Today, we turn to the disparities and inaccuracies of recently-hired CalPERS Chief Financial Officer Charles Asubonten’s Form 700 filing and his depiction of his private equity business.

As we described in our overview post, contrary to the normal practice of private equity firms, consultants, and businesses generally, Ausbonten has very rarely presented a firm name in public settings such as on LinkedIn and other websites, or on important documments. On the rare occasions when he has, we have been unable to find an instance of him using the same business name twice. He has also used a variant spelling of his name, Asubonteng, in Ghana, further making it difficult to examine his activities over time.

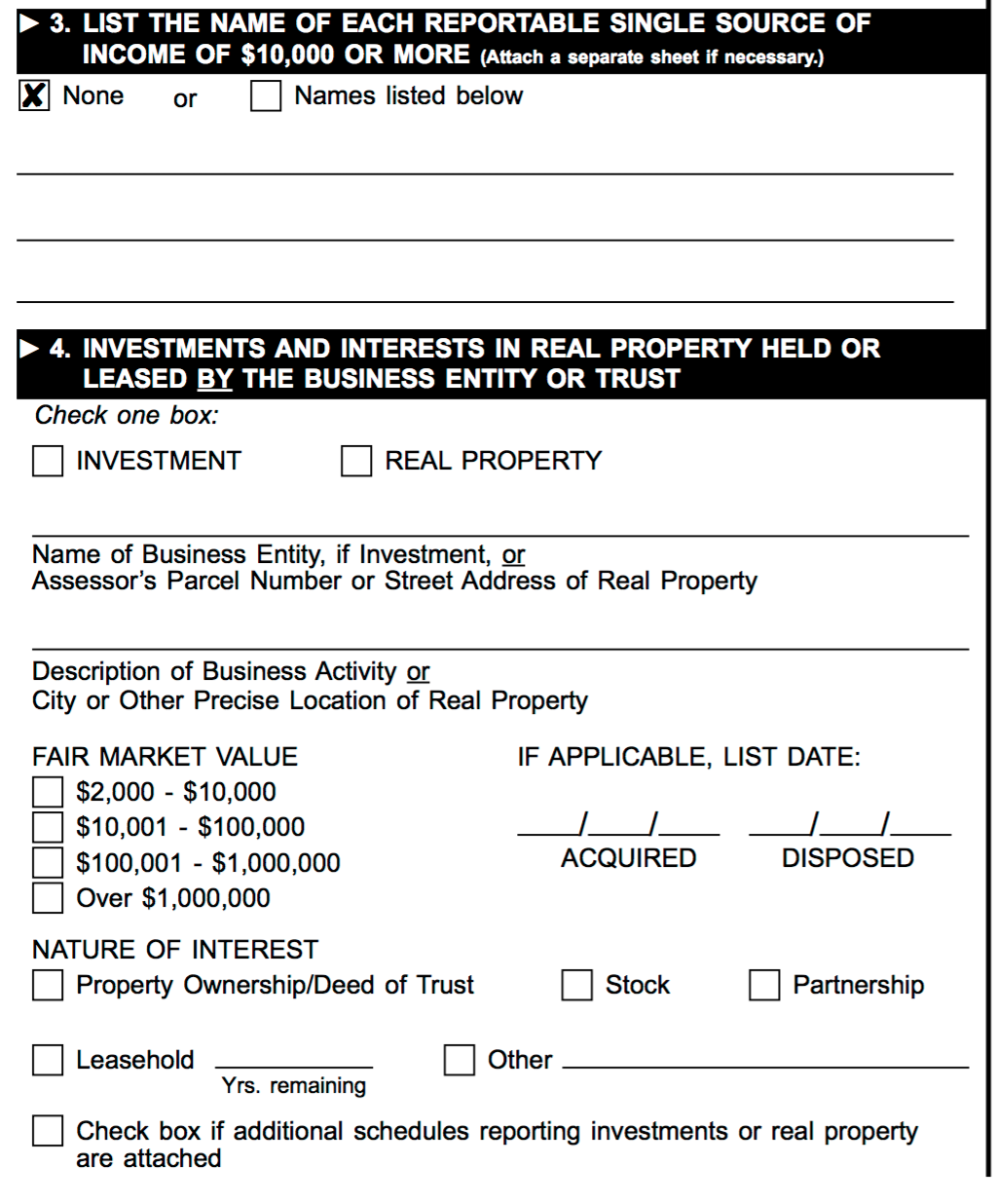

On the Form 700, a disclosure document required of all government officials in California, Asubonten provided an inaccurate address for a partnership which appears to represent most of his net worth. An informal reading from the Fair Political Practices Commission indicated that the response Asubonten provided does not comply with the requirements of the law.

As we discuss in more detail below, further investigation also raises more troubling questions regarding where Asubonten’s “private equity firm” was located and what sort of business it was engaged in.

Asubonten’s Inaccurate Form 700 Filing

Form 700 is an annual filing required of all California government officials, including at the local level. It is a “statement of economic interests,” designed to identify conflicts of interest, and so is not a comprehensive financial disclosure document. Having $200,000 in the bank or owning a dairy farm in Vermont that sold all of output east of the Mississippi would not represent a conflict of interest for a California official and hence would not be reportable.

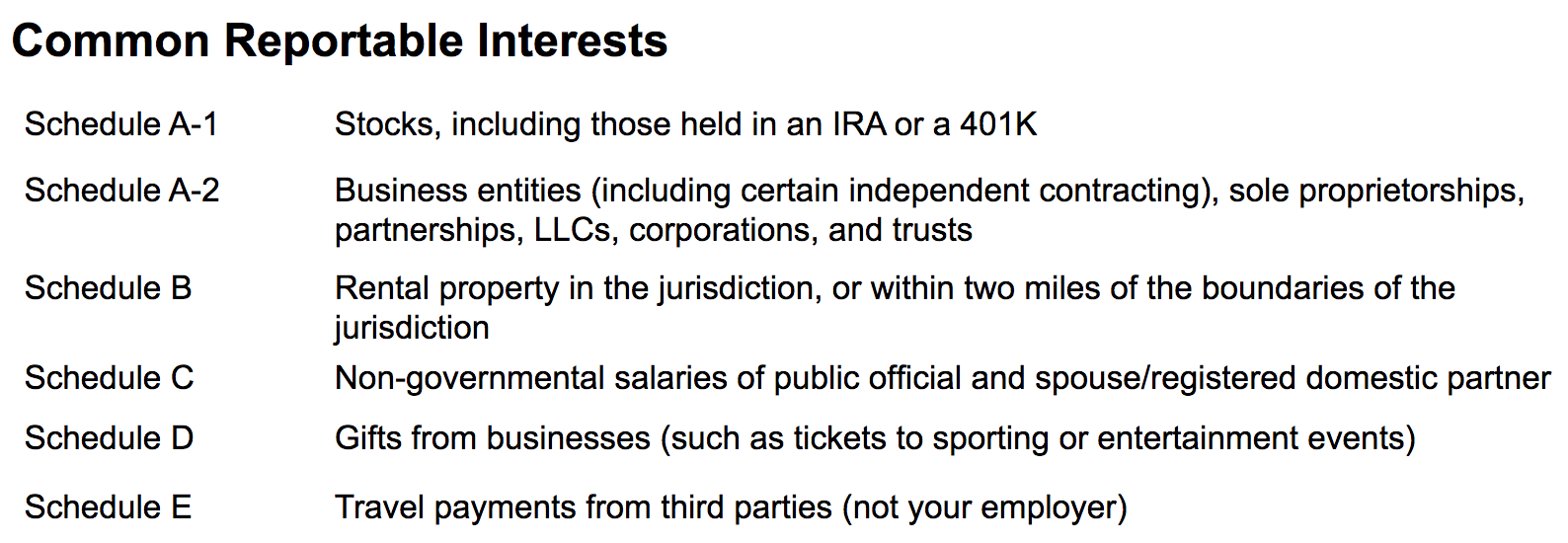

Respondents are required, under very strong penalty of perjury language,1 to identify “reportable interests.” From the instruction section to Form 700:

Below is a screenshot of part of Asubonten’s Schedule A-2, Investments, Income, and Assets

of Business Entities/Trusts for 2017. You can also view it on page 3 of the first embedded document at the end of the post. Note that Asubonten listed only this business entity on his Schedule A-2:

For the moment, we will put aside the fact that this business name does not appear in any Internet searches and also differs from the business name Asubonten provided on his resume.

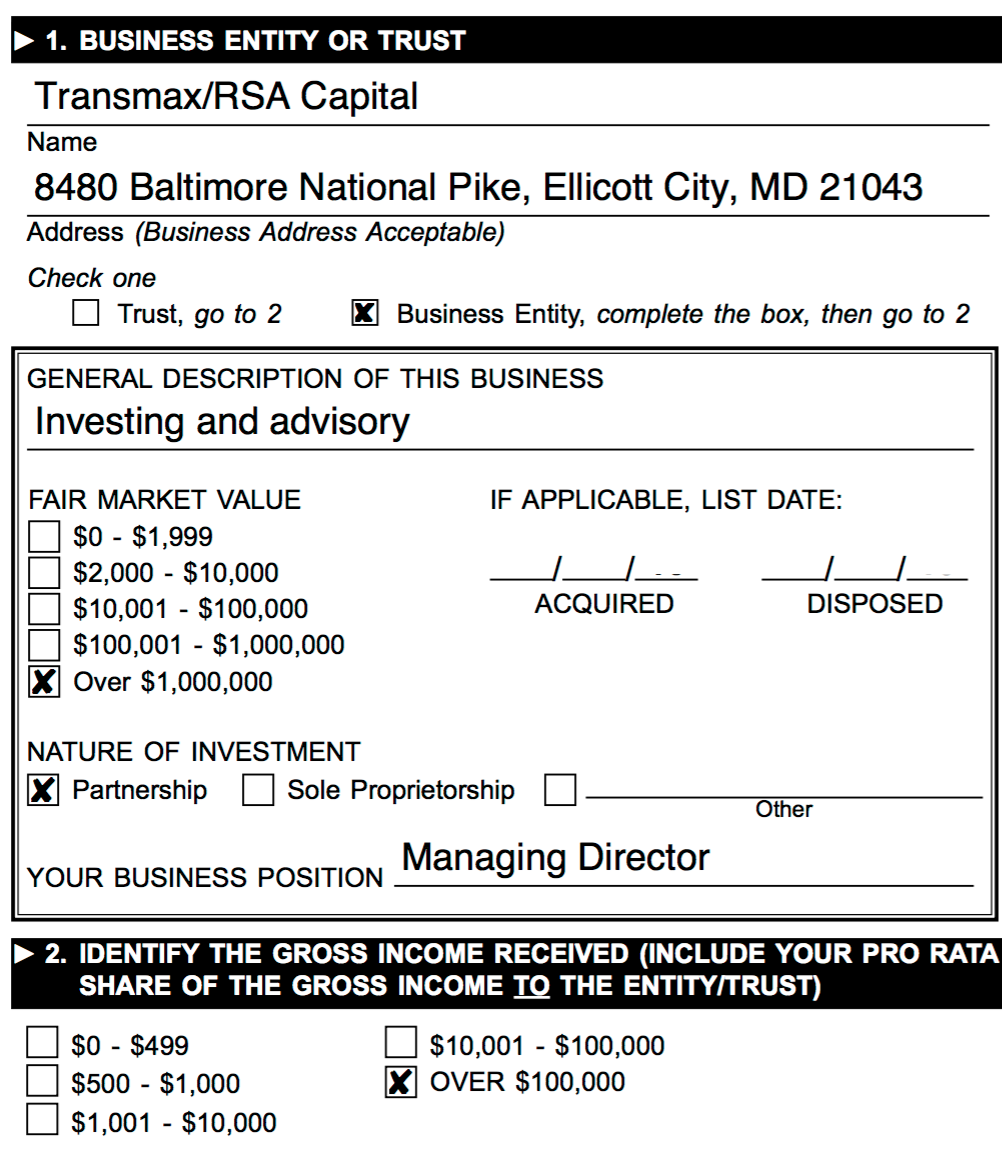

The address is a strip mall and does not look like a fitting location for either a private equity business, a consulting firm, or a financial advisory firm serving so-called accredited investors (high net worth individuals and institutions that are deemed by the SEC to be sophisticated and/or rich enough to invest in non-SEC registered securities and private partnerships).

Tenants at 8480 Baltimore National Pike include:

Ellicott City Taxicab Service

The Maids Home Cleaning in Ellicott City

Kumon Math and Reading Center of Ellicott City – Normandy

Ellicott City Sew-Vac

True Nails in Ellicott City MD

The one “finance” firm is Vaughn Calloway & Associates, a Primerica broker.

Here is another look at the property and the tenants from the listing agent’s website:

We called the listing broker and the property manager. Neither had heard of a Transmax or Charles Asubonten. Both had been responsible for the property in 2017, the year covered by Asubonten’s Form 700.

We asked each of them if there was any business that might be acting as a representative for Transmax, such as a law firm or an accountant. We mentioned the accountant at the address, Daniel Stein, and asked if there were any other lawyers or CPAs who had been at that address in 2017. Both said no.

We contacted Daniel Stein, who had just moved to a new location but said he had been a long-standing tenant at 8480 Baltimore National Pike. He said emphatically that neither a Transmax nor a Charles Asubonten had ever been a client and volunteered that he’d never heard of them operating out of his former address.

We then called the UPS Store at 8480 Baltimore National Pike. UPS Stores offer a mailbox service, so it was possible that Transmax/RSA Capital had rented a box there.

After we e-mailed a copy of Asubonten’s Form 700, one of the managers confirmed that:

There had never been a mailbox in the name of Transmax/RSA Capital or even a Transmax at their facility

Asubonten had rented a personal mailbox there, but that lease expired on October 1, 2017

The UPS Store would not have accepted mail addressed to “Transmax/RSA Capital” or “Transmax.” It would also have refused to take mail with Asubonten’s name plus “Transmax” but no box number, or “Transmx” with Asubonten’s personal box number. The store would accept mail only if it had both the name of the party renting the box and his box number on it

The Fair Political Practices Commission help line has confirmed that a business address that is not valid for mail delivery is not compliant with the requirements of Form 700.

As you can see from the resume embedded at the end of the page, Asubonten did not provide a location for his business. For all of his employers, he typically gave a city and state or country; for Mopani Copper Mines, he listed “Zambia.” By contrast, for his alleged private equity concern, he put “Maximum Transformation” in the spot where he listed the location for all his other job entries.

The fact that Asubonten’s “private equity firm” does not appear to have an office or even a valid address, raises further concerns, which we will discuss later.

Asubonten’s “Man of Many Names” Problem

As we have pointed out, it is very difficult to find evidence that Asubonten is in fact the principal of a “private equity firm,” meaning a firm which has committed capital which it invests on a discretionary basis and earns enough in fees and expense reimbursements to support its partners and staff.

Moreover, as you can see from the resume embedded at the end of this page, the description of activities that he provided is not that of a private equity firm, but a service provider to investors.

In the opening section of his resume, Asubonten further describes himself as the CFO of a “private equity company” when again, the detail under the “Transmax” section of his resume is inconsistent with that.

Moreover, private equity firms, due to their obsession with credentialing, are typically chary of using the CFO designation unless the job would be filled with someone who had CFO-level experience at a large asset manager or financial services company. While there are exceptions, most funds with less than $300 million under management use a more modest title for an in-house financial manager, like “Controller”. As we mentioned in an earlier post, if Asubonten’s firm had more than $150 million in assets under management, it would have been required to register with the SEC and if Asubonten were a principal, his name would be included in that listing. Neither Asubonten’s name nor that of any “Transmax” produces results in a search.

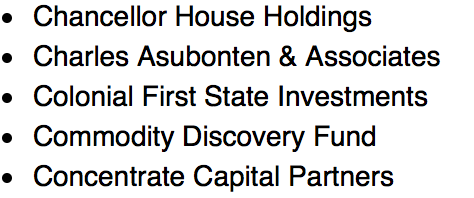

As we also stressed, both a private equity firm or a firm providing services to investors would have strong business incentives to promote their business name. By contrast, Asubonten has repeatedly avoiding the use of a business name and even when he has, he does not appear to have used the same name in a public setting twice. 2 Notice that even with CalPERS, Asubonten gave “Transmax-Maximum Transformation” on his resume and “Transmax/RSA Capital” on his Form 700.

We have also been unable to find a phone number or a website associated with Asubonten’s firm, which again is extremely unusual. We did an extensive search of Transmax-named business, nearly all of which are technology companies. We also searched for “RSA Capital”. While we did get more leads, only two appeared to be in the private equity business.3 One said it had never heard of Charles Asubonten. The other did not reply.

Asubonten’s wife is Rosiland Sheperd Asubonten, so the RSA in “RSA Capital” could refer to her.4

He did register transmax.biz on August 12, 2011, according to cubib.com, but the site appears never to have been built. The domain name is now owned by Dallas R. Dempster of Hyperion Energy in Australia.

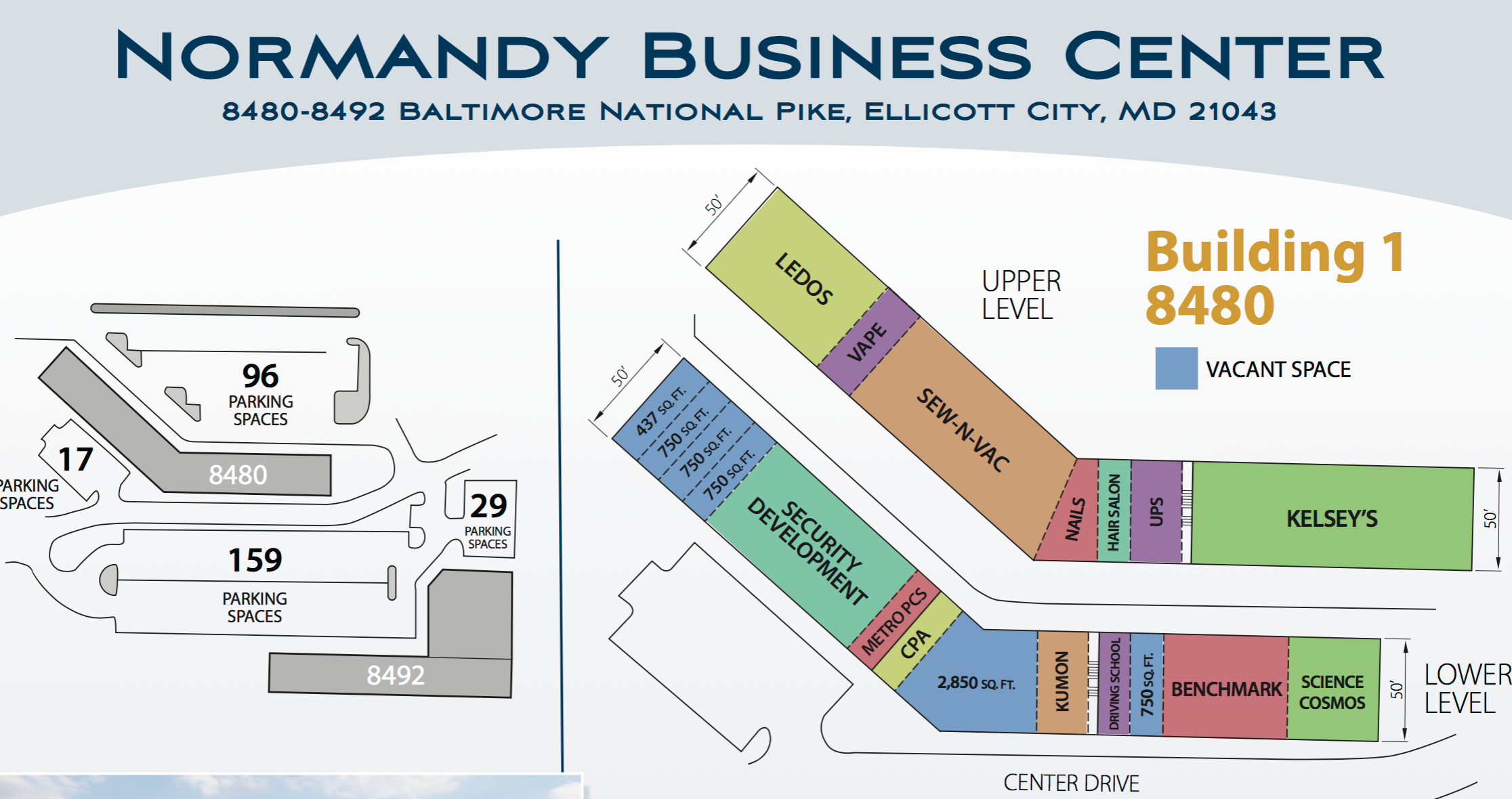

Here is Asubonten’s “private equity” listing on LinkedIn, which true to his practice lists no firm name or location. Notice the prominent play he gives to having taken a two day course:

Asubonten has used firm names other than variants of Transmax when he has had to use names. He is currently renting a house at 5247 Harvey Lane in Ellicott City, Maryland, and public records show he began renting there in August 2015. I called PCF Property Management, who is managing the property, and got them to pull the records on his application. They confirmed the rental history (which Zillow showed initially at $3,700 a month, now $4,200 a month), that Asubonten entered the lease himself without a co-signer or his wife on the lease. They confirmed that he has always paid on time.

I asked whether Asubonten had listed himself as self employed on his rental application or if not, who he showed as his employer. The rental agent pulled up the record and read out “Global Finance.” I said I had never heard of such a company, and asked if she was sure. She reconfirmed it, and added that they asked renters to provide a pay stub and pass a credit and criminal background check. She said she didn’t have an image of the pay stub to see that the employer name matched the employer name on the form, as it normally would.

Asubonten has also described himself as the Managing Director of Tragik Koncepts & Design. This image is from ZoomInfo, which scrapes LinkedIn profiles, meaning this information came from an older version of Asubonten’s LinkedIn page:

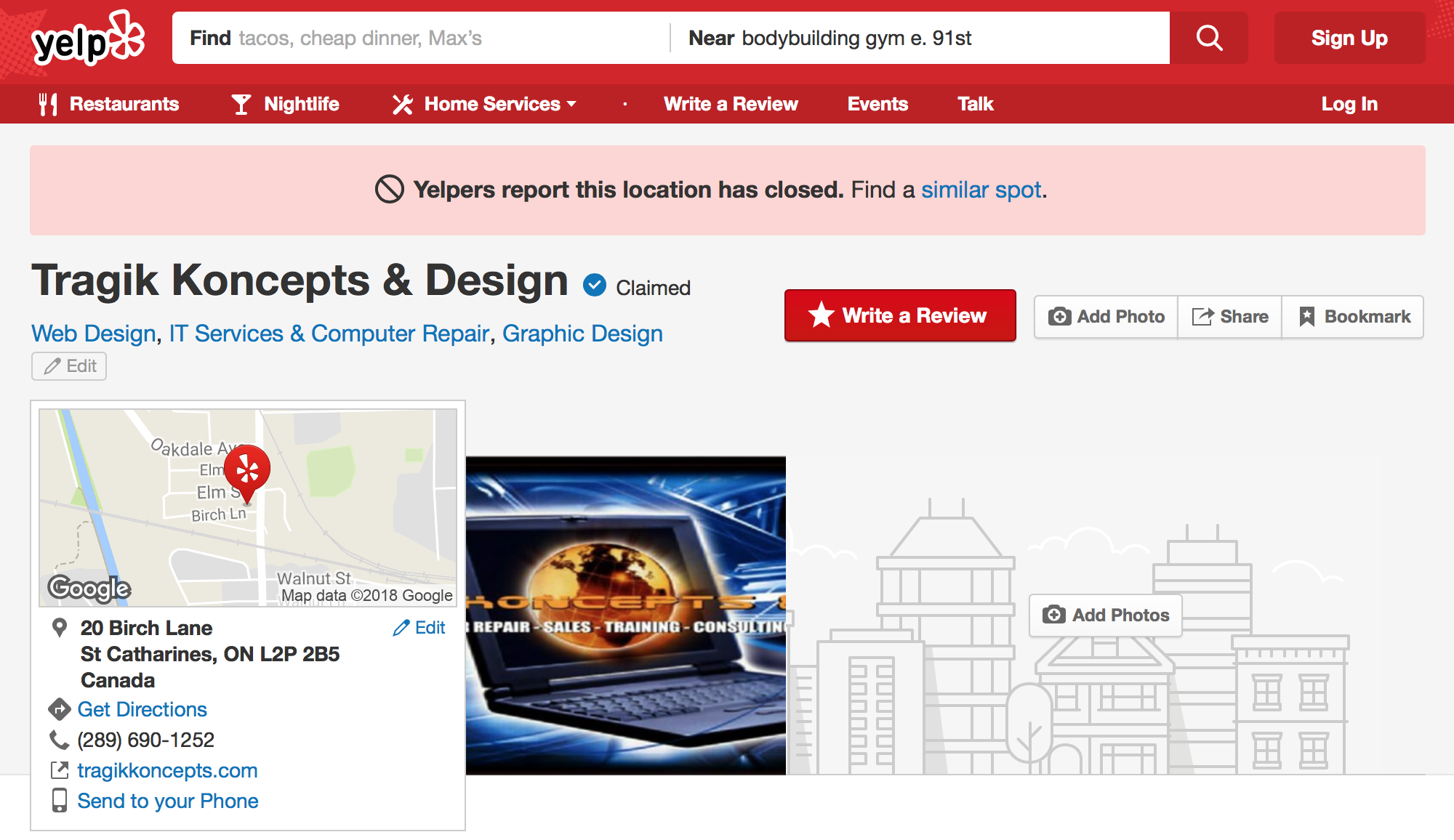

Tragik Koncepts was a tiny computer repair store, founded in 2009, which has closed:

Note again that this is the only company we have been able to find that might have been either an investee business or an consulting client of Asubonten’s firm.

Asubonten has also operated as “Charles Asubonten & Associates.” The Mining Indaba Junior Mining Showcase lists Charles Asubonten & Associates as an “investor” that participated in its 2017.

But finance professionals would regard “Charles Asubonten & Associates” as an un-investor-like company name, and would be more suited to a consulting firm.

ZoomInfo also indicates that Asubonten’s older LinkedIn profiles included him describing himself as a Managing Director of “Private Equity, Inc.” as well as Chief Financial Officer of the Zambia Post Office and of Rio Tinto, a company with $40 billion in revenues and 50 million employees:

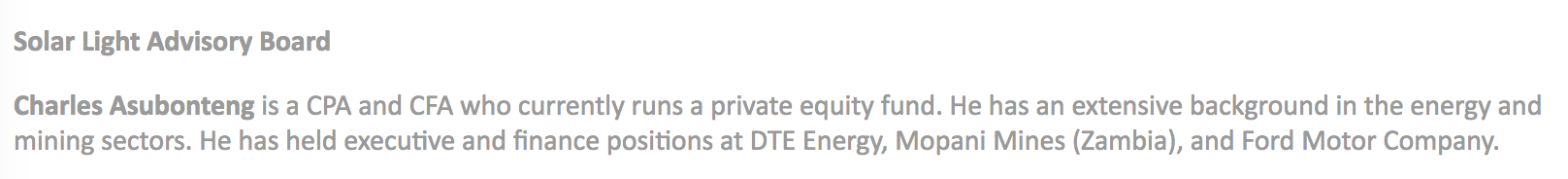

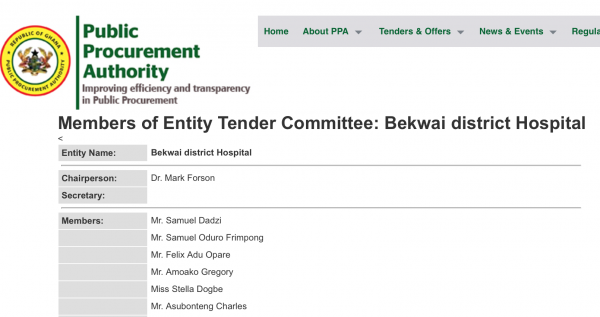

As we pointed out earlier, Asubonten has done business under a variant spelling of his name in Ghana, Asubonteng. As an advisory board member, he is in an influential enough position to have the spelling corrected. And he would have incentive to do so, since he included Solar Light in the resume he presented to CalPERS (as we noted yesterday, misrepresenting it as an independent director role):

While one instance of a misspelling could be a mistake, a second sighting suggests it might be a pattern. While there is another Charles Asubonteng in Ghana, he studies ISO/IEC 27001, Medical Electronics, and Electronic Circuits and appears unlikely to be on a public procurement committee:

The reason to be particularly concerned that Asubonten may have operated under a different name in Ghana is that banking experts point out that the use of a mild variation in spelling leads to “no realistic possibility of detection” that the variant spelling name is that of a completely different individual.

Note that Ghana is on the GFSC Sensitive Sources Notice where financial institutions are required to engage in enhanced due diligence measures and give special attention to “all existing and new business relationships and transactions connected with such countries or territories.”

In addition, one of Asubonten’s fellow advisory board members at Solar Light, Charles Botchway of Madison Street Capital in Chicago, has a less than savory reputation. The firm has pages of complaints about its “boiler room” calling operation.

Further Problems With Asubonten’s Form 700

We’ll return to Asubonten’s Form 700 to look at a final set of inconsistencies.

One has to believe a remarkably convenient set of coincidences to view this section of Asubonten’s description of his firm Transmax/RSA Capital on his Form 700 is accurate.

Recall that listing Transmax/RSA Capital in the Form 700 means Asubonten is acknowledging that it has a California nexus, meaning it has income or investments that are either in California or are companies that do business in California. Recall also that Asubonten has given contradictory descriptions of what business his business is really in. He has regularly described it as a “private equity firm” which means it manages other people’s money on a discretionary basis. But the description of the activities of Transmax-Maximum Transformation on his resume is that of a service provider, such as a consulting firm, and not an asset manager.

Let us first assume that Asubonten’s firm is indeed a private equity firm, meaning it acquires significant, usually controlling, interests in private businesses. Somehow, Transmax/RSA Capital’s owned businesses do business in or are located in California, but by lucky happenstance, Transmax/RSA Capital’s ownership in each of those businesses is worth less than $2,000, so it doesn’t have to tell the State of California or the public about them.

To put it politely, that does not seem like a very plausible scenario, particularly given that California requires Form 700 filers to report on investments that were doing business in their jurisdiction in the two years prior to the filing year as well as ones considering doing business in the jurisdiction.

The other scenario is that Transmax/RSA Capital is a firm that provides advisory services to private equity investors. Recall that Asubonten valued his share of the firm as being in excess of $1 million. Let us assume it’s $1 over $1 million, which is charitable for the purpose of this analysis.

Consulting firms sell for 1 to 2 times revenues (the exceptions are ones with big brand names, which does not apply here). That means Asubonten’s firm would have had at least $500,000 in revenue in 2017.

Having regularly provided advisory services to private equity investors myself, as well as knowing many ex-McKinsey professionals who are in that business, it would be very unusual to have a client who paid only $10,000 in a year for this type of services, unless it was a small invoice from a bigger assignment in a different year.5 Yet the story we are to believe is that none of Transmax/RSA Capital’s clients who had recently, were currently, or were considering doing business in California had paid for more than $10,000 of services.

Needless to say, one would hope to have a clearer and more confidence-inspiring history for someone assuming such an important position.

_____

1 From the bottom of the first page of the Form 700, which incorporates the supporting schedules, such as the one we discuss in this post (emphasis original):

I have used all reasonable diligence in preparing this statement. I have reviewed this statement and to the best of my knowledge the information contained herein and in any attached schedules is true and complete. I acknowledge this is a public document.

I certify under penalty of perjury under the laws of the State of California that the foregoing is true and complete.

2 I did manage to find one occasion in which Asubonten had use the name “Transmax” on the application for a program. But the firm stated they did not publish the firm name and the only place it could be found was in their database, which they do not sell for marketing. So that does not disprove the point.

3 We inquired with some of the firms, such as RSA Capital in New York City, which did not list having a private equity operation but could conceivably still have a small one, and we got no replies.

4 Form 700 also requires that respondents report 50% of their spouse’s community property interest.

5 For a private equity firm or any investor with meaningful funds to deploy, it isn’t worth the hassle to vet and negotiate with a new consultant for a mere $10,000 of bespoke work.

Charles Asubonten - Form 700 2017Asubonten resume

Having spent many years investigating frauds originating out of West Africa, one of the first things you learn is that Surnames and Christian names are highly “mobile” and can appear in any order on documents.

On the exhibit you show from the Public Procurement Authority, the surname and christian name has been switched, giving the impression that one of the Members is a Mr Charles. The person above him in the list is Miss Stella Dogbe. It is quite normal in Ghana for children to be given a British sounding christian name ( Ghana was an ex Brit colony) but they would always retain their tribal family name.

In countries such as Liberia and Sierra Leone which were settled by ex slaves freed from the USA and Caribbean states people often adopted the names of their previous owners. I once met a delightful African doctor called Daphne Taylor-Cummings who told me how her name originated.

Just a quick question here. If filling out a Form 700 document is a legal requirement, would falsifying information in it not be considered a felony in the eyes of the law? A criminal offense in fact? Certainly someone applying for a position as a top exec in a financial firm should have a proven track record along with squeaky clean references. And this is not happening here.

Certainly too this should be raising questions about the competence of CEO Marcie Frost in her job. This is the second time that she has pushed forward a sub-standard candidate as part of her executive team. I am sorry but one time can be a mistake. Twice is a pattern.

Why yes, it would in fact be perjury. From the form:

Perjury in California

Perjury is in general non-trivial to prove in these cases.

In theory, he could use the “I though it was a good address, it’s an honest mistake” – except the form has date of 31 Oct, and the lease was terminated on Oct 1. Duh.

That said, even if any of the above were honest mistakes, it’s unbelievable – CalPers and its CFO are not small institutions, so such sloppiness is IMO inexcusable. Their legal should have checked the form at the very least.

No, the language on the Form 700 is much stronger, in terms of the obligation it imposes to make earnest efforts to insure the accuracy of the information. I’ve spoken to lawyers and they are emphatic that Asubonten’s response amounted to perjury.

It doesn’t wash to provide an address where the business never was. The Fair Political Practices Commission has a help line for informal questions and will provide written responses if you need legal cover.

Plus of all people, a CPA/CFO type can’t go the dumb blonde route when filling out legally important forms.

RSA = Republic of South Africa? RSA is commonly used acronym in the Republic. South Africa used to allow Banks to be nominees of Companies, providing an level of anonymity. I do not know if it still has the ability.

I’d be looking in South Africa for the Company.

Asubonten is not obligated to report on any foreign investments or income he might have. If there were an RSA Capital in South Africa, it isn’t reportable on the Form 700. That is also why I didn’t mention his Ghanian activities as a possible Form 700 violation, assuming he got enough income from them or a teeny stake in Solar Light as consideration for his help on the advisory board (this would not be normal for an advisory board member in the US but practices might be different there). Any income or investments he has in Ghana would not be reportable on a Form 700.

And I did extensive searches. South Africa is English language, so it should come up on Google searches. If you search “RSA Capital” “private equity” and Africa, you get this firm, which we already checked out (they didn’t respond to inquiries about Asubonten, which they would have had he been connected to them):

http://www.rsacapital.com/rsacapltd/theCrew

RSA Capital Limited

6 Gulshan Avenue (Level 3)

Block SW(H), Gulshan-1

Dhaka-1212, Bangladesh

Certainly not located in South Africa, based on their contact information.

Bank nominee companies were used in South Africa to conceal ownership and control. They’d be registered, but difficult to find.

Transmax in MD

https://egov.maryland.gov/BusinessExpress/EntitySearch/BusinessInformation/W12636197

And Transmaxx in MD

Transmax Link is a house in Baltimore.

Transmaxx is an out of state business reference.

I already looked at that. Did you miss that the registration was abandoned? This corp no longer exits and would not be valid for a Form 700 filing or to serve as a liability shield in deal structuring. A dead corporation is an irrelevant corporation.

On top of that, it was registered in MD well before Asubonten was in MD (he didn’t move there until 2013, he was in Michigan before). He was employed at Palabora when this company was registered and Asubonten was still seeking a full time job, per yesterday’s court filing, through at least all of 2010. He clearly has nada to do with it.

One wonders about the circumstances surrounding his terminations, and t he sources of his income after leaving Africa, or if he had amassed a fortune during his sojourn in Africa.

Making his private equity business being one which managed his own fortune.

You have been very busy and diligent. You raise the question in my mind: When does incompetence become concealment of a racket?

One wonders what special skill CA brings to CALPERS.

It is hard to see how someone making a corporate salary, without a rich wife, with no prior investment experience, who was unemployed for a year at least (2010, eating into any savings) could amass a fortune in a mere year and a half (2011 and the first half of 2012). And if he were doing so well at “private equity,” why would he then take a CFO job?

He came back to the US and has been renting. Didn’t even pony up to rent a mailbox in a corporate name. No website. No office. No consistent with having made a lot of money.

Thanky you again, Yves. CalPERS is way more fun than Kardashians!

Yes, it’s entertaining unless retirement benefits of beneficiaries are cut and/or California taxpayers are required to cover funding shortfalls. Then it’s not quite so much fun.

Are we even sure about Ghana?

This guy’s bona fides seems to have Nigerian Scam written all over them. (I hope this doesn’t come under the heading of “Criticize ideas, not people”. It just seemed the comparison was so obvious).

Why would Marcie Frost and CalPERS’ staff aid and abet a “Nigerian Scam” sort of operator or operation? ( So many answers suggest themselves here …)

adding: for those unfamiliar with the term, “Nigerian Bank scam” refers to a type of ongoing confidence trick designed to defraud people of their money. It is played on the unwary through email solicitations. It’s what’s known as an “advance-fee” scam. The emails purport to represent a well-known and legitimate business concern which either doesn’t exist, or is fraudulently misrepresenting a business that does exist. The emails are often marked by a tone of high earnestness and “concern”, and a great desire to “help” the recipient.

This story just gets better and better. (Although not for the beneficiaries of CalPERS.)

Thanks for your continued reporting and investigative journalism.

Governor Brown is gonna be ALL OVER THIS!

As soon as he is done with more important matters.

Yikes. And I thought I was kidding with the Richard Smith reference. As discussed yesterday, this is the entirety of his work experience for 8 of the last 9 years. What has he been doing? Clearly nothing that leaves any kind of public record or paper trail.

It is more and more incomprehensible to me how he could have been hired. Recent work experience is one of the very first things you look at when reviewing a resume. Eight years dismissed in three sentences is a massive red flag, which should trigger follow-up investigation of the type described in this article. Nothing that Yves discovered here would give me any confidence if I was the hiring manager.

Other than the form 700 declaration, I don’t see any evidence that he has done anything illegal here, but he employs a lot of the same tactics as organizations that do, and he has apparently outright lied about some things like the addresses (and as the analysis of past LinkedIn profiles shows, this is not an isolated incident). I simply cannot see how anyone hiring for a position of integrity and responsibility could let that slide, let alone for the position of CFO of the second largest pension fund in America.

The only possibility I can think of is summarized in a Terry Pratchett quote:

“I wouldn’t mind betting a dollar that he thinks he can tell a man’s character by testing the firmness of his handshake and looking deeply into his eyes.”

Is it normally this easy to get customer information from places like UPS or rental agencies? I’d have expected such information to only be available to law enforcement or with a subpoena. If it’s really this easy, it seems like there would be a lot of potential for abuse (not by journalists like Yves, of course, but by other actors).

Go look at any rental agreement. The person signing it explicitly waives confidentiality of any information provided. Landlords share this sort of information, particularly regarding payment history, all the time.

I see that Charles Asubonten was listed as a member of the audit committee of Rössing Uranium Limited in 2008 according to the 2008 Palobar Mining Annual Report (http://www.palabora.com/documents/annual_report_2008.pdf). I understand that this company is majority owned by Rio Tinto as is Palobar but is that a usual thing to have a member of an auditor committee to be located in a country 4,000 kilometers away or are all such transactions done via emails and the internet these days?

I didn’t look into that because it wasn’t germane to his resume claims. I suspect it is a very small operation. And remember, Asubonten got his bad performance reviews starting in 2008, so whatever little he was supposed to have done there could be part of it.

Thanks. Was just curious as to whether that is typical for a corporation like Rio Tinto to have such functions done by people spread over such a large geographical area. Just something that snagged my interest.

So, if I applied for a part-time, minimum-wage position at the local 7/11 for stocking shelves or running the cash register, and gave a false address on my resume, there’s no way I’d be hired, even assuming I passed the criminal background and credit checks. And if (mirabile dictu) I got hired, I’d be fired immediately if it came out.

I guess things are different higher up the food chain for executives with billions of dollars in assets to manage. There, if you give the address of your business as an expired UPS box number in a suburban strip mall where nobody can contact you,* it’s no problemo!

* Did anybody — CalPERS or the headhunters — try?

Just to clear this up…he gave no address at all on the resume, not even a city and state. He gave the business address on the Form 700, which was filed after he joined. Even though that document is on CalPERS’ site, it was filed with the Fair Political Practices Commission and I doubt anyone at CalPERS gave it much of a look.

The address reminds me of the one used by ZZZ Accounting.