By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Markets are in a tizzy. They’re finally reacting to the Fed’s rate-hike cycle, the slowest rate-hike cycle in history. It took three years to nudge up the effective federal funds rate from near zero to 2.40% now. Throughout, the Fed has communicated its goals of “removing accommodation” from the “financial conditions” in the markets — thus tightening “financial conditions” that had become loosey-goosey during years of zero-interest-rate policy and QE.

And suddenly, financial conditions in the markets started tightening in October. So let’s see where we are — and how this might impact the Fed’s decisions.

“Financial conditions” is a key term in the Fed’s official communications. For example, in the minutes from the November FOMC meeting, the most recent available, the term was used five times:

- Once, when “participants” discussed the interest the Fed pays banks on “excess reserves” on deposit at the Fed. This rate, it said, provided “good control of short-term money market rates in a variety of market conditions and effective transmission of those rates to broader financial conditions.”

- Two times, when it discussed financial conditions directly: “Participants observed that financial conditions tightened over the intermeeting period, as equity prices declined, longer-term yields and borrowing costs for most sectors increased, and the foreign exchange value of the dollar rose. Despite these developments, a number of participants judged that financial conditions remained accommodativerelative to historical norms.”

- Once, when it discussed that its “policy was not on a preset course,” and that it could change its policy in one direction or the other, depending on the incoming data, including “the recent tightening in financial conditions….”

- And one more time, to make sure everyone gets it: “Financial conditions, although somewhat tighter than at the time of the September FOMC meeting, had stayed accommodative overall….”

These “financial conditions” indicate how easy and cheap, or how hard and expensive it is for borrowers to borrow. Tightening financial conditions mean that investors are reluctant to fund high-risk companies. This shows up, for example, as the difference (the “spread” or risk premium) between the yields of risky corporate bonds and “risk-free” Treasury securities.

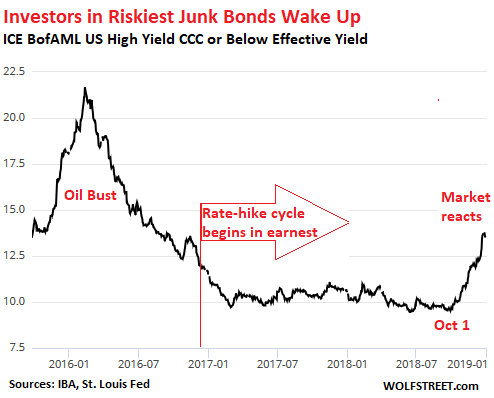

In the riskiest category of corporate bonds, CCC-and-below-rated bonds, just above D for default, yields started surging in October 2018, after being somnolent through the entire rate hike cycle.

The average yield surged in three months from 9.6% at the beginning of October to 13.58% yesterday at the close. In other words, for these companies, the cost of borrowing over those three months has surged by 41%.

Even more telling is the “spread” between the average CCC-and-below yield and the equivalent Treasury yield. It shows how much more investors demand to be paid to take on the extra risks of these junk bonds, compared to Treasury securities.

This spread has widened from 6.7 percentage points at the beginning of October to 11.1 percentage points as of yesterday’s close.

The fact that the spread (risk premium) has widened faster than the CCC-yield has risen over this period is impacted by two factors:

- The surge of the CCC-rated yield from 9.6% to 13.58%;

- The decline of the 10-year Treasury yield from about 3.2% in early October to 2.6% now.

In other words, investors are clamoring for low-risk assets. And they need to be induced with richer yields to invest in high-risk assets. This is a sign that “financial conditions” are finally tightening.

But this spread is still low compared to the Oil Bust when it shot up to 20 percentage points, and compared to the Financial Crisis when it spiked to over 40 percentage points – a sign financial conditions had become so tight that credit flows were freezing up.

So the current spread of 11.1 percentage points is nothing to get frazzled about. But it means that for these CCC-rated companies, the long-prevailing ultra-loose financial conditions have tightened significantly.

The same principle is at work in the category of BBB-rated bonds — the lowest investment-grade category (here’s my color-coded cheat sheet for the corporate bond rating scales). The average yield has surged from about 4.1% at the beginning of October to 6.17% yesterday at the close. And the spread to Treasuries has widened from 2.1 percentage points to 3.61 percentage points.

So, yields on riskier credits are rising, and spreads to Treasury yields are widening at a good clip. This is exactly what the Fed has set out to accomplish three years ago.

But the well-known lag between changes in monetary policy and its transmission to the markets — typically between 12-18 months – was nearly three years this time around, in part due to the very “gradual” pace of the rate hikes that markets brushed off for the longest time. But no more.

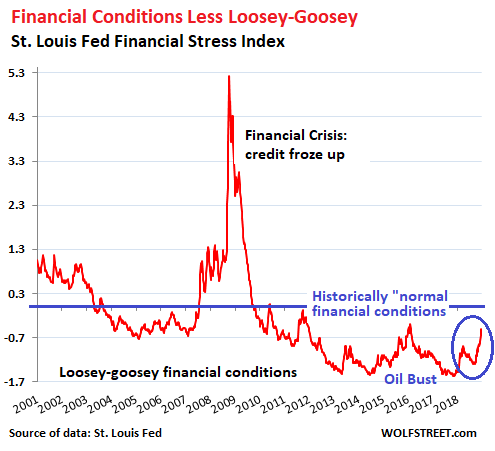

There are various indices that track “financial conditions.” One of them is the St. Louis Fed Financial Stress Index, released weekly, including this morning. It’s made up of 18 components: seven interest rate measures, six yield spreads, and five other indices. A level of zero means “normal” financial conditions (blue horizontal line in the chart below). When financial conditions are tighter than “normal,” the index shows a positive value. When these conditions are easier than “normal,” the index is negative. I circled the recent rise:

Note the enormous spike during the Financial Crisis, when financial conditions tightened so much that credit was beginning to freeze up.

In November 2017, nearly two years after the Fed had started its rate-hike cycle, the index dipped to record lows, a sign of the lag between changes in monetary policies and transmission to the markets.

By “normalizing” its monetary policy, the Fed attempts to “normalize” financial conditions in the markets to bring them back to historical norms. This means making credit more expensive and harder to come by for riskier enterprises. It means risk is getting “repriced.” It means that the Financial Stress Index ticks up to about the blue zero-line in the chart above.

Starting in May 2017, I wrote a series of articles about how the markets were blowing off the Fed. The theme was that the Fed would keep going with its rate hikes until the markets react sufficiently. Now they’re no longer blowing off the Fed. They’re reacting.

So now the question is this: When will the Fed consider financial conditions to have tightened sufficiently to where it can keep its monetary policy unchanged? This point is clearly approaching.

The Fed does not want to trigger another financial crisis where credit freezes up and mayhem breaks out. It just wants to “normalize” financial conditions.

Markets can react wildly, overshooting in both directions. And as we have seen, there is this lag between monetary policy and market reaction to those policies. No one knows yet how much further financial conditions will tighten on their own, even if the Fed just hangs tight.

The Fed’s “gradual” approach has been designed to avoid a sudden market reaction, such as a convulsion into another financial crisis, with all kinds of things collapsing left and right, which would then induce the Fed to once again go haywire with experimental monetary policies that no one can figure out how to undo afterwards without blowing down the entire house of cards again.

[Perhaps the latter part of that phrase is the perplexed state we’re in now.]

From the Fed’s point of view, it would be far better if financial conditions tighten in small increments until they’re “normalized” — at which point the Fed could wait until the dust settles and until there’s better visibility. We’re not far from this point, after the recent market gyrations.

The problem that the markets have – and why they’re in such a tizzy – is that investors have been pampered and coddled for so long by central-bank policies that “normal” financial conditions now seem like cruel and unbearable torture. But they’ll get used to it if there is enough time.

Maybe I’m think as a brick.,….but the around the Oct date the Fed began to mumble about raising rates the 10 year yield was over three. Then the Fed raised rates a bit in Dec. And rates have dropped to around 2.5 or so. How is that logical? Unless they are trying to tank/spook the market to facilitate taking Trump down.

Money Bags is scared and trying to avoid shrinkage by hiding behind Mommy’s skirt, pulling it down.

short answer: Mr Bond Market doesn’t believe the Fed and calling a bluff on Powell’s ‘the Fed will do the right thing’.

aka the marginal money would rather park its money earning 2-ish% in US bonds than in stocks or high yield debt

The bond market pays what the Fed says it will pay…there is no “market” per se for the issuance of bonds.

Primary dealers must buy bonds at the offer price if they wish to maintain Primary Dealer status.

The bond “market” has no control over the tender price of Treasury bonds/notes.

I’m tempted to bring up hysteresis, and note that it seems entirely possible that investors will not, cannot ‘get used to it‘, and like the monkey caught by a simple trap, a banana hidden inside a coconut with a whole too small to allow it to remove its hand if it won’t let go of the object of its desire.

The investor class is addicted to making money by no other means than having money, and they are famously short-term thinkers, so I suspect a tantrum will result rather than getting used to it.

And of course tantrums sometimes result in damage, which might include excess anxiety/panic.

A nominally “innovative” company, Apple, has billions in cash and spends it on buybacks instead of investing in new innovative growth strategy. Now their market cap is down half a TRILLION. So rentiers are running the planet now and seem to be out of ideas. Ten years of money printing can really program you to think differently.

Exactly, and what I mean by hysteresis is, it’s a one-way street, they will refuse to accept the ‘new normal‘.

I predict an inconsolable fit.

But i’ve got a black t-shirt

What’s worse is that they’ve been issuing LT debt to finance their buybacks (at least before the Republican tax bill). I think every CEO and CFO should get a copy of Brealey & Myers before they assume their roles. And be tested on the contents. I can’t believe the financial idiocy being conducted these days.

Is there any simple, easy-to-understand measure of how much debt (domestic, international) was created based on low interest rates? It would seem that there should be some sort of tipping point at which debt created by low rates cannot be sustained by wages and revenues crimped by increases in rates.

I know this question is not easy to answer, but it would seem to be “the” question in this frenzy: to wit, as long as debt can be sustained, the fun can continue. At what point do increases in rates lead to a tipping point percentage of debt that leads to defaults widespread enough to cause a general crisis?

As in that famous movie about the GFC: “Margin Call”……When the music stops. Jeremy Irons: “…somehow I don’t hear a thing!”

I wouldn’t say simple. Most of the papers whose conclusions seemed on point were actually terribly hard to understand. The issue is really more to do with liquidity AND debt, rather than just debt. And the relationship is made less tenuous when considering the global picture.

I found an older article on margin debt <a h: http://www.philosophicaleconomics.com/2013/10/margin-debt/ref=”http://www.philosophicaleconomics.com/2013/10/margin-debt/”>here

Also, one needs to realize that the real economy and the markets are not tied. Markets are really a mix of playthings of the wealthy, channels for excess, and investment or fin instruments.

The only thing I can say is that we are currently, market-wise, in the top 97th percentile in all US history, and the expected return in the BEST CASE scenario is some 5-7% which includes inflation (so really, 3 to 5%). Therefore, this is the time to pair down debt and go into cash or hard assets to wait for the downturn, because you do not want to be apple: buying at the peak to take the hit at the low.

Of course, Apple doesnt care, because Tim and his c-suite would rather take their outsized bonuses (compliments of buybacks) than plan for the longterm. All of the buyback frenzy was the c-suites predicting a crash or slowdown on the horizon and essentially selling out the company to maximize bonuses before the depression.

zer0

“Also, one needs to realize that the real economy and the markets are not tied. Markets are really a mix of playthings of the wealthy, channels for excess, and investment or fin instruments.”

But aren’t they tied in the sense that as industrial capitalism has become more and more financial capitalism, stirrings in the (casino) world of finance affect the flow of real resources, such that we get luxury production and consumption in place of improvements in the productive capacity of industries and services that matter to people. Stagnant wages and salaries, themselves one effect of the concentration of financial capital, mean reduced demand for real products and services, which means, in turn, reduced demand for improvements in medical instruments, buildings material, green energy, more efficient transportation, and so forth.

Finance capital calls the tune, ordinary people learn to live with less. (Or not…)

Needs a P-I-D feedback mechanism to stabilize fluctuations

In the US when we say, “climb that wall of worry”, there’s a counter-narrative of worry. That’s the stabilization function near as I can tell.

And when things are getting too frothy, and demand increases for short term credit (e.g. margin loans and commercial paper), well then that’s the time to take the punch bowl away and introduce real worry.

Compare to the Weimar inflation, where there was no worry. For a time.

Quite a difficult cake that Mr. Powell’s predecessors have baked for him and the members of the FOMC over the past few decades, as well as unrelated third parties. Trump’s tax policies and oppo just the icing on top. Unsurprising that Wall Street, beneficiaries of massive corporate stock buybacks, owners of zombie corporations, and junk bond holders don’t want further rate increases and are seeking restoration of Quantitative Easing. Nuthin’ like free money, right fellas?…

Maybe reversing 40 years of Neoliberal Policies & Market Subsidies should be the theme in Davos later this month, rather than Globalization v. 4.0, holding hands together and singing Kumbaya.

They’ve managed to normalize high, usory interest rates for the average consumer.

That much is for sure.

Any ideas (make that PLANS) other than”trickle down” low interest rates and tax cuts to boost the economy?

Yes, Credit Card rates have come down from 33% per year to 32.5%. Borrow away.

That 30% difference between Bank’s borrowing and your borrowing? Well executives got to eat. /s

The accumulated stink of hundreds of years of BS economics.

The problem is, the markets are uncoupled from anything useful a company might do.

https://www.linkedin.com/pulse/stock-prices-versus-product-development-rd-marc-andelman/

The neoliberal handbook was put together in the 1970s and the globalists refuse to update it by learning from past mistakes.

2008 – “How did that happen?”

It was a “black swan”.

Great, we can’t learn anything and don’t need to make any changes to the neoliberal handbook and our ideology.

Their ridiculous approach has finally reached the end of the line as their debt fuelled growth model has run out of steam.

China was the last debt fuelled engine of growth and the Minsky Moment is near.

Adair Turner has come to the same conclusion.

Adair Turner has looked at the situation prior to the crisis where advanced economies were growing by 4 – 5%, but the debt was rising at 10 – 15%.

This always was an unsustainable growth model; it had no long term future.

https://www.youtube.com/watch?v=LCX3qPq0JDA

After 2008, the emerging markets adopted the unsustainable growth model and they too have now reached the end of the line.

2008 – “How did that happen?”

It was a black swan.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

It’s ridiculous.

Oh look, it’s everywhere and Japan was first in the 1980s.

At 25.30 mins you can see the super imposed private debt-to-GDP ratios.

https://www.youtube.com/watch?v=vAStZJCKmbU&list=PLmtuEaMvhDZZQLxg24CAiFgZYldtoCR-R&index=6

They just kept ploughing on until they hit a brick wall.

The proof is in the pudding.

It will remain there no matter how hard they try and ignore it.