By Jerri-Lynn Scofield, who has worked as a securities lawyer and a derivatives trader. She is currently writing a book about textile artisans.

Earlier this month, the Philadelphia Inquirer reported on some modest good news in the war on cash, with passage of a New Jersey bill that would ban cashless stores in the state:

The measure, which can now go before the full state Senate, would require all brick-and-mortar retailers to accept cash, excluding transactions made online, by telephone, or by mail. That would make New Jersey the second state to prohibit retailers from refusing to accept cash and the first since 1978, when Massachusetts passed a law banning cashless stores.

The state Senate Commerce Committee unanimously approved the bill 5 to 0, with amendments that would exclude retailers inside airports and certain parking facilities from the cash requirement. Specifically, the amended bill carves out municipally-owned parking facilities, parking facilities that only accept mobile payments, and airports as long as a terminal has at least two food retailers that take cash.

…The state Assembly passed a version of the bill in June by a 71 to 4 vote.

In a Q and A with New York City council member Richie J. Torres, Grub Street notes that in addition to New Jersey, politicians in some eastern cities – including New York City, Philadelphia, and Washington D.C.- are also mulling restrictions on cashless stores. Another recent Grub Street piece, More Restaurants and Cafés Refuse to Accept Cash — That’s Not a Good Thing “Just because you don’t have a piece of plastic, you can’t get a sandwich? ”, describes the cashless trend in more detail.

Torres regards cash bans as both classist and racist:

Why do you think cashless business models “gentrify the marketplace”?

On the surface, cashlessness seems benign, but when you reflect on it, the insidious racism that underlies a cashless business model becomes clear. In some ways, making a card a requirement for consumption is analogous to making identification a requirement for voting. The effect is the same: It disempowers communities of color.These are public accommodations. The Civil Rights Act established a framework for prohibiting discrimination in matters of housing, employment, and public accommodations. If you’re intent on a cashless business model, it will have the effect of excluding lower-income communities of color from what should be an open and free market.

And we’ll start to attach a certain stigma to people who pay for things with cash?

Exactly, in the same way that one might stigmatize [Electronic Benefit Transfer (EBT)] cards. When I was growing up, I remember the embarrassment that surrounded the use of food stamps. We live in a society where it’s not enough to stigmatize poverty; we are also going to stigmatize the means with which poor people pay for goods and services.

More Consumers Abandon Cash

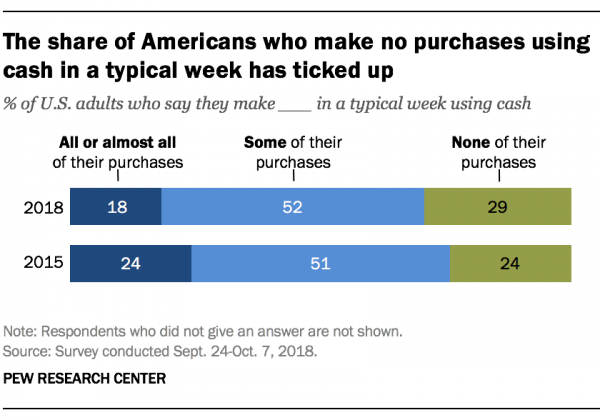

Despite these pushback measures, last week the Pew Research Center reported in More Americans are making no weekly purchases with cash that roughly 29% of US adults say they make no purchases using cash during a typical week – up from 25% in 2015. At the same time, the share of those who claim to make all or almost all of their weekly purchases with cash has dropped from 25% in 2015 to 18% today.

Figure 1

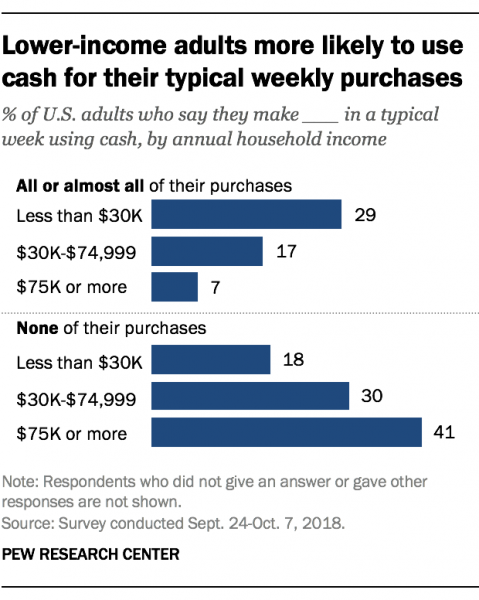

As Figure 2 makes clear, declining use of cash correlates heavily with income. So, adults with an annual household income of $75,000 or more are more than twice as likely as those earning less than $30,000 a year to eschew cash purchases in a typical week (41% compared to 18%). Whereas more than four times as many lower-income Americans report they make all or almost all of their purchases using cash, compared to higher income Americans (29% vs. 7%).

Figure 2

Pew reports that both race and cash use also correlate, with 34% of blacks using cash for all or almost all of their purchases, about twice that of the 15% of whites and 17% of Hispanics who rely on cash. Similarly, age is also important, with 34% of adults under the age of 50 making no cash purchases in a typical week, compared with 23% of those ages 50 or older.

Last week, the Washington Post noted in The global cashless movement meets its foe: Local government, that one reason for the higher reliance of lower-income Americans on cash is their restricted access to financial services:

According to FDIC estimates, 6.5 percent of American households were unbanked in 2017, meaning they did not have an account with an insured financial institution. Another 18.7 percent of households in the United States have a checking or savings account but still relied on financial services outside of a traditional bank — such as payday loans or check-cashing businesses — the estimate showed.

Over to Grub Street and Torres again for a trenchant summary of the main issue:

What do you make of the claim, “But these days everyone has a card!”

People who say that are living in a bubble of privilege — they look around and all their friends have cards. In response I say, “Does it occur to you that your world is pretty unrepresentative?” There are hundreds and thousands of New Yorkers who may have no permanent address or home, and many New Yorkers who are underbanked, either because of poverty or because they lack documentation. Requiring a card is erecting a barrier for low-income New Yorkers — period — and it’s coming from the very communities that claim to be progressive, as if, “Well, I am all for racial justice just so long as it doesn’t come at the expense of my own privilege.”I think that many of these places actively want to keep a certain type of person out.

Of course! Earlier I said that no matter what the intention was, its effect is discriminatory, but I do think that it can also be intentional where the idea is to filter out the deplorables.

Even advocates of cashless transactions concede critics have a point – but reject the stark conclusion that the purpose of cashless policies is to exclude certain types of customers. According to the WaPo:

As CNBC has noted, business leaders such as Shake Shack founder Daniel Meyer have defended cashless policies by pointing to higher security and improved customer service and efficiency, even as they acknowledge their critics. “We know that some have raised concerns about the socioeconomic implications of operating a cashless business” Meyer wrote in a blog post earlier this year. “That’s certainly not our aim.”

The Bottom Line

Some cities and states are actively pushing back against the trend toward cashless businesses. Pending or mulled measures that maintain a place for cash would ensure that public accommodations remain accessible to all – and not restricted only to those privileged to have access to a credit or debit card, or a mobile app.

I think something that’s missed in these discussions of going cashless is the jobs/labor that are being eliminated. It’s not just the card less consumers that are being gated; it’s also entry level employees.

other aspects of going cashless I resent as a citizen of a so-called democracy:

the opportunity for middlemen to extract fees at every juncture

further loss of privacy with every transaction being tracked

g-d forbid a government or financial agency decides to shut you down,

all too easy for them to separate you from your fund$

can citizens rely on the rule of law to protect us?

rhetorical question…

judging from recent trends (foreclosure crisis, etc.), what could go wrong?

Thank You!

Credit card companies rob small merchants of anywhere from 3 to 6% of sales, plus withhold payments where there’s a warranty extension by the CC company. A merchant with a 3% profit margin, like the typical grocer, makes no profit on a credit card sale.

I see these idiots waving their smart phones around the credit card readers that don’t work, holding up the lines and thus forcing their retardation on everyone, as well as surrendering their own privacy to Apple and the buyers of all that aggregated data.

How do you think the following proposal would go over in America?

“Let’s put a sliding tax of 3 to 6% on all small merchants, that they will pass onto customers in higher prices.” That’s what credit card users are voting for every time they don’t pay cash.

Yesterday’s article in links about Janky payment systems and the proposal to institute a federal reserve based merchat’s payment system is dangerous because I believe it’s the first step toward a cashless society with a national I.D. payment card system.

“further loss of privacy with every transaction being tracked”

I’m surprised this isn’t brought up more often. For me, it’s a compelling reason to thoughtfully use cash.

The transactions are not just tracked, that information (as we now well know) is sold and re-sold. Sheesh!

I feel this is a bit of overreach and is talking about theory only. What percentage of customers (low income or otherwise) are refused at these businesses? Does it happen daily? Maybe it only happens once a month, but we don’t know.

The business loses out if they can’t serve their customers and that’s their choice. Any similar local business that accepts cash wins out as they get all the cash customers.

Some cafes or restaurants might be take out only, if I want to get a coffee I won’t go there. I’m not going to suggest a law against that they have sufficient seating. I feel that physical accessibility is a much more important issue to deal with. Most US businesses are inaccessible to a person in a wheelchair. Even washroom accessibility is a more important issue, if you sell food and have seating, you should have a washroom. That’s not always the case and the next nearest washroom could be far away and you will have to pay for food again at a McDonalds or wherever to get access to that washroom.

Conversely, staff employees are at higher risk due to theft if the business has cash. Is it ok to exchange lives? You can look up the local crime rate for your area but it is well documented that business robbery is an issue that leads to employee death, injury, PTSD, etc. I feel it’s better to help prevent these incidents then change business policy for which we don’t know the benefit.

That’s my bunch of random thoughts

A store I’d been a longtime customer of came close to refusing me a cash sale transaction after they switched over to all-cashless. Only because they knew me and that I’d been a long time customer did they accept my cash money, but it was a close run thing. The managers had to consult each other. I’m sure if I were a new customer they would decline the cash transaction. It’s their store. I’ve never gone back. (Hard not to imagine this is being pushed by the banks, which may be offering ‘incentives’ to stores to go cashless.)

Banks might be pushing it, but I expect going cashless has several advantages for some retailers also. Much harder for employees to rob the till (card fraud doesn’t come out of the business’s bottom line). Less opportunity for low-level employees to make mistakes with change. No counterfeit money (I think card scams are typically online transactions rather than fake cards in brick and mortar establishments).

None of these seem like particularly compelling reasons to me, but maybe some owners would see it differently?

Most small owners that I know, an admittedly small set, are furious at the banks for the looting behaviours the banks have indulged in related to Credit and Debit cards. Said small owners relate that raising prices on anything other than high end merchandise or services, where the consuming population is awash in disposable income, is next to impossible. The banks are working on the theory that there will always be other “hungry” small proprietors available to force ‘retail’ prices down to keep the class of small shopkeepers “in line.”

The phenomena of banking, credit and debit card fees are properly the remit of the regulatory agencies. Considering those agencies track records in dealing with the housing crisis, I will not hold my breath.

Short version: I know some small owners who hate the card fees as rent extraction on a grand scale.

They’re not wrong. I try to pay cash for small owners, although I usually use a card for big box and large chains. My point is, even if banks are pushing cashless, it’s plausible that at least some retailers would prefer that also.

I can see the usefulness of the metadata of their customer base to the big chains. Economies of scale come into play. Has anyone done some work on whether the return on metadata guidance for merchandising in big boxx stores exceeds the percentages extracted from the stores revenue stream by the card issuers?

We discovered quite by accident that there are at least two extraction systems at work with card transactions, the banks themselves and the card management systems.

Yes, and when the manure hits the fan and all the debt accumulated by governments worldwide has to be paid ( or at least start to get paid) guess how they will extract money from us proles?

Bail ins, like Cyprus recently, maybe on deposits, maybe a transaction ‘fee’ , probably both.

The demise of cash means we will all be subject to shakedown by our Governments – who needs the mafia?

Other JL: Banks are indeed promoting it like VISA did in 2017. It’s good for their bottom line not necessarily the merchants who will lose business from cash only customers.

https://www.valuepenguin.com/2017/07/visa-offers-500k-food-vendors-go-completely-cashless

It’s ironic that you’re willing to push small businesses on accessibility, considering how little empathy you exhibit on issues of race and class.

Having had to cope with been bankless and jobless — in New York City — I can attest that working-class people are easily shut out of the credit card/debit card market, and that the trend toward a cashless economy is racist and discriminatory.

I think the key thing here is that banks make a lot of fees from low-income people because they do not carry large balances. So a cashless society is a cash register going ka-ching, ka-ching for banks.

My youngest daughter is just entering the workforce. She has a bank checking account but keeps her savings as cash in her bedroom for the simple reason that she had a savings account and found that the fees were sucking it dry. A lot of the transactions she ends up being involved with are cash anyway as some of the people she deals with for a hobby are un-banked.

BTW – she has a small Roth IRA and pays less fees for that at Vanguard than she would pay for a savings account at an FDIC bank.

She should switch to a credit union.

Thanks for this post. Good news. Cashless stores are ‘criminalizing’ low income people… stretching a point made by proponents of cashless that cashless cuts down on crime.

We have a great small store in my town that I used to patronize, but when they went actual cashless (I understand not accepting checks) I quit shopping there. That business is doing well. I can’t participate in encouraging the idea of a ‘cashless society.’

adding: at other stores where I use cash, the cashiers are usually very happy with a transaction that is quicker than most card transactions, not subject to fraud or hacking, and doesn’t give a card issuing bank a fee.

Credit cards have gotten pretty simple. @ Wal*Mart last week, a $80+ transaction pushing plastic into the slot didn’t require a signature, as has been the custom the past year or so.

The worst one I got stuck behind while waiting to pay for my items, was a lady with 5 or 6 WIC vouchers. It turned a 5 minute cash/credit transaction into 22 minutes of wondering if it was ever going to end.

That is the ‘dirty secret’ behind the clumsiness designed into the WIC. Physical Food Stamps held a similar stigma. It makes those dependent on such assistance stand out like sore thumbs and shames them in front of their peers.

If one has an interruption in one’s ‘online presence,’ as we did recently, keeping track of the balances in bank accounts can become a real chore, and sometimes, especially for the poor and borderline poor, a source of ‘gotcha’ overdraft fees. (I have several monthly bills that I budget the checking account to keep the needed sums in the account on the days they are debited from the account. Suddenly one was moved without warning. I was checking the balances every other day or so at the Library. The bank would only rebate me one half of the overdraft fees. Gotcha!) The ‘official’ bank policy is to ‘discourage’ asking the tellers to give you your balances. The first time I asked this service of a teller recently, I was told that I could look it up myself online. I think that I might make that phrase my new “Eff off!” “You can look that up online.”

And for ½ the American population that does not have easy reliable access to the internet (or any internet in some areas for anyone at all) and the ⅓ lacking cards, and ¼ that are either underbanked or unbanked with the three categories not completely coterminous so maybe over half the population has problems with either getting access to their money, paying their bills, or even finding out how much they have.

And with the extortionate costs of internet services even with ready access to internet service and a bank account being able to afford it can be a problem.

So this War on Cash and the blithe acceptance that of course everyone can just go online to check their accounts is all good, right?

1/2 seems an absurdly high figure there. Do you have a sourcE?

It might be a little high honestly. That said, I am adding up those with difficulty with easy and reliable internet access (with could also mention affordable), plus the number that are either under or unbanked, and finally those who cannot get debit/credit cards. All the three areas up, guesstimate the overlap and an any number is going to at least 1/3.

If a cashless society was going to work for all, it will have to have some much different systems of finance and internet access than we have now. The Reservations, the Mississippi Delta, Siskiyou County, Flint, Michigan, Manhattan, and the thousands of homeless in San Francisco are all different countries, or even all very, very different worlds, but people persist in assuming it is all the same.

That’s odd. When I go to the credit union they invariably ask if I want to know my balance, and it always appears on the transaction receipts. Is this an outlier or another difference between CUs and banks?

I’m going to have to look into this. If true, it would be yet another reason to move all our banking over to the Credit Union.

One of my credit union prints the balance on a receipt after an ATM withdrawal; the other does not.

A young relative of a good friend works in online banking security for a TBTF, and when my friend asked him how secure it was, he said something like: “if you only knew! I don’t use online banking”.

FWIW, but I no longer use online banking- or banks, for that matter-

having joined a credit union several years ago. The switch was easy,

at least in my case, and the account, checks, and quite a few services,

are free.

I belonged to a wonderful credit union from my teenage lawnmowning saving account days until just after college, then great depression 2.0 came and they had to merge with an awful larger credit union and became a bank with slightly less nasty policies. It was a real shame.

I’ve moved to another place and joined a cu, they’re very nice, but very slow. I suppose I’ll take that over being signed up for fake accounts and murdered by random fees for nothing.

I have to admit that as my CU- Golden 1, in California-

has gotten larger, the service has gotten a little worse;

more automated and bank-like. Still leagues better than WaMu/Chase, though.

Just in case someone is interested in Golden1 CU,

I want to edit the above from “a little worse” to “substantially worse”.

Almost as if there’s some overarching entity that’s requiring crapification

Short version: The hidden purpose of such dysfunction is to shame the recipient of any aid.

There is a scene at the beginning of “Treasure of the Sierra Madre” where an obviously down and out Humphrey Bogart is pan handling on a Mexican street. He never looks up into the eyes of his benefactors, perhaps from a sense of shame. This sets up an exchange between Bogart and the director of the film, John Huston, playing a one shot walk-on role as a big white suit.

The opening: https://www.youtube.com/watch?v=KqxusLNuz2w

Weaseling around the internet, I came across this much better montage of the Bogart-Houston encounters mini-story arc.

See: https://www.youtube.com/watch?v=FTcGeI5nuvw

You get a trained cashier and they are much faster doing cash transactions than those that pay with cards. Cards take several steps and is especially awkward waiting around for some bank to give you approval. Just by paying the right amount in cash makes it even faster.

I am not sure the wisdom of the elites putting their faith in the US electrical grid. That can be problematical over time according to engineers who look at America’s infrastructure. And trying to force in a cashless society would simply mean that a larger portion of the American economy would become part of the black economy as in beyond the purvey of the IRS. Shame that.

Oh, the horror! sarc/

In one place I worked at the registers were so old that they had a back up handle to actually ring the transactions up. It was funny, but once the power did go out and since we had big windows and plenty of light, out came those handles. We even had the almost as old charge racks to rack or impress the card’s embossing onto carbon paper. So business merely slowed slightly.

I have noticed that cashiers now sometimes don’t have the ability to rapidly take money and give change through lack of practice. It’s a skill like anyother. That lack can make using a card quicker.

And so many young people can’t make change anymore. They have to look at the register to see how much they are supposed to pay you back. I learned quickly back in the early and mid 1970s, when I worked retail while in high school and college, how to figure out what is owed very quickly. Just count back from how much they gave you. I don’t know if math skills have gone down hill that much, or if people are just used to having a machine figure everything out for them. Frustrating.

I was shopping once at the local food co-op where the clientele is mostly young and “hippie” and pay for everything (even a $1 purchase) with plastic cards. As it happened, a thunderstorm, and the power went out. The backup generator kept the registers working, but turned out the card readers could not talk to the mother ship, the internet connection was down. So after a bit they announced “cash or checks only”. I was one of very few who paid cash, which I was going to anyway. Smirk.

I thought that refusing to accept “legal tender for all debts, public and private” was prima facie against the laws establishing the Federal Reserve. I got into that argument with the manager of a local store which is only cashless.

I look forward, in future, to loudly congratulating them on keeping the wrong sort of people out of the store.

Won’t cashless create an incentive to use gold and silver coins again, to evade the gov and to make consumption easier for “cardless” folks, or for “private” purposes of wealthier folks? Cashless will lead many of us to the “underworld” that already exists. At least it will be clear that that’s where capitalism expects most of us to live…Dickens’ karma.

And that is what you see in rural New Mexico: lots of poorer cardless folks, lots of @Wukchumni’s example from above with antique state food stamp or WIK system that embarrasses the hell out of the purchaser, and lots of grumpy old off-of-the-system retirees who’ve grab some land with a house 100 yards from the road.

It’s the escape from social life.

My state put food stamps (SNAP) on a tbtf bank issued card for poor recipients as a way to monitor behavior. The tbtf card-issuing banks charged the users 5% transaction fees in total off their monthly benefit. When the SNAP benefit is already tiny, letting a bank card take 5% in fees from the SNAP recipient – in addition to the standard vendor transaction fees – this is getting into Dickens territory. Nice deal for the bank, though.

Well, you know, Jamie Dimon can’t make his dime without stealing from poor people. After all, JPM Chase owns a bunch of payday lenders so charging fees to those who need food assistance is just par for the course.

And I understand he may be running for president!

It’s legal tender for debts, but it’s not a debt unless you owe the money. If you eat at a restaurant and are supposed to pay afterwards, that’s a debt (after all, they’d call the cops on you if you walked out without paying). If it’s a fast food restaurant where you don’t get anything until after you pay, that’s not a debt, and they are free to refuse the transaction if they don’t like your payment method.

Aha. I was similarly perplexed by the legal tender angle.

Note servers/barkeeps etc. still particularly appreciate cash tips as they don’t have to share (with boss/lazy cohort/uncle sam)

Perhaps the IRS will take note. To open an IRS account, which is a sensible precaution to prevent a fraudster doing it first, requires the individual to allow the IRS to send a text message for 2FA.

Ah, some may say, surely everyone has a friend with a cellphone? I’m sure that’s a really sound plan having A N Other’s cellphone used for account security. Why not give the friend your PIN numbers too?

Cash is used to buy both illicit drugs and legal drugs (cannabis). I suppose this is another reason a store may not want this type of customer, based on the store’s superior morality.

Also, let’s not forget that cash can be confiscated by LEO because markets./s

An enterprise that transacts business in cash is at high risk of loss from fraud or theft. There is the security of employees going to and from the bank with bags of cash. Security at the business location from robberies and/or dishonest employees. It takes time to count and reconcile cash. All of this costs money. Meanwhile, electronic payments are fast, secure and convenient. It’s not about “disenfranchising communities of color.” It is about being in the 21st century (not the 19th) and doing things a better way.

Actually, they aren’t. I just returned from shopping for a couple of items at Target. Along with Michael’s, Target is a store that I believe doesn’t take customer security seriously. Consequently, I stopped at the bank ATM before going to Target so I could be sure to pay cash. I’ve had my card data stolen at least once when used at a large grocery chain so no, cards are not secure, and they certainly aren’t fast. As to convenience, see how convenient it is to have to get a new bank card when your account has been broken into–not so much.

Agreed. Once found forty dollars gone from my card that went to pay for some airfare in Indonesia of all places. Had to cancel the card immediately only to wait around for the bank to send a replacement card which took a week or two. Yeah, not so secure after all.

Also, years ago some floods knocked out the power for a coupla days. We were right as I had cash but the well-off neighbours across the road not so much. Was going to give them a loan so that they could buy essentials when the power came back on. Too many eggs in one basket when you depend on an electrical grid, the internet, and banking networks just to buy a bottle of milk and a loaf of bread.

Buy? What is this ‘buy’ you speak of Captain Kirk?

Well, it’s like quatloos Senator Warren.

Oh, Captain Kirk! You must explain this ‘buy’ to me again and again!

But Senator Warren! That will trigger the two income trap!

Not to worry Captain. The creche will take care of that.

Well as far as credit card security goes for online purchases I highly recommend using this service I found called Privacy. It lets you generate a disposable credit card number for use in online purchases. You can set a limit on the amount charged or make it a 1 time use card, using as many card numbers as you want for free. It automatically deducts from your checking and all refunds and fraud protections work great. Also they give you a $5 credit when you sign up (full disclosure if you sign up with the link I used I get $5 too). They make their money by pocketing the fee credit cards usually charge. It’s great for making online purchases or signing up for things that will be a recurring payment that you don’t want to go through the trouble of canceling.

Until there is 100% free banking, no transaction fees, and a guarantee that business will take my business under a loss of power, I refuse to participate in a cashless society. If you want all the information on my transactions, you better give me something for it.

Bravo Kurtis,

Whenever I’m asked for my Email at a retail store, or at a doctor’s office or am asked to answer a survey, I ask, “How much can you pay for my ‘valuable opinion’ or my information?”

I refuse to do the online access that UMass has been pushing.. I don’t believe for one moment that it is secure not will it be used against me. I cannot believe that an organization that can’t get their billing right (I argue over every bill) can get their internet security right.

At least the supermarket gives you discounts in exchange for giving them all the information.

Further, the last time I read the fine print on printed money, it says something along the lines of “this note is legal tender for all debts public and private.”

Sounds they need to add some more fine print to reword that line to read ” this note is legal tender for only some of the public and private debts.”

…maybe I need to go re-read that!

Bullcrap. I’ve never had someone buy airline tickets with my cash but with my credit card yes. And because it was in a different state no police interest. Has anyone had their credit hacked by paying cash for gas off the interstate? (Antecedent to the aforementioned fraud). Or had that test charge run against their account? Cash favors the customer, credit favors multinational corporations and modern pirates. Its only ‘better’ because they usually don’t charge you for the theft, yet that tells me that the banks aren’t viewing this as a cost to them-which means it’s not.

Thanks, Joey; yes indeed this is another way cash is better for ME.

The enterprises that are transacting business by card are paying the credit card companies/banks an extortionate amount. And they are at high risk of fraudulent transactions by hackers. Electronic security is not very good.

The comment it’s the 21st century, not the 19th, is patronising/superior to say the least. Money has been around for several centuries, for a start. And there is a guy called Edward Snowden who talked about a turnkey totalitarian state. Card transactions make that more likely, since they are not anonymous.

It’s NOT better if someone is keeping track and spying on me; and if someone who isn’t involved in the transaction is taking a cut.

Hell, Suntrust Bank is attempting to go cashless as well.

They charge a fee(minimal of course), a “fee” for a bank to take cash as a deposit. WTF?

And now they recently stopped having paper deposit/withdrawal slips in the branches. again WTF… so if you go in and deposit cash, now everyone has to wait for you to get a slip of paper from the teller, to write down the account number you want the money deposited into… and since the reciept doesn’t show the whole account number, you have to take it on faith the money was deposited into your account… again WTF? SUNTRUST is a horrible bank. The people are nice enough, but the management , in that whoever came up with these ideas are total idiots… nevermind the dilapidated condition they are letting the branches fall into…. I only keep this account for now because of the branch locations are more than my credit unions, but that reason is not going to hold up for too many more months.. it just isn’t worth it…

They are trying to discourage cash use… again a “bleeping” bank….

ANd you better keep that reciept they give you and check it before you leave… because that is the only proof you have actually made a transaction in cash….

Unlike when I deposited a check for $3,000 with a deposit slip, a couple of years ago, then had the proof when they credited my account for $300.. . Luckily I had the deposit reciept which showed a transaction for a $3,000 deposit, as well as a facsimile of the check ;front and back as well as a facsimile of the deposit slip showing a deposit for $3,000…. All of this backed up their “user error”…. Now , this bank is doing away with prudence when it comes to “user error”. and let the customer beware…. Again.. WTF?

I won’t be a customer for long. the end is nigh.

When the banks want to go cashless as well, it is the beginning of the conspiracy theory story coming true…. again.

Not mentioned so far: 12-step meetings, church collection plates, etc, still make cash mandatory. Also, I try to make political donations in cash to retain anonymity from solicitations.

Here in the Antipodes, full-on cash-shaming has been a thing for a while now. The consumeriat seems to be buying it.

Hah! Had the same thought and went looking for the same exact video this morning but failed. You do wonder if the ad agency may have been having a bit of fun at the client’s expense without them realized it in how they depicted the ‘robot consumers’. I know the people behind the counter at my bank aren’t into using pay wave schemes at all so you wonder why.

Thanks for that “I’m an idiotDrone, I pay with a spyCard” video!

I think its not the fact that many people, including myself, use cards or phone for everyday purchasing that indicates a preference for cashless exchange, its the availability of choice that matters to me. If every form of money is under banking control we know very well what they will do. Whatever the bankers say, they will cheat. We know it now, we have seen it occurring throughout history, why would we go down that road again. Fool me once ……

Exactly. As someone who had her online banking payment records wiped out by a large bank at the behest of a crony servicer, I am fearful they could do the same with account balances. The bank’s justification for deleting (and refusing to provide a copy) was “We own the system. We can do what we want with the records.” Needless to say I am as all-cash as is possible now.

Why, in the Richie Torres quote from this article, is going cashless portrayed as a racial issue, when it is so manifestly a class issue?? There’s a handwave to “classist,” but an immediate jump to making it an aspect of racism.

If the majority of Blacks are poor, it is not the case that the majority of the poor are Black, or Latino, etc. Defeating the drive to kill cash is going to require a more universal fightback. As with so much else, an identitarian approach will hinder this.

I’d have to take the various methods of doing transactions over cash if it came to a war of the monies. Cash ain’t king now, just a small percentage of transactions. It’d be easy to squash…

…and then it gets interesting

As everything will be tied to electricity in a money vein.

What would a ‘run on the bank’ entail, when there’s no there-there, to withdraw?

My kids school board pushes cashless, presumably as part of a fraud management strategy.

I don’t like it, contributing as it does to the great maw of corporations devouring public schooling in n-many ways.

Make sure to Christmas gift your mailman and garbageman with cash in an envelope rather than a ‘gift card’ that charges them interest/fees and requires travel to an institution that they may not use.

Some “gift cards” deduct some amount every month if you don’t use it yet. Some even outright “expire” after a while. Apparently getting a free loan isn’t good enough for those parasites. But the main reason I never use “gift cards” is that it ties the recipient to a particular merchant. Cash gives them the freedom to spend where they want.

If you have judgments against you, every financial transaction you have is pushed under the table. You work for cash to keep your wages from being garnished, you carry the cash instead of depositing it so you don’t have an account that can be garnished. Carrying plastic just isn’t an option.