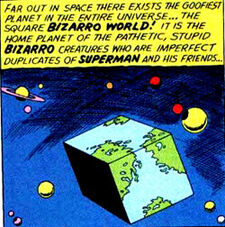

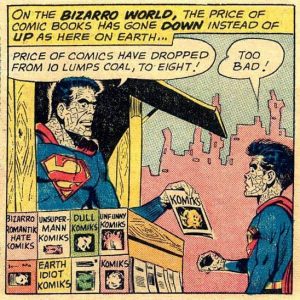

Lambert here: For those not familiar with “Bizarro World”:

More pertinently:

By Marshall Auerback, a market analyst and commentator. This article was produced by Economy for All, a project of the Independent Media Institute.

Remember “Bizarro Superman,” the character who represented the polar opposite of Superman and all that he stood for? Today we have an economic equivalent in the form of Bizarro Capitalism. In the good old days, borrowers paid interest on the money that was loaned to them, and bankers paid depositors a savings rate to entice them to store their money at the bank. Now it’s increasingly the other way around.

Judging from the speeches given at the recent annual Jackson Hole gathering of the various bigwigs in the global central banking scene, the mutation of our economy hasn’t fully dawned on them. For the most part, we heard the same old shibboleths. Indeed, the very notion of having a high-profile forum in a glamorous setting to highlight the views of central bankers symbolizes how far we have come in terms of prioritizing monetary policy over fiscal activism, despite the fact that this has led to a policy “black hole,” according to former Treasury Secretary Lawrence Summers.

The hesitation in embracing fiscal policy further (despite the anomalous presence of negative rates that could be arbitraged away by fiscally generated economic growth) is largely the product of a number of myths that have governed policy-making during the 40-year period of neoliberal ascendancy. Among them: the misconception that excessive government spending “crowds out” private sector investment; the belief that “responsible” fiscal policy and reduced budget deficits in and of themselves create the conditions for sustained economic growth; the questionable notion that “quantitative easing” actually does anything to benefit the real economy (as opposed to merely inciting financial speculation); and, lastly, the very idea that independent central bank technocrats are better suited than democratically elected officials to solve our current problems when the record shows the opposite. Far from being disinterested umpires, the monetary authorities have consistently prioritized financial interests and, in so doing, have acted more like arsonists adding to a major fire. The irony today is that central banks have historically been the traditional agent of deliverance for the financial sector. But in the current environment of negative rates, they are becoming its angel of death.

The huge rally that has characterized this summer’s trading in the global bond markets has culminated with a new phenomenon hitherto unseen: the presence of negative yielding bonds, a growing and increasingly widespread feature of the economic landscape. We now have over $16 trillion worth of negative yielding bonds (out of a total global bond market size of around $100 trillion). Adding to this topsy-turvy financial landscape, UBS in Switzerland has introduced a charge of 0.6 percent on deposits larger than 500,000 euros. Similarly, Denmark’s Jyske Bank has just announced plans to charge negative rates on deposits. To be sure, it’s only wealthy clients who will incur this charge for now (a nice socialist touch, for this Scandinavian social democracy), but it’s an ominous precedent for any saver nonetheless if the banks ultimately decide to extend these charges to the less affluent. Functionally, a charge on deposit represents a penalty on savings that acts like a tax increase. It represents the perverse apotheosis of a “too big to fail” banking system in which depositors are now starting to pay to store their money at banks that survive in their current form because our monetary and fiscal policy officials backstop them.

Think about the implications: Banks are charging depositors to store their money at their institution, and $16 trillion worth of borrowers are now being paid by the world’s creditors for the “privilege” of holding their bonds. Imagine what that is doing to your pension fund (how does a trustee calculate his/her firm’s pension liabilities with a negative interest rate?), or your insurance annuities, let alone the money you deposit in your bank account. Or consider buying a home in Denmark now that Jyske Bank, the country’s third-largest bank, has launched the world’s first negative interest mortgage: 10 years at -0.5 percent. What this means is that borrowers still make monthly payments, as is usual on all mortgages, but the outstanding loan is reduced each month by more than the borrower has paid, by virtue of the negative rate. We are truly in uncharted waters.

We started down this road decades ago in Japan, and it is to the Land of the Rising Sun that we should look for a glimpse of the future. The Bank of Japan owns almost half the stock of the country’s outstanding public debt, so effectively it is the Japanese Government Bond market; secondary trading activity is virtually nonexistent. Not that we should shed any tears for Japanese bond traders (who are gradually becoming extinct—no bond vigilantes here), but perhaps we should ponder the fate of Japanese savers, whose savings income has dwindled as a consequence of decades of virtually zero interest rates. This makes the economy particularly vulnerable to external shocks (such as the planned consumption tax increase, which twice before has created economic relapse in this aging country of savers) because there is minimal income flow to cushion the sharp change.

Outside Japan, the broad global rally in bond prices (which has led to a corresponding decline in bond yields) represents a collective panic attack that, notwithstanding all of the monetary gymnastics of the world’s central bankers, the global economy is rapidly slowing down. The signs are out there: In China, the escalating Sino-U.S. trade war is adversely impacting overall growth; in Germany, a degenerating banking sector and rapidly slowing exports are grinding down the economy; and in the rest of Europe, especially the UK, the imminence of Brexit is engendering a crisis of confidence, as fears of No Deal chaos are rising as we approach the October 31 deadline.

For some decades since Bretton Woods, the tools available to central banks did the trick. Most recently, the markets have increasingly taken to heart European Central Bank president Mario Draghi’s “whatever it takes” pledge to save the euro. Draghi has repeatedly used the ECB’s balance sheet to backstop sovereign euro-denominated paper, leading investors to pile into government bonds in countries once thought to be on the threshold of insolvency. Overall credit spreads between southern periphery and the more “fiscally sound” north have accordingly diminished considerably to the point where 100-year bonds are becoming a thing: Ireland and Austria have both issued 100-year paper (likewise non-Eurozone Argentina, which historically has been a serial defaulter, but still was able to capitalize on this mania). Markets today discount totally the risk of national bankruptcy in the mad grasp for yield and additional income. This is moral hazard run amok.

All the norms of a market economy are being subverted by the very agents—central banks—that embody the market fundamentalism that has taken deep root in the global economy. Borrowers get paid, savers get charged. The solvency of pension funds is also coming under risk in countries like Germany where institutions by law have to buy negative yielding government bonds. The entire German Bund yield curve trades at negative yields, so Berlin is in danger of being hoisted on its historic fiscal austerity petard. The “cure” of negative rates is proving to be as bad as the disease for many, which yet again illustrates why excessive reliance on interest rate manipulation is a terrible way to conduct economic policy.

All of this is to say that governments, not central banks, have the optimal tools for our challenges: money distributed to the public for the general welfare through a range of projects and programs as opposed to central bank-engineered bailouts to a potpourri of financial institutions (many of which should have been shut down in 2009 and beyond). As much as it might frustrate the designs of financiers and billionaires and their fear of government money going to the public, that’s the only thing that’s going to move the needle. Certainly, there is no way out, absent a robust government fiscal response that borrows at these historically unprecedented rates and generates sufficient economic growth to arbitrage away the negative yields.

Far from “crowding out” private investment (the usual argument deployed against “excessive” government spending), public investment via properly targeted fiscal policy could provide a new source of growth that “crowds in” additional business investment. As I’ve written before, “the basis of the ‘crowding out’ claim is that… [excessive] government spending causes interest rates to rise, and investment to fall. In other words, too much government borrowing ‘crowds out’ private investment.” That’s totally wrong, as J.M. Keynes came to realize almost a century ago: “For the proposition that supply creates its own demand, I shall substitute the proposition that expenditure creates its own income.”

For all of his multifold flaws, perhaps Donald Trump’s one singular virtue is that he is not a deficit hawk. In spite of what many have criticized as the president’s fiscal profligacy (in reality, because of it), the U.S. economy remains a conspicuous oasis of growth. As economist Paul Krugman has wryly noted, “[that] isn’t really a surprise given the GOP’s willingness to run huge budget deficits as long as Democrats don’t hold the White House.” Trump’s lack of attachment to prevailing economic orthodoxy, and the political imperatives of the 2020 election, likely mean he will pull out all the stops to try to prevent a recession next year in the U.S. The recent funding agreement secured with Congress on the debt ceiling will likely ensure another fiscal jolt to sustain some growth going forward into the first quarter of 2020, as the government budget deficit as a percentage of GDP is now running at around 4.5 percent.

Which is not to say that all is well in the U.S. It remains a major problem that the bulk of the fiscal policy benefits continue to flow to the top tier, which has the highest savings propensities, and historically unprecedented sums are going to the military. Consequently, the U.S. economy fails to get maximum bang for its fiscal buck (at least as far as the civilian economy goes). It doesn’t grow as efficiently as it could because more and more of the economy’s gains are being funneled to increasingly fewer people.

Moreover, the employment gains that the president has continued to hype have been overstated, according to the Bureau of Labor Statistics (BLS), and companies are now cutting back on hours worked. Normally when the workweek is being cut like this, it signals a slowdown or, at the very least, diminishing confidence in future growth prospects on the part of the private sector. So Trump’s instinct to spend now might not be mistaken, but if past policy is any indication, the president is likely to misallocate in favor of his fellow oligarchs and generals. Only properly targeted fiscal policy that takes aim at raising living standards and delivering the public investments in education, technology and infrastructure will deliver real long-term prosperity for all of us, not just the privileged few.

To reiterate, this is a job for elected officials, not central banking technocrats. At this stage, in fact, ineffective monetary policy is making things worse. Central bankers are perpetuating a perverse risk-reward asymmetry as a consequence of this very low interest rate policy, which is also death for financial institutions. This is a profound irony, considering the degree to which central bankers have consistently prioritized the interests of finance over other parts of the economy. And while a shrinkage of finance relative to the rest of GDP may be good for the rest of us, absent a fundamental philosophical change in overall policy (especially on the fiscal front), we will still be facing an environment characterized by wage stagnation, nonexistent job security, rising inequality, and subpar growth potential, all the while continuing to reward irresponsible economic behavior.

The policy world needs to change course and do it quickly. However, the presence of negative yields (and all the implications that flow from that) suggests that we’re still a long way off from that happening.