This is Naked Capitalism fundraising week. 820 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser and what we’ve accomplished in the last year, and our current goal, thanking our guest bloggers.

Yves here. I’m old enough to remember Sears fondly. I grew up mainly in small towns where the Sears store. although dull to me as a child, was clearly important to my parents and other adults. I remember it as a straightforward purveyor of staples like hardware (those Craftsman tools!) and reliable Kenmore white goods. I know there was more to Sears; both my mother and grandmother, who live with us a big chunk of the year, read their catalogues closely.

Wolf Richter explains why Sears is going down for good. I do have one quibble: he lists Toys ‘R’ Us as being liquidated. That had been the plan, but its new owner apparently didn’t get the bids on the intellectual property it wanted, and has decided to revive the stores with a less sprawling physical store presence and more emphasis on online sales. Toys ‘R’ Us might be able to make it because it was a very much loved store crushed by too much debt. By contrast, as Wolf describes, there’s very little of what is left of Sears for customers to care about.

Private equity expert Eileen Appelbaum has a new article at CEPR, Jobs, Pensions Lost in Sears Bankruptcy, but Hedge Fund King Gets Paid, that describes at length the machinations that hedge fund kind Eddie Lampert went to in successfully enriching himself at the expense of Sears, in particular stripping Sears of real estate that reduced its expenses and had allowed it to ride our recessions and invest. The business and the workers that depended on it didn’t have a chance. Key sections of Appelbaum’s piece:

It was a few days after Christmas when Sears announced plans to close up to 120 Sears and Kmart locations. The year was 2011. ….

The company was a good candidate for a turnaround. True, many of Sears’ stores were in downwardly mobile neighborhoods. But that didn’t stop Dollar General and Dollar Tree from succeeding. Sears owned high-quality brands — Kenmore appliances, Craftsman tools, and apparel maker Lands’ End. It had mastered “online” retailing before the web and email, back when that meant ordering from a catalog. As for logistics, Sears had figured out how to deliver everything a family needed to build its own house!

What Sears needed was a President that understood retailing and could make much needed changes in the company’s business model. What it got instead was Eddie Lampert, a billionaire hedge fund manager who knows how to make money, but not so much apparently about how to improve retail operations. Same-store sales declined every yearfrom the time his hedge fund first invested in the chain to 2011, when it first announced major store closings. Between 2011 and 2016, revenues at the retail chain fell by almost half, with the company losing $8.2 billion in 2016….

Sears has been on a downward trajectory that accelerated after Lampert took control of the company up to its bankruptcy announcement today. In 2006, shortly after Lampert took the reins at Sears, its stock traded at $162 a share; by 2017, it traded at under $10, and in August 2018 was trading at a little over $1. But while the retail giant has lost money, closed stores, and laid off workers — over the past decade it has closed more than 1,000 stores and reduced employment by 175,000 workers,…,

Borrowing from the private equity playbook, Lampert loaded Sears up with debt and sold off many of its most valuable assets. In 2015, when it was already obvious that Sears’ days as a going concern were numbered, Lampert’s hedge fund created a publicly traded real estate investment trust called Seritage Growth Properties. Lampert then had Sears sell 266 Sears and Kmart properties to Seritage for $3 billion. The retail chain then paid the trust a total of $135 million in rent in the first year of the lease agreement for stores it had previously owned, with guaranteed rent hikes in following years. What made the sale suspect is that Lampert was Sears’ chief executive and largest shareholder and, at the same time, was chairman of Seritage’s board of trustees.

While Seritage continued to collect rent from still open Sear stores, it was simultaneously converting the prime real estate of now-defunct stores to expensive new uses. In Santa Monica, CA, it converted the Sears store into office spaces suitable for the area’s burgeoning high tech sector. On Long Island, NY, it is considering redeveloping the Sears site into a 600 unit apartment complex. In Aventura, FL, it has begun construction of a luxury shopping center. Observers labeled it an “audacious feat of financial engineering.” Seritage’s share price has soared as Sears’ shares have turned into penny stocks. But as major shareholders of Seritage, Lampert and ESL stand to do just fine….

The biggest losers in this, as in other retail bankruptcies, are the workers thrown out of work as stores close. There are also about 100,000 retirees who will face cuts in retirement income if Sears can offload their pensions to the Pension Benefit Guaranty Corporation in the bankruptcy. Whatever happens, Lampert is likely to come out of this a winner.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

This follows the script of the brick-and-mortar meltdown of retailers that were bought by Wall Street and subsequently subjected to asset-stripping and cost-cutting, which ruined what little was left of their brands. Mired down in survival mode, those retailers failed to build a vibrant online presence and fulfillment infrastructure. As sales withered and losses ravaged the company, debts became unmanageable. But the bankruptcy by Sears Holdings is just so much richer – and the restructuring in bankruptcy has a zero chance of succeeding.

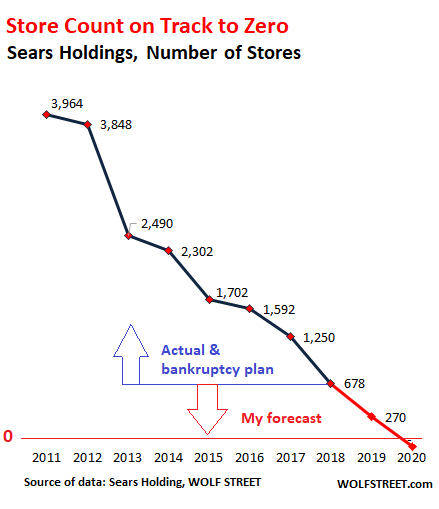

Monday morning, Sears Holdings filed for Chapter 11 bankruptcy with the intent to restructure its debts and obligations, close 142 more stores, in addition to the 46 store closings it recently announced, and in addition to the thousands of stores it closed in prior years. This would bring its store count from the 866 stores in Q2 to about 678 Sears and Kmart stores by the end of 2018. The new goal is to shrink and somehow thrive. Same as the old goals. This chart shows how Sears cut its way to health and profitability, by reducing the number of stores from nearly 4,000 in 2011 to 678 by the end of 2018:

And at this unstoppable trajectory, the store count will drop below 300 by the end of 2019 and dip into the negative by 2020 – if only that were possible.

Every wave of store closings came with corporate verbiage about transforming the company into a smaller but profitable retailer. And so inevitably, there was more of the same in today’s announcement of the bankruptcy filing.

“Over the last several years, we have worked hard to transform our business and unlock the value of our assets,” hedge-fund owner and Sears Holdings CEO Eddie Lampert said with deadpan sarcasm. He, his hedge fund ESL, and related entities are Sears Holdings’ largest shareholders and largest creditors, and what they have lent the company is secured by the company’s best assets. So the “value of our assets” that he has “unlocked” has already gone, or will go, to him and ESL.

In financial terms, the filing listed $6.9 billion in assets and $11.3 billion in liabilities. On paper, there is a hole of $4.4 billion. The size of the hole may change, depending on the magnitude of further losses and the ultimate sale price of the assets, ranging from inventories to the remaining company-owned stores.

In the announcement, Sears said that it has lined up a debtor-in-possession (DIP) loan of $300 million to fund its operations through the bankruptcy proceedings, and that it is “negotiating” an additional $300-million Junior DIP loan. Reuters reported on Sunday that according to “sources,” Lampert may participate in the DIP loan.

One of the ways for Lampert to get the real estate is to pledge it as collateral for a loan and then have the company default on the loan.

Another way is this: Sears Holding already sold 235 of its best stores for $2.7 billion in sweetheart deals to Seritage Growth Properties, when it was still a Sears entity, some of them on a lease-back basis. Seritage was then spun off from Sears via a rights offering in July 2015. Lampert is chairman of Seritage and owns a big chunk of it via the rights offering. Aggrieved investors in Sears Holdings filed suit. In 2017, Sears Holdings and Lampert settled for $40 million.

The Seritage deal is one reason the bankruptcy filing had to be dragged out so long. The two-year look-back period for “fraudulent conveyance” in the federal bankruptcy code incentivized Lampert to keep the company out of bankruptcy at least through July 2017. And state law often provides a longer look-back period. So now was apparently long enough to avoid “fraudulent conveyance” issues of the Seritage deal under state law as well.

Lampert will remain chairman of Sears Holding but will lose his role as CEO, according to the announcement. The “Office of the CEO” – a three-person committee – will assume the executive role.

Sears Holdings had about 89,000 employees in the US as of February, down from 246,000 people five years ago. The employee count will go to zero not long from now.

Sears Canada too filed for restructuring in Canadian courts in June 2017 to somehow muddle on in restructured form. By October 2017, it became clear that restructuring efforts had failed, and the Sears Canada was liquidated .

Toys “R” Us, which was owned by private equity firms, went through a similar program, filing for Chapter 11 bankruptcy in September 2017 in order to restructure its debts and go on, but those efforts failed, and in March, it was over, and Toys “R” Us was forced into liquidation.

Retailers are notoriously difficult to restructure. After years of losses – Sears Holdings has lost money since 2011, including nearly $1 billion in the first half this year – they’re burdened with debts and don’t own enough assets to cover those debts.

But in the case of Sears Holdings, it’s not just a financial problem. It’s a retail problem that is much worse than the retail problems at Toys “R” Us.

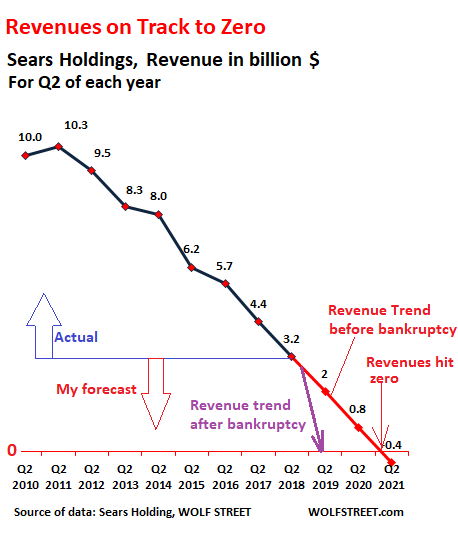

Sears Holdings has willfully killed its sales. In its Q2 loss report on September 13, Sears Holdings disclosed that revenues had plunged 26% from the same quarter last year, to $3.18 billion, continuing their seven-year astoundingly straight line to hell. The chart below shows revenues for Q2 of each year since 2011. My estimates are marked in red, based on past revenue declines:

According to Q2 data, “zero” revenues loom at the end of 2020. But it will not last that long. The show will end sooner: The bankruptcy filing will speed up the sales plunge to perhaps 40% or 50% year-over-year over the next two quarters (purple arrow in the chart above). And liquidation is likely early next year after the inevitable holiday sales fiasco.

You cannot turn around a debacle like this by restructuring its debts and closing stores. This would require an operational turnaround: branding, marketing, merchandising, sales, customer relations, employee relations, etc. Sears would have to get employees excited again about working there and consumers excited again about shopping there. But that won’t work because over the years, the company destroyed customer goodwill, surgically removed any reasons to shop at its desolate run-down stores, and mauled what was left of the brands.

I don’t give “free” advice to hedge fund managers. But if I were to give free advice to Eddie Lampert, it would sound like this: “Don’t write any more blog posts to blame pensioners for the collapse of Sears Holding after you wasted $5.8 billion on share buybacks.” Read… My “Free” Advice for Sears Holding CEO Eddie Lampert

alright, who’s going to be the hapless soul that whips out the abacus and adds up all the self-dealing $$$$ that ESL gained from Sears over the years and balances it out w/Eddie Lambert’s equity wipeout.

Presumably Eddie’s doing ok and I’m not going to see Eddie taking the 4 train anytime soon.

Don’t need no abacus, the answer is “all of it”.

Thank you very much for this post. This sort of information is why I read Naked Capitalism.

My comment on swell guy Lampert’s destruction of a fine company and its workers is unprintable in a family blog. Very much shorter (and printable): it ain’t the workers that are the problem in modern American business.

Sears had the best popcorn, and when the xmas wish book came in the late summer, it’d be dogeared by December, even though we didn’t shop there all that much. It was more the novelty of an inch and a half of possibilities.

Sears la vie~

Saw this twitter thread about impact of sears catalog in jim crow south:

That’s amazing. Thanks for that.

wonderful. Thanks.

My father always used to go to Sears for the Craftsman tools, and he loved good tools. And my first trainset was from Sears: American Flyer (shortly to be crapified with inferior plastic couplers and then liquidated, does anybody else remember?)

My first trainset was American Flyer too, but I don’t think it came from Sears.

I was in Lowe’s this morning and they are setting up a new Craftsman tool display. Doesn’t look like Sears is coming back.

And of course the tool section was always a big draw for the store since they seemed to have any tool you could think of. So the advent of home improvement stores with their own tool departments took a bite out of Sears business as did Walmart which came to appeal to many of the same customers but with lower prices. Personally I think it’s been all downhill since Sears got rid of the catalog.

Just an fyi. I heard that Kobalt tools are supposed to be on deep discount after the first of the year as they clear the way to fully bring in the Craftstmen line

My husband and I are finally to the downsize stage. I was looking over a lifetime of furniture acquisitions to determine what should be kept. I have a Queen Anne chair purchased from Sears Surplus in about 1989. It still looks like new (although it was more an accent piece than anything else). The label under the cushion indicates the chair was made by Sears in the USA by union workers. Remember the jingle Look for the Union Label. That chair is definitely a keeper for the label alone.

Sears’ decline has been going on for much longer than the tenure of Eddie Lampert. I can remember plenty of snarky “Why would anyone shop at Sears?” jokes from my college days, and those days ended in the late 1970s.

I agree 100%. Sears was essentially dead 30 years ago but it’s taken this long to burn through or sell off all their assets and burn through enough debt to force it to close. Their primary customer base died 20+ years ago & there is nothing they could have done to make a significant percentage of 20 somethings want Sears clothes or furniture. JCPenney is headed there, it’s unavoidable. Cadillac cars are heading in the same direction. I’m 51 and I know one person under the age of 60 who has purchased a Cadillac that wasn’t an SUV.

I would happily have bought tools or appliances and maybe even socks from Sears circa 15 years ago and I’m under 40. I bought my first computer from then in the 1990s. Also they had some of the best toys.

They had a reputation for quality that they needlessly destroyed.

Funny how the demise of Kmart isn’t even an afterthought for people. I went into one for the sake of nostalgia recently. Unbelievably depressing.

Edit: the softer side of Sears campaign was the weirdest brand overhaul I ever heard of. How could you possibly convince people born after 1920 that they should get their office clothes where they got their washing machine?

You could easily do so from JCPenneys back when it actually had competent retail and not incompetent financial style of management. I assume that Sears was the same. Plenty of people need some formal or business wear for work, interviews, church, and so on with paying through the nose. A decent employee could walk a clueless person right through the process, perhaps add some accessories, sell an outfit or two, and have them leave happy, not broke, with decent if perhaps somewhat stodgy clothes.

Just where can you do that now? Most people can not afford the few high end department stores or the like.

But then, there are fewer and fewer jobs that actually pay enough to buy good quality clothes. If you find a place that sells them.

> perhaps somewhat stodgy clothes

I remember the last days of Macy’s at the Bangor Mall, where the sales people and the displays stayed classy to the end. But the handwriting as on the wall when I found I couldn’t find clothes that really fit any more. No longer was there a range of numbered sizes in small increments, but S, M, L, XL. From offshore manufacturers. Good for the workers sending money back to the village in Malaysia or wherever, but I’d at least like clothes that fit, too.

My favorite complaint is the decision to switch sleeve sizing from 1 inch to 2 inch increments. I used to be able to get dress shirts that fit, now they’re almost all too short or long. The number of brands exploded, but they’re all the same, so now they have 20 different brands that don’t fit, instead of 3 that do.

More of the crapification™ of everything.

“competent retail and not incompetent financial style of management”

Bingo! Sad thing is the “incompetent”financial style management works out great for those at the very top. When they completely destroy a company they really rake in the money.

“How could you possibly convince people born after 1920 that they should get their office clothes where they got their washing machine?”

You name the company Amazon? Seems to work.

This disappearing of sizes has been happening for at least forty years. You almost need made to measure or at least a great tailor to have your clothes fit well. If I ever get to doing my masters degree that’s one bit of information I would want to put in.

I used to shop at Sears quite a bit in the 1990s and 2000s. Their locations were a big part of their appeal. They were rarely market leaders in any particular category, but unlike Home Depot (for example) you could usually find one at the local mall and pick up what you needed as part of a single shopping trip. If all you wanted was something basic or a standard brand that everyone carried, and it didn’t matter too much where you got it, Sears was very often the best and most convenient choice. I bought all kinds of things from them – clothing, appliances, electronics, hardware. For people that hated shopping, like me, they were fantastic.

If I was still living in the US the Sears bankruptcy would definitely be impacting me personally.

It won’t be the last time hundreds of thousands of peasants get tens of billions of wealth destroyed so one greedy phucker can make a billion.

Here, here

Am I right that profitability makes a company vulnerable to asset stripping? Companies are penalized for success. Amazon and Tesla should be prime targets because they never turned a profit, but, paradoxically, that scares away predators. Systemic 21st Century corruption.

There’s also the real estate asset. Sears had a lot of very valuable real estate holdings, which Lampert appears to be transferring to himself, er, his hedge fund and what looks like a shell company Seritage. From W.R.:

One of the ways for Lampert to get the real estate is to pledge it as collateral for a loan and then have the company default on the loan.

Another way is this: Sears Holding already sold 235 of its best stores for $2.7 billion in sweetheart deals to Seritage Growth Properties, when it was still a Sears entity, some of them on a lease-back basis. Seritage was then spun off from Sears via a rights offering in July 2015. Lampert is chairman of Seritage and owns a big chunk of it via the rights offering.

For Lampert, it’s been a real estate play from the start, with the asset-stripping, fees and special dividends the icing on the gravy…

It’s easy credit/lax lending standards that makes a profitable company vulnerable to stripping.

Borrow at 5%, buy a company with lots of cash flow. Strip, strip, strip. Original management + shareholders get a nice payout. New owners do well too. Employees get the shaft, especially if they have a traditional defined benefits pension plan.

Starting w/Mr. Andrea Mitchell in 2001.

My home is now in Mobile, Alabama, though I spend much of the year in C.A. and in Mexico.

In downtown Mobile one can see the name Woolworth tiled into the sidewalk in front of a building that has not yet been repurposed. Only a few Mobilians I’ve asked remember the store when it was open. Same in Macon Georgia. These downtowns collapsed when the perimeter malls were built.

In Mexico City, or now CDMX, Sears is a prominent, busy retailer still. The taxi driver told me last night that Carlos Slim owns this separate Sears.

There are still 35 Woolworth’s in Mexico, and 90 Sears. But there are more than 3100 Walmarts and more than 600 Sam’s Clubs. Carlos Slim has redefined Sears in Mexico as an upscale department store.

The marvelous old buildings, many dating to the mid-19th Century, in Macon are still in remarkably good condition, and downtown is coming back. Slowly but steadily, with loft and other similar apartments plus new construction, art, music, food, beer, and small retail/services leading the way. The deadly Macon Mall is a desert (Sears closed several years ago), with one ersatz “retail community” on the “good” side of town replacing it. Still, the larger local economy must recover for anything to stick…In the neoliberal universe that is a poor bet, but the only play that makes any sense. It would also help if the local political apparatus could reverse its craniorectal inversion, but that is probably asking too much. So, they will be ignored as much as possible.

so, if our elites and our regulatory agencies don’t slap this guy in chains, what are we mopes to think?

it’s obviously ok to rip people off (stockholders, employees, everyone involved except this fast eddie guy), as long as you do it in a slow, controlled fashion involving a lot of lawyers and legal documents?

the dude did worse than run around with a gun holding people up for their wallets, and they just let him walk because he’s a “hedge fund billionaire”?

he gets to shrug “inevitable” as he glides away on his Bond villian yacht, while the mopes lose their jobs and the higher ups who could do something say “tsk tsk”. seems like a clear sign that among you all (general case “you”, not anyone specific here. i actually worked at a Land’s End for abit and could see the writing on the wall plain as day so i am definitely not “you all”) that taking advantage of your lessers is just fine, as long as the right guy does it using the right processes.

a fine example of why the country is in the state it is in today.

Literally. It’s christened Fountainhead. -eyeroll-

But only the little people have to obey (their) laws! Not the Meritocracy. They are special.

he gets to shrug “inevitable” as he glides away on his Bond villian yacht…..

“Amazon did it.” As convenient as it is the excuse for everything.

The important word here is stockholders. How can those holders themselves allow that asset stripping when only one single holder of ~15% benefits? Isn’t that supposed to not happen? How do the other stockholders keep still? The mopes inside and out the company have no real recourse as intended, but stockholders are a priviledged class that doesn’t do anything here.

Vultures at least wait until the corpse stops twitching before ripping into it. Eating the prey alive is left to hedge funds and private equity.

Trump Says Sears Was Mismanaged. Mnuchin Was on Its Board for Years

https://www.bloomberg.com/news/articles/2018-10-15/trump-says-sears-was-mismanaged-steven-mnuchin-was-on-its-board

Thanks for the link. It just gets better and better…. /s

Mnuchin was a college roommate of Sears Chairman Eddie Lampert, who attended Mnuchin’s confirmation hearing for Treasury secretary in January 2017. Mnuchin cut his ties to Sears when he joined the Trump administration.

Mnuchin said during his Senate confirmation hearing in January 2017 that he had invested about $26 million in Lampert’s hedge fund, ESL Investments Inc. He defended Lampert’s management of Sears, which he said “was already a failing issue” before Lampert invested in the company.

As Treasury secretary, Mnuchin sits on the board of the Pension Benefit Guaranty Corporation, which considers applications from companies to terminate their pension plans. During the hearing, Mnuchin told Senator Bob Menendez, a New Jersey Democrat, that he would recuse himself if the PBGC receives an application from Sears. Menendez noted that would leave the PBGC board with just two voting members.

“I’m not sure that the remaining two can ultimately make a decision on such a case which involves 200,000 people’s pensions,” Menendez told Mnuchin.

Sears reminds me a lot of the Caesars casino bankruptcy.

Caesars Entertainment was formed from a 2008 leveraged buyout of Harrah’s by the PE firms Apollo Global Management and TPG Capital. This buyout straddled Caesars with over $24 billion of debt, which eventually led it to file for bankruptcy protection in 2015. Before bankruptcy, however, Caesars PE owners stripped or sold some of its valuable real estate assets to themselves for below market prices. What the PE firms plan didn’t count on, was that Caesars debtholders included some sharp elbowed hedge funds like Appaloosa and Elliott Management. These creditors sued and had an independent examiner appointed to investigate the claims of fraudulent asset sales at Caesars. Things got so ugly that according to FT “The allegations of impropriety gained enough legal traction that Apollo’s co-founder Marc Rowan and TPG co-founder David Bonderman were ordered by a court last year to produce personal financial documents showing their ability to meet billions of dollars of potential personal judgments against them”.

PE investors were ultimately forced to give up most of their equity ownership to Caesars creditors. In addition, Caesars creditors negotiated an exchange of some impaired debt for shares of a publicly traded REIT named Vici Properties, which would acquire all of Caesars real estate for below market prices then lease it back to them for similarly low rents.

I think the lesson hedge funds ultimately took from this drama is that you might be able to get away with stripping a companies assets for below market prices if you lease them back at similarly low rents, and more importantly if you are this companies largest creditor. Naturally now ESL is both Sears Holding’s largest stockholder and its largest creditor. So I think ESL may have the most clout and priority in the event of Sears’ liquidation, and its not clear how other creditors might challenge them in this arena.

What I do think will be very interesting is to see how the Pension Benefit Guaranty Corporation ( PBGC ) will act, as another unsecured creditor, if they have to cover unfunded pension liabilities at Sears. The PBGC’s Board of Directors are the U.S. Labor Secretary, the U.S. Commerce Secretary and the U.S. Treasury Secretary. Our current U.S. Treasury Secretary Steven Mnuchin is a former a college room mate of ESL’s founder Eddie Lampert, and also an ESL investor. Mnuchin has stated before that he will recuse himself from Sears related PBGC decisions, but I have a feeling this could get very complicated as ESL discloses its net gains from all Sears related entities.

I’m sure Stevie Baby will recuse himself, haw haw haw.

A retail consultant made this observation when Lampert had finished his vampiric work upon Sears Canada:

Jim Danahy, CEO, CustomerLab

“Nothing ‘went wrong’ because Sears’ demise was no accident. Some have called it a 10-year train wreck, but it was actually a deliberate, controlled dismemberment of the company since it was acquired by the current ownership group.”

“Management has acted consistently to siphon-off value by selling Sears in pieces rather than investing in the financial and human capital that HBC, Walmart and others were putting in to their operations to succeed.”

“Specifically, their pattern began immediately after the acquisition with share buy-backs rather than re-investment of profits into retail fundamentals, and it expanded to include the sell-off of the company’s most productive real estate assets and brands over the ensuing years.”

“What may be the most remarkable feature of this sad story is how skillfully the owners used lame turnaround promises to keep the vultures at bay, and the cadaver alive throughout a decade-long harvest of limbs and vital organs at premium prices. The current death rattles are little more than spooning out the remaining bits of marrow.”

Sears had ups and downs in the 70’s-90’s, but not full on corporate thieves. If I recall, one bad decision in the late 80’s early 90’s was trying to fly an investment division. At that time, no one thought of Sears as a wise investment in itself, never mind with customer’s money and as I recall it failed miserably. But as a place to buy things, it was still a good general one stop store for a lot of stuff.

I bailed out as a regular when the hardware dept. stopped selling rope (at least in my area), early 2000. What sort of hardware store doesn’t sell rope and why would I want to go into multiple shopping malls to complete my hardware list when I could just hit Home Depot or some other one stop behemoth instead? Of course it wasn’t just the rope. The tools (other than the craftsman) seemed to be getting cheaper in quality and back then, there were truly excellent buys at Home Depot (that has since changed dramatically). In the few times I’ve gone to Sears since, the same thing has happened a couple of times in other areas. They would have all sorts of kitchen utensils, for example, except the one I was looking for even though the item would be fairly standard fare.

And with a few notable exceptions having to do, I guess, with their more successful categories – such as Kenmore appliances, I found the sales people becoming less and less knowledgeable and more and more lurking about to spot a customer that wanted a high priced item. If you asked where the soap or some trivial item was, they would barely look at you and mutter something vaguely in your direction.

The author and Yves couldn’t be more accurate when they point out that while Sears has a sentimental value, (I still call it, “Sears and Roebuck”), few could care less whether it stays or goes, even old timers – until, that is, you get to the devastation in human costs that Lampert is so profitably leaving behind after extracting every last penny.

Sears was an official distributor in the late 1980’s of U.S. Mint produced silver & gold commemorative coins, proof sets, etc., and then way too many of them disappeared in their care, and that was that, maybe they did it for a year or 2, before the U.S. Mint pulled the plug.

They stopped selling rope after an executive stumbled upon a Marx quote…

They’re not idiots after all.

From Robert Kuttner:

https://www.huffingtonpost.com/entry/opinion-sears-bankruptcy-hedge-funds_us_5bc4b346e4b0bd9ed55c8a58?utm_source=nextdraft&utm_medium=email

As Kuttner says, “there ought to be a law.”

Now after looting the company to his own enrichment swell guy CEO Lampert blames retirees. Retirees.

In an interested other financial development, Sen. Mitch McConnell blames US retirees (SS and Medicare) for the US budget state. Not a word about massive tax cuts for the favored few. (It’s like they’re all using the same playbook to loot Main Street and mom and pop of their life savings.)

Does anybody know whether Lands’ End will be dragged into this or somehow survive? It has a number of international subsidiaries, more than Sears proper did (e.g., in Europe, too). AFAIK it is still an OK brand.

Landsend was spun off several years ago.