This is Naked Capitalism fundraising week. 1476 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser and what we’ve accomplished in the last year, and our current goal, more original reporting.

In his classic book Collapse, Jared Dimond used Montana as a case study of a “society” that would be on a collapse trajectory were it not propped up by trade. One wonders what the UCLA professor would say if he were to speak candidly about California now, starting with its dependence on water from the Colorado River. The massive PG&E blackouts, cutting power to millions of Northern California users on Wednesday, not just individuals but businesses and critical facilities like hospitals and services like traffic lights, demonstrates how vital infrastructure in the US is at third-world levels. And it’s not just our tatty airports but also bridges and roads and water mains.

First, on the scale of the blackout. From NBC, PG&E slammed for cutting power to millions of Californians:

Californians from the governor on down slammed the state’s largest utility on Wednesday for rolling blackouts that could plunge up to 2 million people into darkness as it scrambles to keep its power lines from sparking new wildfires.

Pacific Gas & Electric Corp., or PG&E, began shutting off power in phases early Wednesday to about 500,000 customers in northern and central parts of the state, including sections of the San Francisco Bay Area. A second wave, affecting about 250,000 customers, began in the afternoon.

Because customers include businesses in addition to individual homes, PG&E said the shutdown could affect as many as 2 million Californians. And it said customers wouldn’t be reimbursed for lost business, housing alternatives or spoiled food and medicines.

One vignette of the dislocation. You can be sure the press will have many stories:

A PG&E Resource Center set up tonight at Oakland’s Merritt College parking lot B. When/if the power goes out, people can come here for “restrooms,” charging stations and water. #abc7now pic.twitter.com/ryHttwn0Nq

— watkowski (@watkowski) October 9, 2019

And the economic consequences, from Gizmodo:

Michael Wara, director of the Climate and Energy Policy Program, tweeted that the PG&E blackout could result in anywhere from $65 million to $2.5 billion in losses over the entire planned outage area. That low end of the spectrum only looks at costs to residential losses while the high end includes commercial and industrial impacts and lost productivity.

Oh, and the backup generators that some hospitals, businesses, and even homes use? Most are diesel powered and diesel generators are dirty. And emergency fuel demand could outstrip supply. From Renewable Energy World earlier this year:

According to Bloomberg, PG&E is planning to deenergize the grid as many as 15 times this coming wildfire season in high threat areas, with the average outage duration ranging from two to five days. This means that, for the foreseeable future, California will have the least reliable electric grid in the U.S. by a significant margin…

The expected shutdowns in California are driving a huge and sudden demand for backup power. This demand has spurred a move towards large-scale deployment of diesel generators across the state. While diesel generators may represent the simplest short-term solution, there are several obvious reasons that Californians should find this response problematic. First of all, these diesel generators will be a terrible source of pollution. Secondly, activation of diesel generators for extended duration during outages will necessitate broad diesel refueling operations, for which the supply of fuel will not be sufficient.

And electrical car owners in the blackout areas who didn’t charge up in time will be stuck.

The horrid state of PG&E’s grid is an indictment not just of the utility’s management and operations, but on the lack of oversight by the state regulator and prosecutors who could also have put the boot on PG&E’s neck. As we wrote:

PG&E has become a prime, if not the number one, case study in the human cost of corporate penny pinching…

Yesterday, the Wall Street Journal published a major story based on extensive Freedom of Information Act disclosures, providing evidence of PG&E’s systematic, willful neglect not just of maintenance but even of inspections of its transmission lines, despite knowing full well that their decrepit state constituted a serious fire risk….

The failure last year of a century-old transmission line that sparked a wildfire, killed 85 people and destroyed the town of Paradise wasn’t an aberration, the documents show. A year earlier, PG&E executives conceded to a state lawyer that the company needed to process many projects, all at once, to prevent system failures—a problem they said could be likened to a “pig in the python.”

Even before November’s deadly fire, the documents show, the company knew that 49 of the steel towers that carry the electrical line that failed needed to be replaced entirely.

In a 2017 internal presentation, the large San Francisco-based utility estimated that its transmission towers were an average of 68 years old. Their mean life expectancy was 65 years. The oldest steel towers were 108 years old.

Even as fire risks increased starting in 2013 due to sustained droughts, it kept putting off upgrading its oldest transmission lines. But at least as bad is that PG&E was grossly, one might even say deliberately, ignorant of the state of its network. How can you be in the business of operating a network and not have basic information about its historical and current condition?

A key paragraph comes in the middle of the account:

Documents show that PG&E is unaware of the exact age of many of its transmission towers and wires. In 2010, PG&E commissioned consulting firm Quanta Technology, a subsidiary of Quanta Services Inc., to assess the age and condition of transmission structures throughout its 70,000-square-mile service area.

The firm was unable to determine the age of about 6,900 towers in the 115-kilovolt system. It found that nearly 30% of the remaining towers in that system, more than 3,500, were installed in the 1900s and 1910s. About 60% of the structures in the 230-kilovolt system were built between 1920 and 1950.

Do a little math. If 3,500 towers = “nearly 30%,” assume 29%, which gives a total of the portion that were dated of roughly 12,100. The formula for the portion that Quanta had to punt on was 6,900/(6,900 + 12,100), for a stunning 40%. Even after hiring a consultant, PG&E didn’t have a clue as to the age of about 40% of its system, and it’s a safe guess that it didn’t know bupkis about its condition either.

Courtesy Wolf Richter, here’s an example of PG&E infrastructure in San Francisco, which means the utility presumably had tabs on it:

But the California PG&E problem, of a particularly shoddy electrical utility with doesn’t even have a proper inventory of its assets, is only a part of this sorry picture. California is a US story writ large, of minimally regulated development, of the particular US fondness for housing and a strong bias towards efficiency and cheapness over safety, and of a lack of interest in resource constraints until they hit a crisis level.

Consider California population growth:

1990 29.95 million

2000 33.63 million

2010 37.27 million

2018 39.56 million

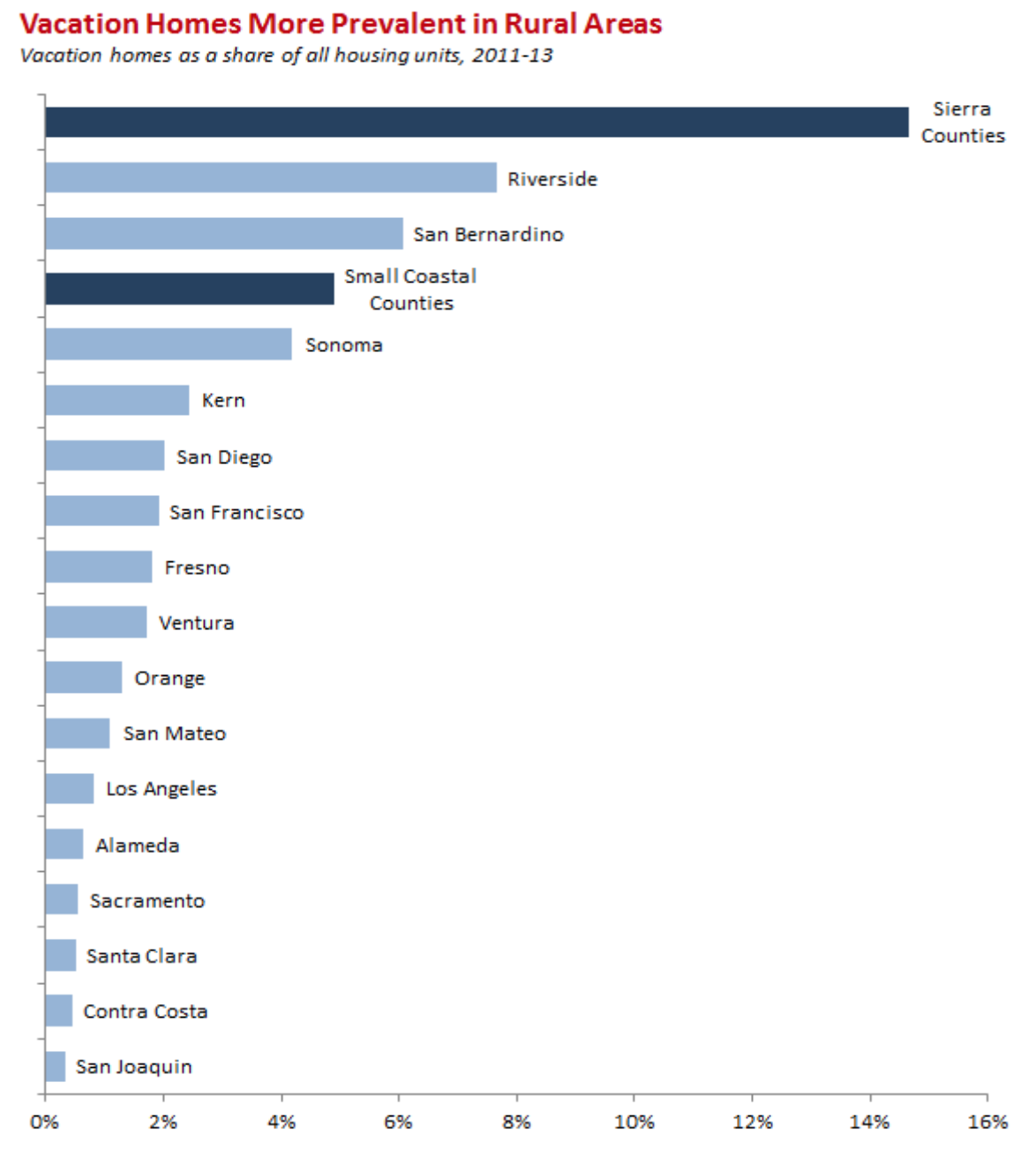

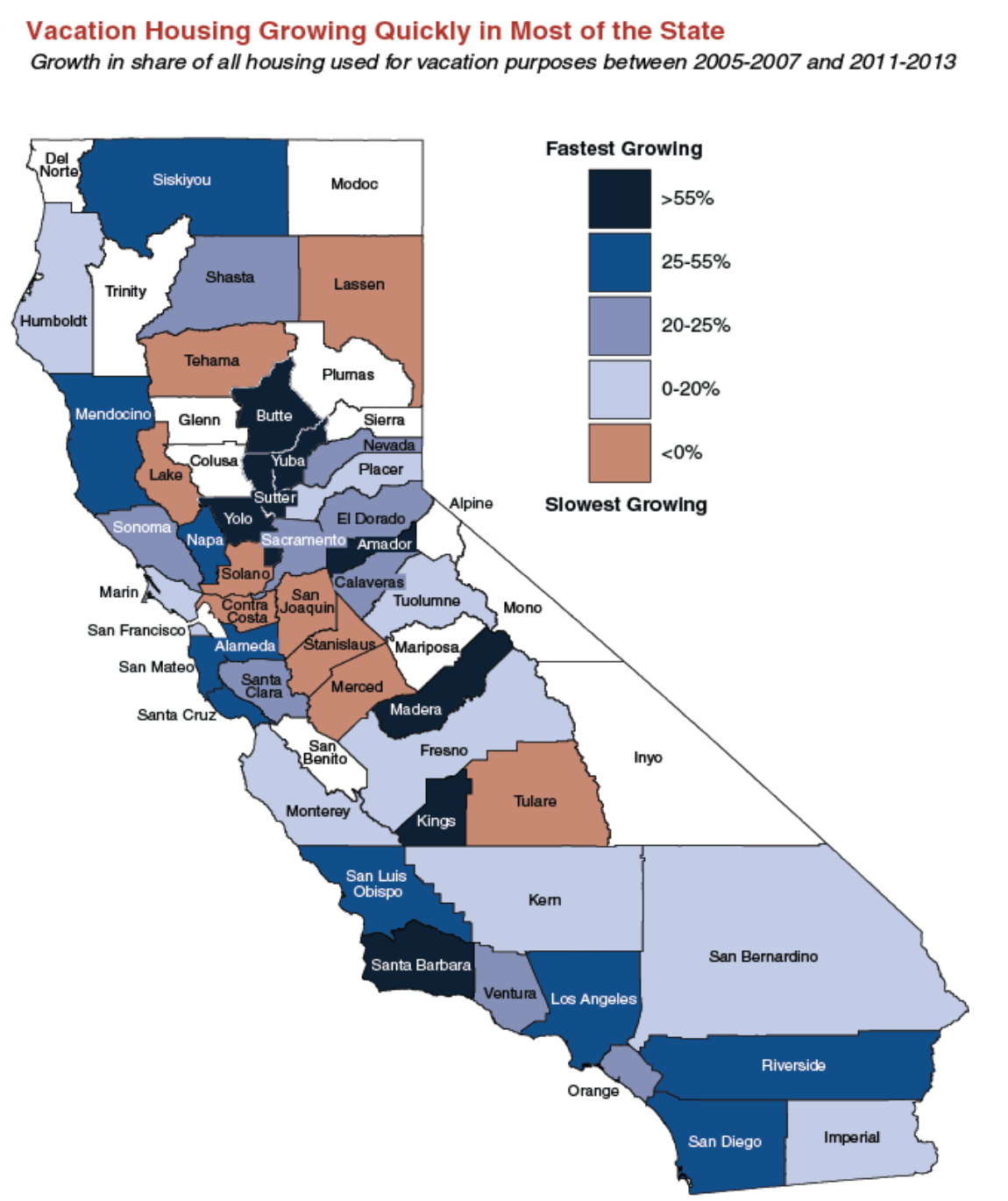

This is a pernicious example of Warren Buffet’s miracle of compounding. A “mere” sustained annual growth rate of 3.4% over 28 years has increased the population by one-third. But other factors have led to a disproprotionate increase in housing. First, the rise in second homes. This data isn’t as long-term but gives an idea:

Second is the more difficult to quantify impact of conversion of owned homes and rentals to AirBnB and other non-primary residence uses. For instance, one of our former WordPress jockeys lived in the Tenderloin district, a relatively affordable, former working class ‘hood in San Francisco. When Twitter moved its headquarters there, her rent increased 40% due to Twitter execs and senior managers renting crash pads nearby.

Third is the effect not just of population increases driving up centrally-located and not-too-distant housing prices, but the intensification of the impact due to rising income inequality.

Fourth is foreign investors buying apartments and homes, which they leave largely vacant.

These developments have led to Californians building homes in riskier and riskier areas: the well off seeing hillsides with vistas, the less affluent winding up in exurbs like Paradise, the site of the horrific Camp Fire that destroyed over 150,000 acres and killed over 80 people.

One can argue that PG&E was obligated to supply power to these locations….but without taking extra safety measures. If PG&E doesn’t even know the status of 40% of its infrastructure, it’s hard to imagine that it cuts dangerous tree branches often enough (something I see happening regularly in semi-rural and poor Maine, where this is a costly exercise due to Maine having more roads per capita any other state).

But PG&E isn’t the only party at fault. The American fondness for lax zoning means firebreaks are only infrequently established, and they are arguably of limited use in California, due to the way fires driven by high winds can jump large distances, and that many houses are in hilly areas where firebreaks are of limited value. There are alternatives like fuel breaks, which both create a development amenity and are much better at containing wind-driven fires, yet my impression is they haven’t been much adopted even in newer developments. From a comment last year at Quora by former firefighter David Sandbrook:

At one time the Forest Service did create fire breaks — bulldozer lines 20–30 feet or more wide of bare dirt — snaking across ridgetops.

They were largely abandoned and brush allowed to reclaim them, for several reasons. A strip of bare dirt going downhill becomes a huge eroded gully the first winter, creating a huge siltation and mudslide problem at the bottom of the hill. They have to be maintained and kept clear of brush. And the third reason is they do not work well at all in a wind driven fire. I personally observed a fire cross eight lanes of interstate highway.

A similar concept is used now with fuelbreaks. These are not stripped down to bare dirt. Ground cover is left. Trees are thinned and lower branches pruned, brush is removed, and the result looks like a park. These are 300 feet or more wide, and usually associated with a road and surrounds a community of homes or other high value resource. A fire will still burn through it, but with lower intensity and the road allows firefighters to stop the fire at the road, or the road is an anchor point to backfire from.

These also must be periodically maintained or the fuel grows back or the fuelbreak ceases to exist, and that is a problem. Any landowner or fire agency has limited funds available for fuel reduction work. There are hundreds of thousands of acres of fuel reduction work needed, and it costs money. Once a fuelbreak is built, periodic maintenance also costs money. A land manager or fire manager has to distribute the limited (taxpayer’s) money to get the best value. So where do you prioritize? Building a new fuelbreak around the next subdivision or maintain the existing ones? The residents of each subdivision want the money spent protecting their homes, and will scream and complain if not (and hire lawyers and go to court, go to the media, protest in front of city hall, support candidates who promise to give them what want…). Residents also complain about tax increases to pay for fuel reduction, refuse to vote for tax increases…

Focus on the magnitude of this approach…football field sized parks. They’d be terrific amenities, but think about the land cost, which developers would build into the prices of new projects. And retrofitting? Fuggedaboudit.

Another open question is where insurers sit in this conundrum. As much as people are attached to their communities and their properties, rebuilding in a known danger zone, like New Jersey shore towns that are likely to be washed again into the sea, or in Paradise, isn’t a great idea in terms of individual risk. It’s surprising that insurers haven’t started writing policies that require people who rebuild in areas with high flood or fire risk to kit out their homes to reduce their exposure, or alternatively, give bonuses to move to safer areas. The flip side is that moves like this could be so controversial that they may have to ultimately be legislated…which you can be sure won’t happen any time soon.

In the meantime, we have pious handwringing. While this section of a Los Angeles Times editorial makes a valid point, it doesn’t go far enough. If everyone is to blame, no one is to blame:

This bitter meal has been years in the making by many cooks.

It wasn’t PG&E officials who approved housing developments in high-risk areas. In fact, the utility can’t say no to serving those homes, no matter how great the fire risk. The utility also doesn’t make decisions about how the vegetation around their customers’ houses and the forests nearby are managed. Nor is it the utility’s fault that human-caused climate change has created conditions that fuel massive wildfires…

Of course Californians must not accept blackouts as the new normal every time the winds blow. But until we make the changes in land use and fire safety needed to ensure that utility lines won’t trigger the sort of devastation that leveled the town of Paradise last year, power shutdowns will be our collective cross to bear.

This may sound logical, but the fact is Californians will accept blackouts because it would take wrenching changes, including abandoning lots of homes and even communities, to reduce fire risk enough. An alternative would be a massive, double-quick rebuild of PG&E infrastructure to much more fire-resistant standards….but even if that were an attainable goal and would make a real difference, it would take years and would greatly increase power costs.

This section of a PopSci article (hat tip David L) is also peculiar in its lack of agency:

Events like the power shutdowns in California—whether preemptive, as is the case this year, or compulsory because of large fires, as in years past—will continue to happen. People in the developed world expect “one hundred percent reliability” from infrastructure, says Mikhail Chester, a professor of sustainable engineering at Arizona State University. But “we have pushed infrastructure to a point where we are going to have to recognize that reliability is going to become compromised more and more often,” he says.

Our roads, our power grids, and our water supply systems were all designed to support a world that no longer exists. That world had fewer people, better funding for basic maintenance, and a more predictable climate. Those circumstances seemed pretty permanent—so the infrastructure that was designed for them is pretty permanent too. That has become a problem, says Chester, because the world we live in now is marked by instability.

Who is this “we”? California citizens didn’t vote for PG&E to grossly underinvest in its plant and network. A Californian I know who has been spending time in Germany and France has been stunned at the high quality of the roads there compared to his home state. Chester, by contrast, acts as if underfunding were an act of God, not political choices that in large measure resulted from decades of right-wing anti government messaging.

Even though the Gilet Jaunes are critical of highway maintenance in rural areas, I have a sneaking suspicion that roads that are sub-par enough by French standards so as to lower driving speeds are still markedly better than highways in, say, downstate Michigan and northwestern Ohio.

The larger point here is simple, but too ugly to face square on, hence the supposed straight talk that minces around the rotting corpse of existing conditions. As Yankees sometimes say, “You can’t get there from here.” There’s a lot that could be done to reduce exposure to the worst effects of climate change and mass species extinctions. There is also a lot we could do to slow and even stop the damage we are doing on both fronts. But they require massive changes and costs, including ending many people’s current livelihoods and making them upend their lives in other ways. It’s easier to deny things are as bad as they are.

In case you didn’t see the Withdrawal from Syria post yet:

But some people estimate it as somewhere between eight and ten trillion dollars has been the cost of these wars, which could have been used to build the infrastructure in the U.S., to take care of the healthcare, to improve education, or in many other ways.

There’s your “we”.

Look this is simple – every MBA knows this.

To make more money cut operating costs i.e. maintenance. No need to understand the business, no need to look past the figures, no need to do any real work.

And if there a consequences just call in the legal staff.

Bob, you are correct. I live smack dab in the middle of El Dorado county, and am experiencing this first hand and in real time. We have lived on our property for 16 years and PG and E have appeared twice…with a weedeater. They “trimmed” the dirt around the power pole lower into the ground. That’s it. We do all our own tree and branch clearing and trimming. Oh, and they tried to kick my dog. After last year’s Paradise fire, they raised our rates and now cut our power randomly. This one is just the most publicized. We have it turned of randomly, for 1-3 days, with less than 24 hours warning and a big F U attitude. They.don’t.care. They don’t care that they caused massive fires/explosions (don’t forget the San Bruno explosion) where people die. SMUD is the sacramento county municipal utility and it has lower rates, better, service, and they maintain their equipment. I moved from SMUDville to PGandE land and much prefer SMUD. Everyone complains…but we all do it in the dark.

I had the house burn down in the October 2017 fire in Santa Rosa,Ca.

After the fire, I asked a lawyer ( who was a local politician at one time ) what state governmental organization was responsible for verifying that the utility companies actually did maintain their infrastructure.

The quick answer was the Public Utilities Commission, which seems to be hors de combat..

In my mind the problem in CA goes very deep as having a utility self inspect their own infrastructure makes little sense to me.

One should have an independent infrastructure auditor for BOTH private and public utility companies.

Perhaps an independent State auditing agency flying an army of drones could verify that the infrastructure met current fire standards.

But this is CA, where experts suggest 100 ft of defensible space around a home while spacing homes with 10ft of separation.

The insurance companies will eventually drive changes as one book I read had that the insurance industry paying $1.09 in claims while receiving $1.00 in premiums in the CA higher risk fire regions.

Eventually the insurance industry will price insurance higher (or stop writing policies in CA).

Note, some areas are passing ordinances to require brush and fire hazard removal.

https://www.marinij.com/2019/08/06/mill-valley-approves-tighter-fire-prevention-rules/

I have my doubts that CA will respond well to wild fire risk as the state seems hell-bent to accommodate ever more people as it pursues “economic growth”

John, the PUC through its ancestral agencies has been corrupt and dysfunctional since at least the 1920s. Even when the rest of the state’s government was fairly honest and competent it wasn’t. This allowed PG&E to do its ever greater pillaging unhindered and note that like Boeing it has lied to everyone. Regulators, investigators, customers, employees, the state, and IIRC the federal government (exploding neighborhoods tends to attract the big boys).

Both the company and the agency have successfully resisted all but very superficial changes for almost a century. Yes, PUC gets rearranged, some new labels, but dig slightly and nothing. The only real one was the one that allowed the buying and selling of energy which led to Enron and the rolling blackouts.

I really don’t know how to reform a system like that especially since none of the senior management is looking at prison. The entire upper half of California’s state government apparently has to be fired first.

> having a utility self inspect their own infrastructure

Works for Boeing! Oh, wait…

“It wasn’t PG&E officials who approved housing developments in high-risk areas. In fact, the utility can’t say no to serving those homes, no matter how great the fire risk. The utility also doesn’t make decisions about how the vegetation around their customers’ houses and the forests nearby are managed. Nor is it the utility’s fault that human-caused climate change has created conditions that fuel massive wildfires…”

Well, what about burying the power lines leading to new subdivisions in fire prone areas? It costs more upfront but would save in the long run as fire risk would be greatly reduced. And, why not bury existing power lines that run through fire prone areas. Should cost less that the $30 billion fire cost.

Lori, PG &E is like a senile old man striking a match on your house while trying to light a cigar. The underlying problem is that everyone wants to build an American style stick built house and live in the woods. Most residential homes in the USA are constructed out of 2×6’s and wood chip “plywood”, and in a wooded area like Paradise, sheathed with wood siding to better blend into the setting. And as often as not have wood shingles for roofing. And their owners wonder why there is nothing left but a burned out fireplace shell when they return!

It is perfectly possible to build a home that will withstand an intensive wildfire and be habitable immediately thereafter. —-The earth sheltered Earthship designs for example. But Americans won’t go there—they much prefer a mini-McMansion designed on the model of a Boy Scout fire teepee.

Of course if you are wealthy enough there is another solution. About 15 years ago the Green Knolls fire exploded near Jackson WY threatening a number of 20 million dollar estates. I know at least one landowner who had a direct line to the Vice President. The phone call probably went like this—- “Dick, your fat a** is in deep do-do if that fire touches a single shrub on my lawn.” Every retardant bomber and hotshot crew in the western US was there by the next morning and they literally bombed it to death.

Maybe PG&E will pay to fix all their dilapidated infrastructure by “borrowing” from CALPERS. Nothing some soft pencils (and erasers) can’t solve.

What I still don’t understand about PG&E is why it would oppose upgrading its transmission and distribution system. My understanding is that regulated utilities usually make money off the amount that they invested at a regulated return on equity, with O&M costs passed through with some incentives to control these costs. This would incentivize PG&E to spend as much on capital projects as possible; spending money to replace a 50-year-old structure with one that will last as soon should be good for PG&E’s bottom line. Yet, this doesn’t seem to be the case. Am I missing something? Does California have a different regulatory structure?

I didn’t have time to look into that, but my understanding as told me by a finance expert with wide-ranging interests, is that utility accounting in fact does not make it attractive to invest. This may be accounting with respect to electrical grids as opposed to utilities in general. This clearly was not true with respect to the old pre-breakup AT&T which had super duper sound quality on its lines, but that was a different industry and a different accounting and regulatory environment.

Separate from the accounting, electrical utilities generally have to have rate increases approved by the state regulator. This is the case for Southern Power. The joke is they are slow to fix outages to send the message that they need higher rates. That is likely the real issue, but I’ll see if I can find out if and how the accounting played in.

Yes, this is a critical point, utility investment accounting (or, perhaps better put, accounting for utility investment) does not “work” properly because a utility’s regulated asset base has few, if any, direct read-acrosses for other asset classes.

Hugely wonkish with all sorts of scary-looking equations, which no academic paper can ben seen without including (!), this whole vexing question was examined by the UK electricity generating and transmission system regulator here. A key excerpt:

Shorter, equity funding for utilities gets all the gravy, it’s difficult to attract debt funding in the commercial paper markets.This is why the equity pricing of utilities like PG&E always looks good, these so-called defensive stocks are the go-to safe place in market turbulence because of their high returns combined with seemingly guaranteed income streams.

The problem, as PG&E showed, it’s a mirage. An inability to attract debt funding means that the regulated asset base is gradually degraded. The inherent looting by equity is, however, not instantly visible. It takes decades or even half a century to begin to show. During which time, the equity investors are overly-rewarded. Eventually the asset base becomes so crapified, the whole thing (literally) falls apart and the ones holding the equity baby lose everything (as PG&E’s bankruptcy demonstrated). But by then, the consumer has an expensive problem and nothing less than public funding will remedy it. Good luck getting public funding through our current political and social moires. Of course, there’s sympathy due to the consumers who’ve paid their utility rates month in, month out so now wonder, legitimately, why they have to pay even more in future.

In my neck of the woods, the electrical grid is in very good shape. Well-maintained, the equipment is new, the response-times to problems are fast. The ‘old’ equipment is also well-maintained. Co-op and normal PUC-regulated commercial providers represented, commercial dominates urban and suburban, co-ops the rural areas.

There is a strong tax-base in my state, and the neighboring states, as well. I hear no stories of dilapidated infrastructure from the surrounding regions.

Recently I was in eastern Washington state, near hydro-power region of Columbia river (Wenatchee). Great infrastructure. County-owned, not commercial. County also provided fiber-optic comm cables almost everywhere. Exemplary operation.

From these few data points I infer that it’s quite possible to be a public utility and make money, and manage infrastructure. I suggest there is something particular about the CA case that makes them especially vulnerable.

This may be more a case of greed/politics/human stupidity manifest, than necessarily a symbol of systemic failure. Wonder what the composition of CA’s public utility commission is. Somebody’s been asleep at the wheel for decades…that’s where I’d look first.

Wenatchee Washington is served by Chelan Public Utility District, a transmitting and generating utility, and one of the strongest in the state.

The Pacific Northwest has one of the best public power systems in the country, largely as a result of the New Deal. The core of the base load is provided by the Bonneville Power Administration dams on the Columbia River, which were publicly funded, that by law deliver wholesale power at discount rates to public entities. Chelan PUD also issued bonds and built its own dams.

I have lived under both public and private systems. Pre-deregulation PG&E seemed pretty reliable. Present-day Southern California Edison is a positive hazard that has almost burned us out of house house twice in the last ten years; their low-income discount program representatives are incompetent and malicious, in my experience. Seattle City Light and Wasco Electric Co-Op have given great service, and are easy to work with.

As for the California PUC, I can assure you they have been wide-awake at the wheel, and are one of the principals responsible for this mess.

I urge readers to go back to the SF Chronicle story a couple weeks ago in Water Cooler about the ballot box lids floating found floating in the Bay and off the coast. What was on the ballot in that election? Establishing a publicly owned electric utility to replace PG&E. The measure lost by a few hundred votes. That level of corruption is what brought California to this power crisis.

The legal tools to end the corruption, and establish and fund public power to replace SCE, PG&E, and SDG&E are all there right now. They are not rocket science, and it has all been done before. The California political elite knows this, but they will have to be forced to do it.

Perhaps you haven’t heard Seattle City Light has neglected to replace rotten and beetle infested power poles for years. In April, a bad storm caused 26 adjacent poles to fail and fall into the road nearly killing two people in a car.

The CEO was on the news tonight and said they will begin shortly to replace 6,000 poles in their region. It will take at least two years. At least they are stepping up to the plate. We’ll just have to hope we can get through the upcoming stormy seasons without any further failures or loss of life.

I hate to tell you, but if you are in an area served by hydropower the economics are so different as to make a comparison to any other power generation system almost entirely irrelevant. The Pacific Northwest is not a model for the rest of the US.

I agree that the economics of the power source mix in the northwest is unique, and is not a model for the rest of the US (though California does have a significant fraction of its electricity generated by hydro). In the case of PG&E, the backlog of maintenance will have to be funded somehow, but that might be better done under direct public control. We’ve tried having it run under financial market control, and look what we have now.

It is the institutional and political structure of public power that can be a good model for other parts of the country. Elimination of investor-owned utilities would excise the type of pandering to financial markets and regulatory capture that caused the San Bruno, Sonoma, and Paradise crimes. That is not to say that publicly owned utilities are free from corruption — anyone that lived in the Pacific Northwest will remember the Washington Public Power Supply scandals of the 70s and 80s. But in that case political pressure by ratepayers on utility boards, and the election of ratepayer activists to the boards, compelled WPPSS to terminate construction of poorly planned nuclear plants.

The leadership team at both of the big California utilities has been terrible for at least a decade. Total mediocrities with an overly chummy relationship with the PUC. And of course, the PUC as a governance organ is almost useless, it’s so compromised and ineffectual.

The real problem is the way utilities are allowed to make money by just earning a ludicrously high rate of return on money they invest in the rate base: it incentivizes them to go for big, expensive projects, not for less glamorous things like maintenance, pole replacement, etc…

As you can imagine, this is a very complicated area. I am not sure I fully understand the comment about not being attractive to invest – the truth is that the greater a ratebase, the more a utility can earn. Utilities do have to get their expenses approved by regulatory bodies, but for the most part, necessary investments tend to get approved with little pushback. (Now, the question of what is “necessary” gets debated a lot, but investments in faulty transmission lines rarely get argued against.) Utilities do get a guaranteed rate of return (which has been lately creeping up).

In Texas, most of the utilities and transmission operators/owners over-earn their approved ROE/ROI (I’d imagine this is the case elsewhere, too). Additionally, they have TCRFs/DCRFs (transmission/distribution cost recovery factors) – meaning they can get recovery of T&D investments very quickly, without filing a rate case. A vote of confidence comes from JP Morgan, which is trying to buy El Paso Electric (an integrated utility), while studiously trying to disguise its stake (https://prospect.org/power/jpmorgan-gets-back-into-the-electricity-business/). Ironically, it was JP Morgan traders’ machinations in California (leading to one of several crises in the CA electr market) that forced JPM to pay a $420 million fine and promise to FERC that it would stay away from energy markets. Did not last too long…

But let’s get some clarity here – one topic is California and its incredible, amazing ability to mess up the way the state provides – or guarantees/regulates provision of – electric power. The other topic is the el utility business. These two have little in common and need to be analysed separately.

As for CA – for example, in late 1990s, Texas legislators/regulators travelled to CA to see how NOT to do el deregulation! The whole thing was so botched… it was hard to believe that thinking people devised the system (just one thing – while wholesale rates could increase, retail rates were capped… unsurprisingly, leading to a crisis and eventually, bankruptcies). Maybe it’s something in the water, but CA just cannot get a grip on meaningful regulation. Or maybe it’s really the utilities in the state – they must be thoroughly incompetent. It makes no sense otherwise.

(On the other hand, the state is in the forefront of the solar power and battery technology adoption – with great encouragement from the state regulators.)

Remember, when investing in utilities was considered safe for widows and orphans? From the regulatory standpoint, not much has changed since then. What is changing is technology – the effect of which is still not fully understood (partly depending on the utilities’ ability to reinvent themselves – though they are not typically known for excessive creativity).

But this brings one to a potential solution for CA – more localised solar and even wind power, with the creation of micro-grids – eventually, eliminating the need for long-distance T lines. If that leads to the elimination of the disliked utl cos, so be it – they’ve already recovered their “stranded” cost at least twice.

Ahem, utilities can’t go and add to their rate base just because they feel like it. They have to get approval of their regulator to add to the rate base and then they also approve the related rate increases. If the regulator won’t approve rate increases, or much of any, there’s no point in having the conversation about adding to the rate base.

This is very well established behavior around the US. NYC also has terribly old infrastructure. NYC gets away with it better because its lines are buried.

As a regulator, I participated in quite a few rate cases and am familiar with the rules. I said nothing about “feel like it;” rather, I mentioned necessary investments (the nature of which and the need get debated). As you can imagine, utilities are not beyond playing games, such as submitting applications with high revenue requirement – that later may get lowered. A lot depends on how good/competent the regulatory body’s staff are and also how determined intervenors are (e.g., representatives of commercial customers, cities, etc.). Regulation also varies by state – some are more stringent, some less. CA is an interesting case in many respects.

Yes, as someone who has spent some time on the utility side of a few GRCs, I found that OFWAT paper by @Clive (but many thanks for sharing!) a wee dram hard to make out. Cost of capital and escalation rates are supposed to take into account such stochastic risks as inflation, particularly of key factor inputs.

There is of course a moral hazard in that if a force majeure factor not in the utility’s control goes way negative they often ask for and get rate relief (socializing losses), while if it breaks the other way they happily pocket the gains until the next rate case.

In general though, a utility only survives as a ‘going concern’ when you put about a dollar of RAB (renewal or maintenance capital) in for every dollar that rolls out in depreciation. The presumption is that the system basically goes on forever, barring some disruptive innovation (real, not financial jiggery-pokery or Muskian greensmoke).

TSR to equity is dividend driven, with the growth component generally predictable and priced in, and any windfall returns clawed back in the next rate case.

That’s a basic flaw in the post-dereg IPP power plant model from the owner POV. That asset is finite and also incurs substantial decom costs (or ought to). Once it’s fully depreciated, it basically runs at cost for the public benefit, and no red blooded capitalist wants that! BOT models don’t work well either, since the owner then runs it into the ground in the last 5 years prior to handing over a wreck to the state.

Some say the world will end in Greed. Some say in Stupid…

The problem isn’t so much the variables (things like maintenance costs, economic lifespan, first cost, discounted cash flow cost, depreciation, inflation etc.) but the sheer complexity of how these particular factors — while known upfront as inputs — interplay over vast periods. Vast by conventional business standards, anyway.

For example, where my mother-in-law lives is a wooded wayleave used by the utilities. There’s a transformer which picks up the 16kV from the distribution ring and steps it down to the U.K. standard of 400v (three phase for light commercial use) / 230v (single phase for residential use). The transformer looks old and indeed it is old — there’s a makers plate visible on it. It says “1935”. This fits, as a lot of electrification was competed here in the ‘30s.

How on Earth are accounting standards supposed to be applied to this kind of distribution infrastructure? You can really pick any standard method for assigning the asset its book value, its replacement value, its maintenance cost, its expected asset life, an assessment of its asset quality and if it needs reviewing for asset impairment — on and on and on.

If the transformer did fail, what sane assumptions could you make for how to do the accounting on its replacement? What is going to be the inflation rate over the next 50 years? What is the economic lifespan of any replacement (given that in 20 or 30 years, the neighbourhood might undergo dramatic changes in use and the design of that particular segment of the distribution grid may need to be substantially revised (such as grid reinforcement for increased domestic loads due to electric vehicle charging, embedded solar generation etc. etc. etc.)

Even if it wasn’t a fix on fail situation, is a preemptive replacement justified? Or rate gouging by the local distribution company?

While you’d have to do some accounting for it, what you do end up doing would merely be a load of posh words for “complete guesswork”.

At my TBTF, we have endless bickering about the correct depreciation policy for ATMs — an infinitely simpler, by comparison, consideration.

Wouldn’t point Texas electric deregulation, its actually worse than California is. As is our infrastructure (how many states have considered turning pave roads into dirt roads,.Texas has.0 in fact if the counties where those roads are hadn’t picked up the tab, they would be today. Course most can’t do that

PG&E did request and got rate increases specifically for maintenance including for gas lines which often did not happened. At least the with the gas, the money was diverted. That is the reason that the neighborhood in San Bruno when boom. IIRC, there was some record keeping issues on that hid the lack of work and the diversions, which only appeared when the state really pushed back and forced the utility to show what very little paperwork it had.

The problem is not lack of funding, but the longterm diversion, sometimes illegally, into pay, bonuses, and dividends. The company was not starved of resources. It just chose to enrich the senior management and investors. I do not think any extra investment for improvement and maintenance would have gone there.

At a guess then I’d say this has to do with the difference between repair and upgrades. Upgrades can in some cases be considered as capital expenses and repairs are considered as operating expenses. Cut the operating expenses and profits increase (almost always at least in the short term). Capital expenses need to be justified by return on investment – will there be increased revenues and/or increased profitability after the investment.

Depending on the regulatory environment then it might (I am not an expert on this particular regulatory environment) be best for the profits if repairs and maintenance are kept to a minimum and if there is no increase in profits/revenues for a capital expense then the capital expenditure might also be nixed. A fully depreceated asset might possibly be replaced as the (accounting cost of) depreceation of the new asset might allow for increased prices (depending on the regulatory environment).

A drastic increase in the maintenance/repairs budget due to not having spent enough in previous years might also be problematic – then it might be argued that previous (accounting) profits should not have been allowed by the regulator but those profits are already paid out…. Public ownership is in cases like this slightly better than private, the private owners might go for the short term profit and leave the losses to a sucker coming after. But it has happened that public sector can do the same – the career of an individual in the public sector might be helped by reducing costs. The reduction might possibly be more accurately described as a postponement of costs and often an increase in costs but what should a career-minded MBA do if to prioritise his/her own good before the public good?

I think that this might be a situation where the ones who know (PG&E) will not speak and the ones who speak do not know.

One thing is certain in PG&E investments; They have the newest and best trucks.

A friend who runs a Ford dealership pointed out that many of PG&E’s vehicles are new and laden with accessories.

For sure trucks with augers to drill holes for power poles, and gas maintenance need to be reliable and new, but brand new $70,000 pickups, usually driven by a customer service representative wearing a hard hat and could be driving her own car, or a five or ten year old PG&E pickup truck are what’s seen on the street.

Maybe there’s some tax advantage to PG&E to this new only vehicle scheme through depreciation or something?

They are going to need to upgrade to bullet proof glass. Someone took a shot at one of the workers yesterday. Folks are angry. We run a generator and are used to the disfunction PG&E provides consistently; the only reliable thing they provide. But many folks–we call them flatlanders since we live in the foothills and tend to be more self-sufficient (wood stoves, propane, solar, etc to be off grid)—they are dead-in-the water and truly at a loss of how to cope with this.

https://abc7news.com/chp-pg-e-truck-shot-at-on-i-5-near-colusa-county/5606773/

Wait, so PG&E are awful people for having decrepit unsafe wires assets, but are also awful people for having newer safer vehicles? And no they didn’t short system maintenance in order to trick themselves out in shiny new trucks, if that’s what you’re implying.

That’s not how it works (how it does work is just as bad), although I’ve certainly seen it done in ‘other’ parts of the 3rd World, especially in state owned enterprises.

But anyway, as you guessed correctly, there’s a cost-benefit model (including safety metrics such as PMVA) that incents most institutions to lease vehicles nowadays, rather than own them. So that increases turnover, leading to what you see.

(And as I hope everyone here agrees, directing violence at work crews is just plain stupid, as stupid as Tim McV blowing up a bunch of people who looked like his mom as some kind of revolutionary act. The field guys aren’t the problem here).

There appears to me to be one workable resolution to this issue— California must condemn P.G.&E. and take over ownership and responsibility for operating, upgrading, and maintaining its electrical generation and distribution facilities. The time has come to acknowledge that private capital and private ownership have no place in public utilitities, highways, health care, law enforcement, penal institutions and other corners of our society which either require monopolies to be efficient, or in which financialization frustrates public purpose and well-being.

+1. Absolutely.

I live in California and it has never made sense to me why the utilities are private entities. I moved here from Nebraska which has no private utility companies (or at least didn’t when I left in 1987). The voters there elect the boards of the utility districts not stockholders. And the bills are much higher for private utilities as well.

Due to climate change and the increasing volatility in the weather, public run utilities will be able to better respond to changes in our environment since they answer to the people and not shareholders and most importantly profit is not a concern.

Totally agree. I hail for Indiana and my husband from NY and we are baffled by the way utilities are managed and maintained.

nice theory. in reality they will answer to their unions.

By popular demand in California, we agree about condemnation and breakup of PG&E.

Another example of the evils, corruption and inefficiency of privatized utilities:

Cal American Water Company that supplies water to the Monterrey Peninsula.

Lousy tardy service from incompetent bottom of the barrel underpaid employees phone calls to their corporate headquarters in the Midwest, impossible to reach a human, “visit our website” levels of customer service etc.

Like PG&E, another Wall Street financial venereal disease loosened on the body of our nation.

“California American Water, a wholly owned subsidiary of American Water (NYSE: AWK), provides high-quality and reliable water and/or wastewater services to more than 600,000 people…With headquaters in Voorhees, N.J., the company employs more than 7,000 dedicated professionals who provide drinking water, wastewater and other related services to approximately 15 million people in 32 states and Ontario, Canada.”

About the only thing that works in San Francisco, and magnificently, is the municipally owned San Francisco Water Department, as well as Marin Municipal Water across the bay, although they have overpaid incompetents on their board.

Every municipality should control the destiny of its infrastructure without profits flowing to Wall Street.

It’s just a ballot measure away in 2020’s election.

I’m surprised California utility deregulation didn’t 180 after the first time (Enron with it’s bogus supply constrained rolling blackouts and brownouts). Maybe people thought it was limited to a few crooks.

Now we are wiser, hopefully.

Richard, taking over PG&E is something that can and must be done! It will take citizens putting together two referendums for the 2020 ballot.

The first would end PG&E’s ability to operate in CA and pay them for their depreciated assets (about $49B for electric and gas) and also take over a) existing purchase power contracts (PPAs), b) maintain employee retirement funds, and c) break PG&E into about 15 local municipal utility districts like SMUD. About ten of these districts already exist as community choice aggregation (CCA) entities that are mandated to buy renewable power. The $49B asset payment would have $35B subtracted to pay for the $35B in fire damage that PG&E is refusing to pay. The money to pay for all the required future upgrades to the system can come from the money that no longer goes to the stockholders.

The second referendum would cover how to fund the purchase of the $49B of electric and gas assets. It is a simple solution that solves two problems at once by requiring CalPERS to lend the $49B at 7% interest to buy the assets. CalPERS needs 7% to be solvent and not reduce payments or raise taxes. Rather than paying the 16% profit rate that PG&E is asking for, the 7% from CalPERS would be a bargain and you don’t have to deal with vulture capitalists like Paul Singer (who is trying to buy PG&E). An additional bonus provision of the referendum would be that CalPERS would be prohibited from using private equity or hedge funds.

Public/municipal utilities provide 25% of California’s electricity in a reliable, safe, and cost effective manner. The remaining 75% needs to be run the same. PG&E currently averages $0.20/kWh and taking them over would have average costs be about $0.22/kWh but the asset purchase would be fixed for 30 years so PG&E’s 4% annual rate increase would no longer occur. Additionally, the transmission systems would be upgraded. Maybe the public Transmission Agency of Northern California (TANC) could be persuaded to help manage the new State transmission assets.

The politicians are paid by PG&E, so it is us citizens that will have to make this happen in the next 13 months.

Just below, Yves says that the stock value of PG&E is actually negative, so this seems like a good time to buy – except that the state would then be taking on the huge liability exposure the company has.

Maybe buy the assets at a liquidation sale after paying off the liabilities? The legalities start to get complex. But yes, given the huge investments needed, the ratepayers might be better off paying off municipal bonds than risky commercial ones.

The common stock went negative yesterday when the judge said the bond holders could submit their own bankruptcy plan so that the stock holders (at least the common ones) are wiped out. However to buy pg&e you would have to pay off the bond holders (see the 1899 Union Pacific bankruptcy for details of how the buy out had to pay off the government bond that were issued to build the rail road. Its just like if your home is foreclosed and you are underwater you get nothing in the foreclosure. Of course Ca’s badly botched deregulation is a piece of it. It did not separate the transmission and distribution utilities like Texas did. The distribution utility takes from the substation to the home, and the transmission takes from the power generation location to the substation, including some intermediate distribution substations if needed.

A much cheaper way is to encourage the adoption of distributed generation (solar, wind, storage) and micro-grids – in time, simply reducing, and then eliminating the need for a large utility (or even the public power – except in some instances). If I recall, PG&E at the start of deregulation got recovery of its “stranded” costs; later, they were paid another $5 bil.

If long-distance T lines are the problem, it does not matter who runs the grid. They will always be subject to dangers (fires, storms, etc.).

Actually with the new building guidelines in Ca all housed build after next year will have solar panels. (I don’t know about the roofs of metal and small screening on roof vents and no visible wood at all on the outside of the house and temperature resistant windows (Heat from a fire can cause standard windows to break.) Of course this will price more folks out homes instead of go west young man it may be go east young man. Of course Pr last year demobstrated value a cistern to supply water (other islands in the Caribbean have those including the USVi) but PR did not and had a central water system. Even with solar alone you can keep fridges and freezers cold, as modern ones take less than 2 kwh per day. Add some led lanterns with rechargeable batteries you can go longer, as well as the various battery packs to recharcge cell phones and the like. Once musks satellite network goes into operation if your house is ok you would not need any immediate local help. ( given a portable propane grill or stove i.e a camp stove)(since ca is doing away with natural gas stoves (which btw will also reduce earth quake damage as breaking gas pipes will not pose as much of a hazard. ) All this one can find by looking at doomsday preppers and homesteaders web sites.

Solar panels don’t provide enough power in the winter and you have a time shifting problem even during the day, with peak usage occurring in the early evening when the panels are not putting out power (we’ve posted on this). And this doesn’t do anything for existing buildings, particularly ones not oriented to make best use of the sun.

Shorter: solar is not a magic bullet.

a headline this morning that solar panels do not function without electricity; they shut down too

Yes. Most inverters sold with solar systems are “grid-tied” and are required to shut off during a power outage. This is a safety feature intended to avoid the accidental electrocution of workers who are trying to restore service by repairing downed lines. UL 1741 explains the inverter shutdown requirement in gruesome detail.

There are standalone inverters that are intended to operate as a power generation “island” that won’t cut off, but you’d have to move your appliances from their regular wall outlets to the inverter to make anything happen. And they can waste a lot of potential energy generation when the attached loads pull less power than the solar array is capable of providing. People generally only install these inverters in remote locations where there isn’t any grid at all.

And finally, there are “switchover” inverters that feed surplus solar power into the grid when the grid is up, and automatically disconnect when the grid is down. This gives you “the best of both worlds”, but they’re also the most complex and expensive. Failures are common. And if your attached loads exceeds what your solar array is capable of supplying, things collapse anyway.

And if that’s not good enough, you can add batteries to supplement your array to handle motor inrush events and clouds and such, but that’s yet more cost and complexity with yet more failure modes. And if you ever experience a fire that involves the battery… Hoo boy. Your house will almost certainly burn down. Battery fires are difficult to extinguish.

Fully energizing a house for 24-hour operation independent of the grid is tough enough with even a diesel-powered generator. Doing it solely with renewable energy is far more complex with much more capital cost.

Yves Smith is correct. Solar is not a magic bullet.

That is only because many are wired so they disconnect from the grid if the grid goes down for any reason. This is so they don’t backfeed into the grid and electrocute utility workers trying to bring the grid back up.

Utilities are now allowing specifically wired solar systems that sense if the grid is down and then disconnect from the grid but still allow the solar to serve the local house/business needs.

Sorry Grumpy, I didn’t see your comment first.

Depends where you are located. In the Bay Area during the SB1 solar rebate program (which I ran on/off for 10 years), we had solar installers trying to install 2 to 3 times the customer’s needs in order to sell solar panels. We restricted the size to 110% of the customer’s prior annual usage to allow all customers to take advantage of the rebates. With ITC of 30% and the rebate, the costs of the panels was reduced by about 50%.

The customer load is also a big component of using solar. In the midwest and east coast the load is very large, but our average customer usage was 400 kWh/month (about 600 kWh winter) because there is no air conditioning. Until recently the cost of batteries was too expensive, but they have dropped enough to make sense in the Bay Area and some people are going “off grid”.

Recently, I was analyzing the viability of using a $10,800, 10.6 kWh lithium carbonate battery to cover PG&E’s outages. It would cover our 28 cu ft refer (722 kWh/yr) for 5 days but would be very expensive (3x the cost of a backup generator) just as a backup.

But, it would take 10 years for payback if it were charged at night (or by solar) and set to provide electricity at the peak time of use rate of $0.48/kWh (4pm to 10pm) and there would be about a $900/year savings.

You need a 3rd referendum to require the state to perform criminal investigations with the power to claw back ill begotten gains for executives & shareholders.

Of course Utilities should be Public. But California shouldn’t stop there. Nationalize and de-Federalize the state’s military industrial sector and bases as well!

I’ve always thought that Cascadia (Washington, Oregon, and Northern California) is the ideal size for a Nation-State. Big enough to have a viable resource and technical knowledge base but small enough to put to rest any thoughts about becoming a Global Empire. Of course the Pentagon, CIA and it’s captive “news” media would object, but the combination of Washington’s Trident submarine fleet and Silicon Valley’s cyberwarfare capabilities would put any dreams of re-colonization out to pasture. The world would certainly breath a sigh of relief if the Empire fractured into the nations of New England, Old South, Greater Texas, Cascadia, and Trumpistan (AKA Flyoverlandia)

Actually, you would have to fight with the rednecks and loggers that want to split California and Oregon into an new state – the State of Jefferson.

https://en.wikipedia.org/wiki/Jefferson_%28proposed_Pacific_state%29

As you leave Weed, CA, there is a sign saying: “Entering the State of Jefferson”.

I could imagine the Great Lakes States and regions functioning as a separate Great Lakestan.

And what if West Virginia were to change its name to Appalachia? And invite any neighboring Appalachian-type country to leave the state they are in and join the new state of Appalachia? At its best and most biggest, the State of Appalachia could cover all the hilly or truly mountain country from NorthernMost Alabama and Georgia on up into Pennsylvania at least.

The State of Appalachia could have fun thinking up interesting State Mottoes.

” Welcome to Appalachia – a Madagascar of the Spirit”

or maybe . . .

“Welcome to Appalachia – America’s Tibet.”

We had our fire safe council meeting the other day, and we were discussing how to approach vacation rentals, in terms of getting out the message that outside campfires are a big no-no in the summer in the Sierra foothills when all it would take is an errant ember to set off a conflagration, and also the idea that an abode that somebody is temporarily occupying means the sojourners aren’t hep with the lay of the land here, and should a wildfire/s happen, where do they go, and where is the fire coming from, etc.

Add in that 30% of the visitors to Sequoia NP are foreigners, and although many speak English-not all do, adding a layer of complexity to an already vexing issue, with so many short term vacation rentals here.

So some believe the State should take over PG&E and rebuild it, but if it does, it will then immediately sell PG&E to the lowest bidder @ a fire sale price to boot. Oh, then the new buyer will raise rates to cover the cost of paying off the loans it received interest free. What could possibly go wrong?

And where is the money to even modernize it in the first place going to magically come from? Tax increases will be a hard sell (although things being as bad as they are, and Californians not the most hostile to taxes … it’s merely state income tax is already at 10% and sales tax the same). So realistically tax increases are probably a no-go, bond issues the only realistic path and I think it would be a pretty huge bond issue as well.

I came across a bunch of very old newspapers when I cleaned out my mother’s house. I’ve been transcribing some of the more interesting stories. This one seems apropos. From The Milwaukee Journal, Thursday, December 10, 1936:

Seems like in the “bad” old days of the Depression, people had no problems with municipalities purchasing utilities and running them in the people’s name. And even providing pensions for the people who worked there! No FOX News back in 1936.

Does anyone know what happened? The usual privatization scheme???

Probably the LADWP? If so it’s not a utility that people exactly rave about though, and mired in corruption and retrograde policies. At least the power turns on? Gotta have low standards here …

Given PG&E’s stock price it would be a good time for public entities to buy out the company. But also given the collusion between developers and various state and local governmental authorities in aiding and abetting development in fire prone and other high risk areas, would that make the electrons run on time and safely?

The ownership isn’t really the problem here, although public ownership would simplify how to implement the solutions. The issue is the massive capital expenditure backlog and impaired asset base of PG&E. This is a monstrous liability, looking for someone to pony up the equally monstrous amount of money it will take to resolve it. The rate/tax paying public no more wants to cough up the cash than do the capital markets. See Yves’ and my comments above for the longer form description of the problems attracting debt funding from the commercial paper buyers and how equity gets preferential treatment under the accounting system for utility assets and investment, but equity is only interested in an existing asset base, not in building out a new one (or fixing up an old one, like PG&E’s)

If we don’t clear out the brush and debris around our house, the fire department, will warn us, then fine us, then on third go round, do the work themself, with a contractor, then bill us and sell our house out from under us if the bill isn’t paid.

Seems that the State of California could do the same thing with PG&E

A. Warning; you have x amount of time to self-finance, the repair of your system without any more blood being withdrawn from the turnip of the ratepayers.

B. If they don’t comply, fine the shyt out of them.

C. The state does the work itself, via contractors, with the seizure

WITHOUT COMPENSATION of the entire system to pay for the fines and the work to upgrade the system.

Following Yves’ “ahem..” post below, the State of California should be paid by PG&E stockholders that would be billed, and certainly civil and RICO criminal clawbacks from all their executives who benefited from their stock sales and bonuses previously.

I think this runs into the issue Clive describes above: the voters/taxpayers are not willing to pony up the funds needed. Any political animal who has the temerity to propose this (or somehow sneak it into practice) will be dumped post-haste at the next election.

A publicly owned untility can issue municipal bonds paid out of power revenues to fund the renovations. I agree it would be no picnic, but it would be better and likely cheaper than any private alternative. It would also eliminate the sources of the political corruption that generated the crisis.

Ahem…..

The company had declared bankruptcy so its equity has no value. In fact, it has negative value due to litigation and the need to massively upgrade its plant.

An analogue is back in the days when integrated steel mills were getting killed by mini-mills (think Nucor), and still had decent defined benefit pension plans. When mills were sold, the buyer would have to be paid to take it off the seller’s hands.

So, PG&E will pay us to buy them with all the money they don’t have. I’m sure it will all work out just fine :>/

PUC – the state- has failed to police pg&e so the solution is for the state to buy pg&e? That’s some fuzzy logic.

In 2019 I retired from a well known “research” university and moved to Hamburg, Germany. The main reason: A well regulated and affordable health care system. My yearly premium is less than my out-of-pocket costs in 2018. And there is no such thing as balance-billing. My most expensive prescription is now just 30€ versus $350 plus a 50% “co-insurance” until I met my deductible.

The infrastructure is amazing compared to the place I left (the only new roads are toll roads and the states refuses to show anyone the contracts with the private operators in gross violation of the Open Records laws). I haven’t needed a large vehicle yet and if I did, they’re easily available for rent.

My colleagues were stunned by my move for one simple reason: Taxes. I left a low tax, low services state where my effective tax rate was 24% (with an 8.75% sales tax rate but I am widowed and I don’t spend much of my disposable income). My income tax rate in Hamburg is greater than 50% and for that I get a livable, walkable city with outstanding public transport (that’s less than a car payment per month by far). In the 9 months I have lived here I haven’t found myself missing anything.

I don’t see myself returning. But I will be voting in 2020.

I assumed you have a spouse as an EU citizen or could obtain it via your ancestry (Ireland lets you go back as far as grandparents) or worked there long enough to become a permanent resident. It is hard for retirement-age Americans to get EU residency, so I envy you.

Yves, you forget marriage… (just kidding!). But seriously, those of us who can, are plotting the return to a civilised Europa. (Of course, if one were a long-term resident of Germany, all you’d hear is how the country has gone to the dogs. But even with that, it is more people-friendly than USA, USA.)

Please read more carefully. The first thing I said was spouse.

From what I know of Australia, and I assume the EU is similar, they are very well aware of sham marriages. You can’t just go marry an EU citizen and then get citizenship. In Australia, you have to be married 2 years. And even then they go to considerable lengths to flush out phony marriages. For instance, they separate the partners and ask them all sorts of personal questions to see if the answers match, like “What color are your sheets?” “Who was the best man?” “What is your Saturday routine?” What beer does he drink?” “Where did you go on your last vacation?”

My grandmother was from a country that offers expedited naturalization. I have always wondered what she should think given her third-class passage to the USA in 1910s to improve her life and her grandson headed the opposite.

Though to be fair, I also qualify for the “EU Blue Card” with my STEM degree and experience.

I don’t hear it clearly stated anywhere recently, and I’m going to do a bad job doing better, but IIRC, in general, the electrical grid used to be part of a vertically integrated system, it was owned and maintained by the same organization that owned the power plant that supplied the grid, and incidentally, was probably a local/regional monopoly granted under laws dating to the time of the New Deal.

Then came the push for deregulation, pushed by various players who saw opportunities to profit from carving up the assets, basically power companies, from their perspective, could profit from selling (abandoning) power plants, and thus avoiding the cost of maintenance, this was seen as an opportunity for some to own the grid without the cost of power plants, they retained the grid assets, and charged customers ever increasing rates for delivery of services, but in an effort to maximize profits, neglected the grids, which BTW, were already badly neglected before deregulation became a craze that enabled continuing, and worse neglect.

On the other side of the equation are the buyers of the power plants who see a great opportunity in owning production without the cost of distribution related to grid maintenance.

In short, the delivery of electricity in the USA quickly evolved from a closely regulated system with well defined responsibilities, and oversight at all levels, to an abstract, wild-west scenario where ownership began extracting immense profits, in part by abandoning maintenance to ‘reduce costs’.

In PG&E’s case, they went from selling power they produced, to being a net purchaser of electricity they bought from, among others, the new owners of power plants they had recently sold.

Deregulation also enabled what was sold as the introduction of competition into the electrical ‘market‘ but which actually introduced the ability to game the system, by allowing brokers to interject themselves between producers of the natural gas necessary to provide electrical power production on the one hand, and also between the electricity producers and their customers, the power companies that delivered the electricity over their grids, remember Enron?

Sending Jeffery Skilling to jail did nothing to undo the damage to infrastructure.

Deregulation of electric utilities resulted in the same sort of chaos/corruption, and damage to the public as the deregulation of the banks, and the immense changes in California’s population and the effects of increasing wealth disparities that that helped drive populations sprawling into semi-wilderness areas prone to wildfires hasn’t helped a bit.

Shorter version;

Every iteration of PG&E since their formation in 1905 has kicked the can down the road as concerns infrastructure maintenance as evidenced by the pictures of hundred year old power poles that have been circulating.

It seems with every change in regulation and corporate structure, maintenance has been at the bottom of their priorities, until now the price of fixing the problem, when added to the price of their liability for recent fires makes for a practically unsolvable problem.

Top it off with the filthy rich moving to the wild and scenic places that require new power lines, and the middle class following close behind to find affordable housing in small rural towns with old powerlines, after being priced out of the cities…

… a recipe for systematic collapse.

Leaving the poor nowhere to go for housing, or if they do find something, it is in some ready made human barbecue pit just waiting for the spark. Has anyone noticed that the areas with the highest levels of homelessness have enough vacation homes to take in all the homeless?

Sonoma does not have a high population, last I looked, but it is still within commuter distance for San Francisco, the East Bay, and even San Mateo considering some of the commute distances of some people I have know, which allow upper middle class workers somewhere to rent, or maybe even buy, a home. Then there is Los Angeles…

On those firebreaks, some areas are just too congested between houses lined up along very curvy, narrow 1 1/2 lane roads completely surrounded by trees including gigantic evergreens like redwoods. Redwood forests do burn. The whole redwood ecosystem is set up to burn on occasion, which is why redwoods have inches deep extremely fire resistant bark.

I can just see some roads getting blocked by a car or an already weakened falling redwood and blocking entire neighborhoods. Even though the various fire departments have been screaming for controlled burns and at least some more limited brush clearing, the various middle class residents in the North Bay have been very resistant. Those dangerous neighborhoods could be made much less so with just some minor effort, but the views are so important. So next time it might not be poor people.

The stupidity factor just astounds me. Tens of thousands of people homeless. Many more living in RVs. Tens of thousands of unoccupied homes, who knows how many places are being used as Airbnbs, and PG&E cutting power off to most of entire counties after setting much of the state to burn and all for profit.

There was a time when my state’s government, higher education, and infrastructure were often envied. Not so much now.

The story you tell in your comment fits what I have read about the electrical utilities. The utility companies took over control of the Public Utility Commissions which were supposed to safeguard the public interest and prevent things like PG&E’s poor maintenance and provisioning for the portions of the GRID they were responsible for and prevent price gouging their rate payers. I am guessing either the utility company management fell asleep at the wheel or they were so focused on directing State and Local government actions in their favor they were caught off guard when a series of new Federal Laws were passed to privatize power generation, and dismantle the old utility company monopoly structures. I am still trying to figure who the players were who could direct this change at the Federal Level. I suspect some big money was behind the scheme that enables giant solar energy and wind energy ‘farms’ to feed their power into the GRID and requires the utility companies to buy that energy at going rates. The utility companies were stuck maintaining the GRID infrastructure and balancing the power on the GRID but deprived of their lock on the profits from generating power. This switcheroo came at the same time Neoliberal management practices encouraged practices like PG&E’s deplorable maintenance and provisioning of their part of the GRID.

California, like many other states — New York, New Jersey — has high taxes rates yet provides less than stellar state services. Where is the money going? The States are not fighting any foreign wars. The suggestion to sell bonds to avoid raising taxes — a suggestion followed a little too often by states like New Jersey — might be part of the answer, but interest rates in the economy are low. Where is all the money paid in for high state and local taxes going? Part of it could be the state programs that once enjoyed substantial Federal support that is no more but that also does not seem a complete explanation.

Well Texas propaganda says it has low taxes (only it doesn’t really). And we get less ‘services’ than other states do. and we do the same bond thing. But usually its for a stadium, or maybe a road (that have toll lanes).

I saw a lot of Californians on the news tonight seriously unimpressed with losing power due to the threat of high winds when there was not enough breeze to make tree branches move or lift flags on poles. The worst thing is that PG&E does not seem to care what Californians think. I could only surmise that PG&E has the same level of political cover that CalPERS has here as in total. If they had any brains at all, they should be sending in crews to replace the worse of the aged infrastructure while the power was out and publicizing the fact. It would not have cost a lot but it might have helped them with some desperately needed good PR.

Cutting the power for such a large State just seems lunacy and just because they are worried about the next set of lawsuits because they completely ran down maintenance? Are there major server farms in those counties that had their power cut? Was Silicon Valley hard hit with power outages along with all those hospitals? Californians should be baying for blood. I wonder what would happen if California Water Service suddenly announced that due to algae infestation, that they are cutting water to about 2 million Californians? Would that finally get a revolt going?

In reading how thousands of transmission towers were built in the 1900s and 1910s and the problem of California’s population growth, I had to look at what the population was of California was back then and it turns out that it was about 1.5 million. And yet they managed to get their power grid going. Just to give people a taste of what California was like when these transmission towers were going up, here is a video clip of fotos showing what the people were like that built these towers. I wonder what those guys would have said if you had told them that the towers that they were building would still be serving their great, great grandchildren-

https://www.youtube.com/watch?v=a4RffaOizM0

One of the first hydroelectric projects in the state is here and dates from 1900 to 1910, still works, just add water.

The flume starts about 7 miles up the present Mineral King Road (there was no road there until the birdge was put in place in 1923) and brings it down to the powerplant in town.

I asked the guy running it, if we could power up our town from the local largess and he told me no, it all goes into the grid as its configured, and can’t be localized.

Wonder what it would take to make it our own, if push>met<shove, and shift happened?

Have you read The Milagro Beanfield War by John Nichols? A local guy in New Mexico decides to water his field from a local water ditch. But that water flowing across his land has been allocated to a distant development by TPTB. Conflict ensues. They made a movie of it, which is pretty good but as is so often the case, the book is better.

Great book. For a dystopian look at future conflicts over water in the USA, The Water Knife by Paolo Paolo Bacigalupi is a fun read.

https://www.goodreads.com/book/show/23209924-the-water-knife

That book was inspired by a real “war” in northern New Mexico, a few years before during the late sixties. The rebels, basically local Latinos trying to enforce their grazing and water rights (about 300 years old), actually occupied a court house. Now I don’t remember just how it came out, but I think they got at least some justice. They have real political power there.

I’ve seen the movie but didn’t know it was based on a book. I’ll look for it, thanks.

@Wukchumni – my guess is, one wire and a couple of big switches. Or one switch, cutting it off from the rest of the grid. That might waste a lot of it, though, to say notthing of the legal problems.

This kind of disruption would definitely be part of the Jackpot.

I shouldn’t this; we don’t have any such local source. It’s all in the Cascades, on the other side of the Willamette.

As a CA native, there are definitely questions about whether PG&E is deliberately massively overshooting in terms of safety precautions to send a message.