By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

Shares of Deutsche Bank fell 7.2% today in Frankfurt to €9.16, the lowest since they started trading on the Xetra exchange in 1992. They’re now lower than they’d been during its last crisis in 2016. And they’re down 71% from April 2015.

This came after leaked double-whammy revelations the morning: One reported by the Financial Times, that the FDIC had put Deutsche Bank’s US operations on its infamous “Problem Bank List”; and the other one, reported by the Wall Street Journal, that the Fed, as main bank regulator, had walloped the bank last year with a “troubled condition” designation, one of the lowest rankings on its five-level scoring system.

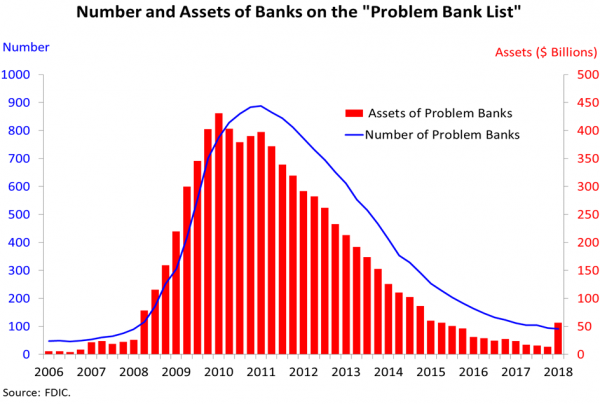

The FDIC keeps its “Problem Bank List” secret. It only discloses the number of banks on it and the amount of combined assets of these banks. A week ago, the FDIC reported that in Q1, combined assets on the “Problem Bank List” jumped by $42.5 billion to $56.4 billion (red bars, right scale), the first such surge since 2008, as I mused… Oops, It’s Starting, Says This Chart from the FDIC:

That increase in assets of $42.5 billion on the “Problem Bank List” nearly matches the assets of Deutsche Bank’s principal subsidiary in the US, Deutsche Bank Trust Company Americas (DBTCA) of $42.1 billion as of March 31. And this has now been now confirmed by the sources: it was DBTCA that ended up on the “Problem Bank List.”

The Fed’s downgrade a year ago of Deutsche Bank’s US operations to “troubled condition” was what apparently nudged the FDIC in Q1 to put the bank on its Problem Bank List. The Fed’s ranking of banks is also a secret – for a good reasons: When these things come out, shares plunge and investors lose what little confidence they have left, as we’re seeing today. This loss of trust can entail larger problems that then coagulate into a self-fulfilling prophesy that perhaps should have self-fulfilled itself years ago.

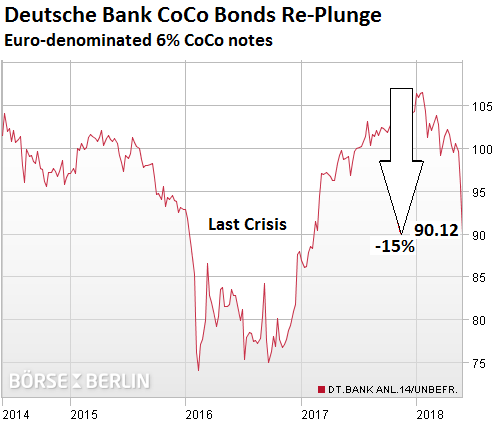

In addition to the shares sinking to a new low, Deutsche Bank AG’s contingent convertible bonds, one of the instruments with which the German entity has increased its woefully drained Tier 1 capital after the Financial Crisis are now plunging again. The 6% CoCos dropped 3.6% today, to 90.12 cents on the euro. They’re now down 15% from the beginning of the year:

“CoCos” are designed to be “bailed in” before taxpayers get the bill. Thus, they count as Tier 1 capital, and they’re a gauge of these investors’ fears about getting bailed in.

Since the Financial Crisis, Deutsche Bank has sold several waves of these CoCos. Unlike most other bonds, they have no maturity date. But the bank can redeem them, usually after five years. Annual coupon payments are contingent on the bank’s ability to keep its capital above a threshold. If capital falls below that threshold, the bank won’t make the coupon payment. But this will not count as a default, it’s just part of the deal. If regulators deem that the bank is failing, CoCos get “bailed in,” either by getting converted into increasingly worthless shares or by getting canceled.

To make these risks worthwhile, CoCos offer a high annual coupon. The 6% CoCos in the chart above, when they still traded at 106 cents on the euro earlier this year, yielded 5.7%; at today’s lower price, the yield has jumped to 6.7%. In other words, investors demand to be paid more to take on the risks of getting bailed in.

Deutsche Bank has been whacked serially by layoffs, strategic redirections and misdirections, CEO chaos, three years in a row of big losses, and many billions of dollars in fines – the price it is now paying for having gone from a stodgy German bank that was taking care of its industrial customers in Germany to a global powerhouse with one of the riskiest, most far-flung operations around.

But once again, there’s nothing to worry about. Deutsche Bank AG, the main entity, in Germany came out with a long press release today to slough off these issues, saying firstly, “As a matter of policy, we do not comment on specific regulatory feedback”; and secondly, Deutsche Bank AG “is very well capitalized and has significant liquidity reserves,” and the US entities, which are getting tarred-and-feathered here, “have very robust balance sheet as disclosed in our quarterly regulatory filings.”

Regulators, however, have been hounding the bank. Earlier this month, the Financial Times reported that the ECB and Germany’s BaFin, which both regulate the bank, were raising alarms about its US operations, their size, and their potential as trigger for instability, according to “four people with knowledge of the discussions.”

The Wall Street Journal summed up why US regulators are fretting, and why the Fed, its primary US regulator, has hit the US entities with its punitive “troubled condition” status:

Fed supervisors grew exasperated with its shortcomings in systems and controls and the slow pace of improvements, people familiar with internal discussions said.

Deutsche Bank’s U.S. operations have drawn regulatory ire for years. They received a stinging rebuke from the New York Fed in 2014 about repeated financial-reporting failures and lack of follow-through on promised fixes, The Wall Street Journal detailed.

Deutsche Bank U.S. operations failed the Fed’s stress tests in 2015 and 2016, and in 2017 was the subject of multiple Fed enforcement actions for perceived lax controls tied to currency trading, money laundering, and Volcker-rule trading restrictions.

In the US, a battle for deposits has broken out, where banks fight by raising the rates on savings products to attract new money while keeping their overall funding costs low, with some twists. HSBC makes it official. Read… “For New Money Only”: Banks Fight for Deposits, But if You Don’t Jump Through Hoops, You Get “Punishment Rates”

Hmm. Better watch the stock and the news for more bad stuff on DB.

When more bad news just keep coming out, corroding the stock price, and management finally caves in and admit every misdeed and screwup for the last decade while the stock only sags a few % on it, then it is usually a really sweet place to invest. I feel that they haven’t quite gone all in on “confessions” yet, their press release shows there are quite a few more “closet-skeletons” left to fall out.

This was passed on to me by a French friend, written by an economist named Steve Ohana who works at ESCP Europe. I am not qualified to judge the validity of this Google translated statement, but it might be of interest as it features Deutsche bank :

” The sequence of events that we have been witnessing for a week is a challenge to all azimuths of the German hegemonic system on Europe:

1) the rise in power of the lega / m5s coalition in Italy reflects the revolt of a majority of the Italian people against:

– the economic policies of budgetary rigour and competitiveness inspired by Germany in Europe, which have failed in Italy even more than elsewhere.

– the migration policy unilaterally decided by Merkel and which Italy directly paid the consequences as the main country of arrival of migrants.

(2) the current financial storm on the Italian debt market (which will lead to contagion in its wake all European mégabanques and, in particular, Deutsche Bank, which will be discussed below) is the direct result of the German will to force the Purchases by the ecb of public debt securities on markets (l’ as qe being restricted by certain conditionalities – see my previous status).

(3) the trade crisis between the United States and the EU is the result:

– the inadequacy of German military expenditure (fruit of the German fétichisme of budgetary surpluses) in relation to NATO commitments

– German mercantiliste policy since the mid-2000 s, but also the disappearance imposed by Germany-current peripheral deficits (Spain, Italy, Greece etc.). ), which were “Twins” of current German surpluses until 2010. With A German trade surplus of more than $ 60 billion and a European trade surplus of about $ 150 billion in United States.

(4) the ongoing collapse of the Deutsche Bank Action (which led to the fact that the United States Bank for banking resolution, LA, officially its American subsidiary as a “in difficulty” Bank) is a reflection:

– an overall bankruptcy of the gouvernance governance (with their extreme interconnection due to their market activities, their obsession with the minimisation of own funds and the maximization of short-term profitability, on which the wages of their Leaders)

– the structural problem of recycling German surpluses (which are invested in assets whose risk is poorly controlled abroad).

– the ban imposed by Germany on member states to recapitaliser European banks in bankruptcy without imposing losses on their creditors (which in the case of Deutsche Bank would not fail to trigger a global systemic crisis). This prohibition has led to the continued existence of zombie banks (Italian, German, Spanish) which should have already been restructured or recapitalisées for several years.

There is therefore great consistency behind the series of seemingly disjointed scourges that seem to have been falling on Europe for a week.

The German hegemonic order is under attack. Merkel has so far responded to the crises by what ulrich beck calls the “merkiavelisme”, that is, the non-choice allowing him to maintain the German éclectorat in the illusion that we could have butter and money from butter. (maintenance of the euro, maintenance of public and current surpluses in Germany, lack of transfers, protection of German savings, controlled German inflation etc.). .

It is this illusion that is coming to an end. And landing may be particularly painful “.

Two major comments:

First: The migration pressure on Italy is mainly a function of African developments. The (short-living) open border policy in Germany was directed towards the Balkans route (about a third of the people, who came were from Syria). It may have incouraged a few more Africans to try to come to Europe via Italy, but as the accuracy of information, what is going on in Germany, in Africa is not very great, I doubt, that the impact was very great, much less than the Libya war, which was initiated by France and the UK and mainly fought by the US. Germany voted neutral along with Russia and China in the United Nations Security Council in the Libyan question. With respect to Syria and the connected countries, as well military actions mainly by the US, but with the support especially of France and the UK are responsible for the situation, in which Merkel felt the need to open the borders.

Second and somewhat connected:

The military expenditures of Germany are appropriate. NATO is evil and counter-balancing NATO’s militarism with a reduced budget (still almost half of Russia’s budget) is the right thing to do. If there are new threats, Germany will step up.

It is not at all helpful to connect the justified critic on fiscal policy in Germany with demands for more military spending. Additional spending should be used for the betterment of the lifes of people, not for destruction.

I suppose that in terms of Libya, Italy got the full brunt of the emigration & I believe that as with Greece have been stuck with something of a log jam which they have to pay for.

My main concern with the above is it’s claim that Deutsche has been hit by events in the South, whereas it appears to be due to the Fed’s position. From what I have read DB is not at risk from contagion through Spanish or Italian banks, but I could have missed something & obviously they can in certain circumstance behave like a line of standing on end dominoes.

Deutsche is now apparently 16 times smaller, but I wonder if that shrinkage appliies also to its one time estimated giant stack of $47 trillion in derivatives, which could be part of that which it seems their systems have difficulty identifying.

It does appear that the spinning plates on poles for Merkel are ever increasing.

Wow!

I think France should be more than pissed off about german mercantilism.

I think Germany did the right thing in the wrong way. And co-cos are the questionable assets involved. The fall of DB has been a prolonged humiliation. I would guess DB was used by the Bundesbank to sorta launder funds (bunds – remember when Merkel hurried off to China) and took the proceeds straight to the ECB to finance all the QE, most of which went straight back to DB so it could gradually divest itself of 50Tr in derivatives. A scheme that took patience. Germany engineered the bail out of the EU and it was technically a big no-no. It was thus done to make it look like a “surplus”. Ironic that now the Fed is looking more conservative than Wolfgang Scaheuble, no?

Thank you for that Susan as I tend to get very muddled up, rather like my days at college in which the accounting module as part of my OND business studies course, when no matter how much mud they threw at me, very little actually stuck.

Ignacio – I suppose they would be if it were common knowledge – the usual media smoke & mirrors I suppose & as I have made clear to Susan, after years of following the situation, I still get lost in the technical financial parts, & I imagine that I am not alone in that.

A translation comment: In point 4, I think ‘Deutsche Bank Action’ should be :’Deutsche Bank share price”.

I should add I don’t know the ins and outs of Deutsche Bank. If there is something called Deutsche Bank Action then my comment is incorrect.

When it rains it pours for Deutsche Bank. Needing cocos as part of their capitalization mix somehow undermines the PR coming out of Frankfurt that worries about liquidity and capitalization are overblown. Re: far flung operations, this is something the new management needs to think very hard about, i.e. do they have the management bandwidth to “profitably” (if and when they return to profitability) carry what appears to be a case of “too thinly spread on the ground” or is their global footprint a vanity play to be where their important competitors are. We’ve seen Barclays pulling back from some key markets in recognition of the new realities it faces as a bank (GM too in the automotive sector) so Deutsche should perhaps think about strategic divestments as the path towards reinvention. Or are we witnessing Deutsche’s coup de grace here? The Colonel might chime in with more insight here…

Hmm. DB just completed an exchange yesterday for $6.3 B in bonds. The exchange moved the bonds from the parent to the NY sub.

https://www.businesswire.com/news/home/20180502005740/en/Deutsche-Bank-Launches-Exchange-Offers-Outstanding-Senior

How badly will Brexit affect Deutsche Bank especially in light of the statement by Jörg Kukies that mutual recognition of financial rules are unlikely to be agreed?

This of course means that Banking and Finance are going to be hit with a hard Brexit regardless of what is agreed elsewhere. How badly or otherwise will this impact Deutsche Bank?