Despite Wall Street rising yet again to record highs, more and more of the rich are taking unexpected reversals, thanks to this generation of the super wealth deviating in a major way from historical norms by regularly taking a walk on the borrowing wild side. As the cliche goes, leverage cuts both ways, amplifying gains and losses. Borrowing against illiquid assets is a classic way to end up in a cash crunch, selling assets at fire sale prices to hold off creditors.

Two stories tonight demonstrate how even some of the ultra-rich are feeling the pinch. The first is a report in the Wall Street Journal on the softening art market and how that is hitting collectors who were too casual about using debt; the second is on the very soft state of the ultra high end real estate market in New York City.

The first story, on art investing gone sour, gives a window on how this business has grown; it’s clear that every bank in the wealth management business has an art lending operation. I recall when one of my good friends, who had been the right hand man to Steve Ross at Related Companies (best known for endowing the Ross School of Business, and in New York City, for developing the Time Warner Center) founded one of the early entrants into the art lending world, Fine Art Capital. I thought the idea was nuts from the collector standpoint (why would you want to pay interest on a non-income generating asset that would be difficult to sell) but clearly I was not in tune with the desire of the rich to leverage their buying power.

The Journal story is heavily anchored on the tale of the decline, in both senses of the word, of retired insurance executive Donald L. Bryant Jr., who was such a heavyweight collector of modern art, with a collection once valued at over $300 million, that he served as a trustee of MOMA. The 77 year old, who has Alzheimers, is overextended, facing $300,000 a month in interest. His third wife, Bettina, a former ballerina, is trying to sort things out as children by previous marriages as well as fired advisers challenge the propriety and even legality of her actions. As an aside, the Journal has been on a roll lately; this is a very detailed investigated account.

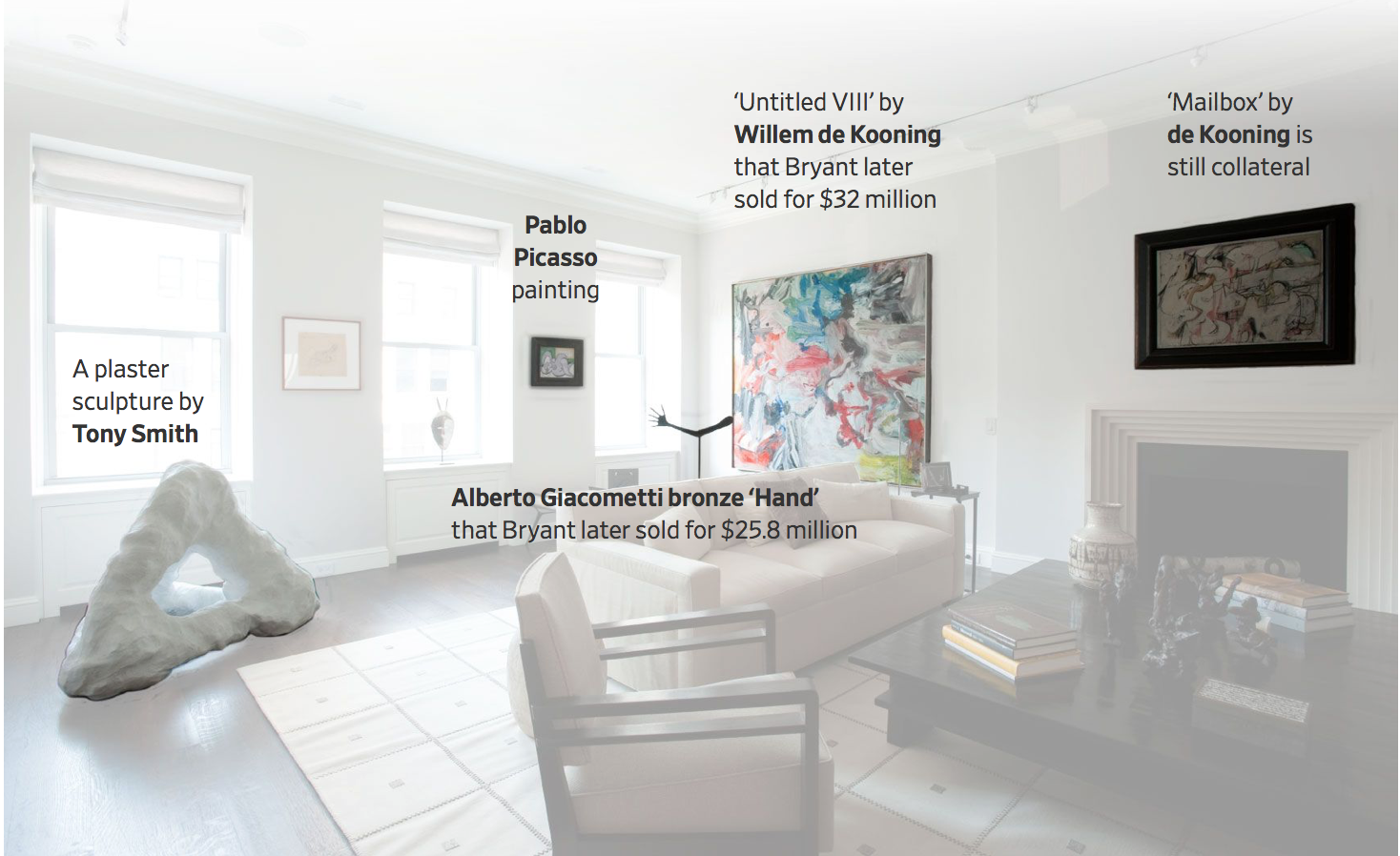

The photo below gives an idea of his holdings:

From the article:

These days, the whole art world is getting a crash course in leverage—and worries are growing that cases like the Bryants’ could prove a tipping point for banks and borrowers alike amid an increasingly skittish art market…

Today’s art-backed loans have gotten larger and riskier for collectors as the art market has started to shrink. U.S. collectors staked their art to borrow up to $24 billion this year, more than double the level a decade earlier, according to the latest data compiled by the Deloitte accounting firm and ArtTactic, an auction-database company. Some affluent borrowers tap their art like a piggy bank to fund living expenses. Others use the loans to buy more art.

But after a four-year rise, the global art market has started to retrench, with the value of sales down 22% at Christie’s auctions in the first six months of 2019 compared with the same period a year earlier. Last week’s $1.4 billion major fall auctions in New York were a third smaller.

One key point missed in the article that was flagged in comments: the valuations for art loans are based on completed auction sales. The problem with that as a basis is that some lots don’t sell, either by virtue of no one bidding (the estimate looked too high) or the bids not reaching the reserve.

The fear is that the Bryants, or others dumping art could create a classic liquidation spiral, particularly since lending has been concentrated in certain artists:

If art values plummet, experts say, collectors may need to sell works for less than they are valued to pay down their loans—or add more pieces to their collateral pool to keep their loans square. If not, they could default on loans and forfeit their art altogether.

“If everyone is taking the same art as collateral—same artists, same bodies of work—and there’s a crisis, everyone may need to sell and you have a big problem,” said Adriano Picinati di Torcello, who issued the Deloitte-ArtTactic report last month.

Lenders typically extend credit of up to half a work’s value, but some are starting to take a harder line. Mitchell Zuckerman, who started Sotheby’s art-lending arm in 1988, said if he were asked to lend against an $80 million Andy Warhol today, the most he would be willing to lend is $20 million.

50% is the level I heard when the business was young, so at least on the surface, lending standards may not have gotten lax. 50% would seem to be an ample margin, but in a crisis, bids dry up.

The second sighting is the perilous state of high end New York City residential real estate. There’s been a ton of construction of super lux apartments….just before Trump decided to square off with China and New York City imposed a “mansion” tax on the transfer of high end properties.

The thing to bear in mind are the various parties on the wrong end of this picture. The first is the developers who are holding the bag. Here the example is the investment fund CIM….which has CalPERS as one of its investors (note we are not sure whether CalPERS is in any of the properties discussed in this article, but the bigger point is that public pension funds, endowments, and life insurers have traditionally had some high end residential development in their portfolios). The other losers are investors who bought properties like this before the market turned.

Mind you, the Financial Times headline, NY property buying rules get bent in ‘scary’ market, has a blood-in-the-streets tone, but a former long-standing NYC resident, letting buyers tie up a property with so little equity is reminiscent of bad bear markets, even if the acute distress is confined to the top end.

New York developers have taken the rare step of easing down payments for residential properties to entice buyers in a sluggish market.

The hard-and-fast rule for those hoping to own a New York City apartment was that they must come up with 20 per cent of the purchase price in cash, a formidable barrier to entry even for deep-pocketed residents.

Yet in an attempt to prod buyers in what has been a moribund market, several developers have begun to show more flexibility by either accepting smaller down payments or staggering them.

One such developer is Los Angeles-based CIM, which is allowing buyers to pay 5 per cent when they sign sales contracts at two new Brooklyn projects it is marketing: Front & York in the Dumbo neighbourhood, and 111 Montgomery in Crown Heights. Another 5 per cent payment is not due until several months later.

Yves here. The article isn’t as crisp as it should be, since the CIM properties aren’t top drawer. However, there has been a glut of development of residential rentals (so lower rents change the rent v. own equation for less affluent buyers) and the super high end market, where properties are developed to be sold, has also seen overbuilding. The article describes forces that hit the very high end particularly hard:

According to Core, a New York City brokerage, median prices in the city fell 12 per cent from the same period a year earlier to $999,950. It was the worst quarterly fall since the last three months of 2009, in the depths of the financial crisis. The number of sales has also plummeted.

“Scary,” is how one developer described the luxury market, particularly along the so-called “billionaires row” of new super-tall buildings on 57th street, overlooking Central Park.

The chilling effect on the high end of the market came as foreign buyers retreated at the same time as New York City introduced a “mansion tax”, intended to fund the renovation of the subway system. The new surcharge came into effect in July with a one-off tax starting at 1.25 per cent on homes worth more than $2m, rising to 3.9 per cent on those sold for more than $25m.

And the gimmies can be extreme:

Short of lowering prices, which they are loath to do, developers have resorted to enticements to try to nudge hesitant buyers. They are offering to pay closing costs and transfer charges and throwing complimentary amenities, such as wine lockers, into the bargain.

At One Manhattan Square, a development on the Lower East Side that came on the market earlier this year, Extell is offering to pay 10 years of common charges, as well as what it calls a “deferred closing programme”.

Buyers make a non-refundable 10 per cent down payment and can live in their unit for up to a year before closing*. It is the equivalent, according to Sush Torgalkar, Extell’s chief executive, of effectively saving a year’s rent.

Extell is also offering a “rent to buy” scheme at One Manhattan Square, with those who end up purchasing a unit having their rent deducted from the sale price..

Reducing or staggering down payments is not likely to sway that prized clique of buyers at the highest end of the Manhattan property market, for whom a $50m purchase is, as Mr Torgalkar observed, more of a “life experience” than a financial transaction.

But developers are hoping it will appeal to the merely affluent, who may be spared having to come up with several-hundred-thousand dollars in cash all at once.

The risk to developers is that a smaller down payment would, in theory, make it easier for a buyer to walk away in the event the market falls further. So many concessions may also constrain cash flow as they try to repay their own lenders.

In other words, if this sort of thing continues for too long, some of these developers may come unglued. Pass the popcorn.

“Everything is getting better and better look at the stock market” the 1920’s believer in free markets

“Stocks have reached what looks like a permanently high plateau.” Irving Fisher 1929.

This 1920’s neoclassical economist that believed in free markets knew this was a stable equilibrium.

He became a laughing stock.

Better shelve this for a few decades until everyone has forgotten.

Now everyone has forgotten we can use it for globalisation.

They believed in the markets in the 1920s and after 1929 they had to reassess everything. They had placed their faith in the markets and this had proved to be a catastrophic mistake.

This is why they stopped using the markets to judge the performance of the economy and came up with the GDP measure instead.

In the 1930s, they pondered over where all that wealth had gone to in 1929 and realised inflating asset prices doesn’t create real wealth, they came up with the GDP measure to track real wealth creation in the economy.

The transfer of existing assets, like stocks and real estate, doesn’t create real wealth and therefore does not add to GDP. The real wealth creation in the economy is measured by GDP.

Inflated asset prices aren’t real wealth, and this can disappear almost over-night, as it did in 1929 and 2008.

Real wealth creation involves real work, producing new goods and services in the economy.

This is why real estate valuations keep collapsing.

1990s – UK, US (S&L), Canada (Toronto), Scandinavia, Japan

2000s – Iceland, Dubai, US (2008)

2010s – Ireland, Spain, Greece

Get ready to put Australia, Canada, Norway, Sweden and Hong Kong on the list.

Infalted asset prices are just inflated asset prices, nothing more.

Thank you.

One wonders if one should add the UK, again, and France and Switzerland, or certain parts thereof, to your get ready list.

The whole world is being put on the list as this entire system is going to be be wiped away in the very near future forever and the Kingdom of God taking rulership from humans on this planet forever. Its why I refused to own hardly anything its not going to be worth a single penny in the new system.

I’m glad the galactic empire of space lizards finally got their branding on point. I, too, look forward to the Kingdom of God® and being relieved of responsibility for being anything but an ingredient of cuisine. How does one say, “Moo”, and “Thank you” in Galactic Space Lizard, I wonder?

Oh, that’s a shame. Presumably, then, I can’t interest you in my Diana, Princess of Wales commemorative tea set from the royal wedding in 1981? At least the tea service lasted longer than the marriage did. Well, apart from a saucer I inadvertently ran through the dishwasher. It scrubbed off one of Charles’ shoulders. I’m open to reasonable offers. Yes, it is a bit naff, but it’s a great conversation piece and lends an air of sophistication to any afternoon tea. And it could have been a lot worse, here’s what I could have ended up with.

Do you think that they will get around to making a commemorative Prince Andrew-Virginia Giuffre porcelain tea set?

Oooh. Cool idea for a collection! Start with Princesses Margaret and Anne, then your suggestions and the jackpot of the current set of royals.

I don’t think we are done.

I am sure Steve Keen has South Korea and Belgium on his list.

South Korea definitely

> The real wealth creation in the economy is measured by GDP.

Just because money exchanges hands, doesn’t mean wealth is being created. Sometimes it is being destroyed.

For the first time in my life, I witnessed an auto collision happen right in front of me. This eldely woman driving a small SUV seemed to have become disoriented after leaving a shopping mall and did one of the most insane moves ever, pulling a U turn in an interection right at the moment a group of cars and light trucks driving along at about 50 mph was approaching, and she got T boned. Luckily she wasn’t killed on the spot.

After the initial surprise and shock, the money meter in my head starts running. Ambulace is called, $5000 minimum for the ride to the hospital or $15,000 if it’s owned by Pirate Equity, a wild guestimate of perhaps $100,000 for the actual hospital; bills, $500,000 if owned by Pirate Equity and if she later dies from her injuries, $10,000 for the funeral or $25,000 if owned by Pirate Equity.

Her newish $30,000 SUV a write off and the young guy that hit her with an older mint small pickup that he no doubt sweated his butt off and spent his paychecks on to get in that condition, a really sad looking truck after the accident, perhaps also a write off.

All this economic activity from this one accident adds up to somewhere between $200,000 and half a million, for a couple of seconds of disoriented driving, and no doubt Larry Summers would approve and chortle how this is good and adds to GDP.

My view is it subtracts from GDP, as the entire incident does nothing but destroy people and stuff, while at the same time transfering hefty insurance premiums from everybody else into the hands of the medical cartel and / or Pirate equity and the ambulance chasers looking for their carve out.

A silly illustration: one could goose GDP by passing a law that required everyone to pay their neighbor to mow their own lawn rather than doing it themselves, and report the income. Absolutely no difference in anything consumed or produced except that money would change hands, reportably. But it would be perceived as “growth”.

We definitely need better measures of “national product”.

my econ101 teacher put it this way:

“how do we increase GDP? well, we could burn down a bunch of houses and destroy a bunch of infrastructure and then build it back again. didn’t change anything, but money changed hands so there ya go!”

he was an unusual guy, for the field. still believed we would magically “find substitutions” for necessary goods like oil/gas/coal, though. and believed in the reserve multiplier of money thing.

ohwell, NC rectified that!

““find substitutions” for necessary goods like oil/gas/coal”

No problem: walking, horse back, buses, sweaters, sweating. Doesn’t mean they’ll be better.

he believed in the tiny Tech Progress fairies.

maybe he saw them in the bottom of the garden.

Is that an analogy to WWII’s contribution to the end of the Great Depression?

The basic value of housing is the price of a lot as the sum of the value of the farmland (based on typical revenue of farming the land) plus the costs to provide roads and utilities plus a small profit. Add to that the cost to build the actual dwelling plus a small profit and you have the basic value of a house.

Anything above that value is a speculative value based on perception that somebody wants to live there and is willing to pay more. That perception is much more changeable than the basic economics of developing farmland, similar to the stock market gyrating wildly around the GDP values.

Much of upstate NY housing is priced as described in my top paragraph, so home prices don’t change much in up or down markets. Places like NYC are far removed from this and pricing can be much more volatile.

BTW – it will be interesting to see if wealth inequality has increased to the point that an esoteric market like art can become so overpriced that a bear market in it could have real economic impacts causing other market drops impacting normal people.

Another fascinating angle is fraud and money laundering where fine art and collectables as an industry (and let’s call it that) is concerned.

A good example is yesterday’s acquisition by the Bronte museum in the U.K. of a miniature book by the author, it was the last one of a set that it didn’t already own. Previously when the item came onto the market, the museum was outbid by a scam consortium https://www.bbc.co.uk/news/entertainment-arts-50458343 operating out of France. The unlawful operation and dubious sources of funds obviously entered the fine arts market and distorted pricing (for instance, the Bronte book was clearly worth far more to the museum to compete its set than the consortium which only had one of the miniature books). It’s impossible to not conclude the consortium was only acting as a blocker — buying the book to try to extract a still higher price from the museum at a later date as it would have still wanted to compete its set.

The consortium was almost certainly a Ponzi scheme — and as with all such, what does them in, in the end, is a fall in asset prices. So it probably won’t be the last to emerge.

Thank you, Clive.

I would add horses, too, in certain locations, including the trade between Mauritius and South Africa.

At the turn of the decade, I had a chat with the CEO of Weatherby’s Bank. He was relieved that the new oligarchs had resisted the lure of the English turf. I could not blame him.

I’ve been told anecdotally that one reason for the explosion property prices in Paris in recent years is money laundering. It’s certainly true that there are entire apartment blocks dark at night in the inner city, that seem never to be lived in. Any thoughts from the experts?

Thank you, David.

Parts of Paris are becoming like parts of London in that regard.

Someone at Emile Garcin explained that people hedging their Brexit risks were buying, but not often occupying, but I was not convinced by the scale and location.

It also goes beyond Paris to places like St Maxime.

It is endemic. UK conveyancers and solicitors are supposed to make source-of-funds checks as are (if applicable) lenders. The lenders are actually pretty good, but the legal profession is very variable. A few of the most blatant money laundering-through-property-transactions are targeted, but anything vaguely sophisticated most likely won’t be challenged.

In some ways, I think that law enforcement is looking at this the wrong way (from the finance and legal professions down, rather than the property developers up). One lunchtime, I went on spec to view a new tower which had sprung up in central London. I was being a bit of a time-waster, but if the price could be made right, I would have perhaps been tempted. In any event, I wanted to discuss with the developer how things were going and how haggle-able, or weren’t, they were prepared to be.

It was ridiculously obvious the developer was not at all interested in selling any apartment to any off-the-street buyer. The sales operation was pitiful — no model apartment to view despite the tower being topped out and the internals finished at least up to floor 10. No samples of kitchen or bathroom fixtures to see in the marketing suite. No firm availability of units — of the apartments notionally for sale, there were only two but this number was very hazy, completion dates were estimated (“Q2, 2018”). I was asked if I was a cash buyer, I said I could be, then was told that there wasn’t much “chance of being eligible to buy” (WTF?!) if a lender was involved, presumably because any valuation report would have been almost impossible given the valuer couldn’t view what was being lent against in any realistic way.

So I concluded then entire project was a money laundering / capital flight-enabler disguised as a property development. Perhaps investor / professional large scale landlords would have had more luck than I did, I assume the building owner wanted some real residents, just to keep up appearances.

I’m sure it wasn’t the only residential tower in London was financed on the same basis.

Wait a minute. Clive is offering cash and they don’t want it?

Perhaps you had the wrong “provenance,” Clive.

Try being a civilian who’s interested in buying art in many/most high-end Manhattan galleries, and you’ll get a huge serving of actitude, followed by dismissal.

Clive, Nov. 19, 3;50 AM

R T Naylor, in his 2011 book “Crass Struggle”, has chapters on gold, gemstones, diamonds, art, antiques, coins, wine, cigars & cigarettes, fish, rare birds, exotic animal species, ivory. He says that it is virtually impossible to evaluate any of these wanna-haves. All of them and more are vastly inflated by their use as vehicles for money laundering, theft, bribery and graft by the fabulously wealthy, and conspiracies among dealers who are profiting from these ponzi schemes.

Couldn’t happen to nicer people, really …

My thoughts exactly. I love the smell of schadenfreude in the morning.

Yes, but that schadenfreude isn’t cheap;

“When the houses of the mighty fall, they fall on the heads of ordinary men and women”

Good quote, and why we shouldn’t ever have let billionaires or anything even close to that to exist.

What’s the point of a fiat currency if you can’t control things like that?

That’s a very good question.

Indeed…I’m sure they’ll find some way to blame this all on the poors, like they did the last financial crisis.

Pawning art used to be the mark of spendthrift heirs in debt to bookies. Now it’s a growth industry. We’re crazy.

Most collector fields are dead or close to it in the low to upper medium end, but the tip top creme de la creme has remained buoyant, as it appears there was quite the scramble for the .01% to buy something with gotten gains, and why not an old framed painting?

Looking at price history of most coveted art, it makes the various real estate bubbles seem like the most conservative investment ever in comparison.

We’re talking about paintings worth a million in the 50’s, that now fetch $100 million, for something that can be faithfully digitally reproduced for a pittance and the average person couldn’t tell the difference from 20 feet away.

Numismatics is similar, got a 1913 Liberty Nickel or an 1804 Bust Dollar, or one of a dozen classic high end USA coins, they regularly fetch astounding amounts of money, and yet values for mundane to better stuff is in the dumpster, as all the market is now, consists of Boomers selling off their collections, and it isn’t as if Gen X or Millennials have any interest, nor the means to acquire.

I was active in the art scene back in the 1990’s. You could have bought an Anselm Kiefer painting back then for (say) $6K, which is now hovering around half a mil. Too big to hang up in a residence tho.

I inherited a collection of remarkable autographed photos – mostly classical music and hollywood notables – along with most of the receipts detailing original and surprisingly dear purchase prices. When I inquired about its value now I was told by many reputable merchants that the market for such collectibles had tanked and was never coming back. They were almost rudely uninterested which I understood as a mask for their dismay.

Then again it was not my intention to sell. I was fortunate to make career in classical music and for me the collection is priceless.

Middle-brow art is in the same league as your autographed photos, a friend just picked up this large framed oil painting of Sequoia trees for not the $130 million a Klimt might cost, but a more reasonable $130.

https://www.ebay.com/itm/163946566791?ul_noapp=true

[huns]

That’s the way the money goes

Pop goes the weasel

[Huns] Typo? Freudian slip? Cassandra speaking through your keyboard?

Debt leverage in the high-end art market?… WRT speculative froth, I suppose anything is possible in this era of zero and negative real interest rates. Can’t think of many things I would find more upsetting as a millennial trying to minimize debt for education or to buy a house to start a family.

At the same time we are again seeing speculative excess in the financial markets. And who also owns the vast majority of stocks and bonds? As the old saying goes, price is set at the margins. Perhaps with the hundreds of billions of incremental Fed Bux and the embedded computer algorithms, they can “summit” at Dow 29,029?… or even higher… 35,000?… 50,000?… sky’s the limit in a Ponzi, no? As one trader said yesterday, the Fed has acceded to extending the market valuation bubble while denying its existence and ignoring the consequences.

But who knows?… the Fed chair quietly met yesterday with the current president and the Secretary of the Treasury in the White House living quarters, not the West Wing. And after 11 years of negative real and/or historically low interest rates, the Fed is publicly acknowledging that a prolonged period of low interest could spark ‘instability’ (like Lambert says, “This is not The Onion.”). Never mind more fundamental concerns about the efficacy of monetary policy as an economic tool in a deflationary environment where many of our fellow citizens and corporations have been larded up with debt to enable wealth extraction.

In fairness, it’s easy to criticize. More difficult to develop and implement constructive solutions to address the compounding policy errors of the past that have led to our current predicament without causing further undue hardship for many. In any event, engineering social division would not seem to be the best policy choice. Its important to appeal to our better selves.

https://www.federalreserve.gov/publications/files/financial-stability-report-20191115.pdf

Speculation shouldn’t just be for the filty rich, so here goes.

What would happen if the FED just said no to the repo market? It claims that they are investigating where the black hole in the financial system is, so that implies they are spewing dollars to prop up entities they are clueless about. So give it up and lets see who blows up. That should help them figure out what’s going on, and so what if a bunch of hedge funds and Pirate Equity greedheads go down, or banks for that matter.

That will make the fine art and rich man’s condo market scream. Price discovery, when allowed to happen, is a bitch. What’s that yacht worth, now? Priceless, cause no one wants to be stuck with it.

Never mind the stawk market, with the Swiss central bank, Japan’s central bank, “soveriegn wealth funds” corporate debt and algos as buyers, there is no price discovery there either.

Isn’t the phenomenon described in at and high end real estate just a scaled up version of sub-prime? I suppose the common people can always pony up if anything goes wrong.

I’ve been reading proclamations that ‘this can’t go on for much longer’, backed up by mountains of evidence of the greatest bubble economy of all time. Yet there is never any real correction.Since the LIBOR scandal surfaced, I’m becoming convinced it’s a command economy. Like the USSR. It’s also somehow meta stable since it can leech off an empire to sustain the precious ‘center’.

I once used an idiot-seller’s inadvertent revelation regarding facing a margin call to strong advantage when buying our company airplane – yes, he was overextended and I mercilessly piled on and made him pay the price, so what? Note; mention of the art world can be extended to classic cars as well. Also, bear in mind there’s drug money involved in purchasing both. This is money, which doesn’t really care what’s going on regarding valuations because it has to be washed regardless of pricing. In any case, the premise of the article is 100% on target. You’ll be careful out there and remember, when folks are in distress is a great time to buy assets.

I’m a few years away from going ‘Swedish Death Cleaning’ as most of what little I have in laying around assets needs to go away, I don’t want stuff, I yearn for memories instead.

Speaking of drug money in the art world, from July:

https://www.theguardian.com/society/2019/jul/17/louvre-removes-sackler-name-from-museum-wing-amid-protests

Art and High end real estate have one thing in common:

The buyer “wants” them but does not “need” them. This makes pricing and selling very speculative (Perceived value).

People “need” food, shelter, and transport. These have hard prices based to some extent on cost. Commodities which are “wanted” have prices based on greed.

The distinguishing factor is “need” vs “want.”

But you see, real estate is primarily a need and the only financial bubble i’m aware of historically that wasn’t a want.

High end real estate is not purchased for the need of shelter. It’s a way for the uber-rich to store value in a safe, steady growth place that can double as their functional hotel room the few weeks out of the year they’re in NYC/London/San Francisco/etc., and as a money laundering scheme for ill-gotten gains.

This is one of the reasons why there’s such a housing crunch. People who need shelter aren’t the only buyers; they’re also competing with investors, landlords, vacation home buyers, flippers, etc etc. We seem to be drastically undersupplied, taking the entire market into account.

But it’s all bubbly…

The first LA home I lived in as a tyke cost my parents $12k when they bought it brand new in 1960 and now zillows for $600k. It’s a crackerjack of a 1,200 sq ft house of the era, nothing special.

To put in the same appreciation performance by 2078, it would then be worth $30 million.

The garage sale of the vanities.

Accurate.

Not accurate. Want accurate, how about garbage sale of the vanities.

$25.8 million for the bronze hand, he sold to another rich putz, What a deal. Lucky if a Chinese copy would sell for as much as $28 in Walmart, and even then Walmart shoppers wouldn’t buy it unless discounted to ten bucks.

Tony Smith is a financial genius selling that plaster atrocity for tens of millions, and it isn’t even art. Who wants to look at something that ugly for even a minute, never mind putting that in your living room.

It just goes to show the filthy rich have no taste whatsoever. It must be an inverse natural law. The moar money you have the less taste you have.

All those old tupperware lids I can’t find the container for are now art. As is my lamp with the broken shade, that big plastic tote full of random electronics and cords, and the dime novels my spouse doesn’t want cluttering up the bookshelves anymore.

I call this piece ‘Monday Pain’. Five squillion dollars. Have your people call my people.

Ya, it looks like a big white turd. Maybe its owners feel it reflects something deeply true about them?