By Christian Breuer, Junior Professor, Chemnitz University of Technology and Head of Wirtschaftsdienst and Intereconomics, zbw – the Leibniz Information Centre for Economics. Originally published at the Institute for New Economic Thinking website

Many critics have sharply attacked orthodox economics, the International Monetary Fund, the European Central Bank, and policymakers for their emphasis on austerity as a cure for lagging economic growth. A group of prominent economists responded by claiming to vindicate the traditional point of view (e.g., Alesina and Ardagna, 2010). They claimed that fiscal consolidations on the spending side can have positive effects on economic growth in the short run – the very opposite of what Keynesian economics would suggest.

Their arguments in favor of “expansionary austerity” have attracted wide attention and reams of favorable press coverage. Some of their claims have been questioned and several intricate debates have been joined, but the specifics of their econometric case have not received detailed scrutiny.[1]

In my new INET working paper, I revisit their method and identify a fatal fallacy of the case for expansionary austerity that by itself overturns the claims made for the view.

Statisticians call the mistake “reverse causality.” What it means, in this case, is that the statistical techniques adopted to test models of expansionary austerity fail to properly account for cyclical movements in the expenditure-GDP ratio. It follows that decreasing expenditure-GDP-ratios appear to cause an increase in GDP, instead of the the other way around.

In practice, analysts track how the rate of growth of the economy behaves when there is a reduction in the budget deficit or an increase in the budget surplus. The problem is that the budget balance itself responds to changes in GDP over the cycle. For instance, GDP growth tends to increase tax revenues. Hence, the budget balance estimates need to be corrected to isolate those “automatic effects” in order to define the direction and strength of the causal link between GDP growth and fiscal measures. The typical measure for this is the so-called “cyclically adjusted budget estimate.”

If the cyclical adjustment method fails to actually correct for the cyclical effects, a decrease in the adjusted deficit will erroneously appear as linked to a measure of austerity rather than to a previous and independent increase in GDP.[2]

In the paper I show that the method applied by Alesina and Ardagna (2010 and 2013) entails an incomplete cyclical adjustment problem. Specifically, it assumes that government expenditures, save for social transfers, vary with the rate of growth as GDP, so that the expenditure-GDP-ratio remains constant. However, this assumption is at odds with standard methods. Usually, cyclical adjustment methods assume that expenditure, save for social transfers vary independently of the cycle. With this assumption the authors generate the possibility that an upswing would automatically reduce the expenditure-GDP-ratio, and vice versa in a downturn.

Hence, their paradoxical result: if we associate any decrease in the expenditure-GDP-ratio with actual discretionary cuts to public spending, such decreases necessarily associate with increasing GDP even if causality clearly runs in the opposite direction: from GDP to decreasing expenditure-GDP ratios. Interpreting this correlation as evidence in support of expansionary austerity – as in so much of the literature and the policy discussion during the Eurocrisis – leads to serious errors.

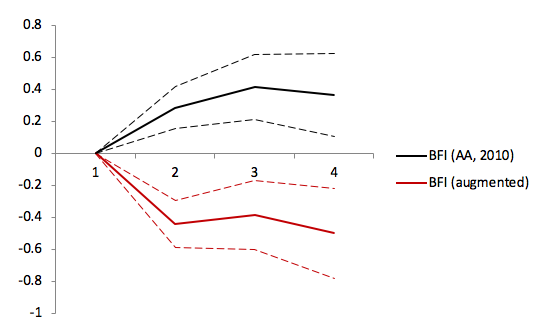

Figure 1 shows the two cases. The black line is the response of GDP to a one-percent reduction in cyclically-adjusted expenditures as computed by Alesina and Ardagna (2010), while the red line is the response of GDP to an identical reduction in my corrected estimate. Only under the special assumptions of Alesina and Ardagna does their approach produce results in support of expansionary austerity at the spending side. If we correct the expenditure-GDP-ratio with the same method but assume that expenditure are independent of the cycle (as it is usually done), the resuls are exactly opposite: expenditure cuts are associated with decreasing GDP in the short run.

Figure 1: Effects of a 1 percent of GDP expenditure-based fiscal consolidation, Alesina and Ardagna, 2010 vs. corrected method Note: t=0 denotes the year of a 1 percent of GDP expenditure-based fiscal consolidation on GDP. Dotted lines delineate one standard error confidence bands.

Conclusions

The critique in my paper focuses on the assumptions made in Alesina and Ardagna (2010 and 2013) which result in claims that spending cuts are positive for growth in the short run. After applying more common assumptions, this result disappears.

Their work and the whole literature following their approach is biased towards expansionary austerity on the spending side. This literature has been very influential in the academic debate, in fact, a large number of studies apply the same methods to test the impact of austerity on political outcomes, financial aggregates, or the current account with similarly innovative conclusions. The findings in my paper suggest that those results as well need to be replicated and subject to sensitivity tests.

My paper provides additional evidence that assumptions matter, not only in economic theory, but in empirical work, too. Researchers should clearly state and justify them, particularly if they are contrary to standards, but critical for the results.

References

Alesina, Alberto (2010) ‘My Answer to the Economist’, available at:

http://www.economics.harvard.edu/faculty/alesina/Alesina

Alesina, A. and S. Ardagna (2010), “Large Changes in Fiscal Policy: Taxes vs. Spending,” in: Brown, J. R. (ed.), Tax Policy and the Economy 24, Chicago: University of Chicago Press, 35-68.

Alesina, A. and S. Ardagna (2013), “The Design of Fiscal Adjustments,” in: Brown, J. R. (ed.), Tax Policy and the Economy 27, Chicago: University of Chicago Press, 19-67.

Alesina, A., C. Favero, and F. Giavazzi (2019), Austerity – When It Works and When it Doesn’t, Princeton University Press, 2019.

Blyth, M. (2013), Austerity: The History of a Dangerous Idea, Oxford University Press.

[1] See Krugman (2010 and 2015), Romer (2011), Islam and Chowdhury (2012), Blyth (2013), Frankel (2013), and Stiglitz (2016) for a critique of expansionary austerity and the conventional approach. More technical critique can be found in Jayadev and Konczal (2010), De Cos and Moral-Benito (2013), Perotti (2013), Guajardo et al. (2014), Jordà and Taylor (2015), as well as Yang et al. (2015).

[2] Refer to Perotti (2013) for a more extensive discussion of the “incomplete cyclical adjustment problem.”

[3] In a new book, Alesina, Favero and Giavazzi (2019) claim they provide additional evidence in support of expansionary austerity at the spending side. I do not address their new argument and methodology here, which focuses on the size of the multiplier and the supposed exogenous identification of austerity measures, using a form of “narrative method” that they had previously disparaged. See Alesina (2010) and the discussion in my paper.

[4] Alesina and Ardagna (2010) for example were cited 1.388 times (in April 2019).

i wonder….would supply side/reaganomics/austerity/market uber alles ever sell to a thinking public without the mighty wurlitzer* of Mindf%ck?

it’s been wall to wall on message for all my life, that government=bad, markets=perfect and that gdp** matters more than one’s lived experience.

(*see:https://www.citylab.com/life/2019/01/pizza-and-pipes-organ-music-restaurant-near-me/580327/ for the reference. when Rush Limbaugh first appeared, then fox news, those chaotic contraptions are what immediately came to mind…and add in the superdogmatic catechism of economics departments and MBA programs, and the all on the same page-ism of the business press(down to the lumpen version in the newspaper)…and it was all a superb example of how, with sufficient money and access, the Mind of Man can be led willingly into the Cave to stare at walls)

(** gdp, the official unemployment numbers, and on and on—the cognitive dissonance between trusting these official pronouncements so implicitly, and “government is Evil” is, i think, an overlooked ingredient to where we’ve come to)

As I was born in 1984 when Reaganomics was in full-swing, it is hard to imagine that there was a time when the monetary policy of many developed countries was not captured by neoliberal ideologues. I was constantly inundated with the neoliberal mantra of “do-well-in-school-work-hard-at-your-job-and-you-will-have-a-great-career-and-if-you-are-unsuccessful-it-is-your-own-fault-for-not-having-the-right-skills-or-education” growing up. Anyway, despite all of the wailing and gnashing of teeth about Brexit, the EU itself is basically a cesspool of neoliberal austerity and financialization at this point.

Sad to say, I think that all of the predictions of neoliberalism’s demise are premature. No matter how many times it seems to be proven wrong or unpopular among the public, it keeps being raised from the grave by the ideological necromancers of the political class. I fear that neoliberalism will continue to dominate much of the developed world for the next few decades at least. I hope I am wrong, but neoliberal financial policies are refusing to die all across the world.

It is amazing any economist could believe that taking money out of an economy would help grow the economy. It’s like applying leeches to cure anemia.

Every depression in U.S. history has been associated with federal debt reduction:

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

Obviously.

Economists believe what they are paid to believe. Anything else would be a betrayal of their absolute faith in ‘Free Markets’.

I’d add the post-Civil War impoverishment in the South to the list of depressions. Lincoln withdrew the greenbacks–which, counter to double-entry bookkeeping conventions were not counted as a liability, so technically a debt reduction not counted as such–and large populations in the post-Civil War South had to purchase everything on credit from the “Furnishing Man”…at interest rates that would make a payday lender blush. The Furnishing Man was later shortened to “The Man” and made part of songs (e.g. “Proud Mary”).

Many Southerners prefer to blame Northern banks for the Civil War (guess who funded the Furnishing man?)…and one can see why. Recommended reading in this connection: Lawrence Goodwyn’s The Populist Moment.

Goodwyn declares that in this post-Civil War era, the entire Confederate South had less currency in circulation than the state of Connecticut. The subsequent wave of asset forfeitures and foreclosures prompted creation of the Farmers’ Alliance and the People’s Party–which elected State and Federal officials. In related news, William Jennings Bryant launched his “Cross of Gold” campaign to encourage silver-backed currency to at least diminish the power of creditors…a movement that ultimately resulted in re-establishing a U.S. central bank (The Fed).

I’d suggest this is the era that most resembles the modern age, and Trump resembles Jackson–the guy who paid that debt off in 1835, then stole the Southeastern U.S. from the Indians.

A history buff told me that the Panic of 1837 wasn’t caused by Jackson’s National ‘Debt’ payoff. His account was that Jackson’s land theft resulted in huge expansions of slave-raised cotton land. The price of cotton tanked (even with 60% warehoused), and asset forfeitures and foreclosures began in the Panic of 1837. But that doesn’t contradict the observation that removing dollar financial assets from circulation by that debt paydown was a contributing cause. After all, the slave owners who bought slaves on credit had no dollar savings because of the payoff, so when their expected income didn’t arrive the effect of the National ‘Debt’ paydowns was to inject fragility into the economy, and make them vulnerable to foreclosure.

Off the wall thought: Maybe what Wolfgang Schaeuble said was the crux. “We are overbanked.” So it could be confused with over-supplied with money by simple association – but in fact being over-banked might well suck money out of an economy; away from grassroots and create massive inequality. And to restrict this sort of banking – say international investment banking – does help the economy recover. But there is no need to combine this with austerity. That clearly slows economic activity among the poorest, creating a dynamic that can no longer support all the high-flying financiers and over time we get the demise of Deutsche, etc. So the whole idea of just what money we are talking about gets lost in the weeds.

Bad assumptioms should be qualified as the worst mistake since these will certainly result in erroneous conclusionsThe Alesina and Ardagna papers should follow the path of that of Kenneth and Rogoff that was widely contested. Not surprisingly Kenneth Rogoff has evaluated positively the new Alesina’s book on this issue. So I wonder why the authors were conducted to use such bad assumptions and the only satisfying reason is that they wanted to please some particular kind of policymakers. Krugman identified the IMF as the main institution they wanted to please although they found criticism at the IMF! EU ordoliberals were more impressed and willing to take their results as an act of faith.

Has Austerity Been Vindicated? asks R. Skidelsky commenting on the new Alesina’s book and reaching a conclusion similar to Breuer’s. Skidelsky focus on the opposite assumptions, ideas and results between Keynes and Alesina and proposes anyone to decide what to believe after a short description of these…

Sorry for autoreplying just I forgot an argument. Skidelsky comments on the two pillars of Alesina’s thinking (he dismisses one as already debunked) and the other pillar is that

I find this argument quite disingenous. And if analysed carefully is quite an intellectual failure. Taxes on consumers or companies do not evolve in parallel during business cycles. Expectations, if it is about expectations, cannot be uniform. Second, and this has been a constant in recent history, companies and the wealthy have evolved ways to avoid paying taxes –or even have seen rates gone to zero in some cases– that make this taxes expectation theory ridiculous, nearly insulting

The problem with the Alesina and Ardagna analyses yielding the paradoxical result: “expansionary austerity” begins with the observation, indicated in this post: “In practice, analysts track how the rate of growth of the economy behaves when there is a reduction in the budget deficit or an increase in the budget surplus.” How did the rate of growth of the economy, GDP, become a function of budget deficit / budget surplus, and how did GDP become the economic measure of interest? “In the European fiscal crisis, this debate [about the effects of fiscal policy] has gained political importance since policy-makers have been searching for an efficient way to reduce government debt.” How did reducing the government debt become the most important problem for policy-makers? What happened to adjusting aggregate demand with aggregate supply up to the point of full employment, deficits and surpluses be damned and why worry about GDP?

The statisticians’ notion of “reverse causality” is interesting … but isn’t there a simpler error to describe the fallacy of constructing a model using expenditure-GDP-ratios to estimate potential increases or decreases in GDP — the “cyclically-adjusted primary balance (CAPB) strategy”? In its conclusion this post refers to “empirical work”. Is there empirical work that shows an increase in GDP following a regimen of applied austerity policy?

Excerpt from Mark Blyth’s Austerity: The History of a Dangerous Idea:

[p.179] “There are … cases where austerity as policy reached its limits and either broke down or broke the society it was being imposed upon. The natural histories of these episodes demonstrate quite clearly that economies do not ‘self-heal’ once ‘the bust’ has run its course. Austerity was tried, and tried again—its application was not wanting—and it simply didn’t work. In fact, its repeated application made things worse, not better, and it was only when states stopped pursuing austerity that they began to recover.”

When has “the obvious” ever been a factor in economic thought?

Globalisation has highlighted the problems of policymakers having no idea how the monetary system works.

Milton Freidman thought central bank reserves controlled bank lending, which is why his monetarism didn’t work.

Ben Bernanke thought banks were financial intermediaries, which is why he couldn’t understand debt deflation when studying the Great Depression.

No one could see the dangers of financial liberalisation or real estate booms and busts to financial stability, including the central banks.

They were never going to see the problem with austerity.

No one had a clue.

Why does austerity make the public debt-to-GDP ratio get bigger?

GDP shrinks more than the public debt.

The IMF predicted Greek GDP would have recovered by 2015 with austerity.

By 2015 Greek GDP was down 27% and still falling.

The money supply ≈ public debt + private debt

The “private debt” component was going down with deleveraging from a debt fuelled boom. The Troika then wrecked the Greek economy by cutting the “public debt” component and pushed the economy into debt deflation (a shrinking money supply).

There are even people in Germany that know why austerity doesn’t work.

“Austerity can actually increase the debt burden because it causes GDP to decline and hence the debt-to-GDP ratio to rise” Hans Eichel, German Finance Minister 17/11/2003

They only remember when Germany is in trouble.