By Blair Fix, a political economist based in Toronto. He researches how energy use and income inequality relate to social hierarchy. His first book, Rethinking Economic Growth Theory From a Biophysical Perspective, was published in 2015. Twitter: @blair_fix. Republished from Economics from the Top Down via Evonomics

Does productivity explain income? I asked this question in a previous post. My answer was a bombastic no. In this post, I’ll dig deeper into the reasons that productivity doesn’t explain income. I’ll focus on wages.

The Evidence

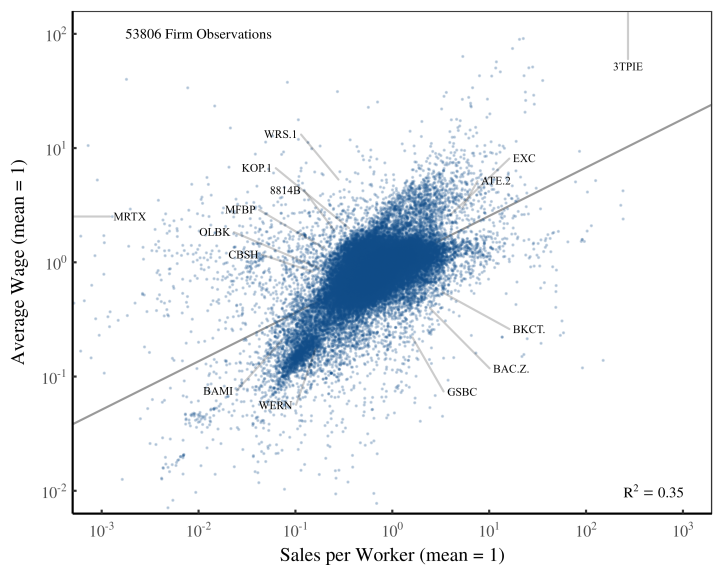

Let’s start with the evidence trumpeted as proof that productivity explains wages. Looking across firms, we find that sales per worker correlates with average wages. Figure 1 shows this correlation for about 50,000 US firms over the years 1950 to 2015.

Mainstream economists take this correlation as evidence that productivity explains wages. Sales, they say, measure firms’ output. So sales per worker indicates firms’ labor productivity. Thus the evidence in Figure 1 indicates that productivity explains (much of) workers’ income. Case closed.

The Problem

Yes, sales per worker correlates with average wages. No one disputes this fact. What I dispute is that this correlation says anything about productivity. The problem is simple. Sales per worker doesn’t measure productivity.

To understand the problem, let’s do some basic accounting. A firm’s sales equal the unit price of the firm’s product times the quantity of this product:

Sales = Unit Price × Unit Quantity

Dividing both sides by the number of workers gives:

Sales per Worker = Unit Price × Unit Quantity per Worker

Let’s unpack this equation. The ‘unit quantity per worker’ measures labor productivity. It tells us the firm’s output per worker. For instance, a farm might grow 10 tons of potatoes per worker. If another farm grows 15 tons of potatoes per worker, it unambiguously produces more potatoes per worker (assuming the potatoes are the same).

The problem with using sales to measure productivity is that prices get in the way. Imagine that two farms, Old McDonald’s and Spuds-R-Us, both produce 10 tons of potatoes per worker. Next, imagine that Old McDonald’s sells their potatoes for $100 per ton. Spuds-R-Us, however, sells their potatoes for $200 per ton. The result is that Spuds-R-Us has double the sales per worker as Old McDonald’s. When we equate sales with productivity, it appears that workers at Spuds-R-Us are twice as productive as workers at Old McDonald’s. But they’re not. We’ve been fooled by prices.

The solution to this problem seems simple. Rather than use sales to measure output, we should measure a firm’s output directly. Count up what the firm produces, and that’s its output. Problem solved.

So why don’t economists measure output directly? Because the restrictions needed to do so are severe. In fact, they’re so severe that they’re almost never met in the real world. Let’s go through these restriction.

1: Firms must produce identical commodities

To objectively compare productivity, you have to find firms that produce the same commodity. You could, for instance, compare the productivity of two farms that produce (the same) potatoes. But if the farms produce different things, you’re out of luck.

Here’s why. When firms produce different commodities, we need a common dimension to compare their outputs. The problem is that the choice of dimension affects our measure of output.

To see the problem, let’s return to our two farms, Old McDonald’s and Spuds-R-Us. Suppose that Spuds-R-Us produces 10 tons of potatoes per worker. Tired of growing potatoes, Old McDonald’s instead grows 5 tons of corn per worker. Which workers are more productive?

The answer depends on our dimension of analysis.

Suppose we compare potatoes and corn using mass. We find that Spuds-R-Us workers (who produce 10 tons per worker) are more productive than Old McDonald’s workers (who produce 5 tons per worker).

Now suppose we compare potatoes and corn using energy. Furthermore, imagine that corn has twice the caloric density of potatoes. Now we find that workers at Spuds-R-Us (who produce half the mass of food at twice the caloric density) have the same labor productivity as Old McDonald’s workers.

The lesson? Unless two firms produce the same commodity, productivity comparisons are subjective. They depend on the choice of dimension.

Restriction 2: Firm output must be countable

When you read economic textbooks, it’s clear that the discipline of economics is stuck in the 19th century. Firms, the textbooks say, produce stuff.

But what about all those other firms that don’t produce stuff? What is their output? What, for instance, is the output of Goldman Sacks? What is the output of a high school? What is the output of a hospital? What is the output of a legal firm?

Yes, these institutions do things. But it defies reason to give these activities a ‘unit quantity’. In other words, it defies reason to quantify the output of these institutions.

Restriction 3: Firms must produce a single commodity

Complicating things further, we can objectively measure output only when firms produce a single commodity. If a firm produces two (or more) commodities, its output is affected by how we add the commodities together.

To see the problem, let’s return to Old McDonald’s and Spuds-R-Us. Suppose that both farms have diversified their production. Spuds-R-Us produces 5 tons of potatoes and 1 ton of corn per worker. Old McDonald’s produces 1 ton of potatoes and 5 tons of corn. Which workers are more productive?

The answer depends on our dimension of analysis. In terms of mass, both farms produce 6 tons of food per worker. So labor productivity appears the same. But suppose we measure the output of energy. Again, we’ll assume that corn has double the caloric density of potatoes. Suppose corn contains 2 GJ (gigajoule) per ton, while potatoes contain 1 GJ per ton. Now we find that Old McDonald’s workers are about 60% more productive than workers at Spuds-R-Us. Here’s the calculation:

Spuds-R-Us:

5 tons potato × 1 GJ / ton + 1 ton corn × 2 GJ / ton = 7 GJ

Old McDonald’s:

1 ton potato × 1 GJ / ton + 5 ton corn × 2 GJ / ton = 11 GJ

This ‘aggregation problem’ is why the neoclassical theory of income distribution assumes a single-commodity world — a world in which everyone produces and consumes the same thing. In this one-commodity world, we can measure productivity unambiguously. In the real world (with many commodities) productivity depends on our choice of dimension.

The Severity of the Problem

Let’s take stock. If we want to measure productivity objectively, the restrictions are severe:

- Firms must produce the same commodity

- This commodity must be countable

- Firms must produce only one commodity

These conditions are so stringent that they’re rarely met in the real world. This is a bit of a problem for neoclassical theory. It proposes that everyone’s income is explained by their productivity. But only in the rarest of circumstances can we measure productivity objectively.

It’s hard not to laugh at this predicament. It’s like Newton proclaiming that gravitational force is proportional to mass. But in the next sentence he realizes that mass can be measured only in the rarest of circumstances.

The Neoclassical Sleight of hand

Neoclassical economists don’t think of themselves as Newtons who can’t measure mass. Instead, economics textbooks don’t even mention the problems with measuring productivity. In these textbooks, all seems well in neoclassical land.

But all is not well. Neoclassical economists perpetuate their fantasy by relying on a sleight of hand. Here’s what they do.

First, economists argue that the purpose of all economic activity is to give consumers utility. Buy a potato and you get utility. Buy a cigarette and you get utility. Utility, economists say, is the universal dimension of output. By measuring utility, we can compare the output of any and all firms (no matter what they produce).

After proclaiming that utility is the universal dimension of output, economists pull their trick. Utility, they say, is revealed through prices. So a painting worth $1000 gives the buyer 1000 times the utility as a $1 potato.

With this thinking in hand, economists see that a firm’s sales measure its output of utility:

Sales = Unit Price × Unit Quantity

Sales = Unit Utility × Unit Quantity = Gross Utility

So sales become a universal measure of utility, and utility is the universal measure of output. Now, when we compare sales per worker to wages (as in Figure 1), economists proclaim that we’re comparing productivity to wages.

Except we’re not.

The problem is that this whole operation is circular. The idea that prices reveal utility is a hypothesis. And as every good scientist knows, you can’t use your hypothesis to test your hypothesis. But that’s what neoclassical economists do. They assume that one aspect of their theory is true (the link between prices and utility) to test another aspect of their theory (the link between productivity and income). This is a big no no.

Why do economists use this circular reasoning? Probably because they don’t know they’re doing it. Economists take as received wisdom the idea that prices reveal utility. But this is just a hypothesis. In fact, it’s a bad hypothesis. Why? Because we can never measure utility independently of prices.

Why are Sales Related to Wages

Whenever I go through the logic above, mainstream economists will retort: “But look at the correlation between wages and sales! How can this not show that productivity explains wages?” Their reasoning seems to be that, absent an alternative explanation, this correlation must support their hypothesis.

In No, Productivity Does Not Explain Income, I gave an alternative explanation. The correlation between wages and sales per worker, I argued, follows from accounting principles.

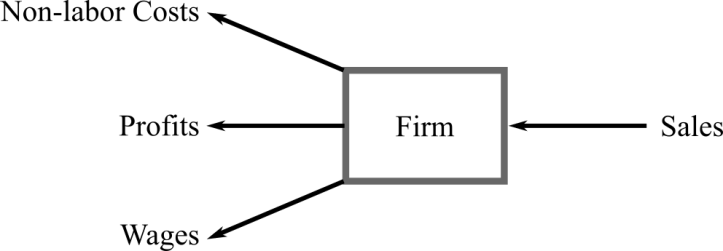

Sales isn’t a measure of output. It’s an income stream. Once earned, this income gets split by the firm into different categories. Some of it goes to workers. Some of it goes to other firms (as non-labor costs). And some of it goes to the firm’s owners as profit.

By definition, the terms on the left must sum to the terms on the right. So it’s not surprising that we find a correlation between wages and sales. They’re related by an accounting identity.

In comments on No, Productivity Does Not Explain Income (and on other sites), some economists pounced on this argument, saying it was fatally flawed. And in hindsight, I admit that I wasn’t clear enough about my reasoning. I was thinking about the real world. But the economists who critiqued my reasoning were thinking in terms of pure mathematics.

To frame the debate, let’s think about something more concrete than income. Let’s think about volume. In rough terms, the volume of an object is the product of its length, width and height:

V = L × W × H

Now, let’s pick a dimension — say length. Will the length of an object correlate with its volume? In general terms, no. I can make an object with any volume using any length. I just have to adjust the other dimensions appropriately. By doing so, I can make a cube have the same volume as a box that is long and thin.

So in pure mathematical terms, the accounting definition of volume doesn’t lead to a correlation between length and volume.

But when we look at real-world objects — like animals — we will find a correlation. If we took all the species on earth and plotted their length against their volume, we’d expect a tight correlation. A bacteria has a small length and a small volume. A blue whale has a big length and a big volume. Fill in the gaps between and we should get a nice tight line.

The reason for this correlation is that animals cannot take any shape. You’ll never find an animal that is a mile long and a few micrometers wide. Such a beast doesn’t exist. Yes, the shapes of animals vary. But in the grand scheme, this varation is small. As a first approximation, animals are roughly cubes. Or, if you’re a physicist, they’re spheres.

With this shape restriction, it follows from the definition of volume that animal length should correlate with animal volume. We’d be astonished if it didn’t.

So too with the correlation between sales per worker and wages. True, this correlation doesn’t follow purely from accounting principles. It follows jointly from accounting principles, and the fact that firms can’t take any form. We don’t find firms that pay their workers nothing. That’s slavery and its illegal. Similarly, we don’t find (many) firms that pay their workers the entirety of sales. That leaves no room for profit.

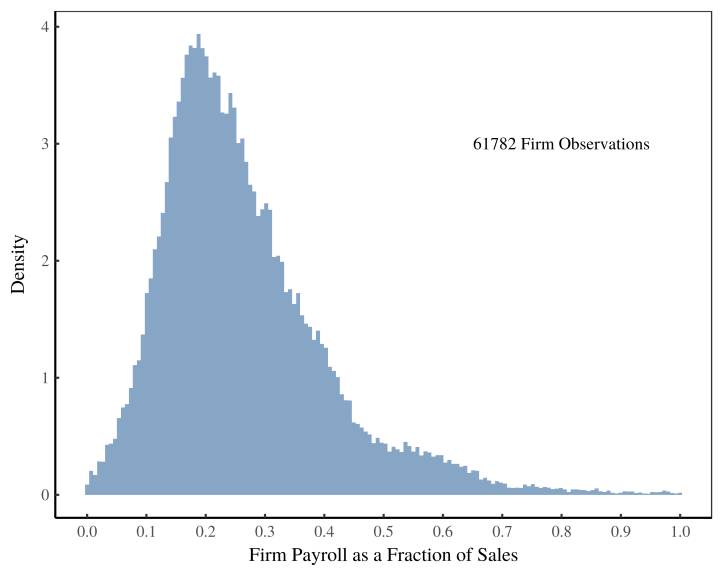

So in the real world, there are restrictions on how firms can divide their income stream. Here’s what these restrictions look like. In Figure 3, I’ve plotted the distribution of firms’ payroll as a portion of sales. This is the portion of sales that goes to workers. Across all firms, it’s a pretty tight distribution, clustered around 25%.

Yes, it’s theoretically possible for a firm to give any portion of its sales to workers. But this isn’t what happens in reality. In the real world, most firms give between 10% and 50% of their sales to workers. Just like with the shape of animals, there are real-world restrictions on the ‘shape’ that firms can take.

Given these restrictions, it’s not surprising that we find a correlation between sales per worker and wages. When a firm’s income stream grows, so does the amount going to workers.

None of this has anything to do with productivity. It’s all about income. Sales are the firm’s income. And wages are the portion of this income given to workers.

Prices … The Elephant in the Room

Let’s conclude this foray into neoclassical thinking. The reason that sales don’t measure firm output is because they mix unit prices with unit quantities. Yes, sales per worker correlates with wages. But the elephant in the room is prices. Greater sales may be due to greater output. But it can also be due to greater unit prices.

In many cases, price differences are everything.

Imagine that a lawyer and a janitor both work 40 hours a week as self-employed contractors. The lawyer charges $1000 per hour, while the janitor charges $20. At the end of the week, the lawyer has 50 times the sales as the janitor. This difference comes down solely to price. The lawyer charges 50 times more for their hourly services than the janitor.

The question is why?

Neoclassical economists proclaim they have the answer. The lawyer, they say, produces 50 times the utility as the janitor. Ask economists how they know this, and they’ll answer with a straight face: “Prices revealed it.”

It’s time to recognize this sleight of hand for what it is: a farce. The reality is that we know virtually nothing about what causes prices. And we will continue to know nothing as long as researchers believe the neoclassical farce.

Further Reading

The Aggregation Problem: Implications for Ecological and Biophysical Economics. BioPhysical Economics and Resource Quality. 4(1), 1-15. SocArxiv Preprint.

..or, more accurately, tori. ;-)

https://www.quora.com/Is-the-human-body-a-torus-donut-topologically

Yep, that sounds right. Zen-ish philosopher Alan Watts observed that animals, including humans, are tubes.

Mostly all…

HF?…Happy Holidays; Happy Solstice! Brighter days ahead…

Actually, genomically, human beings are 70% acorn worm.

https://www.sciencedaily.com/releases/2015/11/151118155119.htm

Tube-within-a-tube. The digestive system being the second tube.

Economists are always prepared for yesterday’s problems.

Inflation was a big problem in the Keynesian era and every effort has been made to ensure that it doesn’t return.

Exceptionally intelligent Chinese economists have been looking at today’s problems.

Davos 2018 – They know financial crises come from the private debt-to-GDP ratio and inflated asset prices

https://www.youtube.com/watch?v=1WOs6S0VrlA

The PBoC know how to spot a Minsky Moment coming, unlike the FED, BoE, ECB and BoJ.

The black swan flies in under our policymaker’s radar.

Our policymakers are always looking in the wrong direction.

They fixate on public debt, and so don’t see the problems emerging in private debt

The central banks look at consumer price inflation, while the problems are emerging in asset price inflation.

Economists assume pay rises with productivity because it did in the Keynesian era, but it doesn’t anymore.

http://www.industryweek.com/sites/industryweek.com/files/uploads/2016/11/29/Declining-Wages.jpg

We need those exceptionally intelligent Chinese economists to look at today’s problems.

They are really good at it.

Thank god for Google images.

That link has gone bad.

https://www.forbes.com/sites/timworstall/2016/10/03/us-wages-have-been-rising-faster-than-productivity-for-decades/#5e26b1637342

The image is the same – Forbes are putting a different spin on it.

I am just reading their take on it now.

industryweek link gets a 404 not found.

“But the elephant in the room is prices. Greater sales may be due to greater output. But it can also be due to greater unit prices.”

How does this matter? If my salesperson negotiates higher prices on every deal, that’s better for my company and I’d say he/she is more productive.

Your salesperson might negotiate higher prices on every deal, and that might correlate with their higher productivity… in a regulated and truly competitive market.

What does sales at higher prices in a (de facto) deregulated and increasingly monopolist market space point to? Not to greater productivity, imo, but to deregulated monopoly. It too oftern points to unregulated rentier-ism, or price gouging. Why has the cost of, say, insulin tripled over the past decade? Not because of greater productivity. How can these price increases in this deregulated market environment possibly point to real productivity? It points to price gouging. Since there is more rentier-ism in the market, the old idea that prices/wages can be reliably equated with productivity becomes meaningless, imo.

see for example this Forbes article:

https://www.forbes.com/sites/johnmauldin/2019/12/20/americans-are-not-free-to-choose-anymore/

There’s the slight of hand

Do your other employees building widgets become “less productive” suddenly when your salesman catches a cold? (You can come up with a bunch of these showing that productive can not be precisely equal to money earned, because they exist on different time scales measuring different firm aggregates).

Is the salesman “more productive” if he kidnaps the children of a client and blackmails him into buying more product? What would “productive” mean in any useful sense if there’s no independent definition of utility? Not every dollar earned is a measure of “productive” — unless you redefine productive to mean “every dollar earned by any measure”.

When the US invaded Santo Domingo to extract debts, was that “productive” in any meaningful sense? That would seem to be an abuse of language, rather than saying what you mean.

The problem here is that “productive” is a moral justification — and so it must continue to mean something more than simply money earned in order to morally justify the order. That’s the goal of the use of the word productive — that thus the results are just.

another narrative take on this curious phenomenon:

https://newrepublic.com/article/155666/life-algorithm

That’s a good one, thanks

“It’s time to recognize this sleight of hand for what it is: a farce. The reality is that we know virtually nothing about what causes prices. And we will continue to know nothing as long as researchers believe the neoclassical farce.”

This is what I don’t understand, I think its obvious why there are prices. The whole idea of business, and capitalism generally, is to charge as much as possible while spending as little as possible.

Beyond a certain point I do believe greed drives inflation — companies will charge whatever they think they can get away with long before there is wage pressure. Wage pressure in my experience is a reaction to inflation, not a driver of it. For some reason many people of the conservative persuasion seem to get this backwards.

Absolutely. The use of “we” here is problematic. What needs to be made clear is the fundamental distinction between those who study capitalism, where the fundamental driver is the search for profit, and those who study “the economy,” for whom profit either doesn’t exist or is the “marginal productivity of capital,” a concept which has been shown over and over to be nonsensical, and the fundamental drivers are things we can’t explain – individual wants and preferences and various completely unpredictable “shocks.”

There is no collective “we.” It’s them against us.

Or, like I say, “Who is “we”, white woman?”

It is obvious that prices are seriously out of kilter with actual value of products & services but is this a result of all that extra money that was created to save the banks after 2008? And what about the vital function of price discovery then. How does that work out? I do believe that there is something missing from this article and that is a break-out of “wages”. I suppose you could break it down to wages, salary & management which may be more instructive. How does productivity relate to management then, both internally and externally? By externally I mean when consultants are called into a company to do management’s job. If you think that this cannot be a serious concern, then reflect that the UK’s NHS paid out between $350 million and $600 million worth of taxpayer money on management consultancy in 2014 alone. What effect did that have on the NHS’s productivity then?

It sounds like the sure path to higher productivity is to encourage monopolies and oligopolies that can raise prices pretty much at will while reducing the number of workers. The question becomes: why hasn’t US productivity surged as its markets became increasingly concentrated?

Blair Fix touches on an important issue behind the layers of terminology, concepts and policies that have so impacted our everyday lives. So if labor productivity doesn’t explain wages, income or prices, then what are the true factors influencing prices and stagnant real wages?

Pricing power, labor cost, and profit margins of large transnational corporations have benefitted from their increasingly monopolistic control of markets to suppress competition, use of global labor arbitrage, enjoyment of very low and even negative real interest rates, tax policies and use of tax havens, hidden subsidies, automation, neutering of organized labor, and purchased political influence. The productivity of labor in the West has essentially been made irrelevant in many cases. Important stuff in so many ways.

Still appreciate the famous EPI chart that shows how the wealthy have captured the entire differential between stagnant real wages and the rising productivity of labor since neoliberal capitalism made its appearance on the world stage four decades ago. Trillions:

https://www.epi.org/productivity-pay-gap/

Hence ‘private equity’ is a euphemism for cannibalizing any source of equity for a quick profit. We have an entire paradigm that is a farce. Based on value (equity) which in turn is based subjectively on whatever you can snooker. It is one step forward and two steps backwards at this point. The Chinese have a beautiful view of our debacle. No wonder they can tease out the contradictions. But it’s not like we, places like NC, haven’t been screaming about all this loud and clear. (Steve Keen for starters.) The thing the aptly named Mr. Fix is saying resides beneath the surface: If we are ever in so desperate a position to raise prices too much nobody will buy and the system will collapse. And because of our horror-at-the-thought we have avoided pricing oil where it belongs. Instead we have burned it with abandon, devastating the environment while we were at it. A very expensive abandonment. It was an unrecognized consequence; an unavoidable one for the sake of profit – whereas the other accounting anomalies are more “discretionary”. When you are desperate nothing is discretionary. If price ever comes to equal “utility” aka value, then there will be very little commerce. It makes Richard Murphy’s advocacy for Oil Bankruptcy a very rational suggestion. Mitigate the devastation – that’s about all we’ll be able to do.

Even Adam Smith admitted that the economic value of something has no relation to its intrinsic utility, but only to the relative balance of supply and demand for it.

If there are more workers than jobs, wages will be driven down and productivity gains will decouple from wages – although with low wages, there will be little incentive to invest in making workers more productivity so productivity may decline as a second-order effect.

If there are more jobs than workers, wages will be bid up, and productivity gains will be largely captured by workers because it is the limiting factor in any economy that captures the profits. At the same time, high wages will tend to spur higher productivity because there will be strong incentive to make efficient use of relatively expensive labor.

At the base of Niagara Falls, water is cheap and it is not used efficiently. Using water efficiently in Niagara Falls will not increase its price. In the Gobi desert, water is expensive and it is used efficiently. Not using water efficiently in the Gobi desert will not make it cheaper.

The core of modern macroeconomics is to take what is fundamentally simple and confuse the heck out of it.

One of the harms of monopoly power is it can artificially create resource scarcity to drive up prices.

then what are the true factors influencing prices and stagnant real wages?

That would be the human factor. Greed, honesty, and desires and conscious acts. Economics cannot capture the human factor.

Every human on Earth is capable of affecting markets dramatically by one act. Humans making multiple decisions every day. All 7.5 billion. One person can change markets and history with one act. Gavrilo Princip, for instance. Or by using an Internet post to affect markets.

To accurately model economics? All decisions made by each and every person on the planet would have to be an input into any model. Each person’s actions would have to have a solid, predictable outcome with no deviations. A person becomes depressed, then A and B and C can ONLY happen.

Which would rule out occurrences such as Malaysia Flight 370 and quite a few other possibilities.

Economics and economists are in no way, shape, or form… capable of accounting for the human factor. Which is why there should be no laws of economics. More like, guesswork and observing trends in a general and gross manner. Only to pray for accuracy.

LTCM was an example of economics and economists over-stepping their intellect. LTCM employed the observations from John Nash (the subject of the move, A Beautiful Mind) and his Nobel prize winning work. Their system worked until it didn’t. Other humans made decisions that trashed.

People chose not to play the game. For LTCM? Such decisions by others outside of LTCM’s control were fatal. The issue with game theory, etc? For it to work, one has to have enforcers or project power to force people to play by a set of rules. One could call this, the basis of American foreign policy – financial in nature.

The “Law of Supply and Demand”? Routinely violated. A person can decide arbitrarily to put items on sale. The Human Factor.

Trends in economics are like trends on Twitter. You just never know. Economists are trend chasers. Having more in common with Internet “influencers” trying to convince people that a $5 pair of shoes is actually worth $400, than with actual science. THAT being an example of how prices are determined, in part.

Neoliberal economics is a case study of a select group (economists) influencing politicians and others, to support their version of economics.

+1000

Great post DF! This whole discussion reminds me of the shortest job I ever had – selling crappy stereo speakers out of the back of a white van for a day.

I’d answered an ad not knowing what I’d be getting into. The people who were “training” me would drive up to an unsuspecting person in a mall parking lot and try to sell these speakers. They had a set dollar amount per day there were supposed to sell to get a bonus, so if they could sell a speaker for $200 they would and if at the end of the day they needed $25 to meet their sales quota, the last speaker would go for $25. The whole thing depended on two very big human factors – greed and gullibility.

I’m sure an economist could come up with productivity figures for this operation, but what it really was was a scam.

Thanks.

The job you describe reminds me of Eastern European bazaars back in the day where items being sold “fell off” the back of a truck. Or Hoboken, NJ market on a certain block. :)

Thank you NC for yet another article exposing the sham of neoclassical economics. Here’s a paragraph from a book I happen to be reading yesterday…

“..the neoclassical economic perspective is the ideology par excellence of capitalist political economy. It is a theory that explains nothing more than how to assure that capitalism remains capitalism. That is, neoclassical economics demonstrates how wealth and resources may continue to function to the advantage of the minority that controls wealth and the immediate access to political power. It is an ideology because it depicts as “rational” only economic behavior that seeks the “utility maximization” characteristic of market exchange. That other motives and values might deserve priority in our action as economic agents is either unthinkable (ruled out by definition) or, worse, held to be economically “irrational.” Neoclassical economic theory is itself a system of morality- and theology and ethics – masquerading as “science.” Yet those who dissent from this hidden morality have a difficult task before them. For this debate concerning the ethics of economics is consistently suppressed in public discourse. Reigning economic theory makes calls for the substantive realignment of existing economic power appear as madness. Dissenters are by definition “unrealistic,” “utopian,” or “irresponsible.””

And this was written almost 30 years ago in the book ‘God and Capitalism – A Prophetic Critique of Market Economy’. The excerpt is from chapter three – ‘The “Fate” of the Middle Class in Late Capitalism’ by Beverly W. Harrison.

I am not trained in economics, but I wrote an article on this subject several years ago entitled “Productivity is Bunk.”

My point was that wages often depend on bargaining power and protected status, rather than industrial productivity.

Cases in point are unionized workers vs. non-unionized workers, and government employees vs. everyone else.

Also note the incredible productivity of American farmers, versus their almost-uninterrupted financial precariousness.

As Groucho Marx used to say,” who are you going to believe? Me or your own lying eyes?”

Can we please get an SEC or FASB ruling requiring the explicit breakout of salary payroll on the income statement of EVERY public listed company?

Capitalism has ALL manner of enumeration of uses of capital, but nowhere is labor listed! I don’t care for labor hidden inside direct/indirect “costs of goods sold”, “SG&A”, “R&D” etc. Just put a payroll expense (minus payroll taxes, minus the healthcare and whatnot, straight payroll) line item somewhere in the 10-k. Is it a crime to ask?