CalPERS, which has endeavored to wrap itself in the mantle of ESG virtue-signalling, now finds itself embarrassed by its connection to Leon Black, the founder and long-standing head of private equity heavyweight Apollo, who in turn is more than trivially connected to sex offender Jeffrey Epstein, whose misdeeds are now coming under renewed scrutiny.

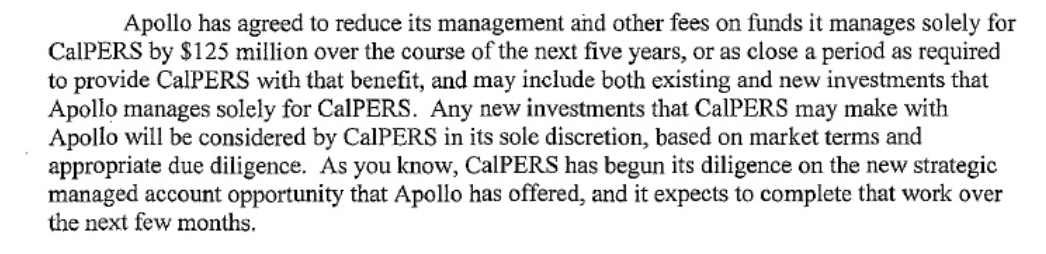

It’s telling that image-above-substance-sensitive CalPERS is bothered by being tainted by being one of many limited partners in Apollo funds, when it chose to look past lasting institutional damage done to CalPERS when a pay-to-play scandal that had Apollo providing the overwhelming majority of the dodgy money led to the conviction of former CEO Fred Buenrostro for fraud. Yet, as the letter embedded at the end of this post shows, CalPERS’ attorney Philip Khinda of Steptoe & Johnson, who headed the whitewash investigation of the pay-to-play affair, the giant fund took a fawning posture towards Apollo in accepting a settlement proposal from Apollo that may never have been properly papered up or accounted for.1 And more important, it looks likely that CalPERS got shortchanged on the fee reductions it was promised.

But back to the current scandal, which has a Master of the Universe looking like he’s been caught with his pants down. Not only is Leon Black’s name in Epstein’s infamous black book, but Epstein was an “original trustee” of the Leon Black Family Foundation, dating from 1997. Black has attempted to disavow state filings that reported Epstein as still on the board through 2012, years after Epstein pleaded guilty in 2008 to solicitation of prostitution. Black has tried claiming that the filings were in error and Epstein left the board in 2007.

Even less credible are Black’s claims about his relationship with Epstein. Bloomberg published a story earlier this week, Jeffrey Epstein Had a Door Into Apollo: His Deep Ties With Leon Black, which depicted Black as having permitted Epstein to solicit other Apollo executives for his “personal tax strategies”. The Bloomberg piece was clearly based on inside accounts. The article also had a section on CalPERS’ hand-wringing:

“Calpers takes this issue very seriously,” Wayne Davis, a spokesman for the Sacramento-based pension, said in an email last week. “The actions our general partners take, both in professional and private contexts, impact our assessment of which firms we desire as long-term partners. We consider any issue, including reputational risk, a serious matter if it impacts a firm’s ability to be successful.”

He said Tuesday that the pension fund is “in the process of contacting Apollo to discuss this.”

All CalPERS can do is make sanctimonious noises. The idea that Black would do anything other than repeat his official story is ludicrous. One wonders who CalPERS thinks will be impressed by its efforts to have a tea and cookies chat with Black about his poor taste in friends. Dumping its stakes in Apollo funds on the secondary market would come at a very high cost, particularly given how much CalPERS would need to unload.

But for CalPERS to act like some sort of naif about Black and Apollo and cop that had every reason to think Black was an upstanding guy is laughable. Not only is chicanery the default in private equity (see numerous articles about how the industry rips off investors, as well as SEC fines and disgorgements, including by Apollo) but Apollo was at the center of the bribery scandal from which CalPERS has yet to recover.

And there would be quite a lot to discuss if Black could be persuaded to be candid. Black claims that he turned to Epstein for professional advice on taxes, philanthropy, and estate planning. Why would someone like Black turn to Epstein, who has no training and no demonstrable basis for claiming expertise, when Black and Apollo have access to the top professionals, including tax attorneys who could treat discussions as attorney-client privileged?2

However, Black sent a letter to Apollo limited partners, which quickly made its way to journalists. Black also read it out loud on the Apollo earnings call earlier this week. It didn’t seem to do much to assuage doubts. For instance, the New York Times pointed out:

Mr. Black described his relationship with Mr. Epstein as one largely limited to tax strategy, estate planning and philanthropic advice.

“I want to emphasize that Apollo has never done any business with Mr. Epstein at any point in time,” Mr. Black said in his letter, a copy of which was reviewed by The New York Times.

Most important, he wrote, “I was completely unaware of, and am deeply troubled by, the conduct that is now the subject of the federal criminal charges brought against Mr. Epstein.”

But so far, Mr. Black has not discussed a company that he and his four children — as well as Mr. Epstein — invested in three years after Mr. Epstein pleaded guilty to a charge of soliciting prostitution from a minor in Florida. Mr. Epstein’s financial advisory firm took a roughly 6 percent equity stake in Environmental Solutions Worldwide in 2011. Two of Mr. Black’s sons serve on the board of the company, which makes emission control products, according to the company website.

Similarly, from Dan Primack at Axios:

Leon Black yesterday spoke publicly for the first time about his relationship with Jeffrey Epstein, in response to a question from JPMorgan analyst Ken Worthington.

He mostly just read, verbatim, the letter sent last week to Apollo employees (which is quite similar to a letter Apollo sent yesterday to its limited partners).

But he also said:

“There has been a virtual tsunami in the press on the subject. It’s seems to be the gift that never stops giving. For the press, it’s salacious. It involves elements of of politics of me too, of rich and powerful people and and my guess is it will continue for a while.”

I can’t speak for other media, but my interest in this story isn’t because it’s salacious or because Leon Black is rich. It’s because he continues to refuse to answer a central question about judgement — why he donated $10 million years after Epstein plead guilty — and Black’s judgement is a big part of what Apollo sells its shareholders and limited partners and portfolio companies. So, yeah, this will continue for a while.

Back to CalPERS. Let’s look at the key section of the deal that Black offered to CalPERS to make up for a pay-to-play fee that was so ginormous that it looked like a bribe, and some of that money did go to CalPERS CEO Fred Buenrostro in cash in paper bags.3

We’ll charitably assume this flimsy commitment was firmed up and properly commemorated.

Notice how this section twice refers to funds managed “solely for CalPERS”. That means a dedicated fund, not a “co-mingled” fund, meaning the common form of private equity fund. These dedicated funds are called “separately managed accounts”.

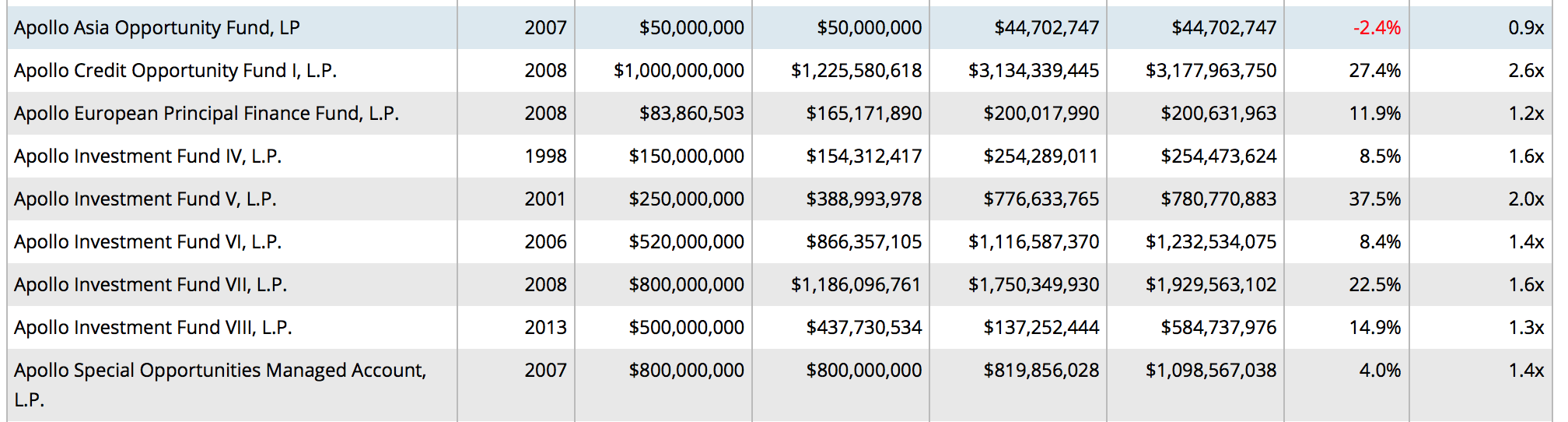

If you look at the list of CalPERS’ current Apollo investments, you’ll see only one that looks like a separately managed account, the 2007 “Apollo Special Opportunities Managed Account.”

In theory, there might have been other separately managed accounts in 2010 that were liquidated since then, but the fact that Apollo hasn’t wound up 1998 and 2001 funds makes that seem unlikely.

The Apollo proposal says it agrees to reduce its “management and other fees on funds it manages solely for CalPERS by $125 million.” It also has verbiage about a new fund that appears never to have been consummates, since its “vintage year” would have been 2010 or later, and we see no fund like that (Apollo VIII in 2013 is a “flagship fund” with lots of investors).

But what are “fees on funds”? Aside from management fees, it’s hard to think of any. This clearly means (well, clearly if you’ve gotten down the curve a little bit on private equity sharp practices) means fees paid at the private equity fund level, not at the portfolio company level. Note also that fund expenses, like the cost of preparing books and records, are expenses, not fees, and aren’t eligible either

The Apollo VIII limited partnership agreement (and any CalPERS agreement is likely to closely parallel it) draws a clear distinction between portfolio company level fees (which are defined as “special fees” and the management and unspecified fund-level fees.

Similarly, the so-called “carry fee” is not a fee as defined in the limited partnership agreement. Pages 37 through 39 set forth “Portfolio Investment Distribution,” known in the trade the “waterfall.” And the 20% cut of the gains that goes to the general partner is repeatedly called a distribution, not a fee.

So CalPERS had $800 million of committed capital that was eligible to have its management fee waived until the $125 million was exhausted. Recall that management fees usually step down after the fifth year and are usually based on the amount of capital then deployed, and not the committed amount.

Some simplifying assumptions:

1. CalPERS was already a full three years into its 2007 fund by the time its fee reduction agreement with Apollo was effective. So it would have only two years of fee reductions at the full management fee rate

2. Due to the size of the commitment, the management fee was 1.75% (this if anything is conservative)

3. It effectively dropped to half that after the investment period of five years, meaning after the two years left at full rate on this fund.

2 x $800 million x 1.75% = $28 million

7 x $800 million x (.5 x 1.75%) = $ 49 million

Total = $77 million

So a reasonable guesstimate is that CalPERS got less than 2/3 of the face amount that CalPERS was supposed to receive from Apollo as compensation for the harm suffered by CalPERS, when CalPERS expected to get it all back in five years or so.4 And that’s before recognizing that letting Apollo and its fellow bad boys pay not a dime in cash was a ginormous concession. Black is worth nearly $7 billion. His worst take-home pay in recent year was $142 million and it’s been as high as in excess of $400 million. But CalPERS is too cowardly to demand that Apollo, which in this case would have been Apollo principals, to be personally responsible for their bad acts.

But the economics for CalPERS are even worse than the simple math suggests.

Remember those portfolio company fees we mentioned earlier? They are hidden from investors like CalPERS but really add up. Remember that the total cost of investing in private equity has been estimated at 7% a year. A bit over 60% of the total, meaning over 4% in total across the industry, are fees that don’t relate to performance, meaning not carry fees. That gives an idea how hefty those hidden charges are.

Some of those portfolio company fees are “offset” against the management fee. We say “some” because only fees that are specified in the limited partnership agreement are offset (and private equity firms have cleverly dreamed up other fees as the press and later the SEC has exposed) and those specified fees may not be fully offset (the average in recent years across all funds is 85%, but CalPERS is generally able to get higher offsets, and the level of offset also depends on how hot the private equity market is. In the most recent flagship fund, Apollo VIII, the offset is 100%).

The effect of getting rid of the management fee is that there would be no management fee against which to “offset” the portfolio company fees that would otherwise be offset against them. The effect is that Apollo could pocket all of the portfolio company fees, rather than have to reduce the amount of management fee to reflect the portfolio fee offset. That effect would reduce the economic value of the management fee reductions, 50% of all portfolio company fees (the not-specified ones that haven’t been subject to offsets and the ones that are) would seem to be a conservative estimate.

So I welcome seeing Leon Black squirm. And I wish the press were making CalPERS squirm for the right reason, for being such a dupe. But sadly, reporters and limited partners would rather play supplicant to private equity overlords, even when that amounts to becoming their victim.

____

1 As the post discusses and the letter below shows, Apollo was supposedly willing to provide $125 million in fee reductions. The so-called Steptoe Report touted that four funds, Apollo, Relational, Ares and CIM had “agreed” which means “offered on their terms” to provide $215 million in fee reductions. Yet of the total in pay-to-play fees, $48 million came from Apollo and another $10 million from Relational, Ares, CIM, and Aurora Capital. So we already have the head-scratcher that Apollo is on the hook for 58% of the givebacks when it supplied 83% of the dirty money.

2 The conventional view is that Epstein’s wealth came from extorting men who took advantage of the women and underaged girls he had in tow. I don’t find that credible since procuring and extortion both are crimes. Anyone Epstein tried to shake down on that basis could stare him down and tell him to try risking going public, it would be a sure-fire jail sentence for Epstein.

However, I am told that private jets get cursory to no checks when coming in from overseas if the jet owner is seen as being reputable and not coming in from a destination perceived as a risk for drug hauls. So I wonder if the real service Epstein was offering was indeed tax “planning” in the form tax evasion by transporting high-value assets to tax havens.

3 The Steptoe & Johnson report attempts to depict Apollo as a victim of the placement agent Al Villalobos. If you think Leon Black could be victimized, particularly to the tune of $48 million, I have a bridge I’d like to sell you.

4 Reading just the excerpted paragraph, it’s clear that the real intent of the fee waiver was to induce CalPERS to sign up for a new separately managed Apollo fund, which it appears never happened.

I wouldn’t be too sure about this. Intelligence services have been doing this for a long time – the British intelligence services specialised in it as a means of gaining control over ‘fringe’ politicians. It doesn’t have to be a crude quid quo pro form of blackmail. It can be simply a case of indirectly letting someone believe that they’ve been recorded with (for example) an underaged girl or boy. It then becomes ‘understood’ that everyone is on the same side (‘hey, we all have our little preferences, nobody outside our circle of friends needs to know’). Epstein could have used this as a means of keeping his contacts firmly on his side, even when it wasn’t always in their interest.

Intelligence services are part of government and anyone who is part of government would have the protection of government and would not be subject to prosecution. Someone would fabricate an alibi in a worse case scenario.

Epstein is not part of government. He’s a felon. He would have been directly procuring the women in question and likely “partying” with the johns. This isn’t at all the same as the case of someone recording sex with a minor (or even a not minor) when the person involved in the set up had or could credibly be made to have clean hands or the person who set up the john was different than the person making the shake-down (the latter is more likely with the intel services, separation of roles).

The widely-held picture of Epstein is a man who was close to openly engaged in sex trafficking of young women (literally buying them on his runs to Asia), sleeping with his stable and whoring them out to other men. This is not even close to how an extortion racket runs. You don’t have a guy with hands who are dirtier than yours, that you could out for even worse crimes, running shakedowns. Epstein was almost certainly having sex with underage women more regularly than any of the men in his circle.

Think of this as violating the rules of mutually assured destruction. You don’t use nukes on a fellow nuclear power.

On top of that, private equity professionals are top negotiators and have an extremely refined sense of power dynamics. Some of them have strong ties to intel services and spooky types. I know of one person who tried defying Mike Milken back in the day. His Lincoln town car was boxed in in broad daylight on Park Avenue and shots fired at it. No one would steal a Lincoln town car, particularly in such a showy way. Everyone in his office understood that this was a message. Epstein would also have been at that sort of risk and worse for trying to shake down the wrong super rich people. Start with the Clintons.

Now the one way he could have extorted someone that I would accept is of a married man without a prenup who was afraid of divorce. But any woman after say 2002 or 2005 would have to know if her man was hanging out with Epstein, he was probably up to no good.

Those are pretty good arguments, I can’t quibble with anything you say.

I was wondering the same myself PK. I came across a story about how Epstein made a deal with the government in exchange for information. I suppose that they wrote off all those young girls as a ‘cost of doing business’. If this was the way that it was, then Epstein could have told Leon Black that everything was sweet and that they could still do business as he had made a deal with the government. This would explain why Epstein was still on that board four years later. It would also explain why the FBI closed out their case against him in 2008.

I went looking for the original article that I saw but Google is only really showing a Daily Mail article. I won’t even mention that the name of the FBI Director back then was Robert Mueller as this sort of deal would probably have needed his stamp of approval. Oh, I just did-

https://www.dailymail.co.uk/news/article-7306597/Jeffrey-Epstein-got-sweetheart-plea-deal-FBI-informant-government-records-reveal.html

I’m sorry but the prosecutors I know don’t buy the Acosta story at all. They get that Acosta was told that Epstein had intel connections as a trump card to get him to back off, but no way do they buy that that was anything other than an excuse. The case would not be reopened if he had bona fide intelligence service coverage. He would have been tipped off overseas and never come back to the US. A guy like Epstein could get a little plastic surgery and hang out in Switzerland.

Also notice how the plea deal was crafted to cover ONLY the one Federal district that prosecuted Epstein. That too is unheard of and not consistent with him having actual protection.

And why would anyone do business with someone who is extorting him? You make a payoff and get as far away from them as possible. So many people continuing to be social acquaintances of Epstein is at odds with him extorting them.

Another reason to doubt it specifically in terms of Black is, if you recall Inside Job, that it described Wall Street types hiring prostitutes openly, as in running the payments through their firms’ research budget, as widepread. Why take the risk of involving a third party when you can keep stuff like that in house? I have heard a credible account with considerable supporting detail of how one major Wall Street firm has prostitutes on its payroll as secretaries.

For historical background: Leon Black’s father was Eli M. Black (1921–1975), who was chairman of United Brands Company. A number of authors have described the role of United Brands (formerly United Fruit) in smuggling illegal narcotics. Eli M. Black committed suicide in 1975 by jumping out a 44th floor window of the Pan Am Building. According to Wikipedia, “at the time, federal regulators were investigating allegations that United Brands was bribing Honduran government officials.”

There was once a small army of investigative reporters seeking the crumbs of truth about United Fruit’s century of alleged crimes in Central America and the support for them from the USG. Apparent suicide by defenestration was popular after 1947, though it declined in popularity owing to the sealed windows in new construction.

United Fruit, like Roy Cohn, attracted the great and good as ruthlessly as it extracted resources. John Foster Dulles, both as Eisenhower’s Sec’y of State and managing partner of Sullivan & Cromwell, vigorously represented United Fruit. His brother, Allen, also a partner at Sullivan and Eisenhower’s CIA director, did the same. They were part of a coterie of Ivy League lawyers and investment bankers that moved interchangeably from private to government practice.

Neither Dulles apparently drew much distinction between theirs, their clients’ and the government’s interests. The apocryphal coinage – what’s good for GM is good for the USG – applied equally to the relationship between United Fruit and US foreign policy.

Yves, thank you for your continuing coverage of CalPers.

I still have seen no convincing explanation of where Epstein’s money came from.

I suspect that there are people who have been very careful to not find out.

It just keeps getting uglier.

“Attorney General Becerra is gonna be all over this!”

+1

My understanding is that honey traps are ubiquitous. That their exposure would result in mutual assured destruction assures eventual cooperation rather than exposure and prosecution. The latter frightens the horses and involves picking up too much broken china.

*Sigh*

Honey traps are set up, usually by government-connected and therefore government-protecte people, with lower level individuals approaching the target. It’s unheard of for the mastermind setting up the honey pot to engage in the criminal conduct in a more visible and extensive manner than the target.

You recite the formulation for govt intelligence agency traps designed to compromise lower level assets and extort their cooperation. It ignores others.

You make clear that Epstein’s limited experience and formal training would have made him an unlikely choice to manage a large investor’s portfolio. It would have put him off-limits to institutions, for example, meaning he needed access to individual large investors.

Sexual procuring would be one substitute attractant for a normal pedigree. But the predation involved in Epstein’s arrangements involves higher than normal risk of criminal liability. Even with a lot of juice, the threat is considerable, notwithstanding Epstein’s Roy Cohn-like ability to attract the great and good. But as with Cohn’s alleged relationships with Hoover and Spellman, to name two, the at risk behavior generates an unusual mutuality.

Presumably, the financial arrangements Epstein facilitated carried a similar level of risk and reward: possible criminal tax avoidance and money laundering, for example. The common thread seems to be the mutual high-risk behavior.

Is it possible that Epstein’s organization simply represents to his clients, the notion, illusury, or not, that he is the influencer of last resort?

It seems the PTB put great effort into making sure that the pols they ‘buy‘ will always answer the phone, with that in mind, could Epstein be a guy who sells the notion that his connections are ‘special’, and so he can promise his clients the sort of back-door access that rightly or wrongly they think they need?

Remember the current push in the intel community to provide our government with full-spectrum dominence, part of which is collecting ‘everything‘.

Is Epstein’s business model selling the notion that he has a corner on that particular portion of the ‘spectrum‘?

IIRC, J. Edgar Hoover was at one time the Tzar of sleazy intel, did Epstein simply take over that function?

IMHO any explanation of how Epstein got to be worth what appears to be hundreds of millions of dollars is worth considering. For the reason outlined above, I don’t buy the extortion theory. I can’t see it working in enough cases to come even close to the $ he has, if at all.

The access idea is consistent with the stories of the sort of parties (not with underage girls, high end Manhattan parties) he’d hold. Important connected people were impressed at how many important connected people were there.

I believe that this “access peddling” theory is going to prove to be correct. Rich people need access to politicians. Politicians need their money. Making this relationship transactional is the definition of “bribery,” so some sort of money-laundering needs to take place.

This is the entire basis of lobbying as a profession — with the lobbyists taking a commission on both ends of the deal. I know of many rags-to-riches stories that have come from this sort of relationship. Access to a president is worth tens and even hundreds of millions of dollars to the right person.

Maybe a good place to look for how he made his money would be his elusive accountant.

https://www.vanityfair.com/news/2019/07/how-jeffrey-epstein-worked-wall-street

It’s downright journalistic malpractice that Cohan doesn’t mention that said accountant was a “senior tax accountant” at the criminal organization of Drexel Burnham Lambert. (Wasn’t tax-avoidant vehicles one of their bread & butter services after racketeering?)

https://www.24-7pressrelease.com/press-release/326436/harry-beller-cpa-named-a-vip-member-of-worldwide-whos-who-for-excellence-in-financial-services

The FCC should invoke the character clause in broadcast licensing to deny the Cox Communication TV station sale. The Apollo CALPERS incident is grounds.

Just to clarify, Buenrostro was convicted of fraud, but admitted to accepting cash bribes in shoeboxes and paper bags as part of his factual proffer in support of his change of plea.

It is uncontroverted that a major source of the bribes was Leon Black’s Apollo, but Al Villalobos, the middle-man, blew his brains out rather than have to face trial. It’s also evident that the Feds tried to “flip” Buenrostro, but that he did a “Frank Pentangelli” and clammed-up. Much of the money was never recovered.

That CalPERS management and the CalPERS board remain in bed with Apollo is further evidence of the “Stockholm Syndrome” mentality in Sacramento. Ironically, the Crocker Bank robbery by Patty Hearst and the SLA fugitives during which Myrna Opsahl was shot dead was in the Sacramento area. Even though Hearst was clearly suffering from “Stockholm Syndrome” just like the CalPERS board is, she went to prison (although not for Opsahl’s murder). Will they?

Follow the money…

Thanks for the fine points. Please note that the US Attorney’s Office used this headline in announcing the Villalobos indictment, Placement Agent Charged with Bribery in CalPERS Corruption Conspiracy , when I don’t see them as having listed “bribery” as one of the counts. I have not looked at the actual filing, but the press release says the charges were “charges of conspiracy to commit corruption offenses and to defraud the United States, engaging in a scheme to conceal material facts from the United States, and conspiracy to commit mail fraud and wire fraud.”

The DoJ announcement of the conviction of Buenrostro also makes the bribery aspect prominent. Its first sentence:

Below are two links

This link has the initial indictments filed against Villalobos and Buenrostro:

https://8lf734editt4cekir2tpb4c1-wpengine.netdna-ssl.com/wp-content/uploads/2013/03/Buenrostro-Indictment-March-2013.pdf

This link has the superseding indictment filed against Villalobos after Buenestro plead guilty:

https://www.justice.gov/sites/default/files/usao-ndca/legacy/2014/08/08/VILLALOBOS%20-%20Superseding%20Indictment.pdf

Thank you!

Yves,

When CalPERS CEO and Board members were caught committing massive fraud, why was CalPERS (new CEO Stausboll who had reported to Buenrostro) allowed to be in charge of the “investigation” literally investigating itself? Did state officials not want the public to know?

CalPERS staff told me that Steptoe staff downloaded files from employee computers and then erased all potentially incriminating files. CalPERS staff were very upset at the whitewash

Thanks for the intel. The investigation was well before I started writing regularly about CalPERS; I did a post on the “Steptoe Report” years later.

My guess re Stausboll is:

1. She’d been Chief Operating Investment Officer, meaning not near pulling the trigger on investments and thus presumed not to be in the bribe loop

2. She’d published the report that showed the ginormous placement agent fee which led to inquiries which led to the prosecution. She could have been naive or she could have been cunning and known that putting the info out there would lead to Buenrostro’s ouster.

The big point implicit in your question, and it’s key, is why didn’t the board lead the investigation? The investigation arguably set the bad pattern of the board ceding power to staff over matters it never never should have delegated. But four of the 13 board members were tainted (one died, one didn’t run for re-election, two resigned, if I have it right), and another at least two looked pretty damaged by defending Buenrostro way longer than they should have (board President Rob Feckner and Priya Mathur). But it seems obvious that the two ex-officio members, the Treasurer and Controller, should have taken the lead. I don’t know why that didn’t happen.

It wasn’t just then-Treasurer Bill Lockyer (a “colorful” career politician, to put it mildly) and then-Controller John Chiang who failed to lead. Then-Attorney General Jerry Brown never bothered to file criminal charges, just a weak-tea civil action. The Feds had to make the criminal case, which was only filed after the CalPERS internal cover-up was well under way.

Follow the money…

FYI, Jerry Brown just endorsed Jelincic’s opponent in his run for CalPERS board.

<sarcasm… Yep, the Democrats in California are ever-so-much more honest than the R's </sarcasm…

This link is to an article in Slate describing how Epstein collected scientists as well as “girls”. The article came to me via someone I know distantly who said she was Leon Black’s secretary at Drexel back in the 1980’s. I was in politics for many years working on civil rights. In my day I would have regarded Epstein as a “fixer”. Someone who had nice things to share such as private islands and who made life easy, connected, and without consequence for the wealthy and powerful.

https://slate.com/technology/2019/08/jeffrey-epstein-science-eugenics-sexual-abuse-researchers.html?fbclid=IwAR2NEpyVB55zkXUcJbGD8LCuxUUlpw-QT8cj8Lw0H5BekRnZjTOFCjnjEYs