Yves here. Gail Tverberg hasn’t been posting her carefully argued pieces on energy, particularly “peak oil,” and environmental issues as often as she once did, so I was glad to see this piece.

By Gail Tverberg, an actuary interested in finite world issues – oil depletion, natural gas depletion, water shortages, and climate change. Originally published at Our Finite World

A few years ago, especially in the 2005-2008 period, many people were concerned that the oil supply would run out. They were concerned about high oil prices and a possible need for rationing. The story was often called “Peak Oil.” Peak Oil theorists have also branched out into providing calculations that might be used to determine which substitutes for fossil fuels seem to have the most promise. What is right about the Peak Oil story, and what is misleading or wrong? Let’s look at a few of the pieces.

[1] What Is the Role of Energy in the Economy?

The real story is that the operation of the economy depends on the supply of affordable energy. Without this energy supply, we could not make goods and services of any kind. The world’s GDP would be zero. Everything we have, from the food on our dinner table, to the pixels on our computer, to the roads we drive on is only possible because the economy “dissipates” energy. Even our jobs depend on energy dissipation. Some of this energy is human energy. The vast majority of it is the energy of fossil fuels and of other supplements to human energy.

Peak oilers generally have gotten this story right, but they often miss the “affordable” part of the story. Economists have been in denial of this story. A big part of the problem is that it would be problematic to admit that the economy is tied to fossil fuels and to other energy sources whose supply seems to be limited. It would be impossible to talk about growth forever, if economic growth were directly tied to the consumption of limited energy resources.

[2] What Happens When Oil and Other Energy Supplies Become Increasingly Difficult to Extract?

Fossil fuel producers tend to extract the fuels that are easiest to extract first. Over time, even with technology changes, this tends to lead to higher extraction costs for the remaining fuels. Peak oilers have been quick to notice this relationship.

The question that then arises is, “Can these higher extraction costs be passed on to the consumer as higher prices?” Peak oil theorists, as well as many others, have tended to say, “Of course, the higher cost of oil extraction will lead to higher oil prices. Energy is essential to the economy.” In fact, we did see very high oil prices in the 1974-1981 period, in the 2004-2008 period, and in the 2011-2013 period.

Unfortunately, it is not true that higher extraction costs always can be passed on to consumers as higher prices. Many energy costs are very well “buried” in finished goods, such as food, cars, air conditioners, and trucks. After a point, energy prices “top out” at what is affordable for citizens, considering current wage levels and interest rate levels. This level of the affordable energy price will vary over time, with lower interest rates and higher debt amounts generally allowing higher energy prices. Greater wage disparity will tend to reduce the affordable price level, because fewer workers can afford these finished goods.

The underlying problem is that, from the consumer’s perspective, high oil prices look like inefficiency on the part of the oil company. Normally, being inefficient leads to costs that can’t be passed along to the consumer. We should not be surprised if, at some point, it is no longer possible to pass these higher costs on as higher prices.

If higher extraction costs cannot be passed on to consumers, this is a terrible situation for energy producers. After not too many years, this situation tends to lead to peak energy output because producers and their governments tend to go bankrupt. This seems to be the situation we are reaching for oil, coal and natural gas. This is a much worse situation than the high price situation because the high price situation tends to lead to more supply; low prices tend to collapse the production system.

The underlying problem is that low prices, even if they are satisfactory to the consumer, tend to be too low for the companies producing energy products. Peak Oilers miss the fact that a two-way tug of war is taking place. Low prices look like a great outcome from the perspective of consumers, but they are a disaster from the perspective of producers.

[3] How Important Is Hubbert’s Curve for Determining the Shape of Future Oil (or Coal or Natural Gas) Extraction?

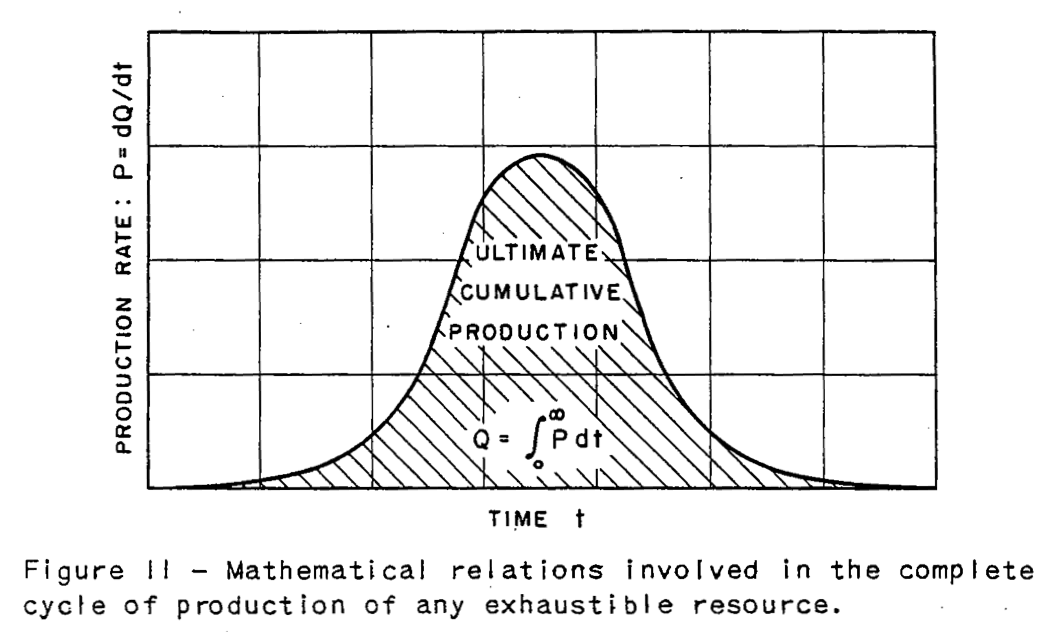

Figure 1. M. King Hubbert symmetric curve from Nuclear Energy and the Fossil Fuels. Total quantity of resources that will ultimately be extracted is Q.

Most Peak Oilers seem to believe that if we see Hubbert shaped curves in individual fields, we should expect to see a similar shaped curve for total oil supply or for the supply of other fossil fuels. They think that production patterns to date plus outstanding reserves can give realistic views of the future extraction patterns. Frequently, Peak Oilers will assume that once production of oil, coal or natural gas starts to fall, we will still have about 50% of the beginning amount left. Thus, we can plan on a fairly long, slow decline in fossil fuel production.

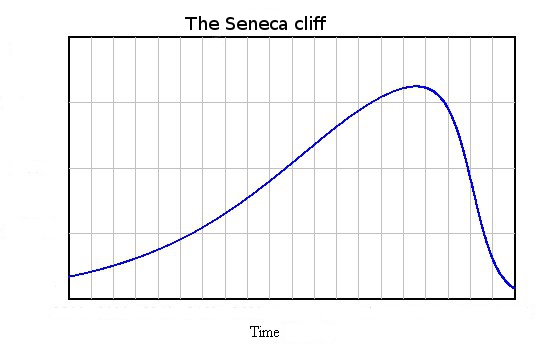

However, many Peak Oilers will agree that if the energy used to extract energy is subtracted, the result will be more of a Seneca Cliff (Figure 2). Seneca is known for saying, “Increases are of sluggish growth, but the way to ruin is rapid.”

Figure 2. Seneca Cliff by Ugo Bardi.

Peak Oilers also tend to limit the amount of resources that they consider extractible, to exclude those that are particularly high in cost.

Even with these adjustments, it seems to me that the situation is likely to be even worse than most Peak Oil analyses suggest because of the interconnected nature of the economy and the fact that world population continues to grow. The economy cannot get along with a sharp reduction in energy consumption per capita. Some governments may collapse; many debtors may default; some banks may be forced close. The situation may resemble the “societal collapse” situation experienced by many early economies.

One concern I have is that the Hubbert model, once it became the standard model for what energy supply might be available in the future, could easily be distorted. With enough assumptions about ever-rising energy prices and ever-improving technology, it became possible to claim that any fossil fuel resource in the ground could be extracted at some point in the future. Such outrageous assumptions can be used to claim that our biggest future problem will be climate change. After hearing enough climate change forecasts, people tend to forget about our immediate energy problems, since current problems are mostly hidden from consumers by low energy prices.

[4] Is Running Out of Oil Our Biggest Energy Problem?

The story told by Peak Oilers is based on the assumption that oil is our big problem and that we have plenty of other fuels. Oil is indeed our highest costs fuel and is very energy dense. Nevertheless, I think this is an incorrect assessment of our situation; the real issue is keeping the average cost of energy consumption low enough so that goods and services made from energy products will be affordable by consumers. Even factory workers need to be able to buy goods made by the economy.

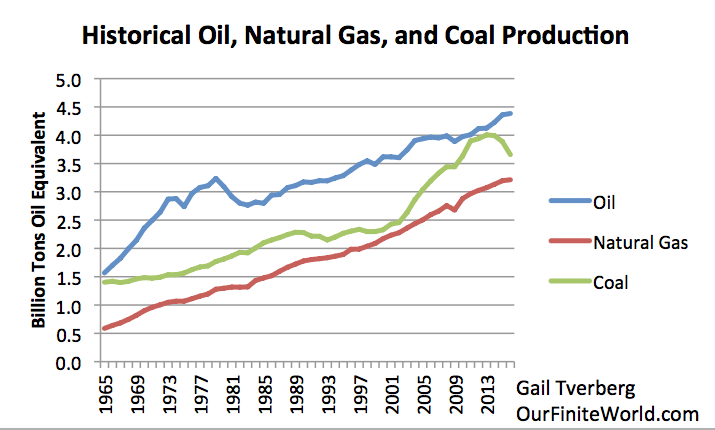

Figure 2. Historical oil, natural gas, and oil production, based on Statistical Review of World Energy, 2017.

The way the cost of energy consumption can be kept low is mostly a “mix” issue. If the mix of energy products is heavily weighted toward low cost energy-related products, such as coal and labor from low wage countries, then the overall cost of energy can be kept low. This is a major reason why the economies of China and India have been able to grow rapidly in recent years.

If underlying costs of production are rising, mix changes cannot be expected to keep the problem hidden indefinitely. A recession is a likely outcome if the average price of energy, even with the mix changes, isn’t kept low enough for consumers. Energy producers, on the other hand, depend on energy prices that are high enough that they can make adequate reinvestment. If they cannot make adequate reinvestment, the whole system will tend to collapse.

A collapse based on prices that are too low for producers will not occur immediately, however. The problem can be hidden for a while by a variety of techniques, including additional debt for producers and lower interest rates for consumers. We seem in the period during which the problems of producers can be temporarily hidden. Once this grace period has passed, the economy is in danger of collapsing, with oil not necessarily singled out first.

Following collapse, large amounts oil, coal and natural gas are likely to be left in the ground. Some of it may even cease to be available before the 50% point of the Hubbert curve is reached. Electricity may very well collapse at the same time as fossil fuels.

[5] How Should We Measure Whether an Energy-Producing Device Is Actually Providing a Worthwhile Service to the Economy?

The answer that some energy researchers have come up with is, “We need to compare energy output with energy input” in a calculation called Energy Return on Energy Invested(EROI). This approach looks like a simple ratio of (Energy Output)/(Energy Input), but “the devil is in the details.”

As I looked through the workings of the Limits to Growth model, it occurred to me that the EROI calculation needs to line up with how the economy really operates. If this is the case, we really need a very rapid return of the energy output, relative to the energy input. Also, in the aggregate, the energy output needs to scale up very rapidly. Furthermore, the energy output needs to match the types of energy needed for the devices the economy is currently using. If the output is different (such as electricity instead of fossil fuels), the EROI calculation needs to be adjusted to reflect the expected energy cost and time delay associated with a changeover in devices to match the new type of energy output.

In a footnote, I have attached a list of what I see as requirements that seem to be needed for EROI calculations, based on the LTG model, as well as other considerations.1

Of course, in a setting of many researchers working on a subject and many peer reviewed papers, a concept such as EROI is gradually modified and enhanced by different researchers. For example, EROI is turned around to become the Energy Payback Period. This is used to show prospective buyers of a device how helpful a particular device supposedly is. Researchers who are trying to “push” a type of energy product will find ways to perform the EROI calculation that are as helpful as possible to their cause.

The problem, though, is that if more stringent EROI requirements are put into effect, wind and solar can be expected to do much less well in EROI calculations. They very likely drop below the threshold of being useful to the economy as energy producers. This is especially the case if they are added to the economy in great numbers to try to significantly replace fossil fuels.

Regardless of their value as energy producers, there might still be a reason for building wind and solar. Building them probably does help the economy in the same sense that building unneeded roads and apartment buildings does. In theory, all of these things might someday be somewhat useful. They are helpful now in that they add jobs. Also, the building of wind and solar devices adds “demand,” which helps keep the price of coal in China high enough to encourage additional extraction. But in terms of truly keeping the world economy operating over the long haul, or in terms of scaling up to the quantity of energy supply that is really needed to operate the economy, wind and solar do very little.

[6] How Should Net Energy Be Defined?

Net Energy is defined by EROI researchers as (Energy Output) minus (Energy Input). Unfortunately, as far as I can see, this calculation provides virtually no valid information. Instead, it promotes the belief that the benefit of a device can be defined in terms of (Energy Output) minus (Energy Input). In practice, it is very difficult to measure more than a small fraction of the Energy Inputs needed to produce an Energy Output, while Energy Output does tend to be easily measurable. This imbalance leads to a situation where the calculation of (Energy Output) minus (Energy Input) provides a gross overestimate of how helpful an energy device really is.

If we are dealing with a fish or some other animal, the amount of energy that the animal can expend on gathering food is not very high because it needs to use the vast majority of its energy for other purposes, such as respiration, reproduction, and digestion. In general, a fish can only use about 10% of its energy from food for gathering food. Limits to Growth modeling seems to suggest a similar maximum energy-gathering usage percentage of 10%. In this case, this percentage would apply to the resources needed for capturing, processing, and distributing energy to the world economy.

Perhaps there is a need for a substitute for Net Energy, calculated compared to the budged maximum expenditure for the function of “Energy gathering, processing and distribution.” For example, the term Surplus Energy might be used instead, calculated as (10% x Energy Output) minus (Energy Input), where Energy Inputs are subject to suitably wide boundaries. If an energy product has a very favorable evaluation on this basis, it will be inexpensive to produce, making it affordable to buyers. At the same time, the cost of production will be low, leaving plenty of funds with which to pay taxes.

Alternately, Surplus Energy might be calculated in terms of the tax revenue that governments are able to collect, relative to the new energy type. Tax revenue based on fossil fuel production and/or consumption is very signification today. Oil exporting nations often rely primarily on oil-based tax revenue to support their programs. Many countries tax gasoline consumption highly. Another type of fossil fuel tax is a carbon tax. Any replacement for fossil fuels will need to replace the loss of tax revenue associated with fossil fuels, because taxation is the way Surplus Energy is captured for the good of the economy as a whole.

When we consider the tax aspect, we find that any replacement for fossil fuels has three conflicting demands on its pricing:

(a) Prices to the consumer must be low enough to prevent recession.

(b) Prices must be high enough that the producer of the replacement energy supply can earn adequate after-tax revenue to support its operations.

(c) The mark-up between the cost of production and the sales price must be high enough that governments can take a very significant share of gross receipts as tax revenue.

The only way that it is possible to meet these three demands simultaneously is if the unsubsidized cost of energy production is extremely low. Wind and solar clearly come nowhere near being able to meet this very low price threshold; they still rely on subsidies. One of the biggest subsidies is being allowed to “go first” when their energy supply is available. The greater the share of intermittent wind and solar that is added to the electric grid, the more disruptive this subsidy becomes.

Afterword: Is this a criticism of peak oil energy researchers?

No. I know many of these researchers quite well. They are hard working individuals who have tried to figure out what is happening in the energy arena with very little funding. Some of them are aware of the collapse issue, but it is not something that they can discuss in the journals they usually write in. The 1972 The Limits to Growth modeling that I mentioned in my last post was ridiculed by a large number of people. It was not possible to believe that the world economy could collapse, certainly not in the near term.

Early researchers were not aware that the physics of energy extraction extends to the economy as a whole, rather than ending at the wellhead. Because of this, they tended to overlook the importance of affordability. Affordability is important because there is a pricing conflict between the low prices needed by buyers of energy products and the high prices needed by producers. This conflict becomes especially apparent as the world approaches energy limits; this conflict was not easily seen in the data reviewed by Hubbert. Once Hubbert missed the affordability issue, his followers tended to go follow the same path.

Researchers needed to start from somewhere. The start that Peak Oil researchers made was as reasonable as any. They were convinced that there was an energy problem, and they wanted to convince others of the problem. But this was difficult to do. When they would develop an approach that they thought would make the energy problem clear to everyone, other researchers would modify it. They would take whatever aspect of the research seemed to be helpful to them and would tweak it to support whatever view they wanted to encourage–often with precisely the opposite intent to what the original researchers had expected.

Thus, the approaches that Peak Oil researchers thought would show that there was a likely energy shortage ahead ended up being used to “prove” that we have an almost unlimited amount of fossil fuel energy available. It seems as though the world has such a strong need for happily-ever-after endings that self-organization pushes research in the direction of showing outcomes people want to see, even if they are untrue.

Footnote:

[1] The following is from an e-mail I sent to some energy researchers concerned about EROI calculations:

A concern I have is that EROI really needs to match up with the concept of Fraction of Capital to Obtaining Non-Renewable Resources (FCONRR) in the Limits to Growth model. If a person looks at how the 2003 World3 model functions, the person can figure out several things:

1. FCONRR is what I would call a calendar year “in and out” function. Forecasting EROI using a model year approach gives artificially favorable indications. FCONRR calculations line up fairly well with many fossil fuel EROI calculations, but not with the usual model approach used for capital devices used to generate electricity.

2. I would describe FCONRR as corresponding to “Point of Use (POU) EROI,” not Wellhead EROI.

3. If a newly built device causes a previously built capital device to be closed down before the end of its useful lifetime (for example, solar output leads to distorted electricity prices, which in turn leads to unprofitable nuclear), this has an adverse impact on FCONRR. Thus, intermittent renewables need to be evaluated on a very broad basis.

4. In the model, FCONRR starts at 5% and gradually increases to 10%. This is equivalent to overall average calendar year POU EROI starting at 20:1 and falling to 10:1. The model shows the world economy growing nicely, when total FCONRR is 5%. It gradually slows, as FCONRR increases to 10%. Once overall FCONRR exceeds 10%, the model shows the world economy contracting.

5. I was struck by the fact that FCONRR equaling 10% corresponds to the ratio that Charlie Hall describes as the share of energy that a fish can afford to use to gather its food. Once a fish starts using more than 10% of its energy for gathering food, it is all downhill from there. The fish cannot live very long, without enough energy to support the rest of it functions. Similarly, an economy cannot last very long, without enough energy to support its other functions.

6. In the model, necessary resources out depend on the population. The higher the population, the more resources out are needed. It is falling resources per capita that causes the system to collapse. This is why FCONRR needs to stay strictly below 10% and energy consumption must be ramped up rapidly. This would suggest that average POU EROI needs to stay strictly above 10:1, to keep the system away from collapse.

7. If there are not enough resources out in total, for a given calendar year, this becomes a huge problem. The way this works out in practice is that if a device uses a lot of upfront capital, these devices can sort of work out OK, if (a) only a few are built each year, (b) they have very high EROI, and (c) they last a long time. Thus, hydro and dams can work. But devices with an EROI close to 10:1 cannot work, especially if they need to be scaled up quickly and need a lot of supporting infrastructure.

8. Clearly, using the FCONRR approach, eliminating a high EROI fuel is as detrimental to the system as adding a low EROI device with a lot of upfront capital spending required. It is the overall output compared to population that is important. The quantity of output is even more important than the EROI ratio.

It strikes me that this argument has profound implications for any kind of “carbon pricing” scheme aimed at addressing climate change by radically increasing the relative cost of fossil fuels.

Sadly neglected in this argument are the economic incentives imposed by the sunk-cost infrastructure of fossil fuel processing, distribution and use. Extraction is one end of a long straw and there is a strong suction set up from the other end, that works against short supply and high price. The pressure to continue to extract the volumes needed to fill the “pipeline” (metaphor for the whole vast system reaching down to consumer lifestyle) seems to likely (as it has) to increase the externalization of extraction costs. We just ignore the financial craziness and poisoning the ground water etc.

Peak oil as an idea has been influenced too much by high price as the path to apocalypse, when the economic danger is prolonged low price but continued volume.

Gail has been emphasizing these points for some time now, so no surprises here. “Peak Oilers” have likewise moved on for the most part from the idea of impending doom due to absolute shortages, to the more nuanced concepts discussed above.

For myself, I’d take all of the above a step further, which commenters to this post in Gail’s blog did as well, and note the synergistic effects of peak oil, peak finance, peak population, and peak environmental destruction (including AGW) all indicate a perfect storm of sorts rapidly coming our way, the exact timing of which still can’t be predicted, but the magnitude and effects of which we have continually underestimated since Limits to Growth and William Catton’s Overshoot fired the first warning shots. Ominous indeed.

Excellent observation.

add peak fresh water, peak potash, topsoil, biodiversity, and on and on. oil is just the doorway to a greater understanding if limits.

we’ll either expand off planet, figure out how to limit ourselves somehow, or Gaia will figure it out for us.

Look at original posting site for today’s post at OurFiniteWorld [https://ourfiniteworld.com/]. The brief for today’s post immediately preceeds the brief for “2019: World Economy Is Reaching Growth Limits; Expect Low Oil Prices, Financial Turbulence”. The “figure 1” which appears in that brief shows a colorful diagram taken from the book “Revisiting Limits to Growth after Peak Oil”. The time between 2019 and 2050 looks especially interesting with exciting times all the way to the end of the diagram at 2100.

Really good article. Three points:

: Limits to Growth mainly showed population collapse due to pollution. As the time ‘pollution’ mainly meant toxicants like mercury and benzene. Climate change wasn’t really on the radar, but a couple of the model runs map well to what is happening.

: The financial part is critical. Don Lancaster gets into this in his ‘Energy Fundamentals’ at Tinaja.com, pretty much shreds the ROI beyond the EROEI.

: “For example, the term Surplus Energy might be used instead, calculated as (10% x Energy Output) minus (Energy Input)” Yeah no, that’s a Shadowstats-style oversimplification. The takeaway should be that the numbers are an entirely inadequate representation of the path-dependence of the energy usage. That’s two kinds of numbers: the energy usage is physically too complex to model well, and the price at point-of-sale is dependent on the needs of the seller and not the energy cost.

Hmmm…. Interesting but… During the ”peak oil” concerns of the early 2000s I was working in a job that required I understand the dynamics of oil supply and demand and pricing. I soon realised it was the cost of extraction that mattered most rather than a lack of oil itself. This is a large part of Ms. Tverberg’s argument, so I agree. However it seems to me she makes the same error that The Limits to Growth was criticised for: the assumption of constant technology – a significant error in evaluating a capitalist economy. On that score I remember reading glowing predictions in the early 2000s about horizontal drilling for oil, a method to re-drill old oil wells and extract a lot more oil from them, and believing they were overblown. I was wrong. Massive new quantities of oil were extracted. It was also said the production of oil from the tar sands would remain very expensive but then extraction costs dropped a lot. So I am now a believer that capitalist enterprises with lots of money will develop new technologies that reduce costs considerably.

Of course we will ultimately run out of oil because it exists in finite quantities. However my current view is that well before we run out of oil that can be profitably extracted the earth will have become unlivable for large mammals, including humans, due to climate change. Unless we do something meaningful to prevent it.

Rereading Ms Tverberg’s piece I note she does make a passing reference to tech change but in my opinion does not do it justice. In addition if the price of oil does rise there will be substitution away to other energy sources, conservation, etc., since there is huge waste today and alternative sources are underused. In the past there have been huge swings in the price of oil and while it has caused problems there was no ”economic collapse”. In summary while Ms. Tverberg does point out a number of interconnected issues I think her fears of ”economic collapse” are overblown.

It seems to me the costs can’t be measured purely in dollar terms, due to the gaping externalities hole in our capitalist system. As we move from easy oil to oil that is less pure, deeper, and/or under less pressure, we resort to solutions that impose greater external costs in terms of environmental damage (fracking, mountaintop clearing) or risk (deep water drilling, e.g. the BP disaster).

So even if we come up with new ways to continue extracting oil at price points ‘the economy’ finds acceptable, we are still heading towards a point of unacceptable cost — or we are blowing past that point because ‘the economy’ is blind to the categories of cost that can be excluded from capitalist ledgers.

I shouldn’t have mixed in the coal extraction technology when I opened the sentence with oil as the subject.

The model of increasing cost, damage, and risk does apply to all hydrocarbon extraction, though.

Yes, and bankruptcy of oil companies, if occurring when oil is still predominant, will be met with bailouts. Big Oil is no less important and influential than Big Finance.

The Limits to Growth team ran a number of simulations with different assumptions. Several of those scenarios assumed a doubling or quadrupling of technological efficiency. Their conclusion was that even if technology improved to the point where we could do four times as much work or create one-quarter of the pollution at the same energy consumption, this would still not prevent a population peak during the 21st century.

The ‘business as usual’ scenario was the one that assumed steady levels of technology.

I first encountered Peak Oil discussion back in 2007-2008. I recall a lot of graphs that peaked around 2012 or 2016 with precipitous cliffs thereafter. I also recall that a lot of the same people interested in those topics engaged in gold-bugging and doom-mongering around fiat currency, debt levels, and the mortgage crisis. Fortunately while our economy is energy based it’s also fiat based with a currency that can be created and destroyed at will. Policy makers had plenty of headroom to forgive the debts racked up by Wall Street.

> A collapse based on prices that are too low for producers will not occur immediately, however. The problem can be hidden for a while by a variety of techniques, including additional debt for producers and lower interest rates for consumers. We seem in the period during which the problems of producers can be temporarily hidden. Once this grace period has passed, the economy is in danger of collapsing, with oil not necessarily singled out first.

To me this paragraph reveals the same confusion I encountered in 2008. The real issue is not debt levels of producers or consumers, it is EROI. In the US we have shale producers who are buried in debt up to their necks but kept alive by what appears to be an implicit policy decision to allow them to rack up more debt. As MMT tells us, as long as real resources continue to be made available to energy producers, their debt levels are irrelevant. They can continue to produce energy.

It is possible that EROI may be marginal for some energy producers. It may even be negative in some cases. This means that real resources will be cannibalized from elsewhere in the economy to allow energy producers to continue. It occurs to me that one way to achieve this would be to immiserate the working class by denying them access to real resources such as transportation. It is possible that policymakers are aware of the trade off, but it strikes me as more likely they are not. They simply mash buttons on the economy (interest rates and so forth) but the real gas pedal and brake pedal lie elsewhere. Therefore the economy picks up when energy producers resort to a new form of energy extraction (fracking) and it dials down when those producers are unable to continue. When another chunk of the population is driven into poverty and lacks the ability to consume energy, energy prices decrease and the economy picks up again for everyone else. For a while. So it remains to be seen how long the North American frackers are able to continue and how quickly additional fracking sources can be brought online in other continents.

Adding two points:

1) It strikes me that a Green New Deal provides the opportunity for a public conversation to take place regarding how energy and resources should be allocated within the economy going forward. If resources are reallocated to efficiency or energy production, who knows, we could continue to keep the plates spinning a while longer.

2) In Minnesota this week there were natural gas shortages and outages. The outages were local but the shortage was statewide — all MN household customers were asked to reduce thermostats to 63F and decrease use of natural gas water heaters, etc. This was during -30F weather. Decaying infrastructure + peak energy + climate volatility make a deadly combination.

I’m still working down my supplies of Y2K toilet paper.

Had we made investment decisions based on years of predictions

of various disasters we would now be homeless.

I concur broadly with your comment and critic. It is already quite difficult to define limits to Oil growth, and on EROI but trying to convert the problem in monetary terms makes the results as arbitrary as money is. I haven’t read Gail’s pieces on this issues but it strikes me that questions like energy waste are not considered. For instance reading the comparison with an animal energy usage model:

In human terms this other purposes include using my yatch to have a trip with my friends, by car to the pub for beers,fly to Thailand next summer holidays… and with this range of energy consuming activities we may be using about 0,1% of our energy output to gather energy with waste ranging 99% of our activities. This may seem exaggerated but I think there are cases that exceed that 99%.

This is one of the most important postings I can remember encountering on Naked Capitalism! Hopefully, it will be just the start of a serious discussion of about energy, economics and the viability of perpetual economic growth as a strategy for preserving a comfortable status quo (for some of us). That said, some criticisms:

1. Tverbers’ focus on costs appears to pretty much neglect the ‘externalities’ connected with the continued consumption of fossil fuels. For example, how much is it going to cost if the world’s major metropolitan centers have to be moved 10 miles inland in this century? For that matter, is cost even relevant if the continued use of fossil fuels renders the planet uninhabitable for our species?

2. There are issues connected with ‘affordability’ that go well beyond whether or not energy providers will be able to make enough money to pay their costs. Even when ‘cheap oil’ was abundant workers forced to compete with fossil fuel powered machines could not ‘afford’ all the wealth industrial capitalism was supposedly producing. Off-shoring is just another example of the short term, devil take the hindmost perspective finance capital has taken regarding management of the economy.

It isn’t just the price of energy at issue. It is the ability to compete in a fundamental life process. Frederick Soddy observed almost a hundred years ago “Life is fundamentally a struggle for energy”. To those who manage the West’s economies, it is irrelevant whether the jobs of Western workers are taken by machines or the lower priced labor of desperate workers in ‘developing’ countries. (Is this the essence of ‘liberal internationalism.?)

Oil has been called ‘the devil’s excrement’ with good reason. See Oil, Power, and War: A Dark History by Matthieu Auzanneau.

Lots of energy, food and water, but infinite, and still increasing, people.

Not to worry. Those ‘increasing people’ will, in one way or another, will become food for Gaia’s other lifeforms, big or small … most likely the latter, sooner, or later.

Who knows, portions of Humanity might actually be preserved as a geological layer, to be discovered by some future sentient species ..

I think we are going to see the nature of the need for energy begin to drive the production of oil and gas. Oil and gas are very portable and good for mobile applications. Many of the renewable sources, such as solar, wind, and hydro require significant fixed plant investment for both creation and transmission, whereas you can put some oil in a tank and easily move around with it.

So I think we will continue to see the shift of oil and gas being extracted for use in the chemical industry and as a fuel source for mobile solutions like vehicles, planes, and ships operating outside of electricity grids. Texas is currently a massive wind power state and electricity generated by wind power can be used to extract oil and gas which then gets used primarily for mobile solutions. So the extraction of oil and gas will likely be driven by the cost of whatever could replace it to move ships, planes, and interstate vehicles around.

We are seeing this shift in coal where coal mining for use in the US is increasingly just for metallurgical coal (Appalachia coal) instead of power generation. Power is increasingly being generated using sources other than coal.

Good points.

While oil (gas, diesel, kerosene) are essential fuel for mobile transportation (cars.trucks, planes) it is still creates too much CO2 in the atmosphere. A reorganization/conservation in our methods of mobility (individual cars vs. mass transport) is important also.

I may have missed it, but it seems like the focus on affordability misses a more critical energy measure, the energy required to extract a certain amount of energy. The following presentation seems, at first, perplexing, but makes the point that the energy required to extract harder-to-get oil reduces the fundamental energy extracted, to the point that it may take more energy to get the oil that it contains.

Louis Arnoux: Thermodynamic Oil Collapse (YouTube)

I am also a bit confused by the claim that wind and solar are subsidized, as if oil and particularly nuclear are somehow not beneficiaries of years of subsidies, most of which are ongoing.

Yes, that last part, the subsidies for oil and nuclear, confuses me as well. And someone above made a good argument about sustainability that boils down to, if everyone is (or even enough of us are) dead from climate change due to the continued use of carbon releasing energy sources, our economy still won’t run as efficiently as required, or perhaps at all, accurate ENROI or no.

Another part of this whole discussion that is not mentioned or factored in, at least as I understand it and that may not be particularly well, is conservation of energy as a critical part of any mix. Assuming that sustainable energy becomes critical due to the existential threat posed by carbon based fuels, energy conservation becomes the cushion that might provide more elasticity for a smoother transition.

It’s likely that we simply have to accept that our current global economy simply has to change radically to adapt to sustainable energy levels (and by sustainable I include avoiding the toxic effects of climate change). If that means we can not maintain the technology needed to produce cheap enough and profitable enough energy that is sustainable and non lethal to humans and our ecosystem (web of life), then indeed we have a problem.

ENROI-> EROII agree. I first heard about Peak Oil thru the Dieoff.org people, and they expressed in terms of energy cost of extracting energy. For them the there’s a hard stop where there’s lots of oil still in the ground but the amount of energy needed to extract it makes it not worth the effort.

They use a similar basis for assessing other proposed solutions. E.G. what is the cost of isolating hydrogen vs the energy storage benefit?

It strikes me that Ms. Tverberg’s contention that any replacement from fossil fuels has three conflicting demands is false in an ecologically-focused MMT-world. While demands (a) and (b) make sense for any input to the economy, there is no reason we need to significantly tax the difference between the price of the non-fossil fuel energy and its cost.

We tax fossil fuels for a variety of reasons including:

* it is a finite resource and the more dear it is, then less we will consume of it;

* it has serious negative externalities (environmental, human health or even geopolitical) that need to be properly accounted for in its price (and that clearly still are not).

Solar and wind are plentiful and have lower negative externalities so the taxes we place on them don’t need to be anywhere as high. Additionally, if we managed government budgets according to MMT principles, as long as we are taxing enough to keep the economy from overheating we are good, wherever our tax revenues come from. So raise taxes on fossil-fuels because that is the right way to account for its true cost, but don’t damn renewables because we cannot tax them high enough.

I certainly agree with this thread. This is one of the most important postings I have read anywhere. I remember way back when Yves talked about how fracking was a fantasy because it cost more to extract the fuel than could be recovered. This post is as if Tverberg just analyzed the entirety of capitalism. Because capitalism, in order to make a return, always externalizes costs. You can subsidize profit only so long by socializing losses – then it’s game over. And those losses, like energy losses, are not even accounted for accurately because, statistically, we don’t even measure them. (Except to superficially acknowledge things like poverty and pollution). We can take a more critical look at the economy and profitability, etc. but there is so much that still goes unaccounted for. Pollution and waste of all kinds. Her analogy with a fish is so very profound. It’s the takeaway I will tell everyone about. And in that context I think she is pointing the way to some serious new accountability that includes all the losses. Or wasted surpluses. If we set our best engineers on it now we could probably create systems, devices, etc that captured that wasted energy much more efficiently. Living in apartment buildings rather than single family homes. Even designing electric appliances that store and share energy, slowing the dissipation of energy through a house or factory. Etc. Like life itself evolving to take advantage of entropy – the dissipation of energy on the planet creating new life forms. And etc.

What chaps me most is that the people who profit from externalizing all those costs (that equal a whole lot of horror, misery and death) never have to experience any of the consequences. Either they live in their perfect wealth bubbles in the “now” and will get to live out their special Tony Hayward lives (the former BP CEO who brought us the Deepwater Horizon Gulf of Mexico blowout and sequelae) and get to die in maximum pleasure and comfort, perfectly cared for by humans who have the caring gene on both chromosomes, or they are already dead — and in either situation, are beyond any retribution or restitution. Buffett and Dimon and Blankfein and Zucker and Gates and the creatures in the black hole called “Monsanto” and the various politicians and high military officers and the rest, enjoy the impunity of immunity.

And remember the bit about nuclear power rendering electric energy “too cheap to meter?” You mention that energy waste and loss is not measured, let alone accounted for or approached seriously by that mythical “we” that is supposed to do all these good things for our species and the planet, enact all those wise and decent policies and all. So I’d reformulate the notion that the thing that is “too cheap to meter’ is “our” collective commitment to use and waste.

I wish so fervently that it were otherwise, but hey, the a$$holes with off-road vehicles have carved 300-+ miles of new ‘roads” through the Joshua tree Wilderness and knocked over Joshua trees that are centuries old — on a lark, as it were. Transport ships belch CO2 profligately, bringing “cheap” (not counting externalities) Chinese and Vietnamese and other neoliberal-landia products across oceans to titillate and distract “us.” So sad that short of a Jackpot, there’s not much likelihood of remedies being applied that are commensurate with the harms being done, or likely to halt, much less reverse, the vector “advance” of “the future.”

That Seneca curve looks rather menacing….yikes!

I do wonder what the energy mix for our society will look like once the flow of capital to all the frackers gets cut off.

And yes, society looks hopelessly unprepared to endure a rapid shift toward energy conservation.

That Seneca curve also illustrates what Hemingway once said about how he went broke – “Gradually, then suddenly” but there is something else that worries me in that steep curve. That is the possibility of cascade failure hidden in it. So instead of peak oil you also have peak finance, peak economy and all the rest of it in a banquet of consequences.

Near coincident collapse of multiple systems appears inevitable. Our best choice is to save and preserve what we can for the future. Humankind may adapt and survive, if we are very lucky. If we do nothing until hammer strikes anvil or waste our efforts on fore-doomed nostrums, the Society on the other side will be left with nothing but their hunger, their sicknesses, their ignorance, their endless fatigue and fear with little to strive toward but death.

Sounds like life on this side too.

5 and 6 are the real monsters.

Jevon’s paradox makes much of the analysis in these paragraphs difficult as, compounded with the difficulty of measuring an energy source’s true EROEI (of course controlling for finance shenanigans) we also have to account for our tendency to consume more resources given improvements in efficiency for particular technological and economic tools.

Finance obfuscates and, in a perverse way, lubricates the gears of the unconventional fossil fuel machinery. You could say modern finance is “more efficient” WRT capital movement, investment, etc., but its disastrous effects environmentally (consumption) and socially (inequality) are readily apparent. That increased capital dynamism and utilization, coupled with a lack of democratic accountability and control, has a tremendous cost, as with increased fossil fuel consumption. More on the technological side, air travel has made incredible progress in 100 years. To where, a NY to LA trip on a full, modern commercial jet liner is more efficient than the same trip made by a 1.5 occupant road vehicle. All fine and good until one considers the increased energy consumption that accompanies more people considering such a trip economically viable WRT their time and money. More trips are made that would otherwise be impossible or difficult, hence more energy consumed, ironically, because of the increased efficiency.

I don’t see a whole lot of options outside of some Eco-authoritarian system when one considers the above. Which, though it may be a provocative position, I’m not necessarily renouncing. If the universe is zero-sum, there have to be restrictions built into any model of economy where the actors are not living by tooth-and-nail. Technology’s costs are just too high, and it allows us to work outside the boundaries set for all other species on this planet. As in, do what the body and environment allows, or die.

A little nitpick on the end of [6], wind and solar subsidies are a modest 40% of total project cost when accounting for fed tax credits (30%), state tax credits (these can be available to nearly any development that qualifies, including fossil fuel), and things like RECs. I think I am being very generous here. It is probably more like 35% of the project cost. Though solar may be more like 40% because of the higher SREC value.

Then there is nuclear with a supposed EROEI of 75 (from Wiki sources). I’ll just say they are full of s***. Where are the below 2% of nominal rate government bonds, and fed loan guarantees? Mining costs? Refinement costs? Decommissioning costs? Waste disposal costs? I could go on and on. I can say similar for coal, nat gas, oil. These industries are subsidized well beyond 30% of project cost when one considers the entire supply line (political policy along with wars, penny on the dollar land rights, etc.). EROEI seems a lot better when half of the cost is lost in the ledger or offset onto states, municipalities, or the whole damn planet (CO2 from oil, gas, coal and radiation from Fukushima, Chernobyl).

All the above is tied into Jevon’s paradox as well. Improvements in government efficiency can also mean streamlined (non-existent) regulation and rock bottom bonds with subsidies. So we are consuming resources, fossil or otherwise, that would be impossible to consume without the “efficiencies” provided through politics (again, war, reg/dereg, etc.). It is a mess.

From a pure material cost/benefits (i.e. no financial economy or social or political consequences taken into account), I remain a strong supporter of non-work (of not driving to work, not wasting resources by working, not dealing with the aftrmath (delayed costs of working, ilness, etc…)) and beliver in shifting people in bu****it jobs over to early retirment (better name than UBI, don’t you think).

The preconditions being that we can come to an agreement as to which jobs are pure bu****it, which are only part BS, and which are actually usefull. My take on this is that it will be impossible without some sort of a planned economy model (one that doesn’t try to pretend that most people have nothing productive to do, and simultaneously doesn’t make a fuss about it).

I’m not actually optimistic about this outcome, obviously.

“I won’t go here into the Russian scientific demonstrations going back to the 1950s which empirically demonstrated that oil is constantly being created deep in the Earth mantle through extreme high temperatures and pressure, and is anything but running out. I deal with the subject in detail in my book, Myths, Lies and Oil Wars.” William Engdahl

https://www.globalresearch.ca/whatever-happened-to-peak-oil-major-new-shale-oil-and-gas-discovery/5664382

It’s not really fossil fuel – the major problem with peak oil theory( which I bought into years ago ). If this sounds strange and bizarre to you it might be time to do some serious reading.

Without disputing Engdahl’s assertion here, I guess the follow-on question would be is said oil being produced as fast as we’re using it (assuming use would continue to increase exponentially as well), and is it as readily available immediately, or is it continually harder to produce, as would be expected?

But regardless of that rather speculative assertion, what would continued consumption mean regardless of the source for environmental degradation (including AGW) and the human population pressures it would enable/encourage, as the underlying problem of problems remains: human population overshoot and our never ending technological cornucopian mindset. The earth exists for a whole world of reasons other than infantile notions of human wish fulfillment. Somewhere along the line during the last 250 years or so we’ve forgotten that.

I think James is being too kind. Did you do some serious reading of this stuff you referenced? What am I supposed to do with a red-herring mentioning Russian scientific “empirical” demonstrations that oil is created by processes deep in the Earth’s mantle, some odd quibbles about Hubbert’s Peak Oil calculations for ‘conventional’ oil, and some hoopla about major new shale oil discoveries in Texas and Arizona? If you’ll recall, shale oil is a ‘non-conventional’ oil, difficult and expensive to extract and explicitly excluded from Hubbert’s calculations. I see little point in belaboring a red-herring and a non sequitur. Take the major new shale oil discoveries at face-value — how long do you expect the great shale oil boom in Texas and Arizona to last? How does this cornucopia of oil affect the analysis in the post? Would you care to draw any assertions using this great shale oil boom as a warrant?

“Thomas Gold (May 22, 1920 – June 22, 2004)[2] was an Austrian-born astrophysicist, a professor of astronomy at Cornell University, a member of the U.S. National Academy of Sciences, and a Fellow of the Royal Society (London)….. Gold was accused of plagiarizing the abiogenic theory from Soviet geologists who first published it in the 1950s, but the accusations were refuted.[43][44] After first publishing his views on abiogenic petroleum in 1979, Gold began finding the papers on the subject by Soviet geologists and had them translated. He was both disappointed (that his ideas were not original) and delighted (because such independent formulation of these ideas added weight to the hypothesis). He always credited the Soviet work once he knew about it.[2] His 1987 book Power from the Earth devoted five pages to describing important Russian contributions to the field, including those by Mendeleev, Sokoloff, Vernadsky, Kudryavtsev, Beskrovny, Porfir’ev, Kravtsov, Kropotkin, Valyaev, Voronoy, and Chekaliuk.[43] ” from Wikipedia

I spoke many years ago with some engineers from the Texas oil patch who had worked in eastern Russia and were well aware of Russian deep wells, putting abiotic theory into practice.

As Ben Stein’s much funnier dad (Herb) famously said “If something can not go on forever, it will stop”.

The assessment of wind and solar power in today’s post contrasts greatly with the happy speculations in the earlier post and links regarding the Green New Deal.

There is no doubt that life depends on energy. It was solar until around 1830s when steam engines and coal exploited underground stored solar energy. WWII was about conquering petroleum sources. In the current nuclear age; extinction and the basic human contradiction between war and cooperation are in play. Energy for Western workers became too expensive after the first Oil Crisis. Burgeoning debt and offshoring are the result. It also means that the only profit in the West in the 21st century comes from extortion and exploitation. Humans can go back to the population and technology of a couple centuries ago and survive for a long time. Unfortunately, as long as our human nature remains unaddressed, greed and incompetence assures that the Anthropocene epoch will end, suddenly.

The Franco-Prussian war was a resource grab for coal. WWI was the original grab for Middle East oil: Austria-Hungary by land and Britain/France by sea. It has continued.

Maybe I read too fast, but I did not see the high cost of technological development and exploitation taken into consideration. STEM requires a large, society-spanning infrastructure and culture, including political culture, not at all cheap to develop, maintain, and use. The fish that lives off 10% food-gathering expense is the beneficiary of billions of years of Evolutionary R&D.