A few weeks ago, we obtained the text of a memo from Silicon Valley lawyer Larry Sonsini of Wilson Sonsini Goodrich & Rosati fame, to key CalPERS executives. It came from someone not with CalPERS. An insider confirmed that this memo, created in January, was presented to the board in May during its meetings.1 We’ve embedded the document at the end of the post.2

Overview of Sonsini Memo and Its Implications

This memo raises huge red flags about the caliber and honesty of CalPERS’ initiative, including:

The Sonsini document is pathetic. The fact that Sonsini would provide it and CalPERS would accept it shows how cavalierly the key players are treating what would be CalPERS’ biggest decision in the last ten years

Sonsini blows off the idea that CalPERS’ fiduciary duty is important when that is its paramount legal duty

Sonsini misleadingly presents a limited partnership as CalPERS’ only option, when that is not only unnecessary but also serves to institutionalize the worst features of private equity governance

Sonsini and CalPERS are also pointedly ignoring real opportunities for CalPERS to cut a better deal

The only plausible theories for what CalPERS is planning to do are utter incompetence or rank corruption

The Sonsini piece is an incredibly shoddy work product. One private equity professional said it didn’t even rise to the level of being bad.

The most charitable thing one can say about it is that it appears not to have any typos. If I had received a document like this from a lawyer, particularly from a high priced one, I’d demand to have the charges related to it removed from the bill.

It’s one thing if Larry Sonsini sent this napkin doodle to CalPERS executives to play back to them what they said they wanted. But if Sonsini were acting as a lawyer, or even a professional, even this rationale does not pass muster. And since this memo from Sonsini has been presented to the CalPERS board, the only conclusion one can reach is that Sonsini is willing to have this joke of a document treated seriously.

But the fact that CalPERS isn’t getting anything that approaches legal thinking isn’t the biggest reason to be concerned, although it does speak volumes about the utter lack of care with which CalPERS and its supposed professional advisors are approaching this very risky project. It’s that it confirms yet again that CalPERS is not placing beneficiary interests first, when that is its paramount duty.

The only conceivable justification for the approach CalPERS is taking is that CalPERS is giving top priority to reducing transparency. And as we’ll discuss, one of the side effects of that will be to increase the odds of fraud, which should in and of itself make this idea unacceptable.

Background: Brief Overview of What We Know About CalPERS’ Plans

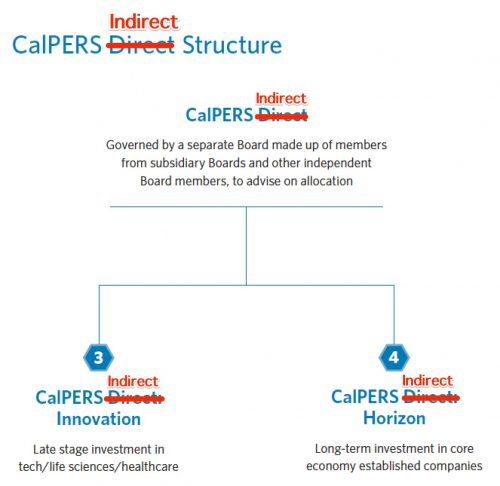

Even though CalPERS has said inconsistent things about its planned private equity outsourcing (for instance, Chief Investment Officer Ted Eliopoulos brushed off the idea that CalPERS intended to reduce fees, while CalPERS’ head of PR Brad Pacheco said the reverse), this chart below is current state of play. The marked-up image comes from one of the slides that accompanied a CalPERS press release:

Notice that the board mentioned in the text in the slide would have members from “subsidiary boards.” That implies that each of the two investment approaches will have its own board, with the result that there would be two layers of boards between the funds and the CalPERS board. Talk about a lot of opportunities to distribute political favors at beneficiary expense via the fees paid to all these directors!

Notice also that these two investment approaches are labeled 3 and 4. Page 3 of the slides CalPERS published showed that approach 1 would be “Emerging Managers”. That is an existing program that also happens to be CalPERS’ worst performing sub-strategy within private equity. CalPERS intends to double down on failure by expanding that.

Approach 2 is the “Partnership Model, which we assume is the fund of funds program for which CalPERS solicited proposals in December, in a cronyistic process designed to favor BlackRock. It has been far too clear that Chief Investment Officer Ted Eliopoulos and perhaps other members of staff have been laboring mightily to throw this business to BlackRock. If that is correct, it is an explicit violation of the “Fiduciary Duties” section of the California Public Employees’ Retirement Law and would automatically disqualify BlackRock as a potential vendor. 3.

Putting aside the obvious corruption in steering an investment mandate to a pre-chosen vendor through a sham competitive process, we have described at length how this funds of funds scheme represents violation of CalPERS’ fiduciary duty based on its economics alone. It would introduce an unnecessary middleman and lead to another layer of fees and costs.

There is no justification for a large institutional investor like CalPERS to use a fund of funds except in niche strategies, and that would be because the amount of money at issue would be small and CalPERS would have difficulty getting a diversified portfolio within that strategy.

How the Sonsini Memo Shows Sonsini and CalPERS Are Violating Their Fiduciary Duties

Let’s start from the very end, where Sonsini shrugs off CalPERS’ fiduciary duties:

The imposition of a Fiduciary Duty standard (e.g.. a duty of loyalty and a duty of care) will be considered and taken into account in balancing and formulating the foregoing Roles and Responsibilities of the various constituencies.

All CalPERS beneficiaries reading this post should stop now and send an e-mail to their Assemblyman and Senator expressing their alarm and outrage. CalPERS fiduciary duty to its beneficiaries is imposed by the California constitution and the Public Employees Retirement Law.

CalPERS cannot contract its way out of or compromise its fiduciary duty, as Sonsini suggests. He appears to be unfamiliar with the standards that apply to actual fiduciaries like retirement funds and trustees, as opposed to the lower standard that applies to corporate officers and boards. The fact that he committed this idea to writing says he is unfit to advise CalPERS.

Sonsini is laying bare one of the dirty secrets of private equity and hedge fund investing: the documents routinely give lip service to the notion they they respect all applicable law, which would include their and their investors’ fiduciary duties, and sometimes even specifically acknowledge that they have a fiduciary duty. Yet other sections of the very same agreement contradict these provisions, such as through indemnification language that sheds key elements of fiduciary obligations, as well as terms that allow the general partner to consider other interests, including his own interest, when a fiduciary duty standard means he has to put the interest of the beneficiaries over all other interests. We’ve provided examples from our trove of private equity limited partnership agreements. A May 31 filing by the plaintiffs in Mayberry v. KKR discusses this issue at great length, arguing that the fiduciary duties are “non-dilutable non-evadable legal obligations” imposed by both Federal and state law.

Sonsini serves up a limited partnership as if it were the only option… when there are only bad reasons to do that.

One of the striking things about the memo is that it assumes that CalPERS will use a limited partnership structure for its new InDirect initiatives. From the beneficiaries’ perspective, there is no valid reason for CalPERS to relegate itself to being a passive investor in investment vehicles it is creating de novo where it is providing all the money for them, particularly when CalPERS has been maintaining it will be hiring new staff for them.4

A limited partnership structure unnecessarily institutionalizes the bad governance features of investing in private equity. The disadvantages include:

No control over the investments and the operation of the funds. Don’t kid yourself, the Advisory Board is purely advisory. The Sonsini memo makes clear that the “General Partner” would have “sole authority over investment decisions.” Sonsini is so clearly out to protect his industry meal tickets and not CalPERS that he won’t even provide for improved governance rights even within the inherently disadvantaged framework of a limited partnership, like veto rights over investments and other important decisions.

And CalPERS doesn’t even get to pick the Advisory Board members. CalPERS’ choices are made “in consultation with the General Partner.” That assures that, as occurs now with private equity funds, the wily General Partner will be able to stack the Advisory Board with individuals who have suitable-looking backgrounds but are sure not to cross swords with the General Partner. So even the weak powers that Advisory Boards would have on paper are sure to be diluted further in practice.

Lack of influence over staffing or pay levels. Despite Eliopoulos maintaining otherwise, the new vehicle, not CalPERS, would be in charge of staffing and compensation.

Premier venture capital investor the Kauffman Foundation wrote at length in a classic study, We Have Met the Enemy and He Is Us, about how the tacit acceptance of the limited partner community of one-sided compensation structures that failed to reward performance even when 89% of the limited partners said management fees were excessive. Kauffman also described at length why the conventional 20% carry fee also produced misaligned incentives.

Yet when CalPERS is in a position to do something about these prevailing bad terms, CalPERS staff and Sonsini seem utterly uninterested in this issue.

Kauffman is equally adamant about the importance of understanding how the general partner structures its own arrangements…a topic that Sonsini and CalPERS staff bizarrely avoid when CalPERS plans to be the sole investor in each fund and is creating the new entities. Recall that by contrast, Kauffman is always and ever a limited partner in existing funds, yet argues that the failure of limited partners to get this vital information is due to a combination of ignorance and cowardice:

When VCs conduct due diligence on potential portfolio companies, they carry out a comprehensive assessment of the company’s financials (cash flow, burn rate, keyexpenses, and stock option plans, etc.) and require complete detail on senior management team salaries, bonus amounts, ‘skin in the game,’ and equity ownership. GPs know this information is crucial to understanding company financial health as well as management team incentives, stability, and succession. Every GP we interviewed acknowledged the essential importance of senior management team compensation in their portfolio company investments. One GP emphasized its significance, saying that not only does his firm “know everything about the compensation…a lot of times we structure it.”

LPs have the exact same interest in understanding the firm economics of the partnerships in which we invest, and the compensation structure of the GPs investing our capital. LPs also have the same fiduciary obligation as GPs to understand the economics and incentives that underlie investments, and to evaluate how fees, carry, and ownership align investor and investee interests. What LPs seem to lack is the conviction to require the information from GPs in the same way the GPs themselves require it. Even more disconcerting, investment committees and trustees fail to require a disciplined approach to understanding and evaluating firm economics of VC partnerships to which they allocate, approve, and oversee large capital investments.

That lack of influence also means if any scandals, say involving allegations of sexual misconduct or discrimination, were to arise (see Steve Jurvetson as an example), CalPERS would have no ability to intervene.

Similarly, the Sonsini document gives lip service to CalPERS’ ESG [environmental, social, and governance] concerns, but how those were implemented (if at all) is up to the General Partner, meaning outside CalPERS’ control.

Continued sketchy to non-existent portfolio-company level reporting. It is hard to think that Sonsini has CalPERS’ best interests at heart given language like this:

Provide full transparency as to portfolio company performance, Direct Investment Entity performance and overall investment policy guidelines consistent with regulatory requirements, CalPERS guidelines, and industry best practices.

This statement is shockingly short of what any company owner would demand, and therefore what would be required if Sonsini took fiduciary duty seriously. CalPERS stipulating an even lower standard of fee and cost disclosure than is now provided for in the watered-down private equity transparency bill, AB 2833.

More importantly, this language does not require that CalPERS board and staff receive copies of the full audited financial statements of all portfolio companies, copies of all interim financial statements, and full and timely disclosure of all fees and costs paid to the General Partner and any affiliates, most importantly including those paid by portfolio companies.

You can drive a truck through the loophole that Sonsini has included on behalf of his meal tickets in the private equity industry:5 “industry best practices.”

The Japanese call this sort of thing “a height competition among peanuts,” meaning the standards are so low it is hard for any non-peanut to see the difference.

Private equity industry norms are appallingly anti-investor. For instance, after the SEC found that more than half the private equity firms were cheating, which often meant stealing from investors, the firms’ answer was typically not to stop cheating, but to act as if admitting to the abuses in their annual SEC filing, the form ADV, made it all OK. Similarly, only a small number of general partners have endorsed the Institutional Limited Partners’ Association’s recent fee disclosure template.

Lack of influence over how the companies are operated. Sacramento political commentator Dan Walters pointed out that one reason to be concerned about private equity investing was its track record of asset stripping and employee layoffs. Again, CalPERS would have no ability to intercede even if a CalPERS fund were cutting jobs in California and thus hurting the ability of CalPERS’ employers to make their contributions because the fund’s own actions were damaging local tax bases.

Sonsini also perversely seeks to further weaken this already poor arrangement by the unnecessary stipulation that the Advisory Board be “independent of all the other constituencies.” What kind of rubbish is that?

The intent of the Advisory Board, even in its very weak way, is to protect CalPERS’ interest (this is the primary role they are depicted at playing in private equity limited partnerships now). It is therefore essential that CalPERS’ interests are well represented and that parties loyal to CalPERS dominate the board. Fetishizing independence in this context looks like Sonsini is scheming on behalf of his other clients against CalPERS.

Moreover, it is hard to dream up any justification for using limited partnerships:

The business models CalPERS cited at its workshop last July weren’t limited partnerships. Cadillac Fairview, the real estate firm owed by Ontario Teachers, and its own Centerpoint, which was a REIT CalPERS took private, are not limited partnerships. With Centerpoint, CaLPERS has contracted with an outside fund manager to oversee its interests in the company.

CalPERS has the authority to hire private equity professionals on competitive terms. It does not need to use a limited partnership or even an independent company to pay market rates.

CalPERS has the ability to pay fully competitive prices to employ private equity professionals as staff members. Contrary to the palaver regularly peddled by uninformed commentators like Leo Kovilakis, CalPERS does not have to use an outside entity, much the less one it chooses not to control, to attract private equity “talent.”

Per California Government Code Section 20098, CalPERS’ board had the authority to set the compensation level of “investment officers and portfolio managers whose positions are designated managerial.” Board member Richard Gillihan, the governor-appointed Director of the California Department of Human Resources. has pointed out that CalPERS could pay $10 million a year as long as it could justify the comp level. Other experts have pointed out that the legislature would agree to a CalPERS request for a narrowly-tailored waiver to allow CalPERS employees to have a carry-pool-type incentive structure.

Aside from rank corruption, the only other rationale for the proposed structure is indefensible: to escape disclosure and transparency. This scheme would mean CalPERES beneficiaries and California taxpayers would have virtually no idea what was happening with 10% to 15% of CalPERS’ funds. CalPERS would wriggle out of the quarterly fund by fund performance report mandated by a 2002 settlement with the Mercury News. CalPERS InDirect, and thus all of the private equity activities CalPERS shifted over to it, would not be subject to the Public Records Act. The top brass of the new entities would not have to show up occasionally at CalPERS public board meetings and have to ‘splain themselves.

This is consistent with what we surmised earlier based on CalPERS’ PR push last month:

Eliopoulos apparently wants to relegate CalPERS not only to being a mere limited partner, as in a passive investor, in its two additional investment rackets, but to interpose two layers of boards between them and CalPERS. One can only conclude he wants to make damned sure CalPERS has no idea what is going on with the money it commits to these vehicles, and that they are even more of a black box than private equity is already. It appears that avoiding even the weak disclosure called for by California law is of paramount importance.

The limited partnerships’ weak reporting, non-existent control, in combination with CalPERS’ plan that they be evergreen is an invitation to valuation fraud. Valuation abuses are already widespread in venture capital and private equity. A recent study found that every one of the 116 unicorns where the researchers could obtain the needed data was overvalued, with the average overvaluation a stunning 49%. Similarly, private equity portfolio companies are regularly overvalued around the time the general partner is raising a new flagship fund, during bear equity markets, and late in a funds’ life.

One check on private equity overvaluation is that fund managers are under pressure to realize profits.6 A reason limited partners aren’t exercised about the open secret of general partners inflating their companies’ values from time to time is that the relatively short holding period of the typical company means that serious lies get caught out when the companies get sold at a loss. That sort of things makes a general partner look bad.

The widespread assumption is that the fibbing, while widespread, nevertheless gets eased out of the valuations before a sale catches the general partner out. Long investment time frames in combination with lax reporting and oversight make it too easy for the fund managers to engage in flagrant overvaluation.

CalPERS and Sonsini are failing to meet the duty of care. A fiduciary is required to meet a duty of care, which Law.com defines as: “a requirement that a person act toward others and the public with the watchfulness, attention, caution and prudence that a reasonable person in the circumstances would use.”

Deficient legal work, and on top of that, presenting outdated documents to a governing body as if they were current, fall visibly short of that standard. But we have also documented at length how regularly staff lies to the board, to its beneficiaries, and California taxpayers. We see here that the board members are so clueless or lazy that they don’t even catch when they are enlisted to lie on behalf of staff.

Consider this statement by Investment Committee Chairman Henry Jones in CalPERS’ May 17 press release, made after the Sonsini memo was presented to the board:

That long horizon also gives the CalPERS Board an opportunity to influence the culture of CalPERS Direct to ensure their actions are in sync with our Investment Beliefs.

CalPERS board will have absolutely zero influence over CalPERS InDirect. It will barely even have any access to its professionals. You can be sure that even when that does happen, it will be highly staged events. Jones looks like a fool for saying otherwise. But the staff appears to have chosen its marks well, because Jones looks like the sort who will reject any negative information out of hand, most of all when it involves him.

It is a slap in the board’s face to be presented with a sketchy memo that is more than four months old. No explanation is pretty. One indicator of how stale this document is: it refers to only one Advisory Board when CalPERS now plans to have at least two Advisory Boards, one for each fund that will implement its two whiz-bang InDirect investment strategies.

Also notice a topic in the memo we have skipped over due to not wanting to tax reader patience further: that of the Private Equity Strategic Partner.

What Sonsini has set forth is CalPERS entering into a well-established type of investment arrangement, a separately managed account, with an existing private equiy general partner, dressed up to satisfy CalPERS unwarranted sense of self-importance as a Private Equity Strategic Partner.

The fact that there is nothing new here might be Sonsini’s excuse for dialing his work in. He may have see himself as doing CalPERS a favor by not trying to gild a tired old lily. But the comments of Ted Eliopoulos, Henry Jones, and other board members suggest that they don’t understand the basic of private equity investing or are choosing to deceive themselves.

Now it is possible that CalPERS and Sonsini have changed their thinking since January, but that means the board is being given the mushroom treatment.

I’m sure the lawyers in the house will have great fun with the memo, so let me limit myself to just one glaring deficiency: the failure to define key terms.

If this document were meant to be legal work, it should define terms clearly. You can see the memo instead takes up the widespread, and imprecise use of the term “general partner,” which is used colloquially to mean any of the legal entities that comprise a private equity firm used to make the general partner’s financial contribution to the investment fund (and that legal vehicle is typically a corporation), the investment firm that the general partner contracts with to provide investment management services to the investment partnership, or the specific natural persons employed by that investment firm who provide those services to a particular fund. Sonsini couldn’t be be bothered to sort that out.

Even back in January, independent parties who were paying attention to CalPERS’ private equity plans could see CalPERS’ conduct was not on the up and up. We wrote then:

As a Harvard Business School contemporary who has spent his career in investment management said, based on reviewing CalPERS’ materials:

For a public pension fund well known for corruption and “pay for play” activities, this under-the-coat activity is astounding. Every current and future pension recipient should question the Watergate-like behavior of CalPERS.

Last week, highly respected Sacramento columnist Dan Walters also wrote about the whiff of corruption coming from CalPERS’ private equity restructuring scheme. Even for those like Walters who don’t know much about private equity, there is too much that is obviously wrong here, from CalPERS not dropping or at least suspending its plans now that its cheerleader in chief is quitting, to CalPERS branding and too many other claims being obviously demonstrably false, to the scheme going firmly against the positive steps other large limited partners are taking, that of building staff skills and bringing more deal-makgin and management in house.

The only two explanations are utter incompetence or rank corruption in the form of Ted Eliopoulos trying to curry favor with BlackRock and other influential players in order to bolster his future employment prospects. And before allies of Eliopoulos in and outside CalPERS act outraged, this suspicion is widespread among the journalists and limited partner community. You are only shooting the messenger.

The more and more CalPERS sticks to this plan in the face of deservedly critical press, the more it looks like dirty dealing. And with CEO Marcie Frost having amassed decision-making authority in her office, she will have nowhere to hide if this scheme blows up on her watch, as we fully expect it will.

______

1 And, no, it was not Margaret Brown. She refused to comment on the story off or on the record. It should occur to CalPERS that at this point that I have multiple CalPERS sources.

2 Some may question the validity of this document, not only as a result of its embarrassing poor quality (it is hard to imagine anyone who passed a bar exam being willing to put their name on it) but also the lack of the Wilson Sonsini logo, which presumably would have been part of the original.

CalPERS would deny the validity of a leaked document whether or not it was authentic. In this case, what has been leaked is not a copy or electronic version of an actual document, but its text only, with no firm letterhead or signature. Our understanding is that CalPERS has become very aggressive in trying to identify and punish leakers, so one anyone who leaked a document would be prudent to go to unusual lengths to break the connection between the original and the version it sent out. The most extreme approach would be to retype the text from the source record. Thus it is possible that this document is a close copy of the original but not an exact replica.

One also has to bear in mind that there are plenty of reasons for people at or connected to CalPERS to be leaking documents to discredit the private equity initiative. This document is sufficiently lame that circulating it would have that effect.

Aside from the fact that principled insiders would opposed this private equity restructuring plan as offering no potential benefits to CalPERS beneficiaries while being almost certain to result in more costs and worse performance (the late stage venture capital idea is harebrained), there are also constituencies that stand to lose, starting with current private equity staff members. That would give them cause to release embarrassing material.

The alternative theory is that CalPERS created a document to try to ensnare and damage the reputation of journalists who have been critical of CalPERS. But this idea does not make sense. First, had CalPERS wanted to do so, it would made sure that the document would have looked like a copy of an original, as opposed to mere extracted text. Second, CalPERS would still want to make sure that any false leak did not potentially damage CalPERS, when this document does. Third, a phony leak would also entangle CalPERS in the question of how the document did originate, which would also not reflect well on CalPERS. Fourth, CalPERS would presumably have wanted to damage a high priority target. While the original recipient of this document is very respected, he writes for a paywalled journal, which means his reach is limited. This would represent a lot of risk and bother for limited gain.

3 This is an open secret among journalists on the CalPERS beat as well as potentially in the private equity community generally. I have heard from reporters with deeper connections at the CalPERS staff level than I have that the staffers perceive that CalPERS senior executives to be putting shoulder to wheel to give the fund of funds business and perhaps all the private equity management (save the emerging manager program) to BlackRock, even though BlackRock submitted a bid on the private equity fund of funds component that is also widely rumored to have been vastly in excess of the pricing of the other candidates.

Since CalPERS launched a formal contracting process, merely communicating with BlackRock about the possible fund of funds business in any way other than as set forth in it is a violation of Section 20153 of the PERL:

§ 20153. Restriction on Communication with Applicant or Bidder

(a) During the process leading to an award of any contract by the system, no

member of the board or its staff shall knowingly communicate concerning any

matter relating to the contract or selection process with any party financially

interested in the contract or an officer or employee of that party, unless the

communication is (1) part of the process expressly described in the request for

proposal or other solicitation invitation, or (2) part of a noticed board meeting, or

(3) as provided in subdivision (c). Any applicant or bidder who knowingly

participates in a communication that is prohibited by this subdivision shall be

disqualified from the contract award.

Section (c) excludes only:

(1) Communications that are incidental, exclusively social, and do not involve

the system or its business, or the board or staff member’s role as a system official.

(2) Communications that do not involve the system or its business and that are

within the scope of the board or staff member’s private business or public office

wholly unrelated to the system.

4 For instance, CalPERS’ May 17 press release stated:

CalPERS’ Investment Office will now begin talking with industry professionals about the makeup of both the independent advisory boards and the management teams.

According to the Sonsini memo, this is false. Go read the sections on the powers of the General Partner, the Limited Partner, the CalPERS Board and Investment Committee, and CalPERS staff. It makes clears that the only role that CalPERS will have regarding staffing is to “evaluate Advisory Board performance and selection of the independent Advisory Board members in consultation with the General Partner.”

So how can we believe anything that CalPERS says about this initiative when documents presented to the board on the same timeframe as public announcements contradict each other? This means either the board is cooperating with the misrepresentations or is a victim of staff’s and Sonsini’s con.

5 Sonsini defenders may say that his firm does not have private equity firms (including venture capital firms) as clients, ergo we are being unfair. That defense is a willfully naive reading of Wilson Sonsini’s interest. As one of the premier representatives of Silicon Valley companies, who overwhelmingly are or want to be funded by venture capital firms, Sonsini’s firm depends on venture capital, albeit laundered through the portfolio companies that constitute a significant portion of his firm’s client base.

6 While the Kauffman Foundation argues that evergreen funds align incentives better than private equity and venture capital limited partnerships, the structure they describe bears little resemblance to what CalPERS is proposing:

Evergreen funds are structured to better align the incentives between GPs and LPs. They have just one annual management fee (not a series of fees that accumulate from subsequent funds), and raise capital from a limited number of LPs on a rolling basis. Investors receive gains from successful exits, which they can choose to reinvest. The fund restructures every few years (usually every four years) and investors can decide whether to continue investing or withdraw their investment based on current values.

CalPERS does not appear to have looked at Sutter Hills Ventures or General Atlantic, which have operated for a long time under the evergreen model. Even with the periodic restructurings, the firms maintain that they can focus on cash-on-cash returns rather than misleading IRRs and look at ten year horizons when it makes sense for the investee company, rather than fixating on shorter time cycles due to “next fund” demands.

Sonsini Memo

Private Equity as long as you retain the secret no-bid contracts will always be a hotbed for corruption

CalPERS should have been — but apparently could not give a damn about — alert to the risk of ending up with investment in businesses which they later find they don’t want to be associated with.

This could happen for any number of reasons such as a massive eithical faux pas, being found to have political involvement in a way which overstepped the mark, environmental damage (think Flint), entire business areas (hydrocarbons) or even merely something that gets condemned in the court of public opinion for some reason, some Russia nonsense which nevertheless is trouble, another Theranos — the list is endless.

In such circumstances CalPERS could do nothing other then wring their hands and try to do damage limitation. As the post above noted entirely correctly, CalPERS’ arrangement gives them zilch by way of management control and not even much, if any, indirect influence. And when these sorts of problems blow up — as they inevitably do, the potential investment areas are too vast to police effectively even if CalPERS could do this, which of course their lack of control means the can’t — feeble excuses about the limitations of your contractual rights simply don’t wash.

This is not some outlandish, vague, low-probability risk. The Church of England entered into an almost identical arrangement and lived to regret it. By means of just such a hands-off investment management policy, it found itself to have put up capital to start up what was probably the worst payday lender ever to have set up business here. They were shockingly bad even by subprime lending standards. Real streetwalkers. It took the C of E years before it could finally unwind its position in the company. The bad headlines just didn’t stop — and the Church couldn’t stop them because it had no control whatsoever in the matter.

And yet CalPERS thinks — what? — that the same couldn’t happen to it? That they’d be able to do better PR? Or that for the staff involved it’d be a case of I’ll Be Gone, You’ll Be Gone? None of these reflect anything other then abysmally on CalPERS’ management.

But what do they care?

I’m sure the CalPERS staff and board have been petted and stroked by PE et al., and told that they – CalPERS – are so very very special that they will be treated with utmost deference by PE et al, and earn boatloads of money. (The ‘Bank of Nigeria’ scammers make the same sorts of promises.)

CalPERS staff and board are such rubes they believe this buttering?

Now a CalPERS consulting atty suggests directly jettisoning its primary fiduciary duty thinking that will work? Take another drink, CalPERS. That will help you sober up. /s

This isn’t directly related to PE or CalPERS but the general idea is a good one. Something about sensible skepticism and due diligence:

https://www.youtube.com/watch?v=cFh_ZWC1CPQ

Thanks for your continues reporting on CalPERS, pensions, and PE.

Yeah, I can’t help but wonder if, when CalPERS get those “I am an African princess who has inherited $10 million and I need your help to give me a bank account to deposit it in” emails, the investment committee don’t sit there and say to themselves “hey y’all, this sounds like a deal we should be gettin’ a piece of, whad’ya think..?”

If John Cox seized on this issue it might very well propel him into the Governor’s mansion.

Newsome is a weak candidate with good handlers, a not very bright and totally amoral cokehead with great hair.

Cox is no bargain, but he might cause less damage.

Maybe.

I wouldn’t count on that. Just saying.

Nothing that Cox has said so far indicates that he’d do anything helpful in this regard.

I’m not a CalPERS beneficiary, but given its historical leadership position among public pension plans, its board’s persistent habit of rolling over and buying into any hare-brained scheme that private equity scammers are able to dream up is of concern to everyone who pays the taxes that ultimately fund what CalPERS’ board and its peers seem to be turning into outright looting by private equity and its acolytes.

I fail to understand why a fund of CalPERS dimension requires any outside investment help. Of course, any organization needs cross-pollination and sanity checks of its ideas, but with 49 other states (not to mention organizations abroad with similar missions), it would seem there are ample mutually-beneficial opportunities for doing that among peers, but with less opportunity for, uhhhm, other side benefits.

Your piece’s first point regarding dilution of fiduciary responsibility is underscored by the presumed Sonsini memo’s passage, “… formulating the foregoing Roles and Responsibilities of the various constituencies.” What “various” constituencies? Seems to me there is exactly one: the State employees who depend upon CalPERS to ensure a decent retirement income after a career of public service. Aside from the ESG [environmental, social, and governance] concerns mentioned in the piece, seems to this non-lawyer that “fiduciary” means no other interest may be taken into serious account.

I’m sure I oversimplify but:

PRIVATE EQUITY: Give us your money. We’ll invest it for you and tell you what you need to know.

CALPERS BOARD: Sounds innovative!

* * *

What could go wrong?

Or:

CALPERS BOARD: Sounds EASY! Where do we sign?

Is it possible that Larry Sonsini was not the original author of this memo? From what I have read, Larry Sonsini has had a long illustrious career in corporate law. What I mean is, is it possible that this was sent to him by someone in CalPERS so that it could be cut and pasted into a memo with his name at the top to be sent back to CalPERS as justification for their actions?

If he was the original author of this memo that would be a bit ironic as he is the co-author of an article called “Creating an Effective Board” (https://www.wsgr.com/PDFSearch/CG04_Wilson.pdf).

Also, looking at that image at the top I was reflecting on how much those 50-odd words will be parsed by any number of lawyers in the years to come.

It’s almost inevitable it was written by a junior attorney and probably polished a little before being presented for a signature. Sonsini maybe could have read it and asked for revisions but could just as soon have signed it off without looking at it.

But if it has his signature on it, it’s his workmanship. If it’s shoddy and legally sketchy — or downright wrong — it’s his name on the paperwork so he has to own it.

At my TBTF they get the law firm with the nastiest, most horrid reputation going in the City. They think they’re buying the legal services version of a bunch of mobsters running the equivalent of a protection racket hidden behind the facade of a plush office in the best part of town with floor to ceiling windows and walnut panelled offices complete with scary looking receptionists to complete the intimidation package. That’s what the law firm sells them but what they get is overworked morally vacant careerists all backstabbing their ways into trying to make partner. It is all-too-obviously reflected in the quality of the legal work which is actually supplied.

It goes without saying, or it should do, than when doing the grifting is more important than the quality of services you supply to your clientele, it soon starts to show in end results. As here.

Thanks for that Clive. You’re right of course. Doesn’t matter if he signed it on the way out the office door late on a Friday afternoon thinking that he was signing for office supplies – it has his name on it so now he has stapled his reputation to it.

In my experience, most of those documents are written by junior (possibly very junior) staff. Then, if the client has any sense, reads them, kicks the law firm, and gets the partner to review it.

If the client has no sense, the document goes out unreviewed – although in probably 90% of cases it matters not. But in the remaining 10, it’s pretty much guaranteed disaster.

> JONES: That long horizon also gives the CalPERS Board an opportunity to influence the culture of CalPERS Direct to ensure their actions are in sync with our Investment Beliefs.

Staggering. Besides the lying, “influence the culture” as opposed to wielding board authority. I’m having a hard time imagining the milieu where a statement like that is greeted with nodding heads, as opposed to hysterical laughter and pelting of rotten tomatoes.

The initial caps for “Investment Beliefs” are a nice touch.

Adding, the more Yves digs up, the more lunatic it all gets.

My limited knowledge of Wilson Sonsini suggests that it would be happy to prepare whatever a CEO wanted to read, especially, as here, it relates to corporate relationships rather than IP or litigation strategy.

It is hard to tell whether it crafted the relationship roles described here, and the authority or lack of it associated with the chosen framework, or is parroting them back to the client.

It is tempting to dismiss the letter as having taken about fifteen minutes to draft, while in a limo to the airport. It is descriptive, and intentionally not analytical. It draws no legal or other conclusions. It is a draft not worth completing. But it is artful in how it restricts by implication. That takes patience and intent.

That Wilson Sonsini let it out of the shop, much less delivered it to a client’s CEO, CIO and their General Counsel, says the firm is not the least concerned about exposure to a competent or critical voice. That should worry every California tax payer.

To give a tad insight into the power the firm holds, Larry Sonsini has been called – presumably by many of Silicon Valley power themselves – one of the Fathers of Silicon Valley and was at the center of the Silicon Valley backdated stock options scandal:

More:

Further, the words conflict of interest have floated around Larry Sonsini for at least two decades since he stabbed engineers he represented in the back in favor of VC firms on Sand Hill Road, Menlo Park. While there was some critical writing on the firm’s conflicts of interest surrounding engineers and VC firms in the nineties, I haven’t read any since, and I seriously doubt any California Newspaper, particularly San Jose based Mercury News, would even do it, both out of fear, and because those older white male editorialists, along with the few (if any?) remaining older white female editorialists – with few, if any exceptions – love that Silicon Valley Meritocracy myth; despite all of the now local, state, national, and worldwide victims of Silicon Valley’s Meritocracy.

ahhh, about those engineer versus VC Angel™ conflict of interest issues, here’s a remaining 1999 link: Double Crossed – Silicon Valley entrepreneurs say they have been betrayed by venture capitalists and lawyers, the very people they asked for help

That piece was one of a five part series, the likes of which, to my recollect and decades of newspaper hounding, have not been repeated since – in Silicon Valley, Los Angeles, or the California Empire State Capital, in Sacramento – about the horrid underbelly of Silicon Valley:

It is sickening, and historically negligent that the chronicle/sfgate online site provides no easy links to those historic writings, even while noting those writings, and of course my comment will fail if I provide those links. Following are the five articles of that Series, they are all well worth reading. All, but the first article, Phantom Riches, mention Wilson Sonsini (at that time noted as Wilson Sonsini Goodrich & Rosati) in a large and UGLY way:

1. Phantom Riches – Beneath the glitter of booming Silicon Valley, executives have been accused of lying about their products and doctoring their books, leaving devastated investors in their wake, By Reynolds Holding, and William Carlsen, 11/15/99

2. Hollow Words – Federal prosecutors say white-collar crime is a priority, but they have filed only a few charges against Silicon Valley executives, By Reynolds Holding, and William Carlsen, 11/16/99

3. Double Crossed – Silicon Valley entrepreneurs say they have been betrayed by venture capitalists and lawyers, the very people they asked for help (which I linked to above) By Reynolds Holding, 11/17/99

4. Stolen Secrets – Technological breakthroughs are so valuable in Silicon Valley that some company executives are willing to do almost anything to get them, By Reynolds Holding, 11/18/99

5. Beyond The Law – As the SEC attempts to crack down on improper accounting, a recent federal court ruling threatens future investor lawsuits, By Reynolds Holding, and William Carlsen, 11/19/99

Since I can’t provide those remaining unlinked to links all at the same time, I’ll provide them 2 by two:

1. Phantom Riches – Beneath the glitter of booming Silicon Valley, executives have been accused of lying about their products and doctoring their books, leaving devastated investors in their wake, By Reynolds Holding, and William Carlsen, 11/15/99 https://www.sfgate.com/bayarea/article/PHANTOM-RICHES-Beneath-the-glitter-of-booming-2897619.php

2. Hollow Words – Federal prosecutors say white-collar crime is a priority, but they have filed only a few charges against Silicon Valley executives, By Reynolds Holding, and William Carlsen, 11/16/99 https://www.sfgate.com/bayarea/article/Hollow-Words-Federal-prosecutors-say-2896423.php

4. Stolen Secrets – Technological breakthroughs are so valuable in Silicon Valley that some company executives are willing to do almost anything to get them, By Reynolds Holding, 11/18/99, https://www.sfgate.com/bayarea/article/STOLEN-SECRETS-Technological-breakthroughs-are-2896814.php

5. Beyond The Law – As the SEC attempts to crack down on improper accounting, a recent federal court ruling threatens future investor lawsuits, By Reynolds Holding, and William Carlsen, 11/19/99, https://www.sfgate.com/news/article/BEYOND-THE-LAW-As-the-SEC-attempts-to-crack-2894526.php

Thank you, LC. Vile stuff.

Glad to share it, and glad Yves had the guts to call out Sonsini.

Even though a guy like Sonsini might be annoyed, people like him usually know that punching down only makes them look bad and calls attention to the unflattering information. We’ve done things that were gutsier, stating with putting up our trove of private equity limited partnership agreements.

just be careful, of course you know that already but somehow Sonsini’s (and other’s) power and connections – despite having ultimately affected the world at large as to money people shutting down inventor’s best intents and then utilizing and monopolizing their inventions for power and destruction, versus life and humanity – have been way, way, way under estimated and reported on.

He does not have a way to get at me. I don’t in any way depend on anyone even remotely in his circle, nor am I interested in that. Sonsini has taken action in circles where he has power. I don’t intersect at all with his sphere of influence.

And as I said, there was much more real risk in publishing the LPAs.

TBH, at this stage, CalPERS beneficiaries should start to lobby the Californian legislature to regulate CalPERS at a level that SEC regulates funds or similar.

I do not understand why that is not the case already, as with funds one can at least have buyer-beware, while with CalPERS you can’t really chose as a beneficiary, which means its fiducary duties should have been very very explicit – and any management/board should be very scared of them.

I’d suggest to any and all CalPERS beneficiaries, do ask your represnetatives why there’s no way to effectively hold fiducary duties as coal to CalPERS heels..

If setting up a commission is a government bureaucrat’s way to dissipate accountability to the point of nothingness, so is imposing two boards between CalPERS and the level of its actual investments. It precludes accountability and transparency. It also makes impossible reducing fees and increasing returns.

I think there’s a third possible explanation (in addition to incompetence and attempted fraud). It is just as unflattering as the two Yves offers.

It seems to me the main purpose of the proposal is to remove investment decisions even further from any meaningful Board oversight, not (or not just) to hide financial wrongdoing but rather (or but also) based on a sincere belief that elected boards governing investments is a bad idea in the first place. In this view (which I emphatically do not share), investment professionals in pension plans should be independent in a way partly analogous to judges in government. We value an independent judiciary, and struggle to find ways to make judges both accountable and independent at the same time. Similarly, investment management is too important to let elected representatives of the beneficiaries get involved in it beyond a purely ceremonial role.

This is a profoundly anti-democratic point of view, and that makes it wrong (to me). But I can picture people (especially investors) convincing themselves that it’s valid.

Late to this, but agreed. CalPERS fetishized independent boards, when a public company with diffuse shareholders at risk of capture by management is totally different than the board represents a constituency, beneficiaries, and NOT management.