Yves here. There’s a school of Hong Kong protestor critics that tries to depict them as sore losers over Hong Kong’s decline in status relative to mainland cities, particularly Shanghai. Some go further and charge that China doesn’t need Hong Kong. This article explains why those claims are exaggerated.

By Alicia Garcia Herrero, the Chief Economist for the Asia Pacific at NATIXIS, adjunct professor at City University of Hong Kong and Hong Kong University of Science and Technology ) and visiting faculty at China-Europe International Business School and Gary NG, Economist at NATIXIS. Originally published at Bruegel

Hong Kong’s current situation is important for the world in as far as its role as major offshore financial centre is key for China’s inbound and outbound investment and financing. Capital outflows from Hong Kong are especially risky given Hong Kong’s so far useful but rigid monetary regime, namely a peg to the USD under a currency board.

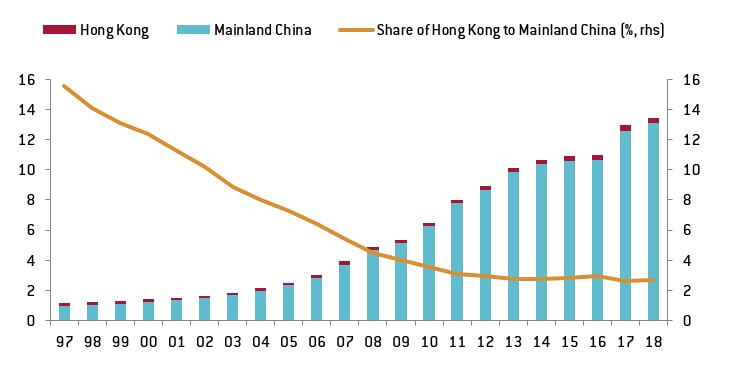

Discontent is running deep in Hong Kong, currently facing the most severe political crisis since the handover almost two decades ago. The recent turmoil has prompted analysts to review Hong Kong’s economic importance to Mainland China and many have concluded that what was the once “Pearl of the Orient” is no longer important. It is true that the share of Hong Kong’s GDP to the rest of China has declined from 16% in 1997 to 3% in 2018 (Figure 1). Statistics seem to provide a clear view of Hong Kong waning relevance but this is not the full story. A narrow comparison solely focusing on the evolution of GDP masks Hong Kong’s economic and financial relevance, not only to Mainland China, but also to the rest of the world.

Figure 1: GDP of Hong Kong and Mainland China

Source: Natixis, Bloomberg

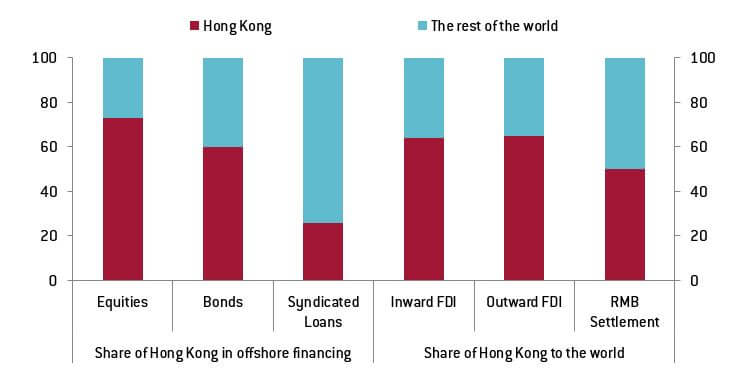

To gauge Hong Kong’s real relevance, we need to move beyond GDP and consider the key soft spot for Mainland China. This is Hong Kong’s financial acumen and, in particular, its offshore centre status. To build an offshore centre of the size of Hong Kong, with global relevance, the city’s economic foundations are based on free capital movement while Mainland China still maintains a relatively closed capital account. This means that Hong Kong can facilitate the Mainland’s access to foreign capital. In fact, Hong Kong is Mainland China’s preferred offshore centre. As regards raising funds offshore, Hong Kong was the home of 73% of Mainland companies’ initial public offerings (IPO) overseas during the period 2010 to 2018. In the same vein, Hong Kong accounts for 60% of overseas bond issuance of Mainland companies and 26% of their syndicated loans (Figure 2).

Figure 2: Hong Kong’s Financial Relevance to Mainland China (2010-2018)

N.B. Non-listed bonds are excluded from calculation. OFDI data as of 2010-2017. RMB settlement data as of 2018.

Source: Natixis, Bloomberg, The People’s Bank of China, China Ministry of Commerce

Beyond funding, Hong Kong is China’s most important springboard for foreign direct investment, either into or outside China. In particular, 64% of Mainland China’s inward FDI comes from Hong Kong and between 2010 and 2018, 65% of outward FDI was channelled through Hong Kong. The high share indicated Hong Kong’s role as the immediator between China and the West, which is due to the trust of Chinese and foreign firms on Hong Kong’s institutional framework and funding pool for their investments. In the specific case of mergers and acquisitions, Hong Kong has played a key role as its unique status has facilitated Chinese companies’ overseas acquisitions.

In addition, Hong Kong has long been China’s largest offshore RMB centre, for long a key policy initiative of the Chinese government in its pursuit of a staggered opening of the capital account. Other than RMB settlements, Hong Kong also holds a special access to China’s equity and fixed income markets, though the Stock and Bond Connect.

Therefore, Hong Kong’s role as the China’s financial arm for the rest of the world has helped Mainland China in keeping its financial sector insulated without suffering the negative consequences of such isolation, i.e. limited access to finance or difficult access to assets in the rest of the world. In essence, Hong Kong has long been China’s financial firewall.

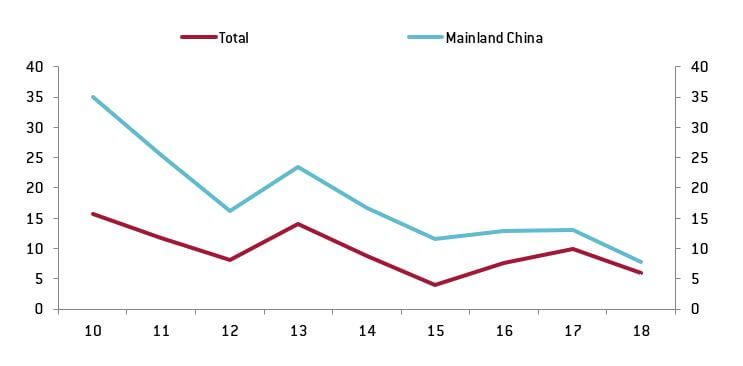

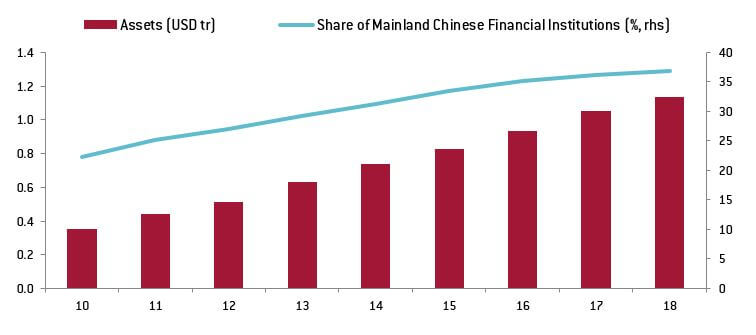

The second important aspect to consider is that Hong Kong’s financial system is increasingly dominated by Mainland Chinese banks. At the same time, overseas bank assets held by Mainland Chinese banks are also heavily concentrated in Hong Kong. The large exposure means that the destiny of Hong Kong as an offshore financial centre affects China even more than it affects those from the rest of the world. Mainland Chinese financial institutions have expanded 3.2 times since 2010, reaching USD 1.2 trillion (Figure 4) and have had a much higher growth rate than the rest of the banking sector (Figure 3).

Figure 3: Growth Rate of Bank Assets in Hong Kong by Institution (%YoY)

Source: Natixis, Hong Kong Monetary Authority

Figure 4: Assets of of Mainland Chinese Financial Institutions in Hong Kong

Source: Natixis, Hong Kong Monetary Authority

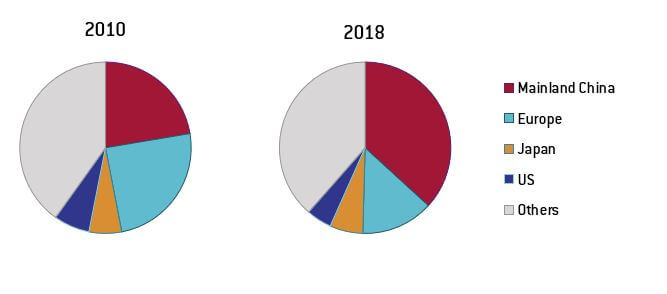

While Hong Kong’s bank assets have grown very fast in an aggregate term, China has outpaced all the other countries as their share of assets in Hong Kong’s banking sector increased from 22% in 2010 to 37% in 2018 (Figure 4). The surge draws deep contrast to European banks, which have barely increased its exposure in Hong Kong, and the much slower pace of Japanese and American players (Figure 5).

Figure 5: Total Bank Assets by Region/Economy of Beneficial Ownership in Hong Kong

Source: Natixis, Hong Kong Monetary Authority

Finally, Hong Kong’s offshore financial sector has been extremely successful so far, at least when measured by the increase in size. Bank assets-to-GDP ratio has expanded from 462% in 2002 to 846% in 2018. Since the introduction of the currency board in 1983, Hong Kong managed to keep the currency peg and stability amid political risks from time to time.

The dilemma that Hong Kong is facing is the increasing dependence on Mainland China both economically and financially has happened with the HKD pegged to the USD under a strict currency board arrangement. In other words, while shocks to the economy are likely to come from Mainland China, Hong Kong cannot count on any exchange rate or monetary policy due to its dependence and linkages to the FED.

There is no doubt that the current HKD regime has helped Hong Kong build a massive offshore financial centre, but it does not offer any respite if a negative shock affects the economy, which is exactly where we are today. And the same huge size of China’s offshore centre can become a problem if Hong Kong experiences capital outflows as a consequence of recent events. In other words, while Hong Kong forex reserves can cover the monetary base by approximately 2 times, the lack of capital controls implies that capital flows can be very volatile. If we add the fact that deposits in Hong Kong are massive, which amounted to USD 1.7 trillion and equivalent to 469 % of GDP, it seems obvious that forex reserves are not as ample if they need to continue to cover the monetary base in a situation of large deposit withdrawals.

Not only is Hong Kong important to the rest of China, especially in the financial sector, but its intrinsic risk is also even higher than that of other financial centres as it sits on a very rigid monetary regime. Beyond Hong Kong’s financial institutions, those who will be the most affected by the arising risks are clearly the Mainland Chinese banks in town.

Had to read this twice. I’m confused. Sounds like HK has gladly become the middleman between China and the world and is making tons of profit from this offshore venue – but because HK has no control over exchange rates or a monetary policy on its own, it is now in jeopardy of having a dangerous economic imbalance where its bank assets (not Chinas?) have doubled relative to its GDP. So inequality thrives. Which means unemployment is a big problem, yet the word is not even mentioned. My synapses went off with the reference to GDP because just a few days ago there was an article about a new bill here requiring all incoming foreign investments to be taxed and that invested money made part of our GDP, all of which was intended to lessen financial profits and benefit society over time. This sounds like HK willingly became China’s financial firewall but did not defend itself very well against capital flows. And because of all the dollar pegging involved HK cannot now get out of this mess. So what I don’t understand at all is why then does HK want China and Chinese banks out of their city when that will crash whatever functioning economy they do have. Why are they so mad at China?

And sort of another question, why are capital flows such an insurmountable problem these days. They have been so since LTC in the late 90s. Is it what it looks like – there really is no place to invest all that “capital” – capitalism can’t keep up with capital? And why, after 20 years, doesn’t HK understand this? Too busy raking in all those fees?

“And sort of another question, why are capital flows such an insurmountable problem these days…”

Trickle down economics is BS to the tenth power???? No matter how many ways it is rebranded or whatever “-ism” is the alleged idrology?… Maybe that is it?

I’m thinking with HK it’s more plunder than trickle down. And HK is caught right in the middle.

Hong Kong could be China’s LTCM as it is highly leveraged.

Any messing with Hong Kong by China’s military could send it over the edge. Speaking of which John Meriwether (LTCM) has a firm (Sycamore) in Hong Kong helping mainland Chinese invest globally. At the same time global investors use Hong Kong to invest in mainland China.

It will be interesting to see how this shakes out. When England signed Hong Kong over to China, a fifty year treaty was put in place allowing Hong Kong to be self governing with an executive with its own financial system until 2047. Two systems and one government.

When the HK handover was being discussed, I remember some crusty old British Lord-or-other advising that every single inhabitant of Hong Kong should be assisted to move off the Island ( though he didn’t say where) and every bit of money moved out and every bit of physical infrastructure destroyed, and then “we can hand back the bare naked rock which first we found here.”

Edit: this was intended as response to Susan the Other

My impression, based on the handful if people I know there (who might not be representative): if they had the choice, they would give up quite some money and living standards, if that kept Beijing at a distance. The PRC has some nasty police-state aspects to it, and as yet Hong Kong has been avoiding the worst of that.

But that choice is not on the table. The people of Hong Kong might give up money, but that won’t buy them freedom from Beijing. So you might as well take the money.If anything, they assumed that it was the opposite: Beijing treated HK with caution, as long as HK shows that they have special money-making tricks that the mainland could not replace.

And they hoped on convergence from the PRC towards Hong Kong. Less poverty, and also less police state. China is a lot less poor now, but the police state is not going anywhere. If anything, it’s getting harsher in the last few years.

When all is well, it sounds like Hong Kong is China’s “City of London.”

Former British colony but kept the colonial’s finance system, why is it so confusing to everyone?

Perhaps one of Nicholas Shaxson’s “Treasure Islands”? I suppose that Hong Kong’s status ultimately depends on how useful they are to the mainland in their current status. Not many countries would be willing to tolerate a two systems-one government after all. If the west ultimately tries to go for a sanctions regime against China to make it buckle under, Hong Kong would be extremely vulnerable in such a case as they are so tightly meshed together.

It’s confusing for me because it looks like an argument without a point – much like Brexit. In fact, it looks like it is Brexit linked because, if the UK crashes out of the EU, the UK will need to maintain its extended City of London in Hong Kong and will fight to keep financial ties with China even though it is causing economic imbalances in HK – It looks like those imbalances are glossed over with talk about how draconian China is, how authoritarian, etc. As if China were the cause of the mess. But the writing is on the wall with the UK’s old blissful, unregulated off-shored finance. Restrictions have been imposed everywhere. It is like they are now squirming and causing riots just to prevent China from imposing more restrictions. And the whole thing is destined to fail. Because there’s nowhere left on Earth for all that “invested” money to make any returns. It is just the illogic of it all. Causing a great deal of confusion for HK. And when the water rises it won’t be the financiers who rescue and salvage HK. It will be the Chinese, imo.

The statement that Hong Kong was responsible for 16% of China’s economy in 1997is false. Hong Kong prospered by being the tollbooth for goods produced in low-wage mainland China and then exported to the West. For a long time virtually everything labelled “Made in Hong Kong” was made in the mainland and relabelled. Hong Kong was for a time the conduit for 16% of China’s economy, but did not produce it.

Now with various ‘free’ trade agreements, Hong Kong is no longer necessary. Oh, certainly trading arrangements are ‘sticky’ and Hong Kong has an efficient system of docks and warehouses, but it is no longer special. Sure, finance can be important but you don’t need a lot of people for that – and in fact, a lot of the financial activity in Hong Kong need not be physically carried on on Hong Kong soil, a lot of the administrative and clerical work can (and probably is) being done in offices in the mainland, and likely India and other places as well.

The real problem with Hong Kong is this: they are a tiny patch of dirt, with almost no resources, and very little native industry, packed full of people. Outside of the big banks, most Hong Kongese live in cages – Hong Kong increasingly is like a well run prison with an excellent medical system. Because living in a cage is not conducive to raising a family of four, the average Hong Kongese are not having many children. Left to themselves, this could cut them some slack, resulting in lower rents, higher wages, more living space etc. But the rich can’t abide that, so they are using massive immigration to keep Hong Kong packed full of people – even as Hong Kong’s past major source of income is drying up.

Amateurs talk politics, professionals talk demographics. The Hong Kong protests are really about immigration, or perhaps more specifically, about government-mandated population pressure. But we can’t talk about that, so the press obsesses about irrelevancies like ‘Democracy.’

>The statement that Hong Kong was responsible for 16% of China’s economy in 1997is false.

Have a source handy?

1. Check the Chinese GDP. Macau and Hong Kong SAR are not included in any official statistics of PRC even in IMF, OECD, World Bank. When you’re going to see chinese statistics GDP, per capita, etc it’s only mainland (EXCLUDING Macau and Hong Kong and of course Taiwan) nothing more.

2. Hong Kong is getting IRRELEVANT to PR China when viewing the overall economy of greater China, especially right now that China’s liberalizing and OPENING UP for the first time their financial market by 2020 as per recent news. (It coincides with PRC’s plan to further liberalize Shanghai Free Trade Zone and Shenzhen by creating independent institutions within those zones (separate liberal laws, etc.) PRC now is blatantly decreasing the role of Hong Kong in financial market of greater china. The only leverage does Hong Kong has is its financial market in which it would decrease its role when China will further open up its financial market this 2020. Shenzhen, tech city has higher GDP already than Hong Kong already and Guangzhou another major city in pearl river delta is going to overtake Hong Kong’s GDP as early as this year if not next year.

3. Hong Kong ports and trade are minuscule compared to China’s port cities. Most of the biggest ports in the world are mostly in mainland china.

“Civil unrest in Hong Kong stems in part from stratospheric housing prices that have locked many residents out of the market, says independent economist Andy Xie.

property prices have appreciated over 300% since 2003 …But wages have largely stagnated in the same period, … Oxfam flagged a ‘particularly severe’ wealth disparity in Hong Kong, which it said was the highest among all developed countries and regions.

Hong Kong is the world’s most expensive city to buy a home, according to another report released in April.”

https://www.cnbc.com/2019/08/15/hong-kong-protests-economist-says-tycoons-are-the-problem.html?recirc=taboolainternal