Yves here. It really is perverse that Democrats have become the party of spending scolds and fiscal worrywarts. But this post suggests that this behavior has become typical of left parties…which given how far right the Overton window has moved everywhere, means “liberal”.

Note that this post fails to distinguish between currency issuers and currency users. For currency users like Eurozone member states, governments need to worry about debt levels. However, it also fails to consider that politicians merely need to believe in mainstream economic views about government deficits and debt for that to influence their behavior; those stories don’t have to be true.

By Fabrizio Zilibotti, Tuntex Professor of International and Development Economics, Yale University, Andreas Müller, Assistant Professor at the Department of Economics, University of Essex, and Kjetil Storesletten Professor, University of Oslo. Originally published at VoxEU

The growth of the US national debt during the Trump presidency is particularly remarkable given its overlap with a period of economic expansion. But in this regard if few others, the Trump administration is no outlier. This column challenges the claim that Republicans adhere to fiscal conservatism in debt policy. Instead, it shows that Republican administrations since WWII have been more prone to expand government debt than their Democratic counterparts. And broadly speaking, the same pattern emerges in a panel of OECD countries.

In an article published in the New York Times on 25 October 2019, Alan Rappeport notes that the US federal budget deficit has swelled to $984 billion, and is expected to top $1 trillion in 2020. Annual budget deficits have now increased for four consecutive years, in a period during which the economy has been booming. According to Rappeport, “the grim fiscal scorecard shows how far the Republican Party, under Mr. Trump, has strayed from conservative orthodoxy, which long prioritized less spending and lower deficits.”

But is this true? Is it really so that Republican administrations have been more fiscally conservative, and the current administration is an outlier? Casual observation suggests otherwise: the debt-to-GDP ratio increased under Presidents Reagan and Bush, both Republicans, and contracted under Presidents Carter and Clinton, both Democrats. True, debt increased under President Obama, also a Democrat, but the Great Recession was remarkably deep and persistent.

The Political Colour of Debt

In recent research, we show that since WWII, Republican administrations have systematically been more prone to expand government debt relative to Democratic administrations. Perhaps surprisingly, the same pattern emerges (with some nuances) in a panel of OECD countries. Broadly speaking, right-leaning governments choose lower taxes, lower non-defense government expenditure, and higher debt. Our findings do not challenge the common wisdom that the political right prefers smaller governments. Rather, they dispute the popular perception that Republicans adhere to fiscal conservatism in debt policy.

Determining empirically how debt policies vary with the political colour of governments (i.e. Democrats in blue; Republicans in red) is not straightforward. For example, during Republican Dwight D. Eisenhower’s presidency, the gross debt-to-GDP ratio fell from 70% in 1953 to 54% in 1961. However, this was part of a longer trend of a falling debt-to-GDP ratio after WWII, which persisted until the late 1960s. Similarly, Reaganomics coincided with a period of growth slowdown and high interest rates. On a different front, the debt-to-GDP ratio may mechanically increase during recessions because of the decline in output. This explains part of the increase in the ratio under President Obama. Changing demographics also play a role. Given that the US pension system is largely unfunded, an ageing population yields an increase in pension transfers, health benefits, and government debt.

Methodology of Our Study

In our work, we take these factors into account. First, we control for the outstanding debt-GDP ratio inherited by each government, recognising the significant mean-reverting component in debt policy (as shown by Bohn 1998). Everything else being equal, governments inheriting a ruined budget try to reduce debt and make it converge to some target level. Second, we control for demographic trends, macroeconomic conditions (measured by the unemployment rate or by an indicator for NBER recessions), and war shocks. Our original study (Müller et al. 2016) covers data until 2013, before the onset of the Trump administration. We have now extended the analysis to 2018. The results we report in this column for the US include more recent years.

Republicans Versus Democrats in the US

We find that a switch from a Republican to a Democratic presidency is associated with an annual reduction in gross federal debt (relative to GDP) of 1.8% on average, statistically significant at the 1% level. The coefficient on the lagged debt-GDP ratio is negative, confirming Bohn’s result that debt is mean-reverting.

We also find that, conditional on the debt level, Democratic administrations pursue higher taxes and spending. In particular, the US federal tax revenue over GDP increases by an average 0.8 percentage points. When looking at expenditure, we focus on federal non-defence expenditure as a percentage of GDP. Although defense is a public good, it is fundamentally different from other goods, being largely driven by wars and international factors. For a given debt level, Democratic administrations spend about 0.6 percentage points more than their Republican counterparts.

Another interesting finding is that while Democrats are less prone to issue debt on average, they pursue more aggressive countercyclical policies. When facing deep recessions, Democratic administrations expand more debt and cut more taxes. More precisely, when the unemployment rate is at least four percentage points above its average level, Democratic administrations are more prone to expand debt than are Republican administrations. Tax policy is also more countercyclical under Democrats than under Republicans. The 2018 tax reform under the Trump administration (which happened during an economic boom) conforms to this general pattern.

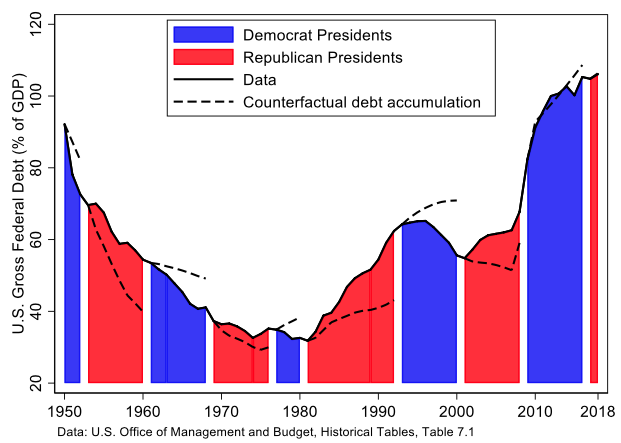

Figure 1 shows the evolution of the empirical debt-to-GDP ratio plotted against counterfactual debt paths where the political colour of the administration is opposite the real one. For instance, based on our estimates, had Democratic administrations been in charge of the fiscal policy in the 1980s, they would have increased the debt-GDP ratio from 32% to 40% (a moderate debt expansion). Instead, under the Reagan and Bush administrations, the ratio swelled to 62% (a stronger debt expansion). In contrast, during the Clinton administration, the debt-to-GDP ratio fell from 64% to 56%. A counterfactual Republican administration would have increased the debt-to-GDP ratio up to 72% during the same period. There is no great difference between the Obama administration and the Republican counterfactual: Democrats adopted strong counter-cyclical policies during the Great Recession; Republicans would have expanded debt after the end of the recession.

Figure 1

Results for a Panel of OECD Countries

The US is an ideal testing ground for how politics affects debt policy, since it has a fixed-term presidential two-party system where, since WWII, the Republican Party has positioned itself consistently to the right of the Democratic Party. Extending the analysis to a panel of OECD countries raises additional challenges. In particular, identifying the colour of governments is often problematic, due to the presence of coalition governments. For example, is the German grand-coalition left- or right-leaning? With this caveat in mind, we extend our analysis to a sample of 24 OECD economies for the period 1950-2010, using the data on government debt assembled by Reinhart and Rogoff (2010). Similar to the US, we find that left-leaning governments are consistently less prone to issue debt, even after controlling for confounding effects (we include country-fixed effects and common trends). Moreover, during the Great Recession, left-leaning governments expanded debt by an average of 2.7 percentage points (per year) more than their right-wing counterparts.

The cross-country estimates are generally smaller and less precise than in the US. This is not surprising given the measurement difficulties. However, the results are stronger and more precise if one restricts attention to countries with a majoritarian electoral system, where a clear-cut alternation in power occurs between left-leaning and right-leaning governments. In this case, a political switch to the left implies, on average, a reduction in debt accumulation between 0.6% and 0.7%, statistically significant at the 1% level.

Theoretical Interpretation

These findings are consistent with the positive theory of government debt presented in Song et al. (2012) and its subsequent development in Müller et al. (2016). The theory postulates that the government spends its revenue on financing the provision of public goods (e.g. parks, public health services, schools, etc.) subject to an intertemporal budget constraint. We assume that the economy is dynamically efficient, implying that the government must eventually balance its intertemporal budget and that debt imposes a burden on future generations. We view this as a sensible benchmark for a long-term analysis of fiscal policy (Abel et al. 1989), even though the welfare cost of issuing debt may be low in periods of low interest rates on government bonds, as argued by Blanchard (2019). Given the looming demographic changes with a fast-ageing population, arguing the opposite case seems far-fetched.

In this environment, we introduce exogenous political shocks that shift the voters’ political support for redistribution and public good provision. During a left-leaning wave, the government increases taxation and public expenditure while reducing debt. The opposite occurs during a right-wing wave. Left-leaning governments are less fiscally conservative when it comes to debt policy because their voters not only care more about the present but also about the future provision of welfare policies. Increasing debt today crowds out future public good provision by forcing future governments to cut expenditure. While debt might also increase future taxation, the option to resort to higher taxes is constrained by its distortionary effect (a Laffer curve). Therefore, left-leaning governments are warier of increasing debt.

Our theory is related to the ‘starve-the beast’ political strategy employed by conservatives in the Reagan era, which assumed that expanding the current debt would constrain future governments and limit their spending on social programmes such as education, welfare, Medicare, and Medicaid. In the economic literature, our analysis builds on the insights of Persson and Svensson (1989), who postulate that the main difference across the political aisle is that the left cares more about the public good than does the right. They then derive implications for how reelection probabilities affect debt policies (right-wing governments will accumulate more debt if they believe they will not be reelected). Our theory is also related to the theoretical work of Alesina and Tabellini (1990) and Battaglini and Coate (2008), and to the empirical analysis of Pettersson-Lidbom (2001) and Lambertini (2003).

Limitations

Like every study, we must acknowledge some limitations. We do not consider the effect of policy on the probability of different parties winning future elections. And we treat macroeconomic conditions and wars as exogenous factors.

Conclusions

The recent debt growth under the Trump administration is remarkable, especially since it occurred during years of economic expansion. The rhetoric of political debate might give the impression that this is an unusual behaviour for a conservative government. For instance, in March 2011, 23 Republican Senators publicly urged President Obama to reduce the deficit to protect future generations. The reality is quite different. Since the end of WWII, Republican administrations have systematically been more prone to expand debt, except during times of crisis. The Trump administration is continuing in this tradition. Our research rationalises these patterns from the standpoint of a rational choice politico-economic theory.

Although the cost of servicing debt is currently very low, we believe that the ageing population trend and slow productivity growth imply that debt will prove a heavy burden on future generations. Debt expansion should not be forbidden, but if there is (as we believe) no ‘free lunch’ in government spending, it is better to save the ammunition for a later day, when the needs for social spending and countercyclical policies loom much larger than they do today.

See original post for references

If people are so worried about debt service (at least here in the U.S.), maybe the U.S. should just stop issuing debt.

Since the debt of a monetary sovereign like the US is inherently risk-free, it should return AT MOST zero percent – otherwise we have welfare proportional to account balance. Subtract overhead costs and we have at least slightly negative returns.

And naturally, shorter maturity debt should cost more with account balances at the Central Bank, having zero maturity, costing the most (most negative return).

That said, arguably, individual citizens have a natural right to use their Nation’s fiat FOR FREE up to reasonable limits on account size and transaction rate.

So, the new debt of a monetary sovereign like the US can be a revenue EARNER, not a revenue consumer.

Also, while welfare proportional to account balance is ruled out by ethical considerations, an equal Citizen’s Dividend is NOT ruled out.

Moreover, imagine if ALL fiat creation beyond that created by deficit spending for the general welfare had to, by law, be distributed as an equal Citizen’s Dividend?

Except for the richest, I doubt anyone would miss their welfare proportional to account balance in comparison.

Nor would wasteful Federal spending such as on bloated military and security budgets be long tolerated either when it could instead go toward the Citizen’s Dividend, where by definition it would not be wasted.

Oh come on, this is because Republicans distinguish very well what is ‘good’ and ‘bad’ debt. There are, of course, classes in debt. For instance it is good if it serves to increase military expenses, or to reduce millionaire’s and billionaire’s taxes. It is bad if it is used for food stamps, or whatever goes to those lazy bones lying in the streets. Infrastructures must be private thus public investments in infrastructure generate ‘bad’ debt.

One can explain this 100s of times and yet no one understands.

Nailed it!

Republican view of “good” vs “bad” debt is even simpler and surprisingly Keynesian:

– “Bad” debt is any deficit incurred under a Democratic President (because it will stimulate the economy and help the incumbent party)

– “Good” debt is deficit incurred under a Republican President (because it will stimulate the economy and help the incumbent party)

Yes, making taxes more regressive is high Republican priority, but they have a much clearer focus on Power (getting and keeping it) than Democrats do (at the national level, at least).

Perhaps eventually the realization will dawn that if the economy is growing, an increase in sovereign debt is a GOOD thing, because it represents a corresponding increase in private assets (which says nothing, of course, about the distribution of those assets — another important consideration).

https://en.wikipedia.org/wiki/Sectoral_balances

Actually in my opinion an increase of private wealth faster than private income is a big problem.

Since we are speaking of debt to GDP ratio, if debt to GDP increases it means that the wealth to income ratio is increasing, that is a charachteristic of very unequal societies (see Piketty’s “Capitalism in the 21st century”).

Second, again speaking of Piketty, in his paper “Brahmin Left vs Merchant Right:Rising Inequality & the Changing Structure of Political Conflict” we see that in USA, UK and France (and presumably elsewere in the West) the left/right axis is not that much based on income but on ownership of assets (the merchant right) VS having good educational credential (and thus usually a good job, the brahmin left).

Since both assets and education tend to increase income the final result is that the left/right divide is mixed, with the bottom 7/8% income group going strongly to the right (very low education), the middle 85% or so going slightly to the left (education beats asset ownership) and the top 7/8% going again strongly to the right (at the top asset ownership beats education big time).

So if we see the right as the party of the asset owners (that is not of the rich in terms of income but specifically of the asset owners) it is obvious that right leaning party will tend to do policies that pump up the value of assets or create assets in excess to the increase in income, as they are doing anywere.

This also explain why it is so difficult to bring down debt: because public debt is private wealth, the only aqctual way to bring it down is to tax directly wealth and not income, and basically punish “savers”.

But the idea that the government has to punish savers is so alien to our culture that nobody really accepts this.

This paragraph parrots the usual “federal finances are like personal finances” myth:

Federal debt is the total of deposits into T-security accounts. It is no burden on anyone or anything. The debt is paid off daily simply by returning the dollars to the account holders.

There is no reason to “save ammunition.” The federal government, being Monetarily Sovereign, has infinite ammunition. It creates dollars, at will, by the press of a computer key.

It is both astounding and discouraging that economics still is being taught to our children without differentiation between Monetary Sovereignty and monetary non-sovereignty. Next class, phrenology?

The system is confusing because it is thieving.

Eliminate the thievery and you eliminate the confusion too.

Plenty of welfare for finance, real estate and insurance, and the military and big ag and big pharma, and a few steel mills and one or two car makers and indirect subsidies like lower interest credit cards, so that consumers can keep their 70% of the entire economy humming along. What are these guys even talking about? What we have is a boondoggle of incentives to keep a consumer economy from crashing, and they are not working. So we are left with doctored statistics… and then researchers come along with a thesis that there is some difference between R and D methods of stimulating the economy – commonly and wrongly referred to as “debt” – and nobody is offered the choice of thinking about a good nationwide social program including M4A; housing; guaranteed jobs; well-maintained environment; good applied science…. This “research” into the most pointless of all the distorted economics (that undefined contemporary surrealist poem about”debt”) topics is ready for the bonfire. No need to read it, just wad it up and light it off.

The most important problems in economics involve:

*Monetary Sovereignty describes money creation and destruction.

*Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps:

Ten Steps To Prosperity:

1. Eliminate FICA

2. Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

In a recent encounter with “team red” I heard a local Republican party committee member proclaim his penitence that the R’s weren’t reducing debt. Of course the last Republican administration to actually reduce National ‘Debt’ was Herbert Hoover’s, and that worked out ever so well, didn’t it?

The penitence was the tricky thing, though. Masterful marketing. He even said that Republicans need better marketing (not better policies, better marketing!).

If I may make a comment. I do not believe the Overton window has moved to the right on the whole of the last 70 years in the USA.

I believe the rest of the world has progressively evolved yet the US has stagnated with a conservative mindset, because we’ve had it so good since WWII that we’ve had no reason to change or progress.

Stated another way, the Overton window moved to the left in the rest of the world, which on a relative basis makes it appear the window is moving right in the US.

I don’t agree. Europe has taken a decidedly neoliberal turn, some of it due to Eurozone design, some of it due to the influence of the UK on policy. Even Sweden has a much weaker social safety net than it did in the 1960s. Australia keeps moving to the right. ALMO, a supposed leftie, believes in balanced budgets, which means he’ll never be able to implement large scale social programs.

Japan and South Korea are also two examples which have developed a little more of an economic neoliberal turn (although the current SK leader is moderately left of centre). I would consider Abe an economic neoliberal on top of all the other baggage he has.

Europe has been shifting slowly to an orthodox neoliberal turn since the late 1980’s at least, although of course every country has its own distinct flavour – but you could argue that much of Eastern Europe has gone from enthusiast neoliberalism in the 1990’s to a more old style right wing stance. I do think that neoliberalism has gone well past its high tide in Europe – the elites still push it, but outside of the UK nobody seems keen to push the agenda too hard, its become too unpopular.

This was done mainly by supposedly progressive parties (think blairites) turning neoliberal more or less after Thatcher-Reagan. Anybody that has been paying attention is well aware of this. Very, very recently the same parties seem to be slowly turning progressive and abandoning the neolib camp. It could in the near future be the case of the SPD depending on which new president they elect. They have now two alternatives and the second is not neoliberal.

First of all, government debt is private financial wealth, you can’t reduce government debt without contemporaneously reducing private wealth (and specifically wealth, not income).

Second, government debt is specifically the f_ng “quantity of money”.

If government debt increases faster than nominal GDP, it means that the “quantity of money” is increasing faster than the economy AND FASTER THAN NOMINAL PRICES.

This means that the government is deficit spending in a way that has a very low multiplier, otherwise GDP would grow faster and debt to GDP would fall either because of growth or because of inflation.

So if we speak of “austerity” in terms of low government deficits then the left looks more austerian, but if we speak of “austerity” in terms of actually increasing government spending in social programs that have an higer multiplier then the right is worse, because it is just creating money and funnellyng it into the pocket of rich people, basically (hence the low multiplier).

Finally if we think of right leaning policies as welth maximizing (and not income maximizing) this makes perfect sense.