By Chad Terhune, Kaiser Health News Senior Correspondent, who previously worked for the Los Angeles Times, where he spent four years covering the business of health care. Before the Times, he was an award-winning reporter for The Wall Street Journal and Businessweek. Originally published at Kaiser Health News

Cooking dinner one night in March, Mark Frizzell sliced his pinkie finger while peeling a butternut squash and couldn’t stop the bleeding.

The 51-year-old businessman headed to the emergency room at Sutter Health’s California Pacific Medical Center in San Francisco. Sutter charged $1,555 for the 10 minutes it treated him, including $55 for a gel bandage and $487 for a tetanus shot.

“It was ridiculous,” he said. “Health insurance costs are through the roof because of things like this.”

California Attorney General Xavier Becerra couldn’t agree more. The state’s top cop is suing Sutter, accusing one of the nation’s biggest health systems of systematically overcharging patients and illegally driving out competition in Northern California.

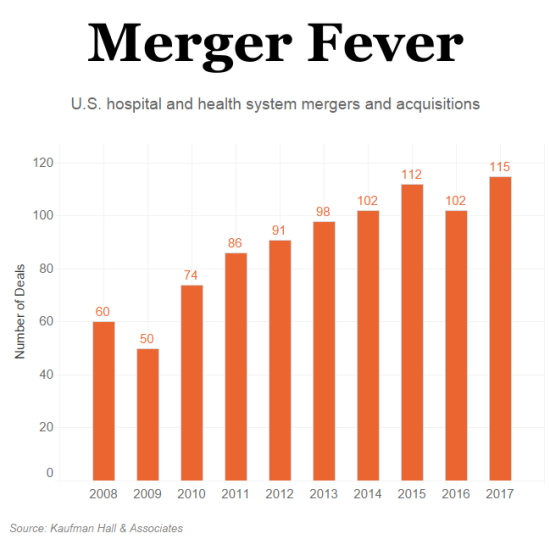

For years, economists and researchers have warned of the dangers posed by large health systems across the country that are gobbling up hospitals, surgery centers and physicians’ offices — enabling them to limit competition and hike prices.

Becerra’s suit amounts to a giant test case with the potential for national repercussions. If California prevails and is able to tame prices at Northern California’s most powerful, dominant health system, regulators and politicians in other states are likely to follow.

“A major court ruling in California could be a deterrent to other hospital systems,” said Ge Bai, an assistant professor at Johns Hopkins University who has researched hospital prices nationwide. “We’re getting to a tipping point where the nation cannot afford these out-of-control prices.”

Reflecting that sense of public desperation, Sutter faces two other major suits — from employers and consumers — which are wending their way through the courts, both alleging anticompetitive conduct and inflated pricing. Meanwhile, California lawmakers are considering a bill that would ban some contracting practices used by large health systems to corner markets.

Sutter, a nonprofit chain, is pushing back hard, denying anticompetitive behavior and accusing Becerra in court papers of a “sweeping and unprecedented effort to intrude into private contracting.” Recognizing the broader implications of the suit, both the American Hospital Association and its California counterpart asked to file amicus briefs in support of Sutter.

In his 49-page complaint, Becerra cited a recent studyfinding that, on average, an inpatient procedure in Northern California costs 70 percent more than one in Southern California. He said there was no justification for that difference and stopped just short of dropping an expletive to make his point.

“This is a big ‘F’ deal,” Becerra declared at his March 30 news conference to unveil the lawsuit. In an interview last week, he said, “We don’t believe it’s fair to allow consolidation to end up artificially driving up prices. … This anticompetitive behavior is not only bad for consumers, it’s bad for the state and for businesses.”

To lessen Sutter’s market power, the state’s lawsuit seeks to force Sutter to negotiate reimbursements separately for each of its hospitals — precluding an “all or nothing” approach — and to bar Sutter employees from sharing the details of those negotiations across its facilities. Becerra said Sutter has required insurers and employers to contract with its facilities systemwide or face “excessively high out-of-network rates.”

Heft In The Marketplace

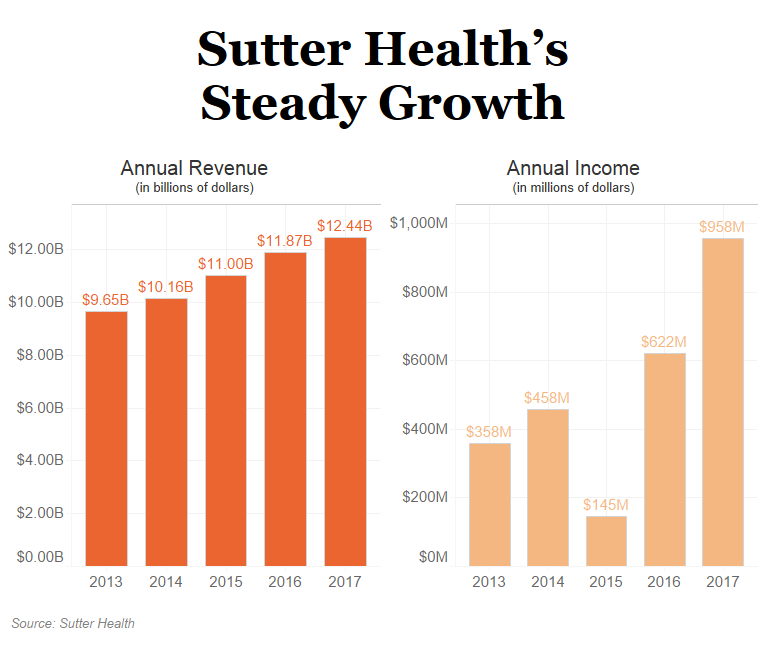

Overall, Sutter has 24 hospitals, 36 surgery centers and more than 5,500 physicians in its network. The system boasts more than $12 billion in annual revenue and posted net income of $958 million last year.

The company’s heft in the marketplace is one reason why Northern California is the most expensive place in the country to have a baby, according to a 2016 report. A cesarean delivery in Sacramento, where Sutter is based, cost $27,067, nearly double what it costs in Los Angeles and New York City.

For years, doctors and consumers have also accused Sutter of cutting hospital beds and critical services in rural communities to maximize revenue. “Patients are the ones getting hurt,” said Dr. Greg Duncan, an orthopedic surgeon and former board member at Sutter Coast Hospital in Crescent City, Calif.

Sutter says patients across Northern California have plenty of providers to choose from and that it has held its average rate increases to health plans to less than 3 percent annually since 2012. It also says it does not require all facilities to be included in every contract — that insurers have excluded parts of its system from their networks.

As for emergency room patients like Frizzell, Sutter says its charges reflect the cost of maintaining services round-the-clock and that for some patients urgent-care centers are a less costly option.

“The California Attorney General’s lawsuit gets the facts wrong,” Sutter said in a statement. “Our integrated network of high-quality doctors and care centers aims to provide better, more efficient care — and has proven to help lower costs.”

Regulators in other states also have sought to block deals they view as potentially harmful.

In North Carolina, for instance, the state’s attorney general and treasurer both expressed concerns about a proposed merger between the University of North Carolina Health Care system and Charlotte-based Atrium Health. The two dropped their bid in March. The combined system would have had roughly $14 billion in revenue and more than 50 hospitals.

Last year, in Illinois, state and federal officials persuaded a judge to block the merger between Advocate Health Care and NorthShore University HealthSystem. The Federal Trade Commission said the new entity would have had 60 percent market share in Chicago’s northern suburbs. Still, Advocate won approval for a new deal with Wisconsin’s Aurora Health Care last month, creating a system with $11 billion in annual revenue.

Antitrust experts say states can deliver a meaningful counterpunch to health care monopolies, but they warn that these cases aren’t easy to win and it could be too little, too late in some markets.

“How do you unscramble the egg?” said Zack Cooper, an assistant professor of economics and health policy at Yale University. “There aren’t a lot of great solutions.”

A Seven-Year Investigation

California authorities took their time sounding the alarm over Sutter — a fact Sutter is now using against the state in court.

The state attorney general’s office, under the leadership of Democrat Kamala Harris, now a U.S. senator, started investigating Sutter seven years ago with a 2011 subpoena, court documents show. Sutter said the investigation appeared to go dormant in March 2015, just as Harris began ramping up her Senate campaign.

Becerra, a Democrat and former member of Congress, was appointed to replace Harris last year, took over the investigation and sued Sutter on March 29. His aggressive action comes as he prepares for a June 5 primary against three opponents.

Sutter faces a separate class-action suit in San Francisco state court, spearheaded by a health plan covering unionized grocery workers and representing more than 2,000 employer-funded health plans. The plaintiffs are seeking to recoup $700 million for alleged overcharges plus damages of $1.4 billion if Sutter is found liable for antitrust violations. Sutter also has been sued in federal court by five consumers who blame the health system for inflating their insurance premiums and copays. The plaintiffs are seeking class-action status.

San Francisco County Superior Court Judge Curtis E.A. Karnow grantedBecerra’s request to consolidate his case with the grocery workers’ suit, which is slated for trial in June 2019.

The judge sanctioned Sutter in November after finding that Sutter was “grossly reckless” in intentionally destroying 192 boxes of evidence that were relevant to antitrust issues. As a result, Karnow said, he will consider issuing jury instructions that are adverse to Sutter.

In a note to employees, Sutter chief executive Sarah Krevans said she deeply regretted the situation but “mistakes do happen.”

In an April 27 court filing, Sutter’s lawyers criticized the state for piggybacking onto the grocery workers’ case. “The government sat on its hands for seven years, exposing the public to the alleged anticompetitive conduct. … Rather than driving the agenda, the Attorney General seeks to ride coattails.”

Outside court, California legislators are taking aim at “all or nothing” contracting terms used by Sutter and other hospital chains. The proposed law stalled last year amid opposition from the hospital industry. But consumer and labor groups are seeking to revive it this year.

In the meantime, Frizzell said he will probably wind up at one of Sutter’s hospitals again despite his disgust over his ER bill. “Most of the hospitals here are Sutter,” he said. “It’s difficult to avoid them.”

KHN senior correspondent Anna Gorman contributed to this report.

The US military half-jokingly says that costs are so out of control that soon will come the day that the nation will only be able to afford one aircraft, one tank and one ship. By the sounds of it, costs have detached themselves from reality a long time ago in Northern California. Maybe the day will come that the entire medical system of Northern California will only be able to afford to provide only one baby delivery, one operation and one minor procedure – with perhaps change left over enough to afford a band-aid.

Would this be the same Kamela who was so aggressive on the Mortgage fraud?

Kamela Kfabe Harris?

And to think, if she had been more aggressive, we wouldn’t have to deal with the perpetual puckered-mouth (similar to a single species of starfish) sourpuss that is Mnuchin. Such a wasted opportunity.

Yep. The same Kamala Harris who was mentioned in Nicholas Kristof’s recent piece about an innocent man on death row (https://www.nytimes.com/interactive/2018/05/17/opinion/sunday/kevin-cooper-california-death-row.html).

“It appears that an innocent man was framed by sheriff’s deputies and is on death row in part because of dishonest cops, sensational media coverage and flawed political leaders — including Democrats like Brown and Kamala Harris, the state attorney general before becoming a U.S. senator, who refused to allow newly available DNA testing for a black man convicted of hacking to death a beautiful white family and young neighbor.”

Harris is now working on correcting the bad press:

https://twitter.com/NickKristof?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

Nicholas Kristof

@NickKristof

1h

I’m delighted that Senator @KamalaHarris just called me and is issuing a statement calling on @JerryBrownGov and CA to allow DNA testing in the Kevin Cooper case. https://nyti.ms/2k2dJqm Thanks, Senator Harris!

That tetanus shot was probably overtreatment, too. Certainly by UK practice standards. Obviously a physician would have seen the wound and the likelihood of contamination and would be the best placed to make a clinical judgement. But tetanus shots are not needed to be done as a matter of routine just because you’ve cut your finger.

No, tetanus is generally called for when wounds are potential infected by animals, or bacterial in soil.

But this is the US, do not underestimate the cost of the tetanus shot vs a negligence lawsuit.

So the patient is paying for the doctor’s defensive medicine (defensive from lawsuits), not for sound medical practice? Or is it just that $487 for a tetanus shot is a huge profit for the hospital?

I got one some years ago and seems like it cost $20.

Certainly it may be time for patients to start asking more questions from providers and seeking other options. For example county health departments would once provide such shots rather inexpensively.

There’s no question that this country’s excess number of lawyers creates a climate where medicine can be as much about lawsuits as care but one suspects the hospitals often use this merely as an excuse for their huge overcharges.

Twenty bucks? That’s about what I paid at the Pima County Health Department.

Walgreen’s charges $54.99 – or so it says on their website. There are ~14 Walgreen’s in SF.

https://www.walgreens.com/topic/healthcare-clinic/price-menu.jsp

It would also be standard practice, especially if a patient could not remember the last time s/he was given a tetanus booster. As with other diseases, the booster is relatively painless and ordinarily inexpensive, compared to the consequences, however remote, of dealing with full-blown tetanus.

The issue is predatory pricing. Tetanus and other vaccines are readily available at any large grocery store pharmacy, on a walk-in basis. The cost would be less than 10% of the price charged by this ER.

Price gouging and other monopolistic practices are endemic in American health insurance and health care. ER and drugs pricing are among the most obvious.

There are so many fools who’ve been convinced by propaganda that every time you have any kind of cut or scrape you need a tetanus shot and they try to convince others to get one.

How will Sutter cut wages and Administrative bloat?

I sense no easy solution here.

The intersection between Law, Medical Practice, litigation avoidance, Complex medical coding, and very complex billing and receivables reconciliation (including thousands of pages of ACA stuff) seems Sisyphean.

The courts can do what they can, but Sutter has to execute (send money), in a very complex environment.

Is the cost of medical service in any way related to the immense real estate costs in Norcal? One suspects a solid linkage there.

The Medical world makes banking look simple.

Instead of creating new laws or going through anti-trust why not simply prosecute them under the Sherman and Clayton Acts, requiring that they (and everyone else in the Medical industry) post their prices and honor them for all comers.

California…criminal self dealing from top to bottom and side to side…but I get a kick out of these articles that say “we’re nearing a tipping point…” like if prices simply stopped rising and stayed where they are now all would be fine

Do hospital systems compete on price? That’s news to me as they seem to just charge whatever they want. Having, say, two competing private hospital systems rather than one merely means they vie with each other to get the most marks, er, patients into the door. A typical billboard around here will promote “wait times at the ER” as the thing potential patients are supposedly most interested in.

Bringing back government and county owned hospitals might do the trick but the trend seems to all be the other way.

Depends on how much of a monopoly they have on the market. Obviously, bigger providers can negotiate higher fees from payers (insurance companies). That’s why having a SINGLE payer would give leverage to reduce the fees, à la Medicare For All.

BUT very discouraging to hear about Cerner and the VA. $10b as the cap for a 10-year contract? When the DOD has had enormous problems implementing the same system? We all know how that goes: $10b will be the floor. Cerner is one of the biggest EHR corporate players and so the VA, a single payer system, is demonstrating that Medicare For All is not by definition invulnerable to being corrupted by lobbying $ and cronyism.

It may be that BEFORE we get single payer, we need to have campaign finance reform.

Many insurers and hospital systems have local monopolies, sometimes duopolies. True even for so-called not-for-profits, such as the renowned Cleveland Clinic, which must employ as many MBAs as it does medical staff.

There has been a great deal of concentration among insurers and hospitals. There is little effective competition. Institutions charge what they can get away with. This topic has come up often at NC. When billing is so complicated that universities offer bachelor’s degrees in it, something is rotten and little is being done about it except to allow further concentration. The market answers all questions.

“Do hospital systems compete on price?”, you ask. The answer is largely “NO”.

One big issue is the increasing lack of competition due to all the mergers and buy-outs. Even though I live on the east coast instead of California, the issues described in the article sound awfully familiar,

A second big issue is the lack of transparency on pricing. When I visit a medical provider, I am often asked to sign paperwork where I agree to pay for all charges that insurance doesn’t cover, but then I’m never told what those charges will be unless I explicitly ask. The whole discussion about prices is largely absent.

And a third issue is that we’ve been conditioned (by a variety of factors) to only worry about our “out-of-pocket” expense. If our out-of-pocket expense for a tetanus shot is only $20, do we care whether the insurance company had to chip in an additional $20 to a cost-effective provider or an additional $400 to a greedier outfit? Most people don’t, but they should. After all, if the insurance company is having to chip in larger and larger dollar amounts every year to rip-off providers, then it’s a pretty safe bet that our insurance premiums will likely go up accordingly.

Lack of competitors, lack of pricing transparency, and lack of concern about the size of insurance company payments to providers all contribute to the absence of a “price competitive” environment.

The Sherman and Clayton anti-trust acts (and Robertson-Patman(sp?)) require they post their prices and offer them to all comers. The industry has sued twice to be free of these restrictions and been turned down twice by the Supreme Court, which (supposedly) usually triggers interest from State AGs nationwide. Not this time, apparently.

Sutter could, for example, charge reasonable prices for its various drugs and services, then add a separate charge for service availability. That would greatly add to transparency. It would also be self-defeating, because transparency is the enemy of profits. There would be great pressure, for example, to cut the service availability charge.

The bigger problem is that lower prices for drugs, equipment and services would make it harder to recover revenue from insurance providers. There is a constant game of overcharging, underpaying, wash, rinse, repeat. The under- and uninsured are the low men on the totem pole, and are forced to make up any shortfall. A Rube Goldberg machine if ever there was one, one that does great damage to society.

American medicine is simply the neoliberal ideology carried to its illogical extreme–the poster child if you will. There was some discussion here yesterday about neoliberalism but I believe Michael Hudson has said that it’s all about the rents: you establish yourself in a power position and then leverage that to obtain unearned income. Hudson says that the need to suppress rent seeking is that part of Adam Smith that neoliberals ignore.

And so we pay vast sums to owners of patents and copyrights that probably shouldn’t have been granted in the first place. We also limit competition from foreign doctors at the behest of the AMA which is what Dean Baker talks about constantly. It’s an entire edifice designed to produce the current Rube Goldberg mess.

There’s also the wee problem that consumers have little information and no market power with which to make choices, regardless of how much skin they have in the game. Standard economics seems to have no conception of that arrangement, since it presumes perfect knowledge and comparable market power among participants.

What defies common sense is that these institutions maintain their “nonprofit” status.

For the many years I have been a single payer advocate, but I’ve recognized that just eliminating the administrative waste of multiple payers would not eliminate profiteering baked into the delivery of health care.

Oregon has only two for-profit hospitals. The legislature has made many attempts to address their huge reserves and tax advantages, but blue Oregon proves that both parties are on the take when it comes to protecting “nonprofit” hospitals.” Obamacare expanded Medicaid coverage, creating an influx of cash. This meant these hospitals had less charitable care to cover. Rather than steering that windfall toward the community (or lowering charges for all patients!), the hospitals justified supplements to Medicaid and Medicare underpayments as “charity.”

http://www.wweek.com/news/2016/04/13/the-five-things-hospitals-dont-want-you-to-know-about-obamacare/

Legislature Should Consider a Surtax on Healthcare Executive Pay

https://www.thelundreport.org/content/legislature-should-consider-surtax-healthcare-executive-pay

Health care prices correlate with market power. Full stop. There are now a half dozen major studies based on billions of individual claims that keep repeating this. These correct for real estate and labor costs in one way or another. In particular, there is extreme variability in price within regions, the most powerful predictor of which is market power.

Meanwhile in the real world, electricity in California costs more than double it’s neighboring states. When asked about the disparity in electrical prices and the interstate electrical toll US AG Sessions recused himself and stepped into the bathroom with a girly magazine with Arnold Schwartezenegger on the cover while mumbling about Russian hackers.

Just a reminder that a hospital has up to 3 years to send all of the billing. Its under no obligation to provide invoices in a timely manner. We learned this the hard way after an insurance settlement was closed.

If one asserts the Health Car must be a part of the commons (aka: Medicare for all), it follows that profit seeking for about 20 % of the US economy becomes a part of the commons, socialized.

It then follows that to be successful at being socialized then costs get cut. especially payroll and contractor costs. Contractor costs because many hospitals have a system where the are multiple contractors billing on one admission.

Thus one world need a “prime contractor” arrangement, where there is one billing point. Cutting these costs, “payroll costs” then focuses on the cost of becoming a credentialed worker (Doctor, Nurse or other licensed professional).

Which moves the socialization focus on the extraordinary rise of credential education, the Universities.

Which in turn, would focus on the costs of the overpriced teachers (/s), or the bloated administrations at universities, where it is reported costs have risen nearly 10 times over about the last 20 years.

Which turn in turn focuses on the costs of the “for profit” regime enacted over the last 20 or 30 years:

Which in turn focuses of the cost to society of the 0.1% class, and the value of their contributions to society, other than bribing (cough: campaign contributions for noble causes).

A focus on the costs of the 0.1% to society would be a disaster, the sky would fall, and many lightly occupied vacation homes would become a glut on the market, and home prices would crash, causing overpriced real estate to fall in value, which would become a financial Armageddon for the Lenders (Who are US Government).

All of which would have been caused by removing the keystone of the present economic system, socialized medicine in the US.

A crash which must be resisted to the last poor peasant in need of medical care.

So the high prices are for your own good (/s). Pay up and keep Warren Buffers (/s) and Bill (Education) Gates in bread and milk and honey!

In addition to practicing medicine in the commons, we’d need a debt jubilee.