By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Oops, they’re already rising

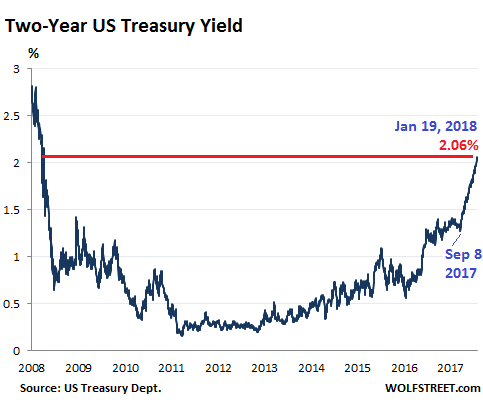

The US government bond market has further soured this week, with Treasuries selling off across the spectrum. When bond prices fall, yields rise. For example, the two-year Treasury yield rose to 2.06% on Friday, the highest since September 2008.

In the chart, note the determined spike of 79 basis points since September 8, 2017. That was the month when the Fed announced the highly telegraphed details of its QE Unwind.

September as month of the QE-Unwind announcement keeps cropping up. All kinds of things began to happen, at first quietly, without drawing much attention. But then the trajectory just kept going.

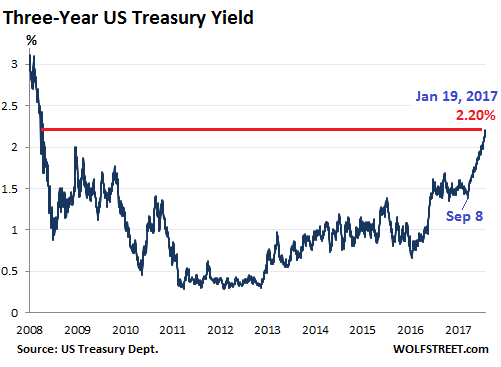

The three-year yield, which had gone nowhere for the first eight months of 2017, rose to 2.20% on Friday, the highest since October 1, 2008. It has spiked 82 basis points since September 8:

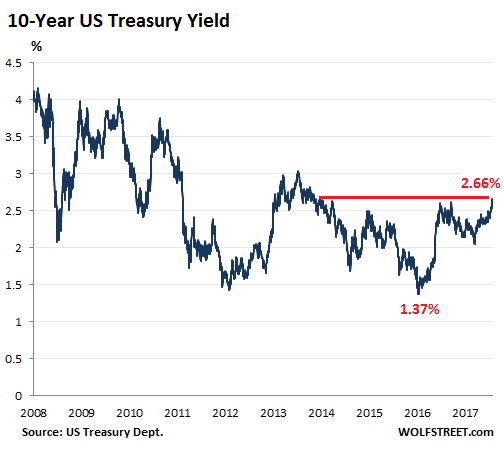

The ten-year yield – the benchmark for financial markets that most influences US mortgage rates – jumped to 2.66% late Friday.

This is particularly interesting because the 10-year yield had declined from March 2017 into August despite the Fed’s three rate hikes last year, and rising short-term yields.

At 2.66%, the 10-year yield has reached its highest level since April 2014, when the “Taper Tantrum” was winding down. That Taper Tantrum was the bond market’s way of saying “we’re shocked and appalled,” when Chairman Bernanke dropped hints the Fed might eventually begin tapering what the market had called “QE Infinity.”

The 10-year yield has now doubled since the historic intraday low on July 7, 2016 of 1.32% (it closed that day at 1.37%, a historic closing low):

Friday capped four weeks of pain in the Treasury market. But it has not impacted yet the corporate bond market, and the spread in yields between Treasuries and corporate bonds, and particularly junk bonds, has further narrowed. And it has not yet impacted the stock market, and there has been no adjustment in the market’s risk pricing yet.

But it has impacted the mortgage market. On Friday, the average 30-year fixed-rate mortgage with conforming loan balances ($417,000 or less) for top-tier borrowers, according to Mortgage News Daily, ended at 4.23%, the highest in nine months.

But historically, 4.25% is still very low. And likely just the beginning of a long, uneven climb higher.

And the impact on mortgage payments can be sizable. When rates rise for example from 3.5% to 4.5%, the payment for a $250,000 mortgage jumps by $144 to $1,267 a month. This can move the payment out of reach for households that have trouble making ends meet.

A one-percentage-point increase takes on larger proportions in a place like San Francisco, where it might take a mortgage of $1.25 million to buy a median home. At 3.5%, the monthly payment is $5,613. At 4.5%, it jumps to 6,334, an increase of $721 a month and an increase of $8,652 a year.

A mortgage rate of 4.5% is still very low! And it is likely headed higher.

Since the Financial Crisis, the ultra-low mortgage rates were among the factors that have caused home prices to soar. But as rates are heading higher, the housing market is in for a big rethink. These higher rates are going to be applied to the now prevailing sky-high home prices.

This will come in addition to the rethink triggered by what the new tax law will do to the housing market.

There’s another aspect to this equation: Homebuyers who are willing and able to stretch to cough up those higher mortgage payments can’t spend this money on other things. Falling mortgage rates gave a huge boost to home prices and to the entire economy in numerous ways. But that process will go into reverse.

So where will it go from here? The 10-year yield is still historically low and has a lot of catching up to do with regards to the trajectory of shorter-term yields. In addition, the Fed will continue to push its buttons – gradually hiking its target range for the federal funds rate and proceeding with its “balance sheet normalization.” And as the 10-year yield rises, mortgage rates will respond, and Housing Bubble 2 will get a lot more costly to deal with.

Even the bond market’s inflation expectations now exceed the Fed’s target. Read… Bond Market Smells Inflation, Begins to React

I just sold a burn lot in Santa Rosa for $275K.

It’s a .24 acre piece that had a 2,500 Sq Ft home of good quality on it, first rate location.

The home sold for $725K in 2015 and Zillow ( Yes, I know) had it at $850K before the Tubbs fire.

It went to a first rate local builder who will rebuild to the original plans, updated to meet current code.

They have economies of scale, so the structure cost will be about $225 per Sq Ft. Maybe a little more.

Builders need a gross margin of about 30%…the math is simple.

These are sharp people and they are betting the house that the neighborhood ( Not Coffey park but hard hit) will support these prices.

They may be right.

The harsh economic reality is that neoliberalism never had a long term future.

Adair Turner has looked at the situation prior to the crisis where advanced economies were growing by 4 – 5%, but the debt was rising at 10 – 15%.

This always was an unsustainable growth model; it had no long term future.

https://www.youtube.com/watch?v=LCX3qPq0JDA

Neoliberalism runs on debt and appeared to work because no one understood debt. Its neoclassical economists don’t even consider debt.

The West’s epitaph – economic chaos through ignorance (of debt)

The UK economy hasn’t been working in a sustainable way since 1980 and was always on a one way trip to a financial crisis.

It gets there in 2008, it’s called a Minsky Moment.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.53.09.png

1929 and 2008 were Minsky Moments for the US economy.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

They were using neoclassical economics that doesn’t consider debt in the 1920s as well.

How can we get the Euro-zone to work without fiscal transfers?

Let the rich North lend the money to the poor South.

Debt initially acts like fiscal transfers, but in the long term more has to be paid back than was lent, the principal plus the interest.

You know it’s going to blow up don’t you?

They call it the Euro-zone crisis.

https://www.youtube.com/watch?v=B6vV8_uQmxs&feature=em-subs_digest-vrecs

Australia, Canada, Norway and Sweden are all on their way to Minsky Moments.

You know they are going to blow up don’t you?

Wait and see.

Neoliberalism’s neoclassical economics ignored debt and this is what it ran on.

As long as interest rates kept going down you could keep adding more debt, but they are now on the floor.

This debt fuelled monster doesn’t work when interest rates rise.

http://newsimg.bbc.co.uk/media/images/45089000/gif/_45089770_us_rates_oct08_226gr.gif

What is going to happen?

There were delays while the teaser rate mortgages reset; the new mortgage repayments became unpayable; the defaults and other losses accumulated within the system until everything came crashing down in 2008.

This debt fuelled monster doesn’t work when interest rates rise.

William White (BIS, OECD) looks at the false economic beliefs that took hold in the neoliberal era.

https://www.youtube.com/watch?v=g6iXBQ33pBo&t=2485s

As a non-economist, and non mathematician, I find this really interesting.

However the jargon wall is daunting. Is there a good simple online text that N.C. readers could recommend to explain these ratios and what they mean? Things like “tail rates” , “bond spreads” etc. Thanks

Add in a wee dash of oil price increase, a half-dollop of runaway real property taxes, and two splashes of 20 years of no-end-in-sight wage stagnation and increased commuting distances–boy oh boy!

Is that a sucking sound, or a slow deflating balloon? If these aren’t just the strangest of times…

Recently, there was a discussion of MMT and jared berstein’s good faith attempt to reach out and get answers.

One of the assumptions that he mentioned in passing was the preference for monetary policy over fiscal policy, professing more confidence in the ability of the central bank to steer things properly.

This idea should be laughed out of the room as loudly and as rudely as possible. 2008 should have buried idea as a quaint fantasy from the 90s era bubble years.

I bring this up because with the yield curve close to inversion, it looks like the fed is going to blunder us into a recession, or at least a serious slowdown.

Sorry to keep harping on it, but J.K. Galbraith put this monetary/fiscal thing straight in his work, “The Culture of Contentment.”

In times like these, taxes on the wealthy must drastically rise, when everyone is doing ok, then fiddle with the interest rates.

We’re doomed. . .

Counties are broke or working on it, and so much depends on property taxes, but what happens when the value of domiciles plummet?

I look to the ‘boomers’ that will be looking to sell their homes and ‘unlock’ their equity over the next 15 years.

Then I look to the Xers and Millennials that have $75k in student loan debt on top of daily living expenses (good daycare is $1,500/month or more – 2 kids? forget it!)

Then I wonder who is going to be there to buy the $500k+ boomer homes as they come on market over the next 15 years?

I’ve been cautioning anybody with collectibles to get rid of them as soon as possible if not sooner-as Club Mill isn’t interested and doesn’t have the do re mi to perpetuate the values they now hold, and used homes fall into that category, certainly.

Foreign buyers…that is who will buy them.

The future is deflation.

Higher rates bring it sooner.

The long bond looking pretty sexy.

I have been waiting for housing prices to return to reality for a decade now – since the 2008 crisis. I was in no position to buy at the time, and I expected things would return to “normal” (i.e.: prices in line with incomes) and I would have my chance then. But in my city (a 2nd-tier tech bubble city) things dropped momentarily, leveled off for awhile, then went right back to climbing and have continued to do so to this day. I know some cities/regions experienced a crash but not here. Today a one bedroom condo costs what a house was going for ten years ago. Papering over the financial crisis didn’t fix any of the underlying problems, and it seems like the average person is worse off than they were a decade ago, but housing prices just kept climbing.

In the meantime, I went back to school, and have since doubled my income from where it was a decade ago, and I still wouldn’t buy at today’s prices. I can’t believe it has gone on this long, and at this point I have resigned myself to being a renter forever. The entire economy seems like it is based on smoke and mirrors, but clinging to my rational worldview hasn’t served me very well. Instead of looking around at things like Theranos and Uber wondering “Is everybody else nuts?” I should have just bought an overpriced house in 2010 instead of being a perma-bear.

Because the housing market wasn’t allowed to crash. All the bad mortgage securities were purchased from the banks by the Fed, and banks and the rich and powerful bought up the foreclosed homes no one else could afford since they could borrow for virtually nothing and had just been bailed out.

So, fraudulent financial institutions on the brink of bankruptcy and liquidation that were bailed out by the US government now own the homes that people used to live in and are now renting them out to the same people that were just kicked out of them 10 years ago, because they can’t afford the houses!

I mean, when you lost you lost, and the American citizen has LOST to wall street. Irrevocably, unless we have a revolution of some kind which is not likely. More likely we will see deflation and worsening inequality as we continue on the path of neofeudalism for the next 10-20 years or so.

Plug your nose and buy…that should guarantee a pop

LOL. That’s always true. It won’t crash until the last bear is in. And since David Stockman will always be a bear, it’s basically waiting till he’s “gone on” till all markets crash.

Plug your nose and buy…that should guarantee a pop

LOL. That’s always true. It won’t crash until the last bear is in.

Don’t I know it. Part of my reticence is that my parents bought at the top before a crash, and I remember them talking about how the place would never be worth what they paid for it. When they eventually sold decades later, I think it was slightly above what they paid nominally, but with inflation… yeesh. So, I always knew that was a possibility and that definitely informed my caution when everybody else was jumping in…

Despite your insane, Lovecraftian books, you’re right on the money. Prices in my area have been going insane for the past year or so, and it’s been pressuring rents way up. I WAS in a position to buy back in 2008/2009, but only a condo, and those came with the risk of insane assessments, or your maintenance fee skyrocketing when half of the units suddenly emptied. Unfortunately, my problem was that I couldn’t get some of the brokers to call me back. They all instantly wanted to max out the amount the bank would lend me, and blanched when I told them I wanted something CHEAPER than the max the bank would allow. Once it looked like they wouldn’t make the percentage they felt was their due, they stopped being interested.

At some point the insanity ends, and there’s nothing to prop up the value of used homes, aside from what people can afford.

The first house I grew up in cost $12k in 1960, and it now is worth $600k, 58 years later. To put in that same kind of performance, it would be worth $30 Million in 2076.

One of our neighbors was the custodian @ the elementary school I attended. Do you think a janitor could afford a $600k 1,200 sq foot house now, ha ha!

Seems that not many of us see a Berraism in the economy – deja vu all over again.

That squeaky sound you can barely hear over the cheers at 1600 over the Dow is the same sound a balloon makes when you keep blowing it up just before it bursts. It still seems that the consensus is still calling for a correction before April.

Meanwhile the Senate is picking the last few petals off Dodd-Frank to enable competition for megabanks to fail in the ensuring recession.