By Carlo d’Ippoliti, Associate Professor of Economics, Sapienza University of Rome. Originally published at the Institute for New Economic Thinking website

Current turmoil in Italy is the result of lack of a clear political majority. An attempt at forming a so-called populist majority shows the real face of populism in the country, which is conservative and neoliberal in its economic philosophy. However, framing the debate in terms of mainstream vs. populists is preventing Italy from intervening in the most important public debate in years, that on the reform of the Eurozone, which can only be framed in the more traditional terms of Keynesianism vs. mercantilism.

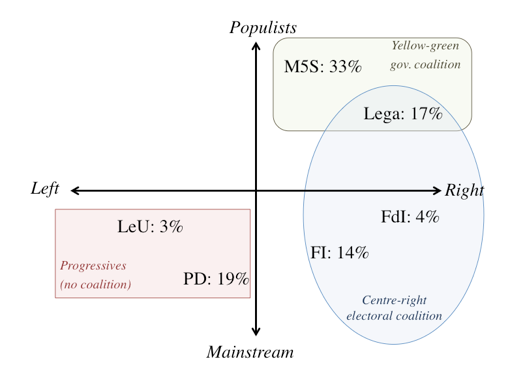

To understand the current situation and outlook for Italy, it is necessary to take one step back. The Presidency of the Italian Republic is one of the most flexible institutions in Western Europe. With a strong parliamentary majority and government, it can shrink to almost a residual role, but with a fragmented and chaotic scenario the president emerges as a leading figure. However, despite current President Prof. Sergio Mattarellabeing under the spotlight since last general elections in March, it is really the political deadlock – represented in the figure below – that is responsible for the recent turmoil in the country and in financial markets.

Tripartition of the Italian Electorate at the 2018 General Election

Partly due to a mixed system that encompasses elements of both first-past-the-post and proportional representation, and partly due to a real fragmentation of Italy’s society, the 5-Star Movement (M5S) emerged as the party with a relative majority in both chambers of Parliament, whereas the center-right electoral alliance of Lega, Silvio Berlusconi’s Forza Italia, and a smaller radical right party (FdI) emerged as the relatively larger party coalition.[1]Following confusion about who had legitimacy and the numbers in Parliament to form a government, the Lega attempted (first unsuccessfully, then successfully the second time) to forge a new parliamentary alliance, with the M5S (it could be useful to recall here that in Italian, “populist” has nothing to do with popular or grassroots, but is rather a synonym for demagogue).

By and large, the initial collapse and subsequent success at creating a Lega-M5S coalition have been caused by Lega’s kingmaker role. Its leader, Matteo Salvini, had taken a long time to decide – or to make it public – whether he preferred to be a minority partner in a government formally led by the M5S (who have many more members of Parliament than Lega, but are far less experienced and could possibly end up being outmaneuvered by Lega’s expert politicians), or the majority shareholder in a center-right coalition, which would not have a majority in the current Parliament, but could no doubt obtain one after a new election (especially since, after a recent verdict, Berlusconi is eligible again to run for public office).

Such uncertainty is still not fully resolved, with many commenters pondering on the likely survival time of the current “yellow-green” coalition government. A few weeks ago, by cornering Mattarella into rejecting an impossible deal, Mr. Salvini successfully deflected responsibility for such ambivalence onto the president, who has been amply regarded as the cause for the failure of the Lega-M5S’s first attempt at forming a government. In the impossibility to rule out new elections in a relatively short term, Mr. Salvini’s behavior is meant to always keep open the possibility both of an electoral alliance with the M5S and the re-proposal of the alliance with Berlusconi: this gives him some bargaining power in dealing with both.

What Will a “Populist” Alliance Look Like?

Such ambivalence will remain at least for the first few months, during which Mr. Salvini could always decide to stop the experiment of a yellow-green government. The M5S and Lega defied Italian coalition tradition by refusing a “relay” gentlemen’s agreement, whereby one party leader acts as prime minister for a half mandate (two and a half years), and another party’s leader for the second half. It is difficult not to see a basic lack of trust between the two parties behind the choice to reject this option, opting instead for the appointment of a technocratic prime minister with no political power.

But most importantly, they signed a public agreement written by a notary, which contains a number of impossible promises – some clearly “beyond our means” (whatever that may mean), some unconstitutional, some politically impossible. By one estimate(a conservative one, if we were to consider all measures to be implemented) the agreement would amount to a fiscal stimulus package worth around 7.3% of GDP in the first year. To be fair, such estimates do not consider the positive impact on GDP growth, but since roughly one half of the package consists of tax cuts for the richer households, the fiscal multiplier of the program would likely be small.

As with all things impossible, the agreement will be locked in a drawer. However, it will always be there, hanging as a sword of Damocles and giving the chance to whichever side wanted to break up the coalition to immediately find a suitable excuse: the obvious lack of implementation of some “fundamental” clause of the agreement.

Radical uncertainty will concern now not only the survival of the government, but the future course of its policy, in the absence of a serious and credible program. These two sources of uncertainty might prove a hurdle for the suffering Italian economy.

In its first few weeks, government and party officials seem busy pre-empting various options by a storm of contradictory public statements and interviews. But the general sense of direction of the “government contract” is clear. Its main economic proposals are: a conditional universal unemployment benefits scheme (a measure implemented in virtually all western European countries except Italy, but for some reason it is called here a “basic income” by the M5S), which is worth around 1% of GDP; and a flat rate personal income tax scheme, implying lower revenues by 3% of GDP.

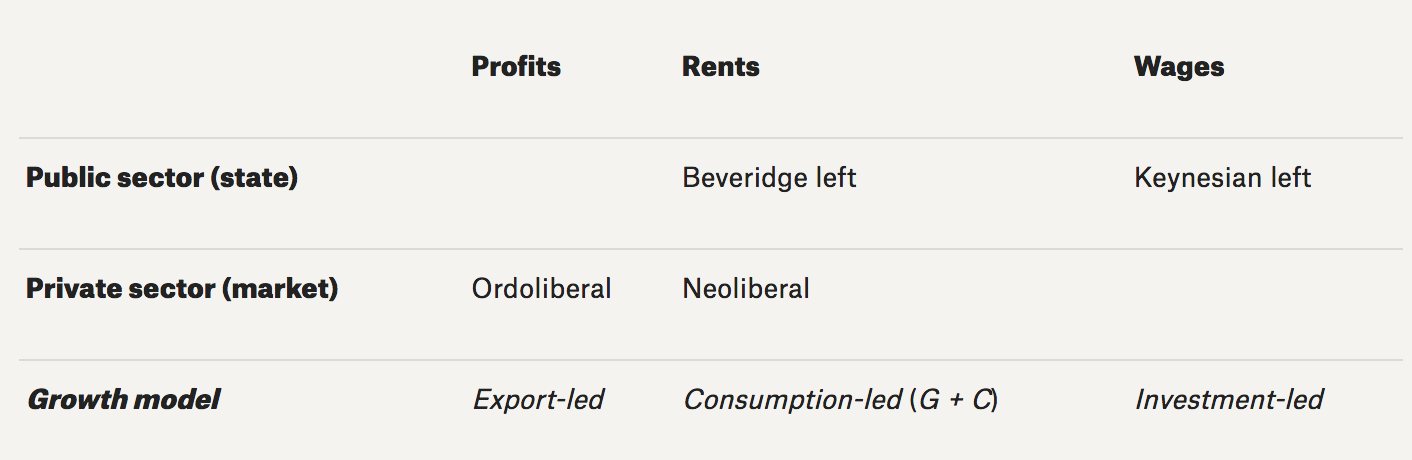

To highlight the underlying nature of such agreement, let us consider a classical scheme of social classes whereby capitalists earn profits, workers earn wages, and those not involved in production earn rents, including among the latter the rents publicly provided by the welfare state. In a back of the envelope (and extremely simplistic) model, we can compare proposals benefiting one of these classes with a party’s pro-market or pro-state orientation, to derive the party’s model of economic development, as shown in the table below.

Party Economic Development Models

A party that wishes to sustain aggregate profits is most likely to pursue an export-led growth strategy based on price-competitiveness, which almost invariably implies the search for cost-competitiveness by means of reducing unit labor costs. Although very different, parties wishing to strengthen the welfare state (which provides resources to the economically dependent) and those wishing to favor financialization of the economy (with the growth of large monopolistic corporations and the “value added” produced by the financial sector) will naturally propose a consumption-led growth strategy. Finally, an investment-led growth strategy boosts aggregate labor incomes both by reducing the number of unemployed people and, this way, by possibly increasing average wages.

In this scheme, mainstream European economic policy falls squarely under the ordoliberal label because it seeks to create unemployment in the deficit countries as a bitter pill, aimed at depressing wages and this way returning to cost-competitiveness. In contrast, the government contract signed by M5S and Lega envisions an alliance between sustaining profits and the highest labor incomes (both concentrated in the north of the country) through supply-side policies, in exchange for expanding the welfare state (but to a smaller extent, and mostly to the benefit of the south – indeed, the unemployment benefits scheme has already been rebranded as a labor market policy aimed at activation and employability). In principle, difficulties to balance the accounts would be bridged by increasing debt.

That populist movements run the elections on a fairy tale platform and then govern on a neoliberal oneis surely not a Latin American phenomenon only. In the Italian case, one has to further consider some strongly racist proposals against migrants and refugees, aimed at appeasing an angry electorate.

Euro vs. Lira, or Left vs. Right?

However, the first attempt at forming a government was stopped by the president of the republic because Lega would not renounce the appointment of Prof. Paolo Savona – who in the past had declared that Italy should have a “plan B” ready in case it became necessary to leave the Eurozone – as economy and finance minister. Prof. Savona became such a symbol that Lega refused to nominate their party’s number two in his place, even though President Mattarella had suggested he would accept that appointment. This move was probably aimed at never forming a government in the first place (Lega was still toying with the idea of going to new elections), but it ended up framing the debate (and the markets’ tensions) in the extremely radical terms of a possible return to the lira. In a second attempt, the M5S and Lega have finally accepted to appoint prof. Savona as minister for European affairs, and selected another university professor, Giovanni Tria (close to several of Mr. Berlusconi’s collaborators), as finance minister.

One cannot exclude that parts of the elite prefer to argue along the populists vs. mainstream cleavage (the vertical axis in the figure), rather than highlighting the differences between conservatives and progressives. As, for example, French elections have shown with the victories of Jacques Chirac and Emmanuel Macron (though within a completely different electoral system), when the debate is shrinking to this level, “the establishment” probably always wins. In the Italian case, all polls suggest a large majority of the electorate is clearly in favor of staying in the Eurozone, despite all the economic suffering.

Truly, even within the narrow constraints of the ordoliberal framework imposed by the rules governing the euro, it would be possible to implement policies that could reduce inequality with a positive impact on growth. In Italy, some years ago the M5S itself had proposed to increase the degree of redistribution within the public pension system, which constitutes the lion’s share of the welfare state in the country, and many parties recurrently talk about the urgency to reduce tax evasion and tax avoidance (though the new government is expected to relax rules on tax collection and enforcement, especially for small businesses and the self-employed).

However, siding unilaterally with the powers that be certainly does not leave significant room for a progressive economic policy platform. There is now widespread evidence that social-democrats lose from joining the conservatives in “grand coalition” governments, much more than the conservatives loose. For the Italian Democratic Party, further complication arises from its large and powerful economically conservative caucus. Therefore, the long-term consequence of framing the economic policy debate as a struggle between the reasonable people and the barbarians at the gate may be the definitive collapse of the left, with a blundering of all left-right distinctions that in fact means simply arguing for the conservation of the status quo (as grand coalitions have mostly tended to do).

Missing Chances

There is, however, a more short-term consequence. As the European Central Bank,[2]the Commission, and Member Statesare discussing what could be the most momentous reform of the Eurozone and its governance in years (or, vice versa, one of the most glaring missed opportunities), Italy is not publicly taking part of that debate.

The country has been in a public sector primary surplus for decades, has successfully returned to a balance of payment current account surplus (and even its previous deficits were never too large), but it is plagued by intolerable unemployment and widespread precarity due to the low-wage sector being the only part of the economy that is (slowly) growing. It clearly suffers from a conspicuous lack of aggregate demand, which has created troubling financial difficulties (most notably the legacy of non-performing loans in banks’ balance sheets). As one of the most “virtuous” Member States, ever since the Maastricht Treaty and despite the slightly racist rhetoric to the contrary,[3]it is the largest victim of (to use former European Commission President Romano Prodi’s words) the stupid rules that regulate the Eurozone.[4]

While largely ignored by our own policymakers, for years now Italian economists have produced sensible proposals for the introduction of project bonds or Eurobonds, in the face of which the Commission’s recent proposal of introducing jointly securitized bonds appears insufficient and inadequate. More innovative proposalssuggest that the European Central Bank could itself issue its own risk-free bonds with which to control the term structure of interest rates, which is currently fragmented along national lines even for countries sharing the same currency. Such innovation, which does not require Treaty changes, would make the ECB act like the Hong Kong central bank. Further proposalsinclude, for example, the creation of components of a euro-wide welfare state (which would help to consolidate a European identity), such as an unemployment insurance scheme.

As Member States are obliged by the stupid rules to keep on deleveraging, even as this often increases their debt burden as a share of GDP, more expansionary policy could be implemented at the Eurozone level. The “Juncker Plan,” based on the central role of the European Investment Bank, shows that this could be possible even without changes to the Treaties that regulate the EU. Since the multi-annual common budget is being discussed these months, it could be relevant to note that many years ago the EU created a “Globalization Adjustment Fund” that could finally be given the resources to step up to the responsibility that its pompous name entails.

Evidently, if an increase in spending and the launch of joint bonds was accompanied by the creation of a European Treasury, with an elected official who has to put her face on the suffering of several people in several regions of the EU, as proposed, for example, by Mr. Macron, it would be but a welcome democratic turn.

The Role of the Economic Debate

All measures hinted at here could look like a wonderful dream list never to be seriously considered in the face of apparently insurmountable opposition from Germany and the several surrounding countries that hide behind its might. This is true to a large extent, but a stronger contribution to this debate from Italy (and other “peripheral” Eurozone countries) could contribute to at least launching some first partial measures. Political turmoil in several other countries has seriously reduced the hegemonyof the conservative European People’s Party within the Council. In the core Eurozone countries too, it is to be hoped that a wider and clearer politicization of EU policies, instead of framing the debate in terms of “in or out,” could lead to an awakening of social-democratic and progressive parties. Perhaps we forget too often that soaring inequality and precarity weigh on the welfare of several people in core Eurozone countries too.

As Italy’s case shows, the populists do not offer chances for real change. Barring an exit from the euro (which is legally nearly impossible, economically costly and counter-productive, and politically undesired by a majority of citizens), in a new twist Lega and the M5S have for a short while even considered appointing as Finance Minister Mr. Cottarelli, the fiscal austerity hawk who was called upon by President Mattarella to form a technocratic government alternative to the failed populist attempt. In the face of possibly serious further cuts in public expenditure (possibly framed as reduction of waste and corruption), gradual reforms of the Eurozone would be a much more progressive outcome.

The ambiguity of the populists, equally ready to embrace a small enlargement of the welfare state and deep cuts to public revenues and expenditure, is partly a consequence of the glaring invisibility of economic ideas alternative to the current mainstream in the EU. Indeed, resistance to change in core Eurozone countries, as well as inadequate mobilization in the periphery, depend at least partly on the common implicit acceptance that the only development model for the EU is the ordoliberal one, based on the struggle (largely internal competition among EU countries) for cost- and price-competitiveness aimed at the mirage of export-led growth. An alternative, investment-led growth model need not lead to competition between member states and could overcome the misleading debate about the “redistribution of given resources” between countries.

However, with its current focus on the mainstream versus populists struggle, rather than the left vs. right cleavage, Italy is not contributing to such needed debate – let us hope that the new government now will promptly frame the debate in terms of a more traditional, but more useful, discussion on the European model of growth and development.

__________

[1]Percentage of votes, shown in the figure, do not correspond to percentages of seats due to the complexity of the electoral law. The yellow-green coalition would be able to form a majority in Parliament, whereas the centre-right would not. Shares of votes do not sum to 1 because of a large number of smaller parties, not considered here.

[2]In his May 11th speech, Mario Draghi proposed the institution of a embryonic European Treasury (“an additional fiscal instrument to maintain convergence during large shocks, without having to over-burden monetary policy.”) and to complete the Banking Union by “a backstop for the Single Resolution Fund. […] in all the other large jurisdictions, such as the US, the UK and Japan, resolution funds are backstopped by the fiscal authority.”).

[3]See Costantini O. (2017), “Political Economy of the Stability and Growth Pact,” European Journal of Economics and Economic Policies: Intervention, vol. 14 n. 3, pp. 333–350, doi: 10.4337/ejeep.2017.0029

[4]One could mention at least the biased metrics used to evaluate countries’ macroeconomic position: from the narrow focus on the public sector net lending/borrowing instead of the country’s balance of payments; to analyses of the sustainability of exclusively public debt, neglecting private debt and the net international position; to endless discussions (and threats) on the role of sovereign bonds on banks’ balance sheets, neglecting the role of derivatives, just to make a few examples. By providing a fuller and less biased picture, the Macroeconomic Imbalance Procedure, activated at the peak of the crisis under strong Italian pressure within the European Council, is an example of how things can change at the European level. That is still applied only “against” deficit countries shows how change is necessarily very slow, in the face of a waterproof majority of the conservative parties within the Council.

What the Italian Government may want is irrelevant.

What it can do under the EU and ECB rules, which I understand is to run their budget with less than 3% defect , is relevant.

Italy is not sovereign, and the EU so constrained that is a crippled sovereign at best. Further the ECB is so “independent” from the EU and the European Parliament that it appears the ECB is the only sovereign in Europe.

An un-elected, unaccountable, self-interested, opaque institution with an mandate constrained between German intransigence and Europe’s mob of non-sovereign governments, all marching to their own tune.

The only economic policy “permitted” possible with countries with deficits is to raise unemployment and immiserate the population. If all the EU countries did run surpluses, who’d be the “cough” deficit countries slowly sinking into the morass?

A “free trade” area where the problem is “free trade,” and the populace pays the price.

Nice

empire,federation,union, continent you’ve got there. Pity its ungovernable.Some very odd and interesting classifications. For instance: “those not involved in production earn rents, including among the latter the rents publicly provided by the welfare state.” We don’t usually lump in welfare with economic rents, but it is true; the main difference is the scale, and the power of the people receiving them.

Then there’s his classification of the M5S on the right side of the political graph. Certainly their announced values when they started were NOT right-wing, quite the opposite. Have they really drifted that far, or would it make more sense to put them on both sides of the line (if there were really a line). One reason the coalition is so shaky is because the two parties disagree about so much. At this point, the larger party appears to be letting the smaller lead it by the nose; he explains that as a matter of experience, but they’re gaining that at quite a clip.

I would defer to Italians on who the M5S really are, but so far I don’t think his chart makes sense.

And incidentally: is there a real Italian left waiting in the wings? The PD certainly aren’t it. At this point, the best strategy might be to move in on the amorphous M5S.

” it ended up framing the debate (and the markets’ tensions) in the extremely radical terms of a possible return to the lira.”

Since a return to the lira, although inordinately difficult, is probably the only real solution, that framing is appropriate. It also remains the pressure tactic most likely to produce real reform of the Euro – though I think that’s even less possible than a return to a sovereign currency. The present government clearly isn’t up to a Samson strategy, but a future one might be. Not that I’d wish that on anybody.

“it is the largest victim of (to use former European Commission President Romano Prodi’s words) the stupid rules that regulate the Eurozone.”

So why does he dismiss returning to the lira as “extreme”? Granted, it would be costly and difficult (I’m not forgetting our previous discussions), but once you say the above, you don’t get to just dismiss the obvious solution.

Somewhere here I just saw that a majority of Italians (in polls?) support remaining in the EZ; so why did they give M5S and the Lega, both of which question it, a majority? As in Greece, I suspect that leadership has a lot to do with popular attitudes on this subject; it they were told, clearly, that the Euro is the source of their difficulties, they might change their tune. Of course, that would precipitate a battle with the ECB and the “markets”. So who is really sovereign?

Excellent insight in the current mess.

But I do not think that investment-led growth is politically viable in Germany or the Netherlands.