By Hubert Horan, who has 40 years of experience in the management and regulation of transportation companies (primarily airlines). Horan has no financial links with any urban car service industry competitors, investors or regulators, or any firms that work on behalf of industry participants

Previous Naked Capitalism Uber analysis now published as a law journal article

My Naked Capitalism series is the only (to my knowledge) analysis of Uber that assembled a complete picture of Uber’s profitability over time from the various fragmentary press reports about financial results. It argued that all the available factual evidence about Uber’s actual financial performance and competitive economics indicated that Uber’s business model could never produce sustainable profits unless it was able to exploit significant anti-competitive market power. None of the contrary claims made by Uber supporters have been backed by any objective economic data. Most media coverage totally ignores the abysmal economics and as a result can’t provide coherent explanations of Uber’s recent scandals and governance battles.

The material that had originally been presented across ten NC posts is now available in a single article[1] published in the Transportation Law Journal and available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2933177. The journal format allows for much more exhaustive documentation of evidence than internet posts, and makes it easier to demonstrate linkages between different aspects of the Uber story.

Newly released data affirm and strengthen my previous finding that Uber is hopelessly unprofitable

Since it is impossible to understand Uber’s behavior without first understanding its actual financial performance, I have updated the data that was presented in Section II-A of the TLJ article and in several parts of this NC series.[2]

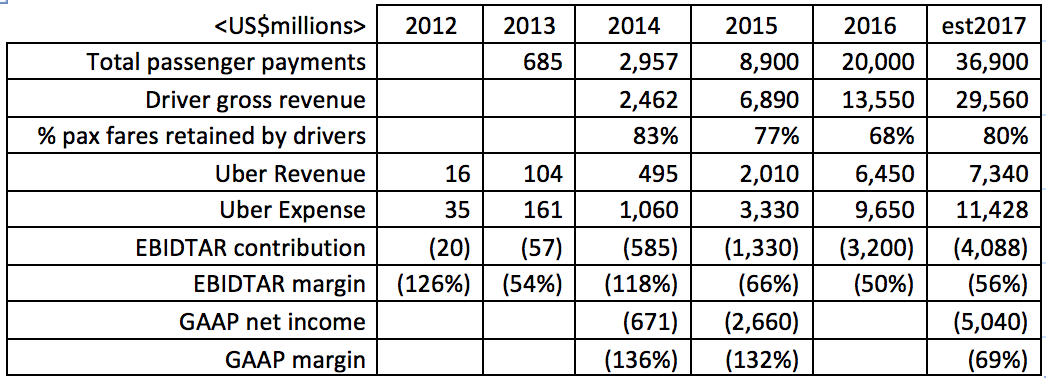

On December 1st, Eric Newcomer of Bloomberg published a new batch of Uber financial data that had been included in a prospectus related to SoftBank’s potential acquisition of Uber shares.[3] The Uber historical P&L table below combines all available data and shows Uber full year results from 2012 to 2016; the estimated 2017 results are the actual 2nd/3rd quarter results reported by Newcomer multiplied by two.[4] Uber has never challenged the accuracy of any of the P&L data that has appeared in the press.

The updated data demonstrates that Uber, in its eighth year of operations, continues to experience P&L losses that are staggering and still steadily growing, The data affirms that since there is no evidence of strong, ongoing profit improvement due to increasing efficiency or powerful scale/network economies, there is no basis for claiming that Uber can rapidly grow into profitability.

The data shows that while margin improvement occurred in 2015/16, it can be entirely explained by cuts in driver compensation unilaterally imposed by Uber, not by improved efficiency. New 2017 data strengthens the finding that the overall Uber business model (the combination of Uber and its nominally independent drivers) is not viable, and that all of Uber’s growth to date is due to billions in predatory subsidies. Those unilateral driver compensation cuts still left Uber billions short of breakeven but threatened the rapid growth its valuation was based on; reversing the cuts restored volume growth but pushed annual losses towards $5 billion.

Uber lost $2.5 billion in 2015, probably lost $4 billion in 2016, and is on track to lose $5 billion in 2017.

The top line on the table below shows is total passenger payments, which must be split between Uber corporate and its drivers. Driver gross earnings are substantially higher than actual take home pay, as gross earning must cover all the expenses drivers bear, including fuel, vehicle ownership, insurance and maintenance.

Most of the “profit” data released by Uber over time and discussed in the press is not true GAAP (generally accepted accounting principles) profit comparable to the net income numbers public companies publish but is EBIDTAR contribution. Companies have significant leeway as to how they calculate EBIDTAR (although it would exclude interest, taxes, depreciation, amortization) and the percentage of total costs excluded from EBIDTAR can vary significantly from quarter to quarter, given the impact of one-time expenses such as legal settlements and stock compensation. We only have true GAAP net profit results for 2014, 2015 and the 2nd/3rd quarters of 2017, but have EBIDTAR contribution numbers for all other periods.[5]

Uber had GAAP net income of negative $2.6 billion in 2015, and a negative profit margin of 132%. This is consistent with the negative $2.0 billion loss and (143%) margin for the year ending September 2015 presented in part one of the NC Uber series over a year ago.

No GAAP profit results for 2016 have been disclosed, but actual losses likely exceed $4 billion given the EBIDTAR contribution of negative $3.2 billion. Uber’s GAAP losses for the 2nd and 3rd quarters of 2017 were over $2.5 billion, suggesting annual losses of roughly $5 billion.

While many Silicon Valley funded startups suffered large initial losses, none of them lost anything remotely close to $2.6 billion in their sixth year of operation and then doubled their losses to $5 billion in year eight. Reversing losses of this magnitude would require the greatest corporate financial turnaround in history.

No evidence of significant efficiency/scale gains; 2015 and 2016 margin improvements entirely explained by unilateral cuts in driver compensation, but losses soared when Uber had to reverse these cuts in 2017.

Total 2015 gross passenger payments were 200% higher than 2014, but Uber corporate revenue improved 300% because Uber cut the driver share of passenger revenue from 83% to 77%. This was an effective $500 million wealth transfer from drivers to Uber’s investors. These driver compensation cuts improved Uber’s EBIDTAR margin, but Uber’s P&L gains were wiped out by higher non-EBIDTAR expense. Thus the 300% Uber revenue growth did not result in any improvement in Uber profit margins.

In 2016, Uber unilaterally imposed much larger cuts in driver compensation, costing drivers an additional $3 billion.[6] Prior to Uber’s market entry, the take home pay of big-city cab drivers in the US was in the $12-17/hour range, and these earnings were possible only if drivers worked 65-75 hours a week.

An independent study of the net earnings of Uber drivers (after accounting for the costs of the vehicles they had to provide) in Denver, Houston and Detroit in late 2015 (prior to Uber’s big 2016 cuts) found that driver earnings had fallen to the $10-13/hour range.[7] Multiple recent news reports have documented how Uber drivers are increasing unable to support themselves from their reduced share of passenger payments.[8]

A business model where profit improvement is hugely dependent on wage cuts is unsustainable, especially when take home wages fall to (or below) minimum wage levels. Uber’s primary focus has always been the rate of growth in gross passenger revenue, as this has been a major justification for its $68 billion valuation. This growth rate came under enormous pressure in 2017 given Uber efforts to raise fares, major increases in driver turnover as wages fell, [9] and the avalanche of adverse publicity it was facing.

Since mass driver defections would cause passenger volume growth to collapse completely , Uber was forced to reverse these cuts in 2017 and increased the driver share from 68% to 80%. This meant that Uber’s corporate revenue, which had grown over 300% in 2015 and over 200% in 2016 will probably only grow by about 15% in 2017.

If Uber had any ability to exploit the type of powerful efficiency and scale driven improvements that rapidly drove other tech companies towards sustainable profitability, one would see clear-cut evidence in this P&L table. There are undoubtedly a number of things Uber could do to reduce losses at the margin, but it is difficult to imagine it could suddenly find the $4-5 billion in profit improvement needed merely to reach breakeven.

The P&L data illustrates why Uber cannot go public

Under Travis Kalanick, Uber had no interest in an IPO because he fully understood that the full financial disclosures required—including historical cash flows, balance sheets and much greater operational P&L detail—would expose Uber’s abysmal economics, and destroy its PR narrative where powerful efficiencies would inevitably lead to success. Dara Khosrowshahi, under pressure from certain Board factions when he was first hired to replace Kalanick, promised an IPO by the end of 2019. This could be a disaster unless Uber somehow finds convincing evidence of profitable economics that it can put in the prospectus.

If Uber had accounting data that could demonstrate billions in efficiencies and a clear path to profits, they have ample incentive to share that data with reporters. Since they have not done that, it is reasonable to assume that evidence does not exist, and the additional data that would emerge during an IPO would actually strengthen the case that (in the absence of significant anti-competitive market power) Uber’s business model can never produce sustainable profits.

[1] Horan, Hubert, Will the Growth of Uber Increase Economic Welfare? 44 Transp. L.J., 33-105 (2017)

[2] That data, which had been leaked in dribs and drabs between August 2015 and April 2017, included the full years 2012-14, but only selected quarters in 2015 and 2016.

[3] Newcomer, Eric, Will Uber Ever Stop The Bleeding?, Bloomberg, 1 Dec 2017. Softbank’s tender offer is conditional on acquire a minimum of 14 percent of Uber shares at a price that would reflect a roughly 30% discount from Uber’s last valuation. All publically available data is strictly limited to high level corporate P&L numbers; no balance sheet, cash flow or regional/product level reports have been released.

[4]. Data from the Softbank prospectus fills in the missing 2015 and 2016 data, and also provided results for the second and third quarter of 2017. There are some minor discrepancies between data released at different points in time; the P&L table uses the most recently released data. Limited first quarter of 2017 data had been released in May, but the Uber revenue number was wildly higher than previous or subsequent quarters. Bensinger, Greg, Uber Posts $708 Million Loss as Finance Head Leaves, Wall Street Journal, 1 Jun 2017

[5] Neither GAAP profit or EBIDTAR contribution includes expenses not directly related to current operations, such as long-term IT/market development costs, or expenses related to autonomous cars

[6] Given gross passenger payments of $20.0 billion in 2016, driver compensation was reduced by $3 billion due to Uber’s unilateral decision to cut the driver’s share from 83% (2014) to 68%

[7] See the TLJ article pp.46-49; the Denver/Detroit/Houston study is cited at note 37.

[8] One report cited the need for drivers to work marathon shifts focused on surge pricing periods. Masha Goncharova, Ride-Hailing Drivers are Slaves to the Surge, N.Y. Times (Jan. 12, 2017). Another report noted the increasing need for Uber drivers to actually sleep in their cars. Eric Newcomer & Olivia Zaleski, When Their Shifts End, Uber Drivers Set up Camp in Parking Lots across the U.S., Bloomberg News (Jan. 23, 2017). A third report confirmed the marathon shifts and sleeping in cars, and compared Uber drivers to “migrant workers.” See Carolyn Said, Long-Distance Uber, Lyft Drivers’ Crazy Commutes, Marathon Days, Big Paychecks, S.F. Chronicle (Feb. 18, 2017).

[9] Observed driver turnover would have been even higher, but most Uber drivers are locked into vehicle financing arrangements, and thus have no short-term ability to move to other jobs.

“Uber’s business model can never produce sustainable profits”

Two words not in my vocabulary are “Never” and “Always”, that is a pretty absolute statement in an non-absolute environment. The same environment that has produced the “Silicon Valley Growth Model”, with 15x earnings companies like NVIDA, FB and Tesla (Average earnings/stock price ratio in dot com bubble was 10x)…will people pay ridiculous amounts of money for a company with no underlying fundamentals…you damn right they will! Please stop with the I know all…no body knows anything, especially the psychology and irrationality of markets which are made up of irrational people/investors/traders.

My thoughts exactly. Seems the only possible recovery for the investors is a perfectly engineered legendary pump and dump IPO scheme. Risky, but there’s a lot of fools out there and many who would also like to get on board early in the ride in fear of missing out on all the money to be hoovered up from the greater fools. Count me out.

Share a thought for employees. Greed knows no bounds.

…”Two former Uber employees, both of whom left the company in 2016, told Quartz that Uber gave them just 30 days after departing to exercise their options. One of those former employees paid about $100,000 to exercise more than 20,000 incentive stock options (ISOs), plus a tax bill of over $200,000. The other paid about $70,000 to exercise about 5,000 ISOs, and then about $160,000 in taxes. Both former employees took out loans from family members to make the payments, and requested anonymity to discuss their personal financial situations.”

https://qz.com/1149381/uber-softbank-shares-debt/

I don’t understand what this means or the ramifications for the employees.

It means the Uber kool-aid is delicious.

Seriously, it means that employees of the company, are making huge personal bets (At least, $300k is huge to me) that there will be a successful IPO, and I would imagine they believe it will be very successful.

This anecdote doesn’t tell us the number of options purchased, or what kind of shares they allow purchase of, or strike price, etc. So we don’t know how much the employees stand to gain.

Will they at least be able to recover the $200k in taxes if the IPO is a failure? Or is that a sunk cost, just like the purchase of the options?

The author clearly distinguishes between GAAP profitability and valuations, which is after all rather the point of the series. And he makes a more nuanced point than the half sentence you have quoted without context or with an indication that you omitted a portion. Did you miss the part about how Uber would have a strong incentive to share the evidence of a network effect or other financial story that pointed the way to eventual profit? Otherwise (my words) it is the classic sell at a loss, make it up with volume path to liquidation.

apples and oranges comparison, nvidia has lots and lots of patented tech that produces revenue, facebook has a kajillion admittedly irrational users, but those users drive massive ad sales (as just one example of how that company capitalizes itself) and tesla makes an actual car, using technology that inspires it’s buyers (the put your money where your mouth is crowd and it can’t be denied that tesla, whatever it’s faults are, battery tech is not one of them and that intellectual property is worth a lot, and tesla’s investors are in on that real business, profitable or otherwise) Uber is an iphone app. They lose money and have no path to profitability (unless it’s the theory you espouse that people are unintelligent so even unintelligent ideas work to fleece them). This article touches on one of the great things about the time we now inhabit, uber drivers could bail en masse, there are two sides to the low attachment employees who you can get rid of easily. The drivers can delete the uber app as soon as another iphone app comes along that gets them a better return…

Go read Hubert’s series. All you have is a handwave. He has relentlessly documented how Uber inherently has inferior economics to traditional taxi companies. And there are low barriers to entry. Uber can’t kill the competition and raise prices. Ridership will fall off a cliff and more important, competitors will enter at a lower price point.

Yet another source (unintended) of subsidies for Uber, Lyft, etc.,

which might or might not have been mentioned earlier in the series:

Airports Are Losing Money as Ride-Hailing Services Grow [NYT]

Socialize the losses, privatize the gains, VC-ize the subsidies.

Airports typically operate via concessions where a private enterprise manages the airport, so any losses aren’t socialized. Furthermore, IATA rules governing international airports stipulates that airports can only charge passengers proportional to the parts of the airport the passenger uses. That means that they cannot raise the price on TNCs and taxis to offset parking. Those two need to be treated as separate concerns. If parking suddenly becomes unprofitable, it is the company managing the airport’s responsibility to reduce costs associated with parking, because they aren’t allowed to recoup those costs by raising fees on other services. They also can’t charge much more than a reasonable margin based on their costs of providing that service. For TNCs and Taxis, the cost of providing the service is essentially the cost of maintaining the roads and curbside pickup and dropoff areas, but of which are not that expensive to maintain and should result in minimal fees when amortized by the number of passengers arriving and departing by TNC or taxi.

Smaller regional airports not bound by IATA rules and regulations are free to cost spread.

The cold hard truth is that Uber is backed into a corner with severely limited abilities to tweak the numbers on either the supply or the demand side: cut driver compensation and they trigger driver churn (as has already been demonstrated), increase fare prices for riders and riders defect to cheaper alternatives. The only question is how long can they keep the show going before the lights go out, slick marketing and propaganda can only take you so far, and one assumes the dumb money has a finite supply of patience and will at some point begin asking the tough questions.

The irony is that Uber would have been a perfectly fine, very profitable mid-sized company if Uber stuck with its initial model—sticking to dense cities with limited parking, limiting driver supply, and charging a premium price for door-to-door delivery, whether by livery or a regular sedan. And then perhaps branching into robo-cars.

But somehow Uber/board/Travis got suckered into the siren call of self-driving cars, triple-digit user growth, and being in the top 100 US cities and on every continent.

I’ve shared a similar sentiment in one of the previous posts about Uber. But operating profitably in decent sized niche doesn’t fit well with ambitions of global domination. For Uber to be “right-sized”, an admission of folly would have to be made, its managers and investors would have to transcend the sunk cost fallacy in their strategic decision making, and said investors would have to accept massive hits on their invested capital. The cold, hard reality of being blindsided and kicked to the curb in the smartphone business forced RIM/Blackberry to right-size, and they may yet have a profitable future as an enterprise facing software and services company. Uber would benefit from that form of sober mindedness, but I wouldn’t hold my breath.

Thankyou very much for your article.

Tim Ferriss early stage investor in Uber and well known author and podcast host, has touted the excitement of an Uber IPO for.years . As a well known successful angel investor he advises to a lot of well known and influential start ups and has aggressively extolled the benefits of Uber to his large audience the entire time of his involvement. I dont know for sure, but he is probably advising Uber also. And even he doesn’t know how ruinous they are? I guess those that know, dont tell. Its an extremely well orchestrated cover up.

In news today a Canadian was charged almost $20,000 for a 20minute Uber trip. Uber actually refused to refund him. Only folding later under public pressure.

Tim is a relentless self promoter. I would take anything he says with a huge grain of salt.

Oh yes. I wasn’t suggesting for a minute he was correct. Calling out the duplicity I guess. Or self delusion. Or perhaps that smart capable people actually do know better but it isnt in there interests to let their audience in on the secret – dont expect ‘smart ‘ to be accompanied by ‘integrity’

It’s not a cover up since the facts are all publicly available.

There is a legal maxim, “the law abhors a volunteer.” Which means, if you see people getting ripped off, there is no reward for warning them, and no penalty for not warning them, and on the contrary, you can be sued by the business that is doing the ripping off.

I’m assuming we’re witnessing this phenomenon on a grand scale. Particularly since Uber has gone after its critics in very ugly ways.

My question: why did Hubert decide to become a volunteer and what repercussions is he facing as a result?

The question is: Why did Softbank invest in Uber?

I know nothing about Softbank or its management, but I do know that the Japanese were the dumb money rubes in the late ’80’s, overpaying for trophy real estate they lost billions on.

Until informed otherwise, that’s my default assumption…

Softbank possibly looking to buy more Uber shares at a 30% discount is very odd. Uber had a Series G funding round in June 2016 where a $3.5 billion investment from Saudi Arabia’s Public Investment Fund resulted in its current $68 billion valuation. Now apparently Softbank wants to lead a new $6 billion funding round to buy the shares of Uber employees and early investors at a 30% discount from this last “valuation”. It’s odd because Saudi Arabia’s Public Investment Fund has pledged $45 billion to SoftBank’s Vision Fund, an amount which was supposed to come from the proceeds of its pending Aramco IPO. If the Uber bid is linked to SoftBank’s Vision Fund, or KSA money, then its not clear why this investor might be looking to literally ‘double down’ from $3.5 billion o $6 billion on a declining investment.

SoftBank has not yet invested. Its tender is still open. If it does not get enough shares at a price it likes, it won’t invest.

As to why, I have no idea.

“Growth and Efficiency” are the sine qua non of Neoliberalism. Kalanick’s “hype brilliance” was to con the market with “revenue growth” and signs of efficiency, and hopes of greater efficiency, and make most people just overlook the essential fact that Uber is the most unprofitable company of all time!

I’ve suspected Uber is pushing UberPool (car pool) because then they can book the entire ride as revenue, then do a payment to a driver.

Of course it makes the entire experience worse for a passenger. I’d say they have improved it a bit in terms of optimizing pickups on a car pool but not ideal.

At least in DC, UberX is far too much and UberPool the default option.

Smart move to go into credit cards; they should offer credit directly.

What comprises “Uber Expenses”? 2014 – $1.06 billion; 2015 $3.33 billion; 2016 $9.65 billion; forecast 2017 $11.418 billion!!!!!! To me this is the big question – what are they spending $10 billion per year on?

ALso – why did driver share go from 68% in 2016 to 80% in 2017? If you use 68% as in 2016, 2017 Uber revenue is $11.808 billion, which means a bit better than break-even EBITDA, assuming Uber expenses are as stated $11.428 billion.

Perhaps not so bleak as the article presents, although I would not invest in this thing.

I have the same question: What comprises over 11 billion dollars in expenses in 2017? Could it be they are paying out dividends to the early investors? Which would mean they are cannibalizing their own company for the sake of the VC! How long can this go on before they’ll need a new infusion of cash?

ALso – why did driver share go from 68% in 2016 to 80% in 2017?

probably, 68% = smart drivers left as their P-L became unsustainable. Uber’s number crunching probably saw the driver churn in 2016, and presumably impact on customer satisfaction/demand, and made a 180-turn for 2017.

Good questions those. I have one. Just who is still giving Uber all this money to operate with? That article mentioned that the past three years they have burned up about 11 billion dollars so any more and you are going to be starting to talk about some serious money here.

I doubt that any serious banker or financier will want to sink more funds into an operation like this but still, who is supplying them with their working capital? As an afterthought. You want to know what the sound effect for Uber is if it was a thing? It goes like this-

tick, tick, tick, tick, tick…

Tick, tick, tick, BOOM!

The Saudis have thrown a few billion Uber’s way and they aren’t necessarily known as the smart money.

Maybe the pole dancers have started chipping in too as they are for bitcoin.

Oh article does answer your 2nd question. Read this paragraph:-

As for the 1st, read this line in the article:-

I suggest you read the article. Hubert explained that. It is against our written site Policies for readers to comment when they have not read an article in full.

in addition to all the points listed in the article/comments, the absolute biggest flaw with Uber is that Uber HQ conditioned its customers on (a) cheap fares and (b) that a car is available within minutes (1-5 if in a big city).

Those two are not mutually compatible in the long-term.

Thus (a) “We cost less” and (b) “We’re more convenient” — aren’t those also the advantages that Walmart claims and feeds as a steady diet to its ever hungry consumers? Often if not always, disruption may repose upon delusion.

…Uber’s business model could never produce sustainable profits unless it was able to exploit significant anti-competitive market power.

Upon that dependent clause hangs the future of capitalism, and – dare I say it? – its inevitable demise.

When this Uber madness blows up, I wonder if people will finally begin to discuss the brutal reality of Silicon Valley’s so called “disruption”.

It is heavily built in around the idea of economic exploitation. Uber drivers are often, especially when the true costs to operate an Uber including the vehicle depreciation are factored in, making not very much per hour driven, especially if they don’t get the surge money.

Instacart is another example. They are paying the deliver operators very little.

When this Uber madness blows up, I wonder if people will finally begin to discuss the brutal reality of Silicon Valley’s so called “disruption”.

Paving the way for socialism, at long last. Or maybe the masters of the universe have a few more scam cycles in the pipe, and the people you mention still have some reserves of gullibility. No doubt, the advent of the smart phone has been vital to keeping this patchwork device spinning, to the extent that it makes people more stupider.

I suspect that there will be a few more cycles of greed. I am concerned about what they will try next at, Silicon Valley.

I suspect that the end of Moore’s Law may push the desire for even more attempts to keep the Valley going.

Uber was trying to save itself with self driving automobiles, but that is largely an idea that is into the future and not in the timeframe that Uber needs to turn around.

To be honest, I don’t really care if very wealthy venture capitalists lose money. They are already quite well off. What is far more damaging is the fact that ordinary folks are being hurt by these disruption hustles.

Plus, unlike say, Amazon or Google, these are not sustainable businesses. Uber when it dies will have displaced a lot of taxi drivers then it will displace those who drove for Uber, many of whom will have high mileage cars with low resale values.

At a fundamental level, I think that the Silicon Valley “disruption” model only works for markets (like software) where the marginal cost for production is de minimus and the products can be protected by IP laws. Volume and market power really work in those cases. But out here in meat-space, where actual material and labor are big inputs to each item sold, you can never just sit back on your laurels and rake in the money. Somebody else will always be able to come and and make an equivalent product. If they can do it more cheaply, you are in trouble.

There aren’t that many areas in goods and services where the marginal costs are very low.

Software is actually quite unique in that regard, costing merely the bandwidth and permanent storage space to store.

Let’s see:

1. From the article, they cannot go public and have limited ways to raise more money. An IPO with its more stringent disclosure requirements would expose them.

2. They tried lowering driver compensation and found that model unsustainable.

3. There are no benefits to expanding in terms of economies of scale.

From where I am standing, it looks like a lot of industries gave similar barriers. Silicon Valley is not going to be able to disrupt those.

Tesla, another Silicon Valley company seems to be struggling to mass produce its Model 3 and deliver an electric car that breaks even, is reliable, while disrupting the industry in the ways that Elon Musk attempted to hype up.

So that basically leaves services and manufacturing out for Silicon Valley disruption.

“It is heavily built around the idea of economic exploitation” is exactly correct. After 22 years in messenger business in CA on a business model of hourly wages and expense reimboursement Uber is not a sustainable model. The whole independent contractor model “profits” are in not matching SSI, UI, Federal UI and Medicare deductions. Methods for bringing in new drivers would make Ponzi smile and Amway nod knowingly.

Would an Uber-Bitcoin merger solve all that ails both?

HaHaHaHaHa!

If uber drivers eat data instead of bananas…

The way I see the merger going, is Uber drivers have pedals in the car with which they can create electricity when waiting around, so as to be able to create Bitcoins.

I really love the idea of a Bitcoin Uber Merger . Could be touted as a $100b corporation . Why not people are stupid aren’t they – most – some ???

We should set up an alternate Uber Pool, along the lines of the Clint Eastwood movie. What day will Uber cease operations?

ISTM that their justification for existence is to get market share by ignoring the local laws that constitute barriers to entry into the taxi business. So either they get spanked by local governments OR they prove to others that there are no effective barriers to entry. So there is no real way for them to become rentiers, making money off of their ability to jack up prices in the absence of competition. So if market share will never “save” them, we’re left with what is essentially a ponzi scheme, were today’s investors pump up stock price so that yesterday’s investors can cash out. Sooner or later the party will end.

I have a very useful iOS app I use in London to find out when the buses will arrive at a given stop (one great technological advance for public transport!). It’s free but sponsored by ads. At least 30% of the latter are Uber ads offering (IIRC) a £5 discount on an Uber ride. Now this app may be very popular and perhaps it’s a good marketing strategy, but it almost strikes me as desperate. And in south London on my bus route I promise you that most of the bus riders would be hard pressed to pay for an Uber ride.

UBER has become a “too big to fail” startup because of all the different tentacles of capital from various Tier 1 VCs and investment bankers.

VCs have admitted openly that UBER is a subsidized business, meaning it’s product is sold below market value, and the losses reflect that subsidization. The whole “2 sided platform” argument is just marketecture to hustle more investors. It’s a form of service “dumping” that puts legacy businesses into bankruptcy. Back during the dotcom bubble one popular investment banker (Paul Deninger) characterized this model as “Terrorist Competition”, i.e. coffers full of invested cash to commoditize the market and drive out competition.

UBER is an absolute disaster that has forked the startup model in Silicon Valley in order to drive total dependence on venture capital by founders. And its current diversification into “autonomous vehicles”, food delivery, et al are simply more evidence that the company will never be profitable due to its whacky “blitzscaling” approach of layering on new “businesses” prior to achieving “fit” in its current one.

It’s economic model has also metastasized into a form of startup cancer that is killing Silicon Valley as a “technology” innovator. Now it’s all cargo cult marketing BS tied to “strategic capital”.

UBER is the victory of venture capital and user subsidized startups over creativity by real entrepreneurs.

It’s shadow is long and that’s why this company should be …..wait for it……UNBUNDLED (the new silicon valley word attached to that other BS religion called “disruption”). Call it a great unbundling and you can break up this monster corp any way you want.

Naked Capitalism is a great website.

1. I Agree with your last point.

2. The elevator pitch for Uber: subsidize rides to attract customers, put the competition out of business, and then enjoy an unregulated monopoly, all while exploiting economically ignorant drivers–ahem–“partners.”

3. But more than one can play that game, and

4. Cab and livery companies are finding ways to survive!

I agree about Uber being a “too-big-to-fail” startup for venture ecosystem. I believe that is the reason why softbank is investing in Uber . It is in interest of softbank like other major VCs that “invincible uber” illusion persists for as long as possible.

Great point you bring up here about ‘terrorist competition’.

I went to do more research and came up on the quote you referenced.

“It has been my experience that these irrational terrorist competitors are often responsible for downward pricing pressure,reduced profitability,and stalled or delayed adoption in emerging categories. the net result of terrorist competitors is that they de-stabilize their own categories by contributing to the ongoing desertification of IT…inotherwords, their bubble-boy cash cocoon allows them to think they are playing hardball,while in fact they are practicing irrational cargo cult marketing”…pg 66

Asymmetric Marketing: Tossing the ‘chasm’ in the Age of the Software Superpowers

By Joseph E. Bentzel

This makes me think of many other companies today growing like gangbusters at the expense of profits while promising investors future returns till infinity.

But what about autonomous cars? Not convinced, then what about autonomous aerial vehicles? Elon can already land his rockets so maybe autonomous intercontinental rockets?

Doubling down rarely is a sustainable strategy. If it is wound down or pivots the business needs to be valued differently but what is the substance? There is the Uber app although it likely is already too specialized for their current model and could be too expensive to adjust to other use cases.There are their customer relationships. There is a database of drivers of whom only some of them will be willing and able to work in a non subsidized environment. There may be some self driving tech but most of that value will still be in the heads that disperse. This is close to zero without considering the leases etc. on the other side of the equation.

If subsidizing rides is counted as an expense, (not being an accountant, I would guess it so), then whether the subsidy goes to the driver or the passenger, that would account for the ballooning expenses, to answer my own question. Otherwise, the overhead for operating what Uber describes as a tech company should be minimal: A billion should fund a decent headquarters with staff, plus field offices in, say, 100 U.S. cities. However, their global pretensions are probably burning cash like crazy. On top of that, I wonder what the exec compensation is like?

After reading HH’s initial series, I made a crude, back-of-the-envelope calculation that Uber would run out of money sometime in the third fiscal quarter of 2018, but that was based on assuming losses were stabilizing in the range of 3 billion a year. Not so, according to the article. I think crunch time is rapidly approaching. If so, then SoftBank’s tender offer may look quite appetizing to VC firms and to any Uber employee able to cash in their options. I think there is a way to make a re-envisioned Uber profitable, and with a more independent board, they may be able to restructure the company to show a pathway to profitability before the IPO. But time is running out.

A not insignificant question is the recruitment and retention of the front line “partners.” It would seem to me that at some point, Uber will run out of economically ignorant drivers with good manners and nice cars. I would be very interested to know how many drivers give up Uber and other ride-sharing gigs once the 1099’s start flying at the beginning of the year. One of the harsh realities of owning a business or being an contractor is the humble fact that you get paid LAST!

SoftBank’s investment is going almost entirely to buy out existing shareholders, meaning it will make perilous little difference in terms of extending its runway. And if Uber and SoftBank think a lot of shareholders cashing out is a great inducement for more dumb money to come in, they are smoking something very strong.

What is Uber’s current cash position? The latest report I saw (August) put it at 6.6 billion, which means they are well and truly on the clock if they are losing $5B per year. We shouldn’t have to wait another 5 years to see how this story ends, although if the Softbank deal goes through it would buy them a bit more time.

A quick Google demonstrates that HH’s analysis has been steadily gaining mindshare, although it’s taken a while to get out there. The vast majority of people that read it seem to accept the analysis, and the ones that don’t usually reject it on spurious grounds (magic technology fairies like self-driving cars saving the day). I believe that idea is debunked by the later articles in the series, but the more informed commentators are quite capable of doing it themselves as it’s not that hard.

We became instant Uber riders while spending holidays with relatives in San Diego. While their model is indeed unique from a rider perspective, it was the driver pool that fascinates me. These are not professional livery drivers, but rather freebooters of all stripes driving for various reasons. The remuneration they receive cannot possibly generate much income after expenses, never mind the problems associated with IRS filing as independent contractors. One guy was just cruising listening to music; cooler to get paid for it than just sitting home! A young lady was babbling and gesticulating non stop about nothing coherent and appeared to be on some sort of stimulant. A foreign gentleman, very professional, drove for extra money when not at his regular job. He was the only one who had actually bought a new Prius for this gig, hoping to pay it off in two years. This is indeed a brave new world. There was a period in Nicaragua just after the Contra war ended when citizens emerged from their homes and hit the streets in large numbers, desperately looking for income. Every car was a taxi and there was a bipedal mini Walmart at every city intersection as individuals sold everything and anything in a sort of euphoric optimism towards the future. Reality just hadn’t caught up with them yet………….

From where I sit, it looks as if Uber’s strategy may be to keep the ride-sharing model and

drivers only so long as they are useful, largely in propaganda terms, and then dump them.

I think they are banking on being able to get “driverless” cars working just well enough to

impose them on communities whether they are wanted or not. Market power, for instance.

Law-be-damned attitude for another. Yes, I read the piece on the Waymo suit and yes, I

agree it is significant. And yes, the whole thing may flop over and put Google into the

“driver’s” seat. The net result for the public, I think, would be about the same.

Now, what makes me think this:

I live about 13 miles north of Pittsburgh. As you all know, Uber reached an agreement with

the City of Pittsburgh, allowing them special rights and access to public streets for research

and development purposes. They didn’t stop there. They are now testing massively in

municipalities to the north of Pittsburgh. One is McCandless township in the Perry Highway

(US Route 19) corridor. Possibly Pine as well. That is where I have seen them. Personally,

I haven’t seen that many (two or three) as I don’t go there very often. I have acquaintances there,

however, who tell me the Uber self-driving cars are everywhere in that area, sometimes

driving in groups of 10 or more and sometimes encroaching on private property without

permission. Sorry, I can’t describe the situation any more accurately than this, at least not

from personal experience, but I can say it is big.

Incidentally, they are using a sleek new model that doesn’t look at all like any of the

pictures I can find online. Also, I doubt that they have acquired any real permission

from the municipalities that happen to be in their way. At least I haven’t heard of it

if they have. Maybe they’ve slipped the police a couple of twenties or something.

Basically, it appears that they just showed up and started testing.

Hubert has a copy of literally every press release Uber put out and every public statement its execs have made.

IIRC, they didn’t start talking about driverless cars until 2014. They weren’t central to Uber’s strategy. And as Lambert and I have discussed (albeit much more in the comments section than in posts, but some there too), fully autonomous cars are a long time coming, if ever. All the hype has been about stage 4 autonomous cars, which are NOT fully autonomous. They have a driver ready to take back control! And the evidence is if anything those cars are less safe than regular cars because drivers won’t be vigilant and won’t snap into action fast enough to avert an accident when the car says it needs help or gets in trouble without sending a warning.

I have always believed the Driverless Cars & Flying Cars PR from Uber was just ponzi bait.

A warm bum in the drivers seat does not an autonomous vehicle make. It is simply a regular car equipped with auto pilot for the drivers convenience.

But even if this autonomous falicy did eventually come to fruition, at the rate at which Uber is burning through their investors cash, they will be long “belly up” and out of business by then.

I just can’t understand Uber’s thinking; As both an observer and an Uber Driver myself, I can’t help but get the impression that they don’t even care to break even, much less turn a profit. From my laymen’s perspective, it seems as if the management is purposely trying to drive Uber straight into the ground.

What about Waymo in Arizona? No one is in the front seat.

Google owner tests first driverless car on city streets – https://www.ft.com/content/397134f8-c36c-11e7-a1d2-6786f39ef675 via @FT

Oh, but as soon as those driver-less cars arrive….

The combined economic model (uber plus drivers) is inferior, but does that matter if there is steady stream of drivers willing to assume the costs? Just look at Herbalife. Similar situation where it us a crummy deal for their distributors but yet the corporate is very profitable

Very thorough well researched article. Thank you for the series. Whilst it is easy to understand that Uber has a failed business model this must also apply to others in Rideshare ie copy cat businesses like Didi & Lyft? Or is it dependent on location ie keep businesses only in countries/cities that have poor transport services & no regulations. My understanding is that based on valuations Ubers has taken a dive to ca $45b as part of the Softbank deal which still has not finalised. But Softbank have given additional funding to Didi that now places their valuation higher than Uber. The EU Courts ruling that Uber is a Transportation Company & not a Tech company throws a new light on its valuation. Valuations of tech companies was always based on futuristic predictions which even for #uber looked terrible. Bundle in driverless cars & flying taxis & the wet dreams of vulture capitalists & criminal banks like Goldmans sets the value at $70b. But this $70b was recently downgraded to accommodate Softbank (not finalised & now unlikely) to ca $40b. But Transport Companies work in the bricks & mortar world & realistic valuations based on assets liabilities profits etc are required. Does #uber have any value at all based on the numbers?