By Konstantinos Efstathiou, as Affiliate Fellow at Bruegel. Originally published at Bruegel

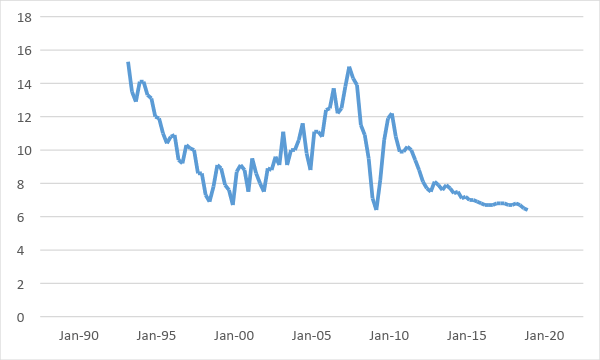

According to preliminary estimations of the National Bureau of Statistics of China, the country’s GDP grew 6.4% year-on-year in Q4 2018, the same rate as during the worst of the global recession (in Q1 2009, see Figure 1). For the whole of 2018, the growth rate was 6.6%, the lowest since 1990. And last week, the IMF published its updated World Economic Outlook (see Table 1), in which Chinese growth in 2019 and 2020 is projected to be even slower (6.2%).

Figure 1

Source: National Bureau of Statistics of China

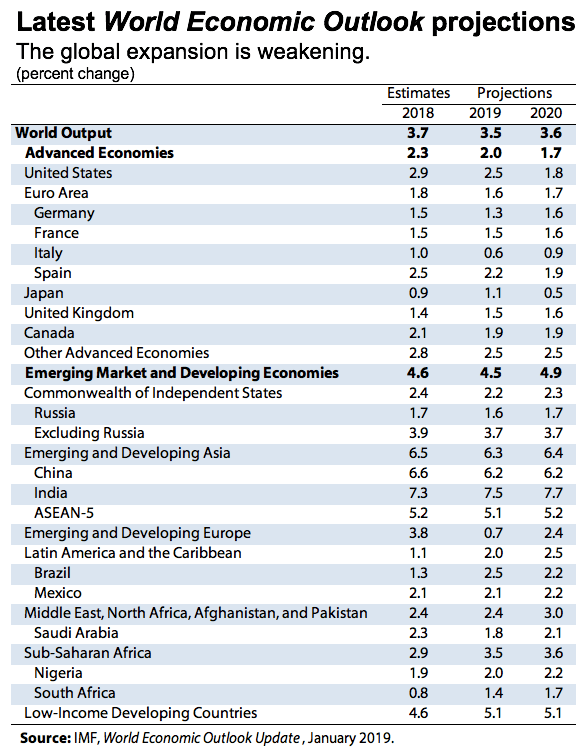

Although there was no revision for China, the IMF cut its forecast for global growth, while Gita Gopinath, the IMF’s new chief economist, warns that “risks to more significant downward corrections are rising”, including the possibility that Chinese growth slows down faster than expected.

Table 1

Although there is a consensus among commentators that slower growth is hardly surprising, they also agree that there is more than meets the eye when it comes to Chinese growth.

The first concern is that the actual situation on the ground is worse than the GDP numbers let on. Michael Pettis at Carnegie Endowment for International Peace subscribes to this view. He argues that true growth may be as low as half of what is reported, but he puts forward three distinct reasons as to why there might be such a discrepancy.

The first two are not limited to, though remain particularly relevant for, China: GDP may be doing a poor job at capturing the creation of real economic value, or the reported numbers may not be accurate. But, Pettis argues, the third reason is far more worrying: GDP growth is an input to the Chinese economic system – as in, a target set at the central-government level well ahead of time – rather than the output. Then several actors, such as local governments, engage in the spending and borrowing required to achieve the target.

As long as this economic activity is productive, as Pettis claims was the case until a decade or so ago, it is a non-issue. Even if it is not productive, however, China can continue to hit any GDP targets it sets, provided that it doesn’t face hard budget constraints and avoids a write-off of the resulting bad debt. The difference is that GDP ceases to be informative about the economy’s health or performance. Pettis’ point is, therefore, that one should worry less about the reported growth numbers and more about the financial risks that have built up as a result of unproductive investment.

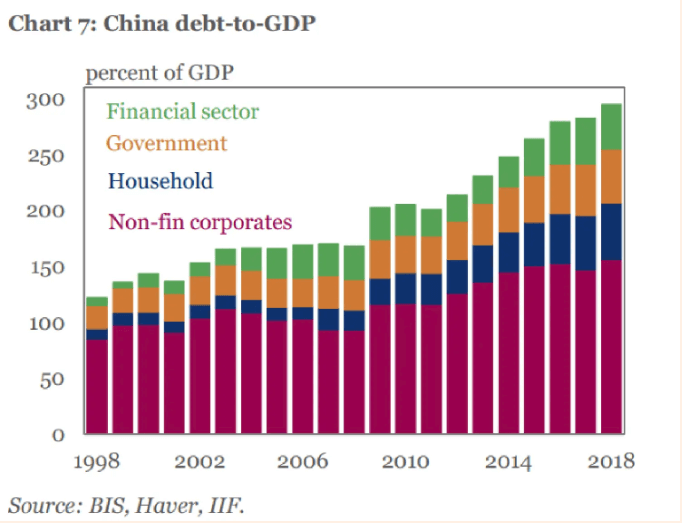

Indeed, Colby Smith in FT Alphaville documents how, after the global financial crisis, China’s domestic leverage increased substantially (see Figure 2). The column notes that the rapid increase in debt fuelled an investment boom that supported, in the words of former premier Wen Jiabao, economic growth that is “unstable, unbalanced, uncoordinated and unsustainable”.

Figure 2

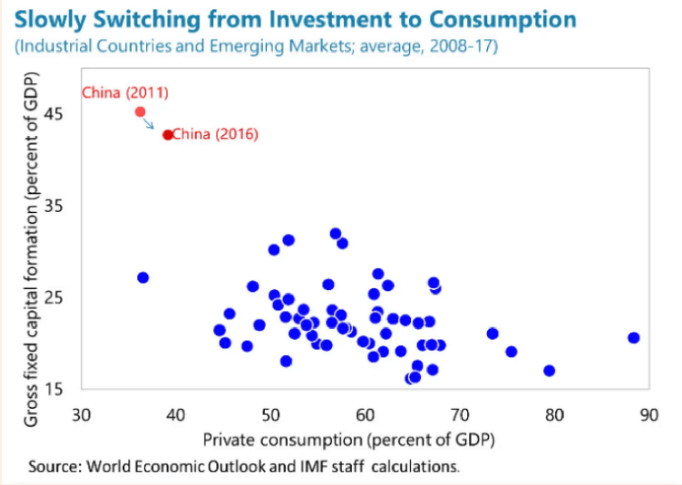

This highlights the chief concern about Chinese growth – namely,- that it is unbalanced, relying too much on investment and too little on consumption. With investment at 43% of GDP and private consumption at 38%, China is an outlier by global standards (the world average for consumption is 60% of GDP) and the progress it has made towards rebalancing since 2011 is small (see Figure 3). Citing the IMF, Smith points out that China’s per-capita GDP is comparable to Brazil’s, but its consumption per capita is analogous to Nigeria’s; if China were to consume like Brazil, its level of consumption would have to double.

Figure 3

Paul Krugman remarks that at such high investment levels, diminishing returns are bound to kick in. Although high investment rates can be sustained for a long time in a rapidly growing economy, the potential for future growth in China has diminished for two reasons: technology has converged to that of other advanced countries, and the working-age population has stopped growing. Yet, Krugman writes, Chinese policymakers seem to be doubling down on supporting investment, instead of rebalancing the economy towards higher domestic consumption, for instance by returning profits from state-owned enterprises to the public and strengthening the social safety net.

Why is that? Chinese policymakers face a trade-off, says George Magnus, former senior adviser to UBS and the author of ‘Red Flags: Why Xi’s China is in Jeopardy’ (per Colby Smith’s Alphaville piece). Decreasing the pace of credit growth to rebalance the economy renders the high-growth-rate objectives of Chinese officials harder to achieve. But Magnus says that, so far, Chinese economic policymakers have tried to meet both ends, thus working at cross-purposes and risking the failure of both aims. Put another way, infrastructure spending, liquidity injections in the financial system, cutting the reserve requirement, and asking banks to lend more to private and small companies all contradicts the calls to banks to raise more capital and keep an eye on their bad debts.

Conversely, in his Project Syndicate piece Yu Yongding does not walk the line and strongly advocates monetary and fiscal expansion. Macroeconomic stimulus may not address China’s long-term problems, he argues, but slower growth is the biggest risk China faces, endangering its economic, financial, and social stability. In Yongding’s view, with inflation running at only 2%, tightening monetary policy to achieve other objectives, such as managing the exchange rate or containing house-price increases, would do more harm than good.

On the issue of rising house prices, Yongding dismisses the view that they are caused by central-bank policy, but reverses that logic and advocates for fiscal instruments to address the matter. Noting that house prices have been on a rise that predates any monetary stimulus, Yongding believes that it is exactly the absorption of liquidity by the residential sector that creates the need for further injection in order to support the rest of the economy.

He also adds that China has the fiscal space, even after considering contingent liabilities such as local government debt, to reverse the slowdown in infrastructure investment, the basic driver of lower growth. To enhance the efficiency of infrastructure projects, Yongding argues for funding projects through the central government rather than leaving it up to borrowing by local governments.

Rather than the short-term ramifications, Jim O’Neill considers the long-term implications of China’s rebalancing. O’Neill draws from Apple’s letter to its shareholders that cuts its Q1 2019 revenue forecast and cites the economic slowdown in China. His premise is that Chinese consumption has driven global growth during the past decade and it has become a major market for companies like Apple.

Between 2010 and 2017, consumption in China grew from $2.2 trillion to over $5 trillion, compared to $10.5 trillion and $13.5 trillion respectively in the US. Going forward, O’Neill argues, the growth of consumption in China will be absolutely essential. Assuming 8% average GDP growth and a gradual increase of domestic consumption to 50% of GDP from 2021 to 2030, he writes, by the end of this period Chinese consumption is projected to surpass American consumption.

O’Neill wonders what it would mean for the global economy if these assumptions do not come to pass, and concludes that no country, advanced or emerging, could fill the consumption void China would create. The US may be one exception, but O’Neill is sceptical about the ability of the US consumer to step up in light of vulnerabilities caused by inflation, higher borrowing costs and pressures on the US increase savings.

Like Krugman, O’Neill proposes more direct fiscal support but also the reform of the hukou (household registration) system. In his view, the economic security generated by such reform for migrant workers from the country’s rural areas, would enable this important part of China’s population to save less and consume more.

Perhaps the most striking statement made by O’Neill is that “a sustained decline in Chinese consumption would be even more worrying than the current US-China trade dispute”. This sense that a Chinese slowdown is imminent and its impact may prove devastating is echoed by the other pieces reviewed here. But as Krugman writes, “the other day I issued a warning about the Chinese economy… unfortunately, the other day was six years ago”. And given the abundance of policy recommendations, China still appears to have a number of options to deal with its growth problem.

Not to be Alarmist, but if mellowing growth in China is inevitable from a variety of factors, but Donny’s trade war continues to be thrust into the spotlight, how likely is it that America gets characterized in public opinion (on both sides of the Pacific) as the cause of the slowdown?

Or more simply, is Donny delivering the Chinese officials the perfect scapegoat on a silver platter?

What other options are there?

Donny is delivering pretty much everyone the perfect scapegoat on a silver platter. Got a policy that’s going to take a lot of flak when the public figures out the side effects or direct consequences? You got 2 years to push it through.

I think its true to say that he is giving the Chinese the perfect ‘excuse’ for a managed slowdown in order to make fundamental changes in the economy. In fact, I thought this is exactly what the Chinese would do – use the trade war as a cover for making the type of switch from an investment to consumer led economy thats regularly recommended by people like Michael Pettis (which would inevitably lead to a painful transition period).

However, so far there is no evidence of this – it does seem that Trump has sown a lot of confusion in the corridors of Beijing, they simply don’t know how to respond to his provocations. They’ve been thrashing around a little which has made Xi and his government look uncharateristically accident prone.

Maybe we can reverse the old adage – insanity is doing the same thing over and over again expecting to get a different result. In China’s case – doing the same thing over and over again (investment) and expecting to get the same result. Welcome to the concept of “marginal return”.

At this point growth can only come from more debt. Look at the US where 60% of folks can’t handle missing a paycheck or two. Not much slack for more consumption there – and that is at full employment.

The dirty secret in China is NPLs. As long as no one screams “the emperor has no clothes” too loud, this can continue for a while. But when it ends … it will not be nice. The increasing authoritarianism under Xi will unleash quite a bit of blowback when the economy falls. Chinese fear most of all “luan” (chaos), so there is more rope that we would expect, but it is not endless.

This is a really good overview. Even by Chinese standards, the government has become more opaque than usual over economic policy. It should be noted that in the past few years the government has been cranking up pressure on foreigners in China and especially academics to ‘toe the line’ or find their visas revoked. So increasingly its harder and harder to find genuinely independent informed commentary on what direction China is going.

I think Pettis’ point on GDP is very important – there is a foreign fixation on the GDP figures which simply doesn’t reflect what is going on in the real economy (I’d recommend reading his blog for this to get his very detailed explanation for this). Its not – as is commonly thought – about faking figures to make things look better. Its confusing the raw measure of GDP with real activity on the real economy. The reality is that as far as many Chinese people are concerned, they are in a recession, there are fewer jobs and people are getting squeezed.

I used to think that the Chinese government had a pretty good handle on what to do if and when the crunch finally comes with the repeated cycles of fiscal and monetary boosts and the Minsky moment arrives. There is no doubt they still have the capacity in theory to deal with it, especially as nearly all the monumental debt load is internal, not foreign debt. But I think there is more and more evidence of confusion at higher levels at when and what they should do apart from keeping the soft money flowing into the economy. One day this will stop working (that day may already have arrived). Unfortunately, it may be that the reflex impulse of the Party is to crack down hard on critics, not make economic reforms.

As to the wider impact, I think the recieved wisdom has been that the Chinese domestic market is not big enough to have real wider global impacts in the event of a downturn. But those comments from O’Neill make me wonder if that is important is not current levels of demand for western goods in China, but in expectations levels. A lot of companies may have staked their futures on rising sales to China. They may be very disappointed, and that could be bad news for the rest of us.

Have there been any studies of what the projected impact on resources would be if China consumed products and produce at the same rate as other advanced economies? It’s one thing to say that a little more than a billion people need to buy more stuff. It’s another thing entirely to make the stuff for them to buy.

I’d be interested to see if anyone has considered the possibility that the net gain from China consuming more will be offset by the decreasing population elsewhere in the world. Otherwise a lot of these papers strike me as economists “assuming a can opener” to paraphrase an old punchline.

I don’t think its a question that can be answered in any meaningful way, as there are so many scenarios. But if you take carbon emissions as a ‘proxy’ for resource use, then there probably (all other things being equal) be a huge difference as Chinese emissions per person are quite high (around the European average) – mostly because of the gigantic construction industry. A switch in the Chinese economy would probably mean less use of steel and concrete, more plastic and cars and other gadgets. Advanced countries have a very high variation in energy and resource uses (basically, north Americans use far more than Europeans or Japanese) for all sorts of cultural, political, economic and technological reasons.

So Mr. Yu is of the opinion that it is quite possible to keep consumption and growth going but not if China relies on private banking and debt servicing – because newsflash, that causes exponentiating inflation in a nation of 1.4 billion consumers. And the residential sector is key – it needs to be directly funded by the government. Yu is no dummy, because the “…absorption of liquidity by the residential sector, and infrastructure, causes the need for more stimulus in order to support the rest of the economy. ” China has lots of room to grow its consumers. Feed me Seymour. Krugman et. al. don’t look at it this way (then they would have to admit the contradictions); all they see is an economy that is out of balance – investment will topple unless there is a stronger base of consumption. China can control this best by direct government stimulus, eliminating the private banks and investors altogether. It’s a no brainer as to which way China will choose. It will choose direct government spending. And the best part is that in so doing, China will avoid complete destruction of the environment merely for the sake of return on investment. Why doesn’t Krugman find a solution for that one?

I would like to see a comment from Pettis on Yu. Yu looks quite “official” and seems to be worried mainly about bad debt and financial stress and that is why he states that “slower growth is what worries the most”. Slower growth is a given once China seriously starts to rebalance from investment driven to consumer driven economy so this economist seems inclined to follow current course with, as Pettis says, investments in bridges to nowhere in order to keep good GDP growth numbers as long as possible. The longer this goes on the more difficult will be the adjustment.

Links to the tables and figures will be highly appreciated.

Thanks in advance

Two points here which cannot be overemphasized – the first of which the author soft-pedals and the second of which he completely ignores:

1. Michael Pettis’ point about China GDP growth numbers representing a *target* rather any sort of measure, however flawed such might be. The various local governments receiving said target from on high and being “expected” to meet it, year after year, guarantees that not just malinvestment but outright fakery will occur. The worse the state of the underlying real economy, the greater the scale of such Potemkin-GDP-ness. IOW, China GDP figures may be not-unreasonable when times are good, but they will likely be worse than useless when downturns occur. In the west, we’ve come to rely on GDP figures as our guide to downturns, even if such guidance is flawed and retrospective in nature. See the conundrum? Even such flawed guidance only makes any kind of sense if GDP is an output. And now that CCP has put the kibosh on the publication of the kinds of real-world data (e.g. electricity usage) which used to serve as a more-reliable proxy for GDP, the whole thing is a swamp of faked data and inputs-rather-than-outputs.

2. Efstathiou: “As long as this economic activity is productive, as Pettis claims was the case until a decade or so ago, it is a non-issue. Even if it is not productive, however, China can continue to hit any GDP targets it sets, provided that it doesn’t face hard budget constraints and avoids a write-off of the resulting bad debt. The difference is that GDP ceases to be informative about the economy’s health or performance. Pettis’ point is, therefore, that one should worry less about the reported growth numbers and more about the financial risks that have built up as a result of unproductive investment.”

— No, it is not merely “hard budget constraints” which limit GDP-to-the-moon economic stimulus, it is hard *resource* constraints, especially on resources which must be imported *and* where global markets’ ability to expand output to meet a massive China-sized stimulus program is limited. Oil is the prototypical example. Also, with exports getting hammered due to the trade war with the US and simultaneous slowdowns in other major regions of the world, China’s ability to boost internal demand sufficiently comes into renewed question. Also, even if they do manage to ramp up construction of empty cities and such, the environmental cost of such excess production should also be of concern. Sadly, real resource constraints and environmental costs of perpetual GDP growth as usual get short shrift among most practitioners of the economics profession.