By L. Randall Wray, a professor of economics at Bard College. Originally published at New Economic Perspectives

In recent days MMT has captured the attention of anyone who can fog a mirror—even those long thought dead. The critics are out in full force—from the crazy right to the insular left. A short list includes Doug Henwood, Jerry Epstein, Josh Mason, Paul Krugman, Larry Summers, Ken “Mr Spreadsheet” Rogoff, Bill Gates, Larry Fink, George Selgin, Noah Smith, and Fed Chairman Powell. After laboring for a quarter century in the wilderness, the developers of MMT are pilloried for unleashing a theory that is “crazy”, “disastrous”, “hyperinflationary”, “nonsense”, “garbage” and just plain “wrong”.[1] Summers here; Rogoff here; Powell here; Krugman here; and here for Kelton Response

What all the critics have in common is that they have not bothered to read the MMT literature. Oh, it is just too much effort for the lazy critics! So they imagine what it must say, conjuring up the most ridiculous thing they can imagine, and then tear apart ideas so stupid that no one could possibly hold them.

And here’s the hilarious thing: every time we try to correct them, they say we are changing our arguments. Or, even funnier, they claim they’ve always held the crazy ideas and so we are saying nothing new.

So their critique goes something like this:

MMT claims that the earth is flat, and that the sun goes ‘round the earth. The first claim is false and everyone already knows the second. Heck, I’ve been arguing for two decades that the sun goes ‘round the earth. To prove it, I sat in my lawn chair last summer and saw the sun come up on the left, travel across the sky, and set on the right. It was hot but I persevered in the name of science. Most of what MMT says is false, and what it says that’s true is not new.

No folks. What you claim to be MMT is not MMT; what you claim you’ve always known to be true is neither MMT nor true.

I already offered a response to Doug Henwood’s here embarrassing critique (I notice that even most of his followers chastised him for his attack); Bill Mitchell responded to Professor Epstein’s neoliberal-like rant against MMT here (I might have more to say about it later); Stephanie Kelton has done yeowoman’s work battling the slippery Paul Kruman (demonstrating that he’s not only got MMT wrong, but his prognostications on the way the world works have been consistently wrong, to boot here); and I have a response to mainstreamers Paul Krugman, Larry Summers, Ken Rogoff (hey, Ken, have you figured out what a credit default swap is, yet?), and Chairman Powell in The Hill.

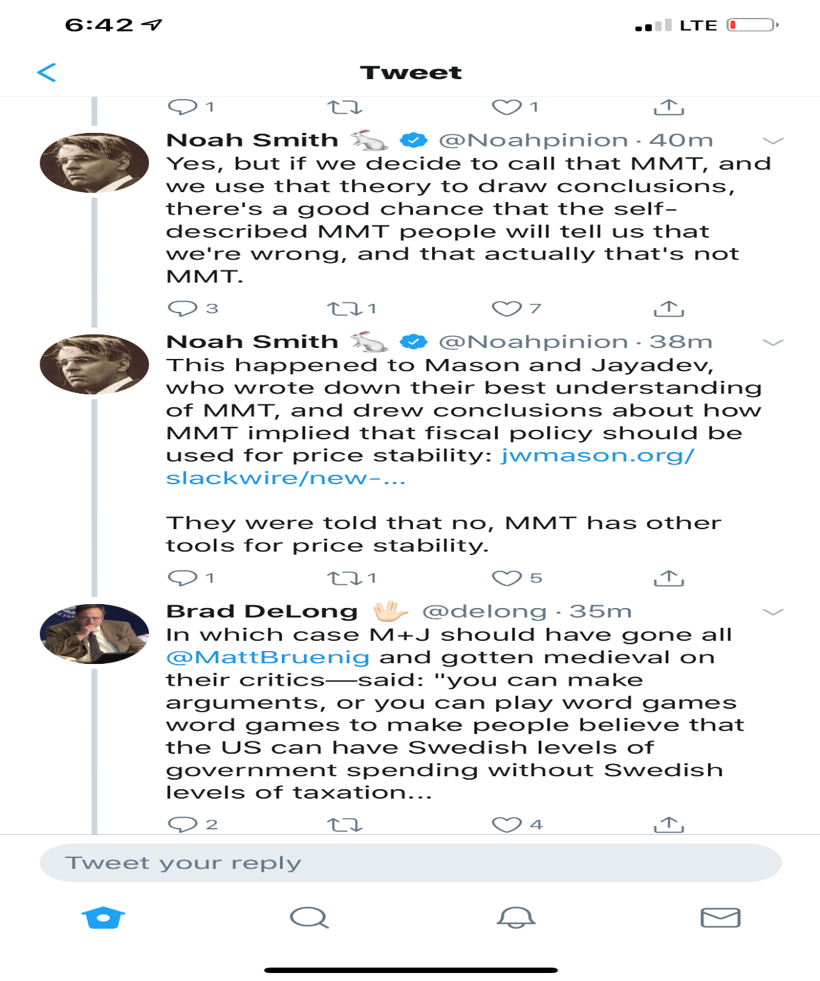

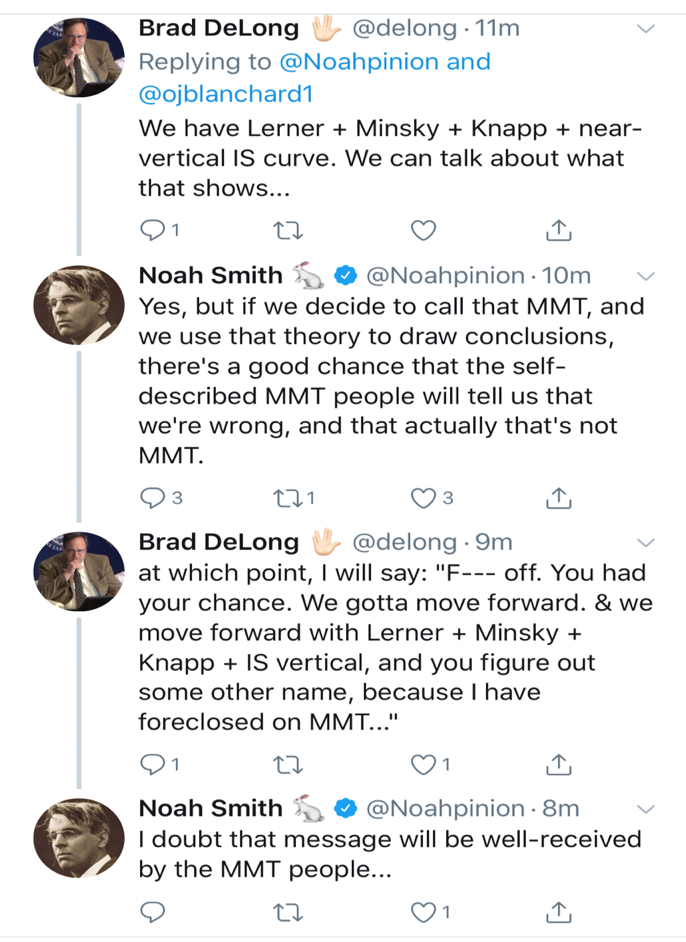

Here I want to respond to a challenge made by Brad DeLong (at the instigation of Noah Smith who garners undeserved attention for cribbing simplistic ideas from intro economics textbooks and passing them along as wisdom). Brad has often weighed-in quite reasonably on issues surrounding MMT so I’ll take his challenge seriously. I do not twit or tweet but these two twits were sent to me and will provide the background to his challenge.

Here’s the second.

To summarize, we have Noah Smith complaining: if we decide to call something MMT, they will just tell us it is not MMT. Poor (Josh) Mason and Jayadev “wrote … about how MMT implied that fiscal policy should be used for price stability. They were told that no, MMT has other tools for price stability.”

Brad DeLong responds: “In which case M&J…should have gone all medieval on their critics—said ‘you can make your arguments or you can play word games to make people believe that the US can have Swedish levels of government spending without Swedish levels of taxes”.

I’m currently writing a longer piece with Yeva Nersisyan on costing and “paying for” the Green New Deal, so I’m not taking up Brad’s argument that we need “Swedish levels of taxes” here. (Hint: We do not need higher taxes to pay for “Swedish levels of spending”—but we do need high taxes on the rich to reduce their power.)

What I’ll focus on here is Mason and Jayadev’s “best understanding” and Brad’s challenge to accept or deny his characterization of MMT as Knapp+Lerner+Minsky+Vertical IS curve.

First, a bit more background. I was on the EEA panel with Mason where he presented his “best understanding” of MMT. He claimed that MMT is not a “settled body of thought” and decided that he can treat its components separately. He then proceeded to reduce MMT to the old Bastard Keynesian “pump priming” version of Functional Finance: just use fiscal policy to pump up aggregate demand until you get to full employment. He then criticized us for supposedly believing that then you’d need to pass tax hikes to fight the inflation set off by full employment. That’s supposed to be MMT.

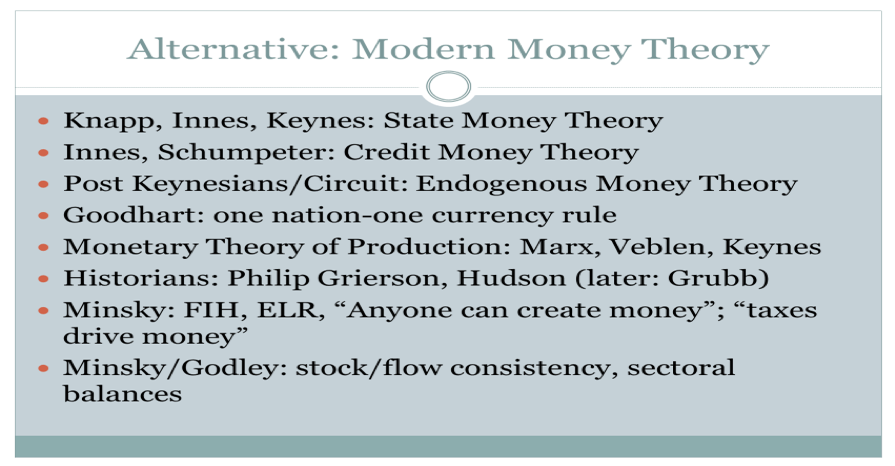

I objected to this characterization, showing my powerpoint slide from the year 2000 that laid out the various strands of thought incorporated in MMT up to that point. Here’s the slide I showed (with an update noted):

Notably missing was reference to functional finance. In fact, the core of MMT was developed before Lerner was brought into it (by Mat Forstater and Stephanie Kelton in the late 1990s). Most importantly, we ALREADY had our full employment policy: the Job Guarantee (also called employer of last resort, public service employment and buffer stock employment). It was from the very beginning THE central stabilizing component of MMT. Many of our neoliberal critics (who HATE full employment) have always tried to separate the JG from MMT. Josh follows in that tradition. We have always insisted that the JG is inseparable from MMT.

What do you get if you take the JG out? Josh’s neoliberal interpretation of MMT. MMT DOES NOT rely on aggregate demand pump priming to get to full employment. Never has. Never will. That will not work.

In 2005 Bill Mitchell and I argued that if desired, JG can be implemented to achieve full employment WHILE REDUCING AGGREGATE DEMAND.[2] To be sure, we’d recommend that only in very special circumstances, where the economy was already operating beyond full capacity—ie in a major war like WWII. Why would you need the JG if you were beyond full capacity? Because even when aggregate demand is very high, some get left behind. We do not think anyone should be left behind—if anyone wants to work at the program wage, he/she should receive a job offer. Only a JG can ensure this human right—the right to work.

Let me be clear. In the neoliberal era we chronically operate below full employment. That is very obvious in Euroland, which is probably operating 25% or more below full capacity. Even the US today has substantial excess capacity—maybe on the order of 10%, maybe more (maybe less). We won’t know until we ramp it up. Further, operating close to full capacity will bring forth investment and more capacity. I have little doubt that we could achieve Chinese growth rates if we put our minds to it—and sustain them for at least several years.

However, we will need well-targeted spending to do that without sparking inflation. It is hard to imagine how you’d do a general pump-priming; and you really wouldn’t want that even if you could. There are no doubt many sectors of our economy that really are at full capacity. Others lag far behind with substantial excess capacity. The problem with the kind of pump-priming we took in the past (mostly through “military Keynesianism”) is that the spending was targeted to the most advanced sectors, with high unionization and oligopoly or monopoly pricing. Wages and prices there rose and boosted measured inflation rates. That is precisely what we want to avoid.

As I said it is hard to think of a general pump-priming; except perhaps sending a $5000 check to every resident. But even this wouldn’t affect all sectors equally. Most Americans, suffering under huge debt loads, would probably pay down some debt. The comfortably well-off would splurge on fancy restaurants and expensive spas that already have long waiting lists. Or add a gold-plated toilet bowl to their third yacht.

I’ve long argued that rising tides raise all yachts—not the little dinghies. here and here As Pavlina Tcherneva’s empirical work has proven here , that turns out to be true. More than all the gains from growth now go to the tippy top of the income distribution. No wonder the Neoliberals hate the JG approach and love the pump-priming approach. As Tom Palley complains, the JG would give income directly to the poor and they’d want food. Neoliberals love unemployment—it keeps the “help” hungry and cheap. They are our inflation-fighting force to keep the comfortable classes comfortable.

To sum up my response to Noah Smith. Yes, MMT does have another tool to maintain price stability. It is the JG approach to full employment. It has always been a core element of MMT. We have never relied the simplistic version of Functional Finance that was presented by Mason. It would take about five minutes of actual research to demonstrate this.

We do often refer favorably to several arguments of Lerner. His “money is a creature of the state” provided a clear summary of Knapp’s approach (actually best explained in the 1913 and 1914 articles by A. Mitchell Innes); this was always in MMT even from before the beginning as I had read Knapp in 1986 and put him in my 1990 book). Indeed we view that as the other side of the coin to the JG.

What we really like was Lerner’s application of Functional Finance to the budgeting process. The budget should be functional, not sound. That is, to achieve a functional purpose rather than to balance taxes and spending. I never liked the steering wheel metaphor see here —although it can be useful in arguing that it is crazy policy to just let the “market” economy swing from speculative excess to deep depression. But economies are far too complex to “steer” like a car. We can attenuate the swings, but capitalist economies will still swing. That’s the Minsky in MMT. Stability is destabilizing. Our job is never done.

Let me be fair to Josh. When I presented my argument on the panel at EEA, Josh Mason graciously accepted it and said he’d look into the MMT position more deeply. It won’t take much digging.

Turning to Brad’s challenge, some of the answers will now be obvious. Do we accept the elements he lists as fundamental to MMT?

Knapp: yes indeed. He’s always been there. But as noted above, I’d refer readers to Innes instead—simpler, and he much more clearly links State Money to Credit Money. (That shapes our response to another set of critics—who disingenuously claim we ignore private monies. I’d wager there are very few economists who have written more about the private financial system than me—except my colleague Bill Black–but I’m not pursuing that here.)

Lerner: dealt with above. What we reject is the aggregate demand approach to full employment and price (and financial) stability. As Minsky argued in the 1960s, pump-priming might get you to full employment but it will never produce sustainable full employment because it will generate financial and price instability. You have to use the JG. He was right then, and he’s right now. To be sure, the inflation constraint is far less binding now than it was in the late 1960s. Further, once we have the JG in place, its stabilizing features will allow us to operate with higher aggregate demand without fueling inflation. The base wage plus the pool of labor ready for hire out of the JG will stabilize wages and prices at higher aggregate demand; and the access to decent wages will reduce necessitous borrowing thereby reducing financial instability.

Minsky. Yep, he was there from the beginning. In fact he was there before the beginning—I studied with him in the early 1980s and that is where I first came across the JG (he called it ELR) and the concept that taxes-drive-money. And then there’s our approach to financial instability. He’s indispensable.

Vertical IS. Now that is a leap. The ISLM framework is completely incoherent. It is not stock-flow consistent. Even its creator—John Hicks—said he could no longer make any sense of it. I think Paul Krugman and Tom Palley are the only economists who still use it. I doubt Brad uses it, at least, hope not. I have never used it. I reject all mainstream models (an exasperated Wynne Godley came into my office a couple of decades ago and announced that every one he had looked at was incoherent). But I think all Brad means is that MMT rejects the notion that by changing interest rates the central bank can move the economy to full employment by stimulating interest-sensitive spending. And if that is what he means, I whole-heartedly agree.

Unlike Krugman, MMT argues this impotence is not restricted to the “lower bound” of zero interest rates. What MMT has always argued is that when the Fed lowers its rate target, we cannot say for sure whether the Fed is stepping on the gas or hitting the brakes. It depends. One factor that matters a lot is what is the ratio of government debt to nongovernment debt. If you are Japan (high government debt, low household debt), lowering rates almost certainly slows the economy (by sucking interest income out). I did a paper with my UMKC colleague Linwood Tauheed that showed that with low private debt, plausible spending propensities, and government debt above 60% of GDP it is possible that raising rates would stimulate the economy.[3]

Now, that does NOT describe today’s US economy—where nongovernment debt is something like 400% of GDP. I believe that “normal” changes of the Fed’s target rate (up or down) have very little impact on the US economy. However a huge Volcker-like hike does have a big effect—but not due to interest-sensitivity of spending. It works through a present value reversal: the returns to holding real assets go negative. No one will invest in new ones. Debtors with floating rates go bankrupt. Financial institutions go massively insolvent. Volcker monetary policy “works” by causing a debt crisis. Otherwise, raising rates gradually in a boom (like the Fed did after 2004) doesn’t work; it does not reduce the demand and supply of loans, it just puts the debtors in a more precarious situation and shifts more income to the creditors. It is a dangerous policy. And no central bank official would admit they’d even consider such a policy. They prefer the myth that small adjustments to rates affect spending decisions. A myth with no evidence behind it, but so widespread that no one seeks evidence.

So, MMT has always recommended abandoning any attempt to fine-tune the economy through central bank interest rate policy. We prefer a permanently fixed rate. Many MMTers prefer permanent ZIRP. I’m a bit of a fence-sitter. I’d like ZIRP but I’d also accept a policy of paying a higher rate on retirement savings—but that is easily handled through US savings bonds, with personal limits on accumulations receiving the favorable rates. This rate should not be discretionary and should not be used as an inflation-fighting tool, rather as a supplement to Social Security until we can reform that system to provide a decent retirement for all. For me it is the permanent fixing that really matters, and I like a low rate but do not insist on zero.

So there you go, Brad, the ball’s in your court. We seem to be on the same page.

And by the way, I like Brad’s recent call for all the neoliberal Democrats to step aside and let the progressives following MMT take over. See Bill Black’s analysis here

[1] Blanchard announced he’s writing a piece(here ); McCulley’s supportive article is here, and he argues MMT provides a “robust architecture for a fiat currency world”; Fink called MMT “garbage”.

[2] Mitchell, W.F. and Wray, L. R. 2005 “In defense of employer of last resort: a response to Malcolm Sawyer” Journal of Economic Issues.

[3] Wray, L.R. and Linwood Tauheed) Chapter 3: “System dynamics of interest rate effects on aggregate demand”, pp. 37 in edited volume (Wray with Mathew Forstater), Money, Financial Instability and Stabilization Policy, Edward Elgar Publishing, 2006.

These discussions assume that growth is desirable. In an overshot world, shrinkage…of population, of throughput, of pollution, of construction, etc. is needed. Currently we have destruction of natural habitat, biodiversity decline, toxification of the biosphere, declines in aquifers, topsoils, fish stocks, etc. Whatever money system is used won’t make much difference, as those are merely the power tools in the process. None are nutritional, provide shelter, or long term well being.

The horror! The horror!

The Four Horsemen of the Apocalypse seem to serve as a natural brake on overpopulation. So far, I have not seen much evidence to the contrary. Anybody seen a bumble bee lately?

You have to have Growth because most people want stuff, or if they have stuff they want more stuff. This hasn’t changed yet.

The problem isn’t growth per say, but the absolute imperative of growth at all cost. If the population is growing, than the economy should grow with it in order to meet the demands of the new population.

But if the population should contract, it becomes necessary to also have the economy to contract as well.

The growth or contraction of the economy needs to be set by the demands of the population, not by the imperatives of the profit margin. The later is self distructive.

Priming the pump might work, if by ‘the’ pump, one meant ‘our’ pump, the common pump.

However, priming the pump as practiced in the neoliberal era actually means priming ‘a‘ pump, and that pump is far removed from the thirsty masses who wait in vain for the mythical ‘trickle down‘ that the owners of ‘the’ pump so work so assiduously to prevent.

And no one wants to address the constant rain of effluent that characterizes ‘our‘ lives down here at the surface, so far from the pump.

What does “JG” mean? I must have missed the intro explanation of this particular acronym.

Job Guarantee

I like the first reference rule when using acronyms.

Tnx Michael, and I agree about the first reference rule. I actually skimmed the article 3 or 4 times looking to see if I missed the original reference.

(Of course, 5 seconds after I posted the question, the answer hit me)

The thing I struggle with is that MMT has become a moniker for a socialist agenda. This piece repeatedly references the neoliberal label and counters with “MMT”, usually followed by a “belief” or policy adjustment.

Maybe I am still just confused, but MMT is a monetary theory based on what is happening today, right now. It seems to me to be agnostic of neoliberal or socialist philosophy. To me, this is important, because the debate needs to be centered not on how we write checks but who is writing them and for what purpose.

M4A. I read the bill currently being proposed. I completely agree philosophically this is the direction we should move as a country, regardless of how we finance it. We can deficit spend, or we can collect taxes or some combination of both. But what really matters is how it will be implemented. The bill gives massive discretionary power to the Secretary that implements it. It destroys the medical insurance industry. It will unleash decades of pent up demand for proper medical services. To me whether the government write checks to hospital or Blue Shield does is interesting, but has almost nothing to do with the ultimate success or failure of the program.

What if the bill is passed and Kamala Harris appoints a crony hack as Secretary of HHS? What if we shut down the insurance companies and have no plan to redeploy the people who work in that industry? While simultaneously the US Government is floundering around under inadequate leadership to replace that function? What if we overwhelm every doctor office and emergency room in the country with 20% more patients that haven’t been to a decent doctor in years? To me, it really doesn’t matter if we print money, issue bonds, implement payroll deductions or tax the rich, the program is DOA if it can’t be executed.

Same with jobs guarantee. Is there anyone who has experience evaluating peoples skills and putting them to useful work? Is some local hack government worker going to get a spreadsheet and decide these 3000 people are going to pick up trash on the highway this week because that is the only choice he has to make? The laid off college professor is going to drive a school bus instead of teaching people how to manage their new found income?

UBI? Are we going to have a plan to put small businesses into communities, or are we going to give everyone monthly cash to spend at Walmart, Amazon and the Dollar store?

I guess my point is, if the issue is neoliberal ideology, then we ought to call it that and battle on those grounds. The bottom line is it will have to be executed better than the oligarchs. The accounting is secondary. And it’s a distraction. The devil is in the details. Anyone who is predicting macro economic success based on “MMT” is just as foolish as Krugman predicting it’s doom.

“Anyone who is predicting macro economic success based on “MMT” is just as foolish as Krugman predicting it’s doom.”

Who thinks of MMT in these terms though? You seem to be lumping MMT in with other structural changes needed. No one thinks that the insights of MMT will solve our structural problems, MMT could just aid us in addressing those things. There are carbon based energy producers that employ lots of people. What they produce is killing the planet, and we don’t have tons of time to change that before it all comes down. Do we go on employing people regardless and think of the oil, coal and natural gas industries essentially as jobs programs? We once heavily relied on slavery, it was central to the US economic system for some time. Right now, this healthcare system kills up to 45,000 a year, costs more than any system in any other developed country, is far more inefficient, has massive social costs not found in other systems. Our economy is also heavily reliant on war and state violence. Transitions are never easy, but you don’t go on with things that have massive negative consequences simply because there is danger involved or because the transition won’t be easy. We could imagine lots of bad scenarios, I would argue that the present trajectory is worse than them all.

What you are pointing to is the need for systematic changes, of which MMT can play a role. On the environment, for example, we do need radical changes quickly. People can like it or not, it doesn’t really matter, capitalism as we know it is not a sustainable system. The non-market nature of the environmental crisis and the problems of trying to use markets to deal with “externalities” is problematic. We have reached the limits to growth in throughput and pollution generation in many ways, and I don’t see how we can deal or at least mitigate the thing without some national coordination and planning. Are there many, many things that could go wrong? Of course, but we have no choice but to change if we want to deal with the crisis. So, if we don’t use the insights from MMT, if we continue on with delusion that government spending should be thought of being something like a household budget, if we ignore how money is created and pretend that the state is limited on spending by what it can tax and borrow, will private interests invest in the things we need to avoid the environmental crisis? No, because many of those things are not profitable, and the benefits and costs often have no market values.

On M4A, could doctors and nurses be overwhelmed? Maybe, but the simplicity of single payer systems will make their lives easier. I see no reason to assume those scenarios will come about. We could do things like hire doctors and nurses from other countries, and we could invest in educating lots more doctors and nurses. Those problems, if things are designed well and if they actually came about, should be transitional in nature. As much as a third of overall healthcare spending goes to just managing the complexity of the system. They will be able to spend less time and money managing that complexity. And while there obviously could be problems, I think up to 45,000 dying every year, spending far more than anyone else for healthcare and relying on interests that profit off of denying others care, as well as job lock, and bankruptcies, these are all huge societal costs. I don’t think it makes sense to do nothing of the present huge costs of this system because of some hypotheticals we could come up with that may result in problems, at least in a transitional period.

The key is to thing of these changes systematically and to elect the right people. If we don’t do that, whatever problems follow won’t be from MMT. And if we don’t elect the right people, they will go on with delusions like the government being the same as a household anyway. If people that identify with the left are increasingly using MMT, it is because our problems are clearly structural in nature and because public spending is key to dealing with those structural problems. If the right or the center has answer to our structural problems, I have yet to see them, but if they have them, they too will need to use government spending and they too will need to ditch many of the delusions of the establishment on these issues. The insights of MMT by itself won’t save the day, but we can’t get those structural changes without the government playing a much more active role in investment decisions.

Very well said, Grant. Thank you.

I’ve updated my Evolution of Selected Economic Schools diagram to include automatic fiscal stabilizers, including the employer of last restore, as a key MMT component inherited from the Minsky region of Post Keynesian economics. Check it out — a picture is worth a thousand words.

Cool, I am going to use that. Thanks!

(c:

The accounting is not secondary. A central belief of neoliberalism is that it is the wealthy who creates jobs and money. Consciously or unconsciously accepting this belief limits which tools you think are available to use on the economy. Achieving worthy “socialist” goals such as Medicare for All or full employment at a living wage is “impossible” unless we heavily tax the rich or cut military spending (both worthy goals independent of anything else).

But do we have to engage in a hammer and tong political battle (raising taxes and cutting military spending) over something that is not true? How much easier can we move past these political shibboleths if we can establish the rules of the road are not what the neoliberals proclaim? How much quicker can we establish a Green New Deal if we dont have to fight on the neoliberals chosen ground of “how are we going to pay for that?”

The accounting is not secondary. MMT opens up lots of promising political ground from which to fight neoliberalism.

OMG people who need to go to the doctor will go to the doctor!!! The Horror!

Seriously though, I think your comment illustrates the discussions we should be having and that is the point of MMT. We should be discussing how we are going to handle the increase in doctors visits and not how it is going to be paid for. Under the current neo-liberal paradigm, the discussion stops at how are we going to pay for it. MMT blows past that and forces us to discuss what actually matters–the real resource constraints and the real administrative issues.

“What if we overwhelm every doctor office and emergency room in the country with 20% more patients that haven’t been to a decent doctor in years?”

If this should come to pass, “they” would have to work a bit harder and longer to catch up. Seems your concern is misplaced to worry about the doctors and med staffs and not the “patients that haven’t been to a decent doctor in years.” Is this not the situation that we are trying to address?? The folks who can’t afford to take care of their health needs under the current system??

Macro-economists assume that money is the impediment to seeking healthcare. Behavioral economists might argue that it is psychological more often as not. Our cultural norm is to play hurt. We also adhere to the notion that “If it ain’t broke; don’t fixit.” Thus, we tend to enter hospitals through the high-cost backdoor (ER) more often than the moderate-cost front door (Primary Care), even if we have insurance.

MMT is a socialist agenda……..a Plutocratic Socialist agenda

Here I thought QE, NIRP and ZIRP were the central bankers and their economist sock puppets very last ditch efforts to prop their 100 year old skim job up.

All you need to know about MMT is who will be benefiting from it and who will be paying for it and that those benefiting it from it the most wont be paying for any of it at all.

Dude we did it before. Please educate yourself:

https://livingnewdeal.org

our neoliberal critics (who HATE full employment)

Yes. BTW, here is a communication problem that economists have to work on when talking to us great unwashed. As a left-brained engineer, my first mental pass at the terms “full employment” is everybody works 24/7. That’s what “full” means in general. Ok nobody is going to do that, even if they could. So adjust for 8 hrs/day sleep? But many people sleep 6 and even shorter. Are they not “fully employed” if they only work for 16hrs? See it just is a ridiculous phrase to those without an appropriate seat in the temple.

So please stop throwing “full employment”, and things like it out in “popular” writings without even an attempt as a definition as it just confuses everybody. I know what the neolibs mean by NAIRU – that means that Joe stays home when Bob and Mary go to work, work Joe could also do and give Bob and Mary more time off and god knows the world would end if we let the three of them do that! – but I don’t know what you guys mean by the opposite.

Here’s the thing: the trick in all of this has now become to not ruin the planet, rather than to put foie-gras on every table. So not only should Joe shoulder part of the load, but maybe less in total should be done by the three?

And I have an both tangential and yet broader statement reaction to the below:

I’d wager there are very few economists who have written more about the private financial system than me

And it is well worth reading, I am sure. But:

There are 7 billion people in the world. In 1930ish, when Keynes ruled the known (cough, Western, cough) world, there was slightly over 1/4 that. So if there was “just one” economist worth reading back then (there wasn’t), there are now likely 4. But there are more educated people, and a much wider developed world – China and Japan have economists, too, good ones I’m sure that we’ve never heard of – so how many papers are getting produced now? I also have to track medicine and technology, and do my own work in a job where the hours have somehow lengthened, not shortened.

I’m just complaining… but it’s near hopeless at this point. So we have to “trust experts” but even the faint grasp of any of these subjects that we need, in order to be able to pick who to trust, is getting out of reach.

Unemployment refers to those who want a job and can’t find one, not just to everyone that doesn’t have a job. Similarly, we could define full employment as everyone works the amount of hours that they want to. Or said in negative terms, full employment is just the lack of unemployment.

Only a JG can ensure this human right—the right to work. L. Randall Wray

Note the conflation of “work” with having a job, i.e. working for wages under someone else’s authority.

I suppose then that the self-employed do no work? That stay at home mothers do no work? That the retired do no work?

And that the military, with everyone having a job, always does positive work even when destroying lives and property?

Thank you MMT proponents for your insights as to how the banking and the money system works. But as for your policy proposals, they leave a lot to be desired and you should consider taking constructive criticism.

And the absolute worst idea of all is the JG. It is an idea only an ivory tower professor could love. See here.

Rodger,

I agree that the job guarantee will be difficult to implement effectively, but disagree that the concept is inherently flawed. Big difference!

There are two big advantages to the job guarantee:

1. It directly addresses the problem of unemployment and, thus, is more efficient in dealing with one of the most serious economic issues. Indirect methods of stimulating the economy often have perverse side effects (e.g. monetary policy which lowers interest rates and encourages companies to borrow money and buy back their stock).

2. It provides an automatic stabilizer for the economy ==> Spending is automatically increased when many people need to take advantage of the job guarantee and automatically decreased when the private sector is overheating. This is similar to what the income tax and welfare spending accomplish today.

People don’t want jobs. They want money and what money can buy.

If unemployment were the problem, I might agree with JG. But it isn’t. Lack of money is a problem. The gap between the rich and the rest is a problem.

But not having enough minimum-wage jobs is not a problem. Quite the opposite.

And thinking of human beings as “buffer stock” is something only a university economist could propose.

As a businessman for more than 50 years, I can tell you this: JG nationwide is impossible to implement and would work only in a world where people are nothing but buffer stock.

Rather than the focus on making the buffer stock sweat for minimum wage dollars, how about Eliminating FiCA?

How about federally funded, comprehensive, no-deductible Medicare and long-term care for All?

How about federally funded college for all?

How about Social Security for all?

How about “the Ten Steps to Prosperity”

But I guess when someone has founded a group called the Center for Full Employment and Price Stability, they’re kind of stuck with JG.

It’s really a shame, for it cripples MMT.

One way to demonstration MMT is by eliminating the FICA tax, and let the current minimal inflation be fought by other means, elsewhere (if inflation is problematic).

Right. Interest rate control = inflation control, just as the Fed always has done it.

MMT is demonstrated by sectoral balances to the penny – Kaleckian model.

Ideology is a poor substitute for critical thinking and has a propensity for painting its proponents into a corner, then all they can do is create arguments out of whole cloth [ex ante] or demand unrealistic proofs.

“As a businessman for more than 50 years, I can tell you this: JG nationwide is impossible to implement”.

Am I to understand that your homo economicus views are superior to the views of the MMT – PK camp due to years of environmental conditioning during the neoliberal period – Rodger. In addition the New Deal refutes your opinion about implementation, might have something to do with a propensity for proclamations which have little supporting historical evidence.

Well which is worse buffer stock or consumer vs. democratic citizen …

You really have a huge chip on your shoulder when it comes to a JG and seem to spend a lot of time over at Lars or anywhere else that promotes it Rodger. The level of emotive embellishment directed at it seems to denote a fundamentalist or doctrinaire ideological attitude, you might be unaware, but that can have just the opposite effect intended. Especially after quantifying your status as a businessman of 50 years, like that has anything to do with the subject matter in a broader socio – political economic topic.

Yet for all your rhetoric it seems your biggest issue is banks and the perspective that informs those views, not that their businesses or that non traditional banking [shadow sector] has many traits that seem to hit your trip wires, but we don’t hear much about those.

Actually I’m put off just by your self awarded authority and ex ante methodology, which is curious when watching your take economists to task, like all economists are the same [boomer memes]. Especially considering neoliberalism dominance during the period in question or the fact that MMT – PK is anti neoliberal, yet you have an issue with it.

For some reason I detect some Rothbard or its ilk ….

In plain language, “Being an egotistic businessman doesn’t make me know more than the economists.”

And I agree with you.

The “businessman” reference was because JG is a business. It’s a nationwide employment agency, that provides minimum wage jobs as a solution to people’s lack of money.

I can promise you, the academics have no idea how to run that business. At one time, Randy told me it wouldn’t require any additional bureaucrats. Yikes!

And the businessman in me says, providing minimum-wage jobs won’t address today’s real problem — the large and growing gap between the rich and rest. The Ten Steps to Prosperity will.

Sadly, my former pen pals (Stephanie, Randy et al) have closed ranks against the real world, and prefer to talk theory among themselves.

They should bounce their ideas off seasoned businessmen rather than assuming their PhDs make them immune to learning from us of the masses.

Thanks for your comments.

Would you rather have people working for the money they receive or just have it given to them by the government as they sit home and watch TV? As you state, people want money. If any of this is to pass the Republican sniff test, working for that money may be the key. And, the jobs don’t need to be government jobs. A living wage and not a minimum wage will also be required.

“In plain language, “Being an egotistic businessman doesn’t make me know more than the economists.””

No I said homo economicus and not anything to do with personality disorders affiliated with day jobs … not that your – in plain language – is just double speak for bias filter with side of common sense [tm].

I don’t share your opinion about economics being a monolith, especially considering the back drop to various ideological pogroms given life over time by some with the funds and power to forward such enterprise or be trapped in their own reflections.

I fail to see how you arrive at the conclusion that a JG has to run like a business e.g. profit incentives, ROI, managed by a pack of MBA’s, et al. I also fail to see where you get the national employment agency opinion from due to the regional democratic administration forwarded to oversee its management.

“I can promise you, the academics have no idea how to run that business. At one time, Randy told me it wouldn’t require any additional bureaucrats. Yikes!”

Eh … I’ll take a check on your promise – thank you. Oh another monolith about this time about academics, seems a rather convenient rhetorical device Rodger. I mean only people like – you – understand am I right. I don’t see why I would require additional political civil servants if administered by social democracy, I mean considering the private sectors penchant for over payed bureaucracy I don’t understand your thrust.

“And the businessman in me says, providing minimum-wage jobs won’t address today’s real problem — the large and growing gap between the rich and rest. The Ten Steps to Prosperity will.”

I think you mean the ideologue, in as conditioned by your environment and its collective biases. Don’t share your perspective on wages as divergence vs productivity when your perspective is to hand out money and point people in the direction of the market as it currently is organized. I also have an aversion to people that quantify life as an easy ten step self help book to prosperity … something about past experiences at tent revivals ….

“Sadly, my former pen pals (Stephanie, Randy et al) have closed ranks against the real world, and prefer to talk theory among themselves.”

Sadly your emotional state is not something I find compelling nor the pen pals quip, as well anyone using the – real world – rhetoric device as it is better quantified as your personal ideological framework that your have gone full Kantian on. You should should take a dose of your own rhetoric about theory, I don’t think you know the meaning of the term.

“They should bounce their ideas off seasoned businessmen rather than assuming their PhDs make them immune to learning from us of the masses.”

Are you suggesting they seek confirmation of T or F by anecdotal feelings from those that cut their teeth during the neoliberal time period without any sort of control group or extended base line. Then people like you are confused why I find MMT or PK far more advanced than what your peddling.

BTW stop playing the business man shtick with me, I grew up in it, dinner table, in the car, on vacation, my national and international experiences as both an executive and a sole – partner ownership contracts.

The best bit is at Lars you don’t even grasp the whole methodological – atomtistic individual observation and then end up being a prime example of it.

Dude, for you “jobs” have to produce a commodity-value. There are lots of other jobs that produce societal good without producing a “profit”

https://livingnewdeal.org

People DO want jobs. Most people need structure. They need social engagement and a sense of purpose. The odds of becoming clinically depressed go up 40% after retirement, for instance.

And no one seems to have read Randy Wray in Understanding Modern Money. There he explains how using a Job Guarantee to set minimum wages and working conditions is a vastly better way of regulating the economy that interest rates.

Isn’t link whoring against this site’s policies??? I know you are quite proud of your opinions, but, really, dude.

I think you have a rather ideological blind spot with your feelings about a UBI. In the past I have linked too and mentioned the thoughts of past neoliberal economists on what a UBI would necessitate from a democratic view, not to mention the ideological based methodology used to arrive at those conclusions. Per se your views on giving people money and then they somehow create their own production which will then end the, as you put it – “stop working for the man”.

As you well know a JG is at its core a means to end the inflation boogieman reasoning for NAIRU and with it forced under – unemployment by the “man”.

There is a dead link in this (important?) sentence of that article:

“Here is Wray’s summary of his JG version:”

Oh, darn. Thanks for pointing that out.

I can’t seem to locate the summary. I think it may be somewhere here: https://nortonsafe.search.ask.com/web?q=oemmndcbldboiebfnladdacbdfmadadm%2Fhttp%3A%2F%2Fwww.levyinstitute.org%2Fpubs%2Fpn_2018_3.pdf&o=APN11908&prt=cr&chn=prev

I’ll keep looking. Meanwhile I’ve eliminated the link. Again, thanks.

A commonality I often see with critics of MMT is that they lump lots of other structural problems and needed structural changes at its feet, as if people are arguing that the work that mothers do in a home not being taking into account by national income and product accounts is somehow an issue with MMT. One thing to think about, I think, is the voluntary nature of a JG. People need jobs because in this economic system they need money to pay for things like housing, clothes, etc. A rich stay at home mother in Beverly Hills will not need work, and so the government wouldn’t be expected to employ her. Her work in the home not being reflected in GDP is an issue, I agree, but not one that has anything to do with MMT. A worker wanting to not be under the domination of another person is a real issue, but the state could support those workers by supporting worker owned enterprises. Many cities (Madison, NY, Cleveland, Austin, Minneapolis, Rochester (NY) among others) are doing just that. The insights of MMT could assist that by the government giving financial support to people wanting to form worker owned enterprises. But, if there are people out there that want a job, and the private market isn’t providing enough jobs, and if they aren’t a stay at home mom, if they aren’t dealing with massive health issues, if they aren’t retired, what is the danger of them seeking work with a public employer, especially when there is so much needed work to be done that private interests cannot be expected to fund? I can see problems in regards to matching skills with work needed to be done, so skills and educational support will be needed, and there will likely be time lags and other complications, but broadly, I don’t see the problem. There are huge structural changes needed, of which MMT could pay a role by simply funding things not be being funded enough by private interests. But, if those interests aren’t providing enough work, especially in services and industries we need to deal with things like the environmental and healthcare crises in this country, I think the government doing a massive jobs program would be a huge societal benefit. I think these types of critiques are useful in refining semantics.

Well said, again, Grant. I’ll clip that for future reference.

MMT provides a clear description of how the economy currently works, and has one policy proposal (the job guarantee) for how it can work better. Other than that, it’s up to the rest of us to come up with proposals. MMT (describing the current economic system) provides the foundation, for better or worse. Of course it’s better to have an accurate and clear description of our current situation as the basis for evaluating alternatives.

Notice how Paul Krugman goes into “wonkish” mode to explain the economy using ISLM. It’s as if you have to understand Latin to understand God’s laws.

I think you miss the point. A job guarantee does not force people to work. It guarantees a job for the people that want to work and can’t find one.

JG provides a minimum pay job, that in today’s world, will not feed an individual, much less a family. And that’s not the worst of JG’s problems.

You seem to be confused somewhere. Nowhere is the JG wedded to the $7.25, or whatever (family blog) wage it’s set to now, federal minimum wage. The JG would set the minimum wage simply because, well, why would you work for less than you could with a JG job? If the federal government is willing to pay you $15 or $20 an hour, and you can always quit your job to go get a federal job instead, then the cudgel your employer holds over you has no power.

Frankly, you seem to be drawing undue conclusions based on semantic confusion (possibly a good nerd rap lyric); either you’re wrongheaded, in which case you ought to read the comments of these people correcting you more thoroughly, or you have an ideological reason to create strawmen. Perhaps I’m a cynic, but I’m inclined to suspect the latter.

However, it does require the allocation of actual capital and the hiring and management of people with some management skills by the state, which is a kind of force. My experience with such programs has been that they are usually underfunded, poorly managed, uncertain of output, and not well-regarded, which is destructive to participants’ morale. It might be better (cheaper, simpler, more effective) to just give the intended beneficiaries the money, and make training, education, tools, and so forth available to the more ambitious of them.

MMT fits perfectly into the natural progression of last gasp end game fiat ponzinomics monetary policies

I mean what is left for them to do to keep the plates in the air and the skim going BUT something like MMT after QE, Zirp and Nirp

I wondered about AOC and why a congress person was being pushed so hard into the public spot light and by who and now I think I see the answer. To promote MMT and by the usual suspects from central and investment banking

Now all they need to do is divide the public along party lines over MMT……….come up with an alternative to MMT with a new name that is pretty much exactly the same as MMT, have some of their economist gatekeepers from both sides agree that MMT is crap but this new monetary policy based on MMT is the bomb and……..viola!……the central and investment bankers, their hedge fund billionaire straw men traders and Wall Street flunkies have their new and ultimate “free money for financiers” monetary policy.

This time 1000’s of new hedge fund and Wall Street billionaires created overnight much to the chagrin of “like you know AOC”,…… or whatever

You would think on this blog that has debunked so many sophist central banking and Wall Street concepts in the past……..efficient market theory….random walk theory…..portfolio insurance…..structured finance……leverage…options based compensation……credit default swaps reduce risk in markets…….reversion to the means trading……HFT….housing prices can never go down in aggregate…….etc etc etc………..ALL of which greatly enriched Wall Street and the hedge fund billionaire gang at everyone elses expense and all of which were supported as theories by MS economists, academia and financial media…….well you would think MMT would be reported here as just another obvious fraud……….just another sophist financial obfuscation…….but I guess not, I guess you have to read Zero Hedge, Karl Denninger, Mike Shedlock or Charles Hugh Smith for that……..unless they are drinking the MMT Kool Aid too!?

-1

The more ellipses, the better the comment. Obviously.

A -1 and a grammar lesson isn’t much of a……..rebuttal

: )

Not trying to be rude, but I don’t think your comment came across as coherent, and a good portion of it was conspiratorial. It was wrong on many levels, and I didn’t respond personally because I don’t have the energy to address everything. Like, you thinking that there is some conspiracy of some sort to get AOC elected in order for the system that she and MMT wants to change is odd. It doesn’t have any basis in reality. Who exactly is divided over MMT, when MMT largely describes how things work? The editor of the Financial Times recently admitted that MMT is obviously true (Bill Black had an article about this on this blog recently) but said that illusions are preferred to reality because the insights of MMT would have negative repercussions. So, what is the public divided about over MMT? Those that want a discussion on these issues to be based in reality, analyzing actual existing dynamics, and on the other side those that want to have models and discussions in a tenth dimensional universe that doesn’t exist?

I honestly say this, I am desperate for a well-reasoned, logical, factual critique of MMT’s insights. All I see is nonsense models like ISLM, loanable funds and the like. I see people that lie about MMT or never bother to read or understand MMT, and I see people intentionally misleading others on what MMT says and the implications of its insights. It’s similar to the debate on other issues like single payer. You have one side based in reality, having factual arguments, and another group that lies, gaslights and says ignorant things. I would like to see a logical defense of this healthcare system versus a single payer system, but one doesn’t exist that isn’t almost entirely ideological in nature. The same is true of MMT. Thoughtful, factual and accurate critiques are in short order.

Grant, you’re on a roll today, haha! Don’t burn yourself out!

Thank you, Grant. I never did get ISLM. I remember thinking this isn’t right and struggled to understand it, but I studied how the model was used and passed the exams. And, this was after Hicks himself had said he didn’t think the model was useful in the real world.

Zap, go and spend a few hours on Bill Mitchell’s website, or do an economics degree, like I did, so you can experience the lies first hand.

What is that a self referential appeal to authority?

Get an economics degree like I did!!

: )

Dude, this is like anti-trolling. Come here much?

Karl Denninger and Charles Hugh Smith haven’t had a new idea since 1971; Zero Hedge is a neoliberal app without a cause; and Mike Shedlock is too smart not to start seeing the light here someday soon. No wonder you are so confused.

Is Mike Shedlock promoting MMT?

Let me know when he does so I can write him off as a credible financial analyst……my guess is he isnt and never will because like you said he is too damn smart to miss what a scam it is.

MMT is just another elaborate sophist academic financial construct being promoted at a time when central banking desperately needs MMT or something equivalent to prop up their 100 year ponzi scheme……which is on its last legs as we all know

You could have predicted in 2008 that eventually they would have to pull something like MMT out of their asses eventually…….they went for QE, Nirp and Zirp instead…..but here we are now

Setting aside the oppo to MMT of those who Randy Wray mentioned and their rhetorical techniques, I would like to further explore the reasons “Why” they are opposed. The opponents mentioned are not stupid or intellectually lazy people. I suspect they understand MMT perfectly well. It is difficult to overlook their concentration in large investment management firms, private equity firms, on Wall Street, at the Fed, and among neoliberal economists who rely on members of the former group and the wealthy for funding of academic sinecures and other compensation. Is their opposition related to a conscientious effort to develop and implement sound public policy, or is it being driven by other factors?… And what might those factors be? Recalling Upton Sinclair’s observation about the difficulty of getting a man to understand something when his income depends on his not understanding it.

per Upton Sinclair, I think it is possible that people who trade assets by the minute really do not understand money at all. It is their gold. As the Conquistadors said, while plundering, “It is a sickness.” They were more connected to reality than Wall Street by far. When your job requires you to deny that you are sick, you deny it. You worry that if we adopt MMT it will “debase” the currency. That’s just Monty Python – I can see the skit now: all the overweening financiers and clueless high-speed traders talking about how money is becoming worthless. And for certain they will all misinterpret Wray as a misanthrope when he says that he thinks rich people should be taxed “because they have too much money.” Nobody realizes that he is talking about balancing an economy so that it doesn’t go Minsky, or so chronically unequal that it prevents itself from being an economy. And etc.

Well maybe Brad DeLong is having trouble with some fixed idea of the value money requiring an alternating application of interest rates to maintain the high-wire act. So Wray just answered my question about interest rates: The usefulness of raising or lowering interest rates depends on whether most of the debt service in an economy is being paid by the government on deficit funding, OR by the private sector which is already being killed by debt service and to raise their rates will kill the economy even deader. Dead, deader, deadest – to paraphrase Orlov. But with low private debt and relative high government debt raising the interest rate can be a stimulus. But not always. So – MMT believes the interest rate just jerks the economy around in a reactionary manner and the best solution is for very low fixed rates and adjust elsewhere. Thanks for the info.

The best form of defence is attack.

Rather than MMT being on the back foot all the time, they need to start pointing out how no one in the mainstream understands the monetary system.

I often use this chart that comes from a Stephanie Kelton talk.

This is the US (46.30 mins.)

https://www.youtube.com/watch?v=ba8XdDqZ-Jg

Does it look like any US policymakers know what they are doing here?

If anyone says “yes”, point out the blunders.

The best form of defence is attack. (Part 2)

Warren Mosler makes the point in the first part of the talk (link above) that private bank created money netts to zero.

For the private sector to be nett positive, then the Government has to have some of the negatives.

We can then use this to worry the billionaires.

They use the spurious notion that as the pie gets bigger everyone gets a bigger slice.

As the monetary system actually netts to zero, there are no slices, but just positives and negatives.

Their very large positives have to be balanced by lots and lots of other people’s smaller negatives.

This frames their accumulations in a very bad light; it does come at other people’s expense.

The billionaires accumulations wouldn’t be a problem if the Government covered some of those negatives.

I think this is what Mariner Eccles is actually describing here.

“a giant suction pump had by 1929 to 1930 drawn into a few hands an increasing proportion of currently produced wealth. This served then as capital accumulations. But by taking purchasing power out of the hands of mass consumers, the savers denied themselves the kind of effective demand for their products which would justify reinvestment of the capital accumulation in new plants. In consequence as in a poker game where the chips were concentrated in fewer and fewer hands, the other fellows could stay in the game only by borrowing. When the credit ran out, the game stopped”

In light of this mornings earlier article by Martin Wolf about economists failings as “experts”, am I the only one who finds this discussion of “expert” economists disagreements over economic theory a bit, uh, ironic?

This article proves why MMT is dangerous. It will never be properly implemented. Not in this country anyways. The compromises required to pass a form of MMT by people much less intelligent than those in this article will ruin it and we will get a disaster for a solution.

The safest thing to implement is something much closer to a balanced budget, which by definition has checks a balances, so I tend to side with conservatives on the issue, on grounds of pragmatism, not on grounds of “being right.”

Sad, yes.

MMT is already happening in all fiat monetary regimes — there is no need to implement it; there is a need to understand it

One of the things that prevents a good understanding of MMT is that there is so little talk of fiscal governance. Just look at the EU – they wouldn’t use the term “fiscal” if they had a mouthful. Because it is in opposition to Germany’s ordo-neo-liberalism, which I think is just a really bad hangover from the gold standard. And because the EU really thought they could achieve an economic union without fiscal sovereignty because creating a sovereign union out of all those European states is the very definition of herding cats and they didn’t want to get into those weeds. So an analysis there (and they are failing because they tried to sweep it all under the rug.) of fiscally balancing an economy without a sovereign authority is impossible. It has been here too because of our mental block about “free market solutions”, but things are changing. Nobody is using any kind of theory like “fiscalism” but it is in fact what we are talking about when we talk about MMT. It is the only true solution out there. People should understand it, it’s not rocket science. It just wonderful common sense.

I am speculating that the Eurozone is sidling into acting on MMT without saying so. Most countries cannot toe the fiscal mark so sooner or later the central bank will just have to print Euro’s to keep the merry go round operating.

But, of course, not doing the job guarantee will run it down nevertheless since too few will have money to spend into economic motion.

> Ken “Mr Spreadsheet” Rogoff

He was a cruel man, but fair. (Not Rogoff. The author.)

” I have little doubt that we could achieve Chinese growth rates if we put our minds to it—and sustain them for at least several years.”

Until the ecosystem crashes. Correction: finishes crashing. Speaking of “resources.”

He’s repeating a fundaental error of economists in general: “assuming” that the world is flat and extends forever in all directions. Not so, for at least 500 years now.

In fact, there are cogent claims that the US economy, at least, hasn’t grown in real terms for at least a decade. It’s all financial flim-flam. That’s why so many people don’t think they’re living in a boom. It hasn’t grown because it can’t; the resources aren’t there. As it says, right there in MMT. People and factories are not the only resources necessary.

I keep playing this role here, and I’m not the only one. (Incidentally, historically Marxists weren’t any better on this issue; I remember a discussion with a college housemate, back in the 60’s, in which he couldn’t grasp that there were physical limits to growth. that’s what he was learning.)

I see the jg as much harder to sell than infra block grants to states or regions with high unemployment, which assures the work is useful and needed while assuring the resources are directed to areas with surplus workers. The jg does neither.

But a second issue noted by many is that either approach means more growth and spending by those that won’t save the income. Certainly a happier population with income and wealth better shared. But the world pop consumes too much fish and habitat already while polluting more than the world can stand. Do we just get to the wall a little sooner and at a higher speed?

So maybe mmt needs to put the pop to work on gnd… assuming it’s not too late and we’re already deep into overshoot. And assuming the gnd can be sold instead of all the other infra that’s falling apart.

Using monetary or fiscal policy to manage an economy is trying to use the tail to wag the dog.

Much better is a variable VAT tax, where the flow of real goods and services in each separate market can be regulated by raising or lowering the tax in that particular market. As needed. Reasonably complete control, given the inherent vagaries of economic behavior, can in principle be attained.

And the process can be made politically transparent. Every interested party can find out exactly how his interests, and the interests of other economic players, are or are not being served. Politicians will be free to offer such excuses as they feel justified, and everyone will be able to judge.

And anyway, the current US tax system is simply dishonest. The appearances of who writes the checks to the taxman to the contrary, People like farmers and miners and factory and infrastructure workers pay all the taxes anyway. People who risk their ‘capital’ pay nothing in taxes. The people who have to chose between food and rent and medical needs, they pay the taxes. They pay the taxes for the rich and famous, whose consumption of the increasing scarce resources of our economy is in no ways diminished, despite their whines of pain. Or for others, their chest thumpings of virtue.

What MMTers don’t quite get is that the purpose of government spending is to reallocate resources to where they are needed, and not just where the people with money want them. Money is just the tool. Taxes are there to destroy money and control the size of the money supply, and so maintain the value of the unit. (The dollar, tor most readers, here,) and indeed are not needed for the government to actually spend money. MMTers have this mostly right. But the current value of the dollar is set by the amount of money in circulation, and not the total money supply. But if the total money supply is significantly larger than that in circulation, the potential for runaway inflation is possible. And thus, given the right circumstances, will happen.

So when taxes fall on the worker, it is their buying power which is being destroyed. And, incidentally the market for the goods they need, which is being diminished.

And this holds the prices down, even as the production of the real economy declines. Meanwhile, the production of the purely imaginary financial economy, that is, the money supply,is increasing,

So while the real demand increases, inflation is prevented because money is constantly being removed from the real economy by our regressive, and fundamentally dishonest tax system. And placed in the hands of our too wealthy financiers. Who, poor creatures, will soon enough again have to be rescued. At the expense of the rest of us.

VATs are terrible taxes. They are extremely inefficient to implement (lots of compliance costs on businesses) and they raise no more than a retail sales tax.

I worked with Lexington Law for years, they are rip off and I needed help so desperately in boosting my credit score so I can be able to obtain a new place to live, I had to pay off medical bills on my credit report, so I contacted SPIDERWEB he helped me erase the medical bills on my report and boosted my score to an amazing 800+, you can reach him on S p i d e r w e b h h a c k a t g m a i l d o t c o m