The Financial Times, apparently cowed by Brexit-boosters, has started underplaying Brexit train wrecks. For instance, a story in the pink paper with the anodyne headline UK-US Open Skies talks hit Brexit turbulence would be more aptly called “US Using Open Skies Negotiations to Eviscerate UK Airlines.”

As we and others have warned, as of Brexit, meaning March 2019, the UK is out of all sorts of agreements with third countries that it had participated in via membership in the EU. A transition agreement with the EU will not extend to these deals with other countries and trade blocks. The UK has a daunting number of agreements to try to stitch up in a bit more than a year, and it barely seems to be taking this looming problem seriously.

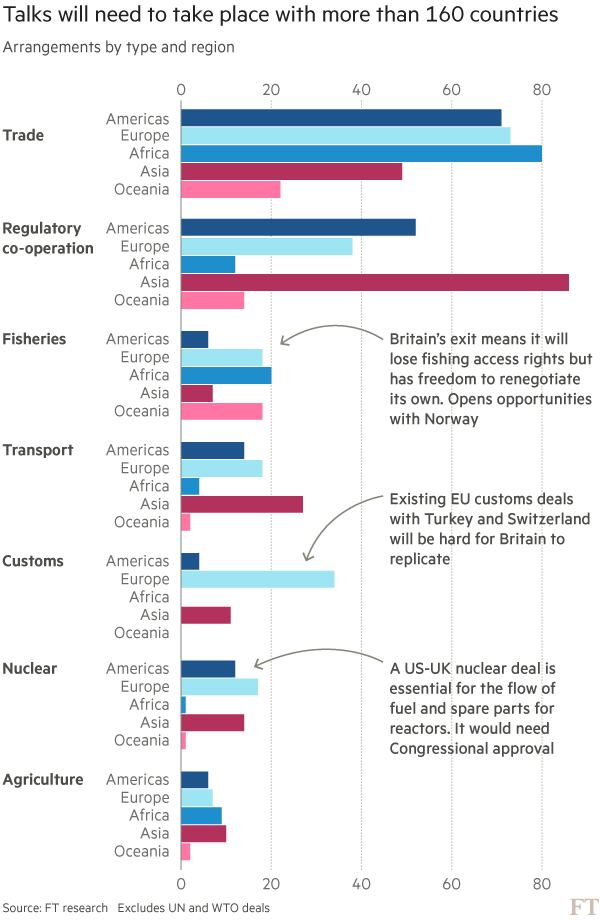

We’ve cited this section and visual from a May 2017 Financial Times article before to underscore the magnitude of what needs to get done:

While Brexit is often cast as an affair between Brussels and London, in practice Britain’s exit will open more than 750 separate time-pressured mini-negotiations worldwide, according to Financial Times research. And there are no obvious shortcuts: even a basic transition after 2019 requires not just EU-UK approval, but the deal-by-deal authorisation of every third country involved…

Each agreement must be reviewed, the country approached, the decision makers found, meetings arranged, trips made, negotiations started and completed — all against a ticking clock and the backdrop of Brexit, with the legal and practical constraints that brings. Most inconvenient of all, many countries want to know the outcome of EU-UK talks before making their own commitments….

***

At its most granular level, the sheer administrative scale of the “third country” question is striking. Through analysis of the EU treaty database, the FT found 759 separate EU bilateral agreements with potential relevance to Britain, covering trade in nuclear goods, customs, fisheries, trade, transport and regulatory co-operation in areas such as antitrust or financial services.

Some of the 759 are so essential that it would be unthinkable to operate without them. Air services agreements allow British aeroplanes to land in America, Canada or Israel; nuclear accords permit the trade in spare parts and fuel for Britain’s power stations. Both these sectors are excluded from trade negotiations and must be addressed separately….

Par for the utter lack of any Brexit-related planning, the closest the Government had done to even acknowledge that this problem existed was a pathetic request in a technical paper last month that amounted to the UK asking the rest of the world to be nice and act as if those old deals they had though the EU were still operative.

As we pointed out even before the Financial Times did the heavy lifting of scoping out how many third country pacts were in play, the UK is going to be at the mercy of pretty much everyone. Unless a country is a decidedly one-sided beneficiary of its current arrangement with the UK, having the UK reopen the agreement gives the other side the opportunity to demand better terms. And all these other countries will have even more of an upper hand with the UK than usual because:

1. The UK will be in a huge rush to get agreements inked or at least provisionally settled to minimize disruption. The side that is in a hurry always has less bargaining leverage

2. The UK is so thin on staff with any relevant technical and negotiating expertise that it will be all too easy for other countries to slip in innocuous-seeming language that is very beneficial to them and have it go undetected (or even if the UK discerns it’s not good for them, they don’t have the time and resources to push back all that hard)

3. The UK is way smaller than the EU, and has also made clear it intends to diverge from other countries, and those reasons separately argue for getting a worse deal than the one currently in place with the EU

The Financial Times report on the Open Skies negotiations shows how things are play out precisely according to script. The UK desperately needs to secure this sort of agreement. Its air transit agreements are completely outside the WTO and no deal means no fallback. It literally means UK planes could not fly into foreign airspace, nor could non-UK flights land in or transit over UK airspace. Some articles have set forth the issues, such as Aviation cliff-edge: How Brexit is sabotaging a British success story by Ian Dunt last month (hat tip Richard Smith). Warning: I can pretty much guarantee what you will read in that post is much more dire in terms of what the UK needs to do and where it will wind up even in an optimistic scenario than what you imagine, even if you have an active imagination.

One of the many key points that Dunt makes is that in the old days of air travel, airlines in countries like the UK were allowed to fly to third countries only if the flight originated or ended in the country where the airline lived. You could have intermediate stops. Another key point (and I am simplifying greatly here, again I strongly urge you to read his post) is that the UK’s safety and equipment certification (which is extremely complicated) comes via the European Aviation Safety Agency. If the UK would be sensible and opt to stay in the ESEA, it could continue to benefit from the big administrative burden it takes, as well as participate in agreements that allowed for airlines to go from point to point outside their home market, like British Airways offering flights from, say, Milan to Amsterdam. Per Dunt, analysts predict that for UK airlines to fall outside ESEA would increase prices to UK customers by 15% to 30%. But since staying in ESEA means accepting the jurisdiction of the European Court of Justice, hard Brexiters are determined to leave.

A final key point: the US’s FAA also relies on the ESEA to oversee safety and equipment standards for its carriers operating in the US.

So the UK, really really really needing an airlines deal, went to its good buddy, the US, first. The UK is finding out how friendly other countries are when economic issues are at stake. From the Financial Times:

The US is offering Britain a worse “Open Skies” deal after Brexit than it had as an EU member, in a negotiating stance that would badly hit the transatlantic operating rights of British Airways and Virgin Atlantic…

The talks were cut short after US negotiators offered only a standard bilateral agreement. These typically require airlines to be majority owned and controlled by parties from their country of origin.

Such limits would be problematic for British carriers as they have large foreign shareholdings. Under existing arrangements, UK-based airlines are covered by the “Open Skies” treaty that requires them to be majority EU owned.

One person attending the London meetings to “put Humpty Dumpty back together” said: “You can’t just scratch out ‘EU’ and put in ‘UK’.” A British official said it showed “the squeeze” London will face as it tries to reconstruct its international agreements after Brexit, even with close allies such as Washington…..

In its opening stance the US side rolled back valuable elements of the US-EU agreement, the most liberal open skies deal ever agreed by Washington. Its post-Brexit offer to the UK did not include membership of a joint committee on regulatory co-operation or special access to the Fly America programme, which allocates tickets for US government employees. Washington also asked for improved flying rights for US courier services such as FedEx…

The biggest sticking-point is a standard ownership clause in Washington’s bilateral aviation agreements that would exclude airlines from the deal if “substantial ownership and effective control” does not rest with US or UK nationals respectively….

London asked the US to adjust its long-held policy since it would exclude the three main British-based transatlantic carriers, which all fall short of the eligibility criteria….

One senior EU official said… “The Americans will play it hard. The mood has changed [against liberalisation], it’s the worst time to be negotiating.”

Despite the fact that the UK walked out of the negotiations, both sides stressed that keeping planes flying was critically important and that there was no reason to think that there wouldn’t eventually be a deal.

But this example illustrates how countries like the US, whether by virtue of sheer economic heft or other advantages, are willing to play hardball with the UK, and the UK isn’t is a position to push back all that much. The Brits are going to learn that being a small open economy doesn’t confer as much freedom of operation as Brexit cheerleaders would have you believe.

Thank you, Yves.

Philip Hammond warned about this in the Commons yesterday, but his warning at the dispatch box has not been reported in the media.

The BBC briefly mentioned Chukka Umunna’s intervention. The BBC, as usual, preferred to talk about Putin’s hit on a former spy in the west country. One talking head, may be American, said on the breakfast news this morning, that Trump is as much to blame for the attempted assassination(s) as Putin, who ordered it, as Trump has Putin’s back.

This was at 05:15 London time today. I felt like getting the Talisker out for breakfast.

I hope that when the reckoning for Brexit happens, there will be enough lamp posts available for the media whores.

Unlikely: The six stages rule probably applies:

Enthusiasm,

Disillusionment,

Panic and hysteria,

Hunt for the guilty,

Punishment of the innocent, and

Reward for the uninvolved.

Are we at (3) yet?

All very entertaining.

Grand theft by speculating with public money and manipulating all markets continues.

Quick! Look over there!

Imagine having to take the train to CDG to catch an international flight. Nicola will be all over this.

The issue of airlines isn’t one I’m following closely, and I must admit to being a bit confused about the issue of foreign ownership and its implications. I know Ryanair stated that they are buying back shares owned by UK institutions in order to re-establish their Irish (EU) status, and apparently EasyJet are doing something similar. I know airlines like Norwegian Air register their transatlantic arms in Ireland in order to come under the EU umbrella.

Am I right in thinking that the US insistence on the airlines being majority owned and operated from the UK if they are to come under a bilateral agreement now puts the major UK airlines in the position of either being able to chose their EU routes (by registering in an EU country) or transatlantic routes (by registering in Britain)? Could they avoid this problem by splitting themselves into subsidiaries in the same way Norwegian Air do?

On a separate Brexit issue, the Guardian is reporting that third level institutions are already starting to feel the impacts in lost staff and postgrad students

The comments BTL on that article are very enlightening, there seem to be a lot of academics experiencing the same problems. For example ‘Adamtut’:

When Brexit first happened my first thought was that the big impact would be on cross-European recognition of qualifications, especially in areas like construction, engineering, architecture and law. That side of thing has gone a bit quiet, it doesn’t seem to have raised its heads at all in the negotiations, but maybe that will change. An acquaintance of mine who works in the marketing and foreign student report side of a small Irish college told me that she is emphasising this in her marketing to Asian students, and its getting a lot of traction.

Incidentally, in that Guardian article it interviewed first a law professor. A colleague who was at a law conference in Brussels said that it was being openly discussed that the EU would encourage the last two Common Law jurisdictions in Europe – Ireland and Malta – to change over to a more European (Napoleonic Code) system. I’m sure this would have lots of implications for those areas of international trading law which are often decided in London.

To your first point, I refrained from quoting more from the FT story. The US opening position is nasty:

https://www.ft.com/content/9461157c-1f97-11e8-9efc-0cd3483b8b80

The use of a temporary waiver means the US could demand a concession every time it was up for renewal.

Remember there is some very bad history between the US and UK in the field of Air Transport. There is long been a feeling that the original pre EU Bermuda 1 and Bermuda 2 were heavily slanted towards UK interests especially towards allowing US airlines access to Heathrow Airport. In particular there was a long time sentiment that the US got taken to the cleaners by the Brits in the Bermuda 2 negotiations during the Carter Administration.

Additionally British Airways/IAG which was and is perceived as the dominant British airline especially at Heathrow Airport has a really bad and mean reputation. For example the dirty tricks campaign they launched against Richard Branson and Virgin Atlantic to which Branson responded with a libel lawsuit that forced the chairman of BA out of his position. Going even further back British Airways was in a big DOJ criminal antitrust probe for anti competitive actions against Freddie Laker’s Sky airlines back in the early 1980s. BA was able to wiggle out of this with political lobbying at the highest levels i.e. Number 10 and the White House.

From the US perspective it is only when the EU took over air transport agreements from the member states including the UK that from the US perspective they were able to negotiate a “fair” agreement to allow US airlines to fly to and from the UK. I suspect there are some still in the US government with first hand experience of this issue over the years who are eager to turn the tables on the UK.

Thank you, PK.

Vlade and I have come across EU27 and British researchers being tempted away from projects in the UK. The packages on offer include family resettlement.

I suspect that the ownership rules are to prevent airlines from shopping around for the best transport deal through corporate inversion. This is to prevent, say Aeromexico from deciding that they didn’t like the Air Transport Treaty that Mexico negotiated with the US from incorporating in London and being covered by the Air Transport Treaty negotiated with the UK. To prevent this sort of venue-shopping you really do need either ownership rules or flight origin rules. Otherwise all the airlines will be similar to shipping, where most ships are registered in a few countries regardless of who owns them or where they travel.

Yes, that’s what I was wondering. I recall seeing an interview with an airline specialist who was saying that British Airways weren’t too worried about Brexit because they would simply incorporate subsidiaries within the EU. But it seems its more complicated than that. I wonder if the airline industry is putting a brave face on it in public, or if they were genuinely slow to realise that its not that simple.

I think they are putting on a very brave face. However, one issue I have the UK airline industry is the are putting out very poor shareholder disclosure as to what the risks and consequences of “No Deal” or very limited deal are. I know shareholder disclosure rules in the UK are different than the US but still I find it quite poor.

Mrs May’s government has already formulated its position for such testing circumstances;

Considering how we all pulled together over a few days of bad weather recently,it looks like we better get prepared for a cannibalism based autarky.

“Small open economy…” That phrase caused a spat on Twitter last year. Tory hack Andrew Neil rubbished a similar comment in a reply to JP Morgan’s Stephanie Flanders. That provoked a reply by London University’s Jonathan Portes, supporting Flanders. The Brexiteers do have an issue with that reality check.

I was cribbing from Willem Buiter, who was once on the UK’s Monetary Policy Committee, and thus in a position to voice views like that and I am sure he used that expression re the UK in 2007 or 2008. He was including it in papers as of 2000:

http://cep.lse.ac.uk/pubs/download/DP0462.pdf

I am now realizing that my pre-2009 policy of lifting way more than allowed by fair use served an important archival purpose. Buiter has a phenomenal blog hosted by the FT, Maverecon, and the FT has not preserved it. One of his seminally important posts was “Is London Really Reykjavik-on-Thames?” is no longer.. All I can find are some pithy paragraphs in my archives. I’m now regretting not having lifted more despite it being improper on another level. And I am separately surprised that someone who produced such a good body of work that would stand the test of time like Buiter hasn’t arranged to have it somewhere on the Web.

This is the key point from that post, which summarizes academic work he and his wife Anne Siebert did:

Buiter though the UK was at risk of a triple crisis in 2008. It had only a banking crisis. Brexit may prove Buiter correct, just on the wrong time frame.

Thank you, Yves.

I fear so, too.

I wouldn’t say that Buiter’s time frame is wrong. One could say Brexit is a continuum from 2008, or the reinvigoration of Brexit from 2010 onwards.

I think this is an interesting (and very big) topic that might be worth some future posting, I’d be very interested to hear what others have to say on this. From the very beginning it has seemed to me that Brexit has set up all the conditions for a triple crisis. The UK consumer is very heavily indebted, whether you look at credit cards, mortgages, or car leases/loans.

Its way out of my skill-set range to be able to look at the odds, but it would seem that a hard Brexit crisis hitting the domestic economy hard, could simultaneously crash the economy, along with sterling and consumer banks while precipitating capital flight out of the country, with the government powerless to spend its way out of trouble (especially if it triggers high inflation). I’ve been very surprised that, so far as I can see, nobody seems to be pricing this into sterling, which has been remarkably stable after its post-vote fall. Unless I’m missing something badly, it would seem to me that the chances of an unprecedented crisis hitting the UK is quite significant within the next 24 months or so.

As far as I can tell, the markets are pricing “she’ll be right” scenario. Which means that in a year’s time it will be a carnage on the current course.

Yes, absolutely, vlade.

Paul Mortimer-Lee (BNP Paribas), who has a decent brain (I know him personally), said on Bloomberg a few days back that the markets are pricing in a deal. If they decide they are wrong then we may see mayhem.

Thank you.

I know some of the government and reg affairs team at BNP, which would be a good employer for me as I speak French and commute into Marylebone. They can see the carnage ahead, but think that may be, just may be, a deal will be stumbled upon as the alternative is too horrific to contemplate, even to the extent that more EMEA work is being allocated to the London team from Paris. They know better than that, especially as some are former Treasury and Financial Services Authority officials. I just don’t see a deal, but I am not as close to the issue.

FWIW It was Buiter who directed me to NC many a long year ago. I am glad he did – a man of high intelligence.

Thank you.

Me, too. Back in mid-2008. I had just attended one of his briefings, facilitated by a colleague and former pupil of his. He talked about the Eurozone, too, at that briefing.

CS et al,

I must say when organising financial service events for a decade that Buiter was easy to get on with and was one of the least demanding folk I’ve ever dealt with. I found him more of an academic than anything else. Never dealt with his wife, but would be a good couple to grace any meaningful event with a focus on monetary policy or regulation.

The Wayback Machine can be quite a gift.

https://web.archive.org/web/20081201032524/http://blogs.ft.com:80/maverecon/2008/11/how-likely-is-a-sterling-crisis-or-is-london-really-reykjavik-on-thames/

Oh, super, thanks a ton!

Some of my daugther’s schoolmates are planning to study in UK universities and one of them has been awarded with a scholarship in Oxford. Talking with their parents it looks that they are eager to ignore any risk arising from Brexit. I really wish that student exchange (apart from Erasmus program closing its UK window) does not suffer a lot. What I’ve read about this in spanish sites is that tuitions will climb, visa will be needed but a cheaper pound could compensate. Nevertheless, it is expected a reduction in the numbers of EU students and Oxford migth open a Campus in Paris to avoid loosing EU subsidies. It is expected that tuitions will triple to equal those of non-EU students, once UE-subsidies and administrative facilities disappear. It seems to me those I talked with are not fully aware of this, or are rich enough to make the sacrifice.

Education won’t, almost certainly, be a priority given the overwhelming task the UK faces and UK Universities are worried they will be the last in queue…

Arguendo, that both the EU and the US seek to pillage the UK for all it is worth using the same playbook that they used in Russia in the 1990s under the cover of Brexit consequences. Then say that the UK’s so-called elite relearn the adage that nations do not have friends, only interests all too late. And that the UK is really on the rocks.

What happens if both Russia and China say together: “Wait! Wait! We will throw you a lifeline – for a price!” At what point would the UK be forced to accept such a lifeline if offered? I’m not saying that the Russians will set up a submarine base in Scotland or that China will buy the Port of London but there could be other concessions extracted.

Thank you, Kev.

There are opportunists and anti-American element in the establishment, vide the late Alan Clarke and Enoch Powell with regard to the latter. The Israel First Judah media family often complain about that.

Its hard to see what the Russians could afford to offer (I suspect that many of the oligarchs have a lot to lose from Brexit given how much London property they own). But I’ve no doubt the Chinese would offer a very good trade deal in exchange for no government objection to buying up key industries such as Rolls Royce or BAE. Although the Indians would put up something of a fight for those too.

I think one thing that any major ‘rescuer’ will offer that will really upset the Brexiters is that any investment will be tied to open visas allowed for the investor to bring in their own cheap labour.

I have heard it suggested that the Chinese would like access to the UK’s arms technology. That could be interesting. The UK might hope to use that as leverage on the US in particular but it would be a desperate move and ensure that the UK was kept away from the latest US military technology permanently.

Thank you.

There was a fear in the City about US retaliation when the UK joined the Asian Infrastructure Investment Bank and warmed up relations with China after the ConDem (conned ’em) coalition took over in 2010.

I forgot to add that Chinese and Russian buyers are active in the Thames valley (ex London) real estate market.

There was a rumour about Chinese investors approaching Cameron and Osborne about selling them the M40. Why the M40? It takes Chinese tourists up to Bicester village. Apparently, the coalition quad thought this was easier to arrange after the 2015 election.

Not the same. UK looting is entirely self-inflicted and avoidable by the UK elites.

Thank you and well said, Vlade.

I would just add that the newer money elite drives this looting more than the older money.

No one has much interest in playing nice, even were the UK to give them incentives to do so. And I don’t see how those scores of negotiations are “mini”. Every one of them is complex and time consuming, and that’s with experienced staff and adequate resources. There’s no evidence that the UK has such resources or the political will to put them to work. The Home Office is already throwing up its hands and just saying No.

The UK is saddling itself with a trillion pound problem that will take two decades to sort out. It could avoid much of that were it to put on its best Emily Litella voice and say to the EU, “Never mind.” The UK can live with the mutual restrictions – and benefits – in its relationships with Brussels and the Member States. Or it could open itself to a neoliberal feeding frenzy and more rapacious, one-sided private sector intrusions into its autonomy.

The private sector’s control over such nits as parking in Chicago wouldn’t be a pimple on the face of the new not-so-united Kingdom. Imagine the bottlenecks – Thames bridges, railway termini, the Underground, the M25 – that would become gold mines for toll revenue. Then there are the concessions for the Queen’s birthday, Hyde Park, Heathrow, passport control and immigration enforcement. Imagine privatized universities releasing the value of their real estate holdings. King’s College could put NYU to shame.

Tory leaders may imagine themselves becoming the new oligarchs of a privatized UK. They are more likely to find themselves out of a job, with a shrunken City, and foreign nationals in the oligarchic role.

I’ve been trying to figure out the ultra eschatology, and that’s about the size of it.

Endogenous Disaster Capitalism.

The neo-liberal feeding frenzy is exactly of course what the hard Brexiters dream of, which is why I find it so baffling that so many on the left are so happy about it. Of course, a Corbyn may manage to engineer a ‘Lexit’ style Brexit, but I find it hard to see that as anything but a long odds bet. Even if he wins power, the need to stabilise the ship will take an enormous effort, let alone fundamentally change how the political economy of the country works.

Yes it could be a very similar scenario to the Atlee government. They ruled during the post WW2 hardship and were blamed for it in 1951, ushering in 13 years of Tory government.

Thank you.

I fear this scenario will play out.

(NB Labour won more votes in 1951, but their votes were not concentrated in winnable seats).

Tory clean skin Tom Tugendhat, former army officer and remainer, comes from an establishment family with an institutional memory. One can imagine that sort of discussion over his kitchen table.

One hopes the Corbynites are thinking about getting their hands on the steering wheel a bit before the omnibus goes over the precipice.

An aside: one wonders how the neo-liberal feeding frenzy calculates the value of the channel island Jersey and its tax haven status. Currently the Jersey pound is pegged to sterling. (Is the UK pound the reserve currency for the tax haven?) What happens to the Jersey/UK financial relationship if UK Brexits itself into a less desirable banking status? Are these offshore tax havens propping up the idea ‘everything will come out right’ (for the UK wealthy if not for the regular people) ? Rhetorical question, of course.

Thank you.

If one compares the Sunday Times rich list from now to when it was first published in the 1980s, one can see this process in play.

I lived in Kentish Town in London in 1996-8 and I had friends in Hampstead – old Hamsteadites, people who’d lived there all their lives (from back when it was possible to buy there without being super rich). The process could be seen on any day of the week strolling around the village.

Then there’s privatizing the NHS. That would require shrinking its payroll while imposing an American-style fee structure – and the lusciousness of American-style health “insurers”. Creating and expanding the ranks of the uninsured would provide new schemes for job creation and wealth extraction. Perhaps reopening the Yorkshire mines could be one.

The New Oligarchs would have to refashion the Home Office. Foreign staff in the NHS, now leaving or unable to obtain leave to enter, would have to be admitted. The oligarchical way to do this would be to copy the Saudis. Grant leave to enter but for limited periods of time, subject to renewal, and without any civil rights. That would simplify wage negotiations and allow for tossing anyone uppity enough to disclose malpractice or join a union.

In following that analogy, the big questions might be what to do about allowing public consumption of alcohol and women drivers. A think tank or two could solve such details in the blink of a Commons division.

A question. Are not many of the agreements (especially on trade) much more for the benefit of other countries than for the EU and by the extension the UK? The UK is a major market for, say, New Zealand apples and wine, which you seldom find in Europe.Would they, like Vanuatu and Botswana, have us over a barrel? I can see that some of the agreements, like the air travel one you discuss, could be very serious indeed, but many of them, surely, are in areas and with countries, where the UK would have a strong negotiating position, in spite of the antics of the set of clowns in charge?

It’s for that reason that I wasn’t as dismissive as some people of last month’s technical paper. The UK line (“let’s carry on with EU rules”) was probably the only feasible opening position for a negotiation. What else are you going to do, after all, make 750 different propositions? An opening bid like that is a way of smoking out where the problems are. It’s obviously not going to work in some cases, but if you are Jamaica wanting to sell bananas, or Malta, heavily dependent on UK tourism, does it really make sense to be awkward?

Its a fair point I think, and no doubt several hundred of those agreements are relatively straightforward. The problem I think is that what may appear at first sight to be a simple ‘single-issue’ agreement, may be nothing of the sort. The UK might be happy in principle to import any number of NZ apples and wine, but perhaps this will trip over the set requirements of another, more powerful negotiating partner, such as the US insisting on allowing its wines and apples must be given first priority. There are also the trip-wires involved when local interests start trying to climb on board, and multi-sided lobbying sets in. Say, NZ pear growers say they want their ‘pears’ to be counted as ‘apples’, or Kent wine growers want a specific restriction on competing light sparking wines.

And of course the biggest barrier of all would be any negotiation with the EU. Ireland, for example, is part of the ‘UK’ as far as Tesco’s supply chain goes. If it introduces produce not subject to EU agreement, then this creates a huge problem for them – they may prefer to lobby to prevent this risk factor forcing them into major alterations.

This was, from what I recall, a major headache in the early days of the EU when they tried to harmonise imports of bananas (a pretty uncontentious product as there are no EU growers), only to find that all the ex-colonial nations had specific preferential deals with their ex-colonies. It proved very difficult to reconcile all the historic trade deals, all for the sake of importing a product that everyone wanted to import.

The “carry on” arrangement may be an ok opening – somewhere. But in a lot of the agreements you have reciprocal quotas. The existing EU agreement does not get dropped because the UK dropped out, so EU keeps the quotas (export and import). For someone like NZ, export quotas (for their apples, lamb and what have you) are ok – as now you have both EU and the UK market.. But the import quotas they may well want to re-negotiate, sa you’d not want to increase the import quotas from the same markets.

Or, alternately, you may want to give the UK no import quotas, and tell them to negotiate it with the EU, that you’ll ok with whatever split the UK and EU works between itself. Have fun.

Did I talk about Gibraltar? The Governor of Gibraltar is just astonished to see that the EU gave Spain the faculty to veto any UE-UK border agreement regarding Gibraltar. He reasoned that “96% Gibraltareños voted to stay”. Well sir, yet you are under UK domain…

I’d be interested to know from the Spanish side, what is the government approach likely to be to Gibraltar? Is it likely to become an issue if it comes down to Barnier seeking agreement for a deal?

In Spain only Catalonia exists these days. The government is almost silent about Gibraltar. I haven’t heard of tough positions but there surely will be issues with the border. Apparently, brexiters in the UK have invoked some kind of spirit of the Malvines but I don’t even know for what reason. The main worry is not about sovereignity but the fact that Gibraltar is a fiscal heaven that the spanish government dislikes.

I find it inexcusable that Cameron offered a Referendum on EU membership without any work whatsoever being undertaken as to what the consequences would be – and, for anyone who did not take their Qs from the MSM, it was a sure bet that the Electorate would opt out if asked for an opinion.

The fact remains, and this is the Historian in my, that at the time of the last EEC Referendum in 1975, one Harold Wilson only called because he was personally assured he had the numbers, is the fact, despite believing he’d win, he actually had a Plan B to Exit, which would have been far less difficult.

Further, I remain outraged that neither Blair or Brown offered the UK electorate a voice on the Lisbon Treaty, which I’m confident the electorate would have rejected.

Cameron and his side-kick Osborne will go down as possibly one of the worst First Ministers and Chancellors this nation has ever had. How anyone can call a Referendum without an Exit Plan in place really does deserve to be hung, drawn and quartered.

The excuse they were pendling then was that if they had a plan, it would make the electorate not scared enough, as in they would think it possible. Turns out electorate didn’t give a toss.

I think May will give Cameron run for his money, as while Cameron may have had the vague excuse of “they will vote in” – even though it was clear since early 2016 it would be too close to call – it was deliquence of duty to trigger A50 w/o a plan. TBH, she’s not alone there, as all the MPs that voted aye are in the same boat.

So burn the boats on the beaches? Always the sign of a good general.

I understand your anger at Cameron. In fact in my opinion he should have insisted that the Brexit side prepare and publish a Brexit plan before the Referendum. Just to explain what will happen once the UK leaves the EU: Plus perhaps insist on a 60% threshold?

(That doesn´t mean I like Cameron!)

My main problem however is with the Brexiters. Several of them were “Eurosceptics” back in the 1990s.

The people John Major called “bastards” I believe?

These people had more than two decades to:

– decide on the goal (Britain out of the EU).. On what conditions? What would be the end status?

– design a plan and a timetable to reach to their goal with minimum interruptions for the British economy.

I can understand why Cameron is blamed.

But…

Why is nobody blaming the Eurosceptics from the 1990s? The very same guys who enthusiastically supported Brexit in 2016? They had years, even decades, to develop a plan (see above). And they had nothing at all after the Referendum. Except chest beating and trying to imitate the Bush fan boys of 2004.

“Brexit would be a success if only the liberal elites would clap louder, cheer harder?”

Not to mention the British media.

Just like the British political elite the British journalists too had no idea about how the EU actually worked.

For them celebrity / politician fights in Westminster were / are a lot more important than the actual problems of a EU – UK divorce.

Its always easier to be against something than for something. I don’t think the Eurosceptics ever really had a clear idea (although some on the libertarian side did have a sort of vision of Hong Kong in the Atlantic). Someone commented that many Brexiters looked like the dog that caught the car after the result came on.

I find people like Peter North of the EUReferendum Blog particularly puzzling. He was an avid (and generally very well argued) Eurosceptic from the right wing libertarian side of things, but he seems to have naively assumed that everyone understood as well as he did that the process would have to happen stage by stage over years – i.e. EEA/Efta first, then a gradual separation. I think some of the more thoughtful Eurosceptics seem to have lived in a bubble, they had no idea that their fellow-travellers were so entirely stupid.

A fundamental rule of politics is that as far as possible you avoid putting things to a vote unless you know in advance you will win. It was precisely because Blair and Brown had the relatively recent Danish and French experiences in mind that they didn’t offer a vote because they feared they might lose. Cameron (and he was not alone) was arrogant enough to believe that the British people would vote to remain – indeed it’s not clear he thought much about the issue. His arrogance helped to ensure the result.

Even that stupidity could have been recovered from if May had actually commissioned the necessary work before invoking Article 50, but she was too afraid of the Tory ultras to do the sensible thing. However this turns out, and whatever your views on the underlying issues, this will go down as the most incompetent British government since, well … help me somebody.

James II? I doubt we’ll see an equivalent of Glorious Revolution afterwards though..

This is hyperventilating again. It is entirely predictable that a UKUSA air treaty will default back to the majority ownership provisions. So BA will restructure and some part of it may even get HMG as a shareholder. Fly the flag!

More ironically, a true ultra would say that if it is owned by foreigners, let them take the pain.

Meanwhile UK is an important market for US airlines so flights will not stop. Life goes on, for richer, for poorer etc.

You really don’t get how heavily regulated industries work. There is no “US/UK” treaty now. If you think the US is not going to extract a pound of flesh for the UK to get a treaty, you are smoking something strong. This sort of willful ignorance and resulting handwaves is why the UK is going to have its larder plucked bare as a result of Brexit.

Only the larder? As I read it seems down to the bone.

If May had openly planned for an exit, she could have used the we might/we might not as leverage, in addition to building a consensus, as the process unfolded.

Short – there is no default. None – without a treaty UK carriers have no right to fly anywhere outside the UK.

Default is NK – there isn’t a WTO here.

But continue to feel free to say that others are hyperventilating. Hysteria will go even better.

Meanwhile, neoliberalism proceeds apace. Universities and other research organizations across the UK are in the process of converting their defined benefit pensions – once common but now rare in the US – to “lower risk” defined contribution plans. University lecturers across the country are on strike over it. Controversially, a majority of the colleges at the dominant and wealthy Universities of Oxford and Cambridge backed the “lower risk” proposal.

UK universities have also been troubled by recent revelations that university vice-chancellors – the operating head, as opposed to the figurehead chancellor – have been paying themselves exorbitant salaries. (Vice-chancellors often sit on the committees that decide their salaries.) The vice-chancellor of Bath University, Glynis Breakwell, recently resigned after an outcry over her pounds sterling 468K annual salary (plus other benefits). Meanwhile, stress and demands on staff and students, and university fees have never been higher.

The article was supposed to be about the US fleecing the UK! What’s new? That has been going on since World War Two when the US forced Britain to give up ports and trading cartels so it would provide support before war was declared on it, forcing US involvement whether they wanted it or not. After the cash for armaments ran out, a loan was accrued anyway. Britain lost vast amounts of national wealth whilst the United States doubled its national wealth over the course of WW2. Where do people imagine a lot of the money came from? I am not sure the Americans were ‘friends’ after all. The yanks did all they could to rebuild Germany and japan. The yanks forced Britain and France out of the action during the Suez crises (and allowed Egypt to form a strong relationship with the Soviets). The Americans have done little for Britain. The tradition simply continues….