larry-summers-bubble/ )

As I understand it, the US government have thrown about thirty trillion dollars away to bail out Wall Street since 2008 and to make the billionaire’s investments whole. That is why there has never been a real recovery for the economy. Just to be sarky, what would have happened if the US government had mailed a cheque for one million dollars to very adult in the United States instead with the proviso that any debts that that citizen had would have to have been paid off with that money first.

Could you imagine it? Student loans – paid! Mortgages – paid! Car payments – paid! Wall Street would have wailed at all the lost interest from these people but all this money in circulations might have lead to a renewed boom. Tens of thousands of people would have used the money to open new businesses and with most citizens freed of the crushing burden of debt, would be more willing to spend money in the economy and to commit to starting families.

Would there have been abuses and wasted money on stuff like drugs, gambling, etc.? You bet. But it would have been minor compared to the wastage of most of that thirty trillion in over inflated property, assets, stock buybacks, etc. that has been the case up to date.

…some of us “paid off” those debts circa 2004, when bush-cheney allowed credit card lobbyist re-write of bankruptcy law…realizing this meant millions of americans were going into bankruptcy….

We didn’t realize banksters would be bailed out (“0” accountability)-allowed place their fraudulent derivatives under FDIC auspices (Sheila Bair certainly didn’t allow-Obama did-which HC “more of same”, enabled trump), “trusting” this was another period of everyone losing everything – historical U.S. economic reset…

Just Over Half of Americans Own Stocks, Matching Record Low

Retail investors are sitting this one out. However, I’m concerned about overleverage, and the record stock buybacks due to cheap borrowing hiding the drop in absolute revenue growth. That and the draining of liquidity as central banks shrink their balance sheets. Bubbles past, in this country and others, did not form their “blow-off” tops until the retail investors were all in. That being said, every financial crisis is diffrerent from the last and the next will not resemble those of 1929, 1987, 2000, or 2007.

What a wonderful read! So many gems …

This one got my attention early:

“If equity markets in places like Greece and Ukraine, ravaged by -in that order- financial and/or actual warfare, are booming, you don’t need to fire too many neurons to understand something’s amiss.”

Too right. No circumstance too tragic to impede the onslaught of profiteering.

One thing not mentioned (re: Japan): even though Illargi is talking largely about equities, he does articulate that Central Banks have made money cheap as it were. Let’s not forget, however, that BoJ interest rate is currently negative – utter madness that also upends the traditional view of investor confidence as it relates to interest rates (where money supposedly follows higher return).

In fact, as adam smith said: profits are made faster in countries going faster to ruin.

There is no contradiction whatsoever in stock markets booming while the economy at large is dying.

What about the way the stawk market is measured don’t you understand?