Yves here. Anyone who romanticizes being self employed or gig work makes clear they either don’t know much about it or are trying to exploit people who wind up there.

By Nikhil Datta, PhD candidate, UCL ,and Research Assistant, CEP, LSE. Originally published at VoxEU

Is the rise of ‘atypical’ work arrangements – such as self-employment, freelancing, gig work and zero-hour contracts – a result of workers wanting such jobs or because they have no other choice? This column reports evidence from the UK and the US that while atypical workers may like flexibility, they would prefer a steady job. Indeed, workers would agree to earn less in order to increase their employment security.

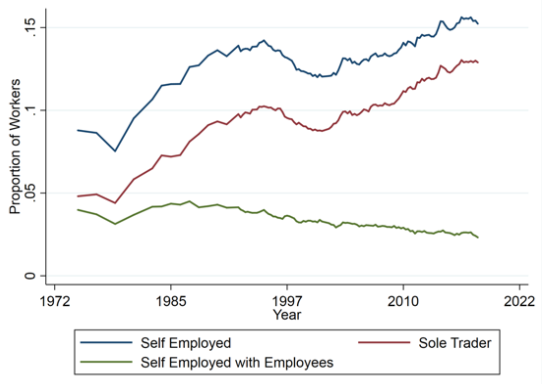

There has been an increase in the number of workers engaged in atypical work arrangements across the UK and the US. In the UK, the proportion of workers who are solo self-employed (encompassing freelancers, contractors, gig workers and one-person business owners) has doubled since the 1980s, as shown in Figure 1. The number of workers on zero-hour contracts has increased from 200,000 to almost a million since the turn of the millennium.

Evidence from Katz and Krueger (2019) shows that the US has experienced similar, albeit more modest, trends with the proportion of workers engaged in atypical work arrangements increasing by approximately 10-20% over the period 2005-2015.

Figure 1 Self-employment in the UK

Source: Labour Force Survey

What Does This Mean for Workers?

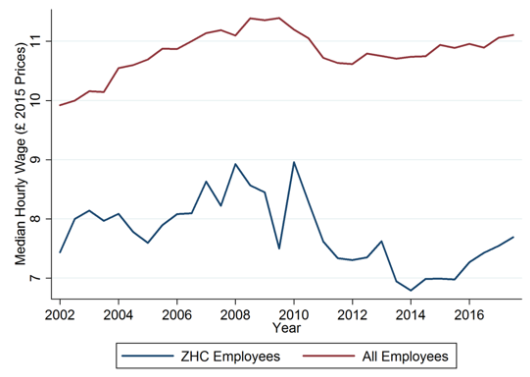

The implications of the changing nature of work have been hotly debated, especially at a policy level. In the UK, it has given rise to the government’s independent review of modern working practices – the Taylor Review (Taylor et al. 2017). Evidence from the UK’s national statistics suggests that the self-employed have lower weekly income than regular employees, and workers on zero-hours contracts experience lower hourly wages that dropped more than normal employee’s wages during the great recession (see Figure 2).

For the US, Katz and Krueger (2016) find that even after taking account of personal characteristics and occupations, workers in atypical work arrangements had lower weekly earnings. Atypical work arrangements are also not usually afforded certain non-pecuniary benefits such as job security, and holiday and sick pay (which is mandatory for all employees in the UK).

At the same time, such work arrangements are likely to offer other benefits, such as work and location flexibility, autonomy, and the opportunity to offset expenses in one’s income tax bill. This suggests two possible mechanisms may be responsible, and each having different implications for worker’s welfare:

- A demand explanation, where labour demand conditions for traditional employees are weak, thus pushing workers into more precarious working conditions with lower wages.

- A supply explanation, where workers are choosing to trade in pay and security for more flexible and autonomous working arrangements, with a favourable tax structure.

Figure 2 UK hourly wages for all employees and zero-hours contracts (ZHCs), 2002-2018

Source: Labour Force Survey

Two recent studies have looked at demand-side effects. Katz and Krueger (2017) find that in the US, workers who experience unemployment spells are more likely to be involved in a form of atypical work, while in Datta et al. (2019), my co-authors and I highlight the causal role of labour market regulation in the use of atypical contracts. The latter in particular exploits the introduction of the UK National Living Wage (which represented a 7.5% increase in the wage floor), and we find that both care homes and domiciliary care agencies responded by increasing use of zero-hours contracts.

A few studies have looked to estimate worker preferences over job characteristics and fringe benefits. Mas and Pallais (2017), for example, estimate how much job applicants would be willing to give up in terms of pay for a more flexible job. They find that hours flexibility is not largely valued by the majority of workers, though there is a small proportion who are willing to pay highly for flexibility. They do, however, find a strong aversion to jobs where employers have scheduling discretion.

In a recent study (Datta 2019), I go further and attempt to elicit the full distribution of valuations for a complete set of job characteristics, which are arguably the most important distinguishing factors for traditional and atypical work arrangements. These include job security, in-work benefits of holiday and sick pay, hours and location flexibility, workplace autonomy, and taxation implications. I do this for both UK and US respondents, thus allowing a cross-country comparison while taking a careful account of institutional differences.

The Experiment

Eliciting labour supply preferences is challenging. Realised choice data has a number of shortcomings including incomplete information on job descriptions and the available alternatives.

To overcome this, I exploit the trade-off between typical and atypical job attributes in an experimental research design where respondents in a representative survey are offered fictitious job choices, and where jobs are described by a wage and the aforementioned attributes.

Furthermore, respondents were explicitly informed that the jobs were identical except for those characteristics highlighted in the description. This part of the question was key to ensure analysis is causal. In total, approximately 4,000 people were surveyed – 2,000 in the UK and 2,000 in the US.

What a Worker Wants

My results suggest that on average, workers in both the UK and the US far prefer job characteristics associated with traditional employer–employee relationships. Workers are willing to give up approximately 50% of their hourly wage for a permanent contract and around 35% of their hourly wage for a one-year contract, in comparison to a one-month contract.

There are important institutional differences between the UK and the US when it comes to permanent contracts. In the US, only around 34% of employment relationship are afforded some type of ‘just cause’ protection in their contracts, whereas in the UK, permanent contracts by law offer benefits including mandatory notice periods, redundancy pay rights and unfair dismissal protection. Despite this fact, the valuations of a permanent contract are very similar between the two countries (55.4% of an hourly wage in the UK versus 44.1% in the US).

After contract length, holiday pay and sick pay (described as 28 days paid annual leave and 16 weeks paid occupational sick leave) are the most valued job characteristics, with UK-based workers willing to give up approximately 35% of their hourly wage for holiday and sick pay.

In the US, the figure is marginally lower at 27%. This is surprising given that employees there currently face no federal legislation on either, 23% receive no voluntary paid leave, and the average US employee only receives 14 paid days holiday per year. These results suggest that the majority of US workers may have a strong taste for UK-style labour market policies.

Workers do value characteristics associated with atypical work arrangements, although on average far less than security. I find that workers are willing to give up on average 24% of their hourly wage for location flexibility, 14% for hour flexibility and 11% for workplace autonomy (the ability to choose the tasks they perform).

Surprisingly, neither US nor UK respondents are willing to give up any wages to be able to declare taxes as self-employed – in the UK, respondents actually want to be paid to take on this job characteristic. This holds even for just those who are self-employed and would have better knowledge of the value of the attribute. This finding suggests that declaring taxes as self-employed is seen as potentially time costly.

Heterogeneity analysis reveals that, at the mean, respondents in atypical work have a comparatively greater valuation for atypical job attributes, suggesting that individuals sort into types of work based on their preferences. Despite this fact, atypical workers still value job security more than any other attribute. Distributional analysis suggests that in the UK, over 50% of self-employed individuals would prefer to be in a traditional, permanent 9am-5pm work arrangement.

Conclusion

My results suggest that the majority of workers prefer characteristics associated with traditional employee–employer relationships, and this even holds for the sub-sample of those in atypical work arrangements. Rather than suggesting that labour supply preferences have contributed to the rise in atypical worker arrangements, I find that the changing nature of work is likely to have significant negative welfare implications for many workers.

In the UK, these results give credence to certain policy recommendations outlined in the Taylor Review (Taylor et al. 2017). In particular, those aimed at securing workers in precarious employment relationships rights closer to employees. It is vital, however, that further analysis be performed on the demand side to confirm how firms may respond to such policies.

See original post for references

The UK benefit package described of 28 paid days off and 16 weeks of “occupational sick leave” (not sure exactly what the distinction may be between occupational sick leave and any other kind) — sounds like nirvana to this American. On this side of the pond, employees have to work 15-20 years for the same employer to get that kind of vacation package.

And in the U.S. of A., of course the answer to a request for 16 weeks of sick leave would be “NEVER.”

File under oligopolistic behaviour rather than competitive behaviour as atomistic competitive with a side of some notion of equilibrium – if there is such a thing …

Do I get a cookie now – ????

I would offer a (very small) counter example – there is a subset of people who do benefit from casual and freelance working arrangements – the retired. I know quite a few retired people who wax lyrical about zero hours contracts (I practically spilt my beer over myself one time when I first heard the words ‘I love zero hours contracts’ said in my presence) – they love the freedom of being able to do occasional work for extra money without any real responsibility. Of course, this only benefits them because they already have a financial base in their existing pensions plus healthcare arrangements.

A smaller subset of people just don’t like permanent jobs. One of my nephews lives entirely off zero hours contracts, trekking tour guiding and freelancing as a personal trainer. He loves the freedom it gives him to do what he wants, but then he has the NHS behind him in the event of illness and to his mothers despair has no interest in the mortgage/marriage treadmill. I know quite a few like him, but they are statistically a very small minority, and many will change their mind as they grow older I’m sure.

I don’t know how common it is, but one irony of greater IT dependency in my organisation is that its cut down on our use of professional freelancers. We once used many – either consultants or ex colleagues who had retired – but our recent IT ‘upgrade’ means that for both practical matters (it takes weeks of training to use it) and data security reasons, we’ve had to cut out his type of arrangement almost entirely, much to the delight of our Union.

My US employer has been outsourcing union IT jobs. They are willing to sacrifice functionality to attack the union. Unfortunately, the contract let’s them do it. There’s now no one on site to deal with problems.

your liabilities (rent, insurance, software “cloud” payments, utilities) are fixed and rising (“nominal” gdp growth obsession).

income is variable and dropping.

guess who the system will finance to expand their business? your liabilities crowd or you?

capitalism is dead. no one wants to figure out the replacement because criticizing capitalism is not good to get a stable paycheck.

capitalism is dead. nothing but the truth

Rather, what philosophically consistent definition of capitalism could possibly require the following:

1) Government-provided insurance for privately created deposits/liabilities rather than inherently risk-free debit/checking accounts for all citizens at the Central Bank itself?

2) A government-provided lender and asset buyer of last resort?

3) Positive yields/interest on the inherently risk-free debt of the monetary sovereign?

correction:

Rather, what philosophically consistent definition of capitalism could possibly ALLOW the following:

And I’ll add:

4) Needlessly expensive fiat?

for those who would bring back the Gold Standard in the name of capitalism.

Long-time freelancer here. And, yes, if someone offered me the right steady job, I’d probably take it.

Warning to prospective employers: Slim has a very low tolerance for BS. Especially when it involves words like the ones described in this NC post:

https://www.nakedcapitalism.com/2019/06/book-review-john-patrick-learys-keywords-the-new-language-of-capitalism.html

Any-hoo, back to my original comment. There are two things that have really bothered me about freelancing:

1. The availability and cost of health insurance for the self-employed. Obamacare has helped, but freelancers were struggling long before it arrived. And many still struggle with insurance difficulties.

2. Getting paid in full in a timely manner. And don’t finger-wag me about having good contracts. There are far too many clients who will treat freelancer contracts like toilet paper.

Been a freelancer for nearly 20 years myself. Lots of ups and downs, jobs that I don’t get paid for months after finishing the job (sometimes never paid), pay rates that fluctuate between less than minimum wage to a couple thousand a day, have never been stable enough to afford health insurance, and doing taxes each year is complicated and expensive.

That said, I too like the “freedom” of it. Having the ability to pursue my own creative passions being the main one but there are other little life perks to it.

Yet, I wouldn’t recommend it to anyone who values stability or wants to plan for their future. There’s a constant feeling, no matter how well things are going, that the rug may be pulled out from under you at every moment. That each job may be your last. I have been evicted twice in those years, had to stay at friend’s places on sofas or whatever. I have many friends who have stayed with me when on hard times (including two right now). Collect bills and debt until a good gig comes along and I can pay them off. Sometimes that’s soon after – right now I’m going on about a year of piling them up. I’m fortunate though that my profession afforde that kind of pay every now and then. No “gig economy” job does that.

There’s a reason the romanticized “starving artist” stereotype exists. Why anyone who isn’t deeply (obsessively) passionate about their work would want to live/work this way is beyond me. I’ve often said this was not a career choice, it’s a mental illness I’ve found a way to get paid for. No one should be made to work/live this way if it’s not their choice. Freelance work is exploitation. Suffering for my art is fine. Doing it for some board of directors and their stock portfolios (or whatever) is horrific.

My wife’s nephews are in the Hollywood Scene, as actors and producers. They are fortunate in having chosen to be born into some wealth. No ‘starving artist’ lives for them. Phyl, their aunt, is a classic ‘starving artist’ type. She would deny herself comforts, sometimes basics, to pay for art supplies. She says that it keeps her sane. I imagine that it does, and, despite my mini-petit-bourgeois ‘sensibilities,’ I always have supported her in this. (Despite occasional passive aggressive persiflage.)

These two approaches to “art” are somehow complementary. The “art” continuum is wide. Good luck on your projects, all of them.

I know quite a few retired people who wax lyrical about zero hours contracts (I practically spilt my beer over myself one time when I first heard the words ‘I love zero hours contracts’ said in my presence) – they love the freedom of being able to do occasional work for extra money without any real responsibility. Of course, this only benefits them because they already have a financial base in their existing pensions plus healthcare arrangements. PlutoniumKun [bold added]

This argues then that people should have independent means FIRST in order to maximize their work satisfaction. Then they can freely choose to work for wages, be self-employed, work gigs, volunteer, etc.

The question then is why wealth is so poorly distributed that this is not the rule, rather than the exception?

Surely injustice is a cause and one need look no further than government privileges for private credit/debt creation to find a major cause of injustice.

The more fundamental power issue is that employees have leverage against their employers even without a union, because to a large extent they are the company. A mass of dispersed, atomized casual workers like Taskrabbits or Uber drivers do not have that leverage because the company has been designed to make them interchangeable parts.

So many analyses of work try to avoid taking into account class conflict and power dynamics, but nothing makes sense otherwise. They also take our current society for granted. It is easy to imagine happy unionized gig workers in a more socialistic society with all the basics of life, from housing to health to education to transportation, guaranteed as rights.

“It is easy to imagine happy unionized gig workers in a more socialistic society with all the basics of life, from housing to health to education to transportation, guaranteed as rights.”

sure. and really the direction we need to move, basic income can all go to the landlord, but the basics of housing provided for all isn’t so easily gamed …

Even more basic, I think, is the failure of the self-employed to organize themselves around work issues. They join professional organizations but not unions or union-like organizations. So they confront the at-work problems of self-employment one person at a time, generally ignorant of their rights and powers while dueling against cadres of managers and lawyers.

For 30+ years I was a member of a union of self-employed writers–yes, a union–and a contract advisor and grievance officer there. Our members got better contracts than non-union members, despite no collective bargaining, and won 80% or so of their grievances. A freelancers organization lobbied for the ability to file non-payment grievances with their state’s Labor Dept and won. A computer programmers collective educated their members about breach of contract and cut in half their losses in contract disputes. I say this to indicate that self-employment can be effective if you, well, work at it. But if you’re passive about making it a success, it usually won’t be.

The other issue, of course, is what can be done to improve conditions more broadly. Like requiring all independent contractors (a subset of the self-employed) to be enrolled in the basic worker benefit programs–unemployment, disability, workers comp–and legislating affordable health care for all. Labor unions should do more, too; they generally don’t see beyond collective bargaining but they should seek protections for all workers regardless of employment type.

I don’t understand this passage. What is the “value of the attribute” of being taxed as self employed?

QUOTE-

Surprisingly, neither US nor UK respondents are willing to give up any wages to be able to declare taxes as self-employed – in the UK, respondents actually want to be paid to take on this job characteristic. This holds even for just those who are self-employed and would have better knowledge of the value of the attribute. This finding suggests that declaring taxes as self-employed is seen as potentially time costly.

I don’t know about the UK, but in America, self employed people have to shoulder the burden of both their “usual” tax withholdong, but also the equivalent amount generally ‘contributed’ by the company one works for. For example, my taxes for Social Security went from about six percent of gross wages when I was an employee of another to about twelve percent when I filed as self employed. Deducting that ‘extra’ half of the gross tax from your Form 1040 is a cumbersome and annoying task. Especially if you are not automated to any degree. That extra percentage adds up over time. If you cannot get higher wages then you would get while an employee when you become ‘independent,’ then it isn’t worth the effort. Unfortunately, many employers now will require one to register as ‘self employed’ to get work at all. This is simple exploitation since the former ’employer’ is offloading some of the regulatory burden onto the shoulders of the former, or potential employee. As is the case of, most famously WalMart, the distressed worker is steered into social safety net programs run and paid for by the State. (I nearly typed Satan there instead of State. My biases showing themselves.) Another case of “Privatize the profits and Socialize the losses.”

Basically, declaring your own taxes is costly in terms of both time and money.

UK doesn’t have filing requirements if your income is wages

I’ll hazard a guess and say that there is no medical insurance tax time song and dance in the UK due to the NHS. Is it a fairly simple process there? The present system here is a huge tax upon an American’s time and treasure.

Employees in the UK are all on what’s called PAYE — Pay As You Earn. Your employer deducts income tax and National Insurance (for the NHS and pensions etc.) from your wage before you get paid.

If you have no other source of income there is no paperwork for you at all, and no tax bills to look forward to.

Sweet!

Grebo and Todde, it’s the same in the US for employees. It’s called “automatic withholding.” You only have to file if you want a refund, and it is a simple form labeled “EZ.”

We are talking about people who are not employees, but self-employed contractors. They have a minor-to-severe paperwork headache to deal with since of course there is no withholding and you have to decide how much of your income is earnings and what can legitimately be classified as expenses. Most people get a tax preparer or accountant to do it, at a cost of at least $500. I would be surprised if the story weren’t the same in the UK.

I’m not up to date on the situation for contractors in the UK. Some years ago the New Labour government eliminated many of the advantages, and also made it harder to claim that status if you resembled an employee too closely. That pissed me off as I regarded it as one of the few ethical ways to escape wage slavery and was heading that way myself.

There were companies that would do all the accounting and tax paperwork for you. It was an extra cost but a small one compared to the increased pay.

Thanks ambrit, interesting points.

Thanks,see also Jeremy Grimms response just below. Being an “Independent Contractor” has it’s limits.

I don’t understand the quote either. In the US you can only pay taxes as self-employed if you are paid on a 1099 form. I did know of friends who went to lengths to get paid on a 1099 but it took some connections and pull to arrange receiving pay on a 1099 form in the kind of contract work I did. Besides many of the supposed advantages of filing as ‘self-employed’ evaporated in a series of IRS rulings and practices.

At one time, someone paid on a 1099 form could profit from incorporating. As a corporation they could purchase health insurance benefits and charge them as a business expense to the corporation thereby reducing the taxable corporate income. Their corporation could lease the car they drove and pay its insurance and these were business expenses. It has been years since I read up on this stuff but there were many other advantages to incorporating yourself when you could. I believe a sole proprietor could also claim these kinds of tax advantages — but your corporation could pay you, its employee a lower salary and keep some of the income as retained earnings [this was back in the day when we still had progressive income taxes].

The IRS was not happy with this situation. It’s one thing to allow corporate persons to weasel their taxes but the IRS saw red when human persons started trying the same tricks. A series of IRS rulings, changes to the tax code, and IRS enforcement practices took away many of the advantages of incorporating. [But don’t worry, the IRS did make allowances for Chapter S corporations which I think were crafted to benefit medical doctors, and some attorneys.] One especially nice IRS enforcement practice — helped promote the creation of contracting firms — also called job-shops — when a person paid on a 1099 failed to pay the taxes that the IRS felt they owed the IRS started seeking the money from the entity that paid the absconding person on a 1099. Of course this meant companies started insisting on a cut-out to generate paperwork making their contract labor an employee of a cut-out “contracting-firm”.

It didn’t take long for the contracting firms to keep larger and larger cuts from the money paid for the work done. State and local governments helped with licensing laws to make if difficult for any person or group of persons who had to work for a living to set up a contracting-firm of their own. In Florida a company that contracts with hospitals and insurance companies to provide temporary nursing services must have a nutritionist on staff. Without that additional cost as well as other costs tied to licensing niceties — what is to stop a group of nurses who might get together pay for a commercial phone and hire someone to call around to hospitals to place them in temporary jobs? Part of the answer is that nurses are not interested in business and business details. They are interested in helping patients. The other part of the answer is that few nurses have much ‘extra’ they could put into setting up a business and even as full-time employees of a hospital most of them don’t have anything approaching regular hours.

I heard about some of this from a contract nurse in Florida who was paid — this was years ago — $7 and change per hour for work providing home nursing care to quadriplegic accident victims. She said her hours were billed to an insurance company at $21/hour by the nursing care job-shop she worked for as an employee. The shop used the difference to pay the FICA and state unemployment taxes and cut checks to their nurse employees. Other than the cost of paying a relatively low-paid phone solicitor to call around for work and place nurses in temporary jobs, the shop had the usual overheads of a small store-front business location, a phone listing, and a list of hospitals and insurance companies who would do business with them, a list of nurses, and a nutritionist “on staff”. The hospitals and insurance companies would only do business with shops and only with some shops that went through some kind of vetting process. Of course the hospitals and insurance companies had considerable leverage over these contracting firms. [I trust you don’t believe in such fictions as a labor “market”.]

I don’t know about nursing, but in the contracting work I did there were several players above the contracting firm that kept a cut from the hourly rate paid by the entity directing the work — the US Treasury in the case of the work I did.

I would not go through any lengths to be paid as 1099, W2 is preferable, as with W2 contracts, I believe Social Security and Medicare has to be withheld, plus you are eligible for unemployment if you otherwise qualify.

Rich people can think some stupid tax break is better than unemployment and contributing to social security for their old age. But working stiffs, even though these aren’t generous programs at all, can’t afford not to get as much as they can from them.

You are saying you won’t jump through hoops for a few piddly tax breaks. Neither would I.

You have to remember we once had steep progressive taxes, contractors once received a substantial bump in pay for working as a contractor — at least in certain fields, medical and dental costs weren’t so outrageously high, few of us carried student debt, rents were were lower, cars cost relatively less, gasoline was cheap, you do pay FICA [Social Security] on a 1099, and the tax breaks could be substantial if you knew how to play it — although most of them are long gone for most people paid on a 1099. This post believes in something called “traditional employee–employer relationships” and apparently believes there is such thing as a labor market, market in the sense of the fictional Market economists believe in.

Very informative, thanks! I know a guy who does freelance art and an accountant once set him up as an s corp IIRC… And he’s able to do what you said used to be done, deduct so much that it wipes out his taxes. Even FICA as I understood him. I looked into it though and the gloss I read sounded like it had no benefit. I don’t have his accountant, ha.

So in your view the labor market is a fiction because stacked in favor of ownership and employers?

I should be more exact. There is a market in ordinary usage wherever you have a seller or sellers of a good and a buyer or buyers for that good — but a market like that doesn’t mean anything special. To me a market in the sense most economists like to talk about markets is what is more exactly described as a market where conditions of perfect competition exist. Grabbing just the bullet point headings from [https://en.wikipedia.org/wiki/Perfect_competition#Idealizing_conditions_of_perfect_competition]:

— A large number of buyers and sellers

— Perfect information

— Homogeneous products

— Well defined property rights

— No barriers to entry or exit

— Every participant is a price taker

— Perfect factor mobility

— Profit maximization of sellers

— Rational buyers:

— No externalities

— Zero transaction costs

— Non-increasing returns to scale and no network effects

Add a few other assumptions to these axioms and you can derive all sorts of results showing how wonderful ‘markets’ are for just about whatever you want them to do. Phillip Mirowski states that Hayek and Neoliberal Economics have gone so far as to make the Market their epistemological tool for discovering Knowledge.

So I suppose there is a labor market using the word market in a very ordinary sense but the labor market doesn’t come anywhere near meeting the conditions of perfect competition.

Well, get enough piddly tax breaks and pretty soon they amount to real money. Then there are the larger tax-deferred savings and being able to control their investment, the depreciation allowances, finding disability and health insurance that suits you instead of your employer, picking up your kids after school or taking them to a doctor when they’re sick instead of when your boss lets you. Things like that. Then, too, there are some fields where self-employment is more appropriate than others.

But, yes, I agree that you need to be able to afford the risk. And, yes, the environment for self-employment has been made worse in the past several decades. All the more reason for the self-employed to organize. And, yes, for employee or self-employed alike, the US leadership is committed to using us up and spitting us out as fast as they can hire H1Bs or impoverished countries to replace us. So isn’t the real problem them, not self-employment?

As a one time commercial construction “job shopper,” I’m here to testify to the long term disadvantages of ‘gig’ work. Except for the fortunate few who are employed full time as dedicated repair workers or crew management most commercial construction workers I have met are employed for the length of the project. After that, back to the scramble for a new job. The long term effects are thus based on, first, a constantly interrupted flow of wages over a worker’s lifetime, second, little or no premium to wages for the nature of the employment, third, a substandard accumulation of retirement resources as a knock on effect of the first two points. I am presently wrestling with the results of those long term effects of ‘gig’ working. Basically, pun intended, I am dealing with a lower level of Social Security payments, and almost nothing else to supplement our “retirement” income. Phyl gets several hundred dollars a month from Social Security because she worked at low paying jobs during the sixties and seventies. If she was on her own, she would be living ‘over the garage’ in one of her sibling’s homes.

Another factor not mentioned here is the fact of worker business ability variability. An example being myself and my miserable business sense. I tried my own business in plumbing and failed miserably. Contractors who wouldn’t pay, either on time or at all. Individual customers who did the same. Misbidding contracts. Materials price rises between the bidding process time and the construction time. In smaller projects, the competition is so fierce, I have seen medium sized contractors purposely underbid a project, as in a small loss, to keep a long term client happy and coming back for more. A really small contractor cannot compete against someone who is willing to take a loss on a project, for any reason.

As for insurance for a really small contractor; what’s that? Never heard of it. The term ‘precariat’ is not restricted to individuals. Small businesses often fall under that definition.

So, from my perspective, the overwhelming desire for “regular” work contracts is very understandable. Especially if you ‘game it out’ into the future.

Oh, and one more point. There is no intrinsic value in being poor, or even near poor. “Poor but honest” is an oxymoron.

I suppose studies like these are necessary, but it boggles the mind to think that we need to prove that all these taskrabbits and Uber drivers don’t prefer these exploitative situations.

For a while — the few years while things were fat in the kind of contracting work I did — a contractor could receive a considerable bump in pay by working as a contractor. You had to be willing and able to move anywhere in the country where a contract had been let, you had to have the right-stuff on your resume [this was not the filter then which it has become now], you had to be able to show up at the job-site in a week or at most two to begin work, and you had to be up-and-running at full speed by the second week on the job. I was young, single, medical and dental care was affordable. All of the jobs I worked had contracts of at least a couple of years so I could remain in one place for a year or two at a time. Of course I could be laid-off with an hours notice and escorted out the back door at any time at the employer’s whim.

Besides the bump in pay what made this kind of work attractive to me was the deep disaffection I felt for working as a direct for any of the companies where I had been employed early in my work life or the companies I contracted to later. Direct employees were paid less, had less challenging work, and the companies were using the employment of contractors like me as a way to trim their employee staffing to bare bones. The companies were constantly bidding on new work or continuation of work so they tried to keep employee staff size at a minimum while being able to quickly staff up with contractors to fill the gaps if a big contract came in. As time passed I noticed I had greater job security than the direct staff at several of the places where I contracted.

As the years went by and jobs left for far far away, there were fewer slots for contractors, and fewer direct employees. There were also a lot more slots for foreign contractors working for the likes of TATA on any kind of job that didn’t require a security clearance and the market was flooded with new STEM graduates. The bump for living like a gypsy grew smaller and smaller and the costs of medical and dental care went up. I left the road and went to work for a large contracting firm with reasonably stable long-term contracts, a decent rate structure and benefits — based on the premiums they could charge for their name — and I hunkered down for slightly more than twenty years.

As for the conclusion of this post — “the majority of workers prefer characteristics associated with traditional employee–employer relationships”. What traditional employee–employer relationships? This is 2019 not 1955! We already have a job-world “securing workers in precarious employment relationships [with] rights closer to employees”. Employment in the US is precarious for anyone who has to work for a living. The main difference for a contractor versus employee shows up in which pile of tax forms they need to file, and employees have crappy health insurance which will soon be as good as the complete lack of health insurance a contract employee might have. And what is this “analysis be performed on the demand side” baloney? The way this post is written it sounds like the author believes there is some kind of “job market”.

Well, a study was needed to show that water is wet. The idea that most people prefer a steady and dependable paycheck as oppose to some hoped for extra hazard pay as freelancers is apparently passing strange to some. So why not believe in a still existing “job market” just as some still believe in the

tooth fairy“invisible hand of the free market.”and the hazard pay often doesn’t show up for what are economic bargaining reasons, if work is always being scrambled for, with contracts always ending, there is some tendency to want to undersell oneself out of the sheer *need* for *work*. Desperate people don’t make the best bargains. The best position to bargain for wages at a new job is when one is employed and not on a contract which is ending in a couple months. Contracts have been becoming shorter and shorter term over time as well.

I find Figure 1 very interesting. It shows a comparable trend between self employed and sole traders, but a great drop of self employed with employees.

Well, it’s the red tape that does that, innit.

To have an employee means not just paying his/her wages, but also an obligatory layer of legal and accounting compliance, coupled with risk of being taken to cleaners by an odd rotten apple.

Been there, done that. Including the rotten apple bit.

I no longer employ anyone. All work done for my firm is on a contract basis.

If projects come our way that may necessitate taking people on as employees, we just don’t bother.

BTW, I run a construction industry related consultancy here in U.K..

The big elephant in the room is incompatibility of contract work with rearing children.

1) By not having a predictable income in the future one risks that in the future there will be a long period of time when he won’t have money necessary to provide for the child. That is even if the long term average income is OK (averaged over like 10-20 years) the sole fact of not having money at some critical period is risky.

2) In cases of child support courts are not good at calculatiing incomes of people without a steady income for the purposes of child support. You risk going to jail because a court “imputed” your income too high in a situation (lack of predictable income) that it is not good at estimating incomes.

In case you are payer of child support and have a lack of income or a depression in income for a long period of time (a period with no contracts) you may go to jail even if your long term average income is OK, because you won’t be able to pay a fixed monthly fee during the period you have no contract.

3) The influence of unpredictable income on ability to have economic ability to have children is highest for young people. Old people on contract can have savings from good times, and use them in bad times. Unfortunately for fertility it’s the young people who have the highest biological ability to have children.

So this contract work system is like biological suicide for a nation – it makes it too risky for the people who can have children (young people) to have children, and moves the economic viability to have children to the time, when they are biologically too old to have children.

4) Having children means the need to have some guaranteed time for the children. The uneven work hours for gig/contract work make it impossible. Again the average may even be OK – like having some months being fully busy, with some months with more spare time than an employee. But the facts that you’d be expect to literally neglect a child for months because of work requirement make such work incompatible with the needs of children.

So in general if we assume that one of the major purposes of the income should be to make it economicaly viable to have children, then the contract/gig work system is a failure.

Did I miss something? Contract workers in the US are rarely, if ever, given benefits such as health insurance. That is part of this push for contract work. In my field (biotech) it is rampant and despite (or because) having a PhD and a wealth of experience, it is not that easy to get a permanent job with full benefits. At least in the UK there is the NHS. the health insurance part is a huge difference between the US and UK

There will NEVER be such security in this current system of things run by Satan. He wants you always worked up so you are blinded to the truth of the Father and His greatness. Fortunately we are now at the doorstep of Gods Kingdom taking over rulership here on Earth and destroying all worldly governments and their adherents who refuse to now acknowledge him and live by his standards.