By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

Exports by China, Japan, and Eurozone under pressure — in part because of globally weak demand for new vehicles, which transcends the trade war.

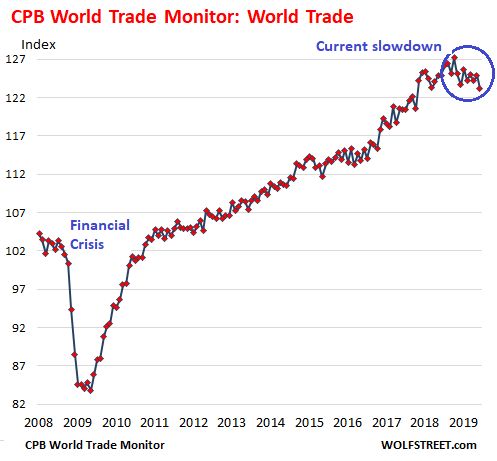

World trade volume – a measure of imports and exports of merchandise across the globe – declined in its zigzag manner in June to the lowest level since October 2017, according to the Merchandise World Trade Monitor by CPB Netherlands Bureau for Economic Policy Analysis. The index was down 1.4% from June 2018. This small year-over-year decline is the biggest year-over-year decline since the Financial Crisis, and it’s a reversal from the heady growth in 2017 and 2018 that had topped out at 6.7%.

A theme emerges: World trade, rather than growing in leaps and bounds as it had done during peak globalization in 2017 and 2018 (which had followed a period of trade stagnation in 2015 and 2016) has now entered its first decline phase since the Financial Crisis. But it’s still a relatively tame decline, reflecting the manufacturing slowdown in the US, the EU, China, Japan, South Korea, and other countries, and not a global crisis. What happened to trade during a global crisis is clear in the chart:

That this year-over-year decline is still so tame, despite the explosive trade-war rhetoric, pandemic threatened and actual tit-for-tat tariffs, and even tech embargos, is largely due to companies having found ways to brush off the rhetoric, dodge some of the tariffs, shift parts of their supply chains around, or push up the tariffs into their supply chains.

By comparison, what happened during the Global Financial Crisis was a “collapse” of world trade when companies – uncertain if the banking system would still stand the next day – shut down their ordering process. This was when American consumers lost their jobs by the millions and curtailed their spending, and when car sales collapsed. From September 2008 through the trough in May 2009, the World Trade Monitor index had plunged 17.5%.

But so far in 2019, there are no signs that the American consumer has pulled back. And despite the trade war, the index has declined only 3.1% so far from the one-month peak.

The US economy is dominated by services, such as finance, healthcare, information services (such as telecoms), professional services (such as computer programming, lawyering, and engineering), housing, and myriad others. And despite the manufacturing slowdown, services are growing at a solid pace. About 70% of what consumers spend their money on is on services, leaving the US as the cleanest dirty shirt.

China.

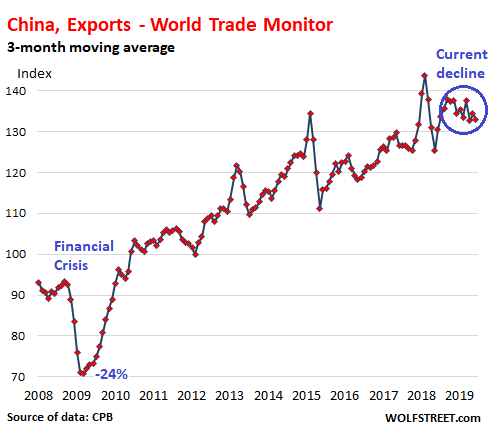

China is experiencing a slowdown in exports that started last fall. In recent years, exports continued to rise from September through June. But not this time. Exports to the rest of the world fell 3.5% from September 2018 through June 2019, according to the World Trade Monitor data for China, which I converted to a three-month moving average to smoothen out the vary large month-to-month ups and downs of the data. The regular spikes in the chart are related to the Chinese New Year. Note the 24% plunge during the Financial Crisis:

But on a year-over-year basis, exports in June were up 2.3% from June last year and marked the highest June on record. So for now, the decline in exports since September hasn’t yet totally wiped out the gains earlier last year. But the trend is in the wrong direction.

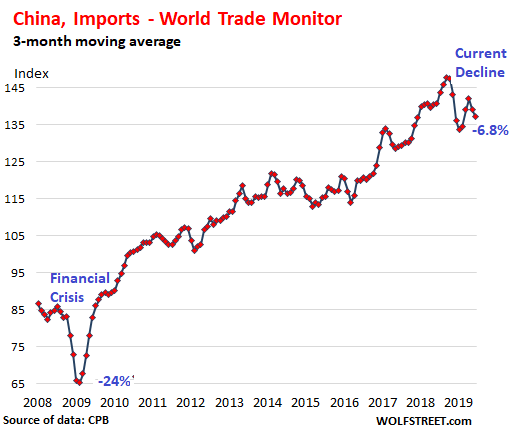

Imports to China from the rest of the world show a similar but harsher picture: Imports in June fell 2.4% year-over-year and are down 6.8% from the peak in September 2018, which would be a sign of weakening internal demand in China:

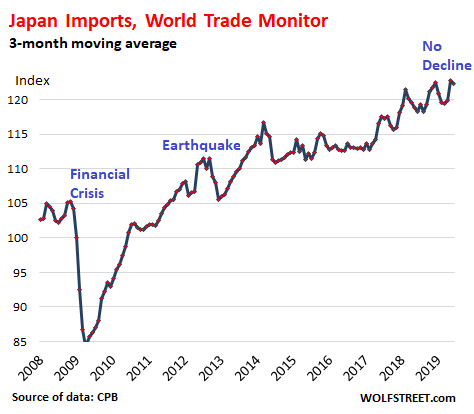

Japan.

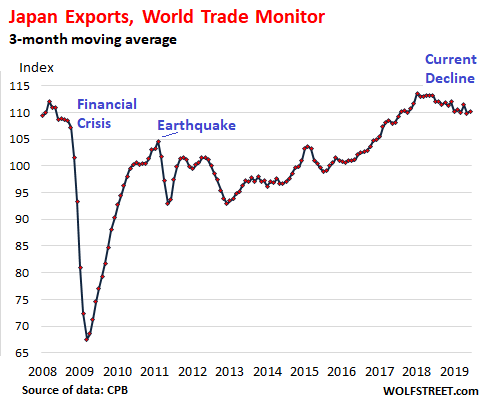

Japan’s exports have been declining slowly but surely since the beginning of 2018. In June, on a three-month moving average basis, exports had dropped 3.0% from January 2018. But that drop pales compared to the export collapse during the Financial Crisis and the sharp drop following the March 2011 earthquake and tsunami, when Japan’s infrastructure was severely damaged:

But Japan’s imports have continued to meander higher. The three-month moving average of the index reached a new high in May and ticked down a smidgen June:

Eurozone.

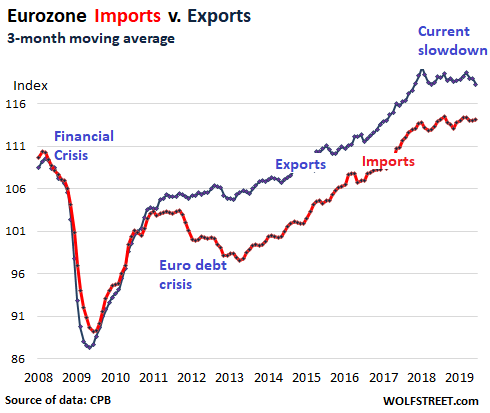

Exports from the Eurozone have declined since January 2018 – but only 1.7%. This was driven by a sharper slowdown in exports of German autos, auto components, and industrial products, softened by increases in exports from other Eurozone members, whose exports also include food, such as olive oil, salami, cheese, and other specialty foods, or wine, and there is no slowdown in food products.

Imports into the Eurozone have remained roughly flat since January 2018. The chart combines imports and exports indices. Note the big impact of the euro debt crisis on imports (red line) though it had little or no impact on exports:

So I get this picture of global trade: Companies are rethinking their supply chains. But actually shifting them from China to Vietnam or Bangladesh or even back to the US is a slow process that has barely started. And it’s a complicated process, shifting large scale manufacturing to countries whose manufacturing and export infrastructure is inadequate to manufacture and export on the scale of China. And so this will take a while.

And the global slowdown in demand for new vehicles – which impacts not only assembled new vehicles but components and materials that crisscross the world – is hitting exports from Germany, Japan, China, and South Korea. But that slowdown in demand for new vehicles is a result of other factors than the trade war, and in developed countries, and even in China, it is becoming structural and includes factors such as saturation. So even a resolution of the trade war won’t help the auto sector. Here are some samples of the challenges the global auto industry is facing:

Vehicle Sales Plunge amid India’s Shadow-Bank Debt Crisis & Contagion Fears

All these headlines add up to one thing. At the micro level, at least in middle class to wealthy California suburbia, people are wallowing in stuff, so why would they buy more?

Many piles of decent quality furniture, art, garden supplies and kitchen goods with “free” signs were visible on a drive around suburbia yesterday. As people get older and downsize, they throw garage sales that have more decent American made goods from the last century than anyone could ever need, so why buy new Chinese crap with a huge markup?

Most of our kid’s high school friends shop for clothing in thrift stores. Even Macy’s is going to open a used clothing section. I haven’t bought a new item of clothing in twenty years other than underwear, shoes and socks. Our cars are ten and twelve years old and we have no intention of ever buying new again when they finally get sold on to teenagers in the neighborhood.

The best thing one can do with money is to pay off debt. Start with whatever has the highest interest rate and get it to zero. Then move to the next highest rate. Fu*K the money lenders and financial parasites.

When people get paid a livable wage and we get Medicare For All, then maybe they will start buying new things again.

I live a life similar to yours, although I do have a small collection of used Dr. Martens shoes carefully sourced from thrift stores over the years. The last time I was in Walmart to buy motor oil for my 14 year old Subaru, the shelves were packed with goods, most from China (I reckon), and people were shopping. I can’t imagine what people will do when $2.99 shower curtains are no longer easily obtainable.

Make their own shower curtains from black plastic and large paper clips.

What a condemnation of our economic system that a slowdown in sales of new vehicles is viewed as a threat.

According to Wilko Stark, head of Mercedes-Benz’s product and strategy: “Not even one in 300 vehicles on the road has electric drive yet, and 99% of customers are still choosing combustion engines.”

Because in the US at least, gas is $2.50 a gallon and the equivalent electric car comes with a 30-80% premium on the price tag.

I suspect that Mercedes will be one of the last companies (Jaguar, Rolls Royce, and BMW are some of the others) that will have a high percentage of electric vehicles unless their customer base suddenly believe in climate change and that they personally need to do something about it. The cachet of one of these logos means you don’t have to do what the masses do.

Last year, for the first time, I got a used car – a 2015 Honda Fit to replace a dying 2006 PT Cruiser. Seems to be fine so far. We have a favorite mechanic who works on our cars.

Also last year, got a refurbished 2015 Macbook Air for $500. Upgraded to Mojave, also fine so far. Even managed to get Picasa working on it. Whenever I start Picasa, I have to click five times on an error message, but then it works OK. No Catalina for me.

Two mottos of mine:

Good enough is good enough.

One advantage I have over many people is that I have low standards.

“The US economy is dominated by services, such as finance, healthcare, information services (such as telecoms), professional services (such as computer programming, lawyering, and engineering), housing, and myriad others. And despite the manufacturing slowdown, services are growing at a solid pace. About 70% of what consumers spend their money on is on services, leaving the US as the cleanest dirty shirt.”

That is one way to interpret what is happening. How about this: a good number of the “services” are so parasitic that it cuts down on not only the desire but the ability to buy goods.

The question here is, are consumers actually purchasing more services/subscriptions, or are they paying more for the services/subscriptions they already have? Perhaps some of each, but in what proportion?

I am assuming that “growth” in this context is measured in terms of GDP.

Regarding saturation of car markets I wish it had been at lower levels. Policies directed to reduce car demand should be implemented no matter how much car makers cry. They already know this is in the cards.

I am really fed up with the Spanish auto industry always asking for subsidies. Better thinking on how to replace jobs to be lost.

The author might make a connection between new auto sales and GDP, but here “in the trenches,” disposable income has been draining off into higher than wage growth inflation in basic services and healthcare costs. Who can afford a new car when surprise medical bills absorb the resources once earmarked for long term durable domestic goods? Plus, automobiles have become as expensive as were homes thirty years ago. Those prices have gone up. Wages have stagnated and now are regressing as a function of purchasing power.

So we are a banking crisis away from that wile e coyote chart move? DB, looking at you. Until then we sing the stagflation chops (but there is no inflation, right, wages stagnate as prices rise).

“…that wile e coyote chart move.” is the ACME of snark!

Keep an eye out for those spindly tree roots poking out of the canyon wall, ambrit .. and grab one, if you can, as you make your rapid descent .. in ‘hope’ ( there’s that dreaded word again !) of dampening your tumble downward into that rocky ‘Gorge de la Americain’.

Or try your luck at a running jump …with the aid of one of those cheap Acmezon purchsed ‘batsuits’ !

“Acmezon” is a keeper. Mind if I steal it?

How else do we end the automobile economy? Seems like this “slowdown” is going about it very gingerly. We’ll still be driving cars for the next decades, just fewer of them. In order to really but the brakes on we have to create a viable alternative. Which we can do, but we don’t seem willing to offer the alternative until the use of cars has been subdued. Are we letting commuters down slowly or are we letting the oil industry down slowly, so as not to topple the entire manufacturing scaffold of the world economy?

This will be a paradigm shift in the American socio-political system. Since at least the First World War period, the hallmark of American culture has been personal mobility. First with trains, and later with automobiles, the average American could relatively easily pull up stakes and move off to some perceived better place. Prior to this, most people were constrained in their movements by the modes of transport, and the relative costs of those movement systems. Rural people who had never been farther than the local county courthouse town were the norm. A radical relocalization is in the offing.

Maybe not, maybe just for the personal mobility industry. I don’t expect a single replacement for the gas personal vehicle. The younger generations don’t seem easily sold on sports cars like their grandparents or on mobile living rooms (SUVs) like their parents, nor into defining their sexuality on heavy rolling iron, not much fun left with personal mobility after you take all that away. My guess, the future will be a mash up of the inadequate trains, buses, subways we have now made more adequate in range and hours, easy online rentals delivered to your door even if you are not home, plus Uber-type cabs, real cabs, NY-Boston $15 Chinese and Flyx type bus lines, zip cars, electric assisted bikes that go like 50 miles, and self driving things like some advanced Zipcar that comes to your door solo and maybe you drive it from there. If you really need it, eg work the graveyard shift in the sticks, you would still own or lease a cheap compact methane/GPL car, same for work trucks, vans, pickups. Many mini mall services like dry cleaners will be like the old milkman, make rounds and come to you. Don’t forget online shopping will likely kill off the mall experience, maybe even the supermarket experience, most people under 40 I know shop plenty but not in person. 39y/o friend bought a riding mower online, shipping was something like $100 from Texas to Cleveland. I asked, didn’t you want to go to the store and try them on, look over the shiny paint and chrome, feel the fit of the seat, hands on with the man toys, talk the man talk with the mower expert? Nope, couldn’t care less, he researched a few nights online, read some mower forums, ordered cheapest price 1500 miles away, had it in his driveway 3 days later. Different generation for sure, for me this kind of big ticket stuff was a purchase you looked forward to, I loved being forced to go to the Sears or even PC Richards to buy something big, even if I was broke it was still fun looking at stoves and fridges. BTW friend feels the same way about grocery shopping, it’s torture, when in NYC he and wife were Fresh Direct all the time. And don’t forget to add in a generation living in a low growth, low inflation, financialized neo feudal economy trying to juggle or totally avoid fixed extraction payments. So, mash this all up and a future w/o a mass of private cars could evolve in 20 years with little inconvenience or resistance. Not at all sure what the auto industry thinks of that, roll with it or try to force the dominance they had for the last 100 years.

My theory is that the costs of fuel and/or electric storage systems will make personal vehicles prohibitively expensive for the average person.

The auto industry can morph into some sort of public transit manufacturing system. Bring things like rolling stock, track design and construction, and control systems under one roof and a large chunk of the present auto industry can survive if not thrive. This will require some pretty big investments in basic manufacturing systems, but it has to be done, one way or the other.

We are not quite there yet in replacing cars and planes in a practical sense: https://www.rte.ie/news/2019/0826/1070958-greta-thunberg-yacht-trip/

Apparently some people will fly into NYC to take the boat back to Europe. So saving a couple of air trips (her’s and father’s) may require more air trips than originally required. I applaud the sentiment, but the practicality of the requests still leave a lot to be desired.

…its only a crisis for those with something to lose…consumers that don’t?…such a bother!!!

Shame!!!

Seeing Trump act crazy and dance around the truth on trade is interesting. He called Xi an enemy, and told America companies to get out of China. Xi is certainly not our friend, but he did not take American jobs. American CEOs gave China our jobs.. Hopefully Trump is insane enough to state the obvious: the elites are screwing the middle and lower class.

Trump likes to believe that he is an elite as opposed to the shady three card monte dealer that he really is, so he won’t state the obvious because he doesn’t want to give the game away to his lemming base and he believes that screwing the middle and lower classes is good for the elites

The slow down in car sales is actcually good news – moving toward less usage of fossil fuels. To replace these cars, the US should be electrifying and expanding its train systems and bus systems.

The money supply is growing like topsy but few believe the real economy is growing at all. Instead of throwing more paper at the markets on the basis of newly created investments of doubtful value, how about withdrawing cash instead? We have known for ever that a bigger economy needs more cash to service it; can we agree that a smaller economy needs less?