We normally restrict our comments on individual CalPERS board members to the uphill efforts of the ones who are trying to move the institution forward. However, at the discussion of the private equity “new business model” earlier this week, as one prominent stakeholder put it, “There were lots of bad moments that you can write about.”

We’ll wait until the new year to discuss the many misrepresentations made by John Cole, the CalPERS staffer who made the private equity presentation. Even if he fully understood how fast and loose he was playing with the truth, he made himself and CalPERS look like marks.

Nevertheless, Bill Slaton deserves special attention. He is a self-appointed enforcer on behalf of staff, regularly shutting down the sort of give and take you see at better-functioning boards, such as CalSTRS. He is also an aggressive and ignorant defender of private equity. If you want a personification of Dunning Kruger effect at CalPERS, you need look no further.

Aside from his significant role in upholding bad norms, Slaton is worthy of attention because his term as gubernatorial appointee is up in January, yet perversely, Slaton won’t leave the board until Gavin Newsom installs a replacement.1 There have been cases where appointees have hung around for years before a successor was named. However, Slaton has been dividing his time between residences in Sacramento and East Cameron, Montana, and has said he plans to retire to Montana. He’s also had his house in Sacramento on the market, although he pulled the listing last month, presumably not to have it look stale when the selling season starts next year. Slaton cannot serve on the board unless he is a resident of California; CalPERS would not even allow Jeff Baker to run for the board in the 2016 election because was living in Las Vegas even though he would have moved back to California had he won. So if Slaton were to relocate officially to Montana, he would have to quit the board.

Recall that Slaton led the shameful attack on former board member JJ Jelincic for false accusations of leaks out of closed session. Jelincic maintains that the few infractions that were alleged were cases where the information was already public, such as in court filings or previously presented in the press.

But even more important was the outrageous manner in which Slaton went after Jelnicic. From law professor and white collar criminologist Bill Black’s reaction to Slaton’s attack, in CalPERS Seeks to Destroy Its Most Effective Director. I have taken only snippets of Black’s critique. The key part is that Black, who is a former general counsel of a major financial institution, stressed that Slaton was violating his fiduciary duty in his campaign against Jelincic (emphasis original):

…we have Slaton attacking Jelincic in a manner one virtually never witnesses in a boardroom. What we do not know is what “confidential” information Jelincic supposedly “disregarded.” Jelincic’s reputation is for pushing boards to act aggressively to fulfill their fiduciary duties, so it is bizarre for Slaton to be seeking to muzzle Jelincic’s efforts to improve the board’s performance of its fiduciary duties on the grounds that (in some unstated fashion) doing so will improve the board’s fiduciary performance….

Slaton had zero excuse for not providing Jelincic with the specific charges so that he could respond and refute any pretext for the board holding a “trial.” Slaton’s attack on Jelincic was planned, not impromptu. It was a serious charge that Slaton knew could do grave damage to Jelincic and CalPERS’ reputations….

[Board President] Feckner’s revelation also means that Feckner and [General Counsel] Jacobs have zero excuse for not insisting that Slaton provide Jelincic and them with the specific charges before Slaton made the facially slanderous charges at the board meeting that I quoted. It is a breach of their and Slaton’s fiduciary duties to CalPERS to knowingly allow one board member to accuse another board member of committing a crime under California law without having vetted the claim to demonstrate that it was well-founded.

Not only is Slaton reckless and working against CalPERS’ best interest, his performance at Monday’s Investment Committee meeting again shows him to be a self-important, bullying ignoramus.

We’ll skip over the painful-to-watch section where Slaton goes on about how CalPES would have an advantage with family owned businesses. First, Slaton seems unaware of the fact that even smallish private concerns are very heavily solicited by private equity firms. The ones that specialize in family businesses are willing to spend years if that’s what it takes to win their trust. The ginormous funds that CalPERS plans to launch would be seen as suspect.

But this extract below is classic Slaton. Earlier, board member Margaret Brown had gotten annoyed with CalPERS staffer John Cole trying to pass off the howler that the advisory boards to the two entities that CalPERS was forming would act as checks on abuses during their budgeting process (CalPERS plans to pay an annual fee based on an expense forecast rather than a management fee). Her remarks at 3:44:10 of the video clip further down:

Senior Portfolio Manager, Global Equities John Cole: We will have provisions to deal with anything that would require a waiver or an adjustment for unforeseen circumstances. By the way, the role of the Advisory Board in this respect is to look at the competitive environment and the budget that’s being proposed and make a judgment as to whether it is reasonable.

Board Member Margaret Brown: Except that it’s an advisory board. So in my opinion, it’s a joke. Because they actually have no authority. All they’re doing is advising. And so that’s how this works. So if they actually have control it’s one thing. But they’re just giving their advice. Not consent. And that’s, that’s a big difference.

As we put it earlier, “What about ‘advisory’ don’t you understand? So the fund managers have to have tea and cookies chats with their advisory boards as a cost of doing business.” Staff has been dishonest with the board about these advisory boards, as the snippet above indicates. With current private equity funds, the limited partner advisory committees actually do have authority over some matters, but it takes a majority or supermajority vote. The general partners choose which limited partners are on the advisory committee, and they take great care to make sure that they have a comfortable majority that will always back them.

The advisory boards for these new funds are indeed a joke. They are advisory boards to the new entities, not to CalPERS, so despite all the hand-waving, they will not be “advising” on behalf of CalPERS. Moreover, their informal incentives will also be to get along with members of the private equity community.

But what do we hear from Slaton? Have a look at this video, starting at 3:52:46:

Board Member Bill Slaton: Just about three things that I want to address, one Ms. Brown made an editorial comment regarding advisory boards, I disagree with that editorial comment. I think hopefully we’re gonna have advisory boards that are impeccable, have impeccable reputations, long experience in this industry, and hopefully are focused on essentially giving back to California. And if we, if the right people are in that advisory board, their reputations are gonna be on the line in terms of making sure this is successful. So their advice and counsel to the people who are running this operation hopefully, and I trust and expect it will be valuable. And therefore listened to.

Did Slaton fall off a turnip truck? He certainly sounds like he believes this blather.

Prominent CEOs who are on advisory boards to private equity firms are perfectly content to take a big check for showing up once a year and give literally five minutes of input on the state of the world.2 They know this is for show. And if they really are Somebody Important, the last thing they want to do is get their hands dirty on what everyone save the clueless (or complicit) CalPERS staff and board knows is a ceremonial gig.

But just for fun, let’s tease this out. Where are these “impeccable” people with lots of private equity experience who want to give it on the cheap to CalPERS supposed to be found? To be credible to the sorts of professionals that CalPERS hopes to attract to this fund, they’d have to be heavyweights. And they are presumably Californians. Many if not most Silicon Valley types, both the money men and the entrepreneurs, are libertarians and don’t like government, to the degree that they don’t even give much to politics. And no one would mistake the $340 billion CalPERS for a charity. A lot of top private equity guys like the business and stay in the business into their 70s. And rich guys who want to do something they regard as socially-minded generally think the way to do that is set up a foundation to remake a corner of the world along their pet lines. In other words, even if these roles weren’t toothless, there isn’t much reason to think that someone with relevant expertise would be interested.

But the best, meaning the worst, comes last.

Earlier in the meeting, both State Controller Betty Yee and Margaret Brown were very concerned about this revelation:

Remember that now departed Chief Investment Officer spoke incessantly about the necessity of private equity as the supposed only investment strategy that could exceed CalPERS’ return target. To the extent that Eliopoulos gave a rationale for this unorthodox, untested scheme, it was that CalPERS needed it to invest “at scale”. Thus the claim was that CalPERS needed this whizbang new approach to put enough money to work and achieve this premium return level.

So it’s not hard to understand that the two numbers people on the board (Brown has managed bond financings and construction budgets) were thrown for a loop that staff said these long-hold investments will have lower returns. What’s the point then? For Marcie Frost to become popular in Silicon Valley by squandering CalPERS money there? And even more upsetting is that the board is being told this fundamentally important fact a full 18 months into the project.

How did Slaton try to rationalize this fatal flaw? Have a look at 3:57:18. Remember that Horizon is the “core economy” vehicle:

Slaton: One last comment I’d like you to comment on, this issue of long return particularly on Horizon. Yes, particularly a long hold should get a better return but if it comes with dividends, then that changes the formula that you’re looking at.

Slaton has just revealed himself as being so unqualified as to be a hazard to CalPERS. While he does concede that the longer holding period requires a higher return to compensate for the risks. But he then goes on to say that dividends will be in addition to the reported returns, as if the staff confession regarding lower returns did not include dividends.

Anyone who buys stocks knows or ought to know that equity index and mutual fund returns include dividends.2 And as a CalPERS board member, he ought to know that that is also true of private equity returns, and that private equity companies can and do pay dividends. One widely publicized type is the “leveraged dividend recapitalization.” Slaton’s remark should disqualify him from being allowed in a room where investment decisions are made.

So we hope readers will help make this happen. Please write or e-mail incoming Governor Gavin Newsom early next year and tell him that CalPERS desperately needs a board member with some knowledge of finance and investments to fill the seat now occupied by Slaton. I am told that Newsom is already getting warnings from well-placed people that he can’t afford to leave CalPERS on auto-pilot, since the odds are high that it will blow up on his watch. So anything you can do to push Newsom to improve the caliber of this board would be very much appreciated.

____

1 Slaton cannot be reappointed. He is in the seat for a local government elected official. Slaton is retiring from his elected position on the Sacramento Municipal Utility District board at the end of the year.

2 This is not hyperbole. At one biggish firm, the advisory board met once a year, for breakfast. The now ex-partner said when the members were asked to opine, they spoke for three to four minutes. They got $100,000 each for this service. The role of these board members is to legitimate the fund, not to consult to it. Since the price is so high for image-boosting, the charge for expecting someone at this level to do bona fide work, even if the partners of the two vehicles actually wanted this sort of thing, would be nosebleed level.

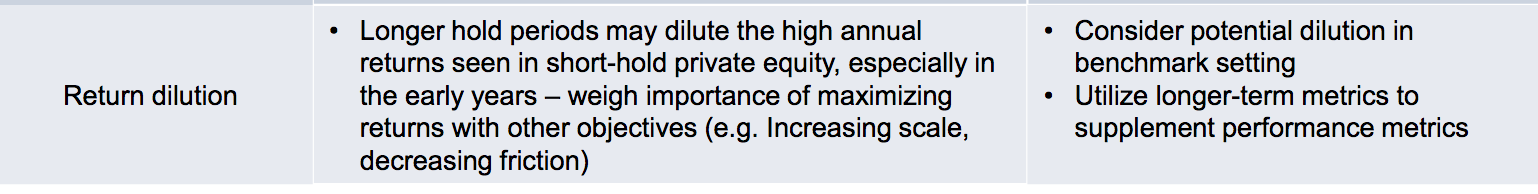

Calpers: “Utilize longer- term metrics to supplement performance metrics”.

When my day trade goes horribly wrong I then decide it was really a “long term investment”, – at least that’s what I tell myself.

Attorney General Becerra is going to Disneyland!

Gawd – you’d think that for Christmas that CalPERS would take a break from their a**hattery. Apparently not. If Slaton is planning to retire to Montana, perhaps the staff at CalpERS can start a GoFundMe campaign to help him with moving costs. After reading this article I am sure that there would be a lot of people happy to chip in and send him on his way. As a public service, here is a link to the CalPERS Board members so that people can attach faces and profiles to the names mentioned here in this article-

https://www.calpers.ca.gov/page/about/board/board-members

The article says that “CalPERS plans to pay an annual fee based on an expense forecast rather than a management fee”. That sounds like the defense industry where a quote is given for something and over time the fee is bloated and padded with “unforeseen circumstances”. So does that make CalPERS the F-35 of the investment world? And this fee is just for advice? I reckon that the NC commentators would be quite capable of giving them advice for free – some of which is even anatomically possible. I was going to watch some of that Bill Slaton video but I realized that if I did, I would never get that time back again. Sorry. I wonder who is slotted to replace Slaton when he goes? Does Gov. Jerry Brown get to appoint another in his place? I understand that Elizabeth Holmes is not so busy these days.

CalPERS plans to pay an annual fee based on an expense forecast rather than a management fee ? So, PE as a subscription service? sure…. that’s the ticket….. /s

I’m glad Betty Yee and Margaret Brown aren’t fooled by Slaton’s nonsense. I’m not a finance-type, and even I can see Slaton sounds like an idiot: he sounds like he’s parroting back whatever CalPERS staff or PE has told him without having the slightest clue what his words mean.

Thanks for NC’s continued reporting on CalPERS, PE, and pensions.

To be clear, a budget-based annual fee to cover overheads as opposed to the current management fee would be an improvement if done properly. It’s something the Kaufmann Foundation recommended in its classic paper, We Have Met the Enemy and He is Us.

But you need to be tough minded about it and understand what things ought to cost. And you’d need to negotiate annually.

I see no evidence that will happen.

On top of that, CalPERS said it expects costs to be higher in the early years!

And CalPERS says no portfolio company fees….and then says consulting fees….which have been the “money for nothing” monitoring fees plus the consultant abuses. Help me.

sad for east cameron, hopefully they can keep him off the board of the HOA,,,

We have a special disdain for Californians here in Montana (no offense to Californians, just stay in yer own dern state, k?). I’ve got half a mind to print up a little fact sheet about old man Slaton and send it around to all the other 50 people who live in Cameron. Someone needs to warn them.

This whole charade reeks of the flop-sweat of a failed scheme to set-aside several billion dollars of pension assets in some sort of “black box” (I may be using the term incorrectly) where it could be skimmed-off by politicians and their friends without any oversight or transparency whatsoever. Certain people seem to have been hell-bent on ramming something through before Ted Eliopoulos and Jerry Brown decamped from Sacramento, and this silly presentation is starting to look like a face-saving exercise after a year of managers shilling for this self-evident scam.

Follow the money…

Sadly, the BS from CalPERS staff seems endless. In a public body with an obligation for transparency, it is a large red flag hanging over everything CalPERS does.

Board member Slaton’s seemingly sexist put-down of Ms. Brown, that she made an “editorial” comment, distracts from the elementary substantive point she made: an advisory board, however well-staffed with the best and the brightest, has no teeth. It cannot make CalPERS accept its advice. And given that these advisory boards owe a duty to the subsidiary entity, not CalPERS, they have no relationship with CalPERS and thus no role in helping CalPERS fulfill its fiduciary obligations.

As for the observation that CalPERS must operate “at scale,” it is elementary, obvious, and rubbish. It can operate any vehicle at scale, an in-house stock index fund or a new, untried, opaque, massively expensive, externally-managed private equity fund. But it can operate only one of those two at a reasonable cost.

Slaton’s performance would be laughable, a winning candidate for a case study in how not to do something, if the stakes for doing it well were not so high.

Yes, “an obligation to transparency” and accountability.

per Dean Baker at CEPR referencing a recent NYTimes story about the Ivies’ losing strategy, much like CalPERS .

The study, by Markov Processes International, examined the 10-year returns of the endowments of the 8 Ivy League schools. The study found that all 8 endowments had lower returns than a simple mix of 60 percent stock index funds and 40 percent bonds. In some cases, the gap was substantial.

…

Typically, these funds insist that their investors keep the terms of their contract secret. The argument is that they are giving the investor a special deal, which they could not do if the terms were public, since they then would have to give the same deal to everyone else. Needless to say, all the investors are not getting a special deal. This is simply a way to avoid accountability.

Full accountability should be a straightforward demand that state and local governments could require of their pension funds. Anyone should be able to go on the state’s website and see the basic terms of each contract a pension fund signed with private equity fund, hedge fund, or other investment manager. They should also be able to see the returns as the data become available so that it will be clear whether fund gained or lost money on the deal. (my emphasis)

http://cepr.net/blogs/beat-the-press/harvard-s-choice-hedge-funds-or-scholarships

Is CalPERS following the Ivies or are the Ivies following CalPERS down this losing game?