Yves here. Wolf’s account of the price collapse of a particular leveraged loan is both a good primer as well as reminder as to how lending goes bad: gradually, then suddenly.

Also bear in mind that a lot of junk bond funds hold leveraged loans, along with a lot of public pension funds, both directly and through credit funds….managed by those friendly private equity firms.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

Golden Gate Capital – the private equity firm now infamous for asset-stripping its portfolio company Payless ShoeSource into bankruptcy and liquidation – strikes again with another of its portfolio companies, Clover Technologies, whose $693-million leveraged loan has suddenly gone to heck.

Slices of that leveraged loan are traded like securities. But because leveraged loans are loans, not securities, the SEC doesn’t regulate them. No one regulates them, though the Fed wrings its hands about them periodically. And there are $1.3 trillion of them.

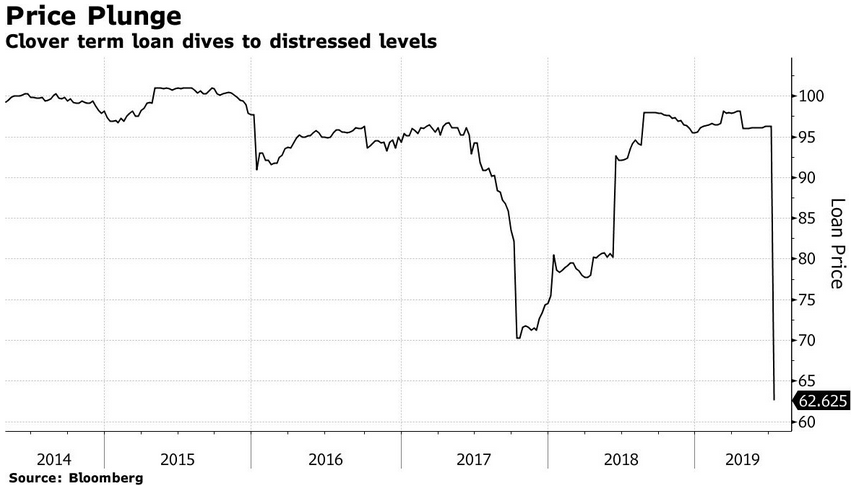

The market for them is very illiquid, even during good times, and before Clover disclosed some issues on July 9, the loan still traded at 97 cents on the dollar, according to Bloomberg. This was the day investors, such as leveraged loan mutual funds and institutional investors that held these slices, suddenly woke up with the foul odor of debt restructuring and bankruptcy in the air. Within just a few days, the price of the loan plunged 35% to 62.625 cents on the dollar.

The loan was “covenant-lite,” giving fewer protections to investors and allowing the company and its owners to get away with all kinds of things. This included the absence of certain disclosure requirements.

Not that we feel sorry for investors that suddenly got whacked: They knew that leverage loans are risky, that they’re issued by junk-rated over-leveraged companies with iffy cash-flows, often to fund their own leveraged buyout by a PE firm, and to fund special dividends back to the PE firm. Both factors apply to Clover’s leveraged loan. Investors don’t care. They’re chasing yield no matter what the risks, in a world where yield has been repressed by central-bank policies.

These slices are not liquid and they take a long time to trade, and trading is thin even in good times. But when investors want to unload, there are suddenly no buyers and the price just collapses (chart via Bloomberg, click to enlarge):

Clover Technologies, founded in 1996, is “the world’s largest collector and recycler of imaging supplies,” it says on its website, such as printer cartridges. It also recycles and refurbishes smartphones in facilities in the US, Mexico, Europe, and Asia for wireless carriers that then resell the refurbished phones to their customers.

So on July 9, Clover’s parent, 4L Holdings, disclosed to investors that Clover was losing two big unnamed customers. One was in its printer cartridge business. The other was a wireless carrier that was buying Clover’s refurbished smartphones, but has “decided to fulfill requirements for refurbished older units by purchasing them directly from the OEM,” such as Apple or Samsung. That customer remained unnamed, but “people” told the Wall Street Journal that it was AT&T.

In its disclosure to creditors, the company said that it had hired restructuring advisors, which is often an indication of a pending debt restructuring or bankruptcy filing. It invited creditors to organize and hire their own advisers. And it proposed a meeting for the week of July 22.

This was the moment investors woke up. When investors tried to sell their slices of the loan, they found that buyers at these prices had evaporated, and to sell the loan at all, they would have to take a big haircut.

When a highly leveraged company in an already tough business is threatened with the loss of revenues, there is no margin for error, as cash flow needed to service that debt can just dry up, and the results can be catastrophic for investors.

And even if the company can muddle through, at some point the debt matures and has to be refinanced, and when no new investors can be found to bail out the old investors, it’s over. This is what Clover is facing.

The $700 million leveraged loan is coming due in May 2020. Clover tried to refinance it last May, when it might have already known about the potential loss of customers, but had not yet disclosed it to investors.

It offered a juicy yield of nearly 9%, but investors balked and wanted a better price (higher yield), “people said,” according to the Wall Street Journal. Now, after the disclosures of the loss of customers, refinancing the loan is off the table altogether.

But Golden Gate, which had acquired Clover in a leveraged buyout in 2010, wasn’t shy about stripping assets out of Clover via $278 million in special dividends it extracted, according to Bloomberg: $100 million in 2013 and another $178 million in 2014.

That $178 million dividend was funded at the time by Clover issuing a new leveraged loan, the current one, whose proceeds were also used to pay off the prior loan (new investors bailing out old investors) and to fund an acquisition.

Golden Gate got its money out. Clover had more debt. Old creditors were bailed out by new creditors. The banks arranging the leveraged loan made a ton in fees. And everyone was happy. But now these new creditors – which include unwitting investors in those funds – ended up holding the bag.

On July 11, Moody’s chimed in with a devastating three-notch one-fell-swoop downgrade, to Caa3, just a couple of notches above default (here’s my plain-English cheat-sheet for the corporate credit rating scales by Moody’s, S&P, and Fitch).

“The downgrade reflects the likelihood of a default is high given the recent downward revision in earnings guidance following the loss of business and pricing pressure in both the imaging and wireless segments combined with the maturity of the first lien term loan in May 2020 that will put pressure on the business,” Moody’s said.

“The company’s hiring of restructuring advisors, request to meet with lenders in a few weeks, and challenges refinancing the term loan indicate a restructuring will occur soon,” Moody’s said.

“We also remain concerned about the longer-term business viability as a result of more limited visibility into forward financial performance and related uncertainties given the unexpected operating developments,” Moody’s said.

The near-default Caa3 rating reflects “the high balance sheet restructuring risk” along with the “near-term debt maturities,” and “the ongoing business and execution risk as management evaluates its strategic options,” Moody’s said.

These things don’t happen overnight for companies. They happen overnight only for investors.

The company had already suffered revenue declines and pricing pressures in its major businesses, according to Moody’s. Clover is also heavily dependent on just a few big customers, two of which are now leaving.

The secular downtrend in the printing sector and the competitive challenges in the smartphone-refurbishment sector, along with Clover’s high customer concentration were known to investors, but given the glory times we’re in, fundamentals no longer matter – until they suddenly do.

Moody’s also lambasted the company’s “aggressive financial policies, evidenced by its private equity ownership and history of shareholder distributions and large debt-funded acquisitions” — a reference to Golden Gate Capital.

Moody’s slash-and-burn downgrade, and the subsequent plunge of the loan deeper into distressed territory turned more institutional investors into forced sellers as they’re limited to what extent they can hold distressed debt. But it’s no biggie. It’s just other people’s money. And that loan is now a plaything for hedge funds specializing in distressed debt, and they’re hoping to make a killing. However this turns out, kudos to Golden Gate. They’ve done it again.

Good cross-post. No one likes losing 1/3 of their investment in 2 days.

A few more of these and we might get one of those ‘sudden stops’ in capital flows into Leveraged Loans and CLOs that Simon Johnson has written about.

If that happens….underwriters get stuck with heavy loan books that they need to off-load. If any of the bigger players find themselves short of liquidity….Fed has to step in to lend.

I don’t think there’s 2007-8 level potential here, but there might be an early-90s S&L level blow up possible.

Yeah, junk bond rates are now showing stress, but have not blown out yet. I thought last fall they were close. I think this fall they finally self destruct ending the expansion next year.

From the Payless Shoe link in the article:

“PE firms Golden Gate Capital and Blum Capital Partners acquired Payless in 2012 in a leveraged buyout when publicly traded Collective Brands was broken up. After Payless filed for bankruptcy in April 2017, aggrieved creditors filed a claim in bankruptcy court, alleging that Golden Gate Capital and Blum Capital Partners had siphoned over $400 million out of the company via a special dividend before the bankruptcy filing. The PE firms were concerned enough about this claim that they agreed to settle it in July 2017.”

Blum Capital is headed by Richard Blum, the husband of Democratic California U. S. Senator Dianne Feinstein.

It is easy to see why some maintain there is little difference between the Democrats and Republicans vis a vis the financial industry.

Nobody is imagining anything with Feinstein. She is one of the most probusiness dems out there that would make country joe biden grimace

That the government is supposedly ready to step in again to save the financial predator class is a sign that the entire system is ripe for collapse. Perhaps Marx will be proven right and Capitalism will destroy itself. I don’t know. Capitalism has shown itself to be quite resilient.

Why worry about the collapse of the big firms bringing on massive unemployment? Their antics these last few decades have already accomplished that task. Let us be pragmatic about it. The Predatory Financial Class has done it’s dirty work. Now it’s time to wind that project up and send those workers home too.

A neo-liberal definition of the UBI; the ‘Universal Basic Immiseration.’

“Perhaps Marx will be proven right and Capitalism will destroy itself.”

It seems of late that capitalists are destroying them self or being revealed to be frauds.

i.e. “McGlashan was charged with participating “in both the college entrance exam cheating scheme and the college recruitment scheme…Other individuals charged in this case work(ed) in the asset management industry (Robert Zangrillo of Dragon Capital Management, Manuel Henriquez of Hercules Capital, and John B. Wilson of Hyannis Port Capital).

https://www.institutionalinvestor.com/article/b1dmpcvw175wbh/The-Closest-Thing-to-White-Supremacy-I-ll-Ever-Get-to-Write-About

Noteworthy that his late brother, Charles McGlashan, a local supervisor, was the engine behind the “Smart Train,” basically a massive “green” land over-development scheme in the counties north of San Francisco.

“The town of Windsor…also hopes to have more than 880 housing units within a quarter mile of its existing train station by the time SMART commuter rail service is expected to start in late 2021 ….“When you look at what all of the other cities are doing along the line, it’s exactly what we need for transit-oriented development and also to provide ridership for the train,” Fudge said. “This is also important for combating the impacts of climate change.” Built it and thousands more will move in to fight climate change?

https://www.northbaybusinessjournal.com/industrynews/construction/9040505-181/santa-rosa-smart-housing-construction

How many ways is this whole process illegal?

Could a revolutionary change in governments and prosecutors put a lot of those involved in prison?

There is a peculiar thing about limited companies and bankruptcy and its been true for the 200 years that joint-stock companies have been allowed to attract investment. Declaring bankruptcy is a last-ditch event. For the Directors its clearly approaching as they observe the constantly shrinking amount of cash they have in the kitty but no-one says a word, hoping for divine intervention until the day dawns that creditors won’t accept another extension on the IOUs.

This is an accounting failure, yet another one to chalk up against that hopeless profession.

The best overall sporting goods store in California was a victim of this PE game. A few years ago almost overnight Sports Chalet went tits up…

Now, why couldn’t the PE pirates have bought Big 5 instead?

Thanks for this post. Until the 80’s this levered buyout biz with all borrowed money was illegal.

I think this line is key to the whole house of cards destroying the real US economy:

They’re chasing yield no matter what the risks, in a world where yield has been repressed by central-bank policies.

The Fed rates have been kept artificially low (below even 4%) for so long that normally conservative investors are driven to junk bonds. It’s almost like the Fed is feeding the grasshoppers eating up Main Street. The Chinese economy is much less threat to the US economy than Fed rate suppression on the one hand, and the domestic financial wild west on the other hand, imo..

You know, I started writing a long contrarian response and by the end I convinced myself that I was wrong.

This article is really about corporate raiding — a game which is played regardless of monetary policy. It is easier and more profitable when rates are low; but raising rates won’t eliminate the practice by any stretch.

On the other hand, loose monetary policy has encouraged companies to issue debt to buy back their own stock; and may also be keeping unprofitable companies alive (zombies).

Only this last item can be claimed to have a tangible benefit: if an economy is largely demand constrained then (after the finances and C suite have taken their massive cuts) a zombie company is still sending out paychecks. So there is a transfer from capital-rich investors to employees — recognized during bankruptcy — it is just woefully inefficient.

I don’t think the encouragement of prima-face toxic corporate behavior — raiding and buybacks — are worth the low-efficiency capital transfer.

>Thanks for this post. Until the 80’s this levered buyout biz with all borrowed money was illegal.

Illegal? Are you sure about this?

As I remember the story, a college instructor mentioned to a University of Pennsylvania class that many companies could take on a lot more debt, but arranging to borrow the enough money to buy the equity was the problem.

A young student in the class by the name of Michael Milken set about proving the instructor pessimistic and the Leveraged Buyout was born, which then morphed into Private Equity.

But illegal prior to the 80’s, I have not read that.

Perhaps banks and wealthy individuals thought it unseemly to attempt LBO’s/PE buyouts as an improper use of capital?

We did have companies taken over by conglomerates in the 1960’s using conglomerate stock as the currency of choice.

US Attorney Rudy Guiliani sent Michael Milken to the big-house for that innovation.

It wasn’t for the Milken Leveraged Buy Out innovation of borrowing a ton of money with junk bonds and buying a company’s equity

Per https://en.wikipedia.org/wiki/Michael_Milken

“In March 1989, a federal grand jury indicted Milken on 98 counts of racketeering and fraud. The indictment accused Milken of a litany of misconduct, including insider trading, stock parking (concealing the real owner of a stock), tax evasion and numerous instances of repayment of illicit profits.”

I may be wrong but his portrait is still on proud display at the Wharton School/U of P.

A true hero and one to be imitated.

He seems to have recovered nicely. He bought the Fleur de Lys estate in Los Angeles for $100 million a few years ago.

CDO – collateralized debt obligation

CLO – collateralized loan obligation

There is a totally different word in the middle

What could possibly go wrong?

Wait a minute, don’t loan and debt mean pretty much the same thing?

Those bankers are so clever, they fooled the regulators.

There is an incredible increase in these and other leveraged fixed income in Public Pensions.

But instead of putting it in the hedge fund or private equity bucket it is put in the bond bucket.

I blame the alternative public pension surge of these and PE and HF on Citizens United giving these firms the means to give secret donations to Governors superpacs and other state dark money pots.

“Noteworthy that his late brother, Charles McGlashan, a local supervisor, was the engine behind the “Smart Train,” basically a massive “green” land over-development scheme in the counties north of San Francisco.”

Transit oriented development, the sweet siren call of developers to ruin communities, over indebt them, trash their zoning laws, while stealing the property rights of their neighbors.

Not content to just trash communities along train lines, they now have a scheme to tell all communities that their R-1 residential districts are an environmental problem that can only be solved by letting developers randomly tear down single family to build high density multi-family. Because multi-family is better for the planet.

Another day, a new scam. Up is down, good is bad, everything you know is wrong. Zoning laws are so old fashioned. Trust me, I’m a developer.