Yves here. I’m old enough to remember when General Electric was widely seen as a superbly managed company and “Neutron” Jack Welch was touted as the CEO to emulate. McKinsey praised GE’s bulking up in financial services, which represented about 40% of its business in the 1990s.

Note the role that overpaying for some big deals played in General Electric’s fall.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

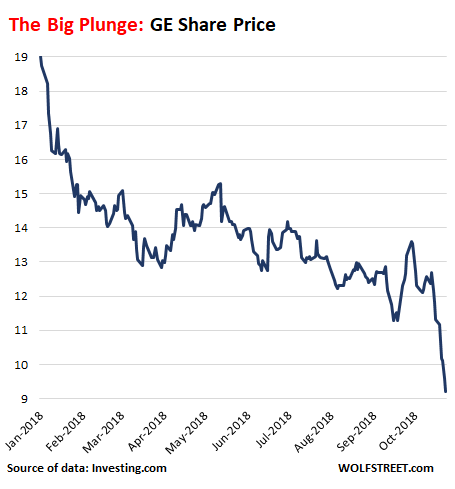

Wolf here: Shares of General Electric [GE] are down over 3% this beautiful Friday morning, trading at $9.20. If they close at this level, they would mark a new nine-year closing low. Shares are down 52% year-to-date:

The lowest close since the 1990s was $6.66 on March 5, 2009, during the Financial Crisis. I remember well: The next morning, then CEO Jeff Inmelt was on CNBC, which was owned by NBC, which was owned by GE at the time. And Inmelt was hyping GE’s shares on GE’s TV station that gave him a huge slot of time to do so, and the share price, displayed prominently onscreen, ticked up with every word he spoke.

Inmelt was also on the Board of Directors of the New York Fed, which at that time was implementing the Fed’s alphabet-soup of bailout programs for banks, industrial companies with financial divisions, money market funds, foreign central banks (dollar swap lines), and the like. This included a bailout package for GE in form of short-term loans, without which GE might have had trouble making payroll because credit had frozen up and GE had been dependent on borrowing in the corporate paper market to meet its needs, and suddenly it couldn’t. Inmelt was involved in those bailout decisions and knew what GE would get, but didn’t mention anything on CNBC.

Now Inmelt is gone from GE (resigned in 2017 “earlier than expected”), and he is gone from the New York Fed (resigned in 2011 “due to increased demands on this time”), and CNBC no longer belongs to GE, and the new CEO is trying furiously to keep the whole charade form spiraling totally out of control hoping to be able to dodge the question: “When fill GE file for bankruptcy?”

Below are some of the things that GE is doing to avoid that fate.

By Leonard Hyman and Bill Tilles for WOLF STREET:

General Electric — at one time the world’s most formidable manufacturing company and now one of the world’s most mismanaged conglomerates — suffered more financial indignities this week: Its bond ratings got hit with back-to-back two-notch downgrades: Today by Fitch Ratings, from A to BBB+ due to the “deterioration at GE Power”; and earlier this week by Moody’s, from A2 to BAA1. This follows a similar move by Standard & Poor’s earlier in October.

The rating agencies also downgraded the company’s commercial paper (CP) program, a form of short-term borrowing. Moody’s cut GE’s CP ratings from P-1 to P-2. The new, lower CP ratings effectively prevents GE from further issuance of CP. However, GE still retains access to other, higher cost bank financed short term funding vehicles. But still, not a good look.

Also this week, GE virtually eliminated its quarterly dividend, slashing it from 12 cents to a penny. A belated Halloween themed headline could read, “Boston Slasher Strikes Again.” A year earlier GE’s board voted to cut its dividend from 24 cents to 12 cents.

In our view the previous dividend reduction was better anticipated than the most recent one. Why the hurried need for a cut last week? Probably for cash conservation reasons. GE badly needs the $3.9 billion in cash saved per year to meet financial needs such as $5 billion required for an underfunded pension fund and $3 billion to shore up the capitalization of GE’s finance arm (or what remains of it).

GE also requires considerable cash to retire existing debt. One of GE’s stated financial goals is to improve ratios of debt-to-EBITDA (earnings before interest, taxes, depreciation and amortization) to 2.5 times by 2020. In the present climate, we might refer to this as virtue signaling. Except here GE’s principal goal is to keep its respectable, investment-grade bond ratings.

The debt burden that GE’s management is presently struggling with stems from a strategy of borrowing heavily for M&A over the past decade. The biggest (and probably worst) was its purchase of French electrical equipment manufacturer Alstom in 2015 in which GE outbid arch rival Siemens. GE paid top dollar just as the market for electrical equipment began a sharp slide. This acquisition was recently written down by $22 billion reflecting the rather subdued prospects for the global power generation. Talk about a winner’s curse.

In order to raise cash and simplify its business, GE has arranged the sale of GE Transportation (locomotives, electric motors and propulsions systems for mining equipment, etc.), plans to dispose of its Baker Hughes oil services business, and intends to spin off (while retaining control) its profitable health services division.

The power division will be split into two businesses: gas turbines and everything else. This last strategic endeavor is probably the one that rankles the most insofar as it’s about two decades too late. A true house that Edison built would have pitted the fossil vs renewables organizations and let the markets sort it out.

How did GE get into the present mess and how did it manage to miss the turning point in a business it used to dominate? Despite recent disparaging comments regarding Harvard’s case studies, we believe this is something business school professors might want to examine. But it is history. For those in the power business, buyers and users of the equipment, what is the message?

First, the manufacture of gas turbines for electric power generation has become an oligopoly. Three suppliers dominate the market: Mitsubishi Hitachi (in clear lead), Siemens, and lastly GE. Oligopolists almost by definition tend to abide one another, meaning that they do not engage in anything resembling robust competition. But with an uncertain business outlook, they may be reluctant to invest more money into their businesses. One almost immediate effect is a reduction in spending on research and development which creates a sort of feedback loop which eventually weakens product positioning against new technology.

The manufacturers may argue that the business will bottom out, that a turnaround will take place. And that revenues from servicing existing equipment will provide a steady stream of business anyway. We do not disagree with these prognostications. Renewables will not provide every new kilowatt of capacity, and gas turbines will be needed anyway to back up renewables.

But we also need to be aware that longer term the competition for gas turbines will come not from renewables but from storage devices such as batteries. In terms of capital allocation, we would wager that there is far more money chasing power storage technologies than there is chasing investment in gas turbine technology.

GE, under its new management and new CEO, Lawrence Culp, may resurrect itself as a well-run manufacturing conglomerate after paying down debt obligations and shoring up its pension obligations. The aviation and health groups (even after disposition of some shares) are large and profitable. And Baker-Hughes, despite its indefinite status, might still surprise to the upside depending on global energy prices.

However, Power, despite its worldwide decline, is still GE’s largest business. New management may succeed in growing the gas turbine business (or maybe better managing its slow decline). But to us the dividend cut symbolizes GE’s fading role in a business that it literally created. By Leonard Hyman and Bill Tillesf or WOLF STREET

The financial Crisis was a decade ago. But its consequences still haunt us. Read… I Was Asked: “How & When Will the Next Financial Crisis Happen?”

Meanwhile, Jack Welch was contacted to give his thoughts on GE’s downfall. Taking time off from counting his $417,000,000 severance payment from GE, he stated: “There was nothing wrong with it when I left it. It was all in working order”.

From what I have read, it was Welch that set GE on the path to self destruction but at the time, he was lionized by some – but not all. It seems that even the CIA took some time off from spying to mock the man-

https://www.cia.gov/library/center-for-the-study-of-intelligence/csi-publications/csi-studies/studies/vol48no3/article04.html

Of course. I remember being particularly struck by his negotiating the use of a GE jet in perpetuity.

Bless him, the old fraud. The rewards of the long con for an arch practitioner. One should probably feel a little sympathy for all of the sold businessmen and GE careerists Jack managed to displace on his way up the greasy pole.

I know little about the workings of Big Corporate Capital (That’s one reason I come to thus site – to learn. I’m an artist puttering about in my world)

but I do remember the the lionizing of GE’s Jack Welch in the nineties in mainstream media. Jack Welch as the ‘Ultimate CEO’ – that type of stuff. Then I heard him speak – that was after he retired. I read some of his political statements during one of the elections … I learned about his investments in For-Profit Colleges. The guy makes my blood chill….cold.

As I said, one of the reasons I read Naked Capitalism to find out what IS going on? Who am I to trust GE’s CNBC? Murdoch’s Wall Street Journal? Bloomberg’s Bloomberg?

When I think of how the city of Boston and Massachusetts rolled out the red carpet for these guys (tax breaks and some highly desirable real estate that’s been tied up in postponed plans for their new headquarters) I want to scream.

A cautionary tale in “attracting investment.”

I think the decision to relocate a headquarters is emblematic of an executive suite who are not paying attention to ongoing business. Similarly, the decision of a museum or other cultural institution to build a massive building/addition designed by a starchitect is a sign that there will be major changes in the leadership as soon as the ribbon is cut (See: Cooper Union)

It’s stunning that they would create this massive internal distraction while the ship is sinking, even if it creates a massive external distraction.

Does this bode ill for the rest of the economy? In a down turn, the pyramids tend to be the first to go.

This story of General Electric echoes the unhappy story of Westinghouse:

“In 1990, Westinghouse experienced a financial catastrophe when the Corporation lost over one billion dollars due to bad high-risk, high-fee, high-interest loans made by its Westinghouse Credit Corporation lending arm.” [refer to https://en.wikipedia.org/wiki/Westinghouse_Electric_Corporation for the rest of the story.]

How are our business schools able to teach and admire such ‘genius’? Why does our Fourth Estate sing their praises and and praise these exemplars for their spoils taken by their piracies? We live in times growing ever more strange to Reason and Ethics.

Thanks much for this! One of those things I would have no idea about were it not for this wonderful site. Would love to read an accompanying story about how the Japanese managed to get past both US and Germany here. Better management? Better engineering? Better vision? All of the aforementioned?

https://www.youtube.com/watch?v=sOEBgSBfko0

David Letteman tries to leave a fruit basket for his new bosses and learns the “official GE corporate handshake” as a consequence.

Couldn’t happen to finer bunch of people.

It looks like their public relations department and building security need a Six Sigma improvement process.

It looks like their public relations department needs a Six Sigma improvement process improvement.

Not sure if the Japanese have a lock on industrial engineering and manufacturing competence. Look what happened to Mitsubishi with the San Onofre turbines.

Guess who paid for that mistake? So Cal Edison ratepayers.

http://www.sandiegouniontribune.com/news/watchdog/sdut-san-onofre-anniversary-2016jan30-htmlstory.html

I run a family business that survived 125 years ( out of India) and we follow one rule: no debt. If we do take debt, we pay it off within a definite time frame. Debt alone ruins all businesses.

I think the bigger issue is again CEO and wall street nexus which is run amok. Jack Welch put himself above GE and pandered to the wall street demand: stock price.

GE is toast, they sucked every ounce of capital from every corner of the business and eviscerated all of it on share buybacks, now they are left with negative tangible net worth 100bn+ of debt with the cost of credit balooning and a pension fund that is 30bn underwater even with crazy assumptions on the returns they can make and more like 100bn underwater with realistic assumptions…. the div is gone forever as they will need to make 5bn a year payments into the pension fund until they eventually throw in the towel.

Jack Welch basically turned the company into a business reliant on providing credit. His labor practices too exemplified the worst of what would be copied by companies like Enron.

Heck even the NYT has an article about this one.

https://www.nytimes.com/2017/06/15/business/ge-jack-welch-immelt.html

Welch was a monster, and a symbol of what is wrong with corporate America. His actions set GE on the course towards what it is today.

I think that as flawed as Asian and other nations are, they do something that corporate America doesn’t. They invest more in the future. They invest in the long term. They will make sacrifices in the short term for long term gains that are greater.

GE is circling the drain and while it is possible that it will turnaround, it’s days as a world leader in industry are done for the foreseeable future.

A few other good reads:

https://www.bloomberg.com/opinion/articles/2018-11-04/electric-cars-face-a-6-trillion-barrier-to-widespread-adoption

This is important: https://dailygazette.com/article/2017/06/26/welch-s-bad-policies-nearly-destroyed-ge

Bolding by me.

What happens when the competition invests, while a “shareholder value” CEO focuses on short term profits, cost cutting, share buybacks, and financializing their firm? In the long run, either the debts or the now more innovative competitors eat them.