Apologies for yet more CalPERS. As we’ll explain in more detail, there’s a board meeting this Monday where CalPERS staff have admitted that the board might commit to its bone-headed, beneficiary-damging private equity scheme. CalPERS released more materials that, as one wag remarked, don’t help its case.

The most damning part is that for one major component, CalPERS has effectively admitted it will get lower returns than from its current private equity strategy, and that’s before you factor in that it will also be taking more risk. If CalPERS board members and staff want to put a target on their backs for a fiduciary duty lawsuit, this is just the way to do it. We’ll also discuss that other attempts to defend the initiative at best demonstrate that the parties driving this bus don’t understand typical private equity fund provisions.

It’s now becoming clear why heretofore, CalPERS has provided only napkin-doodle-level descriptions of its “new business model”. They knew it would not hold up to scrutiny.

CalPERS published a slide deck on its private equity plans as part of its board materials for next Monday’s Investment Committee meeting. This is a public relations move, since CalPERS has been relegating this discussion to its so-called closed sessions and only releasing sketchy PR puff pieces and inconsistent messaging. These slides are meant to create the impression that CalPERS a bona fide rationale after months of providing inconsistent and nonsensical justifications. That has the hallmarks of CEO Marcie Frost being concerned about pushback from stakeholders, as confirmed by a rash of presumably-planted stories on the private equity scheme over the last month.

As one influential retiree said of the presentation:

As an outline of some ideas, this might have been OK a year ago. But now that CalPERS is close to pulling the trigger, this only serves to confirm how little serious thought and analysis has been done.

We’ll go through some of the surprising number of red flags in this short document, which we have embedded at the end of the post.

CalPERS admits the two new fund vehicles will lower returns. Recall that the entire justification for CalPERS’ dogged defense of private equity has been that the assertion that only private equity will beat CalPERS’s return target. As we pointed out in our New York Magazine article, that premise is no longer true. Even using private-equity-flattering cuts of the data, Oxford professor Ludovic Phalippou ascertained that the average private equity fund has failed to outperform the S&P 500 since 2006.

Confirming Phalippou’s finding, the New York Times reported yesterday that all Ivy League endowments had fallen short of meeting a simple stock and bond mix over the last decade, and alternative investments were the culprit. This is particularly damning since at a 2015 private equity workshop, Harvard professor Josh Lerner touted endowments at being better at private equity investing than public pension funds like CalPERS.

This year the 10-year returns achieved by the endowments for all the Ivy League schools lagged a plain-vanilla portfolio of stocks and bonds, according to a new study by Markov Processes International, which closely monitors the performance of Ivy League endowments. It’s the first time that has happened in the 16 years for which Markov has data on all the Ivy League endowments.

The simulated portfolio is conservative, made up of 60 percent stocks and 40 percent bonds, and it achieved an annualized return of 8.1 percent. Not one Ivy League school beat that performance..That the Ivy League universities, with access to some of the best minds and investors with the best track records, would fall short of a simple, low-cost approach over a decade is startling…

All of the Ivies (as well as other schools with huge endowments) have wholeheartedly embraced what has become known as the Yale model, which calls for heavy allocations to these so-called alternative investments. That class includes private equity, venture capital and hedge funds, as well as real estate and natural resources.

These alternatives share a common fee structure, which is typically 2 percent of assets under management plus 20 percent of any gains. As the recent results make clear, those high fees don’t guarantee high returns…

… many institutions have been reluctant to pare back their expensive investments in hedge funds and venture capital — high returns that beat the 60/40 mix could be just over the horizon.

Of course, extremely long measurement periods are convenient for underperforming asset managers, who can always argue that it’s too soon to brand them a failure.

CalPERS is already playing this game. For its liquid investments, it highlights 10 year returns, since that starts just after the carnage of the crisis. But for private equity, the giant fund instead flogs its 20 year returns, since those include some of the last vintage years of high private equity returns, 1995 to 1999.

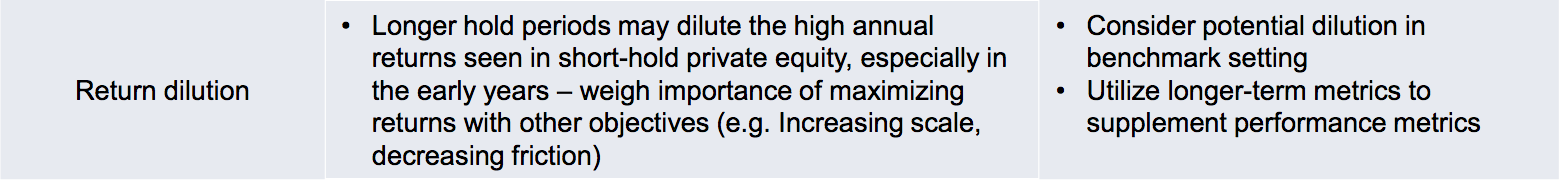

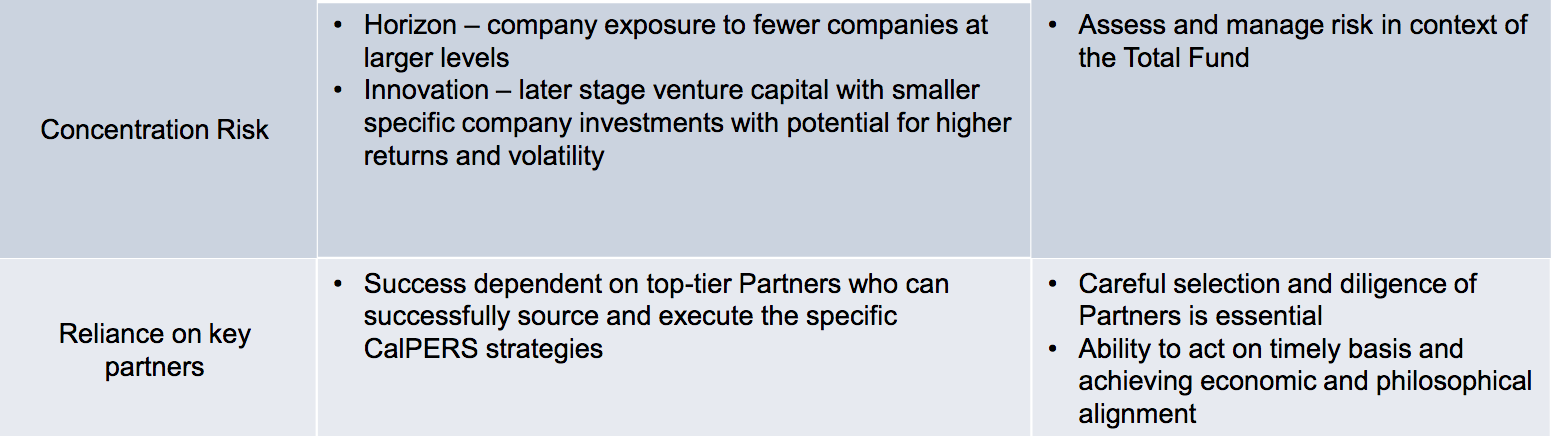

CalPERS has been flogging the recent fad of longer holding periods as a way to improve returns. CalPERS has ‘fessed up that this is false. On the very bottom of page 10, “Key Risks and Mitigation”:

It isn’t “may dilute”. It is “will reduce”. As a private equity industry professional said:

This is what we have been seeing in the marketplace, where firms like Blackstone have very recently been marketing funds that have a longer life than traditional PE and have stated that the expected return should be understood to be lower than traditional PE. This turns the Capital Asset Pricing Model on its head–instead of demanding MORE returns for giving up liquidity, investors are asked to accept LESS returns for giving up liquidity.

In other words, if an investor is taking more risk, he should get more return. CalPERS is instead planning to tie up its money for much longer periods, which is a greater risk and can be justified only if CalPERS is getting a larger return to compensate for the greater risk. Yet CalPERS isn’t just flagging the possibility that it will only get the same returns as now, which would be a worse outcome on a risk adjusted basis, but that they have good odds of doing worse in absolute terms. The fact that big fund managers like Blackstone are telling investors to anticipate lower returns from longer-lived funds means that CalPERS is misleading the board to present it as a risk, as opposed to an expected outcome.

On top of that, there is a separate reason to expect these funds to underperform: first time fund managers don’t do as well established firms.

And what is CalPERS’ response? To game the metrics to hide underperformance. That’s as deluded as thinking that lying about your blood pressure will reduce your odds of getting a stroke.

Let us understand what this means. The admission that the longer-holding period investments “may underperform,” which in light of what very seasoned fund managers are saying, means “will underperform” means CalPERS is fully aware that its board and staff will be violating their fiduciary duty if they approve these two funds. CalPERS beneficiaries and California taxpayers should be outraged and demand that Marcie Frost be replaced. This is proof that she is knowingly harming the fund, and one has to surmise for some sort of personal gain.

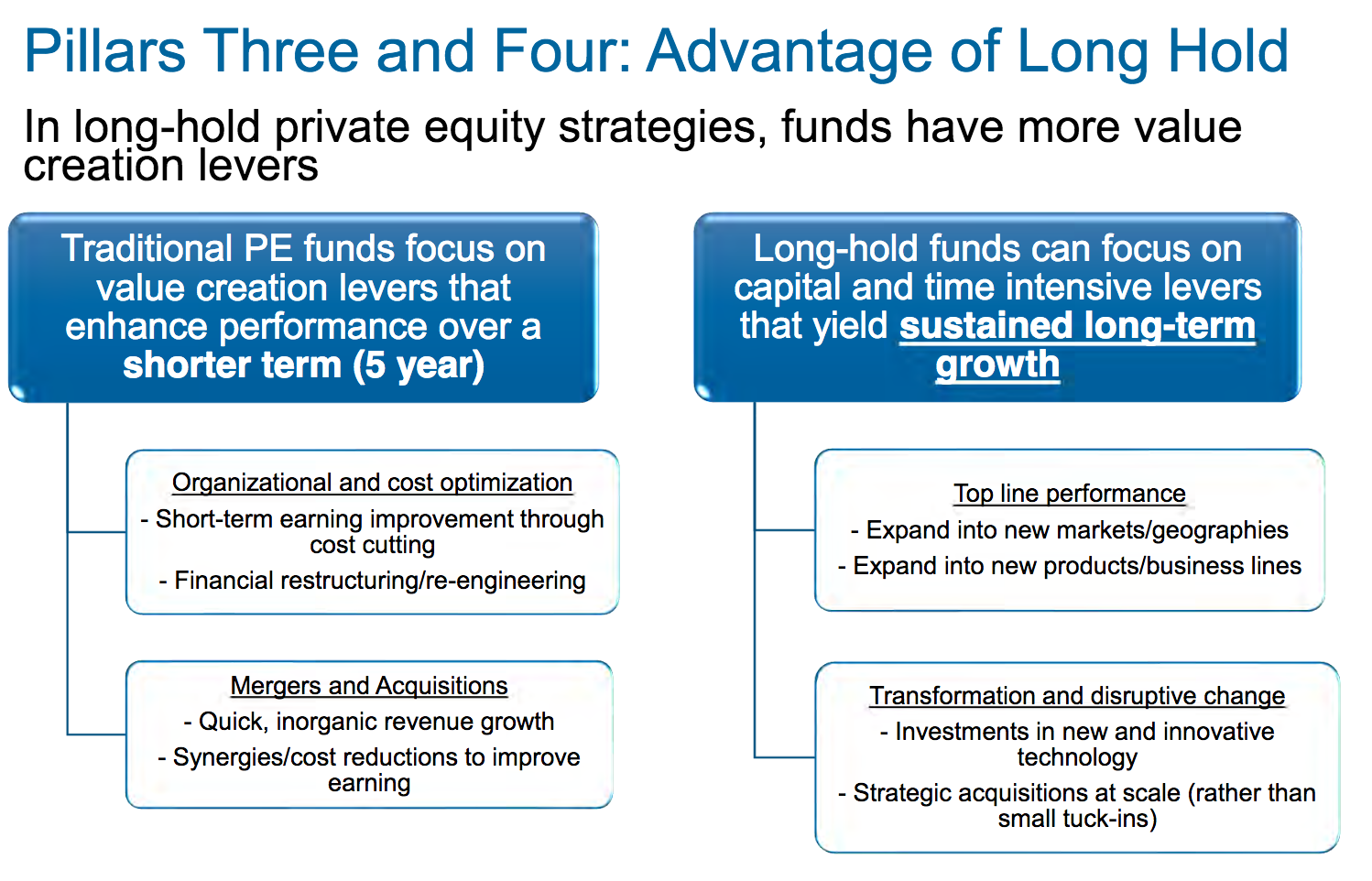

CalPERS tries to bury the truth about the expected underperformance by misleading the board and public about how private equity works:

It is false to depict private equity funds as engaged only in cost cutting and financial engineering. That is true for bigger deal sizes, and CalPERS has wound up heavily invested in those due to the poor decision by now-departed Chief Investment Officer Ted Eliopoulos, to greatly reduce the number of fund managers that CalPERS invested with. That has led CalPERS to be disporportionately exposed to mega funds like the ones managed by firms like Apollo, KKR, Carlyle, and Blackstone. CalPERS’ private equity consultant Meketa deemed the Eliopoulos initiative to have been a failure by reducing CalPERS’ returns.

As Eileen Applebaum and Rosemary Batt described in their extensively-researched book, Private Equity at Work, private equity transactions that are below $350 million focus on growth rather than financial rejiggering. The typical deal is for a company that needs external help (I hate the cliche) to get to the next level. Common examples include a regional firm that needs capital to go national or add a new product line; a company that needs to make widespread changes to systems and operations to handle higher transaction volumes. These acquisitions also feature less leverage than the so-called buyout deals.

There are other big howlers on that chart. Sustained outperformance is so rare that when Jim Collins researched his classic Good to Great, his team examined 1485 companies and found only 11 that made the grade. And he stressed that there was no formula, that the big common element was a management preoccupation with getting the right people, getting rid of the wrong people, and in getting those right people into the right managerial positions. It’s not a process of dramatic change, as the chart mistakenly depicts, but relentless small improvements that accelerate as the company becomes more capable. Notice the absence of a way that outside money adds any value to this process?

And the obsession with scale is wrong-headed, particularly “acquisitions at scale”. Every study ever done of M&A has found that most deals fail, and the failure rate is usually between 65% and 75%. “Fail” means the deal destroyed value for the acquirer. Bigger deals are harder to integrate, so CalPERS is asking for a world of hurt if they think this is a way to make money.

CalPERS misrepresents typical private equity fund terms to create the false impression that its new vehicle will have better governance. This is not hard to understand unless you don’t want to understand it. CalPERS is putting what amounts to two new firms in business, which means CalPERS ought to receive some upside plus have significant control, at a minimum veto rights.

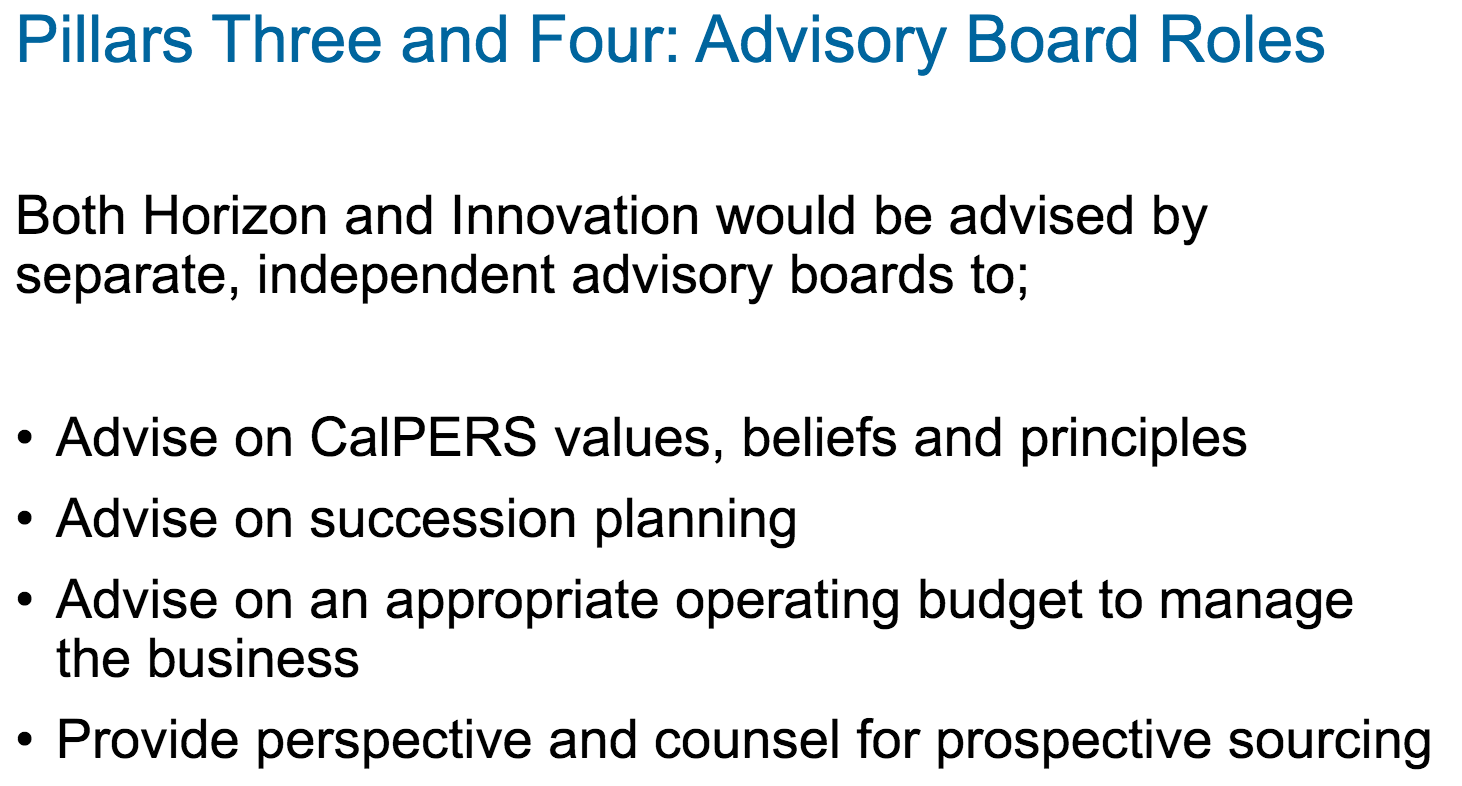

Instead, CalPERS tries to snooker the board and public into believing that the new vehicles would put CalPERS in a better position. Now one could be charitable and attribute the misinformation to the fact that the staff who are leading this initiative being ignorant of typical private equity fund terms. However, when you see a slide like this, clearly attempting to depict these “advisory boards” as meaningful, it’s hard not to conclude that staff knows it is pulling a fast one:

Help me. What about “advisory” don’t you understand? So the fund managers have to have tea and cookies chats with their advisory boards as a cost of doing business. That’s no different than for current private equity funds….except the “independent” means the advisory board members won’t be CalPERS employees or board members and they will no doubt be paid for performing a substantively meaningless role. The only advantage looks to be for CalPERS to have patronage positions to hand out. But that amounts to CalPERS executives misusing beneficiary funds to curry favor.

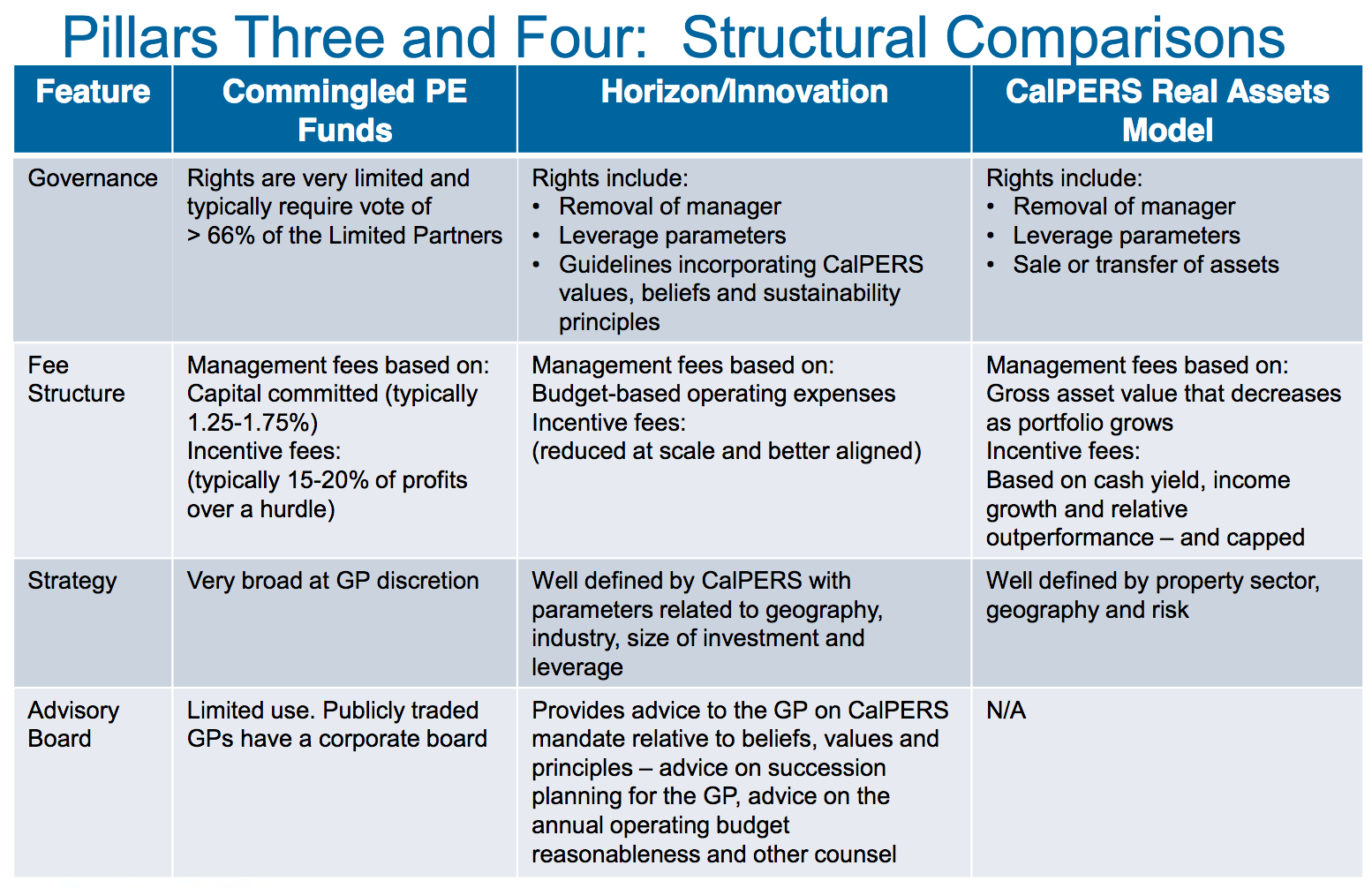

The slide below contains a mini-comparison of CalPERS’ new scheme to current private equity “co-mingled” funds. Notice that CalPERS did not include separately managed funds, which it has admitted is comparable to what it is doing with these new funds, nor co-investments or bringing private equity in house. So it is misleading by virtue of being incomplete.

It is also misleading in its details, as we explain below.

In the first row, CalPERS creates the impression that there is a significant difference between the governance rights it has in its current funds compared to the ones it would have in its new entities.

For instance, it takes a supermajority vote, typically 66%, to terminate the manager for no reason in most private equity funds. They can also be terminated if the manager commits a crime. Investors can also opt out of particular transactions if it is illegal for them to participate, say if a fund were to buy a gun manufacturer and California had outlawed government funds investing in them.

Let us start with the principle that CalPERS is going to have to structure its relationship in line with market norms. No one with an operating brain cell would join CalPERS if it had a free right to fire them. For instance, what if a financial crisis hits and CalPERS realizes these clever-seeming schemes weren’t so smart after all? It is almost certain that CalPERS would have to pay a large financial penalty for removing the manager.

Similarly, it is false to depict co-mingled funds as not restricting leverage. In fact, the vast majority do, at 25% of the total capital committed. For instance, see Section 4.2.c on page 65 of the Carlyle V limited partnership agreement in our Document Trove.

As for the next row, fees, focusing on the management fee is at best ignorant and at worst misleading. Investors have failed to stop private equity firms from extracting all sorts of money directly from the portfolio companies they control, and many if not most of them are sheer looting, such as monitoring fees, or “money for nothing” fee in the words of Ludovic Phalippou or charing transaction fees in addition to paying investment bankers full fees to do the actual work. Instead, the investors got the general partners to agree to offset these company-level fees against the management fee charged at the fund level (well, as we learned thanks to the SEC, that didn’t really work since the private equity firms dreamed up clever new fees that they didn’t credit against the management fee).

Again, remember the basic principle that no seasoned manager will take the risk of joining a CalPERS venture unless he’s going to get similar economics in the end to what a fund would provide. If you eliminate the management fee, they get to keep all of those hidden portfolio company fees. And they can always make them richer if they think they need to or can get away with it.

In the next row, strategy, CalPERS has not made a case as to why narrower strategies are better. But setting that aside, it’s flat out false to say that there aren’t managers that offer funds in flavors. It’s an insult to the board’s intelligence for the staff to pretend that CalPERS has to set up its own venture capital entity to make venture capital investments. Similarly, there are funds that focus on energy, health care, banking, as well as geographies, such as Europe, Asia, China, India, and emerging markets.

And as we said earlier, pretending that CalPERS’ toothless advisory board is any better than the toothless advisory boards that private equity funds now have is silly.

CalPERS shows it is incompetent at risk assessment. We discussed at length how CalPERS is violating one of the fundamental principles of finance by taking more risk via making longer-term commitments with no realistic prospect of getting enough additional return to justify assuming that risk. Even worse, CalPERS admits is likely to do worse!

We see more evidence of either incompetence or misrepresentation:

For its so-called “Horizon” strategy, CalPERS anticipates it will make comparatively few, large investments and implies it can mitigate that at the overall CalPERS fund level.

That’s false. You can’t solve for the risk of being insufficiently diversified. Investors do not get paid more for taking “specific risk” of being unduly diversified. And if CalPERS really believes that private equity is a separate asset class, it can’t compensate for inadequate private equity diversification in its liquid portfolios.

And CalPERS does not acknowledge that it has an even bigger issue of undue concentration with two newly-constituted fund managers. No amount of vetting of them as individuals will tell in advance whether they can work well together. Far too many law firms, consulting firms and investment firms have come apart or not done as well as they should due to friction among the partners.

In addition, firms can stumble due to a divorce of a key partner (they are usually distracted and less productive for well over a year, and that’s before the risk could force a restructuring of the partnership to pay off the ex), sexual harassment charges, or other personal problems.

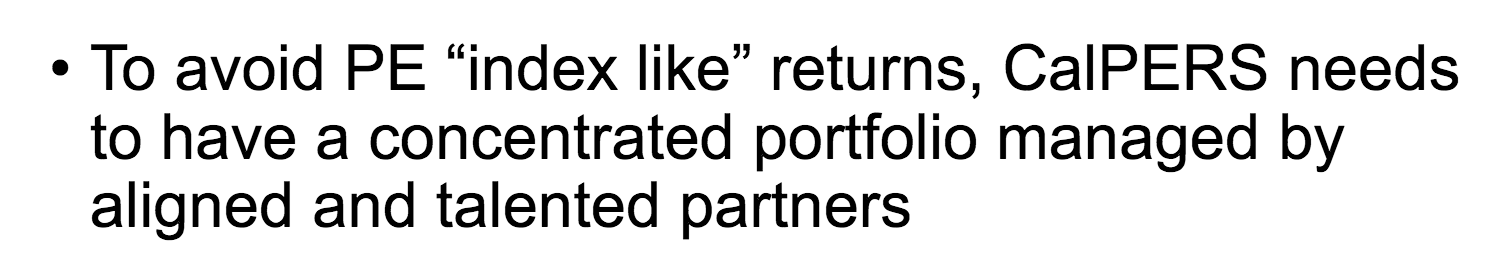

CalPERS entire scheme is based on a bogus, value-destroying premise. We saved what may be the best for last. CalPERS has finally presented a rationale of sorts for what it is doing:

This is a fool’s errand. CalPERS will most certainly avoid making index-type returns. Taking concentrated bets virtually guarantees making lower than index returns over time.

CalPERS wants to deploy so much money to private equity that if it is properly diversified, it will earn returns that are in line with private equity indices over time. As we said above, investors who make concentrated bets are simply taking more “specific risk” with no reason to expect more upside. The danger of particular investments doing badly due to mishaps (factory explosions, executive deaths, changes in regulations and tariffs) are greater than the opportunity to hit a home run.

The fact that CalPERS is flouting such a fundamental investment principle is further proof of JJ Jelnicic’s theory that there is a payoff here, and beneficiaries and the public are being kept in the dark about it.

Thank you for this, for me the CalPers coverage has brought smiles to my face.

I’m sure AG Becerra is going to be all over this…(h/t TS) the impunity of our bettors /s may catch up to them after all

Dude, are you trying to harsh Marcie’s mellow?

Would ‘CalPERS Stragedy’ better describe this unholy mess?

Please do not apologize for more CalPERS stories.

The issues surrounding its apparently intentional mismanagement are important to its millions of beneficiaries and more millions of Californian taxpayers.

Like California as a whole, what happens to CalPERS happens to most other government pension funds. They are being co-opted and raided by private equity, which sees them as a rich but poorly defended frontier, ripe for pillage.

+1.

A lack of serious thought and analysis would explain CalPERS’s actions if it were intent on fulfilling its fiduciary obligations and reaping the highest returns possible, consistent with the appropriate risk for its mission.

But CalPERS staff and much of its board appear unmoved by repeated, thoroughly researched criticism of its plans. It has kept its plans away from those of its own staff who know most about private equity. That is reminiscent of Rumsfeld’s Pentagon, who kept away its plans away from those with the most knowledge of Arabic, Iraq, and the Middle East.

The logical conclusion – often repeated here – is that CalPERS designs are not related to its stated motive. It is lying about what it is doing to meet its central mission. Indeed, it is actively working against it. For an organization in CalPERS’s position, that is intentional and wrongful.

That warrants a full blown investigation of CalPERS. It would be wrongful for those overseeing CalPERS not to conduct one before the underwhelming Ms. Frost throws more billions out the window toward the welcoming coffers of private equity.

.That the Ivy League universities, with access to some of the best minds and investors with the best track records, would fall short of a simple, low-cost approach over a decade is startling…

I would add especially this past decade which has been frantically climbing a (QE) sugar high

Such great reporting, I read them all and there is definitely an elephant in the room. I agree with those who posit that the weak hires of Frost and Asubonten are highly suspect. Thanks for the series, looking forward to the denouement.

Oh look – CalPERS is going to have a big meeting come Monday. Hope they remember to have plenty of biscuits, especially chocolate ones. Actually, considering the idea that they are going to present, it might be better and wiser to have an open bar as well. I think that I can understand their problem though. Think of it like a Bell Curve. Now the CalPERS Management all tend to spend their time in the Peak of Inflated Expectations at the very top. Everybody else, however, has already moved on and have now reached the Trough of Disillusionment on the far side. See? It’s all location, location, location.

In IT I understand that there are languages that documentation can be done in – Technical, Plain English and Idiot. The less technical the documentation, the longer the documentation tends to be. CaLPERS seems to be following this idea as NC has put up some of their documents that contain massive changes but have only a few score words to describe it. At this point when they explain their big idea on Monday on how to lose money – but faster – I suspect that they will be using a few sheets of butcher’s paper and a box of crayons to do so.

Might I suggest that at this meeting that they bring in the idea of having CaLPER Staff adopt new uniforms for the new year? I have just the example in mind-

https://www.cafepress.com/mf/97369858/bullseye_tshirt?productId=1527316338

It’s remarkable that the good coverage (largely by NC) of all the weird stuff at CalPERS has not brought wholesale changes to the organization to date. Is anyone driving the bus? Is the CA AG, or the governor himself, completely uninterested in a gigantic fiasco happening right under his nose? The inexplicable attitude of the responsible parties seems to be “move along, nothing to see here.”

Our society is reaching a dangerous point because the population no longer trusts the establishment to run the society. This type of incompetence and corruption provides excellent justification for these beliefs. An urgent project for elected officials and their appointees is to quickly correct problems when they are brought to light, and punish the guilty parties, as a demonstration that the system works. Otherwise, everyone will increasingly conclude it doesn’t.

I’ve wondered about the CA AG inaction, too. Hard not to think one possibility is ‘all crooks together’.

In some wilder moments of imagination, I imagine Trump looking at CA/CalPERS and looking at the hedge funds and PE outfits targeting CalPERS, and thinking to myself, ‘ He could always ask the SEC to look into these doings for excessive fees, failure of fiduciary duty, and misrepresentations. Or, he could as the FBI to look into outright fraud.’ Won’t happen. Probably shouldn’t happen because of jurisdictional and other issues. But the CA govt isn’t cleaning up this looting of retirees’ pension money and isn’t replacing incompetent staff.

Thanks very much to NC for continued reporting on CalPERS, PE, and pensions.

This looks like desperate delays in avoiding the recognition that CalPERS will not meet its returns, that it has failed in its mission, that Frost and staff are largely responsible for it, and that the legislature, taxpayers and beneficiaries will have to contribute and take a haircut as a consequence.

That scenario is also typical of Frost’s career-long behavior, her emphasis on appearance over the substance and expertise she does not have.

All of that is in addition to the reasonable possibility that key CalPERS staff have been captured by private equity, with all the actual and opportunity costs that would involve.

No apologies needed for posting about these schnooks.

Follow the money.

Why should CALPERS care about deficits? They always have the poor taxpayer to fall back on. I have to pay your pension and mine doesn’t have any guarantees. Most people don’t even have a pension.I wouldn’t feel so bad but two of my clients have CALPERS pensions of over 14k per month.

See the overpaid and over-pensioned at http://www.transparentcalifornia.com and http://www.publicpay.ca.gov