By Justin Mikulka, a freelance writer, audio and video producer living in Trumansburg, NY. Justin has a degree in Civil and Environmental Engineering from Cornell University. Originally published at DeSmogBlog

The U.S. shale oil industry hailed as a “revolution” has burned through a quarter trillion dollars more than it has brought in over the last decade. It has been a money-losing endeavor of epic proportions.

In September 2016, the financial ratings service Moody’s released a report on U.S. oil companies, many of which were hurting from the massive drop in oil prices. Moody’s found that “the financial toll from the oil bust can only be described as catastrophic,” particularly for small companies that took on huge debt to finance fracking shale formations when oil prices were high.

And even though shale companies still aren’t turning a profit, Wall Street continues to lend the industry more money while touting these companies as good investments. Why would investors do that?

David Einhorn, star hedge fund investor and the founder of Greenlight Capital, has referred to the shale industry as “a joke.”

“A business that burns cash and doesn’t grow isn’t worth anything,” said Einhorn, who often goes against the grain in the financial world.

Aren’t investors supposed to be focused on putting money toward profitable companies? While, in theory, yes, the reality is quite different for industries like shale oil and housing.

If the U.S. financial crisis of 2008 has revealed anything, it is that Wall Street isn’t concerned with making a “shitty deal” when it means profits and bonuses for its traders and executives, despite their roles in the crash.

Wall Street makes money by facilitating deals much like a Vegas bookie makes money by taking bets. As the saying about Las Vegas goes: “The house always wins.” What’s true about casinos and gambling also holds true for Wall Street.

Wall Street caused the 2008 financial crisis, with some of its architects personally benefiting. However, while a few executives profited, the result was a drop in employment of 8.8 millionpeople, and according to Bloomberg News in 2010, “at one point last year [2009] the U.S. had lent, spent, or guaranteed as much as $12.8 trillion to rescue the economy.”

JP Morgan (along with much of Wall Street) required large sums of money in the form of bailouts to survive the fallout from all of the bad loans made, which brought about the housing crisis. Is JP Morgan steering clear of making loans to the shale industry? No. Quite the opposite.

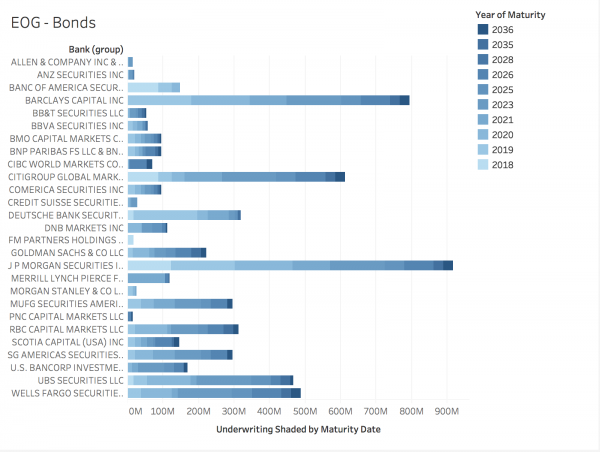

As shown in this chart of which banks are loaning money to shale company EOG Resources, while all of the big players in Wall Street are in on the action, JP Morgan has the biggest bet.

To understand why JP Morgan and the rest of these banks would loan money to shale companies that continue to lose it, it’s important to understand the gambling concept of “the vigorish,” or the vig. Merriam-Webster defines vigorish as “a charge taken (as by a bookie or a gambling house) on bets.”

Wall Street makes money by taking a cut of other people’s money. To a gambling house, it doesn’t matter if everyone else is making money or losing it, as long as the house gets its cut (the vig) — or as it’s known in the financial world — fees.

Understanding this concept gives insight into why investors have lent a quarter trillion dollars to the shale industry, which has burned through it. If you take the vig on a quarter trillion dollars, you have a big pile of cash. And while those oil companies may all go bankrupt, Wall Street never gives back the vig.

Trent Stedman of the investment firm Columbia Pacific Advisors LLC explained to The Wall Street Journal at the end of 2017 why shale producers would keep drilling more oil even when the companies are bleeding money on every barrel produced:

“Some would say, ‘We know it’s bad economics, but it’s what The Street wants.’”

And “The Street” generally gets what it wants, even when it is clear that loaning money to shale companies that have been losing money for a decade and are already deep in debt is “bad economics.” But Wall Street bonuses are based on how many “fees” an employee can bring to the bank. More fees mean a bigger bonus. And loans — even ones that are clearly bad economics — mean a lot more fees.

Shale Oil Companies Are ‘Creatures of the Capital Markets’

In 2017 “legendary” hedge fund manager Jim Chanos referred to shale oil companies as “creatures of the capital markets,”meaning that without Wall Street money, they would not exist. Chanos is also on record as shorting the stock of heavily leveraged shale oil giant Continental Resources because the company can’t even make enough money to pay the interest on its loans.

And he has a point. In 2017 Continental spent $294.5 million on interest expenses, which is approximately 155 percent of its 2017 adjusted net income generation. When you can’t even pay the interest on your credit cards, you are broke.

And yet in 2017, investor capital was still flowing, with Continental Resources among those bellying up to the Wall Street trough for another billion in debt.

“In 2017, U.S. [exploration and production] firms raised more from bond sales than in any year since the price collapse started in 2014, with offerings coming in at around $60 billion — up nearly 30 percent from 2016, according to Dealogic. Large-cap players like Whiting Petroleum, Continental Resources, Southwestern, Noble, Concho and Endeavor Energy Resources each raised $1 billion or more in the second half of 2017.”

How big of a problem is this business of loaning money to an industry burning through billions and burying itself in debt? So big that the CEO of shale company Anadarko Petroleum is blaming Wall Street and asking its companies to please stop loaning money to the shale oil industry. Yes, that’s right.

In 2017, Anadarko CEO Al Walker told an investor conference that Wall Street investors were the problem:

“The biggest problem our industry faces today is you guys. You guys can help us help ourselves. It’s kind of like going to AA. You know, we need a partner. We really need the investment community to show discipline.”

The Wall Street Journal reports that Walker maintains: “Wall Street has become an enabler that pushes companies to grow production at any cost, while punishing those that try to live within their means.”

Imagine begging banks to stop loaning you money. And being ignored.

Growing production at any cost is the story of the shale “revolution.” The financial cost paid so far has been the more than $280 billion the industry has burned through — money that its companies have received from Wall Street and, despite the plea from Al Walker, continue to receive.

The Economist summarized the situation in 2017:

“It [the shale industry] has burned up cash whether the oil price was at $100, as in 2014, or at about $50, as it was during the past three months. The biggest 60 firms in aggregate have used up $9 billion per quarter on average for the past five years.”

Higher oil prices are now being touted as the industry’s savior but, as The Economist noted, the shale industry was losing money even when oil was $100 a barrel.

Still Wall Street keeps giving the shale industry money and the shale industry keeps losing it as it ramps up production. To be clear, this arrangement makes shale company CEOs and financial lenders very rich, which is why the trend is likely to continue. And why Continental Resources CEO Harold Hamm will continue to repeat the myth that his industry is making money, as he did at the end of 2017:

“For anybody to even put forth the suggestion we haven’t had great expansion and wealth creation in this industry with horizontal drilling and all the technology that’s come about the last 10 years, I mean, it’s totally ridiculous.”

No one will argue that Hamm and his partners on Wall Street are not extremely wealthy. That has happened despite Hamm’s company and the rest of the fracking industry losing epic sums of money. The same year Hamm made that statement, his company couldn’t even cover its interest expenses. To put that in perspective, Continental Resources couldn’t even make the equivalent of the minimum payment on its credit card.

Watch What the Industry Does, Not What It Says

Higher oil prices are yielding more stories about how 2018 will be the year that the shale industry finally makes a profit. Harold Hamm refers to it as Continental Resources’ “breakout year.” Interesting how potentially not losing money for a year is considered a “breakout year” in the shale industry.

As reported on DeSmog, the industry certainly got a huge boost from the recent tax law, which will help its companies’ short-term finances. Continental Resources alone took home $700 million in tax relief.

Recent reports in the financial press detail how the new approach in the shale industry will be to focus only on profitable oil production, not just producing more barrels at a loss. As The Wall Street Journal put it in a headline: “Wall Street Tells Frackers to Stop Counting Barrels, Start Making Profits.”

In that very article, Continental CEO Hamm assures that he is on board with this new approach, saying, “You are really preaching to the choir.”

But has Continental actually embraced this new approach of fiscal responsibility and restraint?

Not so much.

The fracking firm appears to have done the opposite, increasing production to record levels along with the rest of the shale industry. Continental recently reported plans to drill 350 new wells at an estimated cost of $11.7 million per well, which adds up to over $4 billion in total costs on those wells. The company currently holds more than $6 billion in debt and less than $100 million cash.

How will Continental fund those new wells? Hamm has promised that going forward, there would be “absolutely no new debt.” Perhaps Continental will fund it by selling assets because without more debt, Continental does not have the money to fund those new wells. However, if past is prelude, then Wall Street will happily lend Continental as much money as it wants.

Why would Hamm say one thing and do another? Well, he personally has accrued billions of dollars while his company has burned through billions.

Despite leading Continental to another money-losing year in 2017, Hamm took home a fat raise.

Funny how the news cycle will go nuts if —insert public pension fund— has 0.07% of its holdings in a gun stock.

But not a peep at ‘golly aw shucks’ Mr. Grandpa USA, Warren Buffet, over Wells Fargo its retail banking or its fracking enabling. or at (pal of chuck schumer and clintons) Jamie Dimon or USA-rescued Citi.

#resistance

Don’t forget that warren buffet also owns the trains that eat a lot of the profits of the koch bros investments in the tar sands. That why they wanted that keystone pipeline soooooooo baaaad…

The article could use an explanation–for those of use who are financial dummies–of who the investors are that are making these apparently foolish bets. If Wall Street is the bookie then who are the bettors? Or are the Wall Street banks using deposit money to invest in fracking?

On a recent drive through West Texas I noticed the landscape dotted with what looked like newish mini factories–presumably fracking operations. Clearly it’s not a low cost endeavor.

I keep thinking that the whole enterprise was bankrolled specifically to crush oil prices and keep inflation tamped down, which provides much more profit to wall street via the assurance that the Fed’s easy money policy lasts a lot longer. All the rest of this talk about profitability is just BS cover story. It’s also an employment plan, in the same way that bankrolling student loan debt was a a huge employment plan for administration and construction, and soaked up unemployment by lifting enrollment rates and taking people out of the labor market. I think we forget how so much of what happened after the financial crisis was a way of getting around the fact that they wanted the stimulus so much bigger than the 1 trillion they didn’t even manage to get. I mean, look at the for profit school industry – that was an obvious total racket and a joke, yet they threw money at it, then pretended to clean up the shocking unexpected mess after when it was safe to do so (when the economy was more in the clear.) The wall street insiders make a mint trading the junk stocks up, then short the hell out of them when they know the game is over and make a mint on the way down.

I’ve been wondering the same thing. There must be a huge pile of non-performing debt on someone’s balance sheet or it’s being moved around to where significant write downs are happening, but I have no idea where either of those two things might be. Who are the stuffees? Is German banks buying subprime again?

> If Wall Street is the bookie then who are the bettors?

It’s a great question that leaves everyone guessing. My guess is pension funds, and calling them bettors is being kind.

A bit off topic but yesterday in links was an article about the long time it takes to sue Goldman Sachs. Now, it’s good to see a little bit of trouble coming their way but the article describes the lady doing the sueing as a sweet innocent young thing being mauled by the male predators at Goldman and her specialty was the “sale of convertible bonds”, a fee generating bullshit jawb that made her more money in a year than a deplorable can dream of making in a lifetime.

There were two problems however. One, the sexual predator grabbing her was a bit of a sideshow and from reading the guts of the article, the much bigger one is about money and how the ladies of Goldman were being cut out from their rightful share of the fee-loot generated at Goldman Sachs.

Bernie Sanders: The business of Wall Street is fraud and greed.

Pension funds is a good guess but one would think the consistent losses would start to show somewhere.

The bezzle at this point has to be approaching trillions.

The simple, short, response is “pension funds across the country, public and private, ARE evidencing/showing considerable shortfalls.”

That doesn’t equate with pension funds being involved in these types of investments, but we shouldn’t be surprised if they are.

In the case of public pension funds, many of not most of the “shortfalls” are in fact intentional under-funding of the plans, with contributions to the funds being skimmed off by state governments and diverted into the general operating funds, because Taxes Bad.

No it isn’t a low cost endeavor and that may be precisely how the scam works. Note that the article mentions at the end that Hamm who founded Continental has made billions personally while the corporation flounders.

So the question is, what else does he own?

I’ve mentioned this book a few times recently that I’m still in the middle of – Railroaded by Richard White. He points out that the 19th century railroad corporations were disorganized, poorly run, money losing enterprises. But that didn’t stop people from investing in them and getting filthy rich. All you need is some fast talking and clever accounting. One example he mentions is that the railroads needed all kinds of supplies to keep things moving and so they would buy them from railroad logistics corporations or fuel from coal companies, etc. But guess who owned the suppliers? That’s right, the railroad investors would set up separate companies to supply their own railroads and these companies were extremely profitable. But the pool of investors in these supplier companies was limited to the smart money in on the scam. In essence, the initial well heeled investors set up the railroads so that they could deliberately fleece them. He gives the example of one of the coal companies charging the railroad three times the going rate, which beggared the railroad but lined the pockets of the select few investors who owned stakes in both companies.

I suspect that something similar may be going on in the fracking industry. So to figure out the whole scam, you would need to know if the logistics companies are making a profit and is there any common ownership between those companies and the frackers.

Also, for anyone interested in the shady world of corporate finance and how it came to be in the US, I can’t recommend the book linked to above enough. One other aspect I found fascinating is how the railroad investors turned to Europe and specifically the Germans to buy their bonds when they couldn’t find enough suckers stateside. Reminds me quite a bit of the mortgage crisis a decade ago that spilled into Europe.

The other book I recently read was The Whiskey Rebellion by William Hogeland which discusses finance and taxation during the period just after the American Revolution. Shorter version – Alexander Hamilton was a crook who deliberately set up a financial system to ensure that the rich get richer off the labor of the rest of us.

The more you learn about the history of this country, the more you realize that there really is nothing new going on and the financial crooks of today are just following in the footsteps of their grifter forebears. And maybe someday they too will have cities named after them or at least a statue in the public square, because the US of A does love its con men.

Thank you very much for the book recommendations!

Maybe their back up investments are in “fixing” the externalized, environmental costs e.g. water filtration systems that remove radiologocals/heavy metals from municipal supplies with the cost of purchasing being inversely portional to the extent of privatized ownership permitted?

https://www.smithsonianmag.com/science-nature/radioactive-wastewater-from-fracking-is-found-in-a-pennsylvania-stream-351641/

https://www.forbes.com/sites/jeffmcmahon/2011/04/09/radiation-detected-in-drinking-water-in-13-more-us-cities-cesium-137-in-vermont-milk/#12e0744e4aa8

https://grist.org/article/2011-02-28-pittsburgh-drinking-water-radioactive-fracking-natural-gas-times/

We spread the radium & strontium flavored “produced water” on as a replacement for road salt. Slickwater fracking of the Marcellus became sellable, after Katrina messed up Shell’s deep water platforms in the Gulf (ie: a Democrat administration in PA, allowed fracking in a huge reservoir, 1/4 mile from two 40yr old reactors and “watering down” return water to “permissable levels” of toxic substances illegal to disclose to the 850,000 folks drinking “treated” water. (note the dates?)

https://vimeo.com/44367635 https://www.propublica.org/article/wastewater-from-gas-drilling-boom-may-threaten-monongahela-river

Hogeland’s book Founding Finance is also great. Michael Perelman’s book Railroading Economics is worth a read. The founders of economics in the US were looking at the example of the railroads and other corporations and acknowledging that competition was destructive and wasteful, but in their textbooks for college students they pushed the simplistic and misleading models that came to define neoclassical economics.

I know nothing, but…

Banks can fund loans by creating deposits and then carry the debt on their books as assets. And they can be hidden there, their assets are secret.

If the stuff can’t be paid back it’s toxic, just like subprime in 2008….

And the party goes on until rising rates push the economy into recession, banks stop rolling over loans, the borrowers go to the Wall, etc.

And then what? The usual thing is for gov to bail out the Tbtf banks rather than take them over, and sack or jail the officers because can’t hurt the biggest donors. But if it all hangs together until 2020 and Bernie wins there might be a change in the script.

If Sanders thinks of running again, he should say something basically like . . .

” If I am elected, I will have in place some responses ready to roll out and apply when the next crisis and depression breaks out during my term.” And he could say why he is predicting a “next crisis and depression”. If he were to get elected and then we had a next crisis and depression during his term, he would get public credibility for having predicted it. And he might have more political latitude for “doing the FDR thing” in response.

I think that would be an excellent thing for him to do, with regard to the People, except it might well get him JFK’d.

Many corporations, education institutions have pulled out of the fossil fuel industry investment funds, a cursory reading of the press will give you an update

Have they pulled out of the fossil fuel inVESTment industry as well as pulling out of the fossil fuel INdustry itself?

Great piece! Thanks for posting. I’m going to try and shop this around at work…wish me luck…

My comment is a question – thanks in advance for your input:

How does Wall Street fare when oil companies who they lent money to, go into bankruptcy?

My guess is that even thought the banks aren’t necessarily lending directly to the frackers and the fees they collect are lucrative, they still have some skin in the game somehow. The investors who are putting up the cash must have got the money from some bank or another. So the banks wouldn’t put up this much money without some guarantee they would be made whole when it all goes belly up.

And I can’t think of a bigger wink and a nod than what happened about ten years ago after the banks blew up the mortgage industry. If Uncle Sugar came to the rescue then, I think it’s safe for them to assume it will happen again. After all, their friends run Treasury and the Fed.

And see article in FT posted in links a couple days ago “liquidity ousts debt as the big market worry.” It provides some charts showing that banks are shifting away from holding debt and playing more of the role of broker (with some anti-regulation propaganda thrown it as editorial spin).

@Jim M

May 6, 2018 at 8:28 am

——

One of the things the banks frequently do when their borrowers go into bankruptcy, is to participate in the debtor-in-possession financing that the bankruptcy court guarantees to be repaid. This allows them to earn some interest to offset any losses.

If the fracking companies don’t go bankrupt, the debt will be rolled over continuously until the whole system collapses and the Fed bails out the banks again.

Rinse and repeat.

I guess that all the money pumped (no pun intended) into fracking must have originated in the several trillion dollars worth of Quantitative Easing funds created in the past decade. All that money sloshing around had to go somewhere. Maybe the only good news is that this will be all one way to cancel some of these excess funds. The bad news is that supporting an insupportable industry will screw up huge tracts of land and water supplies for god knows how long.

Though not as “profitable” as converting as much energy production as possible to solar, wind, and Pumped Storage Hydro (to store otherwise wasted “free” energy at 1/20th the cost of batteries), it seems inevitable that people will not keep paying so much extra for what should be much cheaper energy.

I don’t know what price the planet and ones keeping us on too expensive energy will pay in the long run (financial market losses by suckers, or tax payers for Citizens United enabled politicians and phony regulators), but I suspect the ones that see the inevitable are getting as much profit as they can, while they can, and leaving so many more holding the bag (financially, and in abused environment).

There are some that will make wiser investments in more sustainable energy, as they accept lower returns more in line with energy production at much better cost benefit ratios (which are also less environmentally damaging).

See https://www.hydro.org/wp-content/uploads/2018/04/2018-NHA-Pumped-Storage-Report.pdf

Perhaps Wall Street and the banks are playing a larger game. When the U.S. had $4.00+ gasoline there was a real motivation to rework transportation systems and rely less on cars. Now, with the lower oil prices we are back to SUV’s and pick-up trucks. So maybe a loss leader in the fracking scam has preserved a much larger cash cow in auto finance. There is also the whole oil services industry to consider. With new conventional discoveries at an all time low, what would the oil services sector do if there were no fracking?

Can’t help but wondering if this isn’t all part of the neo-conservatives and their ‘Great Games’. Since 1971 and the peak of conventional oil production in the US, the country has been a power in decline, economically if not militarily. If, as Frederick Soddy wrote almost a hundred years ago “Life is fundamentally a struggle for energy”, then the country which controls that energy controls life on our planet. (I believe Kissinger said much the same thing.) This has all kinds of implications for issues from world (Middle East) peace and transitioning to renewable energy sources. Accidents of geology have left Middle Eastern countries with most of the world’s remaining easily exploitable sources of conventional oil – and also as holders of much of the US and Western government debt upon which the international monetary system is based.

Free the world from its dependence on fossil fuels and you free it from its dependence reserve currencies, US government and Wall Street-created debt. I wish Hudson would return to the theme which introduced me to his work, Super (monetary) Imperialism. End it, i.e. replace the free lunch international monetary system from which the US and its ‘exceptional people’ derive the funds to spread murder and mayhem around the world, and you open at least the possibility for the world to enjoy a little peace and get to work on serious problems like climate change.

I also can’t help but wonder if Reagan shouldn’t be most remembered for his instructions to White House maintenance personnel to ‘take down those solar panels’. This is eight years after Hudson published Super Imperialism – more than enough time for at least policy makers, drawn mostly from the ranks of finance, to understand ‘the game’ (and the orders from Saudi Arabia they must follow if they wished to keep playing.) Fracking is / was just a feeble attempt to show some independence which it and the rest of the world do NOT have so long as they remain hooked on the Middle East’s ‘ancient sunlight’.

i’ll always appreciate carter for putting them on.

They were installed on the roof so that the White House kitchen could have hot water. And they didn’t work well.

So, Reagan had them removed.

ISTR reading that a photovoltaic array was installed while Obama was president.

“Life is fundamentally a struggle for energy”

This does appear to be at the core of human nature, particularly if you substitute “power” for energy as a term to include both physical BTUs, who’s pursuit we share with all other animals, and the social relations that can be commanded with it which are a strictly human thing.

The question now front and center is, “is humanity capable of self-conscious restraint on power, even at the risk of extinction?”

I can only imagine survival for our species if we can make a religion of opposing “power” at the risk of life as a mater of faith. Power has to be a community resource used for community aims that intergenerationally sustain the community, but “the coordination problem” of large groups militates against this notion. A stretch I know, the limits of my creativity are showing!

Thank you for posting this excellent piece. However, I question whether the domestic shale oil industry is financially unprofitable when it is considered in the aggregate, or if it is just the exploration and production sector. Setting aside for a moment the huge environmental, health and other social costs associated with this industrial activity, there is a vast network of entities that depend on this debt-fueled oil extraction and development. They range from oil and gas steel pipe manufacturers in Youngstown and drilling rig manufacturers in Texas to tank railcar manufacturers in Louisiana to major railroads to refineries and petrochemical facilities to pipeline companies and to some extent the domestic auto industry and military, etc. No question the domestic shale oil extraction sector itself is not cost competitive with other global suppliers, but I am wondering about the cumulative secondary and tertiary economic and employment effects.

The primary problems with this industry sector lie in the enormous long-term environmental and social costs it imposes, maybe even raising existential questions. Then there is the issue of oil pipeline companies being granted eminent domain to deliver this oil for export when the nation as a whole is a major net importer. Is that really a “public purpose” for which the eminent domain laws were intended, or simply to line the pockets of a few?…

You can thank our Federal Reserve for all of this!

Considering the environmental impact of Non-conventional drilling ( fracking ) it should be noted that although denied by the industry wells have a considerable leak rate which puts methane aint the atmosphere and threatens potable water supplies. In addition the uptick in fracking has suppressed the development of non fossil fuel energy production which leads us headlong into the 1.5 to 3 degree temperature elevation that the Paris agreement seeks to avoid. The following links are a good introduction to these dangers. It seems likely that human intelligence will prove to be a lethal mutation.

https://www.youtube.com/watch?v=Dxis-vYGM_M

https://www.youtube.com/watch?v=PGfIjCG-zB4

What happens when the true costs of fracking- to the land, soil, water, and communities- become part of

the equation? That can’t come soon enough, in my view.

The squandering of vast natural resources here in the USA! is just so saddening.

At least the poor warehouse worker knows he doesn’t have the time, so he carries his new P-bottle just in around in case; maybe the frack-daddies should wake up and start packing new bottles!

This is a good post. It is an existential question.

If I remember my lessons from NC, in 2007 it was clear that the subprime mortgage securitization scheme would tank as the housing market collapsed. The short spread bettors couldn’t get anyone else to see what was really happening. Then suddenly Bear Stearns was sold, Lehman Brothers went bankrupt and AIG had to be rescued.

I assume that Wall Street will continue to make loans out of thin air and pocket the Vig. The Fed assures that the banks have an infinite money supply with deregulation and not forcing the banks to write off their bad loans. This is similar to the MMT funding of the military’s never ending overseas wars. Wars end – badly most of the time. Fossil fuels are finite. When the fuel costs more money to produce than it can be sold; the system collapses. So, does that portion of civilization that is dependent on that energy source if there is no alternative available.

I work in the oil industry. My job is as a type of low-level geologist, actually living and working out on oil rigs for weeks or months at a time. (I drive to the nearest town with a ChinaMart about once a week or so to wash clothes and buy more groceries.)

Several observations:

1) What the Saudis did in 2014 – 2016, maximizing output and spending ~2/3 of the 800 billion dollars equivalent in savings they then held to sustain their economy and regime, trying to bankrupt the U.S. oil industry (and secondarily, the Iranians, etc.) they quite literally cannot do again, anytime soon. They’re close to broke, and fighting 1 – 2 wars.

2) The U.S. oil industry cut costs dramatically over the 6-9 months from the end of 2014. That was done primarily by cutting WAY back on drilling (active rig counts in ND declined by 90-95% over that time) and reducing what they would pay drilling and service companies. Mudloggers, MWD, directional drillers, casing crews, etc., saw their wages go down by over HALF, if they even still had a job. (Many to most did not.)

3) The oil industry is pretty busy right now, but is running into some constraints. Tops is they are still in the early stages of raising wages back up; I only make about 3/5 as much per day as I did in October 2014 (and there has definitely been some inflation in the prices I pay for most everything since then). Many workers that left were older, so just completely retired or found retirement jobs. Some bought trucks/farms/small businesses, so are reluctant (especially at these still-depressed wages by 2014 standards) to uproot and come back. Many just can’t see the math working, while others (or their wives, which = to the same thing) just can’t stomach facing another inevitable downturn at some point, with inevitable job loss.

4) More than a few oil companies have leases on which they must drill, either in a certain time period before drilling rights expire, or must actually drill to retain them. Further, while many oil industry investors sadly poorly understand the delay between “let’s drill there” and having oil to sell, many do. Some, perhaps a lot, of drilling is done in anticipation of eventually (likely almost certainly) higher prices at some point.

5) Oil companies actually aren’t that bad on the environment most of the time. 5-10,000′ feet down where the zones of interest typically are located, WGAF what is pumped or spilled, as no one travels or lives there. (Very thick, impermeable casing hydraulically seals off those zones from interacting with the surface, with innumerable impermeable strata between fracked zones and surface water wells, the latter rarely even 1000′ deep, and usually more like <200'.) By comparison, ethanol (whether from grain or sugar cane) requires vast acreage be farmed, using POL for many aspects (~90% of commercial fertilizers and nearly all pesticides have oil origins), while windmills chop up tens of millions of environmentally desirable, often endangered or protected, birds every year in the U.S., with little or no sanctions on the windmill companies.

6) People working in the oil industry typically have the same attitude I have about anti-oil protesters. That is, let the ones who don't use petroleum, complain. That's not just gasoline, diesel, heating oil, kerosene, etc., but also lubricants, pesticides, fertilizers, plastics, thermal insulation used in most dwelling and commercial buildings, and anything produced or manufactured or transported by same. No food, no clothes, no utilities, no transport besides feet — that would kill easily 90% of Americans within 6 months. This is part of why I figure all the sincere environmentalists have already committed suicide — and the rest are hypocrites.

That is the conundrum. However, abrupt climate change from continued burning of fossil fuels will kill many more.

Regarding “ The Saudis … trying to bankrupt the U.S. oil industry” – The Saudis were not out to destroy the US oil industry. The US oil industry controls the Saudis through the US Military which keeps them in power. The Saudis were after the wildcat frackers who were not part of the global oil cartel (which includes US Big Oil). The wildcat frackers were not maintaining limited production quotas to maintain the monopoly oil price gouging. US Big Oil allowed the price collapse for long term goals with their Saudi partners. (Source: Antonia Juhasz) Apparently Wall Street was not in on the plan and kept the money flowing in the fracking Ponzi scheme.

Regarding: “while windmills chop up tens of millions of environmentally desirable, often endangered or protected, birds every year in the U.S., with little or no sanctions on the windmill companies.” – This statement is just oil company propaganda. Quoting Stanford Prof. Mark Jacobson: “Wind turbines reduce bird kills relative to natural gas, coal, and oil for electricity and cause about the same bird death rate as nuclear power. A recent study published in Energy Policy found that wind turbines kill less than one‐tenth the bird deaths caused by each of natural gas, coal, and oil and similar deaths to that caused by nuclear power. As a result, wind turbines reduce bird kills relative to fossil energy sources. In addition, according to the American Bird Conservancy, the total number of bird deaths per year due to wind turbines (a few hundred thousand) is orders of magnitude lower than the numbers due to communication towers (10‐50 million), cats (80 million), or buildings (900 million).” Source: https://web.stanford.edu/group/efmh/jacobson/Articles/I/MythsvsRealitiesWWS.pdf

Regarding: “Oil companies actually aren’t that bad … most of the time.” – The same can also be said of mass murders and child rapists. Oil company pollution and their global ruthlessness is well documented – and as the oil man I know once told me – to understand this industry all you need to do is watch the movie “There Will Be Blood.”

Luke is an oil man who brings to mind the Upton Sinclair quote “It is difficult to get a man to understand something when his salary depends upon his not understanding it.” He would have fit right in with those men cutting down the last tree on Easter Island — unconcerned about the future of their people. He thinks climate change is a crock because if it is true, then his job is destroying the planet. For anyone paying attention to global pollution and climate change, it is clear we need a rapid transition to renewable energy (solar and wind), a reduction in consumption (transition to more leisure time), and stewardship for the planet rather than the get-rich-quick mining mentality that leaves a giant mess for future generations to clean up – assuming human civilization survives. The economic/engineering outlines for this needed rapid transition are discussed by Prof. Mark Jacobson in several publications – here is the one for California. (https://web.stanford.edu/group/efmh/jacobson/Articles/I/CaliforniaWWS.pdf) Current non-planning for the coming disaster just leave us “circling the drain” — waiting for the ultimate collapse.

“There’s a sucker born every minute” and Wall Street is P. T. Barnum directing investors with the sign “This Way to the Egress.” The con will last as long as investors have cash to burn and think “product growth” is equivalent to “profit growth” – or in the words of Lucy “Well, uh maybe there is no profit on each individual jar, but we’ll make it up in volume.”

Interesting, if not quite as d&mning as the East Anglia collection of emails showing worldwide fraud among scientists who get money to hawk global warming:

https://www.iceagenow.info/astrophysicist-mini-ice-age-accelerating-new-maunder-minimum-has-started/

“Astrophysicist – Mini Ice Age accelerating – New Maunder Minimum has started

May 3, 2018

We are plunging now into a deep mini ice age,” says astrophysicist Piers Corbyn. “And there is no way out.”

For the next 20 years it’s going to get colder and colder on average, says Corbyn.

The jet stream will be wilder. There will be more wild temperature changes, more hail events, more earthquakes, more extreme volcano events, more snow in winters, lousy summers, late springs, short autumns, and more and more crop failures.

“Carbon dioxide levels do not have any impact – I repeat, any impact – on climate,” says Piers. “The CO2 theory is wrong from the start.”

“The fact is the sun rules the sea temperature, and the sea temperature rules the climate.”

“The basic message is that the sun is controlling the climate, primarily via the sea.”

“What we have happening – NOW! – is the start of the mini ice age…it began around 2013. It’s a slow start, and now the rate of moving into the mini ice age is accelerating.”

“The best thing to do now is to tell your politicians to stop believing nonsense, and to stop doing silly measures like the bird-killing machines of wind farms in order to save the planet (they say), but get rid of all those things, which cost money, and reduce electricity prices now.”

Piers Corbyn is a crank – plenty of them out there – most not related to someone famous. But just a few minutes of research should raise some red flags on this guy.

Red flag #1 — the guy leaves a physics graduate school with only a masters — this is normally a booby prize – these programs are designed for PhDs.

Red flag #2 – Is quoted by Electric Universe – “an umbrella term that covers various pseudo-scientific cosmological ideas” — http://globalwarmingmag.com/tag/piers-corbyn/

Red flag #3 – Piers declines to publish details of his methods — generally a sure sign of a crank. https://www.wired.com/1999/02/weather-2/

Red flag #4 – Piers is quoted as saying “Carbon dioxide levels do not have any impact – I repeat, any impact” – this means he rejects the basic physics of radiation absorption/reflection taught at the undergrad level.

Red flag #5 – economic interests – “For Corbyn, 51, all this is a lot more than an intellectual exercise. He has his eye both on writing a new chapter in meteorological science and on grabbing a piece of an international business worth an estimated $2 billion a year.” https://www.wired.com/1999/02/weather-2/

Red flag #6 – “If I’m to believe Corbyn, his scrawls represent something conventional science says cannot exist: a detailed weather forecast that reaches nearly a year into the future.” – which for anyone familiar with the nature of coupled partial differential equations that form chaos theory, you would know about the inability to make such forecasts. https://www.wired.com/1999/02/weather-2/

Thanx for the info. I will file it right next to the picture of Noah’s ark with baby dino heads sticking up through the deck and the latest minutes from the Flat Earth Society meetings.

Also interesting news item:

https://www.washingtontimes.com/news/2018/may/7/climate-skeptics-more-eco-friendly-global-warming-/

“A study by Cornell and the University of Michigan researchers found that those “highly concerned” about climate change were less likely to engage in recycling and other eco-friendly behaviors than global-warming skeptics.

“Belief in climate change predicted support for government policies to combat climate change, but did not generally translate to individual-level, self-reported pro-environmental behavior,” said the paper.

As Pacific Standard’s Tom Jacobs put it, “remember that conservatism prizes individual action over collective efforts.”

“So while they may assert disbelief in order to stave off coercive (in their view) actions by the government, many could take pride in doing what they can do on a personal basis,” he said in a Friday post.

Mr. Gore, a leading climate-change activist, has long come under fire for his carbon-emitting ways, such as burning 21 times more kilowatt hours annually at his Nashville mansion than the average U.S. household, according to a 2017 study by the National Center for Public Policy Research.

His swimming pool alone uses enough electricity to power six average homes for a year, the study said.”

Luke provides a perfect example of confirmation bias – start with a predetermined position, look for evidence that confirms that position, and reject evidence to the contrary. He quotes The Washington Times — a propaganda paper created by the Moonies (next time he will probably quote Fox News – or is it Faux Noise). Why would anyone cite this Moonie rag as a source? In this case the Moonie paper appears to have found one example of a flawed study to attack supporters of climate science. For those unfamiliar with propaganda techniques, check out the wiki page which identifies this Ad Hominem attack. The Moonie article is classic propaganda – the worst kind of corporate media dribble. The Moonie paper quotes a single study with a statistically small sample (600) using the least reliable form of data collection – self-reporting. There are plenty of other studies that show behavior correlates with belief. But as with many news articles, “man bites dog” gets the headline when we all know the opposite is more likely. The Moonie newspaper begins with an attack on a wealthy elitist politician as an example of a climate activist – someone who is hardly typical of climate activists. Attacking the Democratic Party elites (who deserve our scorn) and climate activists is a twofer. The Moonie paper’s opening line combines class-envy, loaded language, name calling, red herring, scapegoating, and transfer – a good propagandist must have written this dribble. And to be fair and balanced – my repeatedly calling the Washington Times a Moonie paper is also a form of “loaded language” – but it was just so fun to do so I couldn’t help myself. I personally reject the premise that progressives must disarm themselves in the battle of ideas – as long as we acknowledge what we are doing.