By Brian Nolan, Professor of Social Policy, Department of Social Policy and Intervention, University of Oxford. Originally published at the VoxEU

The narrative that globalisation and technological change have been the central forces hollowing out the jobs market, squeezing ‘the middle’, driving up inequality, and undermining growth is frequently taken to apply across the rich countries. This column presents a set of country case studies of the US alongside nine other rich countries that highlights just how varied their experiences since the 1980s have actually been. Country contexts really matter, and policy responses must be framed in light of the institutional point of departure and distinctive challenges each country faces.

Rising inequality is increasingly seen as representing a fundamental societal challenge for the rich countries of the OECD, calling into question the sustainability of their long-standing economic and social models. Tony Atkinson’s Inequality: What can be done?(Atkinson 2015) roots the case for tackling inequality in considerations of social justice, but more instrumental concerns are very much to the fore. Rising inequality is seen as undermining growth as well as concentrating its benefits at the top of the distribution, as the incomes of middle and lower-income households stagnate; this in turn is seen as a key driver of political turmoil as voters reject mainstream parties and anti-elite sentiment is rife. This has led the OECD to put ‘inclusive growth’ at the centre of its work, and the managing director of the IMF to conclude that “reducing excessive inequality is not just morally and politically correct, but it is good economics”.

While this is supported by OECD and IMF studies of trends in inequality and growth across rich countries (e.g. Cingano 2014, Ostry et al. 2014, Dabla-Norris et al. 2015), the experience of the US undoubtedly plays a central role in in current narratives and debates, as it does in economic research on the drivers and impacts of rising inequality. Income inequality has been increasing in the US since the late 1970s, while wages and incomes for ordinary working households have been remarkably stagnant, despite substantial growth in GDP. This underpins the narrative that globalisation and technological change have been the central forces hollowing out the jobs market, squeezing ‘the middle’, driving up inequality, and undermining growth. This narrative is now frequently taken to apply across the rich countries, but a set of structured country case studies of the US alongside nine other rich countries by country experts (Nolan 2018) highlights just how varied their experiences since the 1980s have actually been.

The Evolution of Inequality and Median Incomes

The UK saw overall income inequality rise by as much as the US over this period as a whole, whereas Australia, Canada, Germany, Italy, and the Netherlands saw much lower though still substantial increases, and Belgium, France, and Spain saw little rise in inequality. Increases in inequality were also often concentrated in specific sub-periods, such as the first half of the 1980s for the UK and from 1993 to 2000 in Canada, and so best characterised as episodes rather than consistent trends. Just how important institutions and policy choices have been to these inequality outcomes also becomes more evident when individual country experiences are put under the microscope. To give just a few examples, in Canada redistribution via taxes and transfers offset much of the increase in market income inequality from the early 1980s but not from the mid-1990s. In Spain, market but not disposable income inequality rose in the 1980s as the tax-transfer system became more developed, but it was still relatively ineffective in coping with the severe shock of the Great Recession. In Germany, analysis of the impact of changes in labour and product market regulation and the functioning of wage-setting institutions, as well as in the tax/transfer system, makes clear how much these underpinned the rise in inequality there.

Turning to ordinary or typical living standards, trends in earnings and in real household incomes around the middle of the distribution are key indicators of how these are changing. Putting those indicators alongside trends in income inequality shows that the toxic US combination of pronounced, sustained increases in inequality together with long-term stagnation in wages and middle incomes is the exception rather than the rule among rich countries. Despite a similar increase in inequality, the UK saw much higher median income growth than the US since 1980 (albeit not from the mid-2000s). Australia and Canada also had relatively rapid, if again patchy, middle income growth despite a considerable increase in inequality. Germany and Italy had little income growth and increasing inequality from the late 1980s, while the Netherlands had somewhat higher though still modest growth. France combined little increase in inequality and modest income growth, whereas Belgium and Spain saw greater increases in middle incomes over the decades.

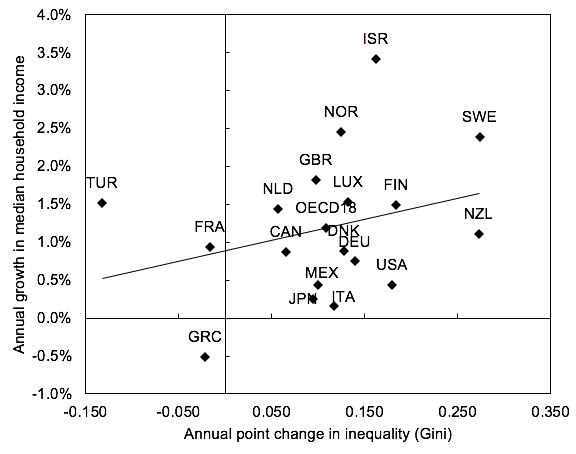

The relationship between changes in inequality and middle incomes thus varies both across countries and over time and is clearly far from deterministic. This is brought out in Figure 1, which examines the association between real income growth at the middle and trends in income inequality over the past 30 years for the broader set of 18 OECD countries for which such long-term series are available. Overall, the association is weak.

Figure 1 Change in median income growth and in income inequality, 1985-2015

Source: Förster and Nolan (2018), Figure 2.5.

This does not suggest that inequality and real income growth around and below the middle are unrelated – instead, they are the joint product of a complex mix of underlying driving forces, institutions and policies, and interactions between them. One can point to specific instances where the linkage does appear particularly clear, both temporally and in terms of drivers. In Germany, for example, widening inequality and stagnation in middle incomes were the joint product of reunification and then the deregulation of product markets followed by the Harz reforms. More generally, though, the relationship is variable and contingent. Increasing concentration at the very top may indeed be central to explaining why middle incomes have seen so little growth over decades in the US, but that cannot simply be transposed to other settings. (The same is true of the divergence between growth in GDP per capita and median household incomes, as described in Nolan et al. 2016, 2018).

The Implications

This has fundamental implications for how one thinks about current challenges. Globalisation and technological change are often portrayed as exogenous forces sweeping across the rich countries, inexorably driving up inequality and forcing workers to accept wage stagnation (and often less security) if they are to hold on to their jobs. Instead, the variation in country experiences shows how much institutions and policy responses matter to how these forces – themselves subject to human agency rather than God-given – play out in the job market and affect household disposable incomes. Wage-setting institutions clearly have a critical influence. The Belgian combination of wages indexed to inflation, collective agreements covering most workers, and a high minimum wage underpinned significant wage growth across the distribution. In Australia, the extension of collectively negotiated employment terms and conditions over much of the work force, together with a very high minimum wage, play a key role. By contrast, the remarkably poor earnings performance of the UK over the last decade is in a context where wage bargaining has become individualised.

Broader welfare state institutions also play a critical role in levels and patterns of employment. Countries with reasonably strong income growth over recent decades have generally combined some increase in real wages with a rise in the overall employment rate and especially female employment. Recent UK and much longer US experience shows, however, that rising female employment when combined with very weak real wages still equates to stagnating living standards. The welfare state is also key to whether the costs associated with increasing women’s employment are borne by the families themselves or socially, with implications for their welfare generally missed by current metrics. Furthermore, countries have made very different choices with respect to the regulation of employment contracts and conditions, offsetting or accelerating the effects of forces making work more precarious.

Country contexts really matter, and policy responses must be framed in light of the institutional point of departure and distinctive challenges each country faces. Promoting economic growth and ensuring that its benefits are transmitted to middle and lower income households need equal attention; redistribution can be strengthened, while wages generated in the market remain fundamental. The current political salience of inequality and stagnation provides a window of opportunity for a fundamental reassessment of how growth and prosperity are being pursued; the US experience should not however dominate in the search for explanations and effective responses.

See original post for references

I think a key element in the impact of inequality is the security of the safety net. I don’t think the US understand how corrosive the high inequality in healthcare is. The prospect of getting sick, losing your, losing your employer-funded healthcare, and then going bankrupt is a real spectre for about two-thirds of the population (civil service rules tend to protect government workers and the top 5% generally have adequate finances. stress is greatly reduced in societies where healthcare is broadly distributed without punitive costs for being outside the employer-based insurance system. It also leads to less risk-taking and voluntary new small business formation because healthcare insurance costs have risen so much.

Similarly, I think the constant nattering and threats to Social Security is another stress-inducer to many people.

I think societies can tolerate quite a bit of inequality if the population does not feel constantly stressed about making ends meet and having some security in their future. I think this is the blunder that many of the libertarian think tanks that have successfully pushed massive tax cuts for the wealthy and businesses are making. They have effectively won at this point, but if in their greed, they go for the entire shooting match, they may lose many of their gains as the populace revolts.

good comment

something’s gotta give here in the U.S.

seems like a lot of government jobs these days are temp, not protected by civil service. i guess that wouldn’t include the cops and the military, though.

” I don’t think the US understand how corrosive the high inequality in healthcare is.”

the poor understand, but they aren’t the ones we elect to run the country.

“the poor understand, but they aren’t the ones

we elect towho run the country.”No pensions, debt due to college, high price of homes, high prices of goods in general, super high price of services (like daycare), all the insurances, permits, certificates, taxes, low wages, etc.

It’s a massive amount of bills & stress.

True libertarianism only works in a free market, and the US is most definietly not a free market. If EVERY corporation paid 0 taxes, them fine. But its like a reverse pyramid: the larger ones pay nothing, the smaller ones pay everything.

Same thing applies to the entire market/industry structure. Used to be, lots of single companies. Now its basically a bunch of PE firms, which added ANOTHER layer of an already bloated management/corporate structure. So most firms, when they say they cant pay their workers more, what they really mean is they cant/dont want to cut their management salaries, and can barely afford to pay the interest on the company debt (1) and the 10:1 ratio of manager to worker (2). Obviously joking about #2, but seriously, I have worked for a company where there were 10 engineers and 25 VPs/Directors. Made no sense.

Correction – the large ones are subsidized by the government with abatements, incentives, not to mention food stamps for their employees who do not earn a living wage.

Libertarianism and a true “free market” would still have the same problems. It is the natural econophysics of the law of thermodynamics taking place under capitalism. Wealth will concentrate under a few. One idea of a tax system is supposed to put a cap on the power of those few, but that idea has continually been eroded in the name of growth.

The shrinking of workers has to do with the increase of productivity. Work processes are continually becoming more efficient and so less and less workers are needed to manage operations. This goes hand in hand with capital’s desire to cut costs for profit by minimizing the number of employees as much as possible.

The increase in the numbers of management has more to do with the increasingly financialized nature of business and industry. Growth from industrial innovations have slowed down and so financial innovations provide new opportunities. To capture growth and profit from them requires managerial/financial expertise. This is especially true in a globalized setting where managers have to oversee complex operations between different countries.

Though I do not doubt inefficiency in management due to the more nepotistic nature of their environment. By being higher up the food chain, they can throw people at the bottom under the bus to save themselves. Or they can abuse the power they wield for selfish purposes.

“I think societies can tolerate quite a bit of inequality if the population does not feel constantly stressed about making ends meet and having some security in their future.”

This may be true, rd. But my question is, why SHOULD societies tolerate “quite a bit” of inequality? And just what have the libertarians “won”? Where will they go when this planet is uninhabitable and Mars isn’t quite ready to receive them yet?

A meritocracy means that there will be inequality of wealth and income. The countries that eliminated that, such as Russia and China, usually replaced it with a bureaucracy form of meritocracy anyway. Afterwards, they went straight to oligarchy – I believe this is the state the American libertarians are aspiring to where the people with the money get to dictate what is viewed as meritorious. Some pigs are always more equal than others.

The big question is how much. Gini coefficients or other similar measures show that instability usually kicks in at the levels we have today in the US (e.g. Gilded Age, Roaring 20s). 2008 should have repaired that, and likely would have, except that the institutions and the people got conflated so the wealthy people were rescued by rescuing the institutions. I was fine with saving the banks etc., but it should have been done by massively diluting or eliminating the shareholders. So we got the crisis without the benefits.

When a bank gets FDIC’d, the shareholders lose everything and the depositers are made whole to the insurance limits. The remaining pieces get sold off to other solvent institutions. A process like that in 2008 would have made a lot of very wealthy people immediately less wealthy and there would have been a reset on the levels of inequality. Alas, there weren’t even investigations done to look for criminality.

This is why progressive tax systems and trials like we see with Manafort are important as they are key to maintaining credible reporting of income and then taxing it to help reduce the extreme inequality.

This probably won’t make you feel any better, rd, but perhaps you haven’t heard of the Financial Crisis Inquiry Commission (FCIC). The FCIC made several criminal referrals to the Department of Justice (DOJ), believing that they had amassed enough evidence to merit criminal investigations/indictments. Alas, we all know what the DOJ did with those referrals.

Government( in many, or most, or all cases) exists to protect the welfare of the elite; and to keep the rest subservient and *productive* . We exist because our lives (and any productivity thereof) are their nutrients.Protecting the welfare of the elite requires keeping us powerless, indebted, distracted, infighting, fearful and diseased. Citizens are expendable; what the heck; we gotta die sooner or later….We are pawns; of value as consumers, or as entertainment, or sacrifices…numbers to be analyzed and manipulated…

Even if we decide we are pawns, that does not mean that we have to decide to be good little pawns. We can be bad little pawns. We can learn and practice the dimming arts of passive obstruction, grudging obedience without cheerful compliance, uncivil obedience, etc.

Good little sheep grow wool. Perhaps bad little sheep can figure out how to grow used rusty brillo.

Essentially then, America is not ‘Exceptional’ in its economy either.

I’m leery of the implied theme of “globalization ain’t so bad after all.” This is a case where the field of economics diverges from politics. As Trump demonstrates, an appeal to the basic needs and fears of the electorate, in toto, is now a winning strategy in American national politics. Even if a deep dive into the arcana of the situation were necessary for prescriptive purposes, politically, a simple, easily recognized meme does the trick. So, ‘Globalization Eats Your Lunch’ resonates with the stagnant wage earners while, “We must weigh all the factors and do a meta study of median outcomes” will not.

Fiduciary duty. The corporate mantra since the 80’s has been that corporations are obligated to provide as high a return to their investors as possible. From this single concept so much bad flows. As it relates to this post, keeping worker’s pay as low as possible is fundamental to fulfilling the fiduciary duty, as this duty seems to be defined. In practice, this fealty to fiduciary duty is a justification for greed, and a driver of political corruption. Our national economic policies are today birthed with only the considerations for our corporations, and more specifically, for the white men who control them or own them. As we were warned:

Thomas Jefferson to George Logan, 12 November 1816

…Your ideas of the moral obligations of governments are perfectly correct. The man who is dishonest as a statesman would be a dishonest man in any station. It is strangely absurd to suppose that a million of human beings collected together are not under the same moral laws which bind each of them separately. It is a great consolation to me that our government, as it cherishes most it’s duties to it’s own citizens, so is it the most exact in it’s moral conduct towards other nations. I do not believe that in the four administrations which have taken place, there has been a single instance of departure from good faith towards other nations. We may sometimes have mistaken our rights, or made an erroneous estimate of the actions of others, but no voluntary wrong can be imputed to us. In this respect England exhibits the most remarkable phenomenon in the universe in the contrast between the profligacy of it’s government and the probity of it’s citizens. And accordingly it is now exhibiting an example of the truth of the maxim that virtue & interest are inseparable. It ends, as might have been expected, in the ruin of it’s people. But this ruin will fall heaviest, as it ought to fall, on that hereditary aristocracy which has for generations been preparing the catastrophe. I hope we shall take warning from the example and crush in it’s birth the aristocracy of our monied corporations which dare already to challenge our government to a trial of strength, and to bid defiance to the laws of their country.

AMEN. It blows my mind to see stable earnings cause stock prices to fall. Irrational earnings expectations leads to amoral corporate policy at best and fraud at worst. Both require corporate officers with greed and without shame.

But what are corporate officers to do when Wall Street manipulators are legally permitted to manipulate stock prices up and down to try extorting desired behavior from corporate officers functioning in the Wall Street matrix force field?

It is unclear to me that the current shareholder value model is “fiduciary duty”. GE is a recent example of this where they almost created the shareholder value model but now have taken it to a point where they have been dropped from the DJIA due to lack of shareholder value.

A corporation has to decide if it is in it for the short or long-haul (Pet Rocks vs. passenger planes). If they are in it for the long-haul, then they need real R&D, capital investment, and management to go along with the financial creativity.

With regards of the aristocracy that Jefferson talks about, it was largely finally undone by WW I and II. The Industrial Revolution gave the common folk the ability to become wealthy which really had not been possible in an agrarian society. As we get more industrialized and informationalized, the pace is speeding up so that it won’t take a century for the next re-ordering to occur.

It seems like the rich are willfully ignorant about history.

Societies function best when there is little to no rent seeking. The sad part is the rich would rather have a bigger slice of a smaller and slower growing pie.

There is also the matter that society could revolt once the nature of the rich is made clear.

I have become increasingly convinced that economic Conservatives are an ideology that keeps the common citizen down and provides intellectual cover for the rich to loot society like a parasite, as Mike Hudson has described.

Take a look at Wall Street here. They are making money playing financial games. That does not really do anything good for society and is actually harmful. Another might be the pharmaceutical industry. All drugs these days are made in part by taxpayer funding yet they get the profits. It is the shareholders and executives the get all the gains. Meanwhile employees are paid little and are often given unstable employment. In other words, there is a disconnect between the people who actually add the value and those who get paid the most.

I think that the rich have taken their greed too far and are not even pretending that there is a social contract. This could lead to blowback or a total collapse.

I think you’ve nailed something of essential importance. We can do all the slicing and dicing we want, measuring this or that particular facet of income inequality and relating it to this or that aspect of a particular localized context, but behind all these variables is a philosophical constant. In or around the 1980s, capitalism abandoned all of its tenuous post WWII “human” attributes. Concern for workers, community, and the environment; national flavor and character and patriotic pride; the very idea that business, to use the words of Marley’s ghost, should at least include the larger interests of humanity–all of these meta-economic values were thrown to the wind. Nothing but a fiercely competitive free-for-all, in which even fundamental laws and regulations, not to speak of higher ethical principles, became merely restraints and impediments to be evaded or transgressed in the new corporate MO…if such evasion or transgression were potentially profitable and worth the risk in a cost/benefit analysis. Man cannot live by bread alone, and, it turns out, neither can business.

Lewis Powell’s memo to the national Chamber of Commerce was the battle plan for that process. He was placed on the Supreme Court shortly afterward.

The work of Michael Jensen, amplifying the zero sum purity of Milton Friedman’s purer capitalism contributed mightily to the corporation’s abandoning “externalities” and the responsibility to ‘other stakeholders’. Powell’s memo was the rallying cry for frustrated CEOs. Ironically, it was Rehnquist who dissented in the pharmacy case, pointing out that the corporation owed its existence to the beneficence of the state and ought to remain subject in some measure to the greater good.

Groaf groaf groaf graof groaf.

What we need to do is tax the ever living shit out of the filthy rich, so they can’t fly their jets and ply their yachts, and use that to pay millions to do nothing. A jawbs guarantee, in reverse.

Bu.. bu.. but what about All those lowly human yeast cells … they need to be kept indentured, as to work that doughy $tuff up to their risen betterens ..

“to do nothing”? Maybe to do socially useful stuff, like providing health care and home care, cleaning up the streets, fixing up buildings or tearing down the trashed structures, learning how to grow food, stuff like that?

All that is contingent on the elites not being able to suborn and subvert all the processes that might lead to ‘doing more good and less harm…”

Because the tax rates of the ’60’s really killed our country? Because the Bill Clinton tax increases were going to kill our economy? Because Obama allowing the Bush tax cuts for the richest to expire was going to crash our economy?

Because the TAX CUTS of W. Bush were going to create 22 million jobs, shore up Social Security for generations, and pay off the national debt in 10 years? Because the President told the country his tax cuts wouldn’t really give him or his friends much money, but would cause corporations to spend on expansions and hiring and raises? Because eliminating the inheritance tax… well, because! Because the conservative’s shifting of trillions in tax funds to the richest has made such an improvement to the poor, lower and middle class population of our country, and will continue to do so?

When I took Econ 201 it was about supply and demand. When wages for the vast majority of our citizens have been essentially flat for decades where is the demand to drive all those rich people to invest and expand their businesses? They don’t. They cut costs and buy politicians to improve their bottom line. As for the increasing demand, there is none, never was, and is never going to be as long as the conservatives govern and legislate by their beliefs and not reality.

Because fictitious millions are going to get paid for doing nothing.

Could have gone under “Austerity Caused Brexit” also.

“Amazon UK corporation tax bill falls to £4.6m despite profits tripling”

https://www.independent.co.uk/news/uk/home-news/amazon-corporation-tax-bill-uk-halves-profits-rise-jeff-bezos-a8475716.html

“The company has actually paid only £1.7m in tax for the year, after deferring £2.9m…

Amazon, which declares the profits made from UK sales through another company based in Luxembourg, defended the lower tax bill by pointing to its heavy investment in its UK business…

…Amazon has repeatedly faced criticism over its UK tax bill. Last year MPs and campaigners expressed outrage after the company received £1.3m back from the UK taxman despite its annual sales in this country soaring to £7.3bn.”

Amazon pleads their case, stating their profits are low and they are investing in the UK. Huzzah.

I think that there is also a fundamental connection between economic hardship and social rights. The places in the world where there is a lot of racism, ethnic strife, or human rights abuses also tend to be areas where there is a lot of poverty and income inequality.

You can have the most progressive laws and ideals in the world, but if people do not have a roof over their heads or food on the table, that is when the knives come out or the violence starts. Any social progress that people have made will then be for nothing as people start scrambling in bitter competition with each other to meet their basic needs. I think that this is because if people cannot make ends meet they become psychologically and socially stressed and then it is human nature to find somebody to blame. This is what probably causes underlying social tensions to flare out of control.

I am just a stupid millennial, but this is why I think that the Democratic (Clintonian, specifically) approach to focus entirely on social issues but completely ignore and often promote the economic inequality that fuels them is doomed to backfire. Social equality is important, but making sure that people have economic security first is of the utmost priority.

The people who do this want economic issues to be ignored as the whole point of focusing on social issues is that they are a most useful device for distracting

suckersvoters from their immiseration by the wealthy and big business via The Wonders of Free Market Capitalism™️, massive corruption, wars, lies, and straight up evil.This is done by both political parties. The only real difference is what issues are used. Racism, abortion, guns, religion, sex, and so on. All of these issues are used to say “those” people want to “insert hyperbolic statement” and they kick puppies and eat kittens too.

Agreements on, and solutions towards, many of our problems will not happened as long as they can be used as distraction, fundraising, vote getting, media coverage, and general s@@@ raising by politicians and their patrons.

The DLC/Wall Street-Hamilton Project/ Clintobamacrats focused on those social issues which have zero connection to economic anything, such as Gay Marriage. Focusing the mind of millions on Gay Marriage diverted those same minds of those same millions away from the International Free Trade Conspiracy and the plot to destroy millions of jobs, for example.

The DLC Clintobamacrats work for the International Free Trade Conspiracy, just to be clear.

He said, offering no support at all for why, in the era of the Sixth Mass Extinction, Global Climate Disruption, and human overpopulation, we need growth. No, it’s such a foregone conclusion, it goes without saying.

How’s that working out, professor? (See above.) Let’s keep doing the wrong thing, now with more feed and better stalls for the brutes? Is that all you got? How ’bout we get the distribution right, right from the start, and save the trouble of redistributing it?

IOW, how ’bout we brutes cut out you middle men? Think of the savings!

The new thinking we need is old thinking. We need to harmonize, in a sustainable way, with our external organs aka “the environment.” Conceiving of and acting in nature as if it were a mechanism has so obviously failed it, too, is going without saying.

The floor has gone out from under H. industrialus, the lot of them, and there they hang. It’s all a bunch of obsolete word salad, pining for a world that never should’ve been (we’ve never been able to “afford” the petro-economy simply because there is no magical “away” anywhere in nature to hide externalities, it’s all been a lie), the continued existence of which, by sheer momentum, threatens not just mere “civilization,” self-labeled, but the whole g.d. biosphere as we know it.

Lookin’ like hi-tech Ghost Dancers from here.

Worldviews: they say the most with the least.

Also, apropos no thing, have y’all tried French press coffee? Woohoo.

I’ve never been in a French newspaper office or broadcast news room, so I have no idea how their coffee tastes. If it’s anything like American supply house brew, watch out taste buds.

The original “Ghost Dancers” were brutally repressed, by the governments agents. I expect a similar fate for this new version of ‘Ghost Dancers’, brutally repressed by the laws of nature.

all revenue gets diverted to rent seeking – corrupting the political system, and rewarding the owners at the expense of those who worked and did not invest in corruption.

all empires collapse this way.

Am I missing something? There’s so much scatter in the data that you can’t really find a correlation!

That’s the whole point. The relation between income growth & inequality is not dependent on ‘inevitable’ economic “laws”- most of which are illusory- but on culture & how cohesive a given society is- or isn’t. Similar to a Natl Geographic article about the 3 “happiest” societies- Denmark, Costa Rica & Singapore. All very different on the surface. But not when you look at ‘belonging’.

The rise of the authoritarianism across the West is history repeating itself. Austerity and inequality give rise to dictators. For no other reason, if the present is bad, humans will reshuffle the deck. The Democrats turning their backs on workers and not dealing with the problems of the gig economy (unaffordable education, healthcare and housing) and the restart of the Cold War are proof positive that the table is going be flipped over. Since my household relies on my government pension, I try bury my head in the sand and think Americans will do what they have to do in the end. Even so, today feels like mid-stage in the collapse of the Soviet Union, all over again, even down to the war in Afghanistan and Pravda on the Potomac.

This exactly. Peter Turchin’s model forecasts a massive social (like a civli war or revolution) upset in the US in the 2020’s. I can see it coming. Like the man said, the center cannot hold.

Funny…there seems not much mention of austerity regarding the U.S….Brexit, Greece… but come on down here; and see it on the street! Right here in the good ol’ USA! Make do with less. And die.

???

Why do we hear about these situations impacting foreigners, who we are supposed to pity, and no mention of WHATS GOING DOWN AT HOME?!?!? Can i use large fonts here?

Anyway, the usual MSM game: Hey!…Look over there!… while they play the melody of economic growth; background music for getting shafted..

What about singapore? Apparently it has worse wealth and income inequality than the usa.

No, Singapore’s Gini coefficient is lower than the OECD average (low means more equal) and much lower than that of the US. See Figure 5, which shows OECD data:

https://www.mof.gov.sg/Portals/0/Feature%20Articles/Income%20Growth,%20Distribution%20and%20Mobility%20Trends%20in%20Singapore.pdf

I’m on vacation in Canada. A woman just passed me pushing a shopping cart several blocks down the sidewalk but she was shopping, not homeless. I jogged in a huge park this morning. Back in Sacramento any space like that would be full of homeless. Here, just happy walkers, joggers, bicyclists. Universal health insurance means no one goes bankrupt to pay medical bills. Very few lose their jobs due to health conditions. Want an inexpensive university degree? Move to Newfoundland. I’m in BC, so more expensive here but still less than the States.

What strikes me most is that people are just more civil to each other. Having that social safety net helps. I stopped by a neighborhood community center (they are all over Vancouver). They have a lot of free activities like pingpong, a zip line, lots of things for kids to play on that would be considered too dangerous in the States. And they have fitness equipment, tennis, lawn bowling, swimming, tons of various classes, etc at very low cost. Healthcare and lots of community spaces create real communities. I’m not sure why I continue to live in the States… I guess it is the climate and I have enough of everything myself but it is disheartening living in a country that seems to prize greed over cooperation.

It is extremely hard to emigrate legally on your own and virtually impossible if you are over 40 unless you have a spouse who is a citizen of someplace you’d rather live or have an employer that will keep you there long enough for you to get permanent residence. I speak from personal experience.

I tried to emigrate to Australia under an entrepreneurial visa, and thanks to the Iraq War (the second one), it threw a wrench in my plans (all new business decisions stopped for six months, the locals in finance and law firms were all talking about it openly) it looked like getting my business to the needed level in terms of revenues and employment was na ga happen (it was always a stretch) and I went back.

Oz has eliminated that category since then. I could perhaps have arm-twisted a local friend to sponsor me (as in treat me as if I were an employee) but that would have been a big ask and I would have been beholden to that person.

You can get easily into countries like Ecuador (but readers who’ve tried it came back and report that more than 50% of US expats do) and Mexico on a retiree visa and not have to show very high income by US standards, but that list is pretty short in terms of places Americans would deem to be OK.

New Zealand similarly restricts all those who represent future costs to their social safety net. Over 40? “Come back when you can bring $X million in capital and start a company” (Advice from an immigration consultant.)

Bear in mind that Canada is just the USA’s slightly retarded kid brother. Everything the big boy does gets imitated a few years later.

My guess is that James was in Stanley Park downtown, or in Pacific Spirit Park in Point Grey. Those are flagship parks, scrupulously policed.

Most of the big Vancouver area parks do have homeless camps, although they are so far still discreet. e.g. Central Park in Burnaby has a semi-permanent squatter population in the dozens, and higher in summertime.

The further you go out in the suburbs, the larger the squatter camps. Some of the municipalities have resorted to nasty tactics to expel the homeless, such as dumping whole truckloads of manure on their scanty belongings.

The thing that makes me feel sick is that thirty years ago the only homeless people in Greater Vancouver were either a few hardcore winos and junkies downtown, or a small number of nudist hippies on Wreck Beach.

But today beggars, garbage pickers and homeless people are an everyday sight throughout the city. That’s not something bad about them–that’s something bad about us.

Now Vancouver has a world class community of needle using drug addicts. Vancouverites love anything, even bad things, that mark them and their city as “world class.” The Vancouverites’ conceit would be amusing if it didn’t result in so much harm. Some Vancouverites actually like to take visitors to see the open-air insane asylum of the “Downtown Eastside,” like Bedlam used to be used as a zoo.

Thirty years there was no part of Vancouver in which I ever felt uncomfortable at any time of day. There were seedy neighbourhoods and colourful characters, but nothing one would ever have called dangerous, except maybe the beverage room at the Balmoral Hotel.

Today the lower east side is not merely sketchy, it is nightmarish. I don’t know if it is necessarily all that dangerous, since the people there are suffering so much I don’t think they could effectively mug people. Nevertheless, it is unnerving to walk by someone at the streetcorner who is clad in sodden rags, reeking of feces, covered in weeping sores, screaming at passersby.

But that’s the more plainly apparent misery. There’s also a lot of slow rot and quiet desperation in the Greater Vancouver region. A lot of people with big debts are trying to pretend life is what they thought it should be.

The inequality is glaring and rampant. The glittering new condo towers in South Burnaby stand a few feet away from ramshackle tenements with tarps on the roof and other jury repairs. The alleyways are crowded with discarded bedding and furniture, from the widespread bedbug infestations which now characterize most of the low rent accomodation in the city. The curbside gutters have accumulated generations of different of shattered auto glass from all the break-ins and vandalism. Graffiti is now a common sight even on private homes, and is abundant on any sort of public facility.

To think that just 20 years ago, that same sort of neighbourhood in South Burnaby was a respectable working class quarter with older buildings, but ones which were freshly painted and had manicured lawns.

I think there can be no question that at least half the population here is worse off, in absolute terms, than 20-30 years ago.