Yves here. Quelle surprise! Economists engage in groupthink, which sounds a little less bad if you call it “ideology”.

By Mohsen Javdani, Associate Professor of Economics, University of British Columbia – Okanagan Campus and Ha-Joon Chang, Professor, University of Cambridge. Originally published at the Institute for New Economic Thinking website

Mainstream (neoclassical) economics has always put a strong emphasis on the positivist conception of the discipline, characterizing economists and their views as objective, unbiased, and non-ideological. This is still true today, even after the 2008 economic crisis exposed the discipline to criticisms for lack of open debate, intolerance for pluralism, and narrow pedagogy.[1]Even mainstream scholars who do not blatantly refuse to acknowledge the profession’s shortcomings still resist identifying ideological bias as one of the main culprits. They often favor other “micro” explanations, such as individual incentives related to academic power, career advancement, and personal and editorial networks. Economists of different traditions do not agree with this diagnosis, but their claims have been largely ignored and the debate suppressed.

Acknowledging that ideology resides quite comfortably in our economics departments would have huge intellectual implications, both theoretical and practical. In spite (or because?) of that, the matter has never been directly subjected to empirical scrutiny.

In a recent study, we do just that. Using a well-known experimental “deception” technique embedded in an online survey that involves just over 2400 economists from 19 countries, we fictitiously attribute the source of 15 quotations to famous economists of different leanings. In other words, all participants received identical statements to agree or disagree with, but source attribution was randomly changed without the participants’ knowledge. The experiment provides clear evidence that ideological bias strongly influences the ideas and judgements of economists. More specifically, we find that changing source attributions from mainstream to less-/non-mainstream figures significantly reduces the respondents’ reported agreement with statements. Interestingly, this contradicts the image economists have of themselves, with 82% of participants reporting that in evaluating a statement one should only pay attention to its content and not to the views of its author.

Moreover, we find that our estimated ideological bias varies significantly by the personal characteristics of economists in our sample. For example, economists’ self-reported political orientation strongly influences their ideological bias, with estimated bias going up as respondents’ political views move to the right. The estimated bias is also stronger among mainstream than among heterodox economists, with macroeconomists exhibiting the strongest bias. Men also display more bias than women. Geographical differences also play a major role, with less bias among economists in Africa, South America, and Mediterranean countries like Italy, Portugal, and Spain. In addition, economists with undergraduate degrees in economics or business/management tend to show stronger ideological biases.

We give more details about our methodology and findings in the following sections, but first let us anticipate some of the conclusions and implications. Theoretically, the implications are upsetting for the positivist methodology dominating the neoclassical economics. As Boland (1991) suggests, “[p]ositive economics is now so pervasive that every competing view has been virtually eclipsed.” Yet, the strong influence of ideological bias on views among economists that is evident in our empirical results cannot be reconciled with it.

Practically, our results imply that it is crucial to adopt changes in the profession that protect academic discourse, as well as the consumers of the economic ideas, from the damaging impacts of ideological bias. In fact, there exists growing evidence that suggests value judgements and political orientation of economists affect not just research (Jelveh et al. 2018, Saint-Paul 2018), but also citation networks (Önder and Terviö 2015), faculty hiring (Terviö 2011), as well as economists’ positions on positive and normative issues related to public policy (e.g. Beyer and Pühringer 2019; Fuchs, Krueger and Poterba 1998; Mayer 2001; van Dalen 2019; Van Gunten, Martin, and Teplitskiy 2016). It is therefore not a long stretch to imagine that ideological bias could play an important role in suppressing plurality, narrowing pedagogy, and delineating biased research parameters in economics.

One important step that helps identify the appropriate changes necessary to minimize the influence of ideological biases is to understand their roots.

As argued by prominent social scientists (e.g. Althusser 1976, Foucault 1969, Popper 1955, Thompson 1997), the main source of ideological bias is knowledge-based, influenced by the institutions that produce discourses. Mainstream economics, as the dominant and most influential institution in economics, propagates and shapes ideological views among economists through different channels.

Economics education, through which economic discourses are disseminated to students and future economists, is one of these important channels. It affects the way students process information, identify problems, and approach these problems in their research. Not surprisingly, this training may also affect the policies they favor and the ideologies they adhere to. In fact, there already exists strong evidence that, compared to various other disciplines, students in economics stand out in terms of views associated with greed, corruption, selfishness, and willingness to free-ride (e.g. Frank and Schulze 2000, Frank et al. 1993and 1996, Frey et al. 1993, Marwell and Ames 1981, Rubinstein 2006, Want et al. 2012).[2]

Another important channel through which mainstream economics shapes ideological views among economists is by shaping the social structures and norms in the profession. While social structures and norms exist in all academic disciplines, economics seems to stand out in at least several respects, resulting in the centralization of power and the creation of incentive mechanisms for research, which in turn hinder plurality, encourage conformity, and adherence to the dominant (ideological) views.

Our own exposure to different parts of this social structure while working on this project has in fact been an unpleasant yet eye-opening experience, and a testament to dominant biases in the discipline that strongly impede critical thinking, new perspectives, and plurality. We have been threatened, accused, and insulted for simply asking an important and legitimate question. We have also had first-hand experience with the Top Five journals in economics and some of their (associate) editors’ exertion of their strong prejudiced views, which is often disguised under the vail of “inevitably subjective nature of editors’ decision-making process,” which is supported by the absolute and unaccountable power that is at their disposal. In some cases, the decision regarding our submission blatantly lacked professionalism and respect for plurality of views.

Our world today is characterized by critical issues that economics has a lot to say about, such as inequality, austerity, the future of work, and climate change. However, relying on one dominant discourse which ignores or isolates alternative views will make the economics profession ill-equipped to engage in balanced conversations regarding these issues. This also makes the consumers of economic ideas skeptical about economists and the views and policies they advocate for. We believe that addressing the issue of ideological bias in economics first requires economists to find out about their own biases. Persistent denial of these biases is going to be more harmful than being aware of their presence and influence, even if mainstream economists do not necessarily change their views. Moreover, the economics profession needs to have an in-depth introspection and a real and open debate about the factors underpinning these biases, including economics training and social structures within the discipline that centralize power, encourage group thinking and conformity, dampen innovative thinking and creativity, and hinder plurality.

Experimental Design

Examining issues such as the impact of bias, prejudice, or discrimination on individual views and decisions is very challenging, given the complex nature of these types of behaviour. This has given rise to a field experimentation literature in economics that has relied on the use of deception—for example, through sending out fictitious resumes and applications, to examine the prevalence and consequences of discrimination against different groups in the labor market.[3]We take a similar approach, namely using fictitious source attributions, in order to investigate the effect of ideological bias on economists (See Section 4 in our online appendix for a more detailed discussion on the use of deception in economics). More specifically, we employ a randomized controlled experiment embedded in an online survey. Economists from 19 different countries were invited to complete an online survey where they were asked to evaluate fifteen statements from prominent economists on a wide range of topics. We received just over 2,400 responses, with the majority of responses (around 92%) from academics with a PhD degree in economics. As reported in our online appendix, our sample includes a very diverse group of economists from a diverse set of institutions. While all participants received identical statements in the same order, source attribution for each statement was randomly changed without the participants’ knowledge. For each statement, participants either received the name of a mainstream economist as the source (Control Group), or an ideologically different less-/non-mainstream economist (Treatment 1), or no source attribution (Treatment 2). See Table A8 in our online appendix for a complete list of statements and sources.

The Findings, in Detail

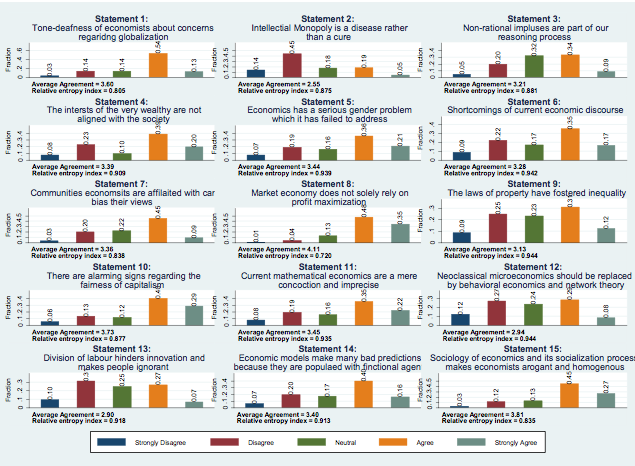

Our analysis of the experimental results reveals several important findings. First, examining the probability of different agreement levels for each statement as well as their comparative degree of consensus (using relative entropy index derived from information theory), we find evidence of clear dissent among economists on the wide variety of topics evaluated (see Figure 1 below). Given that our statements either deal with different elements of the mainstream economics paradigm—including its methodology, assumptions, and the sociology of the profession—or issues related to economic policy, the significant disagreement evident in our results highlights the lack of paradigmatic and policy consensus among economists on evaluated issues.

Figure 1: Probability of different agreement levels – By statement

Note: See Table A8 in our online appendix for a complete list of statements and sources.

Second, we find evidence of a strong ideological bias among economists. More specifically, we find that for a given statement, the agreement level is 7.3% (or 22% of a standard deviation) lower among economists who were told that the statement was from a less-/non-mainstream source. Examining statements individually also reveals that in all but three statements, agreement level drops significantly (both quantitatively and statistically, ranging from 3.6% to 16.6%) when the source is less-/non-mainstream.

For example, when a statement criticizing “symbolic pseudo-mathematical methods of formalizing a system of economic analysis” is attributed to its real source, John Maynard Keynes, instead of its fictitious source, Kenneth Arrow, the agreement level among economists drops by 11.6%. Similarly, when a statement criticizing intellectual monopoly (i.e. patent, copyright) is attributed to Richard Wolff, the American Marxian economist at the University of Massachusetts, Amherst, instead of its real source, David Levine, professor of economics at the Washington University in St. Louis, the agreement level drops by 6.6%.

Interestingly, these results stand in sharp contrast with the image economists project of themselves in our survey. In an accompanying questionnaire that appears at the end of the survey, a strong majority of participants (around 82%) agreed that in evaluating a statement, one should onlypay attention to its content, rather than its author. Only 18% of participants agreed that both the content of the statement as well as the views of the author matter, and only a tiny minority (around 0.5%) reported the views of the author should be the sole basis to evaluate a statement.

Third, we find that economists’ self-reported political orientation strongly influences their views. More specifically, our results suggest that even when we focus on statements with mainstream sources attributed to them, there exists a very significant difference in average agreement level among economists with different political orientations. For example, for a given statement, the average agreement level among economists self-identified as left is 8.4% lower than those self-identified as far left. This already large difference widens consistentlyas we move to the far right, reaching a difference of 19.6% between the far right and the far left, which is an increase of 133%. This strong effect of political orientation on economists’ evaluation of our statements, which does not change after controlling for a wide set of observed characteristics, is another clear manifestation of ideological bias.

The effect of political orientation on economists’ views is even more drastic when we examine how changes in attributed sources affects economists with different political orientations. More specifically, for those on the far left, altering the sources only reduces the average agreement level by 1.5%, which is less than one-fourth of the overall effect of 7.3% we discussed before. However, moving from the far left to the far right of the political orientation consistently and significantlyincreases the effect of changing the source to a 13.3% reduction in agreement level, which is almost 8 times (780%) larger compared to the far left. Interestingly, this is despite the fact that relative to the far left, those at the far right are 17.5% more likely to agree that in evaluating a statement one should only pay attention to its content.

Fourth, our results uncover striking differences by gender. More specifically, we find that the estimated ideological bias is 44% larger among male economists as compared to their female counterparts, even after controlling for potential gender differences in observed characteristics including political orientation and political/economic typology. Moreover, our results highlight a startling difference between male and female economists in their perception of gender problems in the profession. When faced with the statement “Unlike most other science and social science disciplines, economics has made little progress in closing its gender gap over the last several decades. Given the field’s prominence in determining public policy, this is a serious issue. Whether explicit or more subtle, intentional or not, the hurdles that women face in economics are very real.”, the agreement level was a whopping 26% higher among female economists than among their male peers.

In addition, when participants were told that the statement was made by the left-wing British feminist economist Diane Elson (rather than the real source, Carmen Reinhart, a mainstream economist at Harvard), male economists showed ideological biases—their agreement level fell by 5.8%. Interestingly, however, it stayed unchanged for female economists. This seems to suggest that the gender problem in economics is so severe that female economists, who exhibited ideological biases on many other issues (although less than did their male colleagues), put aside their biases in this particular case and focused on the content of the statement.

The discussion around the gender problem in economics has recently taken the center stage. During the recent 2019 AEA meeting, and in one of the main panel discussions titled “How can economics solve its gender problem?” several top female economists talked about their own struggles with the gender problem in economics. In another panel discussion, Ben Bernanke, the current president of the AEA, suggested that the discipline has “unfortunately, a reputation for hostility toward women….” This is following the appointment of an Ad Hoc Committee by the Executive Committee of the AEA in April 2018 to explore “issues faced by women […] to improve the professional climate for women and members of underrepresented groups.” AEA also conducted a climate survey recently to “provide more comprehensive information on the extent and nature of these [gender] issues.” It is well-understood that approaching and solving the gender problem in economics first requires a similar understanding of the problem by both men and women. However, our results suggest that unfortunately there exists a very significant divide between male and female economists in their recognition of the problem.

Fifth, we find systematic and significant heterogeneity in our estimated effect of ideological bias by country, area of research, country where PhD was completed, and undergraduate major, with some groups of economists exhibiting little or no ideological bias and some others showing very strong bias.

For example, we find that economists with a PhD degree from Asia, Canada, Scandinavia, and the U.S. exhibit the strongest ideological bias. On the opposite end we find that economists with PhD degrees from South America, Africa, Italy, Spain, and Portugal exhibit the smallest ideological bias. Similarly, our results suggest that there is the smallest ideological bias from economists whose main area of research is history of thought, methodology, heterodox approaches; cultural economics, economic sociology, economic anthropology, or economic development. On the other hand, we find that economists whose main area of research is macroeconomics, public economics, international economics, and financial economics are among those with the largest ideological bias.

We also find that undergraduate training in economics has a strong effect on our estimated effect of ideological bias. We find that those economists with an undergraduate major in economics, or business/management, exhibit the strongest bias, while those who studied law; history, language and literature; or anthropology, sociology, and psychology show no ideological bias. These results are consistent with the growing evidence that suggests economic training, either directly or indirectly, induces ideological views in students (e.g. Allgood et al. 2012, Colander and Klamer 1987, Colander 2005, Rubinstein 2006).

Discussion

Scholars hold different views on whether economics can be a “science” in the strict sense and be free from ideological biases. However, perhaps it is possible to have a a consensus that the type of ideological bias that could result in endorsing or denouncing an argument on the basis of (one’s interpretation of) its author’s views rather than its substance is unhealthy and in conflict with scientific tenor and the subject’s scientific aspiration, especially when the knowledge regarding rejected views is limited.

Some economists might object that economists are human beings and therefore these biases are inevitable. But economists cannot have their cake and eat it too! Once you admit the existence of ideological bias, the widely-held view that “positive economics is, or can be, an ‘objective’ science, in precisely the same sense as any of the physical sciences” (Friedman 1953) must be rejected.

Furthermore, the differences we find in the estimated effects across personal characteristics such as gender, political orientation, country, and undergraduate major clearly suggest that there are ways to limit those ideological effects, and ways to reinforce them.

Our finding that those with an undergraduate degree in economics exhibit the strongest ideological bias highlights the importance of economic training in shaping ideological views. In doing so, our study contributes to the literature on economic education, suggesting that ideology can be at least limited by changes in the curricula at earlier stages.

Rubinstein (2006) argues that “students who come to us to ‘study economics’ instead become experts in mathematical manipulation” and that “their views on economic issues are influenced by the way we teach, perhaps without them even realizing.” Stiglitz (2002) also argues that “[economics as taught] in America’s graduate schools … bears testimony to a triumph of ideology over science.”

Economics teaching not only influences students’ ideology in terms of academic practice but also in terms of personal behavior. Colander and Klamer (1987) and Colander (2005) survey graduate students at top-ranking graduate economic programs in the U.S. and find that, according to these students, techniques are the key to success in graduate school, while understanding the economy and knowledge about economic literature only help a little. This lack of depth in knowledge acquired, not only in economics but in any discipline or among any group of people, makes individuals lean more easily on ideology. Frank et al. (1993) similarly highlight the importance of economics training in shaping behavior among students by criticizing the exposure of economics students to the self-interest model in economics where “motives other than self-interest are peripheral to the main thrust of human endeavor, and we indulge them at our peril.” They also provide evidence that such exposure does have an impact on self-interested behavior.

But education is not the only problem: social structures and norms within the profession also deeply influence economists’ adherence to dominant ideological views.

For example, in his comprehensive analysis of pluralism in economics, Wright (2019) highlights several features of the discipline that make the internal hierarchical system in economics “steeper and more consequential” compared to most other academic disciplines. These features include: (1) particular significance of journal ranking, especially the Top Five, in various key aspects of academic life including receiving tenure (Heckman and Moktan 2018), securing research grants, invitation to seminars and conferences, and request for professional advice; (2) dominant role of “stars” in the discipline (Goyal et al. 2006, Offer and Söderberg 2016); (3) governance of the discipline by a narrow group of economists (Fourcade et al. 2015); (4) strong dominance of both editorial positions and publications in high-prestige journals by economists at highly ranked institutions (Colussi 2018, Fourcade et al. 2015, Heckman & Moktan 2018; Wu 2007); and the strong effect of the ranking of one’s institution, as a student or as an academic, in career success (Han 2003, Oyer 2006).

As another example, in a 2013 interview with the World Economic Association, Dani Rodrik highlights the role of social structure in economics by suggesting that “there are powerful forces having to do with the sociology of the profession and the socialization process that tend to push economists to think alike. Most economists start graduate school not having spent much time thinking about social problems or having studied much else besides math and economics. The incentive and hierarchy systems tend to reward those with the technical skills rather than interesting questions or research agendas. An in-group versus out-group mentality develops rather early on that pits economists against other social scientists.” Interestingly, a very similar picture of the profession was painted in 1973 by Axel Leijonhufvud in his light-hearted yet insightful article titled “The life among the Econ.”

It is hard to imagine that the biased reactions we find in our study only emerge in a low-stakes environment, such as our experiment, without spilling over to other areas of academic life. After all, as we discussed at the beginning, there already exists growing evidence which suggests that the political leanings and the personal values of economists influence different aspects of their academic lives. It is also not a long stretch to imagine that such ideological biases impede economists’ engagement with alternative views, narrow the pedagogy, and delineate biased research parameters. We believe that recognizing their own biases, especially when there exists evidence suggesting that they could operate through implicit or unconscious modes, is the first step for economists who strive to be objective and ideology-free. This is also consistent with the standard to which most economists in our study hold themselves. To echo the words of Alice Rivlin in her 1987 American Economic Association presidential address, “economists need to be more careful to sort out, for ourselves and others, what we really know from our ideological biases.”

Notes

[1] Several scholars have highlighted the connection between ideological views and the lack of plurality in economics and the failure of the profession to predict the 2008 crisis, or to even have an honest and in-depth retrospective explanation that would help develop accountable counter-measures against future crises (e.g. Barry 2017; Cassidy 2009; Dow 2012; Freeman 2010; Heise 2016; Lawson 2009; Stilwell 2019). There are also those who believe the 2008 crisis was not predictable, but fault the profession, as Colander (2010)puts it, “for failing to develop and analyze models that, at least, had the possibility of such a failure occurring” (e.g. Cabalerro 2010; Colander et al. 2013).

[2] Even if this relationship is not strictly casual, it suggests that there exists something about economic education that leads to a disproportionate self-selection of such students into economics.

[3] See Bertrand and Duflo (2017) and Riach and Rich (2002) for a review. Also see Currie et al. (2014) as another example of experimental audit studies with deception.

20 years ago Dr Sam Tsemberis conducted a double-blind trial of chronically homeless mentally ill people in an effort to learn whether being housed first led to better medical outcomes then placing barriers of compliance before getting housed would produce.

Happily, the common sense proposition that having a secure roof improves people’s health or medication adherence was proven, and the concept of Housing First as a best practice is accepted today.

Economics is always political economy no matter how hard they try to pretend its algebra.

+1

I read this elsewhere yesterday. Seems Econ mags were not keen to publish or link to it :-)

If ideology is dead then good riddance to it. I have seen and read about too many ideologues that have caused massive damage and deaths over the centuries and economics is no different. Personally I am of the school of thought of doing things in an empirical way and ignoring labels but just seeing what works. If it works, adopt it. If it does not, try something else. The economics of today does not do that. It does not work. It never saw the 2008 crisis coming and it has never proposed and backed reforms so that it will not happen again. It is used to justify a world economy that is causing climate change as it refuses to include most factors into their equations. I find it fascinating too how modern economics makes use of labels to stop discussions of possible paths to explore. Ideological labels has itself proven a huge hindrance. Here is what I mean.

“We should have health care for all.”

“That is socialism that!”

“Well I guess that we can’t do that then!

I think that Blair Fix’s article “No, Productivity Does Not Explain Income” (https://www.nakedcapitalism.com/2019/08/no-productivity-does-not-explain-income.html) shows you how modern economists work. You juggle around processes like you do mathematical formulas and expect that it still reflects the real world. In scientific discussion you throw out a theory in a journal. Ideally it should be reproducible in the real world and should be picked apart for any flaws in data or reasoning. But like in Blair Fix’s article. the outcome is designated first and then you work you way back to justify it. It fails blind tests like mentioned here which shows it’s flawed processes. In Washington DC there is the Victims of Communism Memorial but I do think that there should also be a Victims of Neoliberalism Memorial to reflect current economic thought. In the former there is the Goddess of Democracy statue as a centerpiece. For a statue for the Victims of Neoliberalism I would suggest another statue but based on the acronym BOHICA.

The more you see yourself as beyond ideology, the more likely it is that you are a victim of ideology. That’s what the post shows: it’s the very fields such as business management that see themselves as non-ideological, “common sense” and empirical which are the most ideological, least common sense and least empirical.

If you are aware of your bias, you can minimize (but not eliminate) those affects. But if you believe that you have *perfect* vision, no measurement can show you that you have an astigmatism.

Remember, Obama and Merkel see themselves as pragmatists — but an objective observer can be assured of finding deep ideological biases and assumption underlying their thought process.

aye.

the position of Ignorance….Socratic Perplexity…is hard.

but i reckon it’ the only way to avoid the mental traps this talks about.

I’m the only one i know in meatspace that even attempts to begin an investigation there(“I know that i don’t know”).

the idea that economics is just like Physics was always suspect, and i think it’s pretty amazing that it’s taken this long…and this many economic disasters…to get to the point that the idea of econ=hard science is challenged more or less in the open.

I’d add to this that i figure that the break in Philosophy, early in the last century, between Anglo-American and “Continental” probably precedes and enables this strange phenomena in economics(logical positivism, etc…avoiding all that messy humanity…attempting to shoehorn everything into a neat equation)

there’s a similar phenomenon in a lot of the Humanities…anthropology, for instance: taking into account the inherent and largely unconscious bias of the anthropologist embedded with the “savages” he’s studying.

“Orthodoxy is Unconsciousness”-Orwell

A general observation: Economics without ideology or politics is only a rather peculiar way of using math. Without a reference what positive or negative actually means it is impossible to render jugdement or make policy. While economic outcomes are at the same time always political outcomes and vice versa. That is why the discipline used to call itself political economy.

About the experiment: If I understand it correctly all participants receive the questions only once. How then is it possible to attribute a specific answer towards bias regarding the source? Given that the questions are not of a clear 2+2=4 varietiy but at least somewhat open. Intuitively it seems far more likely that the specific answer is determined by the respondents own beliefs than by their bias regarding the source.

“The willingness to indulge in ideological thinking—that is, in thinking that by definition is not one’s own, which is blind to experience and to the contradictions that arise when broader fields of knowledge are consulted—is a capitulation no one should ever make. It is a betrayal of our magnificent minds and of all the splendid resources our culture has prepared for their use.”

Robinson, Marilynne. What Are We Doing Here? (p. 2). Farrar, Straus and Giroux. Kindle Edition.

Towards the end of my final year of econ education I pointed out to a professor that the claim that economics should be a positive science, as opposed to a normative one, was itself a normative claim and hence self-contradictory. He looked at me like I was a crazy person…and he was one of the ‘leftists’ in the department.

Haha are you sure that the source of “crazy person” look was your view itself, or rather was it that in your young naivete you spoke what anybody who needs to put food on the table as a working economist would not dare?

Huh. So ideology influences our thinking even when we think it doesn’t. So in other words water really is wet after all.

(Apologies, this was meant as a top level post)

I had a similar experience, diptherio. It was at the beginning of semester picnic, and one of the profs was holding forth on how the mathematical and analytical methodology would allow us to find the solutions to business questions. Probably because I had drunk too much wine, I piped up, but don’t we first have to define what are the critical questions? Deafening silence.

Yes, questions like “how do we squeeze more out of our workers?” and “how can we crappify our product while simultaneously raising the price?”

It is crazy, is it not, that “Life among the Econ” is still locked behind a paywall, despite being written 46 years ago. Thankfully, there is sci-hub….

Maybe this is it?

http://www.ibiblio.org/philecon/life-econ-crop.pdf

Reminds me of my counselor journey when therapist became aware of the blinders and prejudices that one’s theories of behavior imposed (good & bad) on clients. The admonition became, “don’t marry your theory” which another fellow revised that to “it’s best only to flirt with your theory.”

A friend of mine was an IT Director for a large Insurance company. After the crash in ’08, he said in one meeting an executive said “you know why we employ Economists, to lend credibility to the Astrologers”

The fact that this article has a reason to exist at all shows how poorly educated our highly trained economists are. It’s not just that they reject the better portion of the core concepts and practices of the humanities and social sciences as being somewhere between useless and harmful. It’s also that, as this article illustrates without quite saying, pretenses aside, most economists are worse than clueless with regards to the basics of conducting research in the “hard” sciences.

For family blog’s sake, they don’t even know how to pretend to be scientists. I’m not practicing researcher, but I know enough about research methods and questions to be pretty sure that robust empirical positivist economic research should look a lot more like something from the medical sciences than like something out of a cut rate theoretical physics or math journal. That would have serious epistemological problems of it’s own, but sheesh, at least it might be mildly convincing to people with a modicum of a liberal arts education who couldn’t be bothered to look under the hood.

The only thing that shocks me more than the shoddyness of work from “superstar” economists is their undying faith that their methods make them experts not just on economics, but on basically anything that you can slap a mathematical model on.

What economics lacks is an arbiter. In the physical sciences, nature will bitch slap anyone getting out of line. Economists need to come up with an agreed-upon set of test or natural experiments or something that constitutes independent feedback on the merit of an idea. There is nothing more important for the future of the discipline than this.

Well, the historical data refutes the Phillip’s Curve…but I bet they still teach that. 2008 was a natural experiment that refuted the Efficient Market Hypothesis, as well as the idea that the Federal Reserve could stop a major economic catastrophe through monkeying with interest rates…but I’m sure those things are still being taught. Which is to say that economics does not lack an arbiter — rather, most economists simply refuse to give it any credence.

Given that theories in economics are not testable, an application of group think would result in “everybody was predicting that,” and the consequent “who could have know” blame avoidance, coupled with the economist selecting the analytic method that best confirmed the answers the management wanted.

The only thing missing is a display of the set of Chrystal Balls.

Do Economists speak truth to power, or just confirm what power wants?

Ideology is like accents, it’s easy to fall into thinking that other people have them, but your voice/worldview is just “normal”.

in the real world, not saying what the client/boss/thesis advisor expects you to say is a severely career and bank account limiting move.

more so in humanities like law, economics which are closely tied to advising the powerful.

i’m just going to leave this here, shall i?

http://changingminds.org/explanations/research/design/types_validity.htm

the rest of the social scientists at least test their theories against these standards (or make an appearance of doing so). econ seems to get around them by use of “definitions” so specific that in the end they are describing tautologies.

The link provided is a must read, so take a few moments.

But to gild a lilly, try reading some of the newer econ books devoted to behavioural econ, .e.g. Kahneman, RJ Thaler, Ackerlof & Schiller, etc. as well as the new “complexity” economists. The latter are interesting as they show that if you construct a mathematical model for economics that is essentially non-linear then solving such a system on a digital computer implies getting results that can’t be trusted. (This is a well-known problem in solving non-linear systems.) They are proposing to use analogue computers. Amusing, but even those can’t be trusted.

And if you really want a good education read the book The Nobel Factor written by Offer and Soderberg. It will correct your thinking re the so-called “Nobel Prize.”

An interesting study to supplement this one is of funding sources for economics departments and the extent to which the funding is tied to hiring and model building. Then reanalize the date in this study for correlations with the influence of funding sources.

In 2008 the Queen visited the revered economists of the LSE and said “If these things were so large, how come everyone missed it?”

It’s that neoclassical economics they use Ma’am, it doesn’t consider debt.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

It wasn’t even hard.

How is it still the gold standard for economics ten years on?

Their “black swan” explanation still holds sway.

What happens when they do add debt, money and banks to their economics?

Markets no longer reach stable equilibriums and the intellectual backing for the neoliberal ideology gets blown out of the water.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

1929 – Inflating the US stock market with debt (margin lending)

2008 – Inflating the US real estate market with debt (mortgage lending)

Bankers inflating asset prices with the money they create from loans.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

Richard Vague has analysed the data for 1929 and 2008 and they were even more similar than they initially appear.

Real estate lending was actually the biggest problem in 1929.

Margin lending was another factor in 2008.

Basically, it’s just inflating asset prices with the new money banks create from loans, with Wall Street leverage to make it really bad.