Yves here. As readers know well, on the one hand, services and not manufacturing dominate the US economy. But manufacturing jobs, even now, are relatively well paid and manufacturing growth is often seen as having spillover effects.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

US manufacturing took a turn from lousy to worse in December, according to the Manufacturing ISM Report On Business, released today, with employment, new orders and new export orders, production, backlog of orders, and inventories all contracting.

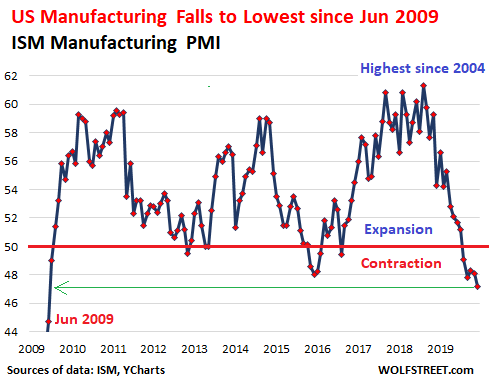

The overall Purchasing Managers Index (PMI) dropped 0.9 percentage points from November to 47.2% in December 2019, the fifth month in a row of contraction, and the fastest contraction since June 2009. Values below the 50% mark signify contraction, values above it signify growth (data via YCharts):

PMIs like the ISM report are private-sector measures, based on how a panel of manufacturing executives – names are not disclosed – see new orders, production, employment, etc. at their own companies in the current month (December). PMIs are the timeliest measure.

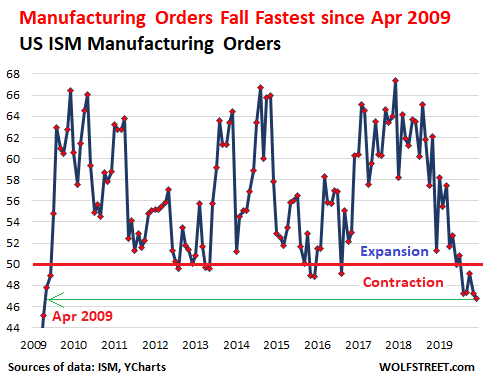

In terms of demand: The ISM’s New Orders Index dropped to 46.8%, the fifth month in a row of contraction, with new export orders having been in contraction mode in five of the past six months, and “recording 10 months of poor performance and likely contributing to the faster contraction of the New Orders Index,” the ISM report said. The contraction in the New Orders Index was the fastest since April 2009 (data via YCharts):

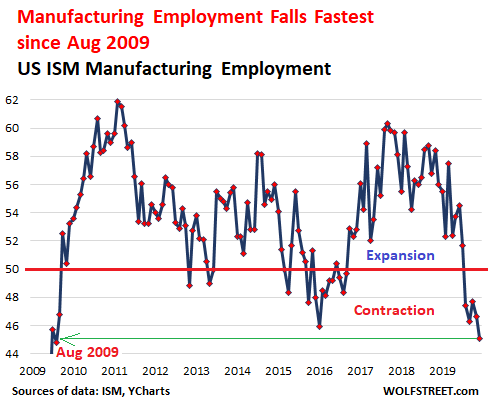

The Employment Index fell to 45.1, the fifth month in a row of contraction, and the fastest contraction since August 2009 (data via YCharts):

Order backlogs contracted for the eighth month in a row to 43.3 as manufacturers have been eating into their backlogs while new orders have declined.

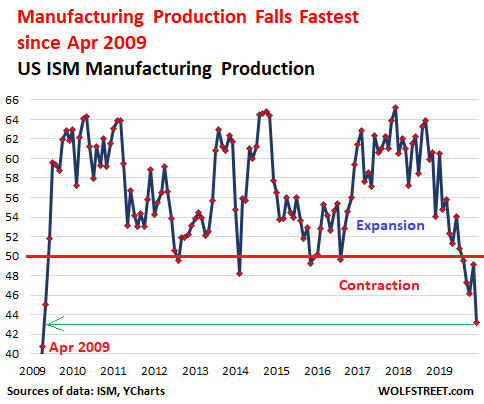

The Production Index plunged nearly 6 percentage points to 43.2, the fifth month in a row of contraction and the fastest contraction since April 2009 (data via YCharts):

The executives on the panel of the Manufacturing ISM Report represent 18 manufacturing industries. Only three industries reported growth in December – down from five in November:

- Food, Beverage & Tobacco Products

- Miscellaneous Manufacturing

- Computer & Electronic Products.

The remaining 15 industries reported contraction in December, with Transportation Equipment being the weakest.:

- Apparel, Leather & Allied Products

- Wood Products

- Printing & Related Support Activities

- Furniture & Related Products

- Transportation Equipment

- Nonmetallic Mineral Products

- Paper Products

- Fabricated Metal Products

- Petroleum & Coal Products

- Electrical Equipment, Appliances & Components

- Textile Mills

- Primary Metals

- Chemical Products

- Plastics & Rubber Products

- Machinery

While the declines were very broad affecting 15 out of 18 industries, December also saw some big special items: Boeing suspended production of the 737 Max and GM’s strike bled into the beginning of December.

How hard will this hit the US economy?

Services-producing industries amount to the equivalent of 70% of US GDP by value added, and to 80% of the private sector economy. In the third quarter, revenues by the services-producing industries rose 4.9% from a year ago. In the Finance and Insurance sector, the biggest of them all, revenues soared 6.6%; in health care, revenues grew 4.4%; in professional services and information services – which include the tech and telecom sectors – revenues grew 6.0% and 5.8% respectively.

We have to wait a little while for the detailed Q4 services data to emerge, but at this point, there are no indications that there was a sharp deterioration in Q4.

But with manufacturing deteriorating at this pace, and based on the historical relationship between manufacturing and the rest of the economy, the ISM Report estimates that the December manufacturing index value corresponds to a 1.3% increase in real GDP in December on an annualized basis, which would be a lot slower growth than the range between 2.5% and 2.1% over the past four quarters.

“The capital markets for oil and gas remain extremely difficult.” Read… Dallas Fed Outlines Somber Oil & Gas Industry, “Flaring” of Natural Gas Comes into Focus