Lambert here: “Don’t look back. Something might be gaining on you.” –Satchel Paige

By Franck Portier, Professor, University College London and CEPR Research Fellow. Originally published at VoxEU.

Business economists argue that the length of an expansion is a good indicator of when a recession will hit. Using both parametric and non-parametric measures, this column finds strong support for the theory from post-WWII data on the US economy. The findings suggest there is good reason to expect a US recession in the next two years.

This summer, the current US expansion, which started in June 2009, is likely to break the historical post-WWII record of 120 months long, which is currently held by the March 1991-March 2001 expansion. It is already longer than the post-WWII average of 58 months. Should we be worried? Is the next recession around the corner?

Yes, according to business economists. For example, according to the semi-annual National Association for Business Economics survey released last February, three-quarters of the panellists expect an economic recession by the end of 2021. While only 10% of panellists expect a recession in 2019, 42% say a recession will happen in 2020, and 25% expect one in 2021.

No, according to the conventional wisdom among more academic-oriented economists, who believe that “expansions, like Peter Pan, endure but never seem to grow old”, as Rudebusch (2016) recently argued. As he wrote, “based only on age, an 80-month-old expansion has effectively the same chance of ending as a 40-month-old expansion”. This view was also forcefully expressed last December by the (now ex-) Federal Reserve Board Chair Janet Yellen, who said “… I think it’s a myth that expansions die of old age. I do not think they die of old age. So the fact that this has been quite a long expansion doesn’t lead me to believe that … its days are numbered”.

My research with Paul Beaudry and Dana Galizia tends to favour the former view, that we should be worried about a recession hitting the US economy in the next 18 months.

There are two reasons why we reach this conclusion. The first relies on a statistical analysis that uses only the age of an expansion to predict the probability of a recession. The second digs deeper into the very functioning of market economies.

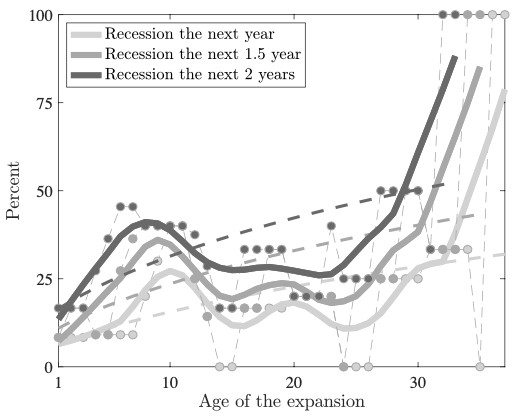

First, we estimate in Beaudry and Portier (2019) the probability of the US economy entering a recession in the following year (or following two years), conditional on the expansion having lasted q quarters. This can be done in a parametric way based on the Weibull distribution, or non-parametrically using Kaplan and Meier’s estimator of the survival function. Regardless of the method, and using post-WW2 US data, there is consistent evidence of age-dependence, as shown in Figure 1. For an expansion that has lasted only five quarters, the probability of entering a recession in the next year is around 10%, while this increases to 30-40% if the expansion has lasted over 35 quarters. Similarly, if looking at a two years window, we find the probability of entering a recession in the next two years raises from 25-30% to around 50-80% as the expansion extends from five quarters to 32 quarters (the exact probability depends on whether we use a parametric or a non-parametric approach).

Figure 1 Probability of an expansion ending in the next year, next year and a half, or next two years (parametric and non-parametric approach)

Notes: the dots are the non-parametric estimates. The thick lines are smoothed version of the dots. The dashed lines are the parametric estimates. Estimation is done using quarterly NBER data for expansions and recessions for the post-war sample (September 1945 to January 2019). The age of the expansion is in quarters.

The non-parametric estimates suggest that duration dependence is minimal for expansions lasting up to 25 quarters. But after 25 quarters, the duration becomes very apparent. For example, when an expansion ages from six years to nine years, the non-parametric estimates suggest that the probability of a recession within a year almost triples. If one looks in more detail at the initial phase of an expansion – up to eight quarters – there is also some evidence of positive duration dependence, reflecting the possible occurrence of double-dip recessions. Then from eight to 25 quarters, there appears instead to be negative duration dependence as the expansion takes hold, that is, during this phase the probability of entering a recession appears to decrease as the expansion ages. Finally, after 25 quarters the probability of entering a recession increases rapidly as the expansion gets old. This suggests that, when they are older than six years, expansions may be favouring the growth of certain vulnerabilities that may make the onset of a recession more likely. In other work (Beaudry et al. 2016), we have shown that US real and financial series tend to follow a cycle of length about ten years. Of course, this does not mean that there are deterministic cycles of ten years, but such a statistical regularity makes a recession all the more probable when the expansion reaches ten years of age. Obviously, we recognise that all our calculations are based on a small sample of data since recessions are rather rare. Our results are the best inference possible given this limited data.

Second, our recent work (Beaudry et al. 2016, 2017) has shown that a market economy, by its very nature, may create recurrent boom and bust independently of outside disturbances. This idea is well captured by the statement that “a bust sows the seed of the next boom”. Although, such an idea has a long tradition in the economics literature (e.g. Kalecki 1937 or Hicks 1950), it is not present in most modern macro-models. According to this view, the economy builds up sources of vulnerabilities in expansions. Those vulnerabilities could be of a financial nature (for example the accumulation of debt/leverage or the concentration of risk or collateral among small sets of agents) or of a real nature (for example the excessive accumulation of durable goods or investment in housing). Because of such a build-up, one need not expect a bad shock to trigger a recession. Such a mechanism creates the type of duration dependence we have seen in the data, namely that as an expansion grows old, eventually the probability of a recession should increase.

To conclude, let us emphasise that the evidence and theory we are bringing forward do not imply a deterministic view of the business cycle. We shall not expect a recession to happen with probability one when the expansion reaches ten years of age. Analysts might find reasons to be concerned (Chinese slowdown, yield curve inversion, etc.). What we suggest is that, even in the absence of a sudden adverse shock, a recession is most likely to happen in the next one to two years, and that this risk is higher than what it was two years ago.

Come on Lambert, the next recession is always just around the corner. But this one isn’t ready to manifest in my opinion. Money is too cheap, employment is too strong, and the vested interests aren’t setting conditions for it yet. Is it coming? You betcha, you’re right to bring this up. Before 2020 voting? I doubt it. Democrats are going to have to win on the strength of their ideas.

The definition of “employment” has changed since the end of WW-2.

Secondly, “money is too cheap” for only a small set of ‘economic actors.’ Here on “the Street,’ money is as hard to find as it has ever been. Go to a bank and ask for a small loan. You’ll get the eternal reply; “You can get a loan from us only if you don’t need it.”

Thirdly, remember “stagflation?” Watch out for the neo version.

Sequentially, “the next recession is always just around the corner.” Well, the corollary is; “Good times are just around the corner.” That corner gets a lot of traffic, going in both directions.

Finally, the Economic Boffins have staked out a position based on the premise that Macro drives Micro. From my degraded perspective, the opposite has just as much of a chance of being true.

Democrats are going to have to win on the strength of their ideas.

Pretty sure that’s snark but I’ll fix it anyway

…Democrats are going to have to win on another epic bait and switch…

@ambrit

May 4, 2019 at 10:34 am

——-

Hi, ambrit. Excellent debunking of the previous comment.

Your last paragraph warrants a discussion, but this might not be the right place.

However, just consider that in mainstream academic economics, it’s the “rational actor” with rational expectations and full knowledge of the future making decisions to maximize his marginal utility that drives the overall economy.

re your last para: I think in MBA school “rational actor” means “if you find a goose that lays golden eggs then kill it to get all the eggs inside it for yourself.” /s

Hi John, how’re you handling the inundation bands there? I see tons of rain moving through your area with great regularity. It doesn’t rise to the level of a true monsoon, but it’s pretty close for my taste.

I will steal the line from Lambert and say that the word ‘rational’ is carrying a lot of the load with mainstream economics. (I’d go so far as to characterize ‘bubbles’ of all sorts as examples of ‘irrational expectations.’) If the preceding were even somewhat true, then the “movers and shakers” of the economy would be essentially trying to manage a semi chaotic process. That prompts me to characterize the Fed as a national level “Economic Emergency Room,” or EER. Alas for many of us, this EER has adopted the tried old casualty management technique of ‘Triage.’

Hope your tax season treated you well.

ambrit and Phyl

@ambrit

May 4, 2019 at 5:39 pm

——-

Thanks for your good wishes. The same to you and Phyl. Yes, a good season.

You’re right in that it is a chaotic process and the macro-economists attempts to fit that into mathematically precise models is an exercise in futility, except that it can be dangerous.

The definition of “employment” has changed, yes, but it’s also being spun.

E.g., WaPo reports US unemployment is 3.6%, “lowest since 1969”, and jobs are being added:

https://www.washingtonpost.com/business/2019/05/03/us-economy-added-jobs-april-unemployment-fell-percent-lowest-since/?utm_term=.3086fbd96c2c

They cite the Labor Department, with positive chirps from some commentators.

But if we dig down into the BLS statistics, we see a different picture:

https://data.bls.gov/timeseries/LNS15000000

Looks to me like 96.2 million people, age 16 and over, are not in the labor force, and this number is increasing by 200,000 to 1 million per month. This may include seniors who are retired, though the Employment-Population Ratio is supposedly growing (currently around 60.6%), which doesn’t square.

There is also the “Alternative measure of labor underutilization U-6“, which measures “Total unemployed, plus all marginally attached workers plus total employed part time for economic reasons, as a percent of all civilian labor force plus all marginally attached workers”. This indicates that current unemployment is around 7.3% — nearly double the number being trumpeted in the MSM.

Finally, if we go with the numbers from the Census Dept, there are approximately 202.3 million people in the US (not counting illegals, I assume, who don’t report census) between 18 and 64, but the BLS numbers for Civilian Labor Force indicate that 162.4 million are currently in the labor force.

So what happened to the other 40 million people between 18 and 64 who are not in the labor force ?

I think non-recession could ride for awhile, wages haven’t increased much, even if employment, by some definitions of employment (with a proliferation of contract and gig work, low labor force participation etc.), is strong.

Wages have gone up at the low end because some states and cities have raised the minimum wage significantly. I suspect a lot of people have two or more jobs because they have to which skews the unemployment rate.

As an armchair observer I thought that recessions happened because various kinds of cruft built up in the boom times. Factories overproduced, inventories piled up, too many loans were taken till the system hit the wall and collapsed. Then inventories and debts were somewhat cleared and the process started again.

It seems now that we have a lot of just-in-time delivery and much greater transparency and better feedback in the supply chain because of computer network, therefore, this model will change. Not that recessions can’t happen, they will be different. The dot-com bubble was maybe an example. Even there, I don’t see the stock market as inordinately high. Some stocks are possibly far too high, but there is a lot of profit to back up a lot of prices.

It could be that we are vulnerable to some other sort of brittleness in the system that we aren’t yet aware of. Of course, a war in or near Saudi Arabia would be a downer for the world economy.

Again: since Clinton, the “major” parties have a deal: they take turns in the Presidency, 2 full terms at a time. I thought 2016 would be an exception, but no. Do you see anything to indicate that deal has been revoked?

Four….more….years.

Come to think: which probably also means, no recession till after the next election.

Realistically, the “next” recession, (given that many of the people I meet every day ‘on the Street’ haven’t recovered from the last one,) can start say, six months before the election proper and still not rise to political prominence by election day. The real killer here is the extent of this next recession. All the ‘usual suspects’ are lined up, but the underlying economy has suffered from some significant damages that haven’t been repaired yet, if they ever will. With the ‘extractive economic model’ being applied to the socio-economic sphere, the changes will be pronounced and dire.

Short term thinking results in long term damage.

I think Trump is tolerated (note the DNC leaders tamping down on the ‘impeachment’ chorus.) because they feel that like Bush II, he’s the perfect chump to be left holding the bag when the Other Shoe Drops.

Any Dem who breathes has better ideas than Trump, period

I’m not convinced that Trump has ideas – at least not ideas more well-formed than those that filter through one’s head while on the john or waiting in line for a hamburger.

I could go to the NY Times comments boards (or anywhere on campus) for knee-jerk digs at Trump. What exactly do you think the Dems (say Biden) would do differently? Reduce defense spending? Rein in Wall Street? Do you think Cory Booker would do anything about drug prices? Or Harris re: prison reform?

I stumbled across Naked Capitalism in the throes of the last presidential election when I was baffled by my “progressive” friends’ blind enthusiasm for Ms. Clinton. I love this site because of the substance, and weighing John’s take, for example, against ambrit’s (above).

Not trying to pick on you but we get it—you hate Trump. But it’s not funny anymore (even as gallows humor) and it just doesn’t cut it for a political argument.

Hey 4Corners, don’t be such a grump! Put it another way: Imagine that Trump came in a less ridiculous form and could more skillfully advance the same agenda. Someone smarter than me would need to unmask the faux populism in such a way as to convince the millions of swing voters who were once-bitten by eight years of “hope & change”.

Trump’s brash style and ham-handed leadership have served as a kind of reactive armor where opponents are stopped at the surface. I’m pulling for the candidate who’s more than not-Trump.

Hey, 4Corners, don’t be such a grump when being a grampus is so much more fun! John is a “Tax Professional” down in Mobile Alabama. As such he is manfully carrying on in the tradition, well established along the Gulf Coast, of “The Crimson Permanent Assurance.” Think Jean Lafitte with a calculator. I am a semi-retiring Geezer from the ‘Plateau of Geezer,’ to the south of Memphis. Think, “Beware what lurks within the Crypt!”

The NC site serves many functions, only one of which is the facilitation of argumentation between members of the public. Another major function of the site is the education of the general public. That education is far ranging and somewhat conducive to socio-political and economic esotericism. Yet another stated goal of the site is to disseminate the seeds of critical thinking skills. Your comment about the NYT Comment boards fits neatly into this niche function of the site.

To sum up, this sites commenteriat is somewhat of a “Rump” of the rapidly disappearing American Middle Class. It, and a few like it say what the old time ‘educated classes’ would have said in letters to the editor, forums, and niche publications in the “Days of Yore.”

The more idealistic of the old time political philosophers hoped that a free press would act as an effective brake to the “Natural and Organic” excesses of the government and elites. As the pool of free range journalism and commentary resources shrinks, the value of Naked Capitalism and ‘Fellow Traveler’ sites soars. Upholding civilization is not beanbag, as the estimable Mr. Dooley once said.

Welcome to the Struggle. Glad you’re here.

Trump may be arranging for the next recession to occur as we speak. https://www.marketwatch.com/story/trump-tariffs-on-200-billion-of-chinese-goods-will-increase-to-25-2019-05-05?mod=mw_theo_homepage

Boom bust will return to its regular schedule after people stop talking about that “scary” socialism.

Wonder if the ramp up in the US push against Venezuela is designed to create the “socialism is bad” meme in the US news ahead of the coming US election.

Yes, I’ve recently had two NeoLib acquaintances try to argue there is no space, institutionally, between extractive NeoLib financial capitalism as practiced at present in the US and Bolshevism/Venezuela: it’s either this or that.

It’s absurdly brittle, but maybe plausible on social media, of which I’m totally ignorant except for what Lambert shares.

Yes, social media is very much helping to polarise political opinions. The echo chambers social media create massively increase confirmation bias, and the rapid fire timing of “information” dissemination mean that little fact checking occurs. Result? The Age of Fake News. Skilful exploitation of this phenomenon is the secret of Trump’s success – he can say what the hell he likes and then dismiss dissent as Fake News.

This is a sad reflection of modern humanity, and I do not think it is taking us anywhere good.

I’ve been thinking about recession for a few days now and I must agree with Summer that in the current framework bernie style social democracy is the big fear, and the PTB, such as they are able, and I think it’s safe to say when it comes to control fraud they are pretty able, will stave off a recession if it looks like a bernie style candidate is likely to win and dump it on their doorstep as they enter office. If they can find legs for a centrist dem, the recession will be dumped on trump. It must be an uncomfortable time in the halls of power. In the end, committed as they are to being moderate republicans, the pelosi dems would rather have trump, and the coming recession, which on the ground here I see little evidence of, will be saved for a reformer. That said I don’t think the country can handle more homeless people…it starts to look like the army at valley forge after a while. We’ll see I guess…

The multitude of homeless are a feature of depressions. This one seems very well disguised, but we might want to reread ambrit’s post, just above.

And speaking of ” the army at valley forge” – remember the “bonus army?” Even FDR repressed them. That’s probably what’s next.

Hoover was the one that repressed the Bonus Army in 1932.

There was to be a 2nd Bonus Army march in 1933, but FDR made WW1 vets the first enlistees in the CCC, alleviating the problem.

They were paid their bonus in 1936, 9 years ahead of schedule.

Sorry I got the culprit wrong. But one implication is that FDR, by the time he took office, had literally been read the riot act. At least he was rational enough to respond accordingly.

The bonus was due in 1945 – the end of WWII (and my year of birth)? Weird coincidence.

Another thing about the ‘Bonus Army’ of 1932 was that it was violently ‘put down’ by the Army, under the command of Douglass MacArthur, with D D Eisenhower an aide to MacArthur and G S Patton in charge of the cavalry contingent of the troops.

MacArthur was generally described by his contemporaries as a quintessential ‘American Patrician.’

It was purportedly the logistical nightmare he experienced in that operation that put the seed of the interstate highway system in Ike’s head.

I am growing very wary of economic and other analysis that draw sweeping inferences using statistical tools and data like “… age of an expansion to predict the probability of a recession.” I far prefer analysis that “… digs deeper into the very functioning of market economies.” However, I’m not sure the observation:

“… the economy builds up sources of vulnerabilities in expansions. Those vulnerabilities could be of a financial nature (for example the accumulation of debt/leverage or the concentration of risk or collateral among small sets of agents) or of a real nature (for example the excessive accumulation of durable goods or investment in housing.”

quite captures digging deeper into the “very functioning of market economies.”

The current US economic ‘expansion’ seems an odd kind of expansion. Sitting at the side of this ‘expansion’ I am confused. What expanded? Looking in the local neighborhood, and in the side streets and at the centers of nearby cities, the expansion I see has a strange shape. I see homeless. I see harried faces rushing to unpleasant destinations. I see empty storefronts. And I see monstrous constructions of new buildings for the taste and grandeur pleasing a very few with monstrous taste. What kind of expansion is characterized by what appears to me like a growing market for used cars, used clothing, cheap easily discarded or dismantled furniture.

To me, this expansion appears an expansion based on returns extracted by reducing wages, leveraging corporate income streams to drive stock prices, and monopoly price gouging as markets are consolidated. I don’t see any of the ‘innovations’ and increased productivity or increased affluence that drove some earlier ‘expansions’. Through my lens this expansion appears one-sided and increasingly unstable. The processes driving the ‘expansion’ have a finite extent — wages, income streams, and markets can only be squeezed so far before they can be squeezed no further. The economy has been restructured in ways that complicate monetary and fiscal policy blunting and redirecting their effects, when they are applied. I believe this further adds to the instability. The structure and processes of this expansion really do seem different this time. I suspect the crash will also be different this time.

I’ll tell you what ‘expanded’ .. Out of Business sales, for rent or lease, mucho garage/ yard sales .. selling mucho junk ! , vagrancy × ratty tents, panhandlers , “Will _ _ _ _ (pick a desperation !) for _ _ _ _ ( pick a need, real or otherwise), crowded Dollar Stores, fewer WallyWorlders, fewer farmer’s market patrons, scummy vigiante types routing the homeless, increase in desperate food-bank recipients .. with children no less ! , savings dwindling whilst EVERY municiple tick and Corpserate Conenose sucks the lowly pleb to a dry husk … while, conisidentally, always GETTING THEIRS’ !!!! , BS politicians campaigning predicated on srcewing the commons, polecat doing what he can for self and family .. on the wing, because he sure as Hades ain’t gonna start that small business he once desired, due to a GFC that NEVER REALLY ENDED !!! .. and has much fewer quatloos to hand over to the Man, be they local .. or those at the pinnacle of Empire !

I’m ready for the appearance of a benevolent dictator — someone who’ll ACTUALLY GET THINGS DONE … for me and mine, for a change !

I have a feeling it’s worse than you think. I spent today at three established indoor flea markets in and around Wilkes-Barre, PA. The places were dead, with just a handful of buyers, and lots of empty spaces abandoned by previous vendors who couldn’t sell enough to cover the $20 rental price. When people don’t even have enough money to buy greatly discounted items at a flea market, it’s time to worry.

I feel that because 2007 was such a big shock (“proving” suspicions ignited by the .com bust) the usual shenanigans cycle was a slow starter this time. The average American has since been more concerned with saving their home than getting rich quick for nothing and given that the two major asset classes (stocks, homes) for most people are now confirmed as risky in the minds of most, have been slow to get back into them.

The sectors with a lot of shenanigans these days are healthcare, utilities, and to some degree academia. (Ignoring, of course, Government.) Academia is too small, and the others are highly regulated. I’m still looking for the out sized risk. Maybe it is corporate debt.

For me de question is what will be the canary in the coalmine next time. Are industrial new orders in Germany indicating a global slowdown or will prove temporary? Boeing? Oil?

I’m looking toward some large municipal debt defaults. Much of the recent infrastructure repair and replacement looks to be fuelled by municipal bonds, yet the underlying local economies are degrading. Already, the ‘breaking point’ for average people’s ability to pay local taxes and fees is being reached. A cascade of defaults and ‘restructurings’ looks inevitable.

Look at the lawsuits municipalities are paying out, $20 million for that Australian lady murdered by a cop in Minneapolis…

Yes, he murdered her because he said he felt threatened by an unarmed blonde in a pink t-shirt who was trying to get him to investigate what sounded like rape or domestic violence.

Even as an Australian it seems to me like they would have been better to spend the money training their officers to be not so f…… Trigger Happy.

I was glad to read that the family donated $3m to a local gun control organisation though.

The militarization of the police is quite something, you’ll see coppers with their pant legs ‘bloused’ as if they were in the 101st Airborne.

You go with the tawdry late stage Sparta you have-not the democracy you want.

I dunno. Anyone here with any recollection of Fascist Italy before WW-2? That’s what I think of when I do consider the historical predecessors to today’s American Homeland.

“Festung Amerika” used to be considered an “over the top” calumny on America. Now, who knows?

Gravel roads will once again become popular … along with the requisite amounts of choking dust and attendent potholes ! .. but hey …at least it’s a permeable membrane .. and mules can still navigate on, around, and through it …

I wouldn’t be surprised if the more than the occasional bureaucrat gets ‘restructured’ as a result of increased rent/fee/assessment/tax skullduggery in a rather diminshed fiscal environment .

My brain must be loading itself up with mucho, mucho, amyloid plaque. Your comment triggered a connection in my liquescent brain to this song by the Grateful Dead.

Dupree’s Diamond Blues: https://www.youtube.com/watch?v=YK3f4SwNCTk

I suspect that heroic measures will be taken to guarantee that any stock market crash will be delayed until after the November election.

They will try and probably succeed, but like in 2008, the system is such that it will soon crash, and if those conditions, like last time, happen there is nothing they can do.

Yes, Powell&Co. will get “offers increasingly hard to refuse” from the White House. However, like King Canute, even the most powerful leader cannot resist the tide. Many pundits in financial newsletters are suggesting on both fundamental and technical grounds that there will be a final melt up in the US markets, then a crash of variously described severity, sometime between this coming October and the end of 2020.

The question is which lance wielding black swan will pierce which bubble first? And when? There is a whole flock circling.

Arthur Burns may be the person to save the Fed. https://en.wikipedia.org/wiki/Arthur_F._Burns

I don’t think Jerome Powell wants to be known as the next Arthur Burns following Presidential edicts and allowing inflation to get out of control. I think the last interest rate increase only occurred because Trump was constantly yapping at Powell and the Fed on Twitter. Trump’s ongoing yapping probably will delay the first interest rate cut as well.

Sorry to intrude, but I flashed on a different Mr. Burns when I cursorily read your comment.

The Other Mr. Burns: https://www.youtube.com/watch?v=uRf-sRZBiHo

Out here in retail land business is tough. We are still not back to 2006 sales levels. 13 years of rising costs, property taxes, etc. but still the same size sales pie to carve it all out of.

The big town put computerized parking boxes in and took out the old meters. You have to climb over snow drifts to start the process, then run back to car to try to get your license plate number, then use your credit card. Too complex for suburban punters. Now even in spring weather customers are voting with their feet.

The town has put a $1.50 per hour toll booth in front of our stores and the software vendor is getting a $.35 convenience for every credit card used.

“I just want to dip my hand in the money stream that flows outside my window”

Ha!! That’s exactly why I no longer go to our large nearby city to shop anymore and the same with the mid size town close by. Nice shops, great prices but messing around with the new central box parking is a no go for me if it isn’t ‘70F and clear and I am not In a hurry. And that occurs here In the NE like twice a year… public transport is not nearby to my home and would take me an extra 11/2 hr minimum to even try to use it. I know because I tried several times. It’s also creepy filthy and chronically late…

Exactly why most of our friends in San Francisco boycott the city for commercial reasons. They time their drive over to California’s wealthiest, healthiest and most educated county, Marin, to shop and spend the day avoiding rush hour or weekends. Unlimited free parking, far better weather, no car break ins, no piles of steaming human feces on the sidewalks, nor raving street crazies like in the city.

In addition, people are nicer and it’s less crowded, with higher quality and less expensive stores than the city. Also, one is not handing their sales taxes to the city government that has, is and will continue to destroy San Francisco. Vote with your wallet.

Ten bucks in gas and the bridge toll for a delightful day and personal safety is worth it, versus paying upwards of six bucks an hour at parking meters in the city, if you can find parking then coming back and finding your are one of the 36,000 (per year) victims of a car break in.

https://www.sfchronicle.com/news/article/san-francisco-auto-burglary-hot-spots-12756952.php

Most people here never lock their car or home doors, I have to remind myself to do so when going to the Big Smokes.

I’m not sure where “here” is, but in SF Bay Area a lot of people leave their car windows and trunk open, or at the very least the back seats down so you can inspect the trunk contents through the windows. The thieves are then free to inspect the car to verify that there is nothing in there without breaking anything.

The pain is largely self inflicted. We voted to decriminalize a lot of minor crimes in the name of saving some money on jails. In that sense, it pays off. However, the auto window glass business is booming for all the wrong reasons, and the Cal. legislature seems primed to pass tougher penalties for problem crimes. Can’t happen soon enough, in my opinion.

Here is rural Three Rivers, Ca. cheek by jowl next to Sequoia NP, about a 4 hour drive from SF.

The nearest set of stop lights is over 20 miles away…

Mixed bag out here in our little town of Medford OR. The chances of getting a job are clearly better than at any time under Blessed Obama. Almost every store and fast food joint has a “help wanted” sign. I even hear help wanted ads on commercial radio.

OTOH, lots of store fronts and houses are still boarded up, and the cardboard sign army gets bigger each year. Tons of trashy encampments around and through the local Bear Creek parkway.

“There’s a Vietnam Vet with a cardboard sign, sitting there next to the left turn line

Flag on his wheelchair flapping in the breeze, one leg missing, both hands free…

We can’t make it here any more”

James McMurtry, Bard of the lost deplorables in middle America.

Accurate description. The question presents; how many “jobs” will it take to afford to live… “here”.

I cannot understand why people are believing the employment numbers as meaning things are great. We are solidly upper middle class living in a solidly middle class area (Philadelphia western burbs). Within a couple of mile radius of my home just in the people we know their are 22 people, aged 59 to 19 (most with a college degree if they are over 22/23 or so) who are working part time or two or three part time jobs. Some lost really good professional type positions in downsizing ( a couple of engineers, a biologist and some computer geeks etc). Others are new grads who cannot get. Full time secure job( ie not on commission) , others had your old fashioned white collar jobs in finance, communications, marketing ,health and safety, Human Resources, insurance industry and on and on and were let go also in downsizing, moving jobs to cheAper places in the world and companies just cutting back

None of these part time pieces of garbage jobs come with any benefits whatsoever. They also do not allow people to work regularly scheduled hours so planning anything like a family outing or picnic or even a trip to the dentist is super difficult. Some weeks they get lots of hours some hardly any. Many are on Medicaid expansion now for their healthcare. God knows what will happen to them if some idiot gets in and does away with it.. I shudder to think…

Is this really what America has become now going forward? If this is considered full employment by anyone in any profession of any party affiliation I would say we are now in the movie Idiocracy for real….. and we are in an ocean liner full of trouble going forward.

Give it some time. Businesses have just started to get desperate. The workers need some time to get used to the situation and get greedy. Those guys with 3 jobs (bless them!) should probably be out looking for one good job. I knew a guy who I worked with night stocking grocery store shelves the summer after high school, who had three jobs. He was not given many gifts in life except his astounding and laudable determination to support his family. I’m not sure I ever talked to him. He didn’t speak much, but it was an excellent education for me on why I should be going to college delivered at just the right time. He numbers among my heroes.

there are not professional white collar jobs to be had, it’s a hard market out there for them, and I know too many unemployed forever seeking such a white collar job, some taking temp work across the country etc… I know white collar people that are quite likely to be forced to drive for Uber. There are low wage jobs though, I’ve seen the first help wanted signs for them IN A DECADE or so this year. (“So take a low wage job” someone will chime in, but that only really works with a very low cost of living, otherwise you can’t actually *live* on the wages – or Uber wouldn’t look better, or moving to another state for a 6 month gig wouldn’t look better etc..). There may or may not be blue collar jobs depending on the field but some blue collar work is in demand.

So when we talk about the economy, the experience of looking for a white collar job now is going to be different than seeking a minimum wage job (in the worst of the recession it was ALL terrible, but that’s really cold comfort).

Is the next recession around the corner?

If it wipes the smirk off Trump’s face it might almost be worth it.

“The Harder They Come, the Harder They Fall, One and All…” Jimmy Cliff.

This is a strange article about a very strange world. There are no observations or data but it seems to be simply say that if the past is any guide to the future maybe hold onto your hat. NBC news last night had a glowing segment on how great the economy is doing and how unemployment is the lowest level since 1969 and wages are starting to raise. I remember 1969, besides flying off to Vietnam, there was no homelessness, education and healthcare were affordable and I easily got a summer job the year before working at the Seattle USDA lab. For the working middle class, it was a hell of lot better than today. The only way I can reconcile the cognitive dissidence between NC and NBC is that corporate media has gone completely over to the dark side and there is no correlation with state propaganda and reality. The scary part is that this is the exact same reason why the Soviet Union collapsed. There is no planning for the future. “Trust the invisible hand”. But, it isn’t a recession that we should worry about; it is the collapse of Empire and the global economy when the dollar stops being a world’s reserve currency and the huge pile of debt that can’t be paid off. Not to mention, in addition, blowback from the new Cold War with Russia, climate change, and the psychotic response of the elite to any loss of their wealth.

Fellow VN Vet, I completely agree. Trump is working overtime (intentionally or accidentally) to push the dollar into international irrelevance. Countries are sick of Trumpian bullying that threatens their economy if they do not support our immoral wars and other outrages (Yemen and Libya at the top of my list). If the dollar loses traction, (likely triggered by leaving the Iran deal during a trade war) the size of our IRAs and other investment wealth will be uninforming because the value of a dollar will be unfathomable.

The media only knows how to parrot government press releases; there is no investigative reporting any more. But if you pay attention, you know the numbers are rigged. One third of the workforce is out of work and has stopped looking. Working one hour a week gets you classified as fully employed. I believe that if you are unemployed but actively looking for a job, then you are not considered unemployed (not sure about that; I read that unemployed folks are divided into two categories and counted differently, even though they all have no jobs). ShadowStats puts real unemployment at about 20% not 3.9%

There’s also very little in the national media about the retail apocalypse, which they always blame on internet buying. However, internet buying accounts for about 10% of all retail sales, so it’s not the reason. And of course the media never acknowledges corporate debt and vulture capitalism. And they never cover international shipping which, last I read, had fallen by 50%.

You know, if things don’t change, they’ll likely stay pretty much the same.

The theory seems akin to stating that the probability of a bus arriving at your stop increases in direct proportion to how long you’ve been waiting for it.

True, but unhelpful.

Seems basically to be a chartist (not intended as a pejorative) argument. With accumulating wealth inequality – Bernanke’s unironically noting a savings glut without considering distributional effects (as far as I can remember), and a huge addition of debt to the Fed’s balance sheet, is it still being Charlie Brown running at Lucy’s football to think “this time it’s different”?

I would think how fast a liberal capitalist economy runs would be determined by emotions, not material facts in the external world (except for very, very big ones). When capitalists feel happy, they create money, and give people jobs. The money communicates their happy feeling to other people, who spend the money, creating some circulation. The government may get in on the spending and lending, too. We have a boom. But after awhile the important people get tired of the boom, feel sad, get depressed. Then we have a depression. We can expect a kind of wavelike succession of moods. Same thing is often observed in biological and ecological systems. Pheromones may be involved.

I think capitalists like Mr. Trump’s style even if they dislike his politics — the exuberance, the dumb wit, the luck, the outraging of liberals, progressives, intellectuals, etc. It cheers them up. Let the good times roll! But after awhile they get tired and need a nap, etc. A seemingly trivial mischance leads to a tantrum or a crying jag. And then that’s it for that round.