Yves here. It’s so much fun to poke cryptocurrency promoters…and I haven’t done it in a while!

By Jon Danielsson, Director of the ESRC funded Systemic Risk Centre, London School of Economics. Originally published at VoxEU

Are cryptocurrencies the future of money, Ponzi schemes, speculators’ dreams, or just a prosperity gospel? While there is money to be made in the short run, this column argues that cryptocurrencies are lousy investments and will eventually reach a price of zero.

Cryptocurrencies have been a fabulous investment for early investors. A Bitcoin was worth $0.06 in 2010, and $6,500 now, an 11 million percent return. Does it make sense to invest in cryptocurrencies today? It depends.

Any asset can get into a bubble state. People buy it because they expect others to pay a higher price in the future, creating a positive feedback between buying and prices. Someone who invests early and sells in time makes money, just like an early investor in a Ponzi scheme profits, provided she gets out early.

This leaves two questions:

- What sort of investments are cryptocurrencies?

- Does it make sense to invest in them?

The price of stocks and bonds follows from expectations of future income. Other assets have value simply because we hope people will buy them at a higher price in the future.

Collectables are in the latter category. The Wall Street Journal ran an interesting story on the risk of investing in collectables recently, “Sorry, Collectors, Nobody Wants Your Beanie Babies Anymore”: “Over two decades after the great Beanie Baby craze, speculators are back, hoping someone will finally buy their floppy collectibles” (Wall Street Journal2018). It is the same with art and stamps. Collectable stamps have scarcity value, with some costing more than $200k.

Money is also in the latter category. Fiat money such as dollars, yen and euros, the form of currency used in almost every country, only holds value because the issuing central banks and governments are expected to manage them properly.

So what about cryptocurrencies? They might make some sense, as maintained by Fatás and Weder di Mauro (2018). Perhaps, following from Friedrich von Hayek in 1977, they beat fiat money in the free market. Or not, as Fernández-Villaverde (2017) argues.

The Promise of a 10,000% Return

Most cryptocurrencies – like the most popular, Bitcoin – are envisioned as a new form of money. The best case for cryptocurrencies, then, is a full replacement of fiat money. So how much would that be worth?

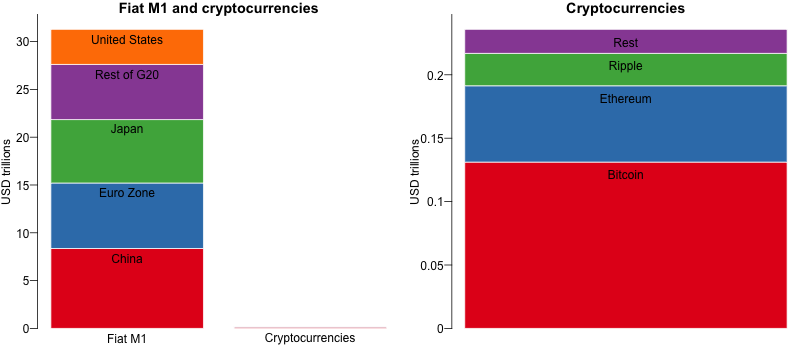

It depends on what we mean by money. Suppose, it is M1, printed money, and demand deposits. The total value of M1 in the G20 economies is $31 trillion, as seen in Figure 1. The total market value of all cryptocurrencies is $235 billion, of which Bitcoin is the largest at $131 billion.

Figure 1 The volume of money in economies with the largest money supply compared to the four largest cryptocurrencies, 3 June 2018

Source: coinmarketcap.com

So what is the value proposition of cryptocurrencies? Their market value is about 1% of M1. While we can debate the specifics, the 1 to 100 ratio provides a useful guide to scale.

There are three possible scenarios.

- cryptocurrencies will fully displace fiat money;

- cryptocurrencies will partially replace fiat money; or

- cryptocurrencies will not usurp fiat money.

Under the first scenario, cryptocurrencies might increase 100 times in price. Under the last scenario, cryptocurrencies only have a logical terminal price close to zero, unless some use is found for them that does not involve displacing fiat money.

The zero times and 100 times returns are therefore sensible lower and upper bounds on the returns a very long-term investor can expect.

Sticking to my back of the envelope calculation for the extremes, a long-term, risk-neutral investor will hold cryptocurrencies if she expects the chance of them entirely replacing M1 to be higher than 1%. If not, she should either not hold or consider selling short, provided the cost of doing so is sufficiently low.

This leaves the intermediate scenario where cryptocurrencies partially replace fiat money. Bitcoin is already used for certain types of transactions. The central banks might also start holding cryptocurrencies as reserves, or large retailers like Amazon may begin accepting cryptocurrencies for transactions.

Unlikely. I don’t think many people would like to earn their salaries in dollars, pay rent in Bitcoin, buy groceries with Ethereum and compensate the hairdresser in Ripple. We want to use a single currency, one that provides price stability and ease of transactions. I want to know how large my monthly mortgage payment is, and will be, as a fraction of my salary. This means using the same money for everything. If fiat money competes with Bitcoin or any of the cryptocurrencies, one will win. That leaves the two extreme scenarios.

The Two Tests for Cryptocurrency Success

For cryptocurrencies to have a hope of making substantial inroads into fiat, there are two tests to be met.

- Cryptocurrencies have to show themselves to be a superior technology to fiat money.

- The government has to allow that to happen.

At least today, cryptocurrencies are inferior to fiat money on every practical criterion, as I discuss in a blog on Vox.

However, the value proposition is not based on today, but what might happen. Fiat money is a very efficient and entrenched incumbent technology, and I have not seen any credible projections of how cryptocurrencies can improve on, and hence beat, the incumbent.

There are plenty of opposite predictions out there, but they are either based on some abstract theories of how we should think about money, computer algorithms, or carefully chosen case studies, not on how money is used in the real world.

Besides, the governments won’t let it happen.

The Desire and Power of Governments

Suppose, then, that I am wrong and cryptocurrencies are found to be superior to fiat money, set to displace them in the free market for money. Would existing holders of cryptocurrencies profit?

Highly unlikely. Such views underestimate both the power of the governments and their strong desire for this not to happen.

What might be the governments’ objections?

- Seigniorage – the profits the government gets from printing money. If cryptocurrencies became real competitors to fiat money, someone is going to make a profit. Full fiat displacement means a $31 trillion transfer from regular citizens to a handful of speculators. That figure is almost the annual GDP of the US and China combined (at $34.5 trillion). No government will allow that to happen.

- The importance of managing the supply of money to suit economic and political demands, both routinely and with lending of last resort. In order to do that, not only does the supply of money have to be variable, it also has to be under the control of the government. The fixed mining schedule of Bitcoin implies increasing deflation if Bitcoin were to displace fiat money. The cost of that deflation would be a very high and unnecessary cost.

Cryptoadvocates might retort that none of these matters since the opinion of the government is irrelevant. Cryptocurrencies live in cyberspace, outside existing economic and financial structures, away from the long hand of the law. A libertarian paradise. It is then only a question of when, not if, we will be able to go about our daily economic life buying stuff on Amazon and paying in cryptocurrencies.

Nonsense. Governments have the power to ensure money controlled by them remains legal tender, and they will certainly do so.

Any transaction involving fiat money is monitored and controlled by the government. If it is US dollars, transactions go through the US payment system in the New York Fed. Any entity that refuses to cooperate can be denied access to the payment system so that it would be unable to transfer fiat money to or from cryptocurrencies. The US government has not been reticent in taking advantage of its reserve currency powers in the past and. Surely it will not be shy if it perceives cryptocurrencies as a serious threat in the future.

As long as money stays within the cryptocurrency universe, that is not all that relevant. However, the point of having money is to spend it. Most of our money is spent within a small radius of our house: real estate, schools, hospitals, grocery stores, hairdressers, etc. All of these are directly monitored and controlled by government regulators. Merchants can be (and are) required to report any transaction, and can easily be prohibited from accepting payment in cryptocurrencies. Perhaps, as someone told me recently, Amazon will accept payments in Bitcoin, but Amazon can easily be required to accept only national fiat money.

There is a reason why fiat money is also called ‘legal tender’ and for governments to insist on having a monopoly on printing money.

What Is Left Is a Prosperity Gospel

This does not mean there is no money to be made. It can be rational to invest in cryptocurrencies even if agreeing with me that they will eventually become worthless. Just keep close attention to the time to jump and don’t be affected by hindsight bias. Also note that they are also about five times riskier than the SP-500 index (http://extremerisk.org/). Those who have made money so far have done so out of luck, not because of anything fundamental.

As I talk to the cryptoadvocates and read their work, I increasingly get the impression that they are not motivated by a rational analysis of the world but rather by an almost religious belief that cryptocurrencies will both change the world and make them really, really rich. Any counterargument threatens that worldview, to be dismissed like fake news. Discussing cryptocurrencies becomes akin to debating religion with the devout.

Cryptoadvocacy is just one form of prosperity gospel.

It is not surprising that so much of the cryptocurrency discussion verges on mysticism. Conventional fiat money also has mystical elements, as elegantly shown by John Moore’s Claredon Lecture, “Evil is the Root of All Money”:

“[M]oney and religion have much in common. They both concern beliefs about eternity. The British put their faith in an infinite sequence: this pound note is a promise to pay the bearer on demand another pound note. Americans are more religious: on this dollar bill it says ‘In God We Trust’. In case God defaults, it is countersigned by Larry Summers.”

When I wrote my first article here on VoxEU on why cryptocurrencies don’t make sense (Danielsson 2018), I got a lot of flack. Social media really lived up to its promise.

I still think that cryptocurrencies are more like a religion or a cult than a rational economic phenomenon. They are a lousy investment.

I still await my enlightenment.

See original post for references

Perhaps cryptocurrencies will be worth zip. Perhaps I am totally wrong in believing in them. Time will tell.

It is however, telling, to look back to 2009 then to today. Do not focus on this year’s peformance of cryptocurrencies… look longer over the years.

I got into Bitcoin (I don’t know if it will be the ONE, tho) after realizing it was the literally the first thing that came to mind when I read Nassim Nicholas Taleb’s book, Antifragile. Great book and a recommended read. I got into lifting weights because of that book. Bitcoin should have died and went to zero. It hasn’t. To me, that was a major clue there is something legit to it all.

There is even a nice website about this. https://99bitcoins.com/bitcoinobituaries/

Bitcoin died 300+ times now according to that link. Yet it is still alive today. I would not be dimissive of cryptocurrencies, especially seeing how lousy governments are doing at their jobs. Especially more after seeing Bitcoin implode time to time and still around today.

Iron Law of Institutions. That is one thing I learned from this website. Based on my research which was spurred by the Great Financial Crisis in 2008 (which led me to this wonderful website!)… governments should not be currency issuers, period. They should collect taxes and spend it… zero to do with the currency itself. They will botch the job and are already doing so. Modern Monetary Theory doesn’t completely make sense to me. Governments will focus on maintaining their power and that is over their fiat currencies. So going with crypto-currencies are the best way to avoid the Iron Law of Insitutions. Note that governments has already tried to crack down and thus far… failed. I bet more on human ingenuity than governments…

What matters to me is that the currency is solid. Most people suck at investing so they should be able to save without the currency being inflated away. Now they cannot truly save malinvestments occur and gross imbalances occur. The trade wars between the US and much of the world is a symptom of the imbalances.

That sounds less like an argument for deflationary currency and more an argument for pensions. Currencies exists fundamentally to facilitate exchange and trade; I get paid my salary or collect my business’ profit or sell stock, the dollars can be used to buy bread or coffee or a new water filter for your house or whatever. Investments, on the other hand, aren’t based in currency but in possession of something profitable. I might express my index funds in terms of dollar value, but the value is actually in the tiny sliver of the companies I have passive ownership of. If currency policy is aimed at deflation and increasing the value of the money, making something out of nothing, then the fundamental purpose is corrupted. That’s my biggest issue with cryptos, it’s not so much that they may or may not crash, it’s that as an exchange medium they’re woefully inefficient.

Pensions?!!!

That is a promise in the future. Best to pay NOW not in the future. Things can happen that cause the pension to fail. Pay NOW don’t promise. Too many promises in the last 50 years causing problems today.

What’s wrong with a deflationary currency? We had it before and in some ways, the 1850-1914 period was one of the best in humanity. Yes, some bad there and there but… light bulbs came from that time. Railroads. Airplanes. Most grand hotels in Europe. Standarization which helped mass production greatly – for tools or for cars. Ignoring the 1850-1914 period, I find it interesting that the Ancient Roman Empire and other Empires all did poorly after their currency were debased. To me, debased currency=worse results. History supports this.

Don’t forget that crypos can be divided down to 1 millionith components. For Bitcoin, that’s called a satoshi. .00000001 BTC. If BTC was worth 1 million per BTC, one satoshi is $1. So in a way you never really run out of money, it can be alway divided down further.

Downside is… not a good idea to borrow money with a deflationary currency. But is that truly a bad thing? It seems to me much of the problems are caused by excessive borrowing! Borrowing begets higher prices begets requirement to borrow even more to afford it. Look at university degrees! Not much borrowing 30-40 years ago, and the cost was relatively affordable compared to today.

Do you truly support the excessive consumerist society we have today? Much of that caused by debt. Have to sell and sell just to pay off the debt. Then inflationary currencies helps to ease the debt and you have to spend spend the money because it won’t be worth anything in the end?

People will always shop out of necessity or fun all because, after all, life is short. Deflationary currency will actually help with that… it’s bad for debt, tho. I don’t see any need for debt. People will always borrow but carefully. That’s for the best.

So many logical fallacies so little time.

1) Feel free to argue for a safety net instead of a pension, then. Both reduce the need for private savings. Although a gold bug’s need to shame the poor for not saving their way out of poverty will never go away.

1(a) One shouldn’t confuse a risky, optimistically-prefunded private pension with federally backed old age insurance like SSI. The latter can’t run out of funds unless politicians want it to.

2) Money hoarders never understand why deflationary currency is bad because they have an emotional need to protect their hoard. You see Timmy, when a currency deflates, economic activity slows because people put off purchases until later, knowing prices will decrease. Because economic activity slows, businesses shutter and people are thrown out of work, which causes economic activity to slow….

2(a) The period between 1850-1914 witnessed the worst economic depressions in history, far surpassing the Great Depression in length and severity.

2(b) Industrialization succeeded despite the gold standard not because of it. It was a result of economic liberalization and the increasing utilization of fossil fuels.

2(c) Gold hoarders in ancient Rome and other societies refused to pay taxes or forgive debts. The same gold hoarders imported expensive luxuries from the East and failed to develop any trade goods other than gold. This caused a significant drain on the gold supply, which is yet another argument for not basing an entire economy’s supply of money on a pretty metal/arbitrary resource.

2(c)(1) Gold is no cure for human greed or corruption. There’s nothing magical about a shiny metal. If fiat can be corrupted so can gold. And history demonstrates it over and over.

3) One can argue the reverse: university degrees used to cost a lot less, therefore there was little need to borrow. In those days the government contributed much more towards the cost of university. Although I agree that student lending has enabled college tuition costs to rise.

4) One can also have a consumerist society by paying workers enough. Then they can afford to buy goods without borrowing. Consumer debt enabled consumerist society to continue while wages, relative to productivity, sank through the floor.

Just a few logical fallacies, plenty of time to refute them.

2). Q: how long will you be able to “put off” purchases at your grocer? Put off paying your landlord? Put off paying your electricity bill? A: You can’t. And as productivity rises the costs of goods and services decline. That’s what’s known as Progress. The logic of subverting this by engineering price rises escapes me. It also escapes an analysis of the data:

https://mises.org/library/deflating-deflation-myth

2 (a) The period you cite was an extended period of rising standards of living (rising much faster than modern times) and low inflation, or deflation. Oh the horror! People could buy more with their money! There were periods where banks extended too much credit, but these quickly corrected. Would you argue by contrast that our current bank credit crisis that started in 2009 has ended? I’d say it’s half over, the other half comes when they’re forced to unwind the parlor trick of QE. Then we can judge whether it “worked” in any real way.

2 (c ) The famous “but there’s not enough gold!” argument. Of course there is. You could base the entire world economy on one ounce of gold, it’s simply a matter of the price.

2 (c ) (1) Yes, there is something magical about the shiny metal. It resists entropy. It does not combine with other elements (rust, decay etc.). Because it is so good at resisting physical entropy people noticed it also resists politicial, societal, and economic entropy. The invading army came and went, the government (and their “decree” money) disappeared, the country itself disappeared, and the gold Grandpa buried in the yard could still be exchanged for goods and services. Contrary to your argument, that is precisely what history demonstrates over and over.

4. Agree! But here’s a puzzler for you: In 1962 the minimum wage was $1.25, or five silver quarters. Today the face value of those quarters would make a lousy minimum wage, but the silver value (+/- $16.50) would be a reasonable minimum wage. So we don’t have a “minimum wage” problem, we have a “fiat money” problem.

Well that’s an awfully convenient cut-off year; “the gold standard years were really awesome for 60-some-odd years, and then some stuff happened after that that had nothing to do with the political economy it had set up!”

Yep, that cutoff year 1914 was when the gold standard basically ended. You can argue that it ended later in the 1960s to the early 1970s. WWI was when the gold standard really died.

Going off the gold standard enabled WWI to be much worse because governments were able to lay claim to the wealth of the entire population.

I’ll shut up now about cryptocurrencies, sorry to waste your time.

You really need to get your head around MMT, then all will become clear. It is not that hard, Mosler’s pamphlet lays it out pretty succinctly. For further clarification look at the teaching models on Bill Mitchell’s site or the stuff written by JD Alt. Just be open to the idea that pretty much the entire mainstream paradigm is upside down and that most pundits are just idiots that have a job on TV. The financial crisis and the Trump crisis should have made it clear that our so called establishment is clueless, or that they are perfectly aware and are just raping the rest of us.

As Dick Cheney said, Reagan proved deficits don’t matter. There’s always money for war and junky military toys and Wall Street bailouts and corporate welfare (but I repeat myself). But somehow when it’s time to fix infrastructure that working people use or pay for Grandma’s healthcare, suddenly all the money disappears and we can’t “afford” anything. What a crazy mystery.

I was wary of MMT when I first encountered mentions of it (right here in fact) because a casual reading of comments gave me the impression advocates of it seemed to advance it as a be -all end-all universal answer. Looking into the details of it however and it made a great deal of sense. Even more convincing was that I realized that just about everyone in power acts in a way that is compatible with MMT when spending on things they personally want are at stake. It’s become pretty obvious to me that deficits, debt etc. are just used as excuses not to enact national policies the legislators and pundits are ideologically opposed to.

Collect taxes in what? If the government doesn’t spend (create money) what would it collect taxes in?

Clearly, if you looked at MMT, you missed the plot. Taxes don’t fund spending.

Governments spend first, collect taxes later. On Jan 1 the govt starts spending at the rate of about $12B/day.

Tax collections (deposits to a bank after deducted from payrolls) occur weekly, bi-weekly, monthly, quarterly and for some at the end of the year, depending on the size of a business or individual circumstances.

At that rate, it is virtually impossible for Treasury to have a positive balance without some accounting shenanigans.

Where do the $ come from that Treasury spends?

I often wonder whether there is a different calculation for cryptos when in a financially repressed environment. A venezuelan friend emailed me to ask about cryptos. I told him i owned none myself and was negative. But i think maybe if i was in Ciudad Bolivar the calculation would look very different.

Crypto is lousy this year for sure. Your Venezuelan friend is better off in the major fiat currencies for now. But… that’s the rub. It may be safer and cheaper to buy Bitcoin vs the black market for fiat in Veneuzuela. Options for the major fiat currencies often are not available to them… You need “permissions” just to do transactions and if your government controls the permissions… you’re SOL. So it is literally easier to buy Bitcoin et al for these people in countries with worthless currencies. Nobody is truly in control of Bitcoin et al. That is the true innovation. A worldwide blockchain currency not in control by any government is defintely in our future, I just don’t know which one. Might be Bitcoin (BTC) or something else.

I have noted that in some respects, people in countries with weak currencies often take to Bitcoin et al faster. They experience the pitfalls of a bad currency much more actuely vs the rich countries.

How do cryptocurrencies interface with the real world?

The last euphoria was all denominated in fiat, was it not?

I’ve always wondered why the genius that invented this energy suck has never been uncovered.

He real smart,move like a shadow, or a galt

I am planning an ICO – Tulipcoin!

? … I’m in!

#BackedByTulips

#WhatCouldPossiblyGoWrong

Cryptos are just another scam in this ‘something for nothing’ economic world. Money is an abstraction of labor value, so whatever form it takes [and in the case of cryptos, imagines] matters not.

Once the status quo figures out a way to exploit its potential, it will be adopted [or not] until the next more profitable ruse comes along.

Even if you assume cryptocurrency will succeed, there’s is still the problem of figuring out which one will survive. Bitcoin seems to have too many technical deficiencies to be useful as a real currency, the transaction costs are simply too high so at some point it seems doomed to crash and burn. Some of the newer ones are technically superior, but odds are the winning cryptocurrency doesn’t even exist yet, but will be created in the future based on the experience of the existing ones and with backing of a government.

Thomas P –

I agree with you 100% with one exception.

It won’t be with the backing of a government – a neutral crytocurrency is best – a government backed one fails that. Unless it’s an one world government. Humans are too varied to accept that, I think.

That said, I do think the winning cryptocurrency already exists today. It would be a fork of an existing cryptocurrency. Why? The best code is usually worked upon the best code. No need to reinvent the wheel because the old code is already worked upon, bugs flushed out, etc.

Even short-term investing in cryptocoins, as Yves discusses at the end of this post, is foolish – so much (as in literally most of the trading volume) of the current crypto market is pure fraud that there’s really no way to gauge when is a good time to sell. You’d be investing in a comprehensively manipulated “market”.

Yves, you might not be aware of this but practices like wash trading are rampant on the crypto exchanges. Analysts cleverer than I have determined that the big price jumps (2013 and 2017) were both engineered by single entities.

Bitcoin is unworkable as a currency for so many reasons that are so obvious that even most of its fans don’t really talk about that anymore; if you look at bitcoin subreddits and so on the talk is all financial speculation all the time. The scenario they imagine, to the extent they think about it at all, is that bitcoin will take over when fiat currency totally collapses, which they all seem to think will happen in the very near future for reasons I can’t really figure out except that basically they’ve inherited a lot of insane goldbug ideas.

If you want to know more, and I’m barely even scratching the surface of how ridiculous cryptocoins are here, there’s a guy named David Gerard who has written extensively on the topic.

Ask the wrong question, get the wrong answer.

Functionally cryptocurrencies are primarily a means of payment. Their potential advantage of anonymity is of enormous strategic significance in this era of pervasive US sanctions.

Numismatics is a mere sideline of existing currencies. That cryptocurrencies experienced a wild price run-up in their early years is equally beside the point. The question is whether we can use them to purchase desirable narcotics and zip funds abroad despite Usgov throwing roadblocks in our path at every turn.

I’m still wondering if the long game is to use a crypto currency as a petro currency, to supplant the US dollar. That way, countries (and corporations) with trade surpluses with the US can hoard their surpluses in the crypto-cum-petro currency rather than US assets (bonds and stocks). In an asset that has neutrality with respect to any nation state. Sort of like the function that gold used to serve. But back then, gold was only a relief valve to balancing books between nation states. In contrast to what we have now which seems to be the use of the US dollar and US treasuries as a way to hoard surplus.

Let’s combine a cryptocurrency and a commodity currency. I want a blockchain currency backed by beanie babies. It can never go to zero so long as the beanie baby baby window is open.

I had a friend who had a 10x theory. To be successful with a new “inovation” – “new mousetrap”or whatever – it has to be at least 10 times better than what it is meant to replace.

That pretty much covers crypto currency. Not even better once.

Pt barnum’s edict about a sucker born every minute stands.

My attitude about crypto is fairly simple… until a 10 year old kid can mow his neighbor’s lawn, get paid in crypto, then walk down to the local bodega and buy a coke and a clark bar with his earnings, and not until then, will it be anything more than a get-rich-quick speculator’s dream.

@JCC

June 15, 2018 at 8:51 pm

——

+1000

Lousy investment or not, cryptos (and block chain for that matter), as currently used, are immoral. How any BS like this can get traction with climate change literally altering our planet before our eyes is beyond me.

Unless we intend to commit environmental suicide we might want to stick with slightly (sarc) more sustainable forms of investment. Maybe investments less akin to “Smaug’s gold” and more in line with perpetuating sustainable productive activities in society.

+1

A secure, nonpartisan means of monetary exchange seems like a great idea.

The mystical mythical invisible inventor of Bitcoin makes it more faith/cult than fiscal reality.

The big thing that screams “Ponzi scheme!” to me is the increasing amount of electrical energy that is being consumed to “generate” cryptocoins by running some algorithm on a bunch of graphics cards. How does that represent value? You might as well create Pi-coin and hand them out to people who calculate π to ever increasing digits of accuracy.

I appreciate skepticism as much as anyone else here but the statement “I don’t think many people would like to earn their salaries in dollars, pay rent in Bitcoin, buy groceries with Ethereum and compensate the hairdresser in Ripple” demonstrates a fundamental lack of understanding of those three technologies.

Bitcoin was intended as a digital cash system but has morphed into a digital store of value. Ethereum is a smart contracts platform and its value is derived from the transactions taking place on top of it (i.e. a monetized version of TCP/IP protocols). Ripple is intended as a highly liquid medium of exchange for banks (although so far it is failing in its goals where the other two are succeeding, somewhat).

That so many skeptics still use the “these coins can’t function as currencies so they’re worthless” argument as an attack vector is a relatively good indicator that they are very undervalued. These aren’t currencies; they’re assets that capture the value of human interactions in ways that were not previously possible.

@r_bachman

June 16, 2018 at 1:23 am

——

“These aren’t currencies; they’re assets…”

Exactly. They are not now, and never will be, currency and will never be able to replace the sovereign fiat currency issued by national governments.

A comment above by Catullus, I think, that fiat currency has value because it’s users expect the central bank to manage it efficiently is way off base. Sovereign fiat currency has value in the country of issue because it is the only way to extinguish one’s tax liabilities to the government. Until the national government is willing to accept cryptocurrency to pay tax liabilities, it cannot replace fiat currency.

And, that ain’t happenin’.

Blockchain technology, and therefore Bitcoin, can no longer support too much more “success.” There’s still no consensus on how to scale it, so even if crypto was widely accepted, it would be very difficult to transact. Until we get to the point where all three elements — scale, decentralisation and security — can be achieved, it’s still pretty theoretical.

Bitcoin is anti government control of currency. If someone will take it for drugs or guns or a yacht, well how about that?

Some people have noted that the flaw of bitcoin is that the mining operation can be cornered. Big BitCoin Mining Company becomes the substitute government anti government.

A government has an army that protects its borders and it pays its soldiers in its currency or a script that limits where that money can be spent when the army personnel are somewhere else.

A nation wants to issue cash which always means some sort of crime in the business that take cash. You never can be sure that the crime isn’t a good idea.

Once the crime is recognized by the government as a good idea it will be legalized and protected by government force which has greater capacity for force than the organized criminal forces.

The definition of a “good idea” is elastic.

Examples of the progression of cash businesses like the cab business, or the jukebox business, or the coin operated vending machine businesses will explain what will happen with Bitcoin which is in existence because of government laws against what it is used to buy.

The criminal vending machine operation gets all these weighty coins and turns them into paper money and uses that money to buy drugs which provide greater profits than candy still paid for with such coins converted to dollars.

Stolen candy bars sold from vending machines mean more profit.

The bitcoin and the blockchain so what is the disadvantage of Bitcoin, it’s ledger that is mined, that ledger, well wow, that will help hospitals keep track of secret info that isn’t secret to them.

People who know how to mine for Bitcoins will have a skill desired by accountants and record keepers.

There may even arise an army willing to defend the Big Bitcoin Mining Company, at which point it becomes a government, and makes laws about who can do what with its “Cash”.

Last I knew Bitcoin Moguls were moving to Puerto Rico. These Bitcoin Moguls will buy Puerto Rico and then pay for its infrastructure and then the US will make it a state and will be instituted taxes on the land you have a deed to.

Bitcoin miners will turn to hacking and cyberwar to defend themselves from the US. Bitcoin Miners of the Big Bitcoin Mining Company will be bought off as a resolution of the cyberwar.

Or what? The deal is always this: Stop what you are doing, Do what you are doing for us, Or we kill you.

Aside from the physical paper and coins, which are a small portion of the money supply, governments don’t print money and don’t get any profit from the printing of money. It’s central banks and commercial banks that create almost all the money in circulation. Governments just tax and borrow it.

I don’t think there’s any reason to fear a deflationary scenario in a crypto world, unless Bitcoin (for example) were the only currency allowed. If there’s a shortage of money it’s easy for anyone to create a new currency. A crypto world wouldn’t look like a gold standard, it’d look more like the system of competing private currencies advocated by Hayek.