Yves here. This post reaches an important, if disheartening conclusion: that financial regulation often does not work because it is reactive and clever financial players find ways to skirt regulations.

I wish the post had given some attention to higher-order question. It makes sense that a narrow, rear view mirror approach to scandals will have limited impact (and notice this study focused on scandals, as opposed to crises). Because mere scandals hurt only particular parties, they are not seen as an indictment of the financial sector. Indeed, people who use a scandal to push for broader reforms are depicted as cranks or opposed to capitalism.

But finance is best kept firmly leashed and collared. Classical economists argued for usury ceilings because otherwise banks would lend to wealthy gamblers, who were willing to pay high rates of interest, over sensible businessmen, who would borrow only if the debt charges were sensible in light of the commercial opportunity. More and more economists have published papers that conclude that a bigger finance sector is a drag on growth. The IMF found that the optimal level of banking system size and development was roughly that of Poland.

So we need systematic approach to regulation, rather than one-off moves. But the notion that financiers can safely be left to their own devices is so deeply ingrained that that isn’t happening any time soon.

By Luzi Hail, Professor of Accounting, Wharton School, Ahmed Tahoun, Assistant Professor of Accounting, London Business School and Clare Wang, Associate Professor, Tippie College of Business, The University of Iowa. Originally published at the Institute for New Economic Thinking

Financial crises have long been a feature of our system. There’s a discernible pattern: Scandals are followed by regulation, only for a new set of scandals to emerge thereafter. Can the cycle can be broken?

During former Federal Reserve Chairman Paul Volcker’s famous remarks to members of the Economic Club of New York after details about Bear Stearns’ rescue by JP Morgan Chase and the Fed came out ten years ago, he pointedly observed that such actions carried an “implied promise of similar action in times of future turmoil.” The Fed’s intervention is commonly remembered as the start of a cycle of institutional collapse and government bailouts that defined the 2008 financial crisis. Volcker went on to observe that such crises have in fact been a “recurrent feature of free and open capital markets” and that “any return to heavily regulated, bank-dominated, nationally insulated markets is pure nostalgia.”

Volcker’s observations underscore that the question of whether anything has been learned from the recent financial crisis is overshadowed by a more pressing issue of whether anything at all has been learned from the long history of government intervention in financial markets.

In our INET paper, “Corporate Scandals and Regulation,” we took on the question of whether regulators have been effective in overseeing financial markets over the last 200 years. Despite the voluminous literature on the economics of disclosure and financial reporting regulation, there is sparse empirical evidence on this topic in a historical, long-term context. We asked the question: “Are regulatory interventions in financial markets mere representations of delayed reactions to past market failures, or can regulators proactively preempt future corporate misbehavior?” From a public interest view, we would expect effective regulation to either prevent corporate misbehavior from occurring (ex ante) or quickly rectify observed transgressions (ex post). Have financial regulations anywhere been “effective” in this sense?

To answer this question, we developed an extensive historical time series of corporate scandals and regulations across 26 countries spanning the years 1800 to 2015. The data set draws on historical publications and regulations in 18 languages gathered in collaboration with local country experts and research assistants. We conducted the data collection in two steps. First, we used a coarse proxy of the underlying constructs and tracked how many of times the terms “scandal” and “regulator” were mentioned in the leading newspaper in each country and year. In a second step, we refined our search. Among the news articles we found, we identified those that cover actual accounting and other corporate scandals like the misrepresentation of financial statements (think Enron), the defrauding of investors (think Madoff), or the illegal business practice of bribing foreign government officials (think Lockheed). We also identified the voluntary conventions and rules that dealt with accounting regulation and investor protection in all those countries over the 200-year period.

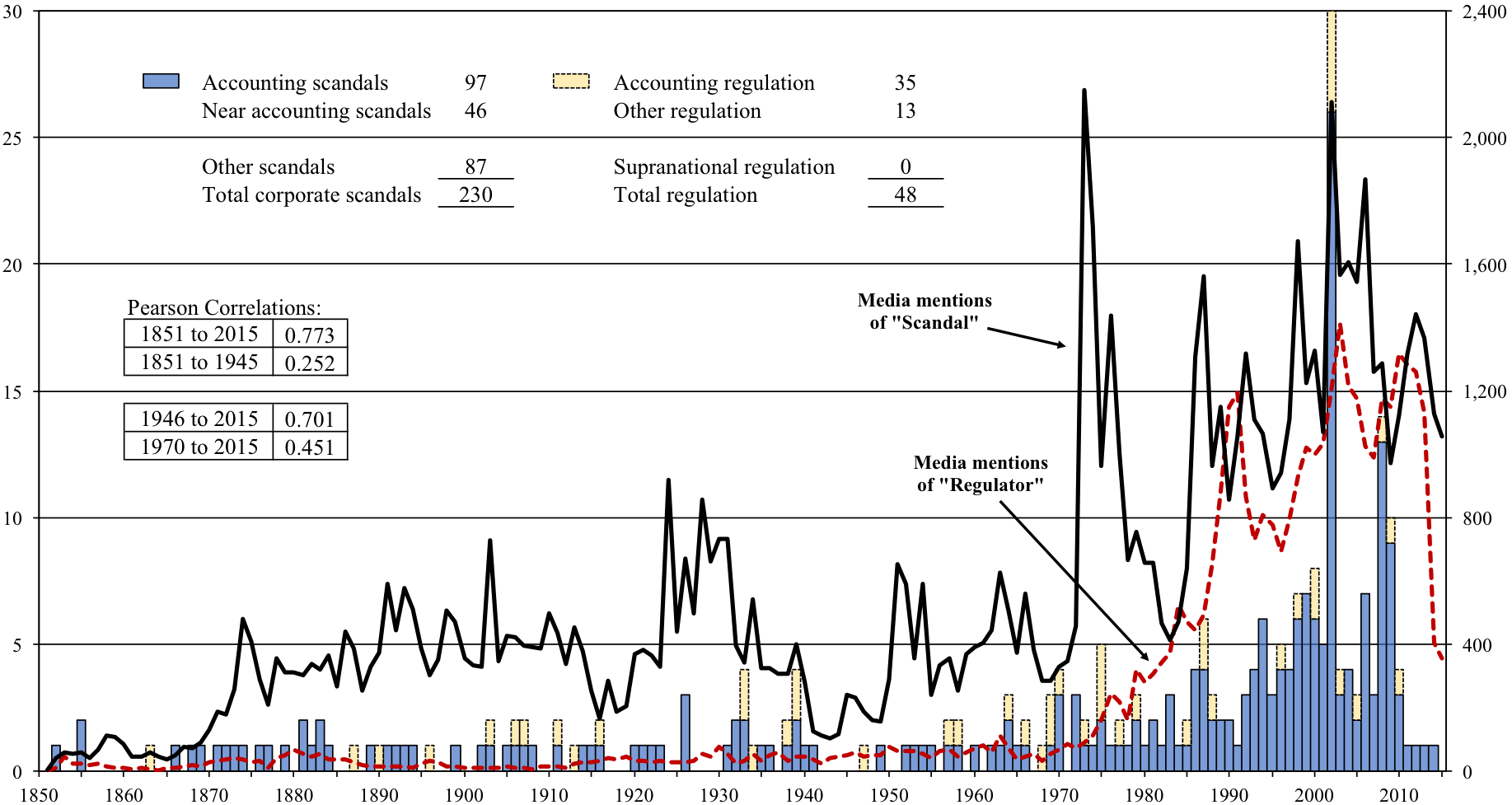

As an example, the figure below displays the data structure for the United States over the 1851 to 2015 period. It plots the yearly number of times the terms “scandal” (solid line) and “regulator” (dashed line, axis on the right) are mentioned in The New York Times. These numbers include all sorts of scandals and are not limited to corporate misbehavior. When we analyzed the news coverage in more detail, we were able to identify 230 episodes of corporate scandals and 48 relevant regulatory initiatives for the U.S. (shaded bars, axis on the left). In this figure, the downfall of Bear Stearns represents just one observation in 2008.

.

.

Figure: Episodes of corporate scandals and regulation in the United States over the years 1850-2015

Media mentions of scandals in The New York Times are very volatile. We observe multiple waves over time: the first in 1870, the second around the turn of the century, the third around 1930, and then again in the mid-1950s, 1960s, and 1970s. Thereafter the level of media mentions of both terms substantially increases.

The pattern suggests that the evolution of financial markets plays a key role in shaping both corporate misbehavior and regulatory action. The correlation between the two time-series is on the order of 70 percent for the entire period and after World War II, but only 25 percent before 1946. The pattern of actual corporate scandals and regulation largely mimics the media mentions, with select individual cases over long stretches of the sample period and a substantial increase after 1970. The year 2002 stands out with 26 cases of corporate scandals (e.g., WorldCom, Adelphia, Dynegy) and four regulatory events (e.g., the Sarbanes-Oxley Act).

We find very similar patterns in many other economies around the globe. In total, there are 4.2 episodes of scandals and 2.4 episodes of regulation in any given year from 1800 to 1969, but this number jumps to 32.5 for scandals and 14.6 for regulations over the 1970 to 2015 period. Thus, frequent scandals and extensive regulation are a relatively recent phenomenon. Notably, both corporate scandals and regulation are highly correlated with economic development.

In our global sample, we found that scandals and regulation are highly persistent over time. Corporate misconduct and regulatory action are not isolated events, but rather come and go in waves. More to the point, when we conduct a Granger causality test, which that examines whether one time series is useful in forecasting the other (e.g., can past scandals predict future regulations?), we find that over long stretches of time, corporate scandals act as an antecedent to future regulatory intervention. This pattern suggests that regulators are less flexible and informed than private entities and often take a reactive approach to regulation. Once something bad happens (e.g., the Enron scandal), public attention and pressure rises, and regulators then put rules in place to remedy the matter (e.g., Sarbanes Oxley).

At the same time, we find no evidence that regulations can effectively curb future corporate misconduct. Rather, today’s regulations are a strong predictor of future fraudulent behavior because firms are quick to adapt to the new rules and move their activities to unregulated areas, because regulators rely on explicitly laid-out rules to be able to identify and prosecute corporate wrongdoing, or because the new regulations have unintended consequences. Further analysis reveals systematic differences in the lead-lag relations of scandals and regulation over time and across countries.

Overall, our analysis of 200 years of corporate scandals and regulation provides evidence of strong time-series patterns. Scandals lead regulatory action, but the relation also goes in the other direction: Corporate scandals follow past attempts at regulatory reform. This finding prompts the question of how to break this cycle of scandals followed by bouts of regulatory activism, followed by new scandals, while keeping the long-term effects on the economy in mind. While we cannot answer this question, our results cast doubt on the historical effectiveness of regulatory action from a public interest view.

Yep, rules without enforcement of rules are not very effective.

Weak internal controls (non-enforcement of internal rules as well as non-enforcement of laws) played and still plays a big role. The current state of the job-market makes it likely that behaviour in the grey area between following the rules/laws and doing something illegal will increase. Some behaviour will cross over into the illegal area, some of those crossing over will do it to keep their jobs and others will do it as the malus/bonus ratio makes it attractive for their less than moral minds. (Would metoo have been necessary if the rules and regulations had been enforced?)

If enforcement is left as is then I agree with the finding:

Enforce the laws, enforce the rules and then maybe the finding would be different.

Perhaps the question should be “How well does the pokey prevent financial industry fraud?”

I would suspect it would prevent it quite nicely.

The reason financial regulation doesn’t work is because those in power do not want it to work. There will always be scammers but they will not be able to get away with nearly as much if we had a systematic approach to regulation.

To use but one example, who thought it would be a good idea to allow people to take out CDS bets on the underlying securities they did not own? As has been noted many times here, you can’t take out fire insurance on your neighbor’s house for very good reason, so why is it allowed in the financial sector? This is not a difficult concept to understand. The fact that something like this was allowed to happen is not simply because regulators don’t have the proper knowledge, or are overwhelmed, it’s because the entire regulatory system has been captured by those it’s supposed to regulate and been deliberately broken by them.

Two follow-ups: 1. Finance is not the only area of regulatory difficulties. Consider civic design / land-use planning. Land speculation is practically a national sport, and the source of many large fortunes. The sense of regulations–at least in California–is that this activity is subsidized and encouraged. Developing 20′ under floodplain surrounded by weak levees? No problem! Often the agricultural land, purchased or optioned at a few thousand dollars an acre, is worth 50 – 100 times as much once local government grants development rights. If the speculators exchange for income-producing real estate (e.g. apartments) they do not even pay income tax on that 5,000% – 10,000% profit. Incidentally, professional sports–exempt from antitrust prosecution–are often part of the speculators’ package. … and 75% of George W. Bush’s net worth comes from a stadium deal in Arlington, TX.

2. It’s pretty obvious to anyone paying attention that land speculation is not much stopped by the regulators. They come up with some weak tea response that is widely ignored. But that doesn’t stop them from “studying” and “working” to make these responses. One discovery I made recently is that a lot of the planning bureaucracy retires and infest local “environmental” organizations, encouraging them to take on no campaign to effectively address land speculation.

Germany has a nice response to this racket: They require developers to sell the land to local government at the ag land price, then re-purchase it at the upzoned price. The entire “unearned increment” (that 5,000% – 10,000% profit) inures to the benefit of the public. Consequently, Germany’s public realm is well-funded and robust. They have excellent infrastructure and education, public banks that help fund productive activities, free tuition at their universities (even for foreigners!)… The arts budget for the City of Berlin exceeds the National Endowment for the Arts for the U.S. of A.

Back in the U.S., schools and infrastructure beg for crumbs from the speculators’ table.

This is a pretty old practice, too. Both Washington and Jefferson engaged in land speculation.

Hear, hear, from a small-time developer that learned how the big boys salve the politicoes for those massive profits. Thank you Germany for showing it don’t have to be so.

Ineffective regulators aid scofflaws in their manipulations. During the 2008-09 fallout era I saw firsthand two execs loot and ruin a company. All the regulators did was admonish them and chase them away. They left the industry, one changed names to return to ‘marketing consulting’ and the other retired with loot. The regulators were earnest and understaffed, and moved on to other ineffective monitoring.

I would say the revolving door works just the way the 1% like.

You didn’t read the post, a violation of our written site Policies.

The study goes back to 1800 and covers 26 countries. “Revolving door” is a new and particularly American phenomenon.

What’s the latest proportion of our economy that is comprised of buying and selling ownership of “paper” (i.e., signatures on enforceable contracts — e.g., “financial instruments”)? I’ve read that it’s grown by multiples across recent decades. Way beyond the proper and effective magnitude of an “agency function.”

I used to work in subprime risk modeling and mgmt (credit cards). In 2004 we got bought by a Wall St. “bad paper” firm. Their subsequent directive? “Securitization.” I quit in 2005 to return to health care tech and analytics; subprime was just too cheesy. But, we’d made record iterative profits every successive year of the five I was with the bank. The joke was “the best things in life are FEE!“

Fully agree that a systematic approach to regulation in the financial industry, rather than one-off moves, is the only way to go. It should be an industry that is treated like the aircraft design industry. I’ll have to back up and explain this comment here. In the early days of aviation, designers were still learning how to build aircraft. Back in the thirties you couldn’t pick up a newspaper without reading about an airplane crash. Over time an approach was developed. Now, every time there is an aircraft crash, a full team of investigators is sent out to understand what happened and why in order to learn from the disaster so that it never happens again.

I recall one series of crashes that was caused by a badly designed cargo door which would blow out in mid-flight and cause the plane to crash. That cause was fixed and was not allowed to bring down another plane again. And that is the difference between the two industries. You don’t have the aircraft designers moaning about all the restrictive regulations. You don’t see them bringing back the old design cargo doors as they are cheaper and anyway, who are these crash team investigators to tell them how to run their business anyway. Or that they should be self-regulating because they are the professionals and know what they are doing.

And that is how we have financial crash after financial crash with all the old mistakes being repeated again. The elimination of the weak Dodd-Frank Act merely underscore this.

Why do banks collapse when asset prices fall rapidly?.

Our current “financial intermediation theory” of banking can’t explain it, though this is what happened in 2008 when Wall Street’s toxic mortgage backed securities tumbled in value to almost zero.

We need the “credit creation theory” of banking to explain it.

When we know how banks work they become easier to regulate..

Do we really want bankers pumping up asset prices with debt when rapidly falling asset prices cause banks to collapse?

This is what they were doing before 1929 and 2008.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

Bad policy decisions come from ignorance.

Let’s have TBTF so they can get away with it.

Monetary theory has been regressing since 1856, when someone worked out how the system really worked.

Credit creation theory -> fractional reserve theory -> financial intermediation theory

“A lost century in economics: Three theories of banking and the conclusive evidence” Richard A. Werner

http://www.sciencedirect.com/science/article/pii/S1057521915001477

Richard Werner was in Japan in the 1980s when it went from a very stable economy and turned into a debt fuelled monster. He worked out what happened.

Bank credit (lending) creates money.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

The three types of lending:

1) Into business and industry – gives a good return in GDP and doesn’t lead to inflation

2) To consumers – leads to consumer price inflation

3) Into real estate and financial speculation – leads to asset price inflation and gives a poor return in GDP and shows up in the graph of debt-to-GDP

It’s too much of type three lending that blows up your economy in a Minsky Moment.

Financial stability in 15 mins. from Richard Werner, it’s not hard.

https://www.youtube.com/watch?v=EC0G7pY4wRE&t=3s

Now we know how banks work, understanding the system and its problems enables simple and effective regulation.

Why was Glass-Steagall so simple and effective?

After 1929 they looked into things and gained a thorough understanding of what had gone wrong, they didn’t attribute it to a “black swan”.

Glass-Steagall separated the money creation side of banking from the investment side of banking. It also stopped the money creation side of banking from trading in securities.

When the money creation side of banking can only trade in real assets there are limits on its money creation.

When the money creation side of banking can trade in securities produced by the investment side, the sky’s the limit and only dependent on the ingenuity of investment bankers in coming up with new securities. They got to work producing CDO squareds, synthetic CDOs, etc …. knowing there was a ready market that can create money out of nothing.

The banks buy the securities off each other with money they create out of nothing and you have a ponzi scheme. The debt fuelled ponzi schemes before 1929 and 2008 can be seen building in the graph of debt-to-GDP below.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

Many harken to the systematic dismantling of Glass Steagall as leading to the recurring financial scandals. I have been increasingly wondering if it is a direct consequence of fully unleashing Neo Liberal economics, starting full throat with Reagan and Thatcher. One of the byproducts was to massively increase the amount of capital the wealthy have in their hands, well above the amount of capital required to support growth in the real, non-financial, economy. As this “excess capital” churns and looks for returns (I am struck that it always expects returns vastly above where they should be given the term structure of interest rates) it almost becomes a self fulfilling prophecy made all the worse once they figured out that government would bail them out if things go awry. Well the elites control government.

Also, the need to produce outsize returns, with argued lower risks, leads to so-called financial innovation — new fangled products. As Yves pointed out in a comment on the Miami bridge collapse, innovation brings new ways to fail. Hence, the regulation can’t keep up. In about 2003 I was retained by a number of very large, very sophisticated investment operations to perform consulting work on CDS and financial derivatives as reinsured by property casualty insurers. I was struck how none of the players in the system had the full picture (we interviewed them all including the various regulators) and it worked until it didn’t as long as everyone was making money. It was the dry run for 2008-09. Oh well.

It is curious that the graphs above changes about 1980 or so.

Just saying.