By Lance Taylor, currently the Arnhold Professor of International Cooperation at the New School for Social Research; formerly a professor of economics at Harvard and MIT. Originally published at the Institute for New Economic Thinking website

Over the past four decades, American household incomes have become strikingly more unequal, along an unsustainable path. But as of late 2017, prospects for attacking inequality are bleak, whether or not the Republican-controlled U.S. Congress manages to pass a tax cut favoring businesses and high-income households. Fundamental changes in income and wealth distribution will require equally fundamental changes in the way the economy generates and distributes pre-tax incomes.

What is required are policies that go beyond the tax code to shift the very balance of power between workers and employers. Doing so would allow real wages to catch up to productivity and capital gains to be more equitably shared among the population. It would shrink inequality for years to come.

This paper looks at several key topics that relate to our country’s growing inequality and the ways in which it can be remedied.

First, it’s worth examining the likely macroeconomic effects of the tax package. They will be visible but small. Republican efforts will push up the federal deficit as a means to transfer funds to business and rich households. Growth dynamics sketched below suggest that the deficit and incomes of the rich cannot rise indefinitely. This analysis also shows how, over time, rising income inequality creates greater concentration of wealth, which is almost certainly on the cards.1 For rich households, wealth accumulation is driven by high saving rates from high incomes, capital gains on existing assets, and receipts from initial public offerings which are highly visible but quantitatively not so important. Over the past few decades, capital gains have been a main driver for wealth concentration.

Crucially, this analysis looks to answer why inequality has grown so steadily since around 1980. The principal cause is that wealthy “capitalist” households have benefitted from rising business profits while wage-earning “worker” households have fallen behind. Are higher profits the consequence of greater power of firms to raise prices against wages, or else their ability to hold down wages against prices? Analysis of producing sectors suggests the latter based upon the creation and extension of a vast low wage labor market.

Growth of Income Inequality

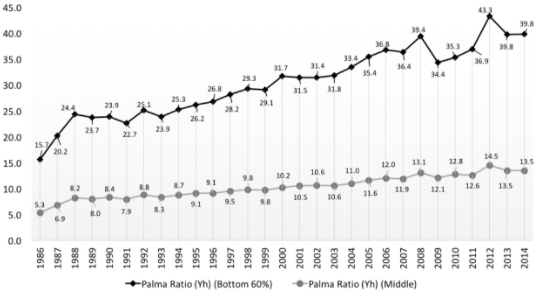

The Cambridge University economist José Gabriel Palma has proposed a helpful measure of inequality – the ratio of the average household income for a wealthy group (for example, the wealthiest one percent) over that of a poorer group (or groups). Based on data from the well-known 2016 Congressional Budget Office study of inequality, rescaled to fit the national accounts, Figure 1 shows Palma ratios for the top one percent vs. households between the 61st and 99th percentiles of the size distribution (the “middle class”) and the sixty percent at the bottom.

Figure 1: Palma Ratios for Top 1% vs 61st-99th Percentile (“Middle class”) and Lower 60% Households

Based on total income per household (Yh) Based on calculations from the Congressional Budget Office and National Income and Product Accounts

Based on disposable income per household (DYh) Based on calculations from the Congressional Budget Office and National Income and Product Accounts

The upper diagram presents ratios for total (or pre-tax) income; the lower focuses on disposable income. Either way, rising inequality stands out, although taxes and transfers cut back on the extreme ratios shown in the diagram at the top. Even for disposable income, the ratio of the rich against the middle class grew at 3.85% per year. Against the bottom group, the growth rate was 3.54%. Such rising inequality is unprecedented. These rates are a full percentage point higher than output growth, and are not sustainable in the long run. The reason is that the share of any variable (say the income of the top one percent) in the total cannot increase indefinitely. Herbert Stein’s Law “that if something cannot grow forever, it will stop” always applies in macroeconomics.2

Minimal Macro Impacts

As of this writing, precise estimates of the effects of the Republican tax cuts on household incomes are not available. Ballpark numbers show an increase of more than five percent of mean disposable income for the top one percent (more for the top 0.1 percent) with blips of less than one percent for most of the rest, all front-loaded toward early years of a ten-year program. The 2014 Palma ratio of 13 for the middle class might rise above 14, an insulting jump atop an inglorious trend.

In round numbers, the annual disposable income of all rich households is $2 trillion. Their consumption is $1 trillion in an economy with overall demand of $20 trillion. Their extra consumption from the tax windfall might be less than $40 billion, about 0.2% of total demand. Through this channel at least, the macroeconomic boost from upper income tax reduction would be barely visible.3

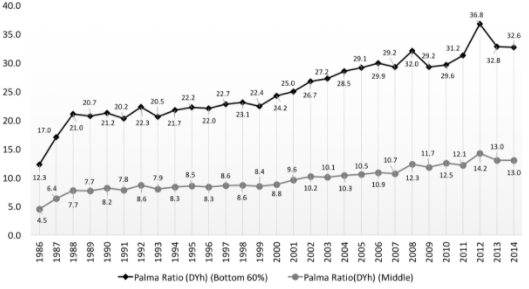

Business tax reductions have been sold as a means to stimulate economic growth. One way to assess possibilities is to look at how much firms are willing to spend on new capital goods (“net investment” in economists’ jargon). The US output/capital ratio is stable in the medium run so that the level of the capital stock regulates the size of the macro system. In other words, output increases track capital. Its growth also stimulates increasing labor productivity, with effects on employment and the real wage.

Will the Republicans’ ballyhooed corporate tax cuts boost net investment? Business net acquisition of new assets (capital, cash, reduction in debt, etc.) runs in the range of a few percent of the existing capital stock. Figure 2 shows data on profits and changes in assets beginning in 1998 (the first year for which capital estimates consistent with the national accounts are readily available).

Figure 2: Gross Profits, Net Profits, Net Profits – Corporate Taxes, and Business Net Asset Accumulation / Business Capital (Kb)

Based on calculations from the National Income and Product Accounts and supporting tables

In the national accounts, “profits”’ (or “operating surplus” or “earnings’) are the difference between corporate revenue and costs of intermediate inputs, direct taxes, and labor pay4. They are an income flow originating from production, as opposed to returns to holding financial claims such as stocks and bonds as discussed below. The relevant rates of return do not move together, contrary to much mainstream economic doctrine5.

Overall business profits relative to capital run between 15% and 20% (plotted in red). The green schedule shows profits net of depreciation (also called a capital consumption allowance or CCA). The yellow illustrates a further subtraction from operating surplus due to corporate taxes. Compared to depreciation, the tax bite is minimal, one or two percent of capital or four percent of value-added. Finally, payments of interest and dividends, over 40% of which flow to rich households, limit net asset accumulation (blue) to one or two percent of capital, especially in wake of the financial crisis.

Will reducing the corporate tax bite strongly boost the ratio of net business investment to capital and so feed into higher output? No doubt a substantial proportion of higher available profits would be distributed as interest, dividends, and share buybacks. In Figure 2, the band between the green and yellow schedules represents the corporate tax burden. The yellow might shift upward by 0.01 from proposed tax cuts, shrinking the band. If in response net investment relative to capital increases by 0.005 (very much on the high side), then medium-term output expansion could go up by a similar amount – well less than the growth rate increases touted by tax cutters.

Finally, a word on deficits and debt. Again in round numbers, Federal debt is $20 trillion and the deficit is $500 billion. The ratio implies a debt growth rate of 2.5%, similar to output growth. If the tax package initially reduces receipts by $150 billion per year but (optimistically) draws in $50 billion in extra revenue due to higher output, then the growth rate of debt would rise by 0.3%. If the output growth rate does not rise as much (as is likely) and/or interest rates go up, Stein’s Law for the debt/GDP ratio could kick in. An unsustainable debt burden would match unsustainably rising inequality.

Root Causes of Inequality

In sum, in the short to medium run, regressive Republican tax reductions would have barely visible macroeconomic effects while providing an income fillip at the top. In the longer run, the weight of the debt burden could rise.

As discussed later, the other side of the coin is that progressive tax/transfer policies would not strongly affect the macro situation but could ameliorate income inequality slightly. They would stimulate consumer demand because lower income households have low or negative saving rates. The trends illustrated in Figure 1 will not easily be reversed.

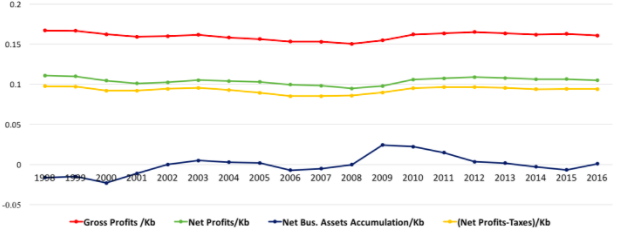

To explore the possibilities, we need background on sources of pre-tax income. The upper diagram in Figure 1 shows that rich households, with a mean income exceeding $2 million per year, have 40 times the income of the bottom 60% and 13.5 times payments going to the middle class. Figure 3 shows where the one percent’s money has been coming from.

Figure 3: Sources of Income for the Top One Percent

Based on calculations from the Congressional Budget Office and National Income and Product Accounts

Starting from the bottom of the bars, labor compensation has increased dramatically. It is not the main source for the top one percent, although earnings exceeding $500,000 per year in Figure 3 are not be sneezed at. To a degree they represent income from capital because they include bonuses and stock options. In the macroeconomic scheme of things, the top one percent’s labor income is not of central importance because it amounts to “only” nine percent of the total. For the top 1% it is also less than income of business proprietors, rents, CCA, etc. (second from the bottom).

The third major component of incomes in Figure 3 is made up of financial transfers including interest and dividends deriving from holdings of financial claims. They are nourished by business profits but as noted above the linkage is not necessarily close. Labor pay, profits, and proprietors’ income etc. all enter into the national accounts. Capital gains also put money into households’ pockets but because they are not a cost of production they do not enter the national accounts. Figure 3 shows that they have added substantially to income since the 1990s (see further discussion below).6

The middle class and households with lower incomes are in different economic boats. Over 70% of middle class mean income of $180,000 comes from wages and salaries. Labor earnings and transfers each provide around 45% of the lower group’s $65,000 per year. To use traditional terms, the top one percent are close to being “capitalists;” the rest of us are “workers” subsidized by fiscal transfers.

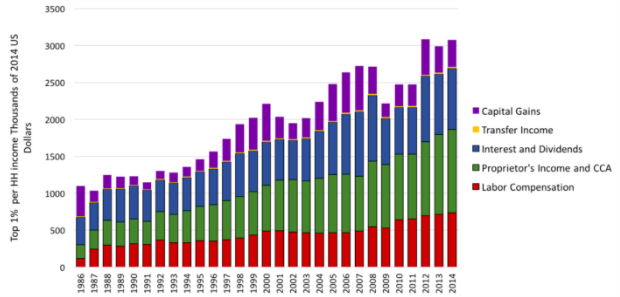

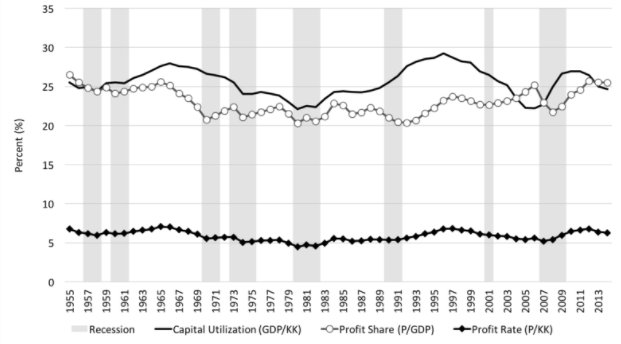

After the 1970s profits moved upward, as shown in Figure 4 which is based on total capital stock (periods of recession are shaded). As noted above, the output/capital ratio is fairly stable over business cycles. Both the profit share and profit rate have trended steadily up since the Reagan recession of the early 1980s. Given that the bulk of income of the top one percent comes from profits through one channel or another, the obvious inference is that the rising Palma ratios in Figure 1 were fueled by an ongoing shift away from wages in the “functional” income distribution between labor and capital.

Figure 4: US Output/Capital Ratio, Profit Share, and Profit Rate

Based on Total Capital Stock (KK) Based on calculations from the National Income and Product Accounts and supporting tables

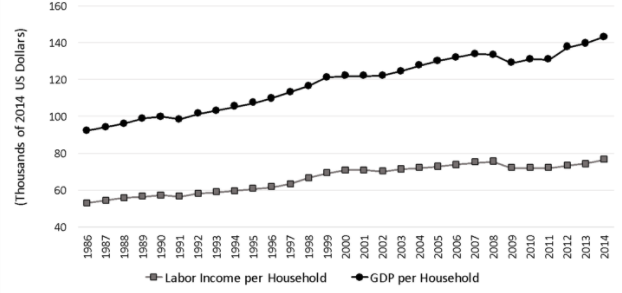

Lagging Real Wages

One common explanation for the distributional shift is that real wages have not grown as fast as labor productivity. Figure 5 is an illustration. Clearly, growth of output per household has outpaced labor income. The increases in payments to labor that did occur flowed predominantly to high income households.

Based on calculations from the National Income and Product Accounts

The question is why wages of ordinary households lagged. Changes in institutional norms (laws, unionization and other of the game) surely played a role. Robert Solow (2015) from MIT, the doyen of mainstream macroeconomics, observes that labor suffered for reasons including “the decay of unions and collective bargaining, the explicit hardening of business attitudes, the popularity of right-to-work laws, and the fact that the wage lag seems to have begun at about the same time as the Reagan presidency [see Figure 4!] all point in the same direction: the share of wages in national value added may have fallen because the social bargaining power of labor has diminished.”

Divide-and-rule in a “fissuring” labor market, as described by David Weil (2014) is one aspect of this process. Globalization, which came to the forefront in the 2016 Presidential election, also played a role. Perhaps one-quarter of job losses in US manufacturing (the sector most open to international trade) can be explained by import competition. It bears note, however, that manufacturing provides less than ten percent of total employment.

Goods and Services Markets vs. Labor Markets

In macroeconomics, the crucial big market involves labor and capital. On the“sell-side,” business firms may have power to push up prices of goods and services against wages as the main source of demand. On the “buy-side,” they can hold down wages against prices. Solow, Weil, and other commentators adopt a buy-side interpretation. Many mainstream economists, however, concentrate on firms’ “monopoly power” to set prices. Looking at behavior of profits and rents in detail provides a means to assess their position

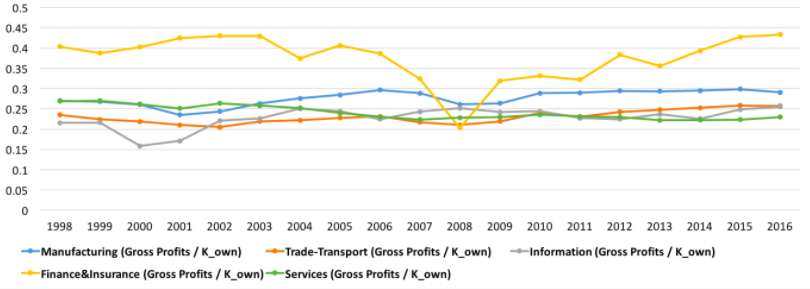

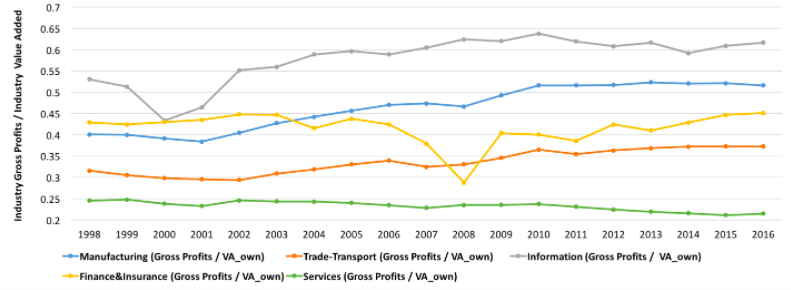

Presumably, monopoly would show up in different profit performances across broad sectors of the economy – they would have different levels of power. The buy-side interpretation suggests that profits across sectors would trend up together. Eschewing econometrics for present purposes, we can look at the evidence graphically.

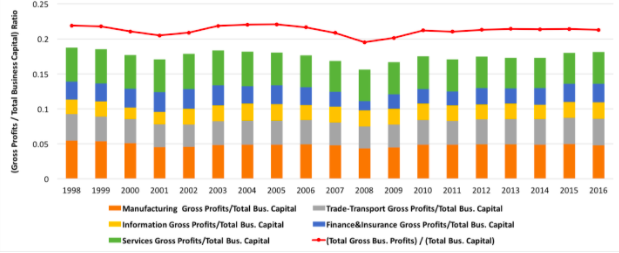

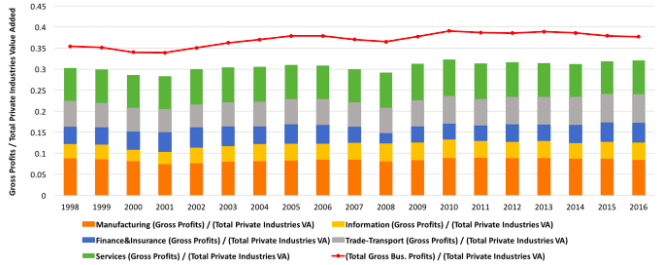

Figure 6 shows ratios of total and sectoral business profits to total capital and value-added.7 The main sources of profits are manufacturing and services, trailed by trade and transport. The widely discussed information and finance and insurance sectors are lesser contributors to total profits.8

Figure 6: Total and Sectoral Business Profits vs. Total Business Capital and Value-Added (Real Estate Rental and Leasing Excluded)

Based on business capital Based on calculations from the National Income and Product Accounts and supporting tables

Based on total value-added Based on calculations from the National Income and Product Accounts and supporting tables

Figure 7 shows ratios of the total and sectors to their own levels of capital and value-added. Ratios to capital for manufacturing and trade and transport cluster in the same range. They have an upward trend, consistent with the wage-lag interpretation of rising inequality. Finance and insurance was obviously affected strongly by the Great Recession but its ratio at the end of the period was higher than at the start. The information sector includes an anachronistic mix of publishing, movies, internet portals, and data processing. Its steady increase in profits after the dotcom crash probably does incorporate an element of monopoly power.

Figure 7: Sectoral Gross Profits vs. Own Capital Stock and Value-Added

Based on capital stock Based on calculations from the National Income and Product Accounts and supporting tables

Based on value-added Based on calculations from the National Income and Product Accounts and supporting tables

Compared to value-added, manufacturing, trade and transport, and (recession aside) finance and insurance show consistent upward trends. Information has enjoyed hearty profits growth. Services lag, possibly reflecting a lack of monopoly power. Taken together, at the broad sectoral level the diagrams do not provide strong support for the monopoly hypothesis.

Real Estate and Rents

A second strand of mainstream discussion attributes inequality to higher rents. If you want to confront that idea with macroeconomic data, you have to look at real estate.

Somewhat confusingly, the national accounts include separate treatments of commercial real estate on one hand and consumers’ “housing services” on the other. The former shows up in the accounts for production and the latter is included in personal consumption expenditure. As noted in footnote 6, profits in real estate are estimated as a residual. They amount to about 95% of the sector’s value-added. An upward trend is consistent with wage repression. The ratio of profits to capital fell with the recession, but then recovered to a bit less than 10%.

“Consumption of housing services” is fairly stable at a GDP share of a bit more than ten percent, trending slowly upward. Its level is inferred from visible real estate data. Three-quarters of the total is made up of “imputed” costs of owner-occupied housing. Subtracting costs gives an estimate of rents. Because it is estimated as a residual the rental share of GDP went up by around two percentage points in wake of the financial crisis due to the sharp reduction in interest payments that the Fed engineered.

For more two centuries, economists have recognized that rents (as well as housing services) respond to demand derived from other income flows. American income has become highly concentrated but the bulk still goes to the lower classes, explaining why ratios of real estate profits and housing consumption to capital and GDP are stable (billionaires’ towers along Manhattan’s 58th street notwithstanding). But we are talking about big numbers here, on the order of 10% of GDP, far larger than any proposed tax cuts. Over time their accumulation contributes to more concentration of wealth.

Rising Wealth

Wealth or net worth is the difference between the values of an economic actor’s assets and liabilities. It rises in response to positive saving and increases in prices of assets or decreases in prices of liabilities (“capital gains,” in a phrase). The accounting underlying GDP and financial tabulations sets private sector net worth equal to the sum of the value of capital, government debt, and a country’s net foreign assets. Private sector wealth can be further split between households and corporate business. Claims (stocks and bonds) issued by business are its “liabilities” and households’ or the rest of the world’s assets.9

The share of wealth held by affluent households is the topic at hand. Putting together time series on the distribution of wealth is not easy. The share of the top one percent of households as estimated from expenditure survey or income tax data was around 50% just prior to the Great Depression, fell to 25% in the 1960s, and is now in the vicinity of 40%.

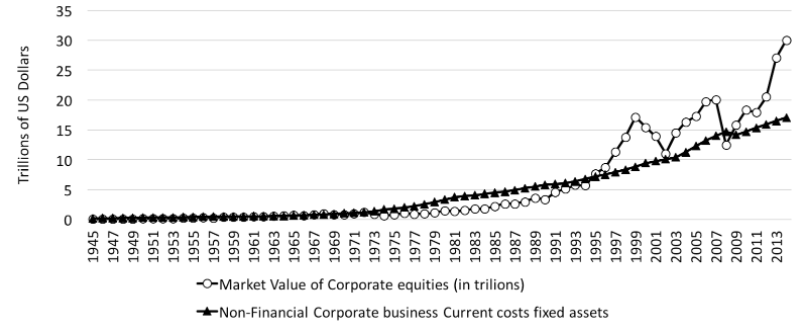

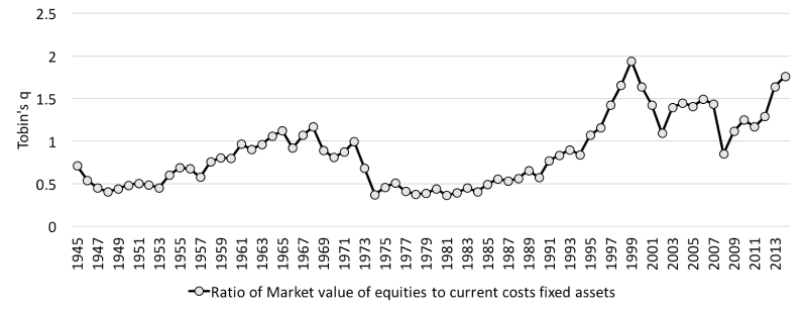

As shown in Figure 3, in the recent period, a main source of growth for household income has been capital gains. They feed into rising wealth. The impact can be seen from a couple of angles. One is the time path of the ratio of a share price index to business capital, emphasized by the late Yale economist James Tobin and conventionally called q. Figure 8 shows how q has varied over time. Its increase beginning in the early 1990s contributed to the large capital gains of the top one percent of households shown in Figure 3. One reason why Stein’s Law may apply to household wealth is that q will “revert to mean” or a value close to one.

Figure 8: Determination of Business Sector Valuation Ratio q

Based on calculations from Federal Reserve financial accounts

Based on calculations from Federal Reserve financial accounts

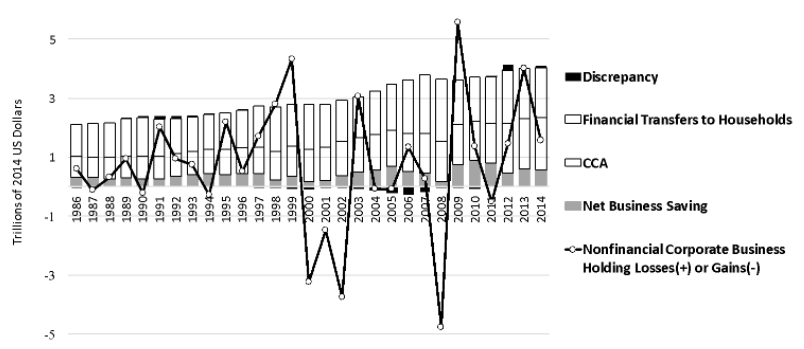

The other viewpoint is from the side of business. Because of the accounting conventions described above, households’ capital gains are corporations’ capital losses. Recall that after-tax business profits break down into financial transfers to households, CCA, and net saving (there is also a “discrepancy” due to minor transfers). Figure 9 illustrates this decomposition over time. The discrepancy is small, and takes both signs. As we have seen net business saving is also “small” – well less than a trillion dollars per year.

Figure 9: Business Saving and Holding Losses

Based on calculations from Federal Reserve financial accounts and the National Income and Product Accounts

The Federal Reserve publishes estimates of business “holding losses” on outstanding liabilities, basically equity. The solid line shows their levels over almost 30 years. Pretty clearly, business holding losses have exceeded net saving so there has been a substantial transfer of corporate wealth to households. That is, households got more money to save while corporations suffered paper losses.

What Is To Be Done?

Figure 1 shows clearly it took 30 or 40 years for the present distributional mess to emerge. It may well take a similar span of time to clean it up. Progressive tax changes of $100 billion here or $50 billion there are not going to impact overall inequality. The same is true of once-off interventions such as raising the minimum wage by a few dollars per hour.

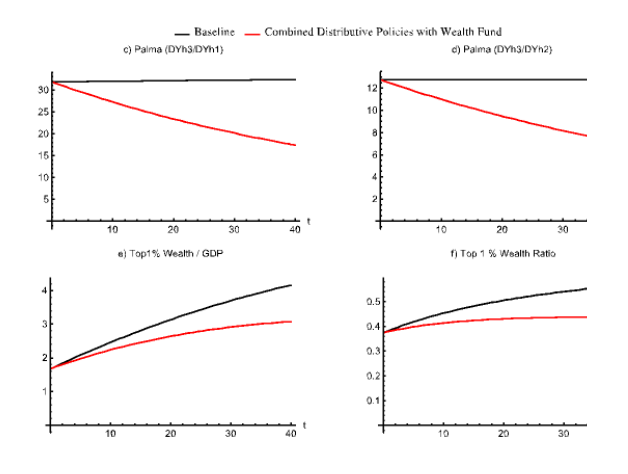

Long-term improvement requires changes to the present situation that can cumulate over time. Following a simulation model described in an earlier paper,10 it is clear that the growth rate of the real wage will have to exceed productivity growth (pegged at 1.4% per year) if Palma ratios are to be forced downward. In a baseline simulation, setting wage and productivity growth rates equal holds Palmas constant. The baseline also assumes that capital gains are equal to business net asset accumulation, holding q constant in Figure 8.

To do better, we can assume that real wage growth is 1.75% per year for the bottom two household groups with zero growth for the top one percent. Shifting economic power from business toward labor would be essential to make these changes happen.

An additional assumption is that there is a one percent annual decrease in the coefficient tying rich proprietors’ incomes to output. Tax reform would be needed to assure this result.

Similarly, there is a one percent annual decrease in the coefficient relating financial transfers to the upper one percent to profits, i.e. firms invest more and distribute less.

These numbers are arbitrary, but illustrative. Over 40 years, such changes would reduce disposable income Palmas by about 50%, more or less reversing the trends in Figure 1. Their effect on wealth, however, would be minimal.

As we have seen, owners of wealth maintain their positions because their large stocks of assets generate big capital gains along with interest and dividend payments from which their saving rate is high. A public wealth fund could become an alternative vehicle for accumulation. Perhaps the best-known proposal is still the one put forward 65 years ago by the Swedish trade union economists Gösta Rehn and Rudolf Meidner, who wanted to extract money from firms to support workers’ pensions. An American version might be financed by a 50% tax on capital gains. It could transfer two percent of its assets each year to households with low incomes. The transfer would mimic a guaranteed minimum income, subject over time to asset price fluctuations.

Figure 10 shows how the institutional changes mentioned above combined with a wealth fund would affect the economy over time. Palma ratios would steadily shift downward. With its high saving rate, an aggressive public fund could make a real dent in the concentration of wealth.

Figure 10: Baseline vs Combined Redistribution Policies and Wealth fund

Model simulations based on constructed data set.

It is by no means obvious that all these progressive changes could come into place. If not, and if Republican tax plans for the rich materialize, the distributional mess will only get worse.

Final Word

Congress’s budget and legislative proposals could only work for President Donald Trump’s “struggling families” and “forgotten people” if they would generate strong trickle-down growth. Structural constraints on income distribution and wealth dynamics won’t let trickle-down happen. Trump’s slogan about making America great again is for the top one percent of the income distribution – effectively a “capitalist” class – not for “workers” in the middle of the distribution or the struggling, forgotten households further down.

I have outlined a feasible progressive alternative, which would generate broad-based progress. Progressive changes may not take hold. If not, and if Trump-style interventions materialize, the distributional mess and his “American carnage” will only get worse until Stein’s Law enters into force.

See original post for references

Bravo. Also inequality is cumulative. New Money turns into Old Money.

People remain confused, as to the reasons for continuing taxes in the US since 1971 … when the sky became the limit. Taxes are how we micromanage the little guy. Has nothing to do with funding the government (except in terms of the self imposed game it plays like “debt ceiling”). The purpose of the corporate tax reform is to bring that expatriate money back, so it can be used for stock buybacks.

Inequality has grown due to a failure of noblesse oblige. The real problems with people are always spiritual/psychological.

Yes! They have no noblesse.

because the Democratic Party’s base like chasing shiny objects like Trump tweets or identity politics instead of putting the DNC’s feet to the fire on economic issues.

California Democrats rubber stamping Diane Feinstein is a great example—-just how much is Diane’s family personally benefiting (real estate husband/pass-thru entities) despite her crocodile tears over tax reform?

The article looks to be a useful wade into the data, but can someone explain why the Palma ratio adds anything to existing indices of inequality?

From Wikipedia

The Palma ratio is defined as the ratio of the richest 10% of the population’s share of gross national income divided by the poorest 40%’s share.[11] It is based on the work of Chilean economist Gabriel Palma who found that middle class incomes almost always represent about half of gross national income while the other half is split between the richest 10% and poorest 40%, but the share of those two groups varies considerably across countries.[12]

The Palma ratio addresses the Gini index’s over-sensitivity to changes in the middle of the distribution and insensitivity to changes at the top and bottom,[13] and therefore more accurately reflects income inequality’s economic impacts on society as a whole. Palma has suggested that distributional politics pertains mainly to the struggle between the rich and poor, and who the middle classes side with.[12]

Author makes a convincing case that capitalism redistributes wealth to the capitalists — who knew, right?

No kidding.

Too long to read the whole thing right away but I did notice this bit:

If the analysis only ‘suggests the latter’ then maybe they need to get better analyzers because companies deliberately holding down wages is precisely the reason why inequality has grown so rapidly.

I do understand why even the good economists like these authors presumably are feel the need use this extensive data analysis to make their points – mainly because the bad economists also try to dazzle with data to reach their conclusions which back the wishes of the monied elite. But doing so only keeps them using the same playing field that the neoliberals have created.

Time for something different besides detailed analyses if we really want to things to change. This type of thing might convince a few academics but to the rest of the people who are bearing the brunt of these policies, it’s common sense that wages are being held down deliberately and they don’t need convincing from the ivory tower.

Productivity gains can either be taken out as money or as time. Working time stopped decreasing and pension age stopped decreasing around the same time that capital started getting more and more of the gains from productivity gains. Might be co-incidence, might be that by agreeing to take out productivity gains as money instead of time then the bargaining position of the ones living off selling their time weakened.

Longer paid vacation, reduced pension age, paid parental leave etc might be worth fighting for more than the obvious reasons.

I am curious as to the minimal amount of comments on this post. Other posts this morning have many comments. In my short time with NC I have been impressed with the knowledgeable comments to posts yet this post has few. Thoughts?

My only take on this post is that the author does not believe that a progressive tax system will help inequality which seems a bit shortsighted. He does not mention that a progressive tax system is not just to redistribute income wealth but to also increase federal and state revenue which can be used for single payer healthcare, affordable college education, infrastructure, social security, etc.

Sadly, readers have less interest in technical posts with charts, particularly long ones.

I can only speak for myself, but I don’t at all mind long technical posts with charts when they are taking me into new territory, that is, when I feel I have something to learn from them. But a long technical post with charts that is only going to confirm what I already know, and maybe leave out what I consider some very important aspects of the situation, I will probably skip, but if I do read, I will probably not comment. Comments are not well designed for long technical responses to long technical posts, and it is too likely that one will inadvertently make a fool of oneself posting on technical matters outside one’s wheelhouse.

But since I’m posting now, I’ll say to JerryB that I support progressive taxation because the alternative, regressive taxation is inhumane and uncivilized, not because I think it will cure inequality. For the author to point out that progressive taxation is not sufficient to reverse inequality does not imply the author disapproves of progressive taxation. It’s true that the so-called post war years had a more progressive tax system, but it’s also true that it had a more robust union system. So there is certainly a place for a technical examination of the question of whether and how these (and possibly other) factors contribute to the astonishing increase of inequality since those years. But some of us old enough to remember LBJ’s “War on Poverty” remember that those years of burgeoning middle class had plenty of inequality still. And that was when we did have both progressive taxation and strong unions. Clearly the solution to inequality includes other factors not under discussion in the post.

Maybe readers feel more intimidated around them. Or at least maybe some readers do.

(It would be worth working through and getting past, because charts and graphs can be very useful and informative.)

I don’t think lack of comments is a reflection on interest in a post. I must admit I just read through this quickly with my morning coffee (as I do all the early NC postings) and went more or less directly to the conclusions when I realised how long and technical it was.

I’m not an expert on the topic so have to take much of the analysis on faith, and I’m certainly not equipped to engage in a technical discussion on some of the assumptions made by the author. I think even if I was, it would take quite a bit of time to go through it. So sometimes with articles its best like this just to read, commenting on everything isn’t necessary. And of course it helps that we can have faith in our hosts here not to put up anything that isn’t rigorous (except of course for when they are a little naughty and put up something bad just to test our critical skills!).

When talking about rents, one should include the various forms of IP, Copyright, Patent, Trademark, and how the terms of these licenses, and hence their societal subsidies, have increased over time.

Look at pharma, the increased exclusivity periods, the privatization of public research thought the Bayh–Dole Act, and evergreening of patents.

This is a transfer of wealth from society to IP holders, who then used these monopoly rents to lobby for more powerful subsidies (they call them protections).

Rinse, lather, repeat.

‘The question is why wages of ordinary households lagged. Changes in institutional norms (laws, unionization and other of the game) surely played a role. Robert Solow (2015) from MIT, the doyen of mainstream macroeconomics, observes that labor suffered for reasons including “the decay of unions and collective bargaining, the explicit hardening of business attitudes, the popularity of right-to-work laws, and the fact that the wage lag seems to have begun at about the same time as the Reagan presidency [see Figure 4!] all point in the same direction: the share of wages in national value added may have fallen because the social bargaining power of labor has diminished.” ‘

I can think of two reasons wages haven’t kept up with productivity gains:

First, as the WSJ says, corporate monies that could have gone towards wages went for non-cash benefits like health insurance. Had we not had the precipitous rise in health care expenses, companies would have had more money to put into wages.

Second, it may be that productivity gains have not been uniform throughout the work force. It’s possible that the top 5% of income earners have become dramatically more productive, while the bottom 95% have lagged in productivity growth. This is the idea proposed by Ed Conard in his book, ‘Unintended Consequences’. The top 5% have been empowered by spreadsheets, the internet, and other inventions, the bottom 95%, not so much. Productivity gains from electricity, the automobile, and air travel were much more broadly shared.

A further point for consideration: it may be, as Bruce Greenwald of Columbia Business School has proposed, that productive capacity is growing more rapidly than demand worldwide. Eventually this means that the profitability of manufacturing will evaporate. European and Asian countries that have bet their futures on the continued profitability of ‘good paying jobs’ in manufacturing, may be sorry they did. I don’t know what kind of politics that realization might bring, but I don’t think they will be happy politics.

If you get your income from a W-4, you’re working class.

Upper Class tax privilege may not be the driver of inequality, but it is one of the tools by which the already unequal-uppers can drive the inequality harder and faster.

And one can’t go from zero to 60 without going through 10, 20, 30, 40, 50 mph first. So “repeal the Trashy Trump tax cuts” could be a first organizing goal to rally people around and for. And if enough Bernies could be shoved into enough officeholder-positions to be able to override a Presidential Veto, then they could forcibly pass a repeal of the Trashy Trump tax cuts. It would be the kind of visible victory which encourages people and makes them see that they may not be helpless victims of the political system. It may encourage people to think they can move on to harder projects and bigger victories, culminating in actions to restore a power balance between Labor and Capital.

Meanwhile, the advocates of Labor-Capital power balance could keep on organizing and propagandizing and agitating right along. When people are ready to get to them, they might have something ready for people to get to.

What is absolutely missing here IMO is the reality that national debt will skyrocket and that will “justify” the further gutting of govt spending not deemed valuable by the powers that be. The corps have already said they are keeping the tax cut windfalls [what a surprise!]. Infrastructure and other costs will be passed to the States. No significant new jobs will be created.

This is the MO of the Paul Ryan and his ilk. This premise [Why Stopping Tax “Reform” Won’t Stop Inequality] is a justification for what is going on? It’s bullshit. Nothing will be reinvested, it will all be sucked up to the top.

OK, I’m a lawyer and not an economist, but I’ll bite. I found the piece to be so much gibberish, except for this paragraph:

The whole analysis falls apart right there, at least from my perch above the Silicon Valley. Globalization has affected far more sectors than “Manufacturing.” That “anachronistic mix” called the “Information Sector” is chock-a-block with H1B’s and other special-visa immigrant groups who are driving down wages in this highly profitable sector. Likewise, I challenge you to find a building site or restaurant in the Silicon Valley/San Francisco Bay Area that isn’t teeming with recent immigrants, both legal and undocumented. Impossible. And the housing and transportation crises that grip the area are directly attributable to population growth — which in a highly-educated region with significant gender equality and small families is completely immigration-driven.

Yes, the post-1980 Reaganite tax-cuts destroyed social cohesion (la noblesse obligé), but it was the Clintonite “free trade” deregulation after the end of the Cold War that opened up the off-shoring of manufacturing and service jobs while opening the gates to massive influxes of both skilled and un-skilled labor. Any fool can see that the globalization of labor and capital markets has created the massive quasi-feudal wealth inequality that we are experiencing in the U.S. Enough fools could see this that the “internationalist” Clinton was defeated entirely by that narcissistic bully Trump’s cynical (and false) calls to “Build That Wall!”

What is considered middle class income (household)? The author refers to a middle class mean income of $180k. I realize that he does not mean this is the mean middle class income (he is dealing with one segment of income). But other than a few major cities and tony neighborhoods like Buckhead and Shaker Heights, where is $180k middle class? That number makes me feel pretty damn lower class!

US median household income is supposed to be about $60k. What is middle class then?

It seems to me like the best option is to raise taxes where the 1 percent gets its income combined with steeply progressive taxes and high inheritance taxes.

Another option is to compensate workers in the form of equity. If workers truly had a stake, then the Piketty problem of capital having higher returns than wages would not be as bad. This would have to be combined though with a wealth tax that at the highest brackets had very high taxes.

The other side if the equation is how much bargaining power labour has. The big one is that what doesn’t go into wages will likely come out as income for the rich. So the government should be actively looking for ways to increase labour’s bargaining power and reduce that of capital.

The biggest obstacle is not figuring out how to build a more egalitarian system. It is how to overcome the fundamental issues of political corruption. The rich will throw everything they have to keep the status quo.

Even if the government could confiscate the assets of the Forbes 400 without greatly diminishing their value, the proceeds would run the Federal government for slightly more than six months.

Here is what Michael Kinsley said about income redistribution in Vanity Fair:

‘I’m all for raising taxes on people making $250,000 or $1 million. But the median household income in this country is about $50,000. You can’t achieve serious income re-distribution if you exempt anyone making less than $250,000 or $1 million. One percent? Forget it. Forget 20 percent (which would be all households above about $100,000). You’re not serious about income re-distribution unless you’re prepared to raise taxes on incomes down to somewhere near the $50,000 (per household) national median. Any higher cutoff and you’re re-distributing from the rich to the above average and even the merely affluent, which is a dubious accomplishment for economic justice.’

If you put a ten percent of income surcharge on the top quintile of incomes (which kicks in around $114,000), and spread it among the bottom forty percent of households, it would amount to about $4,000 per recipient household (in 2012 dollars). Do you think that’s a high enough surcharge so that the top quintile would alter their behavior, and maybe work less, reducing GDP?

In short, the country might not be a rich as you think it is.

https://www.vanityfair.com/news/business/2014/07/thomas-piketty-wealth-money-redistribution

It’s wealth inequality that is the more extreme. Far far more than income.

Taxes serve purposes. You can only pay in dollars so you must use. Second, taxes are the federal government’s way of removing excess wealth not a means of income.

This sums it all up nicely without any numbers or charts:

“The question is why wages of ordinary households lagged. Changes in institutional norms (laws, unionization and other of the game) surely played a role. Robert Solow (2015) from MIT, the doyen of mainstream macroeconomics, observes that labor suffered for reasons including “the decay of unions and collective bargaining, the explicit hardening of business attitudes, the popularity of right-to-work laws, and the fact that the wage lag seems to have begun at about the same time as the Reagan presidency [see Figure 4!] all point in the same direction: the share of wages in national value added may have fallen because the social bargaining power of labor has diminished.””

The cause is a shift in social mores. Away from “We’re all in this together” to the law of the jungle.

In the US, but not in Europe, entropy(kids, divorce, charitable contributions, etc..) tends to dissipate fortunes, with no help needed from the Federal Government. There are still rich Fuggers, after seven hundred years. Vanderbilts? Not so much.

Eventually government restrictions and levies on wealth develop a mindset of ‘You pretend to pay me, I pretend to work.’ We need the top 5% of earners to continue working, just as we need the wealthy to continue contributing money to doubtful, likely to fail ventures. People who take great risks need great payoffs in order to compensate for those risks, which are not just financial, but also reputational.

The US has had significantly better GDP growth and productivity growth than Europe for thirty years, despite employing far more marginal workers. The big question is: why?