Yves here. I feel compelled to clear up a point of confusion as to what the term “money laundering” means. It has been routinely misapplied regarding sales of Trump real estate. While most people informally regard money laundering as getting the proceeds of non-kosher activity, like drug dealing, into some sort of holding well removed from its source, like real estate or stock, anti-money laundering laws focus on keeping dirty money from getting into the financial system. That’s why, among other things, banks are subject to “know your customer” rules and are required to monitor and report suspicious transaction activity.

Banks are responsible for anti-money laundering checks, not owners of real estate.

When Trump sold real estate and the money was transferred through banks, Trump did not engage in money laundering, no matter how illicit the source. Banks are responsible for compliance with anti-money-laundering statutes. The only way a sale of real estate would amount to money laundering would be if the real estate owner took payment outside the banking system, say cash, gold, diamonds…

A way Trump could have engaged in money laundering is via his casinos. In fact, this is almost certainly a meaningful activity for most casinos. However, casinos can’t launder enough money to be of much use to an oligarch.

By Gaius Publius, a professional writer living on the West Coast of the United States and frequent contributor to DownWithTyranny, digby, Truthout, and Naked Capitalism. Follow him on Twitter @Gaius_Publius, Tumblr and Facebook. GP article archive here. Originally published at the DownWithTyranny

The Cult of the High Tech Billionaire

The very rich aren’t like the rest of us, but they’re a whole lot like each other. That puts people like Rupert Murdoch, David Koch (who is ailing, by the way), Donald Trump, Russian gangsters and oligarchs, Jamie Dimon and Mark Zuckerberg in a much more shared world than most of us care to think about.

For example, recent reports show how money from Russian oligarchs, $21 billion between 2010 and 2014 alone, and laundered through places like Moldava and Latvia, ends up at places like HSBC and Citibank. It makes sense: banks are in the business of acquiring money, and global criminal-political activity is where great big piles of it are found. Banks go where the customers are.

The money-laundering bank BCCI, now defunct, didn’t set that pattern, but they were the most prominent to get caught at it. Not too long ago, Jamie Dimon’s bank JP Morgan Chase was also caught with its hand in the money-laundering till, but no one thinks of Dimon and his operation as a money-launderer. The BCCI scandal was back in the 1990s, when banks could be accused of crimes. Starting in 2009, that flaw’s been fixed.

I suspect at this point that the whole of Donald Trump’s operation, or at least the major part of it, involves money-laundering, and that this will be seen by historians as his actual crime. It’s also the reason he could be blackmailed out of office, if his enemies would want to go that route. (“Planning to return to that nice little business you have? Want it to exist when you’re done here? I think we can work something out; consider this an exit interview.”)

The Koch political machine, of course, is a massive money laundering operation, since its donors are invisible and there’s so much money involved. Whose money is being hidden? Who knows? Can any source be excluded? None, not even foreign money from who-knows-where.

(There’s an obvious side story here, but no one with real power wants to tell it. The global big-money network is also a bad-money network that encompasses almost every one in it. Not just Trump; everyone who floats on money floats on dirty money to some degree or another. Why aren’t they all prosecuted? Maybe they’re all in the game, including owners of the media that might do the reporting.)

Mark Zuckerberg’s News Shows

This brings us to Mark Zuckerberg and Rupert Murdoch.

You wouldn’t think these fellow billionaires would have much else in common. After all, Murdoch is in charge of the massive right-wing propaganda machine known as Fox News, Trump’s favorite network and a fortress of evil and destruction to many observers, while Facebook’s Mark Zuckerberg is a Silicon Valley billionaire, one of the brightest lights in a culture with a largely left following.

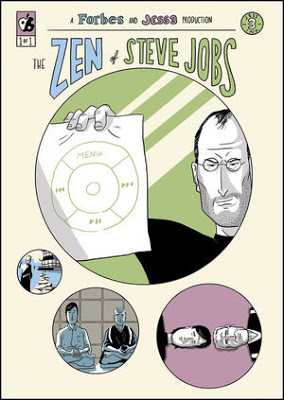

Like Steve Jobs, high tech billionaires supposedly see the better future first and will lead us there. As the poster at the top makes clear, they’re seen by many as the better angels of our aspirations.

The Cult of the High Tech Billionaire is remarkably similar to the “cult of the airman” from the early 1900s, airmen and women being the supposed far-seeing, kindly futurists of a previous era. For more on that earlier cult, see the introduction to this piece: “Google Scores a Pro-Monopoly Seat on Trump Transition Team.”

If you thought, though, that Murdoch and Zuckerberg had little in common but their money, you’d be wrong. Mark Zuckerberg and Facebook are launching a TV news feed called Facebook Watch.

Facebook’s First Wave of Funded News Shows Will Debut July 16, With More on the Way

The first fruits of Facebook’s multimillion-dollar investment in news programming from brand-name TV networks and digital media companies will go live next week — and the social giant has announced another half-dozen news shows that it’s funding.

Starting on Monday, July 16, programming from CNN, Fox News Channel, Univision, ABC News and others will be featured in a dedicated news section in Facebook Watch, its recently launched video platform for episodic programming. The Watch news section will feature news videos from national and local news orgs, and users will see a personalized feed based on the publishers they follow and what their friends are watching. (Facebook users also can access the shows directly from their show pages.)

The first lineup of previously announced shows from news publishers include those from ABC News, Advance Local, ATTN:, CNN, Fox News, Mic, Quartz, and Univision. Over the course of the next few months, Facebook will bring out additional news shows from ABC-owned stations, Bloomberg, BuzzFeed News, McClatchy, Group Nine Media’s NowThis and Tegna.

And guess whose programming is prominently featured? The above report, from Variety, might lead you to believe the mix of shows would be fair and balanced. That’s true, but only in the most ironic sense. Here’s their schedule:

The very rich aren’t like the rest of us. But they’re a whole lot like each other.

Hopefully, the sanctioned True Facts will help us all accept that these individuals Truly know what is best for us. We must be assimilated….

I am a little shocked at the clarification, Yves….

Builders and developers launder money readily.

A simple example involves the cash fund held by builders, often by squeezing their contractors or else supplied by persons of Great Respect….

The cash pays off the labour involved, much of which is unskilled and highly mobile. When the development is sold, the cheque is from an impeccable source: a building! Usually it is sold to small investors or in larger developments, to Pension funds etc.

It only works when there is a lot of cash availability, the very difficulty faced by men of Great Respect from their illicit trading.

You seem to have been misled by a source? Name and shame? I worked for the largest gang in Ireland, demanding very large sums of money, with menaces…. now retired and living in Oz.

That is not considered to be money laundering, and we are discussing US law, which effectively governs all dollar based transactions (see the settlements made by Standard Chartered and Paribas).

As readers discussed recently, US commercial real estate construction is sufficiently competitive that projects very seldom run much more than mildly over budget, like 5%. The fact that projects are also bid competitively does not allow room for padding the project, since you’d risk being underbid. The scheme that people use in Ireland (on the Euro) requires that the developer knows he can pad the project. With there already being plenty of “shit happens” in construction, that’s not a great risk for developer, particularly since if he can’t do what he promised his shady contacts he could do, he has people who are already on the wrong side of the law mad at him.

I know a tax expert who lectures internationally who is an expert on money laundering. The ways you do it in the US are by having a business that would natively take a lot of cash, like a pizza joint. Doesn’t flag anything with the banks when your pizza joint is actually not selling a lot of pizza but is depositing a lot of cash. There are tons of businesses like this in New York. My tax expert buddy points (as in literally walks down the street) to retail businesses that either have to be money laundering operations or be vanity projects of women with rich husbands. Not even remotely enough of the latter to support the number of stores identified.

With so many regular outlets for money laundering, why negotiate a complicated one off with a developer, even if per above he were interested, when there are good reasons why not. There was also money laundering via charities (some Hassidic synagogues were big on that, to the degree the IRS cracked down) but that apparently more difficult now.

The allegations re Trump are that he laundered money by selling condos to Russians in his Soho Millennium project. The only way that could have been money laundering under US law would be if he took payment outside the banking system.

Look up Nugen Hand and Riggs Bank for evidence of Pyramid theory in action?

The most powerful tend to have a need to disguise some or all of the sources of funds… that includes Intel Agencies, that sell drugs, guns and extort some of the guilty.

Using banks can be avoided if land development is gigantic……. we are talking billion $ per source etc. These tend to be trans national…. and the most respectable companies love cheap finance!

All Revenue bodies are hamstrung by the kleptocracies that have grown with the over lending/printing that has occurred. Irish bank shares were very widely held by civil servants in Ireland who among other breaches of oaths, egged on bank lending growth at 30%. The Revenue Commissioners presided over a system that allowed massive non enforcement of legislation aimed at tax evasion assisted by domestic banks. It all came as such a surprise that it had been going on ….

Once the Irish banking system collapsed, and the banks were effectively nationalised, did their books get a thorough going over for revenue raising to help pay for the guarantee to bondholders? ….errr I think not!

Surprise! The algorithms used to help pick the news line-up pick the billionaires’ “truth”. The bots are on their way to “freedom” and “autonomy”.

Also, what if those choices are reflecting the aging of Facebook users? It’s been said Facebook is skewing older than other social media.

A bit more definition: Money laundering involves 4 activities:

Smurfing – Breaking a large sum of money gain from illegal activities into smaller dispersed deposits.

Placement – Depositing the illegal money

Layering – A series of complex transaction designed to conceal the source of the money

Integration – Combining the money from illegal activities with legitimate business earnings

Placement is considered the most risky part of money laundering.

Casinos are ideal for placement, and Layering.

A Wacovia Bank branch received over hail a billion in cash deposits before the GFC.

Behind every great fortune is a great crime. Honore de Balzac.

Why do I know this? I teach it to new insurance agents, because life insurance and annuities, cash value policies, are considered at great risk for Layering and Integration, and agents are required to raise red flags.

#TYVM !!!

“Behind every great fortune is a great crime.”

Then you go into a diplomatic critique of insurance policies.

Will we ever truly knowhow many great and small fortunes were kick-started by insurance scams. Life insurance especially (family values be damned).

While it’s true that banks are where “money laundering” technically happens, one only need peruse Mueller’s indictment of Manafort and Gates to see how others might conspire to aid and abet the “laundering” of dirty money through a bank. Take for example, the Trump Organization’s practice of helping buyers hold real property purchased with offshore money anonymously. If, like Manafort is alleged to have done, the anonymous buyer applied to a U.S. bank for a loan secured by the property, and the Trump Organization were to offer assurances to the lender that the loan applicant was in fact the anonymous owner of the property, with knowledge that it was purchased with offshore money of questionable provenance, they would likely be found guilty conspiring to launder the offshore dirty money through the bank in the form of a real estate loan.

The term “money laundering” can and should apply to the anonymizing of money — through banks — in general, whether passed in custom-made boxes through teller windows in Matamoros, or by real estate loans secured by Brooklyn brownstones of questionable ownership.

Every major and even minor real estate owner in New York sells real estate to corporations which often hide their ultimate owners.

The New York Times a couple of years ago had a major series in which they did manage to trace some of the corporate owners at Time Warner Center, a Related Companies development and they were plenty shady. There was a great hue and cry for better money laundering rules to make the real estate owners responsible for money laundering checks. There was no suggestion that anyone at Related or any of the brokers had done anything for which they could be charged. The same would apply to Trump.

Did Related or the brokers vouch for someone claiming ownership in order to obtain a personal loan secured by the property subsequent to the purchase?

You can’t buy $10,000.00 suits with real estate. The “laundering” isn’t the purchase of the property. The “laundering” happens when the property that had been purchased with “dirty” money is monetized by using it as security for a loan. This is precisely what Manafort is accused of doing.

A seller or broker vouching that an individual applying for a loan secured by real estate is the true owner of a property held anonymously or by an opaque corporation, with circumstantial knowledge of the deception, could be charged as a co-conspirator or an aider-and-abettor to money laundering.

The same would apply to Trump and/or his children and companies.