Yves here. Peter Dorman’s post on how Martin Weitzman was slighted this year in the so-called Nobel Prize in Economics highlights his importance in the climate change debate. I must confess to only having seen Weitzman’s thinking used as a critical part of a paper I have cited often, Andrew Haldane’s The $100 Billion Question, describes, admittedly in economese, how Weitzman provided a way to decide whether to tax or limit/prohibit pollution:

The taxation versus prohibition question crops up repeatedly in public choice economics. For centuries it has been central to the international trade debate on the use of quotas versus subsidies. During this century, it has become central to the debate on appropriate policies to curtail carbon emissions.

In making these choices, economists have often drawn on Martin Weitzman’s classic public goods framework from the early 1970s.13 Under this framework, the optimal amount of pollution control is found by equating the marginal social benefits of pollution-control and the marginal private costs of this control. With no uncertainty about either costs or benefits, a policymaker would be indifferent between taxation and restrictions when striking this cost/benefit balance.

In the real world, there is considerable uncertainty about both costs and benefits. Weitzman’s framework tells us how to choose between pollution-control instruments in this setting. If the marginal social benefits foregone of the wrong choice are large, relative to the private costs incurred, then quantitative restrictions are optimal. Why? Because fixing quantities to achieve pollution control, while letting prices vary, does not have large private costs. When the marginal social benefit curve is steeper than the marginal private cost curve, restrictions dominate.

The results flip when the marginal cost/benefit trade-offs are reversed. If the private costs of the wrong choice are high, relative to the social benefits foregone, fixing these costs through taxation is likely to deliver the better welfare outcome. When the marginal social benefit curve is flatter than the marginal private cost curve, taxation dominates. So the choice of taxation versus prohibition in controlling pollution is ultimately an empirical issue.

By Peter Dorman, an economist and a professor at Evergreen State College whose writing and speaking focuses on carbon policy, child labor and the global financial crisis. Originally published at EconoSpeak

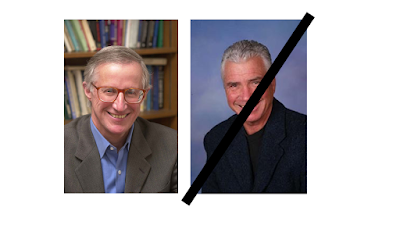

Most of the commentary today on the decision to award Nobel prizes in economics to William Nordhaus and Paul Romer has focused on the recipients. I want to talk about the nonrecipient whose nonprize is perhaps the most important statement by the Riksbank, the Swedish central bank that decides who should be recognized each year for their work in economics “in memory of Alfred Nobel”.

Nordhaus was widely expected to be a winner for his work on the economics of climate change. For decades he has assembled and tweaked a model called DICE (Dynamic Integrated Climate-Economy), that melds computable general equilibrium theory from economics and equations from the various strands of climate science. His goal has been to estimate the “optimal” amount of climate change, where the marginal cost of abating it equals the marginal cost of undergoing it. From this comes an optimal carbon price, the “social cost of carbon”, which should be implemented now and allowed to rise over time at the rate of interest. In his first published work using DICE, from the early 1990s, he recommended a carbon tax of $5 a tonne of CO2, inching slowly upward until peaking at $20 in 2085. His “optimal” policy was expected to result in an atmospheric concentration of CO2 of over 1400 ppm (parts per million) at the end of this planning horizon, yielding global warming in excess of 3º C. (Nordhaus, 1992)

Over time Nordhaus has become slightly more concerned with the potential economic costs of climate change but also more sanguine about the prospects for decarbonized economic growth, even in the absence of policy. In his latest work he advocates a carbon tax of $31 per tonne in 2015, increasing at 3% per year over the following century. This too would result in more than 3º warming. To give a sense of how modest his suggestion is, consider that, in the same paper, Nordhaus calculates that the most efficient carbon tax to limit warming to 2.5º is between $107-184 per tonne depending on assumptions. The target of the Paris Accord is 2º, and most scientists consider this an upper bound for the amount of warming we should permit.

What do these “optimal” tax numbers mean? Based on the carbon content of gas, each $1 carbon tax translates into a one cent tax on a gallon of gas at the pump. If we adopted Nordhaus’ suggestion for carbon pricing, the result would be minuscule compared to the year-to-year fluctuations in energy prices due to other causes. In other words, while his prize is being trumpeted as a statement from the Swedish bankers on the importance of climate change, in fact he is a key spokesman for the position, rejected by nearly all climate scientists, that the problem is modest and can be solved by easy-to-digest, nearly imperceptible adjustments to energy prices. If we go down his road we face a significant risk of a climate apocalypse.

But Nordhaus is not the only climate economist on the block. In fact, he has been locked in debate for many years with Harvard’s Martin Weitzman. Weitzman rejects the entire social-cost-of-carbon approach on the grounds that rational policy should be based on the insurance principle of avoiding worst-case outcomes. His “dismal theorem” demonstrates that, under reasonable assumptions, the likelihood of tail events does not fall as rapidly as their degree of catastrophe increases, so their expected cost rises without limit—and this applies to climate scenarios. (I explain this graphically here.) Not surprisingly, Weitzman’s work is often invoked by those who, like me, believe much more aggressive action is needed to limit carbon emissions.

It also happens that Weitzman is a giant in the field of environmental economics quite apart from his particular contribution to the climate debate. He did the original work on environmental policy under uncertainty and has contributed significantly to other areas of economic theory. (His analysis of the uncertainty problem is explained here.) Even if the greenhouse effect never existed he would be a candidate for a top prize.

Because of this, whenever economists speculated on who would win the econ Nobel, the Nordhaus scenario was always couched as Nordhaus-Weitzman. (For a recent example, see Tyler Cowen, who adds Partha Dasgupta, here.) It seemed logical to pair a go-slow climate guy with a go-fast one. But as it happened, Nordaus was paired not with Weitzman but Paul M. Romer for the latter’s work on endogenous growth theory. I won’t take up Romer’s contribution here, but what is interesting is that the Riksbank committee chose to yoke together two economists whose work is only loosely related. I can’t recall any forecaster ever predicting a joint prize for them, no matter how much commentators have scrambled to justify it after the fact.

The reality is this is a nonprize for Weitzman, an attempt to dismiss his approach to combating climate change, even though his position is far closer to the scientific mainstream than Nordhaus’. An example of the enlistment of the uncritical media in this enterprise is today’s New York Times, where Binyamin Appelbaum writes:

Mr. Nordhaus also was honored for his role in developing a model that allows economists to analyze the costs of climate change. His work undergirds a new United Nations report on the dangers of climate change, released Monday in South Korea.

Wrong. The work Nordhaus pioneered in the social cost of carbon is mentioned only twice in the IPCC report, a box in Chapter 2 and another in Chapter 3. The reason it appears only in boxes is that, while the authors of the report wanted to include this work in the interest of being comprehensive, it plays no role in any of their substantive conclusions. And how could it? The report is about the dangers of even just 1.5º of warming, less than the conventional 2º target, and far less than the 3+º Nordhaus is comfortable with. Damages are expressed primarily in terms of uninhabitable land and climate refugees, agricultural failure and food security, and similarly nonmonetary outcomes, not the utility-from-consumption metric on which Nordhaus’ work rests.

The Nordhaus/Romer combo is so artificial and unconvincing it’s hard to avoid the impression that the prize not given to Weitzman is as important as the one given to Nordhaus. This is a clear political statement about how to deal with climate change and how not to deal with it. The Riksbank has spoken: it wants a gradual approach to carbon, one that makes as few economic demands as possible.

Nordhaus, William. 1992. An Optimal Transition Path for Controlling Greenhouse Gases. Science.Nov. 20. 258(5086): 1315-1319.

i hope some future explorer from an alien civilization finds this and clicks to itself, stupid humans did it to themselves.

I’m going to make the inevitable comment that the Swedish Bank prize is called “the Nobel Prize in Economics” by journalists and the Swedish Bank, but other than the name has nothing to do with those other prizes set up by the Nobel foundation. Absent successful legal action by Nobel’s heirs, this should be pointed out in every reference to the Swedish Bank prize.

You’re so right. In the same vein, it always makes my teeth ache when I hear Paul Krugman being referred to as “nobel prize winner”.

In my more sombre moods I think that Krugman only got this “Nobel” prize because it’s issued by bankers whose product is debt, and Krugman is always calling for more debt and deficit spending as the solution to all economic woes. So the bankers love him. And screwing Weizman is because they hate him.

It fits.

Alfred Nobel never considered economics a science. As should absolutely no one on this earth. It isnt a science, it isnt a math, its like law, manmade and ultimately a poor modeling of extremely complex behavior to try to control markets. Because let’s be honest: economics whole schtick is to control markets, either by predicting behavior or passing new financial instruments. All of which have done basically nothing for the common man except bury him in debt and promises that are impossible to keep.

“Stoopid Hyoomins!”

Is the author from the same Evergreen St College as our hero Marcie Frost hopes to one day claim a degree from?

This approach skates around two major uncertainty issues, one climate science and the other economic. Climate science issue is that the climate change models produce a range of temperature increases, not a fixed value. So in the 3 C scenario (CO2 at 1400 ppm), the range is probably 2 C to 6 C as scientists typically report more conservative numbers for political reasons. As an economist modelling the 3 C scenario, proper way to do the study would be to include the necessary variability in the CO2 level, so that the upper boundary of the scenario is 3 C. For example, instead of modelling only CO2 at 1400 ppm, the upper boundary of the cost would include modelling CO2 at 800 ppm where 3 C is the upper range of the model prediction.

The key economic question, as Haldane noted in the 100 billion dollar question, is estimating the cost to the society (social benefit vs. private cost). Using direct fiscal cost woefully underestimates the true cost to the society as a whole. Haldane uses the example of a banking crisis, where direct fiscal cost in the US is about 1% of the GDP, while the true economic cost was closer to 10% of the GDP.

So that $31 per tonne tax for 3 C looks highly unrealistic, it’s likely based on a conservative (lower bound) temperature increase model and something close to direct fiscal cost rather than true economic cost. This is without even getting into the validity of the economic models themselves, which is a whole other can of worms.

What you write is totally true, and there is an analog in climate science also never talked about.

When speaking about expected temperature rises they look at the effects of doubling CO2 on short time frames of a few centuries (direct CO2 effect plus fast feedback loops). This is called the equilibrium climate sensitivity — ECS for short — and is estimated to be 1.5-4.5 degrees with expected value of 3. This is the geological equivalent of fiscal cost.

The equivalent of true economic cost is the whole earth system sensitivity (ESS) which incorporates changes due to melting ice caps, changing ecosystems, etc. It is almost certainly 4-6 degrees per doubling of CO2 has seen in paleoclimate.

Since 1400ppm is over two doublings, that means Nordhaus was arguing for over 6 degrees in the next few generations and over 12 degrees long term.

This is guaranteed to lead to the collapse of civilization, the melting of all ice on earth and extinction of over 90% of species, with large mammals almost certainly being wiped out completely.

It’s a prize from a bank it’s not a Nobel!

For others like me who get lost in the number-crunching of economics…and who also sense that it misses, perhaps is inadvertently a part of, the deepening environmental crisis that forms the ominous background of modern life:

https://charleseisenstein.net/essays/of-horseshoe-crabs-and-empathy/

Perhaps, this needs to be though of as a global question. Do 8,000 mile supply chains make any sense in a world where pollution is borne globally. If CO2 is this big of a threat, then attacking other sources of pollution produced (ie particulates) from the same processes makes more defensible sense. Maybe the US and EU should have environmental tariffs based on source pollution. Why don’t environmentalists care more about trade from major polluters with lax to no regulation?

The truth is at least in the United States, the environmental movement peaked oh so long ago, and is really of no use in its current guise, despite being a handy whipping boy for the GOP to blame things on.

>>Why don’t environmentalists care more about trade from major polluters with lax to no regulation?

if you want to be cynical….cuz they love their iPhones, year-round avocados, and cheap tube socks……just like every other first world consumerist on the planet. in the first world, we’re all guilty/culpable.

To be glib: being Henry David Thoreau takes so much work—no internet, you gotta chop your own wood, don’t even get 2-ply toilet paper. It’s easier if I rant on internet or twitter.

A perfect illustration of the human and institutional short-termism that guarantees catastrophic outcomes. As long as people who make decisions will die of old age before they see the results of their actions no meaningful de-carbonization will happen.

We barely understand tree time – geological time is beyond most of our intellectual capability. And our robot institutions reflect this squared – they assume unlimited resource and unlimited growth – clearly the ethos of a cancer – clearly wrong.

I went to a dinner several years ago hosted by the Dean of my MBA school – I asked the question – “What are you doing or thinking about the systematic problem that our ethos assumes unlimited growth in a finite world” – crickets as the whole table went silent. Uncomfortable crickets but something no one in leadership wants to think about let alone do anything about.

Adam Smith pointed out that any good or service that requires deception to sell it is an inferior good for which the invisible hand conclusion does not apply. The “Nobel Prize in Economics” is an inferior good, the intellectual equivalent of a fake Rolex watch — which is certainly a Rolex Watch “in spirit”. It was obviously set up as a marketing ploy to assuage the status anxieties of economists, who could jump up and down proclaiming “See! See! We’re just as smart as the physicists. And not any old physicists — theoreticians who are so brilliant they don’t have to do experiments.”

Economics isn’t the same kind of field as Physics, Chemistry or Physiology, so a prize can’t be based on the “same principles”. Similar procedures in nominations and committee deliberations, no doubt. But ritualistic aping of procedure doesn’t transmute the field into something approximating the natural sciences.

A minor but stubborn problem is that there’s an admixture of politics in the choices. Is a prize funded by a bank really going to treat fairly a heterodox theory whose policy consequences would impair the profits of banks? I can’t think of a single winner in the natural sciences whose mention brings to mind a pile of bodies in a soccer stadium.

Alfred Nobel’s will also established Nobel Prizes for Literature and for Peace. The ersatz Sveriges Riksbank

Nobel is analogous to the genuine Nobel for Literature: it is a prize for science fiction.

You beat me to it.

Here’s Yasha Levine’s longform explanation of just how dodgy the whole economics prize is.

ETA:This was supposed to be a reply to Ed.

Thank you for the intro to the work of Martin Weitzman. I was previously unfamiliar with his decision framework. That he was not selected for the Riksbank award by a committee that instead favors a very modest, gradual, and likely ineffectual approach in the face of mounting evidence is reflective of where the views of those who meaningfully influence public policy presently lie. This is unsurprising. However, the duration of their control in the face of both the data and physical experience is highly questionable.

Not to take anything away from Weitzman’s accomplishments in environmental econ, but there’s this in his past. There’s no such thing as free manure either.

https://www.thecrimson.com/article/2005/4/8/economics-professor-causes-major-stink-a/

I think this analysis is much too cynical in that it fails to account for the fact that you never should believe that something is done out of malice when it can be done out of incompetence.

Having met Riksbank staff, this stuff – environmental economics and its broader implications – just is outside the scope of their expertise. It certainly is something that no one at my institution, which is comparable and full of econ PhDs, really understands. I do not know how the Riksbank committee works (nominations can be done by any Scandinavian full professor and some other people), but if someone on it thought that Nordhaus deserves the prize and Weitzman doesn’t, that person with almost probability one was not a member of Riksbank staff – they just couldn’t discriminate.