By Chris Dillow, an economics writer at Investors Chronicle. He blogs at Stumbling and Mumbling, and is the author of New Labour and the End of Politics. Follow him on Twitter: @CJFDillow. Originally published at Stumbling and Mumbling; cross posted from Evonomics

I welcome Professor Sir Angus Deaton’s report into inequality. I especially like its emphasis (pdf) upon the causes of inequality:

To understand whether inequality is a problem, we need to understand the sources of inequality, views of what is fair and the implications of inequality as well as the levels of inequality. Are present levels of inequalities due to well-deserved rewards or to unfair bargaining power, regulatory failure or political capture?

I fear, however, that there might be something missing here – the impact that inequality has upon economic performance.

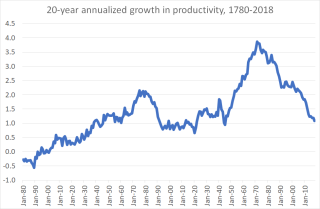

My chart shows the point. It shows the 20-year annualized rate of growth in GDP per worker-hour. It’s clear that this was much stronger during the relatively egalitarian period from 1945 to the mid-70s than it was before or since, when inequality was higher.

Or it might not. This is not the only evidence for the possibility that inequality is bad for growth. Roland Benabou gave the example (pdf) of how egalitarian South Korea has done much better than the unequal Philippines. And IMF researchers have found (pdf) a “strong negative relation” between inequality and the rate and duration of subsequent growth spells across 153 countries between 1960 and 2010.

Correlations, of course, are only suggestive. They pose the question: what is the mechanism whereby inequality might reduce growth? Here are eight possibilities:

1. Inequality encourages the rich to invest not innovation but in what Sam Bowles calls “guard labour” (pdf) – means of entrenching their privilege and power. This might involve restrictive copyright laws, ways of overseeing and controlling workers, or the corporate rent-seeking and lobbying that has led to what Brink Lindsey and Steven Teles call the “captured economy.” An especially costly form of this rent-seeking was banks’ lobbying for a “too big to fail” subsidy. This encouraged over-expansion of the banking system and the subsequent crisis, which has had a massively adverse effect upon economic growth.

2. Unequal corporate hierarchies – what Jeffrey Nielsen calls rank-based organizations – can demotivate junior employees. One study of Italian football teams, for example, has found that “high pay dispersion has a detrimental impact on team performance.” That’s consistent with a study of Bundesliga and NBA teams by Benno Torgler and colleagues which found that “positional concerns and envy reduce individual performance.”

3. “Economic inequality leads to less trust” say (pdf) Eric Uslaner and Mitchell Brown. And we’ve good evidence that less trust means less growth. One reason for this is simply that if people don’t trust each other they’ll not enter into transactions where there’s a risk of them being ripped off.

4. Inequality can prevent productivity-enhancing changes, as Sam Bowles has described. We have good evidence that coops can be more efficient than hierarchical ones, but the spread of them is prevented by credit constraints. Poverty reduces education levels by making it impossible to afford books, or encouraging bright but poor students to leave earlier than they should, and women and BAME people might avoid careers for which they are otherwise well-suited because of a lack of role modelss

5. Inequality can cause the rich to be fearful of future redistribution or nationalization, which will make them loath to invest. National Grid is belly-aching, maybe rightly, that Labour’s plan to nationalize it will delay investment. But it should instead ask: why is Labour proposing such a thing, and why is it popular?

6. Inequalities of power – in the sense of workers’ voices being less heard than they were in the post-war period and trades unions becoming less powerful – have allowed governments to abandon the aim of truly full employment and given firms more ability to boost profits by suppressing wages and conditions. That has disincentivized investments in labour-saving technologies.

7. The high-powered incentives that generate inequality within companies can backfire. As Benabou and Tirole have shown (pdf), they encourage bosses to hit measured targets and neglect less measurable things that are nevertheless important for a firm’s success such as a healthy corporate culture. Or they might crowd out intrinsic motivations such as professional ethics. Big bank bonuses, for example, encouraged mis-selling and rigging markets rather than productive activities.

8. High management pay can entrench what Joel Mokyr calls the “forces of conservatism” which are antagonistic to technical progress. Reaping the full benefits of new technologies often requires organizational change. But why bother investing in this if you are doing very nicely thanks to the increased (pdf) market power of your firm? And if you have, or hope to have, a big salary from a corporate bureaucracy why should you set up a new company?

My point here is that what matters is not so much the level of inequality as the effect it has. And it might well be a pernicious one. If inequality has contributed to weaker growth, then it is very likely to have contributed to the rise of populism and to Brexit and the divisions with which both are associated. In this way, inequality does political damage too.

From this perspective, pointing out that the Gini coefficient has been flat for years (which is true if we ignore housing costs) is like saying that because the bus has stopped moving we need not care about the man who has been run over by it. It misses the main point.

Very good analysis on the consequences of inequality. I miss a conclusive one: disengagement. It is, in part, an objective of the wealthy because it discourages political participation of the masses. It is also root of populist movements. But maybe the most critical consequence of disengagement now is the difficulty to implement social changes badly needed to fight climate change.

The re-engagement is often in a revolutionary cause.

Big one is health goes down for everyone. Sooner or later we all hurt

Who/what wins when reason encounters power?

The reason why there is inequality is because that is what people in power want. So while there are many reasons why inequality is a problem to be resolved I believe that the only way to deal with it is to use power. The power of the ballot at the election. Voting for people with history of serving other interests than the electorate and then trying to reason with them to get them to change their mind is a bad idea.

Is there anyone who believes that the powers that be will change simply by presenting logical arguments to them?

The healthcare situation in the US is the best example. There are few, if any, logical arguments to have a healthcare system as the US has. Is there really anything to do but to elect people who will change it? Or is there a possibility to change the minds of the politicians who maintains it?

There is more to do than just elect the “right” people to office, which is important. As we painfully know, elected leaders have a rather sorry record of making change, so simple reliance on the ballot is inadequate. We need resilience, mutual aid and organizational support in the polis, independent of the political class. This in order to not only elect good leaders, but also to hold them accountable from day one. To create such requires the long work of organizing. Organizing is not just advocacy (lobbying, e.g.) nor just mobilizing (mass demos, e.g.), it is about changing lives. When done properly, organizing changes politics and its possibilities in fundamental ways. But when done right, it is literally one person at a time over time. No quick fixes, no easy solutions. Are we up to this or not? That is the question facing us all.

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” Sinclair Lewis

….

High levels of inequality lead to the economy being demand-limited rather than capital-limited. Now either one can choke off economic growth, but monetary stimulus is more sustainable when it operates on the latter than the former. Buliding a new factory and employing more people in it is hopefully* going to be better for the economy in the long term than loaning cash strapped people money to be paid back with interest.

*But not always, look at all that dark fiber installed during the dot com boom.

We are paying off our existing debt we built up while raising kids. It doesn’t matter how much cheap debt Mr. Powell and Mr. Dimon want to throw at us, we aren’t going to use it and will continue paying off the old debt. the bank calculators tell us we could take on hundreds of thousands of debt to buy a bigger house, fancy cars etc. but that is not happening. One of the key reasons is that we look at the political uncertainty and know that ultimately the best defense is low debt levels and well-diversified savings.

The high student debt levels many people have taken on means they are not taking on much new debt. so they used the debt to pay the universities but that is probably not as productive for the economy as buying condos, houses, cars, etc.

Many other people have been taking on debt because they don’t make enough to cover their ongoing expenses. In a recession, that debt is likely to be high risk.

Corporations have been issuing lots of covenant-light junk bonds because Mr. Bernanke and Powell have provided inexpensive money. Many of those will likely go south in a recession creating a bigger issue. Unlike the dark fiber, most of that has not been for long-term capital projects so is unlikely to provide that economic stimulus in the future.

And a big part of the reason debt levels are so high is because the wealthy have much more money to lend than they can find productive uses for. High debt levels are the direct result and evidence of a greater concentration of wealth than is optimal.

“so they used the debt to pay the universities but that is probably not as productive for the economy as buying condos, houses, cars, etc.” @rd.

The army of college administrators can then buy fancy cars and houses on their six figure salaries.

Here is a good analysis of income distribution from 1913 to 2012. https://eml.berkeley.edu//~saez/saez-UStopincomes-2012.pdf

It is pretty clear that the period of low income inequality from WW II to the early 80s coincided with the giant productivity bump. So when Trump says “Make America Great Again” which I have assumed relates to that post-WW II boom, is he calling for reduced inequality and better sharing of wealth across the society? Or does he assume that the policies that lead to reduced productivity growth are what make America great?

While the stats aren’t strong, my understanding is that the Gilded Age of the 1870s was another classic period of concentrated wealth that then started a period of frequent depressions from the 1880s to WW II, including the Panic of 1908 and the Great Depression. The Great Depression was preceded by a brief period of high inequality in the Roaring 20s that was not erased until after the 1937 stock market drop and the beginning of WW II.

I think the most interesting thing about inequality is how much distortion a short period of it can put into a society. It appears that it takes 2-3 decades for society to fully recover from each decade of high inequality. This is similar to the relative rates of stock market recovery compared to a stock market drop.

My primary hope is that we can come out of this period of inequality without a major global conflict. I suspect that the retiring of the baby boomers and the stress that puts on the system will lead to the realization of many retirees that they are on the menu instead of picking from the menu. That will likely begin to change their voting patterns in the coming decade coinciding with the growing political clout of the millenials.

Point #6 has me confused (that’s not so difficult to do). The section ends with this sentence:

“That has disincentivized investments in labour-saving technologies.”

Huh? I’ve been under the impression that not only labor-saving but labor-eliminating tech. is a very big deal. A big selling point for automation is that by eliminating jobs & job-related expenses it more than pays for itself.

You point to the interesting debate on technology and jobs. IMO labour-saving techs mostly shift jobs. Whether it destroys more or less than those created is open to many informed and uninformed discussions. It almost certainly ends in higher productivity, but what about inequality? For some time technology raised all boats but lately not. I would argue that technology itself is not the evil. Erik Brynjolfsson signalled the “winner take all” dynamics of Silicon Valley as an example on how technology drives inequality nowadays.

The big question is what happens to those doing the jobs that are left? If they share in the benefits of productivity growth through higher wages, they can buy more of OTHER products and services which creates demand and provides employment for those creating those products. But If they do not get higher wages, those displaced are competing for jobs with other displaced workers and depressing wages. The economy simply works better, with fewer speculative bubbles and more economic security for the vast majority when productivity gains are linked to rising pay, as they were in the post-war period. How to achieve this is a non-trivial question, but increasing the minimum wage and capital gains taxes are a start.

Some of the jobs have been automated. However, many have gone overseas to cheaper labor. Instead of keeping the jobs in country and using automation to reduce the labor cost and increase productivity, they just shipped everything off. In some cases where they kept the work in country, they simply moved the jobs to non-union states where the workers would work for much less.

If all you are concerned about is earnings per share, it doesn’t really matter where or how the work gets done as long as you reduced the cost per unit revenue.

Someone, please remind me why we all need more growth in our economy. So far as I was aware, it was capitalism’s need for constant growth that was a major cause of climate change. Whilst inequality has dreadful effects in other ways, surely lowering overall growth might be a good thing for the natural world. Infinite growth on a finite planet can go on only so long without serious consequences – or so it seems. The much-vaunted and much-hated Green New Deal takes as given that there is such a thing as green growth. Is there?

https://www.counterpunch.org/2019/01/17/that-green-growth-at-the-heart-of-the-green-new-deal-its-malignant/

https://foreignpolicy.com/2018/09/12/why-growth-cant-be-green/

https://www.degrowth.info/en/2015/10/the-decoupling-debate-can-economic-growth-really-continue-without-emission-increases/

No fiscal policy, no democracy. Politics is reduced to PR, nothing more.

“The formulation of fiscal policy lies at the dead center of democratic government. It is the very essence into which is distilled the conflict between the haves and have-nots. It represents the terms of compromise between powerful economic forces in the community. Utterly divergent economic forces are seeking to use the financial machinery of the government to promote their own ends.” ~ E. Pendleton Herring

40 years ago, the neoliberal globalists separated politics from the economy, rendering democracy unplugged from policy decision-making. Alan Greenspan confirmed this by saying:

“We are fortunate’, he replied, ‘that, thanks to globalisation, policy decisions in the US have been largely replaced by global market forces… it hardly makes any difference who will be the next president. The world is governed by market forces.’”

But today, we know that neoliberalism, the conservative revolution against progressive policies, has been thoroughly discredited. It is obvious that fiscal policy, government investment in public purpose, is essential to a democracy and a healthy society.

Here’s an article on how globalists decided to divorce economics from democracy and politics.

Terrific post, as well as terrific comments.

The problem faced by the hoarders of capital is that of democracy. How do you drive-down participation by the masses? Gross economic inequality, combined with the precariousness engendered by job insecurity, indebtedness, poor access to health care, and parsimonious social security benefits, leads to hopelessness — and to the sort of non-participation that caused both major-party candidates in the 2016 U.S. presidential election to pursue strategies that intentionally only attracted 26.3 and 26.6 percent of eligible voters, respectively.

Inequality has been a brilliant strategy for minority rule in America, Britain, France, and elsewhere.

Someone, please remind me why we all need more growth in our economy.

Debt-based finance requires growth to pay the interest.

So far as I was aware, it was capitalism’s need for constant growth that was a major cause of climate change.

Otoh, finance with shares in equity allows but does not require growth. But why should anyone with equity share it when government privileges for “the banks” allow them to instead use the public’s credit but for private gain?