Jerri-Lynn here. I’ve previously crossposted many segments of Justin Mikulka’s excellent series for DeSmogBlog on fracking follies. Here’s Wolf Richter’s take on the issue, wrapped up with a discussion of collapsing prices for oil and natural gas.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

Following the sharp re-drop in oil and natural gas prices in late 2018, bankruptcy filings in the US by already weakened exploration and production companies , oilfield services companies, and “midstream” companies (they gather, transport, process, or store oil and natural gas) jumped by 51% in 2019, to 65 filings, according to data compiled by law firm Haynes and Boone. This brought the total of the Great American Shale Oil & Gas Bust since 2015 in these three sectors to 402 bankruptcy filings.

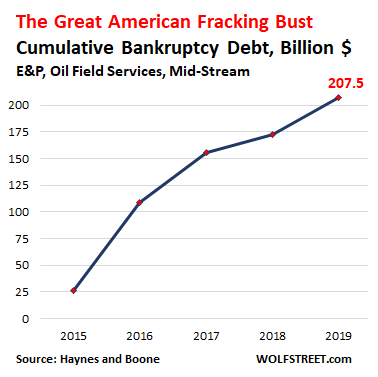

The debt involved in these bankruptcies in 2019 doubled from 2018 to $35 billion. This pushed the total debt listed in these bankruptcy filings since 2015 to $207 billion. The chart below shows the cumulative total debt involved in these bankruptcies since 2015.

But this does not include the much larger losses suffered by shareholders that get mostly wiped out in the years before the bankruptcy as the shares descend into worthlessness, and that then may get finished off in bankruptcy court.

The banks, which generally had the best collateral, took the smallest losses; bondholders took bigger losses, with unsecured bondholders taking the biggest losses. Some of them lost most of their investment; others got high-and-tight haircuts; others held debt that was converted to equity in the restructured companies, some of which soon became worthless again when the company filed for bankruptcy a second time. The old shareholders took the biggest losses.

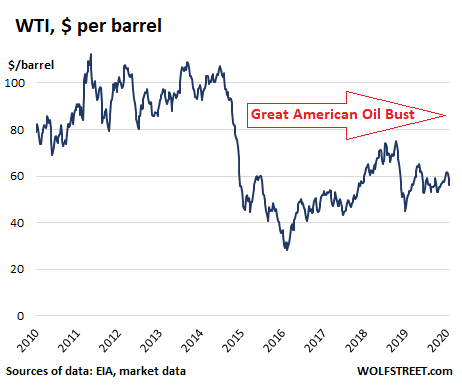

The Great American Fracking Bust started in mid-2014, when the price of WTI dropped from over $100 a barrel to below $30 a barrel by early 2016. Then the price began to recover, going over $70 a barrel in September and October 2018. But then it began to re-plunge. By the end of 2018, WTI had dropped to $47 a barrel.

Two major geopolitical events in the Middle East – the attack on Saudi Aramco’s oil facilities last September and the US assassination of Iranian Major General Qasem Soleimani – that would have shaken up oil markets before, only caused brief ripples, quickly squashed by the onslaught of surging US production. At the moment, WTI trades at $56.08 per barrel, which is still below where the shale oil industry can survive long-term:

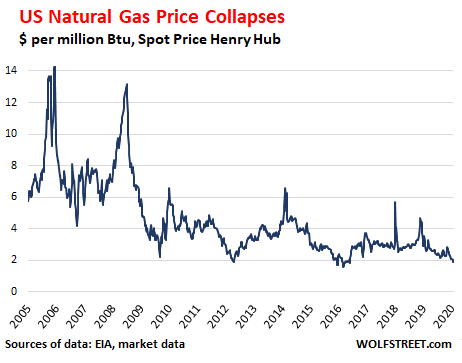

And 2020 is starting out terrible for natural gas producers. The price of natural gas has plunged to $1.90 per million Btu at the moment, a dreadfully low price where no one can make any money. Producers in shale fields that produce mostly gas, such as the Marcellus, are in deeper trouble still, because oil, even at these prices, would be a lot better than just natural gas.

Producing areas with constrained takeaway capacity (it takes a lot longer to build pipelines than to ramp up production) are subject to local prices, which can be lower still. In some areas, such as the Permian in Texas and New Mexico, the most prolific oil field in the US, where natural gas is a byproduct of oil production, limited takeaway capacity has caused local prices to collapse, and flaring to surge.

The chart shows the spot price for delivery at the Henry Hub:

Texas at the Epicenter.

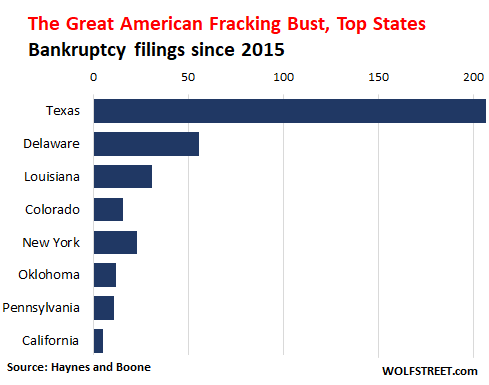

The most affected state, in terms of the number of bankruptcy filings, is Texas, the largest oil producer in the US. Since 2015, the state had 207 oil-and-gas bankruptcy filings, of the 402 total US filings. In 2019, Texas had 30 of the 65 US filings.

Delaware, obviously, is not into oil and gas production, but into coddling corporations, and many companies are incorporated in Delaware, including some oil-and-gas companies in Texas. When they file for bankruptcy, they do so in Delaware. These are the eight states with the most oil-and-gas bankruptcy filings since 2015:

Bankruptcy filings are triggered when the E&P companies no longer get funding from Wall Street or from their banks to continue with their perennially cash-flow negative operations and service their debts. And this is what is happening now. Wall Street and the banks have started to demand that these companies stick to an entirely new mantra in the fracking business: “live within cash flow.”

When E&P companies run short on funding, they cut back on drilling activity which puts the squeeze on oilfield services companies that provide products and services to the oilfield, including drilling and completing wells. And then these OFS companies go bankrupt.

This is what happened to oilfield-services giant Weatherford which filed for a prepackaged bankruptcy last July. Back in 2014, before the oil bust, it had 67,000 employees; by July, it was down to about 26,000. The reorganization plan allowed Weatherford to shed $5.8 billion of its $7.6 billion in long-term debt. Old shareholders got wiped out. The creditors got 99% of the restructured company’s new shares.

In its report on the OFS bankruptcies, Haynes and Boone cited this pressure from Wall Street and its cascading effect, which Weatherford had pointed out in its bankruptcy filing:

We note that Weatherford, in its July 2019 filing, attributed its insolvency in part to reduced drilling activity by producers who have also been dramatically affected by the commodity price slump since 2015. Investors’ pressure on producers to “live within cash flow” is further reducing demand for OFS services and supplies leaving the OFS sector with little near term hope for a turnaround in prospects.

What this sector needs are much higher prices for oil and natural gas. But that cannot happen while production continues to surge. A large-scale culling in the sector – a lot more bankruptcies – could reduce production, and support higher prices.

But as soon as prices rise above certain levels, with investors still chasing yield at every twist and turn, the flood of new money will wash over the sector again, with investors having already forgotten by then that shale oil and gas was where money went to die every time. And this new money will cause a new surge in production, which will collapse prices once again. It’s a cycle that the shale industry has a hard time getting out of, under the current loosey-goosey monetary conditions.

The cratering of natural gas prices is bad news for any attempt to encourage renewables.

From my own situation, I made a substantial capital investment in moving my domestic space heating from gas to ultra-high efficiency air source heat pumps.

The economics worked out as broadly favourable (this wasn’t my motivation, but it helped justify the investment). My heat pumps have a raw (non-seasonally adjusted) coefficient of performance of a little over 5. So I get 5kW of heat for every 1kW of electrical input). Here in the UK I was paying 14 pence per kW/hr for electricity compared with 3.5 pence for natural gas. With a AFUE efficiency on the gas heat of 90% my heat pumps generated heat at just under 3 pence per kilowatt, the gas heat would work out, net, at around 3.8 pence. So I saved about 10% to 15% in energy costs doing space heating via renewables. Again, here in the UK market, electicity is about one-third to 40 percent from zero-carbon sources, wind, hydro and nucelar. So my carbon footprint for space heating using heat pumps was hugely lower (maybe up to half).

I’ve just got my utility’s latest quote on energy prices. Electricity charges are about the same. But I’m being quoted 2.5 pence per kilowatt hour for natural gas.

There’s no way my air source heat pumps can compete with that. I might as well just burn the gas and say screw the carbon dioxide emissions. I won’t, of course. I’ll grin and bear it. But the shale glut and the uneconomic (wasted) investment in overproduction is massively distorting the energy market.

Yes. Those are the calculations to be done. I am in the same situation though in Spain the “spread” between gas and electricity prices in energy terms is smaller compared with the UK and will probably get even smaller in the future despite the natl gas glut (because tariff policies and investment in renewables). I am paying about 0,14€/kWh on electricity consumed (fixed power contract apart but I needn’t change it) and gas is at 0,06€/kWh. The seasonal coefficient of performance of my reversible air/water heat exchanger is 4.5 by Eurovent (third party certification of performance) so current expenses relative to natural gas are 0.14/(0.06 x 4.5) = 0,52 that means I save 48% relative to the gas boiler. In fact a bit less because the seasonal COP of the condensation boiler was about 1.05. But then, there are other advantages about getting freed of natural gas: not needed periodical inspections. Also my boiler was ageing and requiring more frequent revisions and repairs. In Spain the electrical mix is now about 60% renewable + nuclear (approx). Gas prices are also more volatile.

I among other things was designing, sourcing and installing high efficient NG powered floor heating system in the North West of British Columbia. I once participated in 2012 in a symposium by a supplier of heat pump systems.

The maximum savings one could expect because of the demand of the system (basically a reverse refrigerator with a compressor demanding the most power) was actually 30% of the cost of gas.

However – and that is the big one – a gas powered system at the time using high efficiency boilers cost about 5 – 7$/ square foot, depending how much electronic controls you threw into the system.

This way a new house install at an average 2500 square foot house would set you back an average of 15 grand. Installing a heatpump system with either 8 -10′ buried PEX loops or wells to 100′ deep would add between 25 – 30 000$ on top minus the cost for the boilers at an average of 4500$.

And the typical heat-pump unit would cost between 8-10 000$ with a lifetime of about 10 years, double the cost of a boiler who usually have a somewhat longer lifespan.

The reason: air heat extraction systems in Canada do not work, when the heat is needed the air temp. is at about – 5 to – 35C…..so only subsoil extraction works with attending cost of machinery and labour.

The conclusion by all 25 contractors attending was quite unanimous – heat pump systems in Canada except maybe in the most southern portions – are a waste of resources and money.

Even here in mild England, despite having a heat pump installation which has capacity for the space heating load even on a design condition day for winter extremes (let’s say minus 5C) I have done a lot of data logging which has shown that in some not exactly challenging or unusual climatic situations, the heat pump performance doesn’t meet anything like submittal sheet claims.

A few weeks ago, I’d forgotten to run the systems overnight at a low setpoint (but enough to keep the space at a reasonable temperature — I usually pick 16C or the low 60s F). When I went into the kitchen / breakfast nook at seven o’clock-ish it was freezing cold (okay, maybe not freezing, about 14C) with an outside temperature of 1 or 2C (low 30s F).

I turned the heat pump on, set it to a high output as I needed the space to warm through relatively quickly before I had coffee then had to leave.

After less than five minutes, the outdoor unit went straight into a defrost cycle. Why? Because it was one of those typically English damp, foggy mornings (where there was almost 100% RH outside). Even though the outdoor coil would have been, say, 2 or 3C, as soon as the system started, the coil surface temperature would have crashed to minus 3 or 4C — whereupon the saturated outside air promptly froze the coil solid. Coefficient of performance would have been less than one for the twenty minutes or so I needed to heat the space. I’d have been better off firing up the gas heat.

Only an isolated and probably unusual use case. But a good illustration that green technology has limits. For US climate zone 3 or 4 inhabitants, I suspect heat pumps will only ever be viable in the shoulder months. For the severe winters you guys get, I can’t see how you can avoid combustion heat sources. Not to say that renewables such as air source (or ground source) heat pumps aren’t a partial solution, but the capital costs will be high, probably prohibitively so for a monovalent system and overall carbon emissions savings won’t be especially spectacular.

Coastal temperate US regions might the best. Many inhabitants there. But I guess it works in Texas, New México, Arizona (may be not so well in high plains north to the Canyon) and others. May be Arkansas for instance and north up to Iowa?. It has to be noted that when temperatures go close to 0ºC or below, and for long hours, performance is much worse. So, in Madrid (a urban heat island itself) this occurs in winter for about 3-10 hours during the night (I set thermostats at 19ºC during the night) in an average January day and it is not big deal.

But, again, the climate is very important indeed. It has to be carefully analysed.

IMO Air heatpump is good for Oz, NZ and the likes, with the south UK being marginal now, but not-applicable once Gulf Stream goes :)

ground-water, or water-water HP are needed for anything that gets freezing 3-4 months a year, but that, as you say, has nontrivial capital costs, unless costs of carbon goes up by a lot.

And, TBH, there are problems even with that. Say if ground-water is using subsurface loop, it actually has a measurable impact on the soil temperature over few years, which is bad for a number of reasons. Water-water can be ok if the water source is running water and not over-used, but I’ve seen water-water sources that were using ponds freeze large ponds that under normal circumstances would never fully freeze.

That said, ground-water well driven HPs are IMO very good for large office or apartment buildings, especially if they work both ways (i.e. cooling into ground in the summer, avoiding city heat islands).

I think the broadest lesson to be drawn from Clive’s experience is that investment capital is actively making it difficult to transition away from fossil fuels because investment managers and underwriters absolutely insist on continuing to invest in fossil fuel projects, even if it loses tons of money!!!

How can we compete with rich, powerful people who insist on wasting money!?!?!!

I have long wanted to use geothermal heat pump. In my case it simply won’t happen, sadly. For one, I would never be able to get the permit to drill the well in city limits. Two, the equipment would cost more than my older, poorly insulated house itself. Three, our state government has allowed and caused some of the highest electric prices in the nation, despite having a huge hydro electric plant in town. We don’t get that electricity, it gets sold to NYC at greatly inflated prices. We don’t get the money either. Instead we are forced to import our electricity with full taxes and tariffs on it.

Last week, the temperatures were down to -15C at night… And of course the snow.

Yes, the condition of the building is such a crucial aspect. I used to have beautiful hardwood window frames, but there were an unmitigated disaster for energy efficiency and creating a good building envelope. They were an almost complete thermal bridge. And they could only accommodate the thinnest of double glazing. In a really cold winter’s day, I’d have to set the leaving air discharge temperature fairly high on the heat pump indoor coil to get warm, which hampered efficiency. I was able to change to triple glazing (which fixed the problem and significantly reduced heat loss but, again, at a cost…) because the property is modern. If I’d had an older property, the windows would only have been part of the problem (solid or poorly insulated walls and an un-insulated slab, for example, would be worse). And the chances of getting permission to replace windows in a historic house would be slim, certainly with the UK’s tight building control.

And as you say, if you’re in zone 5 or 6, you’re a bit stuffed with regular drops to -15C (5F). My heat pumps guarentee operation down to -15C, but capacity takes a nosedive. Luckily, design conditions here in southern England are -5C, which reduces capital cost massively. And if design conditions demand operation is guaranteed down to -20C (c. 0F), there is not much choice of air source equipment available at any price. The only unit I know which is rated down to below -30C is a Panasonic mini split, which here in the UK costs nearly £2,000 (c. $2,600) for a 3/4 ton unit. Out of reach for most. So you’re left with ground source, but — as you say about NYC — forget that idea in, say, London where tunnels and utility wayleaves can’t be interfered with. And ground conditions are difficult too, with a heavy clay.

Green tech is not a panacea. I don’t want to be discouraging, just the opposite. But some of the talk about how practical it is is fanciful.

I do believe that much good is possible by greatly revising and liberalizing the building codes, but practally trying to accomplish this is like pulling teeth. For some reason there is large political resistance to change in this area. Older buildings can easily be made quite efficient with current tech, but then the problem becomes an economic one. How to overcome the first costs when the cost of upgrading is more than the structure itself?

FWIW many homes in my area were built in the 70s and 1980s with the assumption that electric power would be free, or nearly free once the original bond issue for the power plant was paid off. LOL the bastards managed a 30% rate hike the same year they paid it off, using every little excuse possible.

Reading your reply, I was struck with just how underdeveloped the building insulation field is. I have seen blow in and spray in foam retrofit insulation systems used in commercial construction. (I particularly remember a system for inserting expanding cellular foam into the void spaces in concrete block walls. [Yes! It can be done!])

Saying the above, I have read about the building insulation codes in the Nordic countries being very ‘tight.’ Anyone from there care to enlighten us?

All the above is referencing winter heating. Where we live, summer time air conditioning is the main energy sink.

Excellent points. Of course there is one plus. In the US we also need cooling in the summer. My impression was that the heat pump systems could provide this as well, and very economically.

Yes, we had a hot summer (hot by north European standards at any rate, we had about 10-15 days in the low 90s F and only a single day over 100F, maybe another few weeks in the 80s) and my A/C cost was well under $100 for the whole cooling season, just because the heat pumps with variable speed compressors and larger coil surface areas are so efficient when in A/C mode.

As ambrit says above, even with low US electricity costs (in some areas, anyway), I don’t know how feul-poor folks manage in the south and so-cal with 10 SEER equipment and poorly insulated homes when you have day after day at 95-100F.

It’s dry in SoCal. One can easily survive by opening the windows, avoid direct sun on windows, and dress accordingly.

I lived in the tropics under the same conditions, no direct sun on windows, behind insect screen. That, one bed sheet to cover oneself, and a ceiling fan worked well.

Yes, the avoidance of service costs for gas-fired equipment plus the utility connection fee for the gas service does make me consider the idea of moving away from gas as a fuel source entirety. I must run the numbers on that to see how it might work out. It’s a good point to consider for anyone looking at the long-term costs for air source water or space heating.

And you UKers are not precisely big spenders of electricity in per capita terms. About half than French with all that nuclear power in place. Guess that how the power is delivered to the grid has an important effect in consumption patterns.

If natural gas prices stayed cratered just long enough to exterminate thermal coal beyond hope of revival in many countries before the natural gas prices went back up . . . would that be a good thing?

Can someone at NC explain why the government allows burning flared gas? If it was outlawed production would drop for oil as well until some way to store and use the gas was developed. It seems burning natural gas at the wellhead must increase CO2 since gas is a hydrocarbon.

I think you’ve answered your own question. The US govt has long had a policy to INCREASE oil/gas production, side effects be damned.

There’s a collective action problem among producers where they’d all benefit if they all agreed to drop production 20%, say. But, each individual player benefits if they get to cheat on those production cuts.

Plus, they’ve all floated a ton of high interest debt, which requires that they put capital to work to generate cash flow to service that debt. It’s clear that we’re in the ‘ponzi finance’ stage of the cycle where new debt has to be issued to keep up payments on the interest of the older debt. That’s why the bankruptcies are perking up.

Bond underwiters, investment mgrs, oil services execs, and other players are all very incentivized to keep getting new deals done.

First of all, it seems to be up to the states (?). There actually are regulations in Texas (the Permian basin is the marginal-cost producing location in the US, where most of these stories are centered). But the state is a friend of the industry and these regs are loosely enforced. Secondly, emitting unburned natgas (mostly methane) is even worse than CO2 as a greenhouse gas. Thirdly, they are drilling for oil, not gas, and are hoping to maximize the oil-to-gas ratio. With low natgas prices and smaller amounts per well than elsewhere in the US, putting in pipe for natgas is not economical. In fact the oil-gas-ratio varies in simple geographic pattern that was known for years. The best, i.e. oil-rich land was claimed early, subsequent waves of development that came on line during the oil price spike in mid 2000s, are now getting killed. Fourthly, the ones losing money can’t afford the extra ongoing capital investment anyway – recall the very short life cycle of wells in fracking. They are certainly cutting corners in other environment related tasks, like wastewater disposal.

So will it stop? Not at the moment no. On the legal front, not until the next Ralph Nader comes along and we get another wave of federal public interest legislation like we had in the 70s (which neither major party wanted at the time, just like now, and always). Economically, also no. The marginal producers who were late to the gold rush will exit, but there is no shortage of oil at even $50. The wildcard is in international developments. We are suppressing production and export of conventional oil from Iraq, Iran, Libya, and Venezuela. We are suppressing transport of natural gas from Russia to the EU. There is also unconventional oil in Canada. I.e. US policy is supporting prices. Net effect on global oil and gas use? None, since we just produce the difference ourselves, with a bunch of extra natgas the world doesn’t want, and can’t be stored, so we burn it. Sucks.

Flaring is usually classed as solution gas flaring, emergency flaring and just unwanted gas flaring.

These days flaring unwanted gas is rare because of the huge waste. But not long ago producers could just flare stuff they didn’t feel like getting to market, so entire reservoirs of gas were burned just to get to the oil. This mostly doesn’t happen anymore.

Emergency flaring happens in production or refining when a sudden unwanted flow of gas manifests and for safety reasons, it must be disposed of rapidly. This appears a sudden very large luminous flares over short timescales. Again, this is rare and essentially can’t be avoided. Flaring is much safer than just releasing.

Solution gas flaring is the bubbles of gas dissolved in liquid that come out of solution during production as liquid pressure drops close to the wellhead. These need to be collected or they would fill up liquid storage tanks. The volume and composition of the gas flows determines the cost of collection. Companies have to balance the cost of collection vs. the damage to the environment if flared. They usually try to make a case that the containment cost (the cost to produce it to market, since the market value is usually minimal) is prohibitive and request a permit to flare. This is the usual minimum compliance approach of most resource development.

Basically, the conditions to obtain flaring permits vary with jurisdiction and are based on a balance of revenue vs. environmental damage. These days most places encourage developers to collect solution gas, but for remote locations in sour plays, that is costly to the viability of the play.

If no one will build the gas-flaring oil fielders a free pipeline from oilfield to gas-market, and building their own pipeline would cost more than what the oilfielders could sell the gas for; they will just burn it in place. The other alternative would be for them to release the methane UNburned into the air, which would be even worse than burning it first.

This among the agricultural folk is called the “Schweinezyklus” or “pig cycle”. Typical for larger scale farming when from a previous oversupply the market has tried up, raising prices and everyone increasing again their pig production till – again – the market collapses.

I studied agricultural economy and production in the early 1970’s when this type of cycle became typical when farmers moved from mixed production providing risk compensation to dual or even single products.

has tried up…didn’t catch that, shoud read “dried up” of course – or even better: crashed…

Indeed, the situation you refer to looks suspiciously like a process of financialization of agriculture. Not to wax nostalgic for the “good old days” of backbreaking labour and crummy living standards, but agriculture used to be a form of ‘calling.’ Now it’s just a job. Of course, the serfs and other ‘forced’ agricultural labourers of yesteryear disproved the ethos of Goldsmith’s “The Deserted Villiage.”

There was a Golden Age, but it was not evenly distributed.

Frankly it is hard from Wolf’s figures to know if he is even right. $207bn of defaulted debt sounds like a lot of money, but is that from a total of $250bn or $2.5tn? I have no idea if this is a lot of the industry or a little. And 2019 may be worse than 2018 for defaults, but both 2016 and 2017 were way higher than that. Are things really getting worse or not? I am deeply sceptical about the financial viability of fracking, but the case being made here doesn’t justify the sensation rhetoric.

Heat: Superinsulated tight homes with air-exchange… conservation remains the low hanging fruit…

A refrigerator and incandescent light bulb provide a lot of heat, if one can preserve it…

In 1993 I built a house guaranteed to use 6,192 Kwh per year for heating and cooling here in central PA, near Harrisburg. That includes resistance electric heat for backup. At that time the cost was less than $40 a month.

Following the specifications to achieve this added about $2,500 to the cost of this 1288 sq.ft. house. It was a result of government requirements but no subsidies except for administrative cost by the utility. Those requirements were subsequently dropped and the program disappeared.

My question would be, was this program dropped because of complaints from the general public, the homeowners as a group, or the builders and developers? $2 USD a square foot added to construction expense wasn’t chicken feed back in the 1970s.

Great article! It causes me to wonder, are the neocons trying to start a shooting war in the Middle East to drive up US petroleum prices? Make America Great… at least Texas. ;-)

I feel like supply control over there is more about petrodollars and perhaps efforts to hurt Russia and Iran. Meanwhile the US seems to essentially be dumping oil with QE and repo money funding money losing small fracking plays. I figured ages ago the plan was always to have the supermajors mop up the wreckage at pennies on the dollar when the party ends.

Paper bankruptcies seem like a small price to pay for the gain in geopolitical influence of all that extra production. Not being at the mercy of someone turning down the crude tap can foster much more unilateral, terrible decision making in the middle east.

The invisible hand of the market did well to coddle a massive infrastructure buildup I saw first hand in the Eagle Ford in Texas. Long term well production may have dropped off significantly faster than the sales pitch but all of those wells will still be in place to re-fracture when the market demands it.

How do I short fracking?

Short Continental Resources, Howard Hamm’s Company,

He’s the Genius who married his corporate Lawyer, and then went womanizing.

Isn’t this another aspect of the torrents of cash swilling round the planet looking for a home? Isn’t that the factor behind the rise of AirBnB, WeWork, Uber and the rest of the new global brands – soaking up the flood of paper the Fed is throwing into financial markets to keep all the balls in the air? Do debts still have to be repaid? Isn’t it enough to be one of the ‘safe pairs of hands’ approved for loans?