By Hubert Horan, who has 40 years of experience in the management and regulation of transportation companies (primarily airlines). Horan has no financial links with any urban car service industry competitors, investors or regulators, or any firms that work on behalf of industry participants

Overview

- Morningstar released a research report three weeks ago predicting that Uber would become profitable in 2020 and could achieve an IPO value of $110 billion. Understanding the problems with Morningstar’s report is important because it illustrates the exact process and challenges Uber will face when it tries to sell its shares to investors next year

- Morningstar’s analysis is horrendously bad. Its profit forecast depends on plugging $4.5 billion in arbitrary and indefensible P&L gains into its forecast spreadsheet. Its valuation estimate depends on the equally indefensible claim that 39% five-year CAGR demand growth will occur independently of pricing, industry profitability or economic conditions. It provides absolutely no evidence substantiating its various claims about Uber efficiency improvements, fails to explain the source of these efficiencies, let alone demonstrate how they could drive powerful P&L gains, or explain why they didn’t generate profits until Uber’s 11th year of operations. They omit major factors relevant to a legitimate valuation analysis, such as pre-2017 P&L results, cash flows, and the costs and returns from current investments in future businesses such as driverless cars.

- Uber’s IPO will be the biggest challenge in its history. Uber’s Board believes it needs to achieve an IPO valuation north of $100 billion to ensure all existing investors achieve the profits they are expecting. The IPO process will inevitably result in Uber losing control of their heretofore tightly and effectively controlled media spin. The SEC requires that Uber release detailed, audited historical financial data, and independent financial analysts will be able to scrutinize their IPO forecasts and valuation claims

- As Morningstar’s atrocious analysis demonstrates, there is no legitimate way to reconcile a valuation estimate anywhere near $100 billion with objective data about Uber’s abysmal economics and financial results.

- For its entire history, Uber has gone to considerable length to evade public scrutiny of its black hole of losses and the dependence of its business on massive, and ultimately unsustainable investor subsidies, most importantly by presenting only fragmentary financial data that is largely non-comparable over time. Uber has succeeded nevertheless in using talking points that plays heavily on Silicon Valley mythology and libertarian gospel to create the impression that it is a highly successful venture. Uber is likely to rely heavily on PR and propaganda to convince investors it is worth over $100 billion.

- Morningstar’s report illustrate how difficult it will be next year for Uber to maintain its sales pitch in the face of hard financial data. A legitimate valuation would consider a wide range of objective evidence and critically scrutinize key company claims. Instead Morningstar’s report uncritically repeats longstanding elements of Uber’s sales talk. The report is not designed to help potential investors, but to serve as advocacy on behalf of Uber’s current shareholders.

- Morningstar’s report is potentially valuable to Uber because it allows them to claim that “independent” analysis by an “objective” financial firm endorsed the idea that Uber’s is worth more than $100 billion, and that claims Uber is likely to make during the IPO process have been independently verified. Given all of the problems and deficiencies documented here, it is important that no one ever grant any credibility to the profitability, valuation and long-term growth arguments Uber or others might make because Morningstar reached similar conclusions.

Uber’s 2019 IPO will be the biggest challenge in its history

Uber plans to go public a year from now. Committing to a 2019 IPO was an essential element of the pact that resolved protracted board-level battles and allowed Dara Khosrowshahi to replace founder Travis Kalanick as CEO. Kalanick believed that Uber was not ready to face full capital market scrutiny, but faced open rebellion from Board members who wanted to convert their paper profits into real money.

Uber’s IPO valuation needs to meet two objectives. It must be high enough that all of Uber’s current investors can cash out with big profits on the funding (roughly $18 billion) they have provided. However, the share price must also provide IPO investors with the opportunity for additional equity appreciation.

Uber’s Board seems to believe an IPO valuation of $100 billion would meet these objectives, and has agreed to pay Khosrowshahi a $100 million bonus if the Uber goes public at that valuation in 2019.[1]

The Uber IPO process would start with the publication of a prospectus that would include much more detailed audited historical financial data than Uber has released to date. It would present a narrative explanation of why investors (despite dismal historical results) should expect the many years of robust, highly profitable growth needed to justify a $100+ billion valuation. It would also need to include pro-forma forecasts of profits and cash flows consistent with the claims in the narrative.

The central question here is how Uber will be able to reconcile these aggressively optimistic pro-formas, narratives and valuation justifications with the documented, audited record of the first nine years of Uber’s actual economics and financial results.

Over its nine-year history, Uber has largely succeeded in controlling how the public sees the company. While the press gave extensive and highly critical coverage of sexual harassment and other “cultural” issues at Uber, reporting about the business was almost completely consistent with Uber’s positioning. Perversely, the press failed to connect the “cultural” issues with the fundamental businesses strategies that created them.

As Kalanick feared, Uber will no longer enjoy this freedom from scrutiny and level of control over public discussion once the IPO process begins. For the first time, independent outsiders will be able to use objective financial data to scrutinize its historical performance and business model economics, and anyone considering an actual investment will have ample incentive to do so.

If financial analysts and business reporters were to scrutinize the data in Uber’s IPO prospectus seriously, it is difficult to see how they could ever reconcile that information with a $100+ billion valuation.

Uber’s losses have grown steadily. No previous venture-capital funded company lost over $2 billion in its sixth year of operation and then doubled those losses to $4.5 billion in year eight. It would take one of the biggest corporate turnarounds in world history to rapidly replace those growing losses with growing profits.

In addition, despite numerous attempts over nine years, Uber has never successfully leveraged its car service position into any other businesses. Many of its attempts to expand ridesharing overseas have been spectacular failures.[2]

If investors realize that Uber’s economics are far worse than what past press coverage led them to believe and its current performance is totally inconsistent with claims that its equity will appreciate beyond its target $100 billion value, Uber will face an enormous crisis. If IPO investors would accept only a substantially lower valuation, many current investors would lose money. Perhaps even more important, the bubble of favorable Uber publicity would burst, as Uber’s claims could no longer be taken at face value.

On the other hand, Uber has survived and grown for nine years despite these abysmal economics and episodes of highly negative media stories. As this series has separately documented, one of Uber’s greatest strengths is its ability to construct and promulgate a very positive public image. This image is divorced completely from Uber’s performance because the company has successfully gotten the press and public to accept the sort of narratives commonly used in political campaigns. They rely heavily on emotive language to obscure agendas, distract attention from contrary arguments, and conceal the lack of factual support.[3]

Despite ample evidence to the contrary, Uber’s executives have convinced the vast majority of interested observers that Uber is an extraordinarily successful company, that its rapid growth was driven by innovative, cutting-edge technology, and that it has transformed urban transport and created massive public benefits. It has even succeeded in portraying the rare voices criticizing Uber as either beholden to corrupt, entrenched interests or ignorant of what it takes to build economic value.

With $100 billion on the line, can Uber develop an IPO narrative that will once again triumph over pesky facts like audited financials?

The Morningstar/Pitchbook Uber Report illustrates the structural approach Uber’s IPO prospectus will likely take, and the problems it will likely face

While this series has described why Uber is structurally unprofitable, until now, no one had ever attempted to lay out a detailed quantitative counter-argument claiming that Uber could rapidly become profitable and justify the huge valuation its investors hope to achieve.

On July 19th, Morningstar (and its subsidiary firm Pitchbook) issued the report “Uber may Pick Up Investors, Along With Riders, in its IPO” and subtitled “The ride sharing pioneer is likely to maintain its competitive advantage via its network effect.”[4]

Morningstar did not include detailed historical Uber financial data. But its report covered everything else that a future Uber IPO prospectus would. It included pro-forma Uber financial projections through 2022 that showed Uber producing profits in 2020. The text described how Uber will gain share as it expands globally and thus grow much faster than competitors. The document asserted that there are “narrow moat” protections in the ridesharing market and forecasts profitable growth in food delivery, freight services, bikesharing, other public transit services. It also foresaw huge long term potential for autonomous and flying cars. And most importantly (certainly from Dara Khosrowshahi’s point of view) is the central finding that Uber’s greatly-improved economics justify an IPO valuation of $110 billion.

A review of the Morningstar paper quickly answers the central question. There is no way that an honest, rigorous financial analysis could reconcile actual Uber economics with the need to justify the $100+ billion valuation that Uber’s current owners need.

The challenge here isn’t finding factual or logical flaws with Morningstar’s attempt to do this, but how to sort through and prioritize which of the many egregious analytical errors to document.

The Morningstar report is an embarrassingly shoddy piece of work, and its major conclusions don’t hold water. But it is important to understand why the Morningstar report is so bad: it shows the remarkable number of distortions and omissions that it takes to try to reconcile Uber’s story of an inevitable march to profits to at least some financial analysis.

We contacted the authors of the report, sent a detailed list of questions, and considered their responses. In most cases, the replies appeared to reflect a lack of comprehension of the issues we were raising.

The next two sections look at the problems with Morningstar’s forecast spreadsheet while the subsequent sections will discuss how Morningstar then refocused its efforts on building a propaganda-style narratives tightly aligned with existing Uber PR narratives.

Morningstar’s profit projection depends on $4.5 billion in gains from two huge but totally unjustified spikes in profitability.

To claim that Uber will become a profitable soon enough to justify a high 2019 share price, Morningstar needs to quickly reverse Uber’s $4.5 billion 2017 loss. It did this by making arbitrary, unexplained (and inexplicable) plugs in in 2018 ($1.5 billion) and 2020 ($2.5 billion) forecast numbers.

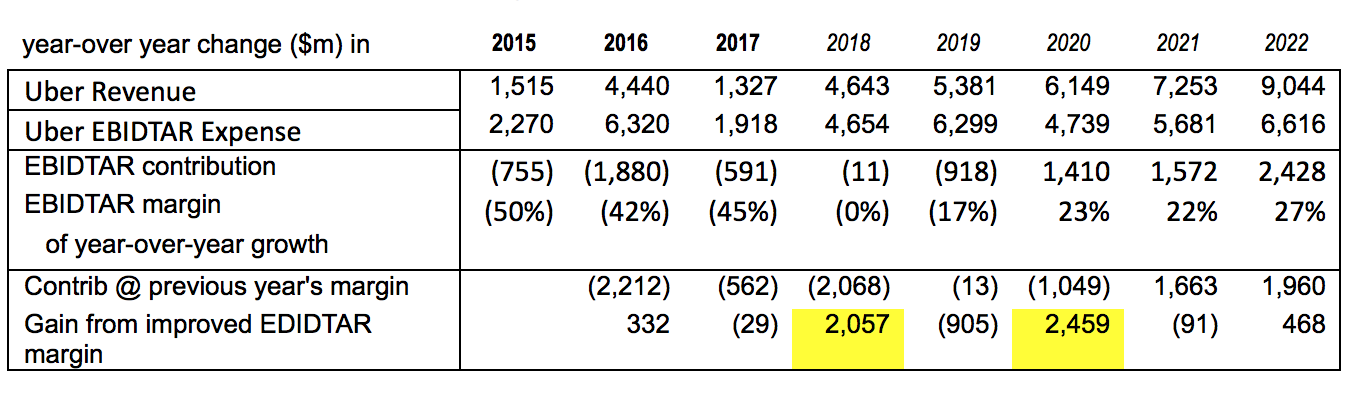

The table below combines historical data with Morningstar’s forecast, and shows year-over year changes in Uber Revenue and Uber EBIDTAR expenses and the calculated EBIDTAR contribution margin of the each year’s incremental growth.[5]

The contribution margin of actual Uber growth 2014-17 improved very gradually, and Morningstar’s post-2020 forecast shows similarly gradual EBIDTAR margin gains. But there is a 45 point margin improvement in 2018 growth versus 2017 growth and a 40 point margin improvement in 2020 growth versus 2019 growth, which drive P&L gains of $1.5 billion and $2.5 billion respectively. The text fails to mention these huge 2018 and 2020 profit spikes, much the less give any justification for them.[6]

Morningstar’s forecast is based on indefensible claims about exogenous market growth, and Morningstar assumes Uber can grow rapidly regardless of pricing or profitability

Morningstar must show extremely high rates of revenue growth to justify Uber’s valuation target. Instead of basing its revenue forecast on Uber’s actual past results and analysis of what prices Uber would need to charge to operate profitably in the future, Morningstar’s forecasts assume demand will grow completely independently of the ability of operators or drivers to make money or the prices customers pay.

The double-digit demand growth forecasts that drive Morningstar’s valuation are based entirely on crude calculations that claim to measure the size of Uber’s “addressable markets” (i.e. aggregate market demand for ridesharing, food delivery and other products). Morningstar claims that the overall rideshare market will grow at a 29% five year CAGR (compound annual growth rate) and that Uber will grow at a faster 39% rate. If Uber only grows at a 25% five-year CAGR (Morningstar’s “bear-case”), its valuation estimate gets cut in half, to only $49 billion.

Seasoned investors know that trees do not grow to the sky. 39% growth for years for an already large company entering its second decade in a well-established industry is in the category of trees growing to Mars.

For these growth forecasts to be remotely plausible, one would need to provide indisputable evidence of both overwhelming new efficiency advantages (e.g. ecommerce versus brick and mortar) and the huge cash flow/profit generation that would warrant ongoing investment in capacity growth. Morningstar gets the economics entirely backwards. Instead of growth occurring when companies figure out how to exploit major new efficiencies profitably, companies suddenly become efficient and profitable because market demand magically falls from the heavens into their shareholders’ laps.

Data on the total market demand for urban car services is extremely limited and unreliable, and revenue data is largely nonexistent.Morningstar extrapolates a single revenue datapoint (New York City taxi revenue in 2014) to a global scale to come up with its ginormous growth forecast. This is ironic in that New York City, having recognized the destructive impacts of a massive oversupply of unprofitable capacity, is considering limiting the number of Uber drivers.

Using ginned-up global numbers allows Morningstar to grossly inflate its growth multipliers, by combining demand for transport in hundreds of huge, rapidly growing non-US cities with the much more mature transport markets in the US.

This distortion also allows Morningstar to ignore the fact that with a handful of possible exceptions (e.g. London) the available evidence suggests that Uber’s efforts to penetrate these faster growing markets have been financially disastrous.[7]

Finally, this approach also ignores evidence that (like many other startups) Uber’s rate of revenue growth has slowed over its nine years of operation and was only 20% in 2017, in part due to efforts to reduce its financial losses. Nothing in Morningstar’s report explains why, despite large continuing losses, Uber will suddenly increase revenue growth to 60% in 2018.

Morningstar’s car service revenue analysis never mentions the word “price” and its report completely ignores the fact that its historical revenue growth was largely driven by multi-billion dollar subsidies. Readers have no way of knowing whether Morningstar’s forecast of five year 39% revenue CAGR is due to market stimulation from increasingly lower prices, from Uber’s ability to charge increasingly higher prices than customers they pay today, or whether Morningstar ever even considered these issues.

Morningstar’s forecast of aggressive Uber growth in non-car service markets also depends on totally ignoring the economics of those industries. Its optimistic view of food delivery demand growth is based on a single article noting that Uber has rapidly captured share from a financially struggling (but still much larger) competitor. Morningstar has no evidence that Uber Eats generates positive cash flow or actual GAAP profits, or that the business is rapidly moving toward GAAP breakeven.

Morningstar’s paper best seen as as PR and propaganda, not financial analysis

Morningstar’s effort confirms that there is no legitimate way to reconcile financial forecasts that would justify a $100+ billion IPO valuation with Uber’s economics. As discussed earlier, if honest financial analysis cannot justify a $100+ billion IPO valuation, the alternate path is to focus exclusively on boosterism.

The vast majority of Morningstar’s report is pure narrative that is almost entirely disconnected from any specific spreadsheet numbers, and many of the critical numbers the spreadsheets are not explained in the text. In fact, the the apparent purpose of the spreadsheets is to create the appearance that the report’s conclusions were based on legitimate financial analysis.

The next three sections will discuss specific components of Morningstar’s narrative in greater detail—the emphasis on “network effects” in lieu of actual evidence of operational efficiency, the misrepresentation of the driver’s role in Uber’s business model, and how discussions of autonomous and flying cars are intended to create the vague impression of long-term growth potential but misrepresent their impact on Uber’s actual value.

Morningstar’s narrative depends on totally unsubstantiated claims about Uber efficiencies driven by “network effects”

Morningstar’s central claim that Uber efficiencies are driven by “network effects” is false. Worse, Morningstar’s attempt to imply that “network effects” could explain either a rapid $4.5 billion profit improvement or profitable growth at 39% CAGR over five years is complete nonsense.

Morningstar’s paper mentions “network effects” over 40 times. Evidently they believe the use of Silicon Valley buzzwords has a talismanic effect and eliminates the need for economic evidence.

The authors fail to explain where these alleged network benefits come from, how they actually drive cost efficiencies or increased revenue, or whether they create any material, sustainable advantages over competitors. Morningstar presents absolutely no evidence linking any operating efficiencies to the dramatic revenue growth and profit improvement they are claiming. In keeping, they cannot explain why these effects have failed to produce profits over the past nine years, let alone why they will suddenly gain immense power. Nor do they provide any other examples where a new entrant with “network effects” was able to drive incumbent operators out of business and create $100 billion in corporate value.

They claim that “Uber’s network effects benefit drivers and riders; the benefits for each create a continuous virtuous cycle” and cite Facebook’s network effects as a comparable example of network benefits for consumers.

But Uber has none of Facebook’s network economies, where (following what is known as “Metcalfe’s Law”), each additional user makes the company and its platform more valuable to all other (existing and potential) users.[8]

Uber users may like its prices and service, but they do not care how many other people download the app. Aside from purely digital companies like Facebook and Ebay, no consumer companies with app-based platforms have created the tens of billions in corporate value that Uber falsely attributes to “network effects.”

Similarly, if Uber “network effects” created meaningful (and steadily increasing) benefits for drivers, there would be corresponding evidence of better (and rapidly improving) driver economics and work satisfaction.

In fact reports of drivers having to sleep in their cars are becoming more common. Driver take-home pay has fallen below minimum wage in most large cities,[9]and as Morningstar acknowledges, 96% of drivers quit Uber within the first year.[10]

“Network effects” supposedly explain Uber’s capacity utilization advantage, as they eliminate the “need for bright yellow cars to roam about, waiting for a hand in the air to match with it.” In fact Morningstar has no evidence that Uber has a capacity utilization advantage over traditional taxis that could have any material bearing on its growth and profitability forecasts. The only relevant data Morningstar actually provides shows Uber utilization falling 7% in 2017.[11]

Morningstar badly misrepresents the economics of Uber’s drivers

As readers of this series, know, the Uber/driver split of gross passenger fare revenue is critical to any discussion of Uber’s economics and profitability. To stem losses, Uber had been unilaterally increasing its “commission” from 20% to 30% while also eliminating many driver incentives. These changes resulted in the driver share falling from 83% in 2014 to 68% in 2016. That increased Uber’s EBIDTAR contribution by over $2.6 billion, and improved EBIDTAR margins from (118%) to (50%). But Uber would have still had triple digit negative margins if the driver share had remained above 80%. The only major progress Uber has made towards a breakeven P&L required pushing driver compensation to (or below) minimum wage levels.

Morningstar’s forecast ignored the importance of the Uber/driver revenue split to Uber’s bottom line, and asserted that 21-22% Uber shares (similar to 2017 actuals) will remain stable for the next ten years.

Even though it would be arithmetically impossible for both Uber and drivers to increase their share at the same time, Morningstar set that forth as a scenario. The report made the absurd claim that as pressure to increase driver pay increased (as seems likely given tightening labor markets, regulatory pressures and widespread driver recognition of the raw deal they’ve gotten), Uber would respond by simply increasing its share of passenger fares from 20% back towards 30%.

More fundamentally, this intelligence-insulting narrative illustrates either Morningstar’s ignorance of Uber’s business model or its willingness to flagrantly misrepresent it.

Morningstar insists Uber is not a transportation company but a software company, and its software serves as a passive intermediary between passengers and wholly independent drivers. Aside from eliding questions about depriving drivers of basic labor law protection, Uber drivers are not economically independent; Uber’s business model ties them into vehicle financing obligations. Uber could not have imposed $2.6 billion in unilateral compensation cuts on truly independent drivers.

The fiction that the drivers are “independent” conceals the fact that Uber’s drivers contribute 83% of what passengers are paying for, and that the overall Uber-driver business model cannot survive unless both parties can earn satisfactory returns on what they contribute to the business.

Morningstar’s narrative badly misrepresents the impact of Uber’s autonomous car and flying car programs on its corporate value

Morningstar provides detailed arguments about Uber’s long term potential to exploit businesses such as autonomous vehicles (AVs) and flying cars (Uber Elevate) but then totally excludes the cost of developing them from their valuation estimates. One might argue that these investments will increase the value that IPO investors will get (long-term potential greatly exceeding near-term costs) or that they will actually decrease Uber’s value (the low probability of far-off returns doesn’t justify the costs and risks), But it is unacceptable for Morningstar to claim a specific ($110 billion) Uber value while pretending none of these issues exist.

Morningstar defense of Uber’s AV program rests on Dara Khosrowshahi’s false claim that autonomous vehicles would allow Uber to reduce the price of rides by 60%.[12]Drivers do account for roughly 60% of the costs of a traditional taxi operation, but the introduction of autonomous vehicles would significantly increase other costs (vehicles, databases, communication links, machine leaning systems, vehicle planning and control systems, new safety/insurance models, etc).

More important, a shift to autonomous vehicles would also require Uber to become a highly-capital intensive business, since it could no longer push all the costs and risks of AVs onto its drivers. It is not clear whether Uber has the management skills or strengths appropriate to the challenges AV or flying car businesses would pose. Since Morningstar ignores the questions of what would be required to succeed in those businesses or how long it would take to determine who the competitive winners would be, it is impossible for a reader of this report to have any idea whether Uber’s current investments make any sense.

Uber has openly acknowledged that Khosrowshahi’s narrative is the primary driver of its AV and flying car investments. As one interview reported, “… working on flying cars is important to the Uber narrative, according toUber COO Barney Harford.. ‘I think being able to demonstrate [to investors] that we are a company that is able to deliver multiple growth engines and is able to incubate and execute upon a few different opportunities, I think that’s a really important story.’”[13]IPO narrative imperatives have led Uber to claim it can have flying cars in full revenue service within five years, a ludicrous claim given the immaturity of the technology, the huge public safety and infrastructure implications, and the well-established rigor of aviation regulatory requirements.[14]

Khosrowshahi has acknowledged that his original plan after joining the company was to cancel both programs given their huge cash drain and uncertain returns, but changed his mind once he recognized that the IPO pitch required giving investors the prospect of growth beyond ridesharing.[15]That narrative transforms Uber’s rideshare ordering app into the gateway to all forms of urban transport, and transforms Uber into “..the Amazon for transportation.”[16]

Lots of investors might be interested in investing in the “Amazon of transportation”. But a good-faith valuation analysis of this opportunity would examine whether Uber’s economics gave it the same potential to profitably expand across new transport modes that Amazon demonstrated when it expanded from bookselling into other ecommerce fields. Morningstar fails to provide that legitimate valuation analysis.

Morningstar’s evasiveness here is designed to prevent its readers from understanding a fundamental contradiction in Uber’s pursuit of a $100+ billion valuation. There are many things Uber could do to improve short term profitability, such as abandoning unprofitable overseas markets, eliminate spending on AVs and flying cars, but all of them would directly undermine their long-term growth narrative. Hypothetically, one could show strong 2018-19 P&L improvements, or one could show the investments Uber thinks will be required to become the “Amazon of transportation” but under no circumstances could one show both.

The report shifts Morningstar from independent analysis of Uber to proactive advocacy on behalf of Uber’s shareholders

Regardless of the size of the final estimate, even if it were supporting a strong, positive valuation, the text explaining a bona fide valuation analysis would show how it had considered a wide range of objective evidence (historical financial trends, sensitivities to external factors, comparisons showing how claimed strengths/risks affected similar companies) supporting it and that it had critically scrutinized key company claims.

Morningstar’s narrative did not do any of these things. Reading it one gets the impression that it started with its bottom-line conclusion (a $110 billion valuation), worked backwards and plugged numbers into a spreadsheet that would produce that bottom-line, and then filled its paper with unsubstantiated but pro-Uber opinions roughly in line with its positive valuation.

Much of Morningstar’s story line repeats longstanding elements of Uber’s talking points uncritically, without any attempt to provide objective supporting evidence. Thus Morningstar’s report should not be seen as independent analysis designed to help investors but as proactive Uber advocacy, in support of the number 1 priority of current Uber shareholders, an IPO valuation north of $100 billion.

Uber wants people to believe that its growth was driven by powerful operational efficiencies derived from things like “network effects” “capacity utilization” and “synergies between ridesharing and food deliveries.” Morningstar simply repeats Uber’s preferred messaging, without providing any evidence that things are real or economically important, or explaining why they won’t produce profits until Uber’s 11th year of operations.

Uber wants people to believe it is a technology company, and not a company that provides rides in automobiles. Morningstar simply repeats the claim that Uber is a software company, and that independent drivers freely chose its software because of the huge benefits it provides them, without showing any tangible evidence of these benefits, or explaining why their well-documented experience blatantly contradicts the idea of driver benefits.

Morningstar emphasizes that “ridesharing” is significantly different economics than “taxis” even though it has not done any analysis of the competitive economics of the two approaches.

Morningstar then claims that the companies with the most comparable economics are Facebook, Microsoft and Google. This serves Uber’s theme that its IPO value should not be based on comparisons with any other transportation companies but only with reference to the most elite companies in the Silicon Valley.

Morningstar does not explain why Uber is many years behind these “most comparable” companies in terms of the scale economies needed to convert growth into profitability, in terms of generating enough positive cash flow its core business to fund all its future growth, in terms of achieving dominant market positions or being able to go public.

As with any propaganda-based approach, distracting attention from the issues Morningstar (and Uber) don’t want investors to think about is just as important as the positive impressions that one is trying to create.

Morningstar presents no pre-2017 Uber financial results, and heavily emphasizes size metrics, in order to distract attention from the nine years of huge, steadily increasing losses in pursuit of growth-at-all-costs. This also allows Morningstar to conceal the huge discrepancy between recent P&L trends and the sudden $4.5 billion profit spikes it has forecast for 2018 and 2020. Morningstar asserts that “network effects” fully explain Uber’s ability to capture share from yellow taxis in Manhattan, in order to distract attention from the huge subsidies that actually created Uber’s price and service advantage.

Although Morningstar’s methodology statement opens with “At the heart of our valuation system is a detailed projection of a company’s future cash flows” its report does not actually include projections of Uber cash flows. These would seem to be critical to any investors trying to evaluate Uber’s future value, but Morningstar wants to distract attention from the nearly $11 billion in cash[17]Uber has already burned through so far, the continuing operating losses Uber needs to fund, and the huge cash requirements of its longer-term growth opportunities that Morningstar failed to analyze.

The Morningstar does mention a variety of widely-known negative Uber issues (low entry barriers in ridesharing, the failure of Uber China, the pedestrian killed by an Uber AV, growing legal/regulatory threats, etc.) But it ignores other important issues such as Uber’s open pursuit of quasi-monopoly industry dominance and artificial market power, the huge sensitivity of the P&L to driver compensation changes, and Uber’s inability to produce urban car services as efficiently as the traditional taxi operators it has been driving out of business, and makes only passing reference to its largely dysfunctional management and corporate culture.

Morningstar’s worst case scenario does not consider the possibility that it may take years longer to reach breakeven, or that full-time Uber drivers win the labor law protections of other full-time employees, or that its autonomous and flying car programs fail to ever generate positive cash flow. The only downside Morningstar quantifies is that 2018-22 Uber revenue grows at a 25% CAGR, instead of 39%.

It is not obvious as to why Morningstar chose to publish an Uber IPO valuation estimate a full year before they go to market, although the report would seem to be highly useful for Uber as its builds its own valuation PR/propaganda narrative. The Morningstar report will allow Uber to claim that “independent” analysis by an “objective” financial firm has directly endorsed the idea that Uber’s 2019 IPO might yield a valuation north of $100 billion and that many of the justifications Uber is likely to use have been independently vetted. One can expect that as the actual IPO approaches, more seemingly “independent” voices will endorse the idea that Uber has a value north of $100 billion, with many years of robust, highly profitable growth ahead of it.[18]Given all of the problems and deficiencies documented here, it is important that no one ever grant any credibility to the profitability, valuation and long-term growth arguments Uber or others might make because Morningstar reached similar conclusions.

_______________

[1]Kolhatkar, Sheelah, “At Uber, a New C.E.O. Shifts Gears”, New Yorker, 9 April 2018. https://www.newyorker.com/magazine/2018/04/09/at-uber-a-new-ceo-shifts-gears?currentPage=all

[2]Source references for evidence and arguments presented in prior parts of this series will not be repeated here. All of the central arguments about Uber’s economics, and Uber financial results through mid-2017 are documented in my Transportation Law Journal article Will the Growth of Uber Increase Economic Welfare? 44 Transp. L.J., 33-105 (2017) which is available for download at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2933177 Uber financial results for full year 2017 and the first quarter of 2018 were presented in this series in Part 13: Even After 4Q Cost Cuts, Uber Lost $4.5 Billion in 2017 (16 Feb 2018) and Part 15: Uber’s Q1 Results – Reporters Show They Aren’t Up to Reading Financials (24 May 2018)

[3]The evidence showing that Uber’s communication efforts fit academic definitions of propaganda, and the actual development of Uber’s PR/propaganda narrative over time is laid out in part IV of the Transportation Law Journal article.

[4]The 48 page report can be downloaded at https://pitchbook.com/news/reports/3q-2018-morningstar-pitchbook-uber-may-pick-up-investors-along-with-riders-in-its-ipo. The authors are listed as Ali Mogharabi, Julie Bhusal Sharma, Asad Hussain and Brian Colello. Three of the four work for Morningstar; for the sake of brevity I will refer to this as the Morningstar report instead of the Morningstar/Pitchbook report.

[5]It is not possible to prepare a similar table showing year-over-year changes in total revenue versus total expenses because Uber has never disclosed total expense or net income data for 2016.

[6]I sent Morningstar’s authors (via email) the table shown here and asked them to explain how their of 2018 and 2020 forecasts could diverge by $2+ billion from the P&L trends in every other year between 2015 and 2022. Their answer completely ignored the question I had posed and simply repeated the following text from their report: “Besides the driver take rate, which is netted out of Uber’s net revenue, we believe a portion of Uber’s cost of goods sold is fixed and revenue will grow at a faster pace than these costs, leading to gross margin expansion. We also project that Uber will benefit from operating leverage in the years ahead. The firm might be able to increase revenue at a faster pace than selling, general, and administrative costs, especially in the sales and marketing lines, while also having to spend relatively less on operations and support costs. However, we anticipate that R&D will remain elevated as Uber invests in new ventures, resulting in only slight declines in R&D as a percentage of net revenue.”

[7]Given the failure of Uber China Morningstar does exclude China ridesharing demand from its claimed “total addressable market” but it did not exclude other markets Uber has already abandoned (Russia, Southeast Asia) or is rumored to be failing badly (India) markets where it has been totally blocked (e.g Japan), or where it is facing much better financed competitors such as Didi Chuxing. Morningstar fails to disclose what portion of its future Uber revenue estimates are domestic and foreign.

[8]Andreessen Horowitz, All about Network Effects, 7 March 2016; http://a16z.com/2016/03/07/all-about-network-effects/ Noah Smith, Uber Still Doesn’t Look Like the Next Facebook—it lacks the powerful network effects that compel customers to stick with it, Bloomberg 6 June 2017; https://www.bloomberg.com/view/articles/2017-06-06/uber-still-doesn-t-look-like-the-next-facebookMany companies have app-based platforms that generate no network economies. For example no airline passenger or pizza consumer cares how many other people use the American Airlines or Domino’s Pizza app. Consumers may derive benefits from the size of these companies (enabling them to offer more flights or take-out locations) but those are scale economies, not network economies.

[9]Mishel, Lawrence, Uber and the labor market: Uber drivers’ compensation, wages, and the scale of Uber and the gig economy, Economic Policy Institute, 15 May 2018; https://www.epi.org/publication/uber-and-the-labor-market-uber-drivers-compensation-wages-and-the-scale-of-uber-and-the-gig-economy/

[10]Amir Efrati, How Uber Will Combat Rising Driver Churn, The Information,20 Apr 2017; https://www.theinformation.com/articles/how-uber-will-combat-rising-driver-churn

Chantel McGee, Only 4% of Uber drivers remain on the platform a year later, CNBC, 22 Apr 2017 https://www.cnbc.com/2017/04/20/only-4-percent-of-uber-drivers-remain-after-a-year-says-report.html

[11]This is shown in Morningstar’s Exhibit 11.The issue isn’t that Uber might not have some utilization advantages in some situations, but that there is no public evidence supporting the broader claim, and no evidence that it has a powerful impact on overall cost competitiveness.

[12]Amir Efrati, Uber Seeks Deal for Waymo Cars, The Information5 Mar 2018

https://www.theinformation.com/articles/uber-seeks-deal-for-waymo-cars

[13]Johana Bhuiyan, Uber wants to sell a flying car service in five years — but we don’t know if the tech (or the law) will happen by then, Recode 11 May 2018 https://www.recode.net/2018/5/11/17332646/uber-flying-car-vtol-barney-harford

[14]Bhuiyan 11 May, also Sean Captain, How Uber Plans To Get Flying Taxis Off The Ground, Fast Company, 2 May 2018. https://www.fastcompany.com/40522758/how-uber-plans-to-get-flying-taxis-off-the-ground

[15]“To Kalanick, the autonomous-driving unit was the jewel of the company. When Khosrowshahi took over, he considered closing the program, since it could potentially cost billions of dollars.” Kolhatkar, Sheelah, “At Uber, a New C.E.O. Shifts Gears”, New Yorker, 9 April 2018. “Khosrowshahi now believes Elevate fits into Uber’s mission to be a platform for all types of transportation.

“What you’re trying to do as a company is take growth that is coming in today and stage them and invest them in forward opportunities down the road … opportunities four years and six years and eight years from now,” he said.” Johana Bhuiyan, Uber’s CEO says he’s willing to lose money on flying cars — at first, Recode 9 May 2018. https://www.recode.net/2018/5/9/17337764/uber-ceo-dara-khosrowshahi-flying-cars-elevate-vtol “

[16]“Khosrowshahi says he wants to transform Uber into a multi-modal company that connects people to bikes, buses, car rentals, and maybe even flying taxis” Andrew Hawkins, Uber CEO: Our Future Won’t Just Be Cars, The Verge, 15 May 2018. https://www.theverge.com/2018/5/15/17340064/uber-ceo-dara-khosrowshahi-interview-elevate-flying-cars “..we wanna kinda be the Amazon for transportation.” Swisher, Kara, Uber CEO Dara Khosrowshahi at Code 2018, Recode, 31 May 2018 https://www.recode.net/2018/5/31/17397186/full-transcript-uber-dara-khosrowshahi-code-2018

[17]King, Ian & Newcomer, Eric, “Uber Spent $10.7 Billion in Nine Years. Does It Have Enough to Show for It?” Bloomberg, 6 March 2018 https://www.bloomberg.com/news/articles/2018-03-06/uber-spent-10-7-billion-in-nine-years-does-it-have-enough-to-show-for-it

[18]This is consistent with Uber PR/propaganda techniques previously documented in this series.

Part Eight of this series (Brad Stone’s Uber Book “The Upstarts”– PR/Propaganda Masquerading as Journalism, 16 Feb 2017) describes how Uber got a seemingly independent journalist to write an entire book promulgating Uber’s main PR/propaganda narratives while ignoring all contrary financial and economic evidence. Part Six (Latest Data Confirms Bleak P&L Performance While Stephen Levitt Makes Indefensible Consumer Welfare Claims, 12 Jan 2017) illustrates how Uber paid a seemingly objective outsider to make (largely specious) claims about how Uber created huge consumer welfare benefits, and then how press reports and articles by Uber supporters amplified the findings and created the appearance that it was a widely-held consensus view.

I absolutely love this series. I routinely advise friends online to “Google Uber Horan Naked Capitalism. Bring a Snicker’s you’re gonna be a while.” Are they going to be able to pull off this huge Con?

Reminds me of the honest analyst in London whose advice report on a dodgy IPO was headlined with the clue in the cap letters

Can’t Recommend A Purchase

(ie CRAP)

Thank you, JJ.

I recall that, too, but not the name of the firm intending to float or the analyst.

Sadly, there are few characters and independent minded souls left in that community. One wonders what impact the new investor protection rules (MiFID II) will have on the producers and recipients.

Yet another excellent analysis by Mr. Horan. He is such an expert on transportation economics, and his writings on Uber Cab so devastating, that I am genuinely surprised he has not ended up committing suicide with two bullets in the back of his head, the way people who get in the way of the Clintons tend to go.

Uncalled-for. Yves?

g-d forbid

Q? That you?

Uber is basically an app and a franchise.

I wonder what factors made it possible to blow 4 Billion USD on developing a rendevous-type app and running a franchising operation (which is not exactly rocket-science also)?

The IPO in 2019 should be interesting to watch from a safe enough distance.

$4 billion? That’s only one year’s losses! 2017 was $4.5 billion, to be more precise.

See:

https://www.bloomberg.com/news/articles/2018-03-06/uber-spent-10-7-billion-in-nine-years-does-it-have-enough-to-show-for-it

This article is good stuff.

On another note, it looks like Yves is back amongst the living!

Thanks for taking notice!

Problem is, Yves, when you’re ‘en forme’ your output is so prodigious that I can’t keep up! To say nothing of keeping up with Lambert and Jerri-Lynn! It’s like waking up every morning and being presented with a luscious smorgasbord where you want to eat everything but you just know you won’t be able to do it.

Your being ‘under the weather’ gives me some much-needed breathing space. (Not that I am wishing ill-health upon you. Just a few days of vacation, maybe.)

Fajensen, I would describe Uber Cab (its original, or true, name) more as a successful scheme that used computers to steal cars from naïve broke people (and capital from rich VCs that’ll never be returned). The drivers are basically driving for free, spending heaps of time to sell their cars a bit at a time. Better they just drive their cars down to Greasy Bob’s Gently Used Lemons, sell them for what they can get, and walk home. At least they’d have their time free for job hunting and then working.

If Morningstar’s “analysis” is this bad on Uber, should anyone trust them on anything else?

Since the Morning Star is the name of the newspaper of the British Communist Party, maybe they commissioned the wrong organisation by accident and this is all a secret plot to destroy capitalism.

They don’t even seem to understand how the taxi business works.

First of all, Ubers do roam all over the place all the time waiting for a fare, and in numbers much larger than those of cab fleets. But cabs don’t just roam around waiting for a hand in the air, they have these people called dispatchers and they tell the cabs where to go. If a cab gets a bell from the dispatcher, you can wave your arm in the air until it falls off but the cab is not going to stop on the street for you. Which is pretty much what uber does – they let drivers know where to go to pick people up. They are nothing but a glorified dispatching service. They took an existing concept that works pretty well already and made it somewhat more convenient with a mobile app. But Morningstar couldn’t be honest about that, not with Uber claiming to be a software rather than a transportation company.

Travis Kalinick could have made a LOT of money by selling his app to existing cab companies to improve their dispatching. But he decided it would be a lot more fun to run this long con instead and see if he could get away with it.

Two thoughts: every I-bank must be salivating over the fee potential of a $100BN IPO, so expect more garbage from them. Never let actual facts get in the way of a chance to make money.

Second, I have prior experience with Pitchbook in the Fintech space. They publish similar cheerleading, factually challenged junk, in the guise of analysis, to promote their business. They have no credibility. Their business model seems to be tell the VCs and PE firms what they want to hear.

Their name suggests as much. At least they’re being “honest.”

On a more positive note for Uber, and a horrendous one for New Yorkers: one of the unspoken pre-suppositions for Uber’s potential success is the destruction and abandonment of local mass transit, which is rapidly proceeding apace in NYC…

It may be that the dumb money funding Uber isn’t so dumb. Perhaps they regard the destruction of public services and public goods as a duty, or even a moral good, and well worth the money.

Perhaps they regard the destruction of public services and public goods as a duty, or even a moral good, and well worth the money.

Correct. Bill Gurley at Benchmark Capital came up with the idea for the Uber app and articulated precisely those reasons for doing it after he couldn’t get a cab immediately in San Francisco.

He then chose one of the sociopathic dupes he had in his back pocket — Travis Kalanick — to front as CEO. Gurley’s ability to take a fairly negligible idea like that app and successfully set it up as a *technology* company — let alone turn it into what may be the first TBTF unicorn, which is where Uber could be going — takes a mastery of the long con that may be sociopathic but is anything but dumb.

Yikes.

They will have to spend a lot more on PR and prop before the IPO. More difficult, will be to silence critical voices.

This goes well beyond kool-aid. Something has been smoked or injected.

Great piece again. I’m sure the clear insight of Hubert will be widely ignored, Uber will IPO, and retail investors will get stuck holding the bag. That probably includes myself in my piddly little 401k.

On the other hand, Elon Musk might be happy…Uber would probably replace Tesla as the most shorted stock.

Soooo, all the board want to take the company public as they want to cash in and Khosrowshahi has been promised a $100 million bonus if Uber goes public at $100,000,000.000 valuation next year. No place for a Cassandra there. All I can say is that if Khosrowshahi can pull it off, I know where he can earn himself another $100 million bonus – by taking Saudi Arabia’s Aramco public as well. My own guess is that Uber blows up first after outsiders get a chance to look at the books. Then after that maybe Morningstar can go join Arthur Andersen.

The CRAP acrostic was the work of a UBS analyst commenting on the Maxwell Communications float. Sacked for being too brutally honest, of course.

UBS is another fine acronym!

Well, it worked for Tesla.

Reminds me of Peter lynch aphorism of invest in what you know….anyone can be an uber driver or good chance an uber driver will talk your ear off if given a chance.

Uber still relies heavily on new driver subsidies and passenger promotions even with its cash burn.

There is value in the model, but not at $100b..and not with its current fare structure, which grosses (not net) drivers barely more than the IRS standard mileage deduction

Horan totally ignores Uber’s secret plan to buy Tesla and take it private!

It’s going to electrify the stock price, $100BN will look like Trump change.

Think of the synergies the dynamic duo of Kalanick and Musk could bring to such an enterprise…

The business models are so similar ( Burn cash, Blow smoke) that merging the firms into a seamless hole ( Do Event Horizons have seams?) should be a no brainer.

Horan’s analysis is just yummy!

My kids and grandkids and their peers have made ‘uber’ into a verb. As in, ‘Cassandra’s working late, but we don’t have to pick her up, she can just uber home.’

I remember a decade or two during which we used ‘Xerox’ as a verb; ‘sweetheart, xerox three hundred copies of this report before lunch, will ya.’ And the University of Rochester’s endowment fund rode high on the strength of its Xerox holdings. The company still exists, but not at the level of its former heady glory.

And “xerox” became a synonym for “copy” regardless of the actual brand of copier – “Go xerox this!” even if the copier was actually a Canon. Similar to how in some areas you can order any soft drink and call it a Coke.

Uber might last longer as a verb than it does as a company.

It looks to me as if the phenomenal wealth accumulated at the top has resulted in massive distortions in every material, and psychological dimension, leaving most of us unable to measure, let alone navigate.

So everyone is basically lost, unable to chart a satisfying course, we can’t find our way home.

The love of money, worship really, has resulted in a sort of mass psychotic break on the part of the ‘investing class’ that leaves them chasing, or more properly, being chased by their own unreasonable expectations of return on their investments.

It is interesting to notice that the 1% and their minions, the 10%, have been castigating the rest of us for clinging to the ‘unrealistic’ expectations that Social Security can ever provide the promised economic support it was, and is designed to deliver, and that universal healthcare is possible, while they, on the other hand, are busy burning immense piles of money in an effort to reinforce the various illusions that underpin the neoliberal consensus of endless growth.

There is no greater irrational sense of entitlement, than that surrounding the expectations of the investing class.

When traffic in New York grinds to a halt due to a tsunami of desperate Uber drivers clogging the streets, will the governor send out the National Guard to enforce the rights of investors opposed to a regulatory cap, by directing traffic to clear the way for Uber?

This is the end result of infinite wealth inequality, the ability of money worshippers to enforce their irrational expectations with the captured power of the government, and media.

The word that comes to mind is momentum.

What happens when the irresistible momentum of greed runs into the immovable object called reality?

Breaking news;

How much suffering will Turkey endure due to Trumps threat to cancel the sale of F-35 fighters, the most expensive useless product ever conceived?

You can’t make this stuff up.

The shear momentum of greed has carried us into a parallel universe where red ink is black, and investing in Uber is going to return double your money…

…or else.

Great comment; perfect accompaniment to Hubert Horan’s very fine post. Thank you.

And that makes the case for another way Uber could become profitable: the average person who wants to own a car to drive is regulated and/or priced out of existence.

Uber is a canning ‘trading sardines’. We no longer have much in the way of a true investing class. This is the great age of speculations and tulip madness.

Trying to remember where I learned the term “trading sardines”. Was it Liar’s Poker?

The investor class appears to be hoping for another Amazon here.

The issue is that Amazon was cash flow positive. This is also a criticism leveled against Tesla.

https://realmoney.thestreet.com/articles/08/12/2016/comparing-amazon-then-tesla-now

One big problem – Uber does not have a sustainable business model. They have no path to positive cash flows.

As for no F-35s for Turkey, that may be a blessing in disguise. It is an expensive and if DOT&E (the Pentagon’s independent testors) are to be believed, riddled with flaws.

Wow… This is Great Stuff! However, over the years I have learned not to misunderestimate Wall Street’s ability to market financial securities when there is a big payday for the underwriters and their associated services network, and particularly when they have their own seed money in a deal. In this instance, setting aside Mr. Horan’s well-founded criticisms, the flying cars are particularly captivating conceptually. Somewhat akin to when pigs fly?…

Regarding Morningstar’s analysis, I am reminded of author Tom Wolfe’s observation regarding the Favor Bank. Generally, this type of thing doesn’t occur in a vacuum.

This analysis begs the question: is there a way for Uber to float an IPO that doesn’t look like securities fraud?

Does it matter? When there is no enforcement, there is no law!

Another year, another nimitz unit sunk. Oh well.

The dumb money wants to be bailed out by dumber money.

Once again a great piece. Thanks Hubert.

I routinely send these to some of my colleagues who still believe in Technological

Transcendence and the Magic of Silicon Valley.

“Morningstar insists Uber is not a transportation company but a software company, and its software serves as a passive intermediary between passengers and wholly independent drivers.”

So with the righr PR and lobbying, if medical diagnostic software companies ramp up their game, they can allow people in the future to bypass regualtions and become independent medical doctors? The sociopathic environment exists where life and death issues and services are not differentiated from industries like “widget” production or financial services.

You may argue that is comparing drivers to doctors is a false analogy, but Sillycon Valley has mastered that type of jibberish selling their deregulation mantra to regulators amd legislators, easy and willing to be manipulated.

And while the article points out that PR will be key in Ubers drive to go public, the identity of those major shareholders wanting the big buyout return will also be paramount.

Who they are will matter greatly to the workings of “the market.” Or does anyone doubt that unicorn valuations have a lot to do with social connections?

UBER IS IN MELTDOWN

Uber’s meltdown continues. Mass exodus of drivers because they soon wakeup and realize they were lured into a sucker deal. The average driver can not even net minimum wage after paying his operating expenses and the diminished value of his personal car. Uber take 30-40% off the gross fare. Intense social media recruiting of drivers is deteriorating as the public is becoming educated to the sucker deal.

The exodus of Uber executives continues as they too wake up and do not want their name and resume tainted as being part of a toxic culture.

Net income continues to become negative as the toxic business platform is structured not to make a profit. There is absolutely no hope of ever making a profit. Banks and investors have finally realized this.

Massive lawsuits continue to be filed weekly globally. Uber’s burn rate is expected to top 90% shortly. No more investors, no more credit lines, only increased losses. Cash is burning recklessly.

No chance of an IPO ever. Uber has never had a certified audit of its stock sales and financials. SEC requires the last three years of certified audits by an outside accounting firm. No honest accounting firm nor securities law firm are going to put their signature on a S-1 registration or “comic book” prospectus .

SEC Chairman Jay Clayton, would never pass on such an issue. ( He can not be bought)

No company can operate unregulated in a regulated industry. Uber and Lyft refuse to comply with the US laws, let alone state and municipal laws. Their guise as an app company” only” is over. They are a Motor Carrier who CONTROLS all operations portal to portal, including the driver, the app, the money, hiring/firing, rating/scoring systems, pays the insurance premiums, has electronic employee handbooks for the drivers,

Uber is an employer of drivers and the driver is an employee whose rights have been grossly violated. Uber does not pay payroll taxes, labor costs, workmen’s comp, income taxes and sales taxes where applicable, ad valorem taxes. Tax evasion galore. Absolutely no labor benefits are give to the employee driver.

The latgest scam has been the lure of Mr. Son and Softbank in selling them 15% of the Uber worthless, unregistered, private stock which has been diluted over 16 times. Of the $9B purchase, $8B went into the pockets of the early investors and co-founders, namely Travis Kalanick, ex-CEO but still board director, where he pocketed $1.4Billion dollars and Tusk, Gurley, Camp, Graves, Salazar, and Goldman Sachs cashed in. Charley Ponzi must be smiling looking up from hell. Only one billion dollars was left for the Uber coffers and that has been burnt.

Uber’s meltdown is headed to Chapter 7 which is all that is left for them. The sooner the better before the FEDS come.

Does Uber pay the insurance premiums for the drivers? I didn’t know that. I believed the drivers were either paying their own insurance or were simply not carrying the insurance required for a taxi.

Uber has to cut out the 35% or so paid to drivers. How could they do that?

Kalanick was correct. The autonomous driving product is essential for any future profitability. Let’s assume it is a large software effort.

Billions of Dollars? In software? That’s another F35 effort. Unlike most I see the F35 software as an Operating System for airplanes, and operating systems are expensive to create, but form a huge barrier to entry for competition.

Conceptually I conceive an Aircraft operating system easier than a vehicle operating system. There’s less complexity in the air, and take off and landing are under very controlled conditions.

There are fewer bicycles, dogs and children on runways.

User and others are trying to produce an operating system for Road Transport.

1. It will be late ($$$ and cash flow)

2. It will have bugs ($$$, cash flow and lawsuits)

3. It faces the “3 release problem”. Release 3, which is what’s need to actually do the job will be, shipped three to six years after release 1.

To go public the company has to be between Release 1 and Release 2, or it is has little of value.

If first to market, That level of working software, as a market monopoly, could be worth $100,000,000. If third of fourth to market, not so much.

Lease the software to the car manufacturers, and collect a software license fees. The remainder of their current efforts with drivers and cars is just ongoing testing. Technology and Market testing.

Can someone point me to a pre-IPO prospectus that contains:

“…pro-forma forecasts of profits and cash flows consistent with the claims in the narrative.”

?? I am not sure I have ever seen one in a

If Uber is early to market with self driving software, they dominate that space, and Uber becomes the “operating system” for transport, with huge royalties from all car manufacturers.

The Microsoft of transportation.

That might support a 100 Billion valuation.

I’ve taken to checking the news every now and then for Uber after following this series. It usually doesn’t disappoint. There was this one from four months ago on the flying car plans:

And of course another one from the Uber exec search playbook, where you leak the name to the media while you’re still negotiating and before their current employer knows, it runs under an “Uber to hire X for position Y” headline, and the candidate promptly backs out.

Barry Ritholtz comes to Uber’s defense. I don’t think he has read Hubert Horan.

http://ritholtz.com/2018/08/misunderstanding-ride-hailing-apps/

Re Uber Cab’s “insurance”: I have heard that it is some foreign-domiciled company that has never actually paid out a claim for Uber Cab passengers or driver employees. Remember the Matt Damon/Clair Danes movie “The Rainmaker”, with the medical insurance company “Great Benefit”? That fictitious company denied all claims, with the business strategy of instead using lawfare to delay all legitimate claims eternally, commonly until the plaintiffs either die or go broke and give up. It’s kind of analogous, where Uber Cab has done a VERY few hush-hush settlements for open-and-shut cases, mostly after huge needless delay and mostly for less than would be the standard compensation.

Oh, and there are multiple exceptions written right into the coverage contract as well. Since essentially all personal motor vehicle liability insurance explicitly precludes coverage while providing livery service (as all cabs, legal or not, are doing), that means that driving for Uber Cab, or being a passenger in one, is inevitably driving around in a fully uninsured state. No coverage for medical expenses or lost work from injurious accidents, no vehicle damage coverage, or getting sued by whomever the (likely groggy from insufficient sleep) driver runs over? That could be a VERY expensive “side hustle” or discount-price ride home from the airport or bar.

A driver in Minneapolis was involved in an accident immediately after dropping a customer, Lyft insurance refused his claim because he wasn’t doing Lyft business at the moment, (no passenger)

I believe his own insurance didn’t cover the loss due to his using the car for business, and being logged into Lyft app at the time.

Car was totaled, driver left holding the bag for $15,000 loss.

My guess is that he would have had the same outcome with Uber, (He also drove for Uber)

The latest news is that uber CEO has announced the emphasis will no longer be on cars but on bikes & scooters. Basically admitting to the congestion problem & saying their business & their drivers will take a hit financially but bikes & scooters are the future because they will make shorter journeys quicker & easier.

I had to laugh as seriously this is 3rd world stuff but more grist for the mill or more ponzi bait. Who seriously can buy this BS?

If they flood city pedestrian walkways with scooters it will be nightmarish ie lots of accidents. And, riders on bikes are always in danger of serious accidents.

I was recently in Singapore a city vacated by uber however I did witness the problems being experienced by bike hire companies. Anyone who knows Singapore & Singaporeans sees them as clean law abiding ie no graffiti or mess but these bikes were a blight on the landscape. They were left anywhere & everywhere restricting walkways. in drains & even saw them up trees.