By John Weeks, Professor Emeritus, School of Oriental & African Studies, University of London, and author of ‘Economics of the 1%: How mainstream economics serves the rich, obscures reality and distorts policy’, Anthem Press. Originally published at openDemocracy

The 20thcentury American comedian Rodney Dangerfield had a catchphrase: “I don’t get no respect”. The public debt is the Rodney Dangerfield of government finances. It is a long term benefit treated as perennial problem.

When we change our perspective on of the nature, size and ownership of the UK public debt we can see that it poses no threat to economic stability. Its size is modest and its burden on taxpayers is minor. If we treat the national debt as an asset, we can use it as a means to end austerity.

Give the Public Debt Some Respect and End Austerity!

The claim that our public debt is excessive has been used as a major justification for austerity – cuts in spending. That massive debt, we are told, 1) must be repaid, 2) threatens our country with bankruptcy, and 3) is a burden on future generations. All these are wrong. Let me explain why.

When our government borrows it does so by selling a promise to pay, called a bond. For example, a household buys a £100 bond and our government promises to buy it back at the same amount in ten years with interest (at present 2.5% or £2.50 every year). A pound note also is a promise to pay (look at the small print near the Queen’s picture). A pound note is a bond paying zero interest.

Britain’s national currency is managed by our central bank, the Bank of England, owned by the citizens of the United Kingdom (that is, our elected government). As a result, the British government can never default on its bonds. Our government can replace maturing public bonds with new ones. Should private buyers, households and businesses, refuse to purchase the new bonds at the interest rate set by the British government, our government can sell them to the Bank of England. The option to sell to the Bank of England provides a fool-proof mechanism to prevent excessively high bond rates.

Whether the economy is strong or weak, the British government can never default on its debt. The debt is nothing more than pieces of paper that the government promises to buy back on a specific date. These pieces of paper can be bought back with new pieces of paper (new bonds) with later buy-back dates. If the private owners of the debt paper do not want the new bonds (new debt paper), our government can sell those new bonds to the Bank of England for cash and use the cash to pay the bond holders.

This buying and selling of public bonds is not the much-misunderstood Quantitative Easing (QE). QE was a one-way street – our government bought private corporate assets from companies threatened with bankruptcy. In a phrase, QE was “bail-outs” of reckless private sector financial behaviour.

The Size of the Public Debt Is Not a Problem

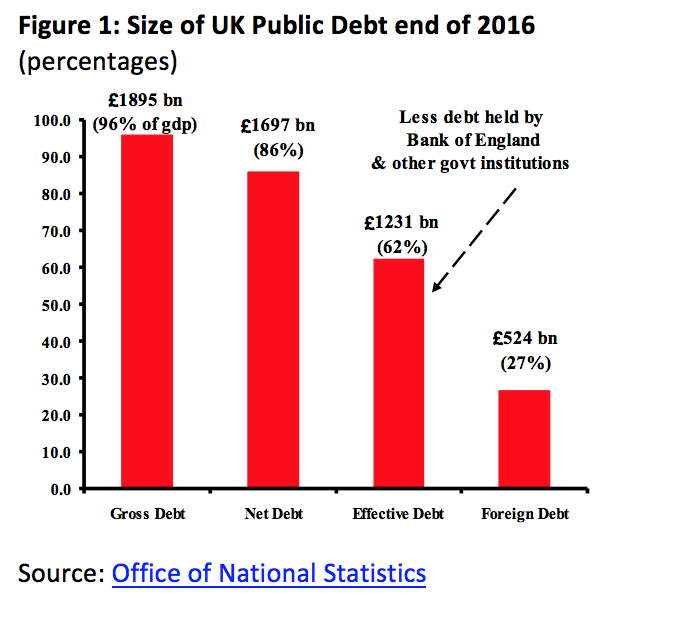

Figure 1 shows that outstanding public bonds (called “gilts” from the days when the edges of the bond had gold gilt) amounted to £1.9 trillion or 96% of GDP at the end of 2016, which was the UK gross debt.

When we look closer at the national debt, its nature changes. Public sector liquid assets (for example, cash deposits held by the central and local governments and financial assets such as stocks and bonds) reduced this to £1.7 trillion or 86% of GDP. When we subtract the government’s assets from its debt, we have the net debt, the measure of public indebtedness used by the Treasury. The gross/net distinction also applies to households. A household with a £300,000 mortgage and £50,000 in the bank has a net debt of £250,000.

Another 27% of the net debt amount (£466 billion) was held by public sector institutions, the vast majority by the Bank of England. This portion of the national debt is what the public sector owes itself. Subtracting this gives the effective debt, the debt that the UK government owes to others. In 2016, the effective debt was 62% of GDP.

The Public Debt Is Not a Burden

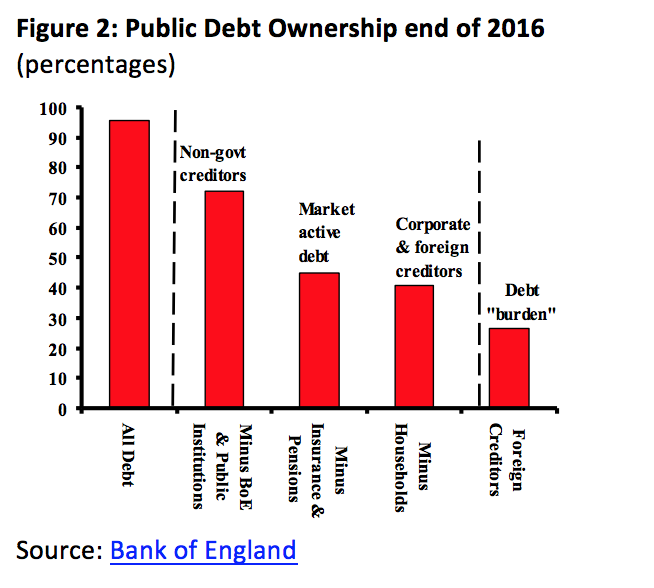

Who the government owes is an important factor determining whether the public debt is a burden. In the UK, the public sector itself owns 25% of the £1.9 trillion UK gross public debt (see Figure 2). The government pays the interest on this portion of the debt to itself. Thus, one-quarter of the debt and the interest paid on it are not a burden.

Pension funds hold a large portion of the 75% of gilts not owned by the government. The interest paid on debt held by pension funds is income to retired households. As such, this portion of the national debt is a source of household income, a benefit not a burden to citizens.

Debt held by the government itself and pension funds are long term holdings, rarely bought and sold. They do not represent a speculation danger that might put upward pressure on bond rates. When these are subtracted the remaining “gilts” constitute the market-active public debt, £808 billion, or 45% of GDP.

At the end of 2016, private corporate and foreign gilts holders owned 41% of the UK’s national debt. Only the £524 billion of gilts held by foreign creditors could be considered a “burden” in that the associated interest payments are from UK taxpayers to non-UK creditors. For fiscal year 2015/16 interest payments to foreign creditors were approximately £12 billion, or 0.6% of GDP – quite a small burden.

This analysis of the nature, size and ownership of the UK public debt shows that it poses no threat to economic stability. Its size is modest and its burden on taxpayers is minor. From this come the following policies to end austerity:

- Sound management of the national debt means more public borrowing for investment and current expenditure, which is justified by the modest size of the effective debt.

- The minor burden represented by foreign interest payments could be reduced by measures that would limit bond sales to domestic buyers (already applied in several other countries).

- Implementing a fair and progressive taxation system will ensure interest payments to domestic bond holders don’t have negative redistribution effects.

- Any speculative pressure on government bond interest rates can be prevented by selling bonds to the Bank of England.

The premise is familiar, Weimar is the mechanism and Hitler the solution. In peacetime the rich get a piece of the pie, in wartime, much goes to the military. The end result is the people are impoverished due to the value of their money being debased daily. Pension funds are crippled and they have to seek more and more yield at 0% interest. Inflation continues unabated until ……

An apologist for the current insanity. The author lives in a land where the 1% are waiting for the call to royalty, firmly believing they are worthy and righteous. The author probably even understands that the best analogy for continuous growth is cancer.

The people don’t have any money to be debased.

What the people have are debts that the 1% don’t want debased.

For like the hundredth time the proper questions are:

Who profits from deflation?

Who profits from inflation?

The answers to those questions will tell you why we have the policies we have.

The people don’t have any money to be debased.

What the people have are debts that the 1% wish to make sure are never debased.

The proper questions are:

Who profits from deflation?

Who profits from inflation?

Once you answer those questions you’ll know why we have the policies we have.

Uh, the Weimar regime had to pay war reparations in gold.

The pound is a pure fiat currency. As such, the UK is not revenue constrained.

Not only is the author correct, but he understates the fact that a Monetarily Sovereign’s debt is no burden on the government or on taxpayers.

In fact, the debt isn’t even a debt in the usual sense. It is deposits in T-security accounts that are paid off by returning the dollars in those accounts.

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

St. Louis Federal Reserve: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e.,unable to pay its bills.

Unlike state and local taxpayers, federal taxpayers do not pay for federal spending.

Professor Weeks lost me here. I cannot understand how this is not a “burden”. Does not every unit of currency plus interest have to paid in full by future generations via taxation? Or is the presumption that more bonds will be issued in future to pay the old ones off? In that case is there not a debt spiral underway? Is Professor Weeks saying that it does not matter how much debt a country incurs?

It seems to me that national debt is a means of boosting today’s consumption at the cost of future generations. To take his example, moving money to pensioners today at the cost of burdening all taxpayers in the future, some who are not yet born. Is this not a burden?

Epistrophy– Government “debt” is essentially money that pays interest. Central banks can and do convert cash to government debt, and vice versa (with no taxes involved). This happens all the time with short term government debt to set short term interest rates, and happened with long term debt with “quantitative easing”. A bunch of debt was liquidated (removed from “effective debt” in chart above).

Of course, if the govt prints too much money (whether cash or “debt”), then inflation is possible. Inflation in and of itself does not affect real prosperity, but can have distributional effects. For example, inflation can hurt lenders and help borrowers by lowering the real value of the debts outstanding.

The best explanation of this, in my opinion, is provided by Modern Monetary Theory.

Please let me know if you’re interested in further references.

> if the govt prints too much money

Or even if they don’t. If you run low on important stuff it doesn’t matter if your gummint prints money or not. The price goes up. All that changes with printing is the notional value.

>Inflation in and of itself does not affect real prosperity, but can have distributional effects.

Oh I *like* that… note that “distributional effects” are not without agency. That explains why Argentina is just as capable of growing foodstuffs this year as last year, the population has not changed much, but most of them are going to go seriously hungry.

Are you referring to “Pension funds hold a large portion of the 75% of gilts not owned by the government. The interest paid on debt held by pension funds is income to retired households.”?

Pension funds also deal with people who haven’t retired yet. In these cases the government bonds are actually taking money from people now in order to pay them back in the future. For these people, your “at the expense of burdening all taxpayers …” is way off the mark. Remember that these pension funds are an ongoing thing. Pensioners now are getting the benefit of the money they parked with the government before, and employed people now are storing the money they will get back after retirement. Lending it to the government only makes it safer. I don’t see a downside at all.

>Does not every unit of currency plus interest have to paid in full by future generations via taxation?

No. “Future generations” itself isn’t actually a definition of anything, you know. You act like the debt is in bananas, and we can’t see how these vapors “future generations” are going to grow enough bananas. Well they won’t, they’ll just lie and say their kids will.

Now this is the point where immortality would become an actual issue, though…Thiel would believe we were actually going to pay him for every vaporous piece of “knowledge” that he “owned” to the end of time and we assuredly will not.

The US Federal Debt grew from $9.99 trillion to about $20.21 trillion from 2008 to 2017. Under unprecedented, historically low, negative real interest rates, the CBO projects that interest payments are expected to double from $310 billion to $618 billion in just the next 5 years.

It seems to me that we have gone from linear to exponential. Is the author saying, with such a growth rate, that this is not going to become a burden?

Yes — anything compounded is exponential. Thus, it’s not possible that we were ever in a linear mode for debt.

Inflation is exponential, debt is exponential, economic growth is exponential, population growth is exponential, technological development is exponential… a few things are even hyper-exponential.

The question is: $e^((growth-debt)/t)$ — is that top term negative or positive.

I cover this here: The Socrates Show, with guest Pete Peterson. It’s a bit long, but easy reading.

Thank you for this link. I have read it and I’m still not convinced. You see, at its heart, national debt still has to be paid – with interest. So who is going to pay? It is the future generation of Americans. You can argue that it is Americans paying Americans but it still must be repaid, correct?

OK. If that debt was being created to invest in infrastructure or other productive assets, for example, that might last 100, 150 or more years, then I could better accept it. But it is not. It is being created to bail out banks, finance an ever-increasing (and in my opinion dangerously wasteful*) government bureaucracy, expand an all-intrusive surveillance state, fund hopeless military escapades and enable consumption over production. Meanwhile, infrastructure initiatives are being done under the so-called ‘private-public partnerships’ and taxpayer assets are being sold off to, sometimes foreign-owned, private sector interests.

If debt does not matter, then why not completely do away with personal income taxes, cut back the bloated and intrusive bureaucracy, set government budgets not to exceed a fixed percentage of private sector gdp, and then just print the money to finance it each year?

*Project Veritas has revealed persons who are not even carrying out their duties, but instead the duties of other organizations while collecting their salary from the taxpayer.

No, national debt does not have to be “paid”. It represents net spending by the government and could be 100% created out of thin air by the central bank with no debt issuance whatsover. It could also be redeemed in its entirety by the central bank.

Yves, since you don’t have a direct line for that, I will write it here and hope you read it. I’ve been an avid reader of NC for over a year now, and consider myself quite intelligent. Yet I still have much confusion when it comes to this basic, and it seems game-changing, idea of MMT — that government should produce debt for the sake of public good.

The points of confusion are:

Government debt — does it mean selling bonds? If not, then what are the bonds for?

For example, Russia doesn’t sell much bonds. Is it good or bad? Should we be selling more? Or is it an anachronism in the world of fiat money?

Or does govt debt mean public sector spending, creating jobs and infrastructure and just plain stuff, paying for it with money that can be simply printed by the central bank?

The scare of inflation — is it overinflated by the neoliberal folk? Will inflation be created if govt spends money on infrastructure and jobs by printing more money?

Is there any good post already describing it with a simple example?

Or could you maybe take a country as an example and lay out it’s economy as MMT sees it? But not the US, since the question is yet again complicated by the foreign debt and dollar being a world currency. If you could use Russia, it would be great, since we are a tad unwelcome right now at the cool Western party, and have to fight our way to sovereignity against weaponized US and EU economies.

As has been explained repeatedly, the issuance of bonds is a holdover from the gold standard era. ‘

The way the government spend is that the Treasury debits its account at the Fed. There’s no need to issue bonds, and this occurs only because it is the way we do things in the US.

The proof of this is that the government has spent $21 trillion entirely outside the official Treasury bond issuance regime since 2000. Our war spending operates on MMT principles.

Congress could eliminate the issuance of bonds and just have the Treasury do all net spending directly. However, investors really like Treasuries as a risk-free asset, and having a global risk-free asset is of great utility from the standpoint of pricing all financial assets (it’s a critical input into tons of valuation and optimization models).

The critical understanding is that money can be manipulated, created, or destroyed at will, but tangible products and useful services is another issue.

The problem with the military, for instance, is not how many dollars are spent, but how much actual production, labor, and resources are diverted from the things people need to live. Make a bomb and blow it up, or make a bridge; make a tank and let it rust over time without getting anyone to work, or make a car so people can get to their jobs, or go shopping; hire people to march around and salute, or hire people to make and deliver products to stores, or teach kids how to read and write — where does the actual value lie?

It’s like the difference between using a tape measure for lumber and building real houses.

(Hat tip to Alan Watts — https://thesocietypages.org/socimages/2014/06/02/what-is-money-alan-watts-on-the-false-idea-that-money-is-a-resource/ )

Some have a drama with equivocation when conflating commodity money with fiat.

@Epistrophy

Just curious, where do you think the National Debt™ comes from?

This essay may help put things in perspective:

https://www.ineteconomics.org/perspectives/blog/worrying-about-the-deficit-is-so-17th-century

Or can not every bit be paid off via inflationary printing? Why would there be any presumptions? What is a debt spiral at this scale, given the coupling between interest rates, inflation and government spending? What is debt at all, when it’s internally denominated as opposed to intersystem trades in external denomination?

How can I buy a burger for a pensioner today by taking a burger away from a pensioner in a hundred years?

It seems to me that we can choose how to boost consumption today which have implications for the class structure in the future but that it’s impossible to have future consumption pay for today’s consumption, unless we’re talking about non-renewable resources.

Why would I make an argument by just pasting together questions as if I was posing questions rather than straight-forwardly presenting claims?

Not sure I understand your question here, but more money in circulation is only inflationary if it is chasing a finite supply of goods/services, resulting in more $$ than things to buy, so people with the $$ will bid up the prices.

Govt spending is, by definition, for goods/services that are there, or shortly to be created, for govt use, so no excess $$ floating around looking for something to buy/invest in.

OTOH, we have QE, in which the govt creates *real* money for *bogus* (aka ‘troubled’ or ‘toxic’) assets. The sellers of which then spend/invest that money in the stock market, the real estate market, the politician market, and I think this goes into insurance as well. With QE there is a ton of money looking for a place to park but looking for ‘returns’ rather than consumables (food, clothing, housing, regular-folk stuff). Why is real estate so expensive? It is inflation, and the process is as you suggest, but it is localized to the markets that the beneficiaries of QE patronize.

“Boosting today’s consumption” does not cost future generations anything, with the exception of non-renewable resources. The issue is not a currency constraint, but rather a real-resource constraint.

“. . . national debt is a means of boosting today’s consumption at the cost of future generations.”

The thing is, money is a fiction. If you think strictly in terms of goods produced and consumed, it is not so clear how a money debt incurred by the state accomplishes this shift of consumption from the future. There are no time machines that can export future production back to us in the present — or ship bales of cash forward in time to “pay” for these exports from the future.

We only have the present moment in which to live and act. We may choose to live in anticipation of the future, better or worse, but we can only act in this present moment. Whatever we are doing with money, we cannot make decisions for our posterity, only for ourselves. This is the great tragedy of involuntary unemployment, brought about by public austerity in a time of private retrenchment: it is a waste of time and life. We can never get back the time when we could have been productive. We cannot save up our productive powers for a future time.

That’s not to say we cannot invest productively. We could use our time and resources now — time and resources that cannot be recovered if squandered in the idleness of pointless austerity — to build for a better future. We have enough foresight for that, I think.

The one sure way we can ensure that our posterity is poorer is to run down the infrastructure, dumb down the young, lay waste to the environment, all in the name of containing money deficits. Money deficits which are simply fictions, symbolic constructions.

I am not saying money isn’t useful. It is a very clever institutional invention that let’s us keep score and coordinate our behavior in the system of production and distribution that is the economy. We use money to calculate our chances, hedge our bets and figure the odds as well as weigh the costs and benefits. Money is an all-purpose incentive and means of motivating people and property.

But, let’s think for a moment about what it means, this claim that we can “burden” later generations by using money and debt to marshal resources in the present. If we fail to use resources in the present productively, if we fail to put people to work doing worthwhile things in the present, we lose them, we lose the time and the opportunity . . . forever.

If the state borrows money, it typically issues marketable bonds that embody a promise to pay principal and interest on some fixed schedule. The state will levy money taxes in the future in order to keep those promises. If you are familiar with the concept of present value, you will understand that the bond is exactly worth at issue the present value of the anticipated future taxes to repay principal and interest. The stream of payments to the bondholder is exactly equal in value to the stream of payments from taxpayers that fund the bond.

Now here’s the tricky part: if the bondholder and the taxpayer are the same person, then the bondholder has in hand, in the form of the bond, the funds he needs to pay the taxes necessary to fund the bond. Of course, realistically, there may not be a precise correspondence between the bondholder and the taxpayer. The point of the thought experiment is simply to establish that the future is not “burdened”. Taken together, collectively, to the extent that bondholders and taxpayers form a common community, there is no burden, because the taxes are paid in money funds from money funds circulated by paying off the bond.

Creating the debt, in and of itself, has no consequence for future consumption, places no constraint on future public or private choices.

Of course, public policy can have consequences for the future. What public goods we choose to invest in, the bridges we build, the knowledge we develop, the communities we nurture — these things matter to the future.

I won’t say public debt is inconsequential. We need it as a vehicle for savings and for hedging the payments systems. We need an efficient fiscal system for collecting taxes, particularly taxes on economic rents. But, that’s another comment for a future time.

When the government sells a bond it swaps cash for interest paying IOUs but the cash is not spent back into the economy. When the government spends it creates

money out of thin air. It spends money into existence. When it taxes it destroys money previously spent. It doesn’t need to borrow or tax to spend.

It sells bonds whenever there’s a deficit to keep the interest rates close to the target rate. Otherwise interest would fall to zero.

Following this OK, I think, but I wonder, are bonds spending money into the future? Sincere ask, anyone who has thoughts on the pls chime in.

I’m sure it’s just my thickness, and that of people I try to discuss the money cycle per MMT with, but maybe this bit is where the eyes glaze over or disbelief begins:

“These pieces of paper can be bought back with new pieces of paper (new bonds) with later buy-back dates. If the private owners of the debt paper do not want the new bonds (new debt paper), our government can sell those new bonds to the Bank of England for cash and use the cash to pay the bond holders.”

Where does that “cash” that the august BofE uses to buy these bonds, the ones not bought by private owners with the wealth (from some creation of money, somewhere in the cycle or flux,) actually come from? “Deposits” does not seem to clearly answer the question — because the “deposits” are pieces of paper that also have to come from “somewhere.”

And I don’t know the numbers, or even how to find them, but I doubt that “deposits” of that hard-to-get-one’s-mind-around stuff called “money,” that also flows into trips to the pub and supermarket and petrol purchases and bets laid off at the bookie, are sufficient to explain what looks like magical creation of the real current “stuff of life,” without which us mopes suffer and die.

Pieces of paper with printing on them: forest -> factory -> printing press.

Electron bits: oil -> power plant -> computer to flip 0 volts 5 volts at nanoamps.

I can’t understand where the confusion lies. Are you trying to figure out which accounting books these magical symbols are inscribed in?

I don’t think Professor Weeks has done a great job here, and ape is a bit elliptical too.

Since 1971 most countries in the world have had fiat monetary systems. No gold or other commodity backs money. It is just numbers in the national ledger, numbers which the government can change at will. It doesn’t “come from” anywhere, in the same way that the points in a football game don’t. The referee just says “more points for team A” and they appear on the scoreboard.

Now, in a ledger the numbers have to add up so when the government adds money to someone’s account the same amount must be recorded as a deduction from the government’s account. This looks like a massive debt to the uninitiated but it is just numbers, not a real liability. It measures how much money the government has put into the economy, not money it has to pay back to anyone.

Let’s take it one step further. The Gov spends 1 Billion in cash on improving highways. There is now 1 Billion more in circulation which would create some inflationary pressure. If they sell bonds instead of paying cash, they have actually taken 1 Billion out of circulation from the bond purchase so the net effect is a wash. Either way, the country now enjoys better roads and has those roads as a physical asset.

If the Gov just hands out 1 Billion in cash, or steals it, then we have no new asset, but we may get the inflation if that Billion is spent and demand pressures apply. This does devalue our money and we get nothing for it. This is the effect of criminal and incompetent government behavior.

In the final analysis, debt is OK if you get something valuable (assets) that benefits broadly and if we do not maintain our roads and other infrastructure, we will surely pay in the long run. Waste, incompetence and corruption hurt us all.

We should be concerned about wise management of our resources more than how much money we print or borrow when we are making broad improvements to the benefit of our society. Of course that leads to a whole different discussion – benefits who?

Why is it that many intelligent people still fail to grasp the concept of fiat money; i.e., that it comes from nothing but a decision to spend made by a currency-issuing government? Perhaps the difficulty lies right here, in the (mis)use of the word “spend” in reference to such a decision. A more accurate and less misleading phrase than “decision to spend” would be “decision to make happen.” For example, let’s imagine that I was the proud possessor of a perfect counterfeiting machine and wanted a new car. I would go to my machine, print up the purchase price, give it to the dealer, and drive off in my new vehicle. In this imaginary scenario (imaginary for me but real for a currency-issuing government), I haven’t really spent anything. I simply wanted a new car and made it happen. THAT is the essence of MMT, the bedrock principle upon which it stands, and once that single simple fact sinks home, the rest, as the saying goes about Plato and philosophy, is commentary.

Maybe it’s a problem with the chosen verb: “The government SPENDS,” which might better be rendered “creates” or “injects.” Or “applies.” But what do I know? Personally considering “spending,” on a fixed income, has a very particular and anxiety-producing effect on people like me.

I still lock up at that notion that “banks take money out of their depository accounts to buy treasury bonds.” Seems like an awful lot of billions, maybe trillions of “dollars” (whatever they are — analogized by some to just “points” in a football or first-person-shooter game, or the “points’ one gets for using a particular credit card or frequent flyer accounts,) to be materialized, not by the government in “spending,” but by private banks in somehow moving “dollars” from their balance sheets (works of fiction too?) to the government’s balance sheets. Dollars to me are yes, pieces of paper in my wallet that can be exchanged for cat food and ramen. Apparently that’s not the whole picture. A subject that has been actively discussed here at NC and everywhere else in economy-land.

I doubt that the private banks have “deposits” from people and corps who have put real money, from real-economy activity not notional derivative “dollars” and casino winnings, into depository accounts in said banks, big enough to ‘equal” what travels from balance sheet to balance sheet, but don’t know where to look to avoid the circularity that “dollars are deposited by banks to the T bills and that’s where money comes from.”

Sorry to waste time trying to puzzle this out. Maybe it’s just that I clearly, from my financial state, am not a fish evolved to swim in the water that so many others seem to just grok…

Edit — Finn, thanks, you beat me under the wire with that.

“I still lock up at that notion that “banks take money out of their depository accounts to buy treasury bonds.” Seems like an awful lot of billions, maybe trillions of “dollars” ”

Me too. It might be that Quantitative Easing left a huge oversupply of reserves with the “important” banks so that they can run it back to the Treasury in exchange for bonds.

Another path looks like it might be possible. The FED has a Primary Credit program under which it will loan basically any requested amount to a respectable bank, over a short term, no questions asked, at 50 basis points over the FOMC target rate. Combine this with FED Open Market Operations; If you’re a respectable bank, and you know the FOMC is buying on favorable terms, you can borrow overnight, buy Treasury bonds, then sell them to the FED at a price reflecting the rate of return on the Treasury bonds. QE tapering might make this stop working, but perhaps it worked before.

I’m with you JTMc. This seems nonsensical and counterintuitive to many of us who tend to relate federal monetary policy to personal finance, and I think that’s the main problem. It’s partly because of the language: “Debt” for example, has very real consequences for households.

A non-economist such as myself has to pore over these posts repeatedly to begin to grasp the concept.

As this topic has profound political and public policy implications, it seems the major challenge will be educating the public. Difficult enough here at NC! (I’m trying to think of how to explain this to my elderly mother.)

I used to be a ‘dungeon master’ — for the role playing game, Dungeons & Dragons. Players would go around slaying imaginary monsters and find ‘gold pieces’ in its lair.

I, as dungeon master, would tell them they now had some gold, which they could use to buy swords, food, torches, etc. I had a concern not to award too much so as to destroy the incentive and fun of doing more delving and monster battling, or too little so they could not advance and buy things, but I had no need for an accounting system and paid no attention to what the totals had. There was ‘bank’ or ‘treasury department’.

It worked fine. So why does a government need an accounting system? One is because people keep track of such things, and measure wht the economy is doing, but a big reason is that we used to use real ‘gold pieces’ and had a limited supply which had to be kept track of. And we also have limited resources, including monsters and lairs to be raided. We are tied to a physical universe. (Inflation or depression did not exist in the fantasy world we played in). At this point we don’t need deposits or taxes to lend or create money, but we do need to tie the economy to real-world resources, production, labor, and consumption. Otherwise, all we need to do is work the creation, movement, and destruction of money to keep the system humming. The constraint on running a game is to keep the people playing happy; the constraints it the real world also include the physical reality — but not disregarding the people.

@Newton Finn

September 22, 2018 at 9:26 am

——-

“the rest, as the saying goes about Plato and philosophy, is commentary”

The saying actually comes from the story of the time that the great rabbi Hillel was asked to explain the Torah while standing on one foot. His response was “What is hateful to you, do not do to your fellow: this is the whole Torah; the rest is the explanation; go and learn”.

I guess Rebbe Hillel is not much heard of or respected in that part of the world any more. Unless one assumes that all the hateful stuff that is being done by nominal co-religionists of Hillel is how they want to be treated. Of course the commentary since then apparently concludes that the people being done to are not fellows, within the meaning of the Torah — not a new observation if one looks back into the traditional history of the migration into Canaan…

Would not the world be a better place if only that Golden Rule were universally observed?

@JTMcPhee

September 22, 2018 at 1:23 pm

——-

No, he is not. In fact the Zionist Israeli government has become what they have historically despised.

Of course, saying that would earn me the label of “self-hating Jew” from the Zionists, but I think that’s actually projection.

Thanks, John, for giving credit to whom it is due. Hillel coined the phrase, or at least the gist of it, and then Whitehead played a similar tune when he said: “The safest general characterization of the European philosophical tradition is that it consists of a series of footnotes to Plato.” Whitehead, however, unlike the great rabbi, had to keep both feet on the ground.

” If they sell bonds instead of paying cash, they have actually taken 1 Billion out of circulation from the bond purchase so the net effect is a wash.”

The quoted sentence describes taxing and spending, not “borrowing” and spending. As Alexander Hamilton said, the bonds become assets of the lender and serve most of the purposes of money. Thus, neither the lender nor the private sector lose any monetary value when the government “borrows”, so when it spends that amount back into the economy, there is twice the amount of money in the economy. This 2-for-1 multiplier is what drives up the debt. It can only be reversed by government running a surplus and taking dollars out of the private sector and not replacing them with spending.

This, I think, is the most basic fact of MMT.

I was having an argument with someone in “The Guardian” comments section who was a diehard MMT devotee, but hadn’t realised there is more than one thing that’s wrong.

He would point to things Keen and Werner had got wrong that meant everything they said was wrong. Their thinking evolved, like that in MMT from its early beginnings in the 1990s, it’s better now than it was earlier.

Michael Hudson’s “Killing the Host” is very good, but not that hot on the money side, but by the time he got to “J is for Junk Economics” the money side was good too.

Look at the roots.

Minsky’s work was based on Irving Fisher’s theory of debt deflation that was deduced from the Great Depression. Luckily, Ben Bernanke’s work on the Great Depression wasn’t around then as he would never have got anywhere.

Irving Fisher was a 1920’s neoclassical economist and he thought all those things that neoclassical economists think about the markets, e.g. they reach stable equilibriums; they represent real wealth and they are accurate indicators of current conditions.

“Stocks have reached what looks like a permanently high plateau.” Irving Fisher 1929.

He became a laughing stock, but being an economist who liked to understand the economy, he worked out where he went wrong and came up with his theory of debt deflation.

Hyman Minsky picked up this work and developed it into the financial instability hypothesis in 1974, which was then picked up by Steve Keen who saw 2008 coming in 2005 by looking here.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

There are two offshoots from Minsky and they like to think they are right and the other lot are wrong.

The two offshoots actually merge nicely together and hopefully they will work this out.

1) Private money/debt side – Steve Keen, Richard Werner

2) Public money/debt side – Modern monetary theory

I think Steve Keen is getting there and has certainly picked up quite a few things from MMT.

Keen is a circuitist, a post-Keynesian school emphasizing the role of banks in running the payments system and balancing its books via the circulation of credit. MMT is chartalist, emphasizing the role of sovereign currency issuance and taxation in giving money value. In the historical emergence of modern money there is evidence for both views, but neither is fully adequate IMO, like two halves of a broken circle that don’t quite fit together.

The chartalist view does not contradict the circuit model. They complement each other.

The puzzle is solved in Perry Mehrling’s concept of the hierarchy of money and credit: at the top of the pyramid there is the dollar (reserve or base money), a liability of the Fed. One step down we have bank deposits (“money”), a promise to pay dollars on demand, at par value. Another step down in the pyramid and we have credit – a promise to pay in the future, in bank deposits, with an interest charge included.

Bank deposits are this subordinated to the liabilities issued by the sovereign.

In the first place, banks emerged and evolved in the late Middle Ages before there were sovereigns. (Lots of bankers were wiped out back then when rulers defaulted on the bankers loans, so it was long a fraught relation.) Sovereign money, as the chartalists account for it, really only became possible in the 18th century and even then it was not the paper fiat money of MMT. And you should consider the possibility of international money, which might escape from sovereign control. I’m not thinking of cryto-currency BS, but of exchange rates between multiple sovereign currencies, different possible exchange rate policy regimes, various devices or schemes that might be used to escape sovereign control for various purposes such as tax or sanction evasion and the decline of U.S. $ hegemony due to Fed policies that have disregarded the effects on other nations and the weaponization of finance by the U.S. treasury, with the likelihood, not soon but in the offing, that we might end up with multiple international reserve and exchange rate regimes using different international tokens.

Keen did write a piece that was re-posted here criticizing the frequent claim by MMTers that trade deficits are a good thing because you get free stuff for paper. He argued to the contrary that, even leaving aside the loss of employment and domestic demand involved, persistent and large trade deficits damage the domestic economy by dis-integrating production supply nexuses and instituting an unlearning-by-not-doing curve. I think he was right there.

MMT is not all that and I think is a bit over-simple in abstracting away from lots of issues. It is correct descriptively against neo-classical accounts in explaining the actual workings and constraints of public debt and deficits, but prescriptively, aside from ignoring the issue of current account imbalances, it offers only a vague goal of “full employment” via an employment-of-last resort buffer stock as the sole means of macro-economic management, which would be difficult to effectively implement and administer, and doesn’t address what the public purposes of public debt and deficits might be. Like much of economics, it seems to me to be trying to construct a perpetual motion machine.

In these discussions, I’m always reminded of the Parable of the Elephant — six wise (but blind) Indian men, out seeking truth and enlightenment, encounter as many different parts of the elephant, and are convinced that from their encounter that they know the full creature from touching the trunk, the tail, the leg, the tusk, etc. https://www.allaboutphilosophy.org/blind-men-and-the-elephant.htm

In modern times, one of the six might succeed in dominating, suppressing, or killing off the others, or persuading a complaisant Rajah to do so if the winner’s “truth” was ‘convenable’ to the Rajah, thus establishing “truth” for all…

MMT doesn’t apply under a gold (or silver) standard Monetary regime. It is a description of the workings of a fiat currency, floating exchange rate regime.

But the concept of a hierarchy of money and credit also applied during the gold standard era. In say 19th century England, then at the center of the global monetary system, at the top of the pyramid there was gold, the currency for international payments, an asset that is nobody’s liability. The pound then was just a promise to pay in gold at a stipulated, fixed rate.

If there was a crisis, however (such as a war or a financial panic) the Bank of England could and would suspend convertibility into gold. So it is definitely the case that the sovereign still had the last word, even under the gold standard.

Archaeologically, debt precedes money. And sovereigns certainly predate banks.

Relevance?

The chartalist view does not contradict the circuit model. They complement each other.

The puzzle is solved in Perry Mehrling’s concept of the hierarchy of money and credit: at the top of the pyramid there is the dollar (reserve or base money), a liability of the Fed. One step down we have bank deposits (“money”), a promise to pay dollars on demand, at par value. Another step down in the pyramid and we have credit – a promise to pay in the future, in bank deposits, with an interest charge included.

Bank deposits are thus subordinated to the liabilities issued by the sovereign.

They seem to explain an awful lot to me.

I started off on the private money/debt side, and that explained a lot.

I thought there can’t be any big new things to discover and although I was aware of MMT, I hadn’t really got into it.

The Guardian commenter was giving me a hard time and to counter his arguments I had to know what he was talking about. Also, I could tell he thought he was onto something really important, and this also pushed me to get into it more.

When I did get into it, it really helped me to get the big picture and explain some of those things that were a bit flaky by just looking at the private money/debt side.

Richard Koo’s work in Japan is really important and I understood a lot of it before, but I needed the MMT side to fill in some of the gaps. I could now make sense of the flow of funds charts he uses.

https://www.youtube.com/watch?v=8YTyJzmiHGk

The money supply ≈ public debt + private debt

You need both to get the bigger picture.

(It should have gone in the first one, but I only just thought about it)

Public “debt” is equivalent to net financial assets of the private sector.

Not to quibble, but to keep the so-called books balanced, the private sector’s wealth (i.e., asset) is offset by the public sector’s equity not by liability (debt) nor by asset.

“Rich peoples’ wealth” balances against Equity On the Great Balance Sheet: I wonder — I can sell stuff I own that I have “equity” in, but how can we the public realize some kind of return, wealth even, on that Public Equity? Seems somehow that several quadrillion “real” and notional dollars, in part based casino on games played with bonds and stuff, is locked up in obscure “accounts” in places like (genuflects to the City) like Panama and the Channel Islands. And any effort in the direction of something like “redistribution via ‘fair’ taxation” or pursuit of a “peace dividend” gets shrunk down and drowned in a bathtub of vastly expensive Champagne…

And forgive the ignorance and incomprehension of me and others who swim in this sea of obscurity, if we dare to note that NOBODY apparently “understands” how this all works, what the real structure and functions and rules (sic) all are, and even, just from this thread and post, what ‘money” is/are and how it all works (until it doesn’t.)

Does not mean that the vampire squids and other self-licking parasites don’t understand enough to figure out how to strip all value and lootable wealth out of the whole complexity. Like orcas eating just the tongue and lips of a blue whale, or likeliness “the Market” these days, working cooperatively with other predators (humans, in this case) to draw in and slaughter the

muppets and dumb money“Investors,” some humans doing the harpooning and the orcas getting the choice bits with the bulk of the carcass going to the naked apes…Well, the wealthy are included in the public and yes, often when they act in their own interest it is at the expense of the public’s.

Equity sits on the same side of the balance sheet as liabilities (assets = liabilities + equity). Since public debt never needs to be repaid (if issued in domestic currency), it isn’t a liability. But it isn’t an asset, otherwise we would need to depreciate it somehow – which doesn’t really make much sense.

Equity is a more accurate term. In the private sector, equity is invested with an expectation of return.

The public realizes a return on public spending to the extent that it increases the productive capacity of the domestic economy. This should be the purpose of public spending – the well-being of the citizenry being a critical part of the overall productive capacity.

Of course, not all public spending does so. To the extent it does not, that is poor policy by the government and/or an investment that didn’t pan out.

Equity is a policy-neutral term. “Debt” is laden with ideology. And, one problem of equating public debt = “bad” is that the “badness” is applied indiscriminately.

When was the last time there was a debate on the deficit when a military spending bill came up? But when an increase in health care spending (say Medicare For All) is raised, the first question is: “How can the government afford it?”

The answer should be, “How can we not afford Medicare For All, the economy will save $XXX billion annually, it’s a slam dunk investment!”

We need to get beyond “government spending = debt” and therefore “bad”. Some of the tools we need to get there include a basic understanding of how the monetary system is currently structured and operates.

There is a big difference in debt in America when a state or a municipality goes into debt than when we as a nation go into debt.

I live in the second most indebted town, in the most indebted county, in the most indebted state in the nation.

My property taxes to pay for this local debt have increased exponentially!!!

This seems to evade a big problem – that kicks the poor in the nuts.

Banks themselves only really make property loans. Those property loans mostly serve to drive up the price of land. Which turns the landless poor into serfs to their landlord – or turns them into near-homeless if they miss a paycheck or three. That price of rental housing is quite deliberately distorted in inflation numbers – esp long-term. While money is created when those loans are actually made, stuffing the banking system with public debts serves effectively to keep stoking housing-based debt with never a correction. An asset bubble. Which is quite lucrative for those at the top who own all the land – and quite shitty for those at the bottom who don’t.

I don’t have the numbers for England over time (though their current numbers are like Spain and the US the highest most-burdensome in the world) but for the US:

Rent as % of renter’s income:

1930’s – 14% (the 28% mortgage affordability benchmark was set at twice the average then)

1940’s – 16%

1950’s – 19%

1960’s – 22%

1970’s – 25%

1980’s – 25%

1990’s – 26%

2000’s – 28%

2010’s – 32% – with some CA cities hitting close to 50%

So how much more rent do you expect poor people to keep paying – so that we can avoid paying for very high paid bureaucrats (6 of the 10 highest income counties in the US are the ones around DC). This is reverse Robin Hood – and I’m personally one who thinks most bureaucrats are absolutely useless. Russia made do with one czar. Why does DC need 50+? Forgive me – but getting rid of them is NOT austerity no matter how much they whine about it.

If you think government bureaucracy is bad, wait till you see what happens in the private-sector boardrooms. Now, *that* is expensive, *and* inflationary — Orders of magnitude worse.

So you’re perfectly ok with jacking up rents on the poor to pay for bureaucrats