As a long-standing million mile American Airlines customer who has chosen to rack up even more frequent flier points via a Citi Aadvantage card, until recently, I’ve thought well of Mastercard and Citi. Citi once had intelligent and competent phone representatives who also seemed to have more discretion to solve cardholder problems than was typical for large banks.

That is no longer true. I’ve stumbled across Citi violations of Mastercard’s chargeback procedures which have the earmarks of being institutionalized (note I’ve been to this rodeo a few times, not just as a consumer but as a seasoned consultant to large banks, as well as to American Express).

This fiasco is relevant not just as a matter of prurient interest, but more importantly, as a demonstration case of ham-fisted chicanery on two fronts. The more important one is Citi’s chargeback abuses, since chargebacks are a very important but not widely recognized last vestige of consumer protection.

What Citi is up to could be dismissed as predictable bank grifting. But the question remains why is Mastercard, which is reported to be vigorous in protecting its brand, letting Citi get away with trashing Mastercard’s image? And then there is the icing on the cake of Citi cornering customers into accepting its plan to use voiceprints.

Below is a voice recording and a transcript from a recent call on a badly and apparently deliberately mishandled chargeback on a Citi Mastercard. I’ve been put through persistent HAMP-level runarounds, for instance, of not being told to send in supporting documentation (when from prior experience I knew that was required), to being affirmatively discouraged from sending in documentation which I nevertheless sent in anyhow. But in keeping with them not wanting to consider it, it was ignored.

As we’ll discuss in more detail, on this call the Citi disputes agent for its Aadvantage Mastercard not only made multiple misrepresentations of the history of a particular chargeback but finally ‘fessed up to a key violation of Mastercard rules.

And to add insult to injury, before I got to the disputes department, I had a strenuous conversation with the initial agent who kept refusing to implement my demand that Citi not use my voiceprint. Since I am not convinced the eventual assent was genuine, I now have to waste even more time writing Citi’s general counsel to demand my voiceprint not be retained. If they will not comply, I will cancel all of my Citicards.

Why Chargebacks Matter: Protecting Ordinary Consumers from Shady Merchants and Practices

The ability to dispute charges is one of the most important reasons to use a credit card, as opposed to a debit card or cash, where the vendor irrevocably has your money and the customer’s ability to right any wrongs are limited and costly.

Indeed, given the widespread decay in business ethics, consumers’ chargeback rights are one of the few remaining checks on everyday misconduct. For instance, I’ve had two instances in the last five years of professionals making fundamental misrepresentations about their services where my huffing and puffing didn’t get them to give back the money, but putting in a chargeback did (as in both quickly capitulated and issued a refund).

Chargebacks are a very important part of the value of a credit card to customers. As we’ll discuss shortly, with Citi’s Mastercard operations setting about to vitiate them, there’s no good reason to use a Citi Mastercard and effectively be overpaying for a deficient service (one with badly and apparently deliberately compromised chargeback rights).

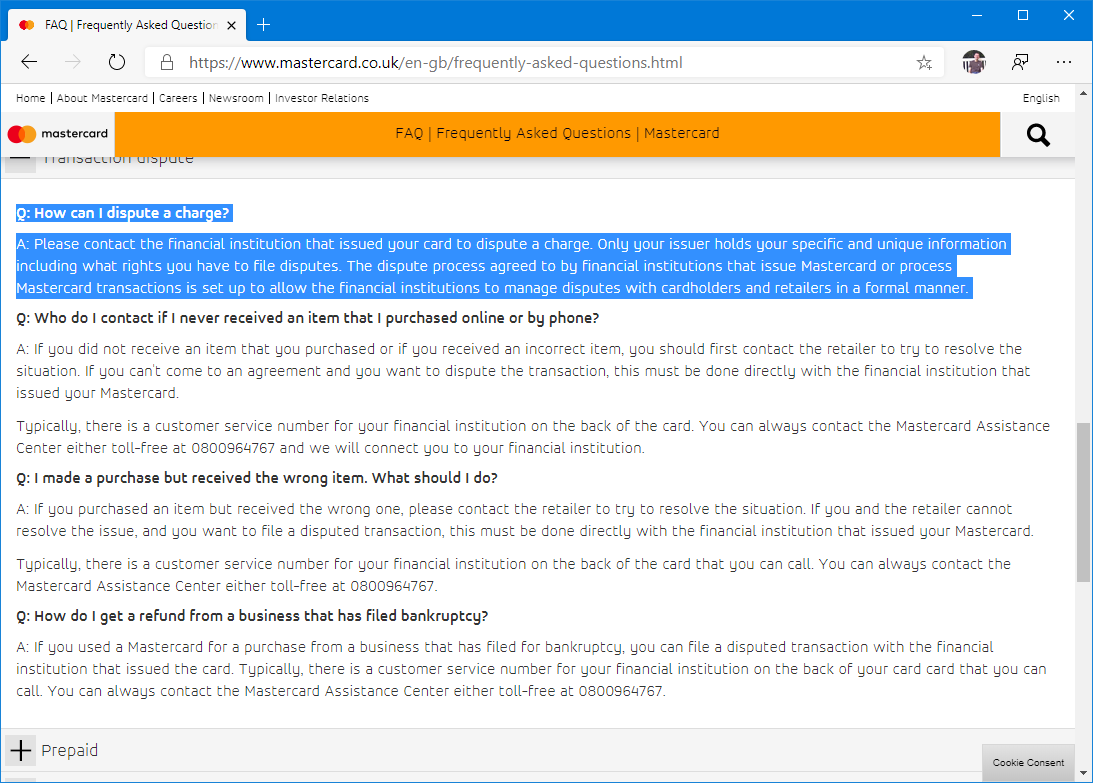

Mastercard specifically imposes the rules on card issuers like Citi and makes positive claims to cardholders that this is how disputes will be resolved in their marketing materials. See https://www.mastercard.co.uk/en-gb/frequently-asked-questions.html (you have to click on an expand button (“+ Transaction Dispute”) to see the text)

Q: How can I dispute a charge?

A: Please contact the financial institution that issued your card to dispute a charge. Only your issuer holds your specific and unique information including what rights you have to file disputes. The dispute process agreed to by financial institutions that issue Mastercard or process Mastercard transactions is set up to allow the financial institutions to manage disputes with cardholders and retailers in a formal manner.

Note the “… in a formal manner”. In other words, card issuers like Citi can’t make stuff up as they go along. These card issuers sign a binding contract with Mastercard to this effect (which is what is meant by “The dispute process agreed to by the financial institutions that issue Mastercard…”) as a condition of their use of Mastercard under licence.

Mastercard (like Visa and other credit card networks) ruthlessly and diligently police the use of their brand and their standards (look at how stringent they are on brand assets: https://brand.mastercard.com/brandcenter/mastercard-brand-mark.html). And they micro-manage merchants and card issuers when the need arises, such as clamping down on crypto-currencies being treated as goods rather than the equivalent of a cash advance.

Keep in mind that Citi Mastercard’s sort of misconduct also greatly weakens the Visa, Mastercard, and American Express networks’ efforts to preserve their egregiously high fees in the US. They managed to win an epic battle a few years ago by retailers, led by the likes of Walmart, demanding that the US put the kibosh on high merchant fees. The retailers pointed to the fact that overseas, the network operators had much newer and more secure infrastructure despite having much lower legal fee limits. Gutting service levels while trying to justify nosebleed-level fees is not a winning political proposition.

Why and How Citi Is Trying to Get Out of Processing Many Chargebacks

Card disputes are high-touch, high-skill servicing tasks for card issuers like Citi. They are not very amenable to automation. Even though the Mastercard and Visa guides are detailed, someone at the card issuer has to determine whether and where a particular chargeback request maps into that rulebook. A well-run bank will engage in triage when the chargeback is called in, with simple ones on one end of the spectrum to, on the other, fiendishly complicated issues which are one-offs or happen so infrequently that even a skilled case handler might see such an instance only once or twice in their tenure.

So finding a way to get rid of a lot of the complicated cases would mean less need for well-trained chargeback staff, far less time spent per case, meaning ka-ching, more profit! And Citi’s assumption no doubt is that customers would be too unsophisticated to see they are being had.

I encountered Citi’s ruse by accident, by virtue of having two fairly large chargebacks (over $1000 each) within a few months of each other, and by having initiated enough chargebacks over time to be familiar with Citi’s former routine.

Remember that in the world of highly routinized operations like call centers, one incident could be a mistake, but two strongly indicates a policy.

When I initiated a chargeback in the past, the Citi representative would unfailingly tell me I would be getting a letter in 7 to 10 business days and I needed to fill it out and send it back. That letter would always contain a ridiculously short space for describing why you wanted the chargeback (although my dim recollection is that it did say to provide any supporting documents). I would always attach a narrative, any communication with the merchant, and other backup.

On the first of these chargebacks, I noticed no one at Citi told me to be on the lookout for a letter. Remember, you need instruction not just on what to send in but where to send it!

And no letter came. This first one was a complex chargeback (merchant was supposed to execute some custom work, didn’t deliver on the specs, and then said in writing it couldn’t). It was clear there was no way any reasonable person could rule in my favor without evidence.

I was still wrangling with the merchant and updated Citi by phone. I even pointed out in one call that I hadn’t sent anything in and wondered when Citi needed it and said I would know more after I went another round (I was hopeful of agreeing on a partial refund + a repair).

Citi reversed the chargeback because I had sent nothing in, even though I had raised that very question with them! I made a stink and was able to get the chargeback reopened. With the benefit of hindsight, it was dumb luck. It appears the merchant had also sent nothing to Citi.

So with the second chargeback, I had wised up. Not that that did me much good.

When I called in on this one (a shoddy Westin Heavenly Bed mattress, it developed a deep trough where I sleep in a mere six weeks despite my weighing 2/3 as much as the average American), I took care to specify the two relevant categories in the Mastercard chargeback guide: “defective goods” and “goods not of reasonable expected quality”. Even though I had given a pretty detailed account, the agent (clearly working from a script) told me to state what the problem was and encouraged me to vent, sometime to the effect of “Let it rip, here is where you can say what you feel”. I found that weird, since banks are not in the business of providing emotional support. It appears that all of this faux sympathy was to cover for not taking the chargeback process seriously.

I specifically asked where and when I needed to send in documentation. The rep assured me I didn’t need to do that. “We’ll take it from here”. That was clearly incorrect but it was also clearly in that rep’s script.

But since I knew where to send the documents due to the other chargeback, I dutifully sent in my stuff, including e-mails where the merchant had agreed to issue a refund (effectively admitting the mattress was defective) but imposed physically demanding and haxardous requirements I could not meet. They went silent when I said I could not risk injury and made other suggestions. I also sent in evidence of the mattress’ defects.

I called Citi after I e-mailed them in, asked if they’d been added to my disputes file, and was assured they were. Had I been more clued in, I would have asked if they had been uploaded to the Merchant Dispute Resolution System, which is where the merchant, in this case Westin’s Heavenly Beds business, would see what I had sent to substantiate my claim.

Citi closed my chargeback and reversed my conditional credit. Why? Because Heavenly Beds had responded. Citi sent the records, which simply showed the details of the transaction on their end, and that they’d shipped the mattress! That was it. No response whatsoever to the two chargeback categories, which suggests that even that information, from the initial call, wasn’t entered into the Merchant Dispute Resolution System.

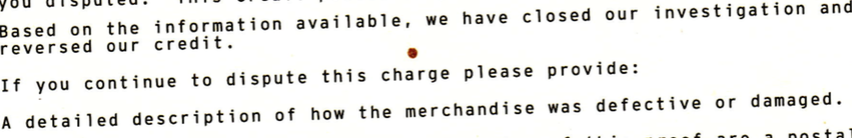

Citi’s note included this maddening, HAMP-esque “Our dog ate your homework” section:

I called twice to complain, and one of the two times even got a supervisor, each of whom said that Citi reversed the chargeback merely because the merchant responded. It was of no importance that I had already sent in documentation substantiating the mattress was defective and Citi had confirmed on the phone that they’d received it. or that the merchant response was irrelevant to the chargeback categories invoked. This is clearly improper under the Mastercard chargeback playbook.

But despite this obvious servicing failure, under Mastercard rules (which as you can see are only being used against me, not to my benefit), I could then only pursue what in Mastercard-land is called an Arbitration Chargeback.

One party involved in this escalation took interest in Citi’s abuse of Mastercard rules via shutting down the chargeback merely based on the merchant sending in irrelevant documents. Even thought the paper trail clearly showed that, I thought it was important to get Citi on the record saying so yet again. The result was the Alice in Wonderland call below.

Citi’s Chargeback Falsehoods and Run-Around

Quite a few readers offered to help with audio editing. Due to my concern about getting it done on a timely basis, I asked two very overqualified audio editors to have a go. Both turned it around almost immediately. I used Hank’s version because he took it upon himself to amp up the Citi voices where they were hard to hear. I’ve also included a rough transcript.

We’re starting in the middle, when I finally got past the initial rep to the Disputes department. That section begins at 8:50, or on the transcript, on page 3 the first time you see “Dispute agent” as a speaker. It takes her until 10:20 to find the dispute even though I offered twice to read out the Dispute ID.

Our retail banking ops maven Clive was appalled at the amateurism:

The World’s Worst Handoff – not passing through the already-established ID and verification. That’s clown-car stuff.

It got even more awful, if that were possible, didn’t it – why didn’t they accept your suggestion to work from the Dispute ID when you offered it, when they clearly couldn’t accurately pull out your dispute record?

If you have the patience to listen or read, you can see I got distracted from my main mission of getting Citi to reconfirm what they had told me on February 1 and February 7, that they had closed the chargeback merely because the merchant had replied. The disputes agent attempted to claim that the chargeback had not been denied, when in fact the only way Citi could now be pursuing the matter was as a new type of chargeback, the afore-mentioned Arbitration Chargeback.

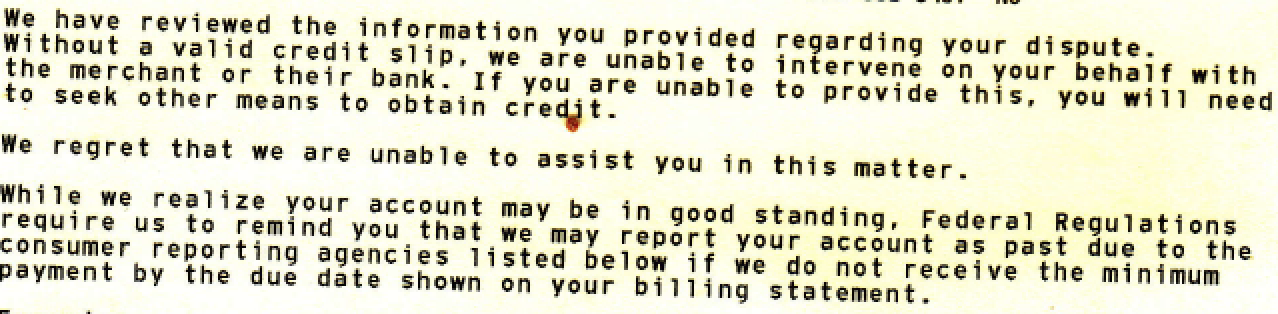

In fact, Citi had attempted to shut down the Arbitration Chargeback on February 24 on yet more procedurally invalid grounds:

This again is utterly irrelevant to the chargeback categories invoked. It’s as if Citi has a random cardmember turndown letter generator and this is what popped out. I included the credit bureau language because this letter also incompetently acts as if the chargeback credit was just reversed, when that happened had happened in early January.

So again to recap:

The disputes agent acted as if the chargeback was alive all this time when I had to make a stink to revive it from the dead twice.

Worse, the disputes agent kept harping on my needing to send in information when the extensive documentation I had sent in twice clearly had not been read. And on top of that, if Citi really did need more information, they should have contacted me to request it rather than make noise about it only because I had called in.

Even though it is painful, I urge you to listen to or read the exchange. As our Clive said:

I am the most patient person you can imagine. But I would have totally lost it with the Citi agent. I really don’t know how you kept your temper. “Can you send the documentation again?”. FF’erty-F’s sake.

But the really good outcome – was they (Citi) confessed. The agent said (eventually) that they reversed the Chargeback simply because the merchant “responded”. And you’ve got the evidence right here, in this call.

This, coupled with them asking for the documentation you’d already sent again is a smoking gun that Citi are simply reversing first-presentation chargebacks any and every time a merchant sends a response. They are blatantly trashing the entire dispute simply on the basis a merchant has said something. And that something can be anything.

Unbelievable. They’ve so hollowed out credit card servicing so that all calls other than the most routine matter is simply closed off, without them willing to expend any manpower on it.

I can’t wait to see what Mastercard do. Isn’t Citi one of the biggest card issuers in the US? And this is how they’ve crappified their servicing?

Citi Shoving Voiceprint Verification Down Customers’ Throats

More and more financial services firms are tying to impose voice verification on customers, even though well-run firms that need to keep clients happy like Vanguard take “no” for an answer with no guff. Not Citi.

First, Citi instructed me to punch in my full card number (normally they could find my account using my phone number and the last four card numbers). The system did not recognize that or my manually-entered phone number. It was obvious they had disabled the touch/voice recognition feature to make verification a hassle to push customers to accepting the use of voiceprints.

Our house expert Clive concurred:

Comical. “We’re experiencing high call volumes”. Well get some more bloody people on the phones, then, you cheapskates.

Their IVR/touchtone is mis-configured. Deliberately. It’s the oldest trick on the call centre book – deterring “casual” servicing calls by putting on a faux touchtone listener that isn’t actually picking up any tomes. And the voice-print rigmarole was Kafkaesque (sorry, I couldn’t help but listen, it was too awful to pass up on!) was a cherry on the top of a rancid cake. It was pure entrapment – intentionally forcing an opt-in by default. You really had to stand your ground didn’t you? You have to admire their nerve – a double-whammy fail – deterring people form calling by putting on a dummy touchtone prompt, then if they persist, force them into biometrics.

It isn’t simply that retaining voiceprints for verification is offensive to privacy-sensitive customers. It’s also a really bad idea, particularly for people like me who have done TV and radio and thus have lots of voice recordings out in the wild. It’s already possible to create audio deepfakes with a mere 3.7 second clip and banks are playing catchup. One was already caught out in a stunt; how many more have been snookered but were able to keep it out of the press?

Citi has gone from having well-run card operations to being an embarrassment. But it’s clear management doesn’t care, or it never would have gotten in this shape in the first place.

00 Citi Mastercard transcript 2020-03-10_18_39_15

Unfortunately, crapification of credit card quality of service is not restricted to Citi. In my case, the biggest monetary loss I had was with American Express. I asked them to block any future charges from Vail Ski Resort and they failed to do so. AmEx software felled for the easiest trick in the book: a company having more than one vendor code. AmEx admitted that it was the case, after I did the debugging for them, credited and reversed the credit several times, and finally refused the chargeback. I decided not to pursue the matter in Small Claims Court after getting advice from my lawyer friend. The amount was $560.

Another annoying case is Bank of America, which has permanently broken eBilling software. For some of my accounts, I can only set the autopayment at a fixed amount, instead of statement balance or minimum payment. I tried many times over last 4 years and their reps assured me each time that it will be fixed. Nothing changed. The downside for me (upside for the bank) is that fixed amount autopayment will draw payments even for negative (credit) balance, ad infinitum. When that happens, you have an quick option in BoA automated phone system to get a refund check sent to you and drive to the bank to deposit it or you can wait on the line for the next representative, which will take over an hour due to unusually high call volume. BTW, the call volume was unusually high each of five times I tried at different days and hours.

I suspect the problems with customer service are somewhat evenly distributed. I had a pretty good run with Citi and CapitalOne so far.

It seems that the only practical recourse is to stop using bad actor cards for a couple of years, keeping an eye for non-use closure conditions. In general, the incentives are just too high to be too picky, e.g. 2% off all transactions, 0% APR no transaction fee cash.

IS small claims court even applicable? Don’t most corporations hit the sheep via mandatory arbitration in contracts no one reads/sees?

What about the CIti Visa card? I ended up with this card after Costco moved away from American Express.

Unfortunately it will almost certainly be the same numpties on the servicing team following the same make-it-die-in-a-fire approach to disputes for both Visa and Mastercard scheme cards issued by Citi. They clearly are filing all dispute documentation in the trash can when sent in by a cardholder, for anything than trivial, simply-resolved disputed transactions. That can only be done by a formal or informal Citi policy for such matters.

It could be that there’s more than one disputes team in Citi and only one has gone rogue (which Yves was unlucky to end up with for both of her disputes). But usually these things are centralised so I’d be quite surprised if Citi didn’t have a shared, single team. So there’s in all likelihood no escape from the mire that is Citi’s card servicing!

Thanks! I guess I’ll have to check around for another card to use. After my I.D. was leaked not once but twice by DoD I locked my credit. Getting another card will be [should be — if my credit is locked?] a pain.

I unlocked mine using the 800 numbers for a recent flute purchase. It was pretty painless, you can set the window of time you want it unlocked. I had zero confidence in the web based forms but the phone worked fine.

Wow – And there was I,thinking that if my dispute with Uber didn’t get resolved by Uber that I’d go and dispute the issue with (Costco) Citi instead – wonder how much joy I’d have got. But reviewing my 11 email chat with Uber ( they don’t do phone support just email – for passengers ), there seems to be yet another kink in this chargeback issue..

So, 14 months ago, there was a fraudulent tip+drive transaction on Uber. I disputed it with them, told Citi of the fraud. Citi closed the account. I’ve forgotten how I was made whole but I was – and Uber definitely reversed the drive portion of the charge- I have the refund letter – it reads as if they’d also reversed the fraudulent tip part too. Except.. 14 months later I used Uber again, in Puerto Rico. This time Uber resurrected that 14 month old fraudulent charge and charged my new credit card WITHOUT my sayso while charging the two trips to my Paypal account WITH my sayso.

Thus began the 12 email and 11 day to and fro chat to get back that resurrected 14 month old charge Eventually on 20th Feb 2020:

What’s intriguing is that phrase : initiating a chargeback will create an outstanding balance on your account that must be repaid in order to take a trip

It seems to mean – “just because the credit card company agrees with you that you don’t owe us, you STILL owe us !”

That is absolutely outrageous. An upheld Chargeback is automatically a disgorgement of your debt to Uber. They have no right to make any residual claim on you. And as the original charge was fraudulent, they (Uber) are acting as coconspirators.

Sadly probably passed the limit for redress via PayPal or the applicable card scheme. But if anyone encounters similar, file a disputed transaction with both PayPal and the card issuer. If they persist, write to the card scheme concerned. I am literally stunned and appalled by this and Uber have sunk to a new low (and they were already subterranean in my opinion).

What truly pissed me off right royally was that Uber resurrected that 14 month old fraudulent charge SILENTLY:

1. There had been NO communications from them in the 14 months saying: “We think you owe us $78.46”

2. When, 14 months later I booked my first in 14 months Uber ride there was NO Message from the app saying : “Sorry you still owe us $78.46. You need to pay that before you can book this ride -do you agree Y/N?”

3. There were NO emails or receipts saying “We have charged you 78.46 for old charge from 14 months ago.

It was only when my wife looked at the credit card statement 10 days later that she spotted this. Thus began the email chain. And mannn, the runaround I got :

1.responding in Spanish to my English language disputed charge email.

2.telling me to take it up with Paypal ( which is connected to a bank account) – for the visa charge ????

3.telling me – sorry its 30 days later ( since Nov 2018 I suppose ), you should dispute charges within 30 days ! this is when they’ve charged me 14 months later !

Sigh. but will I switch to Lyft or some much ? I dunno, now that I’ve got measure of this Uber devil and they’ve got the measure of me…I reckon the chances of Uber and me getting along ok in the

future are higher – better the devil you know, rather than starting afresh with a new partner with unknown diseases.

Thanks for sharing this disturbing and discouraging story. I bought a mattress that was similarly useless within 6 weeks, and had no idea that chargebacks are even possible. I’ll certainly use this as a reference going forward if I ever take advantage of that feature, assuming it’s still credibly honored anymore.

So what service provider offers to confirm that goods are defective in an affidavit? That wasn’t covered in business law 101 sadly. That would have been college I could use!

I would definitely bring this to the attention of CFPB.

I’ve had pretty good luck with the agency’s help.

Recently, filed a complaint against a VISA issuer … they denied the error, but then, when I paid off the balance in full – the payment was miraculously “mis-applied” to a different card. How convenient… (luckily, I noticed the error myself, otherwise, there’d late charges and blaming the customer all over again).

One has to remain vigilant, but it is a shame jut how much damn time one has to spend on these stupid “errors.”

Glad you’re publicising it.

I gave up on the major banks years ago and use a card issued by my credit union. No “points” with an airline, etc. However, whenever I have a problem, there is a branch office 400 yards from my house with a human that I can sit across from and make my case.

Really helped when I discovered lingerie items and jewelry charged in Amsterdam. I’m in Alabama.

Cash only people! You don’t have to play these damn games! Btw, I also own everything.

This is probably the most thorough and well-documented example of Bank Hell I’ve ever seen, the Old Liz Warren could have used it in Congressional hearings.

I recall the local Head of Financial Services at Microsoft (a real truthteller) addressing a room with 400 bankers at a conference. He started as follows:

Good Morning. Why do people hate banks?

(uncomfortable pause)

Because banks hate people.

(Room goes absolutely silent. No guffaws or protests because every last suit knew it was 100% true)

I think I will write to Costco Corporate Headquarters,

P.O. Box 34331

Seattle, WA 98124

referencing this Post and asking them when they will find a more reputable credit card company to deal with. The Citibank rap sheet at: [https://www.corp-research.org/citigroup] is long and ominous.

I suppose it might not hurt to make Mastercard and Visa aware of Yves Post also.

Just for another data point, my experience with disputing charges with Chase has been painless. File dispute online, a few days later they credit the account. A couple of these were with car rental companies in Europe and South Africa who tried to tack on bogus charges after the rental was completed and car turned in, and one was a sleazy taxi driver in New Orleans who overcharged us to take us to the airport. I suspect the ease of this process was because the amounts were small, less than $100 in each case, but who knows?

All the more reason (besides being a slam-dunk ethical* imperative) that all citizens (at least) should have checking/debit accounts at the Central Bank ITSELF.

As for charge backs, don’t we have a court system for that? And if it’s inadequate then FIX IT.**

* per a citizen’s inherent right to use his Nation’s fiat.

** Or is the provision of justice not an inherent duty of government? Or is the Federal Government limited by how much it may spend to do so?

This is what we did when Citi tried (twice) to force us into their credit cards by (once) leveraging

an existing store credit account (Macy’s) and (next) by converting another credit card to their

own (Costco), without permission.

Please bear in mind that part of the reason for this approach is that all too often “closing” an

account does not result in actual closure. Although Capital One is a big offender in this regard,

I’m sure they all do it.

Here is most of the letter that did the trick. A few short passages are edited out to prevent

disclosure of personal info.

Mr. William E. Johnson

CEO, Citi Retail Services, itigroup, Inc.

CEO,Department Stores National Bank

338 Greenwich Street

New York, New York, 10013

Dear Mr. Johnson:

I have recently received correspondence from your company indicating, with respect to my

Macy’s Star Rewards relationship that I am being “upgraded” by establishment of an account

which you call a “Macy’s American Express Card”. You have apparently already opened such an

account in my name and you have indicated in your correspondence that it is a “Macy’s

Account ending in ****”. You have also enclosed a “Department Stores National Bank

American Express Credit Card Agreement”. the [Agreement], which evidently applies to the

same account. However, I did not apply for, request or give permission for any such account

and demand that you immediately close it.

You have additionally provided an “Opportunity to Decline Upgrade until 04/19/19” which

does not operate satisfactorily or securely enough to guarantee that the requested action is

actually taken. The website given does not accept information entries to identify my existing

Macy’s account and, further, does not show that provision of said information would result in

declining your proposed “upgrade”. The telephone number provided connects to an

automated function which requests two items of information, the last four digits of my Social

Security number and the last four digits of the “account number”, presumably the number that

you stated in your correspondence. It does not require sufficient information to ensure that

any actions taken are secure or valid and it does not provide any means of receipt or

confirmation.

I hereby reject your “Department Stores National Bank American Express Card

Agreement” in its entirety and in all its parts and I further declare that no credit, banking or

other financial relationship exists or will ever exist on my part with respect to said Agreement

and that liability, obligation or responsibility on my part pursuant to any terms or conditions of

said Agreement does not exist.

I deny you (Citibank and/or Department Stores National Bank any permission or right to create

or issue any credit card, debit card, other card or document or instrument bearing my name

and personal information and indicating that I have any credit, banking or other financial

arrangement pursuant to any terms or conditions of said Agreement. I deny you any

permission or right to send or mail to me or to deposit with the United States Postal Service or

with any other carrier, with the intent to deliver to me, any such card, document or

instrument. Should you, notwithstanding, attempt to send or deliver to me, by any means,

any such card, document or instrument, I will decline to accept it and return it to the USPS or other

carrier. Any loss, unauthorized use, activation or other disposition of any such item is at your

sole risk and does not constitute responsibility or liability on my part.

I deny you any permission or right to extend any credit, to make any payment or financial

transaction on my behalf, pursuant to said Agreement, to maintain any account or other

financial or credit facility in my name or on my behalf pursuant to said Agreement, to impose

fees or costs with respect to any such account or facility or to report to any credit rating agency

or other party any information with regard to such account or facility. Any credit so extended,

payment, transaction or error is a t your sole risk, without my request or permission, and does

not constitute responsibility or liability on my part.

We did this twice and although the first time they did actually send a card. we have not heard

from them since. Clearly these people are utterly stupid and the rot goes right to the top.

The heart of this method is rejection of the “Agreement”, which really closes the account, whether

they like it or not and puts them in a really bad place should they try to do anything else with it.

Interesting. Do you have to have the letter Notarized? Proof of transmission?

Proof of transmission, yes. It was sent Certified, Return Receipt.

Notarized. I don’t think that’s necessary. All the factual points are provable.

Did run it past my attorney,who said it’s fine.

Certified mail would do it.

On Citi’s legal department, too.

State Attorney Generals should be notified about this.

This is fraud and, as policy, is massive fraud.

Civil and criminal.

It’s not going away soon.

Fraud? Not exactly. In fact it is explicitly legal to convert accounts in this fashion,

although it is pretty sleazy and put a great many people in the uncomfortable position

of having to accept the results.

Nonetheless, I wish a few more people could take the time for something like this.

Citi wouldn’t like it!

I’ve only had on experience with a scam credit card charge. It was a Bank Of America MasterCard. I , on the net ordered some JBL speakers and used my MasterCard to pay for them. My card was immediately charged but after a month I didn’t receive the order. I contacted Bank of America and filed a complaint. They called me and said they would investigate. After a couple days they called back and said they would credit my card for this transaction. In a day they did, which mad me very happy. They were very professional and efficient in handling my complaint.

Lets turn this around for a moment an look at the other side. How about protecting merchants from shady customers. Small businesses, especially service ones, are regularly victimized by people with stolen cards. The charge back is passed onto the business owner. That business owner then needs to send pictures of the credit card, front and back, plus a picture of a photo id, in a long, and uncertain appeal to the credit card company. With a faked card, even that does not work. There is also no way a business is allowed to call up the card company and verify prior to accepting the payment. The secret service is supposed to police this. They do not, not at all. They will ignore you if you have evidence of past or even imminent theft with the opportunity to catch them red handed.

Stolen and counterfeit cards are rampant, and, this risk is being transferred to the small business. The fault and the risk belongs with the credit card company, and/or, the credit card holder who was careless with their card. As usual, risk is foisted down the food chain.

If a business wants to take a card payment, the onus is on the business to obtain a valid payment authorisation from their payment processor / merchant services provider. If you get an auth code, and you’ve not failed to adhere to card processing standards to avoid EMV liability shift, it is the card issuer who has to take the loss. If the business is running out-of-date EPoS equipment and can’t PIN-verify, then the business needs to invest in EPoS terminals which will avoid liability shift. This is a legitimate cost of doing business — if a business wants to accept card payments, it has to stay current with EPoS best-practices. If it doesn’t want to make that investment, it has to be prepared to stand the losses.

If a business relies on card-not-present transactions, these are inherently more risky than card-present ones and it must take additional steps to ensure it isn’t targeted by fraudsters.

I’m not supporter at all of the TBTFs or the card networks when they don’t live up to their obligations to card holders. But I’m even less of a supporter of businesses which want something for nothing — the “something” being the ability to accept card payments with no liability for fraud, the “nothing” being the amount they are prepared to stay current with industry standards.

There’s a documentary film called “Petition”, which follows ordinary Chinese citizens, and often their entire families, who apply to one select bureau in China, to redress grievances with the state and state entities.

Most of these people camp out (with their families) in the surrounding area, remaining for weeks or, in some cases, years, often with children in tow. Some have grievous injuries, having been beaten by police or quasi-official security guards, and their families do the petitioning. Others seek compensation for state appropriations of property or (most commonly) the larcenous behavior of corrupt local officials. Although the office accomplishes virtually nothing for anyone, local governments from all around China, fearing exposure, send thugs to deter complainants, accosting them on the way to the office, physically preventing them from moving forward, and with threats of beatings and murder (and actual beatings and murder).

Some of the petitioners literally go mad. They, and others who aren’t mad, but who are persistent in a way uncomfortable for the authorities, are routinely imprisoned in Chinese mental institutions (and you really don’t want to know).

It’s a fascinating and horrifying demonstration of how, in a foundationally corrupt world, the search for justice drives people mad.

We all have stories where we utilized the appropriate dispute resolution with a major credit card for a “bad” purchase and still ended up with nada, zilch, big ‘ol fat nothing.

But my local credit union, Golden 1, has expertly handled a small number of disputes for me, including a large purchase for equipment whose specs upon ordering were adequate for my needs, but the actual equipment did not measure up.

The vendor fought the charge back but my Credit Union came back to me several times for more information. Bottom line, my CU actually reviewed my documents and photos, and I ultimately received the credit.

It’s time to dump the BIG bank cards for the smaller more personal bankers with call center staff that work to solve problems for their customers.

I have a friend who worked for Citi back in the early 00s. He said that big banks hate their retail customers. After dealing with similar problems that Yves had with dispute resolution, I can honestly say – yes, they do. Also, more and more financial institutions was customers to go along with “voiceprints” to access their accounts. Chas. Schwab tried this on me, and I had to emphatically tell them that I didn’t want that – I don’t want any biometric info. about me in anything! It’s always “for your convenience” which is BS – good for you Yves. Banks, credit card companies just want their customers to give up and go away.

I keep thinking of the phrase: “what’s in your toilet?”

Had similar experience, and pursuing arbitration. Even when the merchant reversed the charge after 6+ months, they withheld the credit balance for weeks claiming that the funds would be back in 3-5 business days everytime we called. Anyone interested in pursuing a class-action?

Recently I was suddenly overdue on my Citibank MC, even though I have always had auto-pay enabled, which is set to pay more than the minimum due. I checked my account and sure enough Auto-pay was somehow disabled and I had been charged $29 (and who knows if there was a ding on my credit score!) I have called them every day for a week and I get the same message saying “we are experiencing extremely long wait times, we are sorry” and then the call automatically hangs up. I tried chatting with a rep and only after 2 hours was there a response, but I only found this later after the site had timed out and I was automatically logged out of the support site so I couldn’t receive the notice there was a chat agent. I tried calling at 10pm on a Saturday hoping I could get a call center in the Philippines or something but still the line hangs up on me. Has anyone else had their Autopay mysteriously disabled and now they can’t get in contact with support?