This is Naked Capitalism fundraising week. 1586 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser and what we’ve accomplished in the last year, and our current goal, more original reporting

Recall that the global financial crisis, the Great Depression and the Asian market crisis, to name a few, all were nasty events because they were credit contractions that threatened to or actually did impair banks and the payment system. So even though stock market train wrecks are very dramatic, unless they do damage to banks or to quasi banks that collectively provide a lot of essential lending, the real economy impact will be limited. Admittedly, China’s stock markets allow investors to margin their shares heavily, so there could be blowback from a stock market bust.

As we’ll discuss a bit more, the market plunge at the end of the US trading day got some pros panicked, to the degree that if the selling picks up again tomorrow, it could feed on itself.

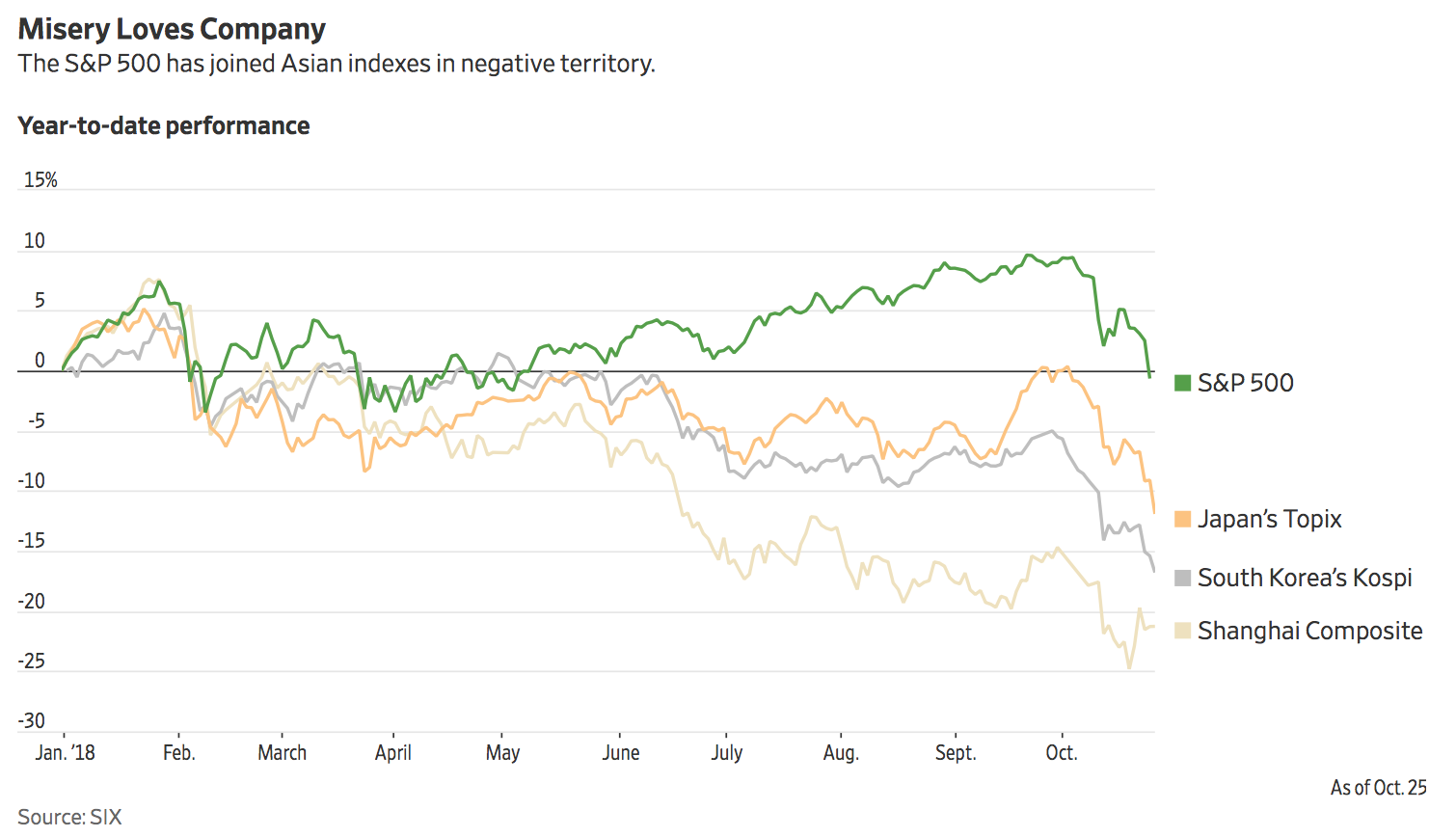

Yet even though, as headlines blared, the selloff in October wiped out the gains for the S&P 500 and the Dow for the year, they’re still up over the last 12 months. And the wave of selling continued overseas. The Nikkei fell 3.7%. China’s CSI 300 was off by as much as 2.8%. As of this writing, the FTSE was down by 1.5% and the Dax by over 2.6%. US futures are up but the US markets were in and out of positive territory yesterday before taking their swan dive. And with 80 companies reporting earnings today, fund managers will have a lot to digest.

If the US stock market continues to be sloppy or worse today, it might have more significance that it would normally due to the proximity to the midterms and the importance of the stock market to Republicans. One of the reasons Trump voters regularly cite for why they still approve of him is that their personal portfolios are up significantly. An October wipeout would dent that satisfaction.

In terms of “why?” who knows? Yale economist Robert Shiller claims there was no reason for the 1987 crash, although the Brady Commission begged to differ (they saw a proposed rule change by Treasury to make the tax treatment of highly leveraged transactions, as well as some weak Treasury bond sales, as triggers). It would seem a broad revaluation is overdue as central banks are trying to engineer a way out of the protracted post crisis new normal of super low interest rates. Super low interest rates, as we’ve seen for years, goose asset prices because future cash flows are discounted at a low rate. Increase the discount rate and everything is worth less. So if you believe that the Fed really is going to keep increasing interest rates, even in a very measured way, it means that earning multiples will fall. And even if the ECB and Bank of Japan don’t seem as bloody-minded, they aren’t in the monetary stimulus game right now.

And before you get to valuations, another prop for US stocks that is falling off is stock buybacks. Many companies have borrowed to fund them, and that become less attractive at higher interest rates. On top of that, many companies have also borrowed so much that they’d face higher interest rates because they’ve made themselves less creditworthy.

But what seems to have focused investors’ minds are trade tensions, which threaten global supply chains and creates all sorts of uncertainties as to how much particular companies might be hurt, and some negative earnings surprises, not all of which are due to tariff-related hits.

Some snippets on the rattled nerves, first from the Financial Times:

“It’s super-ugly, and who knows when it will be over,” said Adam Sender, chief investment officer of Sender Company and Partners, an investment group. “I’m very defensively positioned.”…

“There are a multitude of reasons why markets came down in early October, but everyone said it would be OK because US corporate earnings would prop them up,” said Kerry Craig, a global market strategist at JPMorgan Asset Management. “But they have not been as strong as expected — cracks are appearing in earnings.”

Against a backdrop of rising interest rates and growing trade tensions, a feeling that the best days of the economic cycle were in the past was taking hold, fed by the results of bellwether industrial companies such as Caterpillar and 3M this week.

“That is definitely the fear — that we are at peak earnings,” said Max Gokhman, head of asset allocation for Pacific Life Fund Advisors.

From the Wall Street Journal:

Investors have been grappling with a range of uncertainties this month, including rising interest rates, concerns that earnings might have peaked and the possibility that rising trade tensions have weakened Chinese and global economic growth…

Some investors have also apparently lost conviction that a strong economy in the U.S. was enough to insulate it from gloom elsewhere.

“It seems like people are finally coming to a point where they are questioning if the U.S. is very different from global markets,” said Felix Lam, a portfolio manager at BNP Paribas Asset Management. “We are still quite globally linked,” he said, adding that trade tensions will ultimately affect the U.S. as well.

“The fear is palpable in stock markets at the moment,” Greg McKenna, a markets strategist at McKenna Macro, wrote in a note Thursday. “When folks are struggling to explain the driver of a move that means an obvious circuit breaker is also not in evidence. So this could get much worse before it gets better. Collapses happen after falls. That’s the danger.”

Now having given all that gloomy talk, Bloomberg’s headlines depicted European markets as stabilizing and pointed out that US futures are up. So yesterday’s action could prove to be a case of jitters that Mr. Market shakes off today. But technical maven Jesse thinks the trajectory is baked in:

The decline in the equity markets was very real today, although there was a distinct lack of tangible fear amongst the wiseguys. Although the professional cheerleaders and spokesmodels were uncharacteristically at a loss for words and rationalizations, being suitably confused by the selling— homina homina homina…

We will likely see some bouncing around since we are still in monetary la la land. But the handwriting is clearly on the wall.

I mean I even labeled these ‘blow off tops’ pretty much in near real time. I added a ‘ding ding ding’ to the big cap tech chart in case you missed the hint. Sometimes they do ring a bell, right?…

There may be some bright moments ahead. There always are.

But things are probably going to get worse, and maybe a lot worse if we continue to be stiff-necked, easily manipulated, and refuse to reform. History does not hold out much hope if we do not.

I just wish there were not so many innocents in the blast radius of this madness.

Markets aren’t terribly rational, so your guess is as good as mine.

Update 2:00 PM: Even though US stocks are on the mend, investors are sulking that the Fed didn’t run to their aid. The Wall Street Journal has only a smallish headline, Stocks Gain After Rout, above the fold now; you have to look to the right to their little “Markets” chart to see that the Dow is now up 1.46% and the S&P 500, 1.7%. From Bloomberg:

Besieged global investors swimming in a sea of red are consumed with one magic number: the strike price of the so-called Powell Put — or how much more blood stock markets need to shed before spurring the Federal Reserve to temper its hiking plan.

For now, a chorus of Wall Street voices say the $2 trillion tumble in U.S. equities this month has yet to tighten financial conditions to levels that would spark a dovish monetary offset. That’s even as traders in eurodollar markets lower wagers on interest-rate increases next year….

And the Fed is of our view: wake me when there’s a credit market issue:

The market rout has yet to inflict much pain on corporate bonds, a key component of financial conditions monitored by central bankers. The spread of junk bonds over investment grade corporate credit has narrowed about 14 basis points this year….

After last month’s Fed meeting delivered an interest-rate increase, Chairman Jerome Powell hinted at the prospect of a pause in the hiking plan, notes Anand Ramachandran at River Valley Asset Management.

“He tackled it twice — first by pointing out that market valuations are at the higher end of historic ranges, and from that perspective a correction would not be unusual,” the Hong Kong-based investor said. “Second, after a repeat question on the topic, he stated that the Fed looks at secondary effects and the nature of corrections.”

The S&P 500 has returned about 35 percent since the Fed began its tightening cycle in December 2015.

More of the same, as the last few decades have shown.

That fictitious financial wealth has a nasty habit of evaporating.

What is real wealth?

In the 1930s, they pondered over where all that wealth had gone to in 1929 and realised inflating asset prices doesn’t create real wealth, they came up with the GDP measure to track real wealth creation in the economy.

The transfer of existing assets, like stocks and real estate, doesn’t create real wealth and therefore does not add to GDP.

The real wealth in the economy is measured by GDP.

Inflated asset prices aren’t real wealth, and this can disappear almost over-night, as it did in 1929 and 2008.

It seems to me there is a problem with GDP figures as well, in that they are measured in units of currency, which can be variously manipulated and framed. Real, usable wealth is something else. Certainly the inflation of asset prices driven by low interest rates have very little to do with it. Hence the periodic crises in which the funny money suddenly evaporates.

And GDP includes profits in the FIRE sector as a positive contribution, even though it actually represents the rentiers’ extraction of wealth from the productive capacity of the country. It would probably be more appropriate to subtract those ever increasing gobs of filthy lucre, but I would settle for ignoring them in GDP calculations.

Don’t worry, if it comes down to it my neighbor and I will help keep the GDP up. Right now we just tend our own yards but if the GDP needs a boost I’ll pay him $100 per month to take care of my yard and he will pay me $100 per month to take care of his. That’ll give the GDP a nice little boost! Just think, if everyone did what we plan to do we can end the next depression before it even gets fully started!

Wouldn’t it be interesting if Dow Jonestown, in a manufactured downturn that coincided with the election, set off another 1929?

The timing is perfect from a late October perspective…

…there’s never been a better time to not own stocks

I know Wuk, put my entire stash into cash beginning of month.

And, then they said they’d lost the switching form.

Well, I hadn’t and had proof of lodgement…

Some crappy business people in this world.

————

Next direction? Feels different this time… And most of the LT investors are still up big time..?. ‘Tensions’ feel subdued, or just overwhelmed by finance news

Could be all these bomb threats too exacerbated the selling.

It is easy to instil a belief in the markets.

Maintaining it is another matter altogether.

Everything was going so well in the 1920s and free market; neoclassical economics had nearly everyone in its thrall.

Along came 1929 and that was the end of that.

Once you have got everyone believing in the markets, people think the higher the markets are the better things are, but this is not true as they found in 1929.

The central banks have spent ten years inflating asset prices as they have forgotten the markets should be a measure of real economic activity.

The FED’s QE and US company’s share buybacks have just got US markets up to 1929 levels again compared to fundamentals.

When people believe in the markets they get confused and start just inflating the markets although this just sets you up for a big correction as the markets get back into line with the real economy again.

“Don’t fight the FED”……….. Lesson 1 page one from the book of Wall Street rules.

After a lot of gorging on low rates by corps., homeowners, car buyers, home buyers, ect. The FED is now raising rates and selling off it’s balance sheet.

If Blue wave hits in Nov. Trump tax cuts may be reversed. Corp earnings and cash flow go down just in time for refinancing of Corp debt taken at ultra low rates…..

Did I mention Lesson 1 Page one?

There’s an election coming, could it be those meddlesome Russians again on Faceborg?

Seriously though, it could be an October Surprise designed by those who actually do control our “democracy”, but since Trump appears to be in full compliance with the Neocons and the ME country they represent, it’s a little puzzling. Perhaps a minor blue tide is needed to ensure the status quo on immigration and rigged trade.

Under the new abnormal, IMO the market simply cannot be allowed to tank. The Fed (sic) Reserve Cartel will simply print whatever it takes to buy US stocks in volume for a floor. They’ve been doing it thru proxy buybacks and directly thru QE toxic bond purchases for years. The cartel no longer has a leash. It will continue printing debt until the paper empire folds completely.

Panic? I suppose so but notice, although the Dow closed down about 611, there was also

someone else there, as it in fact ROSE about 50 points in the last minute.

Markets are up this morning, as I presume the successor to the “Plunge Protection Team” came in with their latest gap-and-ramp, firing on all cylinders with algorithms blazing. The question I have is where the trading capital fueling this pushback “rally” in the casino is coming from, and who is being denied funding? Maybe it’s something along the lines of “Just get me through the mid-terms, baby”?… as “Buy The Dips” minions and trillions of dollars in corporate Stock Buybacks funded with debt and massive corporate tax cuts increasingly appear to have had their day under the ZIRP sun at the nexus of politics and big money. In any event, setting aside fundamental questions relating to values it’s hard to see how an ordinary citizen can rationally invest in these subsidized markets given the volatility we are witnessing daily. But gambling is pervasive in our culture, one might even say a dominant feature. So evidently it’s “Forget the macro fundamentals and focus on the technical indicators”, for it’s onward and hopefully upward with our casino-owning president, at least for this morning.

It’s worth noting that in the run-up to the French Revolution, that gambling was rampant in France.

Book tip: The Days of the French Revolution, by Christopher Hibbert.

Why would a share of an 8 million dollar robotics company be worth 20 dollars now? Corning is worth 30 dollars.

Far as I understand it now is a great time to look for stocks to buy, though it is a better time to buy T Bills. If you see a nation as if it were just another company to invest in or not invest in, there is no real problem for the professional gambler.

Whatever is being trick traded is probably overpriced. I mean by that those trades done by AI systems. Sure they are fast but what do they really know?

I’ve characterized the FIRE sector as “parasitical pirates”, and far as parasites that is how Michael Hudson characterized them of that system. For that bunch the Americans have been made into the reinsurers. They are not getting their due for services rendered.

The transformational sectors such as AI and robotics have been sluggish. The higher price of steel is a big deal. The focus of industry now must be made to conform to and advance planet maintenance. Chinese steel was being made without conforming to best practices sending air pollution to the West Coast of the US. In fact we ought not be buying that for whatever price as long as it pollutes so much. Until the issue of the price for steel is straightened out one ought expect slowing of the real economy.

There simply will not appear a real replacement for steel for even with a rise in price it will continue to be less expensive for the strength and weight of something like a bulldozer. We do need to replace the engines for bulldozers and tanks with batteries and electric motors.

I’ve suggested in tweets that Elon Musk make an electric tank. Changing the tank divisions of the armies of the world over to electric motors offers an opportunity for Tank Limitation Treaties which offers greater chance of effective Nuclear Arms Treaties. In so much as investing can satisfy human needs and humans need clean secure prosperous food secure places to live, investments that jettison the old dirty and inefficient ways for the better practices will pay off.

Sweet Info!

Curious that nobody has touched on the fact that the USA is engaged in GLOBAL TRADE WAR with almost everybody. How could that affect the market? Then there are the annoying anklebiters such as Saudi’s 007 adventures that could massively disrupt oil prices, China’s over-leveraged economy, and good ole global warming. Alternatively, it might just be a little pre-Christmas profit taking.

If the 20-25 largest banks in the world are financially intertwined, it’s possible the reality of a crash-out Brexit is beginning to rattle some nerves in international banking, in addition to everything else written in the post.