Yves here. I am cross posting this article because it is the sort of thing that will infuriate many readers for valid reasons. It contains some good information but then connects the dots in ways that reveal assumptions about how things work which are increasingly not operative.

The premise of the article is that Millennials “ought” to be saving more for retirement and are spending way too much. First, paying down loans is a form of saving, and the article gives no credit whatsoever for that. Second, some of the factoids are missing key context. For instance, quel horreur, half say they spend more on nights out that on their mortgage or rent! How profligate!

Now consider: 1/3 of Millennials live with their parents and presumably pay no or only token rent. So that means that only 1/6 are spending more on their nightlife than on what most people would think of when they think of housing costs. Now how many of those might be in high income cohorts, have rich parents (so they know they are getting an inheritance and don’t need to put away as much) or are making dating a priority because they want to get married and plan to cut back once they’ve found a spouse?

Or consider the supposedly damning factoid that “Half of Millennials have made unplanned purchases because of something they’ve seen on social media.” Help me. This means nothing if you don’t know the amounts involved. So someone heard about a new bakery and bought a muffin as a result? And we are supposed to get bent out of shape about that? Moreover, there’s no baseline. How much to older people buy in response to good old fashioned ads? Are social media somehow more magically powerful than Madison Avenue? Another factor that could lead to mistaken inferences is that young people may more candid about their (gasp) “unplanned spending” than older folks.

And the article pointedly ignores the elephant in the room…high unemployment rates and poor earnings among the young, particularly among the college educated who had the misfortune to graduate during or shortly after the financial crisis. Why are so many living at home? Why have so few bought houses? Aside from the high-fliers who land in fast track jobs in Silicon Valley, finance, or increasingly, the Beltway, Millennials face short job tenures and not much reason to expect their incomes to get a lot better down the road.

And recall that many of the basics are much more costly in real income terms than they used to be. A reader who bought his first car in the 19§0s pointed out how it took not all that many weeks for an average earner to buy a Volkswagen Beatle outright. Cars and housing are much more pricey in real income terms than they were when people who were born in the 1940s and 1950s were young. Even if you want or need to live modestly, the cheap options are pretty much non-existant if you can’t or won’t live with your folks or in your car. It follows that if you have trouble making ends meet, you won’t be in a position to save beyond at best a minimal buffer for emergencies.

The article also fails to acknowledge that the idea of investing for retirement looks like a sucker’s game when super low interest rates have driven pretty much every financial asset into bubble territory. And the article makes the further and not unreasonable point (without putting it in quite so stark terms) that Millennials doubt the current system will be intact when they get to what would be retirement age. We are in the midst of global warming, which is already producing social and economic dislocation, and a mass extinciton event. Worrying about investments seems like sticking one’s head in the sand when the Jackpot is coming….

By Michael Scott, a news editor for Safehaven.com and Oilprice.com. Originally published at SafeHaven

Fear of Missing Out (FOMO) is a huge part of the Millennial psyche. But while that extends to everything that goes down on social media, this generation doesn’t seem to be worried about missing out on retirement funds.

Millennials—or Generation Y—are today’s late teens and twenty-somethings born in the 80s and 90s, and they number some 80 million people in the United States.

And because FOMO is the Millennial common denominator, the financial detours are numerous.

Thanks to the meteoric rise of social media advertising, Millennials have endless options for spending money, and they account for an estimated $1.3 trillion in annual consumer spending.

Half of Millennials have made unplanned purchases because of something they’ve seen on social media.

And half claim they spend more money on nights out than they do on rent or mortgage payments.

Some studies even suggest that nearly 70 percent of millennials experienceFOMO when they can’t attend something that their family or friends are attending.

FOMO rules their days and nights, but so does an apparent gut feeling that the world won’t exist in its present form by the time they retire.

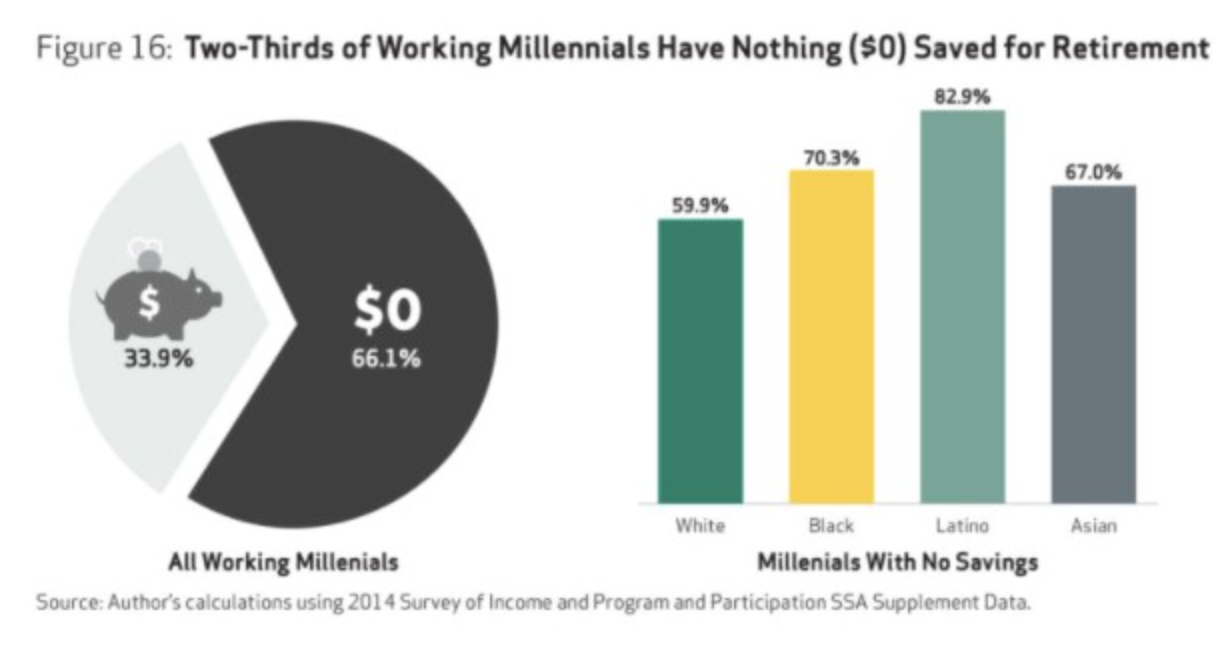

According to the National Institute on Retirement Security, some 66 percent of Americans between the ages of 21 and 32 have nothing saved for retirement.

It also suggests that 95 percent of Millennials aren’t saving enough for retirement, and just over one-third participate in employer-sponsored retirement plans.

Exacerbating the situation, Millennials also face a higher life expectancy, lower income replacement from Social Security, and are less likely to have a traditional defined benefit pension.

“This means Millennials must save significantly more than previous generations to maintain their standard of living in retirement,” the report says.

The March 2018 report is based on 2014 census data, so we’ll give it a wide berth, but if even 50 percent of the people that fall into this age group have zero saved up for retirement, the country might look like a very different place in 40 years.

But that’s exactly what Millennials are counting on.

Because they see limited economic prospects that prevent them from saving, they’re banking on social change. Or, as Salon put it: “Some Millennials aren’t saving for retirement because they don’t think capitalism will exist by then.”

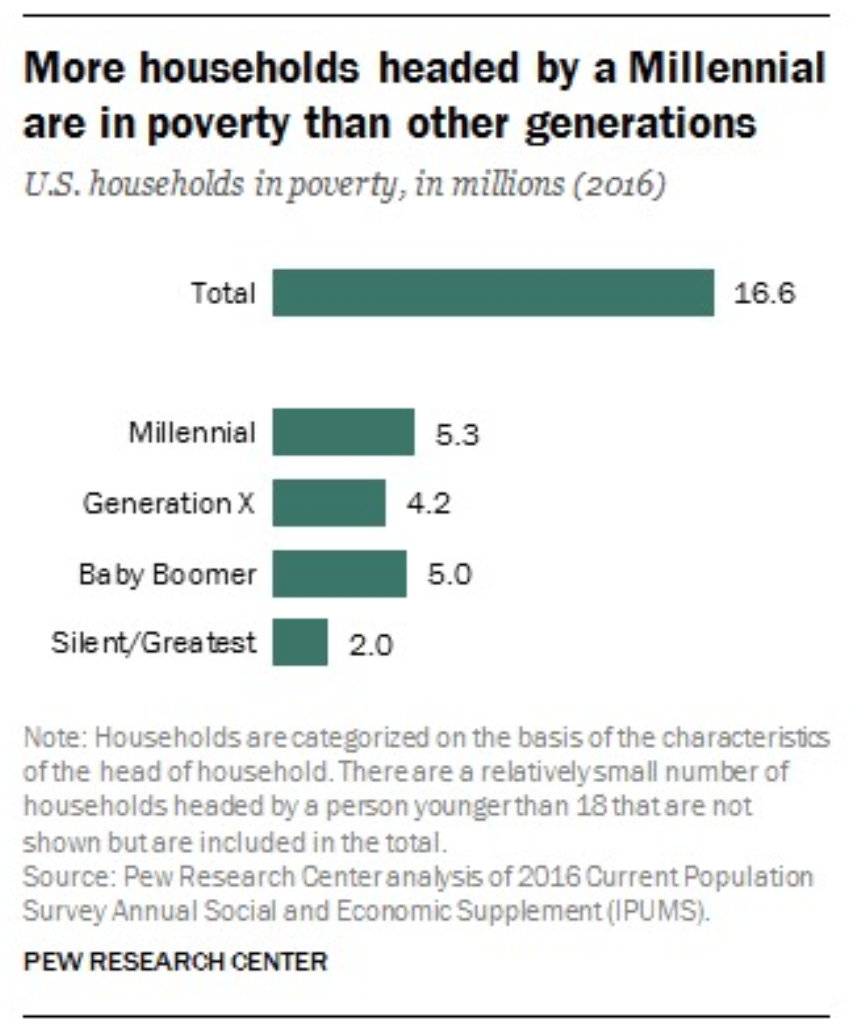

It’s not a crazy notion for a generation that lives in poverty more than any other. A Pew Research poll from last September noted that “5.3 million of the nearly 17 million U.S. households living in poverty were headed by a Millennial”.

Millennial finances took a hit in the 2008/2009 financial crisis, and the high costs of education have also taken a toll.

According to a recent Bank of America survey, 16 percent now have savings of $100,000 or more, double the amount of young people who had saved that much in 2015.

But the bank warns us against thinking that Millennials are just bad with money: “Despite stereotypes of Millennials as being foolish with money and not long-term planners, they are actually behaving quite responsibly when it comes to money,” the report said.

Millennials aren’t as convinced that the status quo will remain unchanged in the, and they appear less inclined to make long-term decisions. And it’s not just because of the instant gratification habit honed by social media. Millennials see a world soon to be dominated by artificial intelligence—for better or worse— and a higher potential for instability and social change.

It’s not simply frivolous short-term thinking. They may see retirement funds as at risk either way. If the world gets darker, Millennials might end up being more self-sufficient.

The intro to this article is so well done, it seems pointless to read the article.

We are in the midst of global warming, which is already producing social and economic dislocation, and a mass extinction event. Worrying about investments seems like sticking one’s head in the sand when the Jackpot is coming….

Hard to put it any better. :-)

I think the issue is with investment “sediment” and giving it the rule of the day, you know, only markets manifest truth.

If I could expand on that a wee bit:

Professional investment may be likened to those newspaper competitions in which the competitors have to pick out the six prettiest faces from a hundred photographs, the prize being awarded to the competitor whose choice most nearly corresponds to the average preferences of the competitors as a whole; so that each competitor has to pick not those faces which he himself finds prettiest, but those which he thinks likeliest to catch the fancy of the other competitors, all of whom are looking at the problem from the same point of view. It is not a case of choosing those which, to the best of one’s judgement are really the prettiest, nor even those which average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.

J M Keynes General Theory

Plants and Animals are great antidote du jour, albeit Lars P. Syll is more my cup of tea, if I can’t think I can’t observe.

Brooklin Bridge is right. The rigor in Yves’s analysis is better than the article itself. The Millennials have grown up seeing both the Republicans and Democrats attempt to privatize Social Security and hand it over to the tender mercy of Wall Street to administer so they have no illusion what will happen to them when they are much older. It probably won’t even exist in its present format.

As for “Half of Millennials have made unplanned purchases because of something they’ve seen on social media” how about we change that to “Half of Baby Boomers have made unplanned purchases because of something they’ve seen on sale in a store”. That first sentence starts to sound like a non-starter now, doesn’t it?

And Millennials also face a higher life expectancy? Last I saw life expectancy was on the way down. The Millennials have got another forty to sixty more years of lifespan left so the jury may still be out on that assertion. In any case, getting back to the main point of this article, you save money on excess earnings and considering how many Millennials can no longer afford a house or car as compared to previous generations, for too many I would classify this under the heading of a ‘forlorn hope’.

Wages flat-lined back in the seventies while prices continued to rise, hence the storm of credit the past few years. If wages had kept pace with productivity then I am sure that the Millennials would be in a much better to be “more responsible” with their money. In short, they are trying to play the hand that they were dealt with.

You are aware this blog has a anti generational perspective, people can not be arbitrarily assigned agency due to birth dates.

Umm, the generational perspective is in the title with the word Milennials here. Of course trying to understand a society by a generational perspective can be a useful tool – if not abused as it has been. By the same token whole societies in the past were organized along generational cohorts such as the original Bantu societies of southern Africa. Actually the Romans too for that matter. And partially the modern Swiss as well. We just happen to live in a society where it is no longer convenient to have age cohorts used for organizational purposes. We divide societies now by how much money we have so, progress?

We divide societies by how much greed we have? Right?

It was the result of a marketing study, not a social science perspective.

Yep. This is Suze Orman with power point. I have woken up several times to a blaring TV with Orman proselytizing about the virtues of saving, “No matter how small.” And then had to listen for the time it took me to sort things out and find the gooser (remote). Once I hear her actually admit that for some people,. no matter how small was a problem, but she went on rather quickly – after all, the ludicrous premise that every one can save, and that all is well in the best of worlds and the future like the past is just one big constant highway for us to “take charge”, is how she and an army of “financial advisors” make their living.

And don’t forget the financial advisors’ favourite – the miracle of compound growth.

As if anyone starting off now from zero, regardless of how regularly they save, will have a chance against the great fortunes accumulating since the eighteenth century … well, maybe the chance to be left behind in the dust. These fortunes can thrive on interest rates of 0.1%pa! Everyone else has to eat their capital

Yes exactly! I thought of that after I posted but too late to use the edit function to add it to the last sentence as in, “…highway of compound interest….”.

What great fortunes from the 18th century are intact today? No American one I can think of. A few European ones.

Among the European aristocracy and industrialists certainly, and also the English like the Grosvenors (present Dukes of Westminster)

“No matter how small.”

This one is particulary ridiculous; there can be no point to saving if the numbers are smaller than the general tendency of un-anticipated entropy events to happen (ha, did I not just make up a term, techno-babble is me).

Anything that comes around is bound to suck all your savings away if they’re small enough; either your regular earnings are high enough (above and beyond the regular costs) or you will need to rely on charity (or suffer in it’s absence), when disruptions arrive.

The “Save!Save!Save!” mantra only makes sense if they mean to say “lower your regular costs down, until significant percentage remains” but for this strategy to work well, one must be in the upper-middle class at least; if the game is played in it’s hard-form (removing the money from the economy), it’s also deflationary and a harm to economy; if it isn’t, the only benefactors seem to be financial middle men.

The casino is rigged, and they don’t have any chips to put down anyway.

All it takes for a system to lose legitimacy is for one generation to lose faith in it. Anyone born after 1980 who believes capitalism is fair, equitable, or worth defending in any version of its current form has either not been paying attention or has been successfully propagandized.

The millenials I know do not suffer the delusion that they are but temporarily embarrassed millionaires.

“Young Man Blues” The Who Live at Leeds, 1968.

Succinct and uncannily predictive

And we thought we had it tough then, see below. Its obviously harder now.

Exactly. Back then, a young man had nothing, now a young man has like -$30k due to student loans.

“Fear of Missing Out (FOMO) is a huge part of the Millennial psyche.”

Complexity squashed flat and meaningless by some vague notion of generational pigeonholing, premised on equally subjective environmental preferences e.g. rational market based assumptions.

He learned it in a conversation with a taxicab driver on the way from the airport. Also, the world is flat.

I loved those Chris Rock Taxi skits.

“FOMO” is very lucky find. It looks great; it owns the space it takes on the printed line. It’s easy to pronounce. Wonderful concept for a column, whatever it means. Is it more than luck there?

FOMO – a new soft drink from the Coca Cola Company? Or is it Starbuck$?

Had the opportunity to ask three Millennials today, “Is your greatest fear ‘missing out’? Result: 2 @ “What?”, one “WTF”. So, maybe not.

Since 2009, the whole notion of saving for the future is over. It is QE to infinity and beyond. The finance business simply wants to suck up any loose cash that they didn’t already grab before the average Joe got his. The exponential function means that you need more than 100% of anything to get by.

Saving means you believe in the government’s ability to maintain some level of global value of the dollar over time. I have ZERO confidence in the USA’s ability to maintain dollar hegemony. Same with virtually every other Millennial I meet. Most save the exact percentage their company offers in 401k reimbursement (usually 3-6%) and those are the lucky salaried ones. Everyone else is barely able to pay rent, or living in a slum eating insta-ramen to save up for a car or house out in the boonies.

Did I also mention that Millenials have to pay bloated rents due to asset prices surging due to QE/Fed’s bubble mania? Millenials pay on average something like 40-50% of their after tax income on rent. Then, they need to play the part of the American worker, which means: decent car, healthcare, decent clothes, etc. I find it hilariously frustrating when Millennials get called out for buying things “they cant afford”. Do the Baby Boomers that make these comments realize that you cant afford anything these days without pulling in at least 100k/year? Name me one thing you can afford at 55k/year. Walmart clothes & fast food? Anything more than $300 is considered “expensive” and this is in a time when $20 barely covers lunch in the city. Did I also mention that all the jobs are in cities?

So when a Millennial buys that $600 phone but cant afford _____, give them a break ffs. They are in the prime of their life, they shouldnt have to be living like a yogi. They especially shouldnt have to when they spent $200k on education.

Agreed. The global value of the dollar is a whiff of smoke on a windy day. People believe there has been little inflation for the last 25+ years. It is all I can do to not drop even further behind the standard of living I enjoyed 25+ years ago. Real inflation of 4% year on year, is little offset by a mere 2% wage increase, if you can even get that. Why in 50 years, of going backward 2% per year, we should be happy to live like Zimbabwe.

I agree the prospects for millenials are bleak. Massive tertiary education fees are socially destructive, economically f…… Stupid and massively reinforce the positions of those born to financial privelige.

However it was not all easy street for us baby boomers; I remember having to hitch hike everywhere, leaving messages for friends written on their doorstep in pieces of cut grass- didnt have alandline and mobile phones hadnt been invented. Couldnt afford shoes one year, and learnt to ( badly) patch clothes, and lived on a diet of baked beans, white bread, liver and sausage meat – the cheapest foods at the time.

Girlfriend? No car, no way, not in Perth, WA

But at least we had job prospects if we survived Uni. And we didnt face the job killing effects of AI and robots. I am just amazed that millenials arent rioting in the streets, especially in places like Spain, Portugal and Greece where unemployment rates are ridiculously high, even for graduates.

We’re all depressed and just surf the internet waiting to die.

Sounds like you weren’t part of the “better class of Boomers”.

Hi Yves. I agree with the general point you make about the article. But there is an elephant in the room that is mentioned but not really given as much attention as there should be: it is the fact that we have allowed corporations to colonize and dominate the minds of the young. Starting with ads for fast food on childrens TV and then hooking them on smart phones and social media. Unfortunately it is true that young people don´t have neither the opportunities nor the salaries that we older ones had. But is is also true raising kids helicopter fashion and then making them dependent on electronic media has resulted in really huge problems in the work space. That is true world wide. Consider young engineers here in Germany who do have really good entry level salaries. There is a huge problem with them not being able to part with their smart phones. They need to be with them all the time. What that does with their concentration I don´t think I need to spell out. Same with apprentices who are expected to master the controlling of highly complex machine tools. These are real problems and without solving them – aka controlling and maybe nationalising the four horsemen of the acopalypse – there will be nothing to distribute in the not so distant future.

. . . there will be nothing to distribute in the not so distant future.

Don’t worry, China is already on the case.

This would seem like an easy problem for companies to solve — simply jam cell phone signals during working hours, turn the jamming off during coffee and lunch breaks.

Look, Tom. I started saving for retirement (I wanted to retire *REALLY EARLY!*) in the mid-70’s, when I had a steady job and as soon as I learned how the Miracle of Compound Interest ™ worked. I figured that my pension, govt or otherwise, would not be there when I needed it (just call me Cassandra..) so I started saving. Oh, and interest rates back then were 7% and often higher, so money saved would double in 10 years. Woohoo!

I saved up and bought a house, since I calculated that I would need a place to live as long as I lived, presumably many years after I stopped working. I reasoned that if landlords can make money renting, then it is probably a better deal to own, provided you want to stay in one place, which is my plan. Crunching the numbers, it was so. Still here, never regretted.

Well, looks like I was right about most everything back then.

But it is 3 decades (=~one generation, just so you know) later now. Interest rates are so poor and inflation is so high that saving is stupid. You buy what you need ASAP, before the price goes up. If you have extra money (what a thought!!!), you buy for the future, as best you can afford. I know I do — it’s just smart.

Tom, times have changed. Back in the day, there were part time jobs, after school and summers, I earned a lot of my tuition money working part-time like that. Grocery bagger, car jockey, gas station attendant, baby sitter, caddy — most don’t exist. Forget working part-time at a grocery store or hardware store, those jobs are taken by retired folks who need to pay for their medical insurance, and tuition these days is enormous. Enormous, and this doesn’t even go back as far as when I went to college.

Young people nowadays! We have done badly by them, from how allowing our schools to crapify, to destroying their part-time and entry-level jobs, to making their college educations an exercise in debt-building, to allowing ‘unpaid internships’ that winnow out all but the children of the rich, to ruining the small and medium industries that provided local entry-level positions and provided the ladders up.

We have cut our society off at the ankles, and we will pay for this. But our young people will pay more, so long as capitalists make all our policy.

You nailed it!!! Unfortunately things will have to get a lot worse before they get better. We will need to break the strangle hold of corporate media on the minds of us and our children. That will only happen once reality becomes so dismal that there is no electronic escaping anymore. I am a pessimist in the short to medium term. But in the end we will win.

” We have allowed . . . ” Really? We have allOWED it? Was there anything we could have done to preVENT it?

Annoying.

5.3 million millennial head of households in poverty vs 5.0 million boomer head of households in poverty. Plus another 6.3 million with a head of household…which just makes you wonder how many NOT head of households are in poverty. Not to mention, it’s a bit hard to survey someone living in their car.

Maybe we should be talking about why so many households are in poverty and how to get them out rather than singling out particular generations just for being poor.

I guess they can wait for the end of capitalism too?

Lambert brought up an excellent point the other day

This is a hard problem. How to re-brand the safety-net? More broadly how to re-brand being poor?

Maybe this has to be flipped on its head. Let’s start with “walking a tight-rope”. Do we want that to be the best metaphor for how we live our lives? If not, let’s define what we want that to be. The “safety net” metaphor should be replaced with whatever makes sense as a complement to whatever replaces the “walking a tight-rope” metaphor.

But even then, what better metaphors do we have when constrained by capitalism? Because that pretty much puts us in a model where the idea is to either collect the surplus from other parties, or have the surplus collected from you. I.e. a system which creates winners and losers, and makes us compete. If we want better metaphors, I think we do have to break out of the capitalistic model.

And I don’t think we can simply wait for capitalism to end. Capitalism will end when there’s no other option. We have eons to go before that’s going to happen.

” Millenialls are…today’s late teens and twenty-somethings born in the 80s and 90s”

Nope. Someone born in early 1980 is 38 right now. Someone born in late 1999 is 19 going on 20.

Would anyone here address a room full of people ranging from 20 to 38, at, say, a professional development session, as a “you teens and twenty-somethings?” Imagine the outrage if a “twenty-something” addressed a room full of 50 and 60 year olds as “seniors.”

Lol. My millenial co-worker (who I adore) called me an older person yesterday. I am 55.

In Hipster Bingo, anyone over thirty (or more precisely, any hipster over thirty) is known as a “grandpa”. I am 48, which I suppose would make me a “corpse”. Eventually, I will just be a “skeleton” — probably around retirement age.

I try to remain focused on class warfare and not buy into the generational variety, but as a college educated millennial, I know I love it when a supervisor in their late 50s with a high school diploma that routinely asks me how to do the most basic computer operations (cut and paste, page numbers) makes 3x what I make.

The icing on the cake is regularly being told my entire generation is spoiled and lazy and socialism is evil.

A lot of people of his generation probably didn’t go to college. Yes college is the new high school (and about as useful).

Do you really expect credentialed elitism to lead to socialist revolution and a society where everyone is considered equally worthy (even if they don’t gasp have a college credential). Good luck with that!

and once that dinosaur goes extinct, the salary and benefits of his position will disappear while the job gets subdivided between 2 people who strangely do not get a raise. Rinse, repeat.

I’m tempted to say plus la change. The willingness, or lack thereof, of 20 something’s to starting saving for retirement has vexed commentators for some time. In that sense, this generation is actually no different from those before. As Yves has pointed out, the ability to save is under doubt, and I agree that is more important than before. Looking back 50 years the changes in the job market are significant too. The effective demise of corporate pension schemes has created this problem.

Having said that, causes are easy to find. Solutions are harder!

You’re right with the ‘plus ca change’. I doubt that the majority of young people have ever spent more on housing or retirement than having fun.

In my twenties I paid around $500/mo in rent. I spent about $300-$400 per week on beer, smokes and cab rides back from the bar.

While I do pay a mortgage and save for retirement now, I’m still pretty dubious about the whole thing. It seems that when you get older and start to need more health care etc and ask how much it will cost, the answer is exactly how much you’ve ever bothered to save. In our late stage capitalist country, someone’s going to make sure they take everything from you before you get any ideas about dying with anything left.

Makes it hard to be like the ant rather than the grasshopper when the odds are good that someone is going to come stomp your anthill no matter what you do.

“… the country might look like a very different place in 40 years.” 40 years?! The only constant is change, and it is accelerating in the digital age.

On a tangent: the tail end of the baby boomers (Birth year 1960) will reach ‘retirement age’ in 7-8 years. America- and the world- have a looming tsunami with underfunded Medicare/Medicaid, and Social Security. “Socialist” Countries like Canada have recognized it, and have adjusted funding commitments accordingly with clear eyes and a moral compass.

The vast majority of wage-earning Americans – those not in the Pete Peterson demographic or philosophical bent, will have physical and fiscal needs and expectations that, like in a hurricane, tornado, or forest fire, that their own nation and Gubmint gonna be there for them and us.

I’m not hearing ANY politicians talking this up, having a plan, or ‘leading’ the discussion with a firm acknowledgment that this is our problem, our obligation- that it is a laudable goal to prepare for and fund.

The implication of this potentially looming fiscal trainwreck, from the eyes of a Millenial, coupled with the evident existential threats of a nuclear, chemical/biological war, species extirpations, the death of Eaarth, anthropogenic climate change, population growth, rise of corporatocracies, and oligarchs— well, Millenial behavior which doesn’t incorporate a long view is understandable and rational.

The public school system ran out of Kool-Aid, and information at the speed of light is nailing the coffin of hope shut. Reminds me of a REM song about the end of the world..

What trainwreck? We had a plan, we enacted it, and we’ve been paying for 30 years. Reagan and Congress doubled Social Security taxes during the 80s and told everyone it would “pay for” Boomer retirement. They promptly cut taxes on the rich. Not that centrists ever stopped whining about Boomers with the audacity to expect to receive Social Security.

Of course, it’s a form of delusion to believe one can “prefund” retirement by stockpiling financial instruments. When you retire, the things you actually need are concrete material items like a roof over your head, food to eat and medical care. Unless your method of saving for retirement involves stockpiling freeze dried food and geriatric nurses in a warehouse, your goal is to ensure the economy is strong enough to produce the goods and educated labor you’re hoping to purchase when you yourself become surplus to requirements.

Fearmongering about Social Security and retirement is how the .01% justify policies that favor themselves and starve the real economy of investment. Worked out great for them, not so well for anyone else.

Obama nailed the coffin of Hope shut when he made it clear that Democrats will always give reach-arounds across the aisle, as vigorously and as often as necessary to prevent any Change.

Yep, its all Obama’s fault.

Most of the Millennials I know in my cohort (mid-30s) who have the means to invest long-term generally choose to invest in a home that’s a bit beyond their means rather than a 401K.

Most have kids, so the need for extra space is viewed as temporary. Most think (rightly or not) that a home is a more stable investment than a 401K. Most think the notion of an investment that you can live in is better than one you can’t (cuz living someplace costs money anyhow). It’s also possible to improve and maintain the value of a home through physical labor, which is nice for some of us. And most of us with the means think best-case scenario for retirement is a small apt. in Costa Rica or some such (which actually sounds nicer to most of us than a gaudy ranch house in Florida).

Alternatively, many of us with means know we are going inherit lots of nice shit before we retire (alas, not I) , sooooo, really, why worry.

If the home has a yard around it where gardens may be made and food-plants grown, then that home is indeed a potential investment. And making some high-powered gardens would be realizing the potential of that investment.

So would super-weatherizing the home itself. So would retro-fitting it with sun-capturing south-and-west facing windows if such don’t already exist. So would setting up multi-thousand-gallon water tanks to harvest and store all the sky-water falling down on the roof.

Such a home with a yard around it presents many doomsteading-investment opportunities which vastly outvalue a 401k. Lucky ( or good) the millenial who finds hermself living in a home which can be converted into a fortress-doomstead of semi-peasant semi-survivalism.

The time will come when you can’t by that with any normal amount of money.

Oh yeah, I’ll stop spamming this thread after this, but let us not forget that more than a few boomers primarily “saved” for retirement in their 20s and 30s by working someplace with a defined benefit plan and buying a house that proceeded to quadruple (or in some cases, a lot more) in value.

Then again, more than a few boomers thought they were doing that very thing only to have the defined benefit plan retro-abolished on them and the price of their house crash right back down to earth around them.

Of course, if they turned their house and yard into a survival doomstead, they at least kept the survivalist value of the house and yard, even if not the hoped-for Final Price.

>Some studies even suggest that nearly 70 percent of millennials experienceFOMO when they can’t attend something that their family or friends are attending.

What the (family-blog)ing (family blog)? Isn’t spending as much time as possible with your “family and friends” a good thing anymore? And it’s funny because when I first read FOMO I thought of my generation, where it would relate to material things, was bad, and that is so not Millennials even if you argue it’s only because they’ve given up on getting it.

Reading the whole piece I can’t tell if it’s a criticism or a pat on the back, but the last bit seems to point to the latter despite the awkard attack on spending time wiith other human beings. What is a “long-term plan” anyway but a bunch of guesswork, which becomes more unlikely the farther you go out. Long-term plans and savings were a way of life in Eastern Europe and then WWII, you know.

The “Millennials spend too much and aren’t saving” trope reminds me of people who cry that the sky is falling over the federal deficit and debt, and then complain that the interest rates on their Treasury bonds are too low. You can’t simultaneously complain that Millennials throw all their money at online purchases and smartphones and products they saw advertised on social media, and then turn around and expect Amazon, Apple, Google, Facebook, and Twitter stocks to fund your retirement. If the system requires contradictions or long-term non-viability, then the issue is the system and not those trapped in it. Don’t hate the player, hate the game.

Let’s be honest, the article’s goal is to give boomers ammo to wag their finger at the younger generation and blame the victims. It’s pandering to their predilections.

Confirmation bias + punching down = baby boomer catnip

Years ago, liz warren’s book on bankruptcy pointed out that spending on discretionary items, like going out boozing, can be cut back instantly in a crisis. You can’t easily cut spending on house or car payments.

Again, with no confidence in future earnings, it makes no sense to think about the long term.

30 year mortgagee with job insecurity… um… something about risk and uncertainty being quantified.

As there most drugged (legally), marketed to, and controlled generation I just feel very bad for them. They were also sacrificed, along with fixed income savers nearing retirement by Obama’s fiscal policies. I cut them a lot of slack!

“doesn’t seem to be worried about missing out on retirement funds”

-If you need most (if not all) of your paycheck to sustain yourself then you can’t fund a retirement account. And since equities are expensive and bonds have dismal returns, what are you going to invest in anyways?

“some 66 percent of Americans between the ages of 21 and 32 have nothing saved for retirement”

-The median savings for families whose wage earners are between 50 and 55 years old is only $8,000. For those who are between 56 and 61, it’s $17,000 reports the Economic Policy Institute. https://www.cnbc.com/2017/06/13/heres-how-many-americans-have-nothing-at-all-saved-for-retirement.html

“A Pew Research poll from last September noted that “5.3 million of the nearly 17 million U.S. households living in poverty were headed by a Millennial”

-Aren’t households headed by the young typically poorer than those headed by middle-age adults?

“Fear of Missing Out (FOMO) is a huge part of the Millennial psyche.”

Uh huh. What a new concept! I don’t remember all of my parent’s friends running out to buy flat screen when they first became available despite having $50k in credit card debt and being mortgaged to the gills. Silly me trying to get an education so I can get a good job (something the baby boomers told me was a guarantee), now I have $200k in student loans.

Here’s a boomer who bought into the “get a good job, get a good education” BS. Oh, did I ever.

Then came the 1980s. The Reagan years. When that “good education” wasn’t good for anything but stints as a dishwasher, shelf stocker, and cashier. Yeah, those were the days.

During that time, I got an education, all right. Major course of study: Propaganda vs. the world we really live in.

Color me as someone who’s still very leery of credentialism.

Learning about MMT and some comments by Mark Blyth got me thinking about student loans and retirement funds as an inter-generational transfer scheme. Lots of assumptions or simplifications one could make but you wouldn’t see people as going from paying off debt to saving until half way through their careers or more in such a simple scheme (all personal assets are another person’s liabilities). In other words, if you want a retiree to have 2 million at 65, show me a 20 year old with 2 million in student loans. Obviously government and corporate debt change this, dramatically, but I think it a useful thought problem.

Wow! Thank you or this! I will go forth, crunch some numbers and most likely do some preaching.

“And recall that many of the basics are much more costly in real income terms than they used to be. A reader who bought his first car in the 1950s pointed out how it took not all that many weeks for an average earner to buy a Volkswagen Beetle outright. Cars and housing are much more pricey in real income terms than they were when people who were born in the 1940s and 1950s were young.”

Aye. They are much more costly. And yet many people out there insist that inflation is low. There seems to be a disconnect here.

If it requires debt to buy it the price has skyrocketed. If making it can be outsourced to China the price has fallen. So the rate of inflation will vary strongly according to how you measure it, and the path to riches is to sell cars made in China.

basketball shoes are made by Asian serfs and cost more than ever.

The issue is that needs have gotten more expensive.

– Food

– Rent for apartments and houses

– Healthcare

– Transportation (for those who live in cities, relying on mass transit is not an option outside the city core where rent is expensive, especially not in rural areas and in North America, where the car culture is dominant – not to mention transit itself is crapified – https://www.nytimes.com/interactive/2017/06/28/nyregion/subway-delays-overcrowding.html)

This is not a sustainable situation.

Cars now a days routinely his 200,000 miles.

Back in the 1960’s, it was time for a new car before the odometer his 100,000.

And don’t forget seat belts.

I followed the link to the study. (I haven’t read the actual study, just the NIRS discussion). First, they define Millenials as those born between 1981 and 1991, numbering 83.2 million.. Contrast that with the Safehaven reporting: “Millennials—or Generation Y—are today’s late teens and twenty-somethings born in the 80s and 90s, and they number some 80 million people in the United States.”

So right off the bat the Safehaven is misrepresenting who is in the study while still using the N size from the study. Bad/sloppy reporting.

Second, here are three statements that seem self-consistent, but the reporting seems to focus primarily on the 1st (negative) rather than the 3rd (positive):

1) Even though two-thirds (66%) of Millennials work for an employer that offers a retirement plan, only slightly more than one-third (34.3%) of Millennials participate in their employer’s plan.

So yeah, sounds bad. Barely more than half. But…

2) Four out of ten (40.2%) of Millennials cited eligibility requirements set by employers, such as working a minimum number of hours or having a minimum tenure on the job, as a reason for not participating in a plan.

So just because your employer offers a plan doesn’t mean you are eligible.

3) More than nine out of ten Millennials participate in employer-sponsored retirement plans when they are eligible to participate.

So 26 to 38 year olds do mostly “save for retirement” through their employer, when they can. Now, I’m not sure how that is consistent with “The analysis finds that 66 percent of working Millennials have nothing saved for retirement”, except maybe by percents of percents and/or nothing being equated to “next to nothing” (e.g. less than $1000).

Two more quotes and I’m done:

“Two thirds of Millennials are concerned about outliving their retirement savings. More than nine out of ten Millennials agree that the nation’s retirement system is under stress and needs reform.” Yeah, me too. As others have pointed out, these are not problems/opinions unique to Millennials and has nothing to do with FOMO.

“Financial experts recommend that Millennials set aside 15 percent or more of their salary for retirement, which is a much higher rule of thumb than recommendations for previous generations.”

So yes, Millennials are getting screwed relative to other generations because the bar is being set much higher out of the gate. This is not FOMO, it is BOHICA.

But again, my take away is biased/sloppy reporting.

Thanks for this. Very helpful!

How can Millennials be expected to save for retirement with the burdens of student debt that can’t be cleared in bankruptcy or usurious credit card rates that would warm the heart of a Mafia loanshark?

Plus remember Health insurance.. 20 years ago my health insurance was such a small percentage of my salary it was negligible. Now it’s 12% plus all the random bills I get by surprise 6-16 months later. Until this elephant sucking almost 20% of the GDP is addressed forget savings.

And remember savings interest rates vs inflation rates. Srsly, in this mileau, saving is just stupid. Buy it now.

You can’t actually prepay all your regular bills that way, so at least save for unemployment, because everyone can and will be unemployed for long periods of time at some (and probably at many different) points in life, and unemployment checks won’t cover it all.

Sandercrats should run on Repeal The Biden Bankruptcy Bill. But only if they really want to repeal it.

It would be another way to name, shame and out the Clintocrats.

LOL OMG WTF

When I read the title I assumed that the thesis would be that Millenials are sick of neoliberalism and want societal changes in which citizens are allowed to care about each other (communities sharing concrete material benefits).

Right now, we are expected to be consumers (homo economicus) looking out only for number one (F you, I got mine).

A simple Google search leads to the information that Michael Scott is 26 years old. Which was surprising, because he writes as though he has never actually met a “Millennial.”

I have read articles like this one, telling 20-year-olds to start saving for retirement, my entire life. Thank god I never paid any attention to them!

If 70 percent of Millennials fear missing out on life now, they definitely will if they mainline the kind of fear this article is purveying. We can hope the 30 percent that did not fear missing out on life were too busy doing extreme sports, high on mushrooms, having sex, making or seeing art, playing or listening to music, having flaming romance, reading the greatest works of the human mind, riding motorcycles across the country, and just using all the force and passion of their young bodies and minds to live. And we can hope that the 70 percent that filled out the survey did it by letting the cat walk across the keyboard, decided to fill it out blindfolded, or did it randomly, or filled it out with a group of witty ethylated friends they introduced it to with, “Hey,let me read you this stupid survey…”

Their futures will hold plenty of mortality, babies keeping them up all night, lost jobs, swindling oligarchs and politicians, war criminals, and old age. Backed with the experience of a youth spent growing and experimenting, this stuff can be faced and even faced down — it has been done before. May they miss out on nothing!

I’m a 22 year old man. What separates me from my father the most is that he grew up reasonably believing that the future would be better. And because his mind was shaped by that era, and because his brain lost all plasticity after that era, he still acts as if the postwar dream exists. And I have to be the one to tell him Santa isn’t real, like he’s a child. Except he has seniority, money, and “wisdom” over me. It’s a weird feeling.

He might not be wrong. “A better future” does exist for people with money (or perhaps luck). Perhaps the issue here is that you and your father have different ideas on what that term means.

Global warming, nuclear fallout. You can bet the elites are prepared. There will be human beings even after those have happened. And as long as there are human beings, “progress” would continue out of greed, etc and some people will benefit. For those people, it will be a “better future” indeed.

Be like Varys from the Game of Thrones:

“The storms come and go, the waves crash overhead, the big fish eat the little fish, and I keep on paddling. (Varys)”

When he grew up he wasn’t competing with billions trying to all sell labor on the market, with corpoations and government both trying to suppress wages at every opportunity. Plus ask him how much his down payment was on his first home, and how much it cost him to have you. He never had to compete under the same conditions.

There are other concerns. For example, an erratic, basically illiterate man (who says the only book he ever read was The Fountainhead!) has just filled his cabinet with what can only be fairly described as vicious lunatics. These people seem hell bent on plunging the world into a nuclear holocaust beyond anyone’s imagining. Then there’s Fukushima. Nope, it didn’t go away. It didn’t get any better. It’s still there. It’s getting worse by the day. By the hour. By the minute. Sit down. Figure the odds. How long can they get that we will even last another six months with utter madmen in the Whitehouse and Whitehall?

Global warming? I’d take that bet if you could take these other things off the table. There’s a rattlesnake and a cobra in the living room.. but most of us are worried about that little house spider over there in the corner! Madness! Who can blame these “millennials” for not giving a crap. If you’re a billionaire with a vast private underground bunker.. fine. Otherwise.. forget about it. The game is tilted. The ball is in the gutter. Saving money? For what? Why? Lunatics are steering the bus. The cliff looms!

I think if we give Millenials enough money, they will MAINTAIN capitalism whether it’s global warming or not.

Nothing new or special about Millenials.

Is this some sort of cruel joke? I’ve saved $2500/month for years for a down payment for a house and prices are rising so fast in SoCal I’m not even treading water, I’m falling behind. I’ve recently given up on ever owning a house. I’m going to take the paltry sum I’ve saved and take a mini retirement and travel the world, and go back to renting for another 20 years. The rat race is for suckers.

By the time you’ve paid your property tax, HOA, repairs, and mortgage interest, aren’t you really just renting? At least actual renting lets me go where the work is.

And to be clear, I’m the sucker.

They’ve been saying since the 90s “the average person will switch careers X times and switch jobs X times by age 55”.

And the mortgages are for 30 years. Right.

In reading this I felt it to be a typical, ideologically driven hit piece on the victims of neoliberal policies that attempts to foster generational faultiness and assumes the status quo will continue into perpetuity. I hope I’m wrong in my assessment. IMO, the millennials as described here are responding to the current policy set and the profoundly troubling social, environmental and economic issues they have inherited in a predictable and entirely rational manner. They are passively awaiting the natural mortality of the current policy elite who have created the economic and political environment that the millennials have experienced; and the subsequent changes to the political, financial, economic and legal system they hope to implement (as the title to this article suggests).

Capitalism left the building 10 years ago for the One Percent, Wall Street, and corporate CEO’s. For the members of this relatively small group it’s been a “privatize the profits, socialize the losses” joyride. For most Americans, though, it’s been austerity and raw neoliberal capitalism during their entire working years. For confirmation all one needs to do is consider the incredible concentration of wealth in the hands of a few that has occurred, the long list of failures to prosecute elite criminal behavior, no enforcement of anti-trust or environmental laws, endless wars, the recently enacted tax legislation, de-regulation, central bank policies over this time period, repeated threats by politicians and their donors to undo what remains of the tattered social safety net, etc.

In addition to the well publicized societal issues these policies have fostered, a widely ignored aspect of the current policy set is that it has led to the rise of zombie corporations and institutions, ascendancy of the incompetent, declining national economic productivity, and related social and economic malaise. Is this now anything like a vital system?

Yves, Thanks for the good summary. The article is just more generational politics garbage propped up with “particular” numbers. These kind of shallow overviews need to be classed with horoscopes and astrology as far as I’m concerned.

I’m 31 and the only thing I have pretty well figured out is that I’m as dumb as a 31 year old from 50 years ago. Every conversation with my elders seems to confirm this. They worked a job to make money, paid bills, and acted as rationally as they thought made sense for their day-to-day reality. Rinse and repeat until dead.

Thanks again, Yves, for a timely article on millennials.

I am the mother of four millennials; three of my four are now heading households of their own. Two of the three have children of their own and the other has a beautiful, wonderful stepdaughter who I am proud to call my only granddaughter.

One of my sons has his own construction business in NJ; he has two sons and another is still working on his degree and has a wife and son. The one who owns his own business is doing quite well but I do worry so about the one who is going to be saddled with huge student loan repayments.

They live with his wife’s parents and they contribute to the household as much as is possible since they are both in school this is difficult for them. They assume all of the costs of their year old child and the wife’s parents are wonderful and generous people who I feel fortunate to have as relatives now. They are very understanding and helpful with my son and their daughter and our grandchild. Being working class home owners they realize how difficult it is out there for young folks these days.

Another of the boys works as a metrologist and he is finding it difficult to get paid a living wage even with a sought after skill – by scientific (GMP) manufacturing companies, among others – but has recently found himself inundated with calls from local recruiters who do recognize and value his skills. It feels good to be wanted and he has had several interviews and now has a couple of different offers of full-time permanent employment with a more than living wage. His wife is a highly skilled administrative secretary and does pretty well, salary wise.

My other son, the youngest, is disabled and lives with my husband and myself. He’s a great young man and is very thoughtful of others and works part-time regularly every week.

Life is tougher than ever out there in the US of A as far as rents, healthcare, food, transportation and other assorted costs of living are concerned and I applaud my kids and all of the others who do their best everyday just to make it.

Our country makes it extremely difficult for young people to get out of mom and dad’s house and to have what once was a ‘quality life,’ i.e. middle class existence and I think we should give these young people credit for a job well done considering what they have to ‘work with’ as it were.

I am also recently re-employed in the healthcare racket so I am happy to finally be able to give Yves and Lambert, over at the Water cooler, a couple of my hard earned bucks every month. On my first paycheck I will be proud to be giving this group a little bit of financial support for a site which is, for me, absolutely indispensable.

Thanks so much to you all, readers and moderators, commentariat and those who post everyday. You are my unsung heroes.

I find these articles rather amusing. I’m not quite sure what the system we have in place currently should be called, but it’s definitely on its way out. I’m reasonably assured, the status quo will not continue into perpetuity.

Agreed. Even though it’s a big subtext of the material at NC and other similarly-inclined sites, economists, pundits, and most people regard Western countries as being under the same system since, oh, the start of the 20th century, or at worst, the end of World War II, the change from democratic socialism (strong form in Sweden, weaker form in the US) to tooth and claw neoliberalism amounts to a change in the system, but because it happened incrementally over time, very few are predisposed to put it such stark terms.

Crapitalism.

Another issue – what would happen if everyone lived within their means, as this article argues people should ostensibly do?

A massive aggregate demand collapse.

– If people consume less, then there are fewer jobs

– This in turn means that there are more layoffs and people will be forced to consume even less

– Which becomes a self reinforcing cycle into deep poverty

Most people have no money left to consume. Debt has been temporarily buoying up consumption, but the issue is that debt must be repaid or consumption drops later. Plus with creditors getting to write the bankruptcy laws, well … it gets worse. As Michael Hudson notes, debt that cannot be paid won’t be paid.

The end result would be a deep economic depression. Likely that would be followed by the rise of the far right. The best possible outcome is someone similar to Roosevelt.

As others have noted, the low rate of inflation cannot possibly accurate. Apart from the top 10%, we are falling behind each year …

Haha, the Federal government would have to spend more! Quelle horreur!

I tried to comment early today but I think I took too long and it failed to post.

This evening I see that the number of comments is quite high and suspect that this article had some traction elsewhere. I want to ensure that one idea gets out, and it’s one that I never see anywhere. We need to repopulate rural America in order to address inequality and financial insecurity. That means making life in rural America sustainable–making agricultural life sustainable for everyone who supports it. Here is what I originally wrote…

I’m not a millenial, but I have stopped worrying about retirement savings. I can’t stomach the idea of working for a retirement when I should be using that energy to address our collective existential problems. I also think that the need for retirement investments is just a consequence of economic growth obsession and the colonization of communities.

I am counting on an eco-socialist revolution where we work towards demonetizing human needs and localizing how they’re provided. This is a deliberate process of forcing degrowth on a national and global scale through the efforts of communities to grow by redirecting their energy and resources inwards and making them sustainable. The obvious concern there is that 20th century mass migration from rural to urban communities limits where such a notion can thrive without overwhelming challenges.

I agree. As much as I like cities, I could see living in a smallish town, provided it had some minimal amenities (some hangout places like a bar and coffee shop, a post office, drug store, dry cleaner, grocer, bank… and a library!). But I’m too old and don’t have the joints for farm life or even gardening. About all I could do in that category maybe would be to keep some chickens.

In the meantime, perhaps people living in towns and cities can note the emergence of new little microfarms owned and run by 30-and-under-year-olds in the near country surrounding the cities and towns. Perhaps people living in cities and towns can even help these young new micro-farmers and mini-farmers survive and succeed by buying and eating what the new young farmers are growing and producing.

And that is how urban-suburban foodbuyers can help push the pace of near-country repopulation until larger movement-loads of people are prepared to study and analyze the history of Official Antifarmer Policy in America starting with the Eisenhower Administration till now. Perhaps it could be reversed and replaced with an Official Profarmer Policy designed to foster economic-viability reasons to repopulate skeleton-towns and maybe even redivide and re-homestead ( or semi-re-homestead) some of the megafarms and gigafarms of today.

One way to understand the spending of this cohort is to compare entry level wages ‘then’ and ‘now’. In 1971, my first teaching job after university paid $85,000 in current money. Entry level salaries at IBM in the mid-60’s paid roughly $89,000 in current money. Any baby boomer can go to any online calculator to find the current value of your entry level pay. It clarifies a lot of things and puts this article in the ideological perspective required. Blaming the victim and dividing the country: the key tools of the right wing ideologues trying ruin this country.

I’m 22. The way things are going I’ll be able to retire at what, 70, 75? I do save a significant part of my income, its very much possible, but I most of my peers don’t. I dont blame them! Theres a very definite mood of ‘We’ll never be able to afford a house, never going to be able to retire’. Average house prices are £200k+, before you even think about house prices living in a city, which is where all the jobs are.

But anyway. 50 years is a long time, assuming I don’t get cancer or heart failure or have an accident before then, things are looking shaky for the current system. We’re essentially the bottom rung of a giant ponzi scheme – I know the rent I pay helps to fund my landlord’s (not extravagant) retirement. The population is only getting older. How can we have kids if we dont have security in wages or housing? How long before it all collapses is anyones guess, but I wouldn’t bet on another 50 years. And thats not even taking into consideration the climate change mutator. It’s not looking great.

Oh, and I’ve never heard of FOMO, let alone think of it as my biggest fear.