By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

I don’t think there has ever been an entire sector that skyrocketed as much and collapsed as quickly as the cryptocurrency space. The skyrocketing phase culminated at the turn of the year. Then the collapse phase set in, with different cryptos choosing different points in time.

It doesn’t help that regulators around the world have caught on to these schemes called initial coin offerings (ICOs), where anyone, even the government of Venezuela, can try to sell homemade digital tokens to the gullible and take their “fiat” money from them and run away with it. There are now 1,596 cryptocurrencies and tokens out there, up from a handful a few years ago. And the gullible are getting cleaned out.

And it doesn’t help that the ways to promote these schemes are being closed off, one after the other.

At the end of January, Facebook announced that, suddenly, “misleading or deceptive ads have no place on Facebook,” and it prohibited ads about ICOs and cryptos.

On March 14, Google announced that it will block adswith “cryptocurrencies and related content,” including ICOs, cryptocurrency exchanges, cryptocurrency wallets, and cryptocurrency trading advice. Its crackdown begins in June.

On March 26, Twitter announcedthat it would ban ads of ICOs, cryptocurrency exchanges, and cryptocurrency wallet services, unless they are by public companies traded on major stock markets. It will roll out its policy over the next 30 days.

On March 29, MailChimp, a major email mass-distribution service, announcedthat it will block email promos from businesses that are “involved in any aspect of the sale, transaction, exchange, storage, marketing or production of cryptocurrencies, virtual currencies, and any digital assets related to an Initial Coin Offering.” This broadened and tightened its policy announced in February that promised to shut down any account related to promos of ICOs or blockchain activity.

The overall cryptocurrency space, in terms of market capitalization, peaked on January 4, when market cap reached $707 billion, according to CoinMarketCap. Less than three months later, market cap has now plunged by 65% to $245 billion. $462 billion went up in smoke.

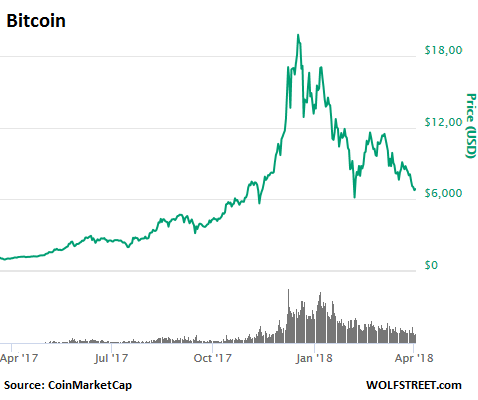

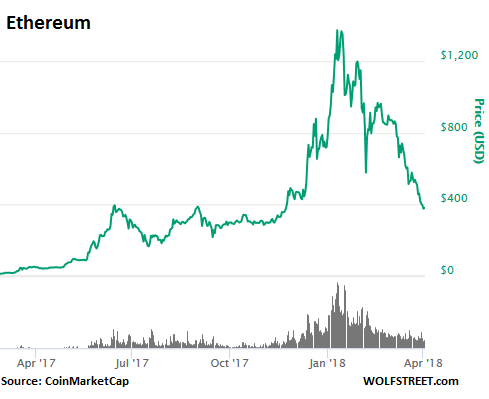

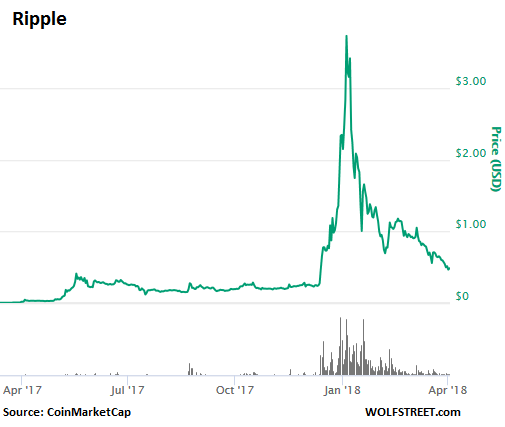

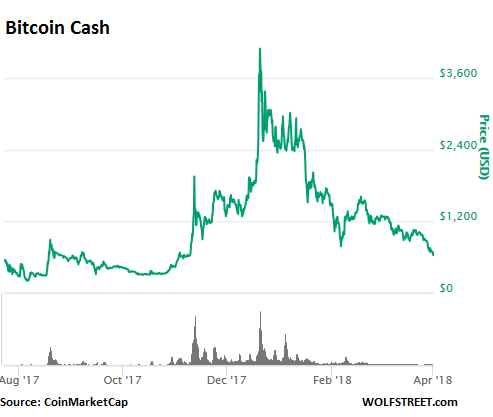

Here’s how the top five cryptos did over the past few months. Together they account for 76% of the total market cap of the space:

Bitcoin plunged 67%from its peak of $19,982 on December 17, to $6,573 at the moment. In just over three months, its market cap collapsed by $225 billion, from $336 billion to $111 billion. But as this chart shows, nothing goes to heck in a straight line (chart via CoinMarketCap):

Ethereum plunged 74%from its peak of $1,426 on January 13, to $367 at the moment. Market cap collapsed by $102 billion, from $138 billion to $36 billion (chart via CoinMarketCap):

Ripple plunged 88% from its peak of $3.84 on January 4 to $0.47. Over the period, its market cap went from $148 billion to $18 billion. On March 28, when I last wrote about the collapse of Ripple, it was at $0.57, but has since plunged another 18% (chart via CoinMarketCap):

Bitcoin Cash plunged 85%from its peak of $4,138 on December 20 to $632 at the moment. Market cap dropped from $70 billion to $10.8 billion. It was split from Bitcoin last August. On November 12, I featured Bitcoin Cash, in an article subtitled “Peak Crypto Craziness?” I was observing, practically in real time, how it quadrupled in two days to $2,448. It is now back where that quadrupling had started out:

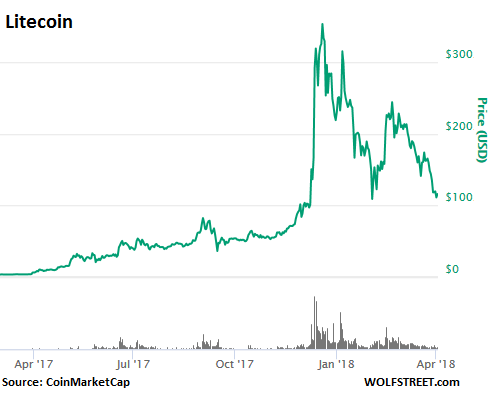

Litecoin plunged 70%from its peak of $363 on December 19, to $110 at the moment. Curiously, its founder admitted on December 20 that he’d wisely cashed out at or near the peak by selling his entire stake. The true believers who bought the tokens have been eating losses ever since. Market cap went from $19.7 billion to $6.2 billion.

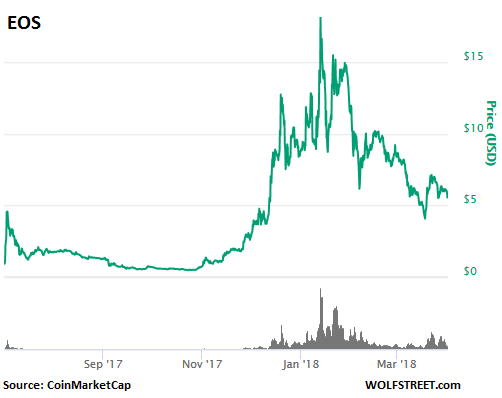

EOS plunged 71%from its peak of $18.16 on January 12, to $5.30. Market cap went from $11 billion to $4.1 billion: I pooh-poohed it on December 18 with “The Hottest, Largest-Ever Cryptocurrency ICO Mindblower.” The purchase agreement that buyers in the ICO had to sign – the ICO was not offered in the US due to legality issues – stated explicitly that holders of EOS have no rights to anything related to the EOS platform, and that they get nothing other than the digital token. Here is what the chart of this scam looks like:

And the blockchain technology (the distributed ledger technology) has nothing to do with cryptos. Cryptos merely use it. There have been a number of efforts underway for years to find large-scale commercial use for blockchain, outside of the crypto space. Those efforts have yet to bear fruit, though they may someday. All we have for now are small-scale experiments. Even if blockchain finds large-scale use, it will do nothing for these collapsing cryptos.

But the ancient theory that nothing goes to heck in a straight line still holds true, borne out by the charts above, and we can expect sharp volatility and a good amount of whiplash on the way there.

And here is an update on the hated “fiat” currency, the US dollar that cryptos were supposed to annihilate or at least obviate. Read… What Could Dethrone the Dollar as Top Reserve Currency?

Now lets map out the harm this madness caused –

1. HUGE amount of CO2 released for nothing

2. Drove up the prices of graphics card in used and new markets to absurd levels

3. Funded illegal activity

4. Wasted huge amount of nonrenewable energy resources in developing countries

5. Doubt that the cryptocurrency community as a whole even has a better understanding of the monetary system.

6. Empowered billionaires with even more money to do harmful crap.

So much for computer nerds saving the world!

Yep, that all sounds pretty accurate. Sums it up well. Just be grateful that they never succeeded in pushing it through for all the above reasons.

Anyone interested in this space should watch the hedera hasgraph release video on YouTube.

Hashgraph is a superior algo to blockchain. Hedera is using proof of stake which is not energy intensive but imo isn’t good enough yet ( can’t be proven secure).

If crypto currencies were currencies, rather than a day at the dog track, stability would be favored over appreciation.

Are there even realy currencies?

In my professional life I have just come across my first company using blockchain for real. It will do the job they are asking it to do, but I don’t see any benefit in their circumstances over more established technologies. In their case they are using a private blockchain, which to my mind kind of takes away its main virtue. But it is more energy efficient!

Yes there has clearly been a cryptocurrency bubble. However blockchain (distributed ledger) technology is here to stay. In the next phase of development, it won’t require the huge energy and processing power that bitcoin mining consumed.

Here is a good overview of blockchain and industry adoption in the 2018 Congressional ECONOMIC REPORT (pdf)

Another example: The Australian Securities Exchange (ASX) will replace its current clearing system with blockchain technology.

“Market cap” is a really meaningless metric for crypto coins FYI – they calculate it by just multiplying the number of coins by the current market price. The major reason cryptos are collapsing right now is that there’s never been anything close to $700 billion in actual money invested into this stuff. All that “market cap” is evaporating because it was never real to begin with.

amen Chibboleth

But isn’t that all that “market cap” EVER is? The market cap for General Motors does NOT imply that that is the price that one could get if one tried to sell all the stock. And it doesn’t imply that much was SPENT for all the stock existing. And it doesn’t imply that the plants and machinery could be liquidated for anywhere near that amount. Indeed a high market cap that has gone too far beyond those measures, or even the time weighted value of future dividends may indicate a troublesome level of speculation.

. . . or even the time weighted value of future dividends may indicate a troublesome level of speculation.

What does that remind me of? Mmmm, . . . Amazon.

I agree with you. Market cap is an illusion that causes euphoria or terror, depending on circumstances, but where would the excitement be if it were measured as the sum of the price difference between original buy and current selling price of the share multiplied by the number of shares traded for the day and added or subtracted from the previous day’s total?

There is no doubt that it has been “the wild west” with the beginning of cryptocurrencies. Where it settles into is a big question. I’ll point out a few things:

1) all the “alt” coins value pretty much follow Bitcoin for a couple of reasons: The people who invested in Bitcoin (crypto-investors) have extra value to invest in other tokens when Bitcoin is up. And everyone pretty much looks to Bitcoin as the industry index. So listing each of the other coins just makes the same point.

2) The massive spike in mid-2017 was highly volatile, so listing 67% etc down from peak just underscores that volatility. Mr. Richter completely ignores that value gains from a year ago for these currencies. Bitcoin was about $1200 in April 2017, so that’s about a 580% rise over the year to about $7000 now.

3) Yes, the nascent industry is riddled with scams, and there are some very legitimate, well-thought-out and well-staffed projects. As a new unregulated funding mechanism, it is very risky, and investors should be discerning, not just driven by FOMO. The value of this is bringing in development funds for new tech much more quickly than traditional means, as we are seeing fewer IPO’s. As with the dot-com boom (or bubble), there is opportunity and risk. A great outcome would be to apply this funding mechanism under SEC regulation for existing company funding, getting past the IPO barriers.

4) Lastly, yes, Bitcoin, in particular, is extremely power-inefficient. The tech is in its infancy, and newer generations are much more efficient. Hopefully, even Bitcoin can fork to reduce its footprint, even while there are multiple efforts to power mining ops with renewable power.

Bottom-line, there is plenty to criticize crypto-currencies about, but a drop from peak is the least of them in these early stages of a new, transformative tech. Many have viewed Bitcoin coming back down from the ~$20K mark as a good thing. Sussing out the projects with real opportunity value remains the challenge, as with any new type of business.

Once again, an over-hyped technology goes thud.

Almost all of the top 100 cryptos move in tight correlation with Bitcoin on most days. Sometimes a bit of news or some high volume trading on a particular coin will move something drastically different, but usually use see the same exact curve for all of them on the 24 hour price chart. This means there is really only one cryptocurrency. Everything is linked through Bitcoin. Indeed, buying and selling smaller currencies usually requires trading in and out of bitcoin as there is no exchange possible directly between alt. cryptos.

Crypto is dead. It is a direct threat to too many vested interests that have the resources to kill it. The crash started when BTC futures were introduced. Surprise surprise, the big boys stole the market.

FYI, there’s a non-crypto use for blockchains, and that is Git, which is the de-facto version control system. Simple and efficient (once you get past the learning curve).

As an avid reader of NC and someone who has been tangential to the blockchain world for 5+ years, I have to say that these types of posts are extremely weak material. Simply saying a volatile asset “crashed” doesn’t give much information and certainly doesn’t come close to being a substantial criticism of the whole technology.

Here’s a post by Richter from 9 months ago with exactly the same template, reporting on the recent crash in cryptocurrencies and bemoaning their fate, except that between that post and this one bitcoin is up 300%+, and Ethereum us up 200%+. If we take Wolf’s previous post as a prediction, we would say he was massively wrong. Furthermore, at the time that the July 2017 post was published, Bitcoin and Ethereum were both up 200%+ in the previous year! If an asset appreciates 10x and then deflates by half, it’s still up 5x. You have to have a memory longer than 3 months to judge how an asset like Bitcoin is doing.

I also have complex feelings about cryptocurrencies. There’s lots to criticize, like it’s motivations from california tech-libertarianism, and the fraud/bubble dynamics it’s promoted, and in many cases the image of the society blockchain is trying to create. But these posts don’t do anything to make that case, and in fact, I think they might reinforce the beliefs of blockchain-believers that there isn’t much to criticize in their field, or make it harder for substantive critiques of blockchain to get attention.

Just my two cents.

+1

Pure FUD. There seems to be a strange disconnect on NC when it comes to cryptocurrencies. I’ve notice an almost vindictive spitefulness, universal condemnation, and endless predictions of only doom in the tone of linked articles and comments. I’m not sure where it comes from, but even though there is a lot to criticize about it as noted above, everything I ever see here is completely one sided. And even though NC can usually be very critical of wall street and current monetary systems, when it comes to discussing crypto markets and cryptocurrencies, suddenly wall street markets and $USD, not to mention Big Brother/Big Data filtering what we see online all seem to become legitimate and beyond reproach. The dismissive tone just doesn’t match the rest of NC, from my perspective anyway.

I think leftist-minded-people are naturally suspicious of cryptocurrencies for a couple reasons, initially because it comes straight out of the aforementioned california tech libertarian political mindset, and then later because it does bear the smell of concentrated capital. Good reasons to be suspicious, but I think the intersection between tech-, civil-, and left-libertarianism is larger than most people think. You can see this in some of what Snowden talks about, or whenever Rand Paul fillibusters a pro-surveillance CIA/NSA director. There have also been bitcoin millionaires fighting in the international brigades in Rojava. I’ve found I can often convince (left-)anarchists that decentralized currencies could be useful in some types of anarchist societies (e.g. bookchin libertarian municipalism).

I posted a similar comment to a previous Bitcoin weak-tea post, which was lost in moderation Hell. According to my Bitcoin widget, it is still up >%500 yoy. Wake me up when it’s actually down yoy.

OK Jay Pee, that will be roughly a month or two from now when the ponzi scheme hype that inflated this scam up from $2000 per digital slug totally implodes.

You are watching it implode in slow motion now as the whales use OTC methods to liquidate their positions, all the while the clueless herd hoping for free money rally around an asset based on nothing but a scam.